Tax Management Market Synopsis

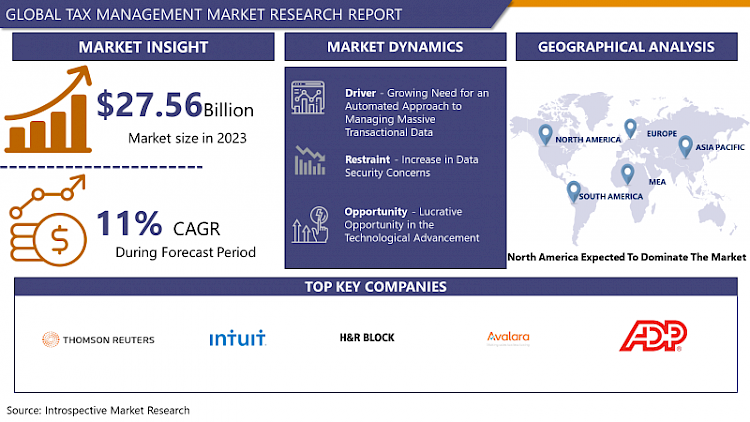

The Tax Management Market size is estimated at 27.56 billion USD in 2023 and is expected to reach 70.5 billion USD by 2032, growing at a CAGR of 11% during the forecast period (2024-2032)

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc.

- Increasing demand for tax recordkeeping solutions is expected to be a key factor driving revenue growth in the global tax management market over the forecast period. Record keeping is a crucial strategy for most businesses when it comes to storing essential tax documents, and tax software can facilitate this process.

- Using cloud-based tax software, businesses can store tax information from prior years in a secure manner on cloud storage. Using such a solution, businesses can gain immediate access to the essential tax information for any fiscal year.

- Increasing demand for tax calculation software with high precision and few errors are anticipated to contribute to the expansion of the global tax management market over the forecast period. Taxpayers are aware that even a minor error in their tax estimates will result in significant penalties, interest, and other costs.

- When taxpayers calculate their taxes by hand, the likelihood of an error increases significantly. If they file their tax return manually, they are solely responsible for compiling and correctly filing sensitive tax information across multiple forms.

The Tax Management Market Trend Analysis

Growing Need for an Automated Approach to Managing Massive Transactional Data

- Due to the constant globalization and proliferation of e-businesses, there has been an ongoing need for a platform that enables enterprises to conduct business across countries, trading zones, and multiple interaction channels. With increasing digitization, corporate tax and IT departments aim to find more partners and satisfy specific customer needs.

- Tax Management Software aids businesses in enhancing the reporting and administration of ever-changing transaction tax laws and regulations. This software for Tax Management can handle and manage compliance reports and meet tax filing-requirement deadlines without imposing an unnecessary burden or requiring excessive manual labor.

- Moreover, the taxation ecosystem's constant evolution exacerbates the difficulty of implementing effective strategies for gathering, processing, and analyzing data that is typically difficult to obtain from standard financial reporting. Globally, this has contributed to the expansion of this market.

- A Tax Management Software aids financial institutions and businesses in analyzing the massive amount of data collected by monetary transactions and aids businesses in making informed decisions. Tax and customs authorities collect information from Value-Added Tax (VAT) and Goods and Services Tax (GST) payers via their financial transactions.

- Moreover, tax administrations are processing and analyzing collected indirect tax financial data electronically. This software allows tax administrators to use data extracted from taxpayers' systems to conduct VAT/GST audits. Thus, the adoption of data analytics solutions to improve eVAT/GST compliance is regarded as an emerging growth driver for the market for tax management.

Lucrative Opportunity in the Technological Advancement

- In the market for tax management software, technological advancement is a key trend gaining popularity. To strengthen their market position, the leading companies in the tax management software sector are concentrating on developing technologically advanced products. For instance, in 2021 Wolters Kluwer N.V., a Dutch information services company, introduced the cloud-based CCH AxcessTM Validate expert solution, which uses blockchain technology to expedite banking confirmations for CPA firm auditors.

- Its blockchain-enabled workflow provides firms with the simplicity, speed, and trust that auditors require in today's environment, reducing the authorization portion of the auditing process to less than 5 minutes. These technological advancements will make operations easier and quicker to complete.

- Avalara Inc., an American software company, acquired DAVO Technologies LLC for an undisclosed sum in April 2021. With this acquisition, Avalara anticipates assisting DAVO teams and products in critical areas, such as small business compliance requirements and partner synergies, and advancing its mission to become the universal cloud compliance platform for businesses of all sizes.

- DAVO Technologies LLC is a U.S.-based company that automates the daily and ongoing sales tax requirements for emerging small businesses.

- Therefore, the implementation of advanced technologies offers the opportunity for the tax management market

Segmentation Analysis Of The Tax Management Market

Tax Management Market segments cover the Component, Deployment Mode, Tax Type, and Organization Size. By Component, the Services segment is Anticipated to Dominate the Market Over the Forecast period.

- With the increasing adoption of tax management software across major industries, organizations have a greater need for supporting services. Services play a crucial role in assisting businesses across all industries to maximize their use of tax management software. Tax management services consist of consulting, integration and deployment, training, and support and maintenance.

- These services are being adopted by businesses to improve their tax management procedures. Consulting services assist a business in selecting the tax management software that best meets its specific needs.

- These services advise end users and assist them in integrating and deploying software that is configured to their specifications. In addition, they help determine the type of integration required by organizations to meet their tax demand. In addition, they assist businesses at every stage of software usage.

Regional Analysis of The Tax Management Market

North America is Expected to Dominate the Market Over the Forecast period.

- The United States and Canada are anticipated to generate the most revenue for the North American tax management market. The adoption of tax management solutions offers advantages such as reduced tax deductions, simple tax calculations, time savings, automatic tax filing, and error reduction.

- The developed economies of North America have been adopting tax management solutions at a greater rate than other nations around the world. Avalara, ADP, Intuit, and H&R Block are the most prominent tax management vendors in North America.

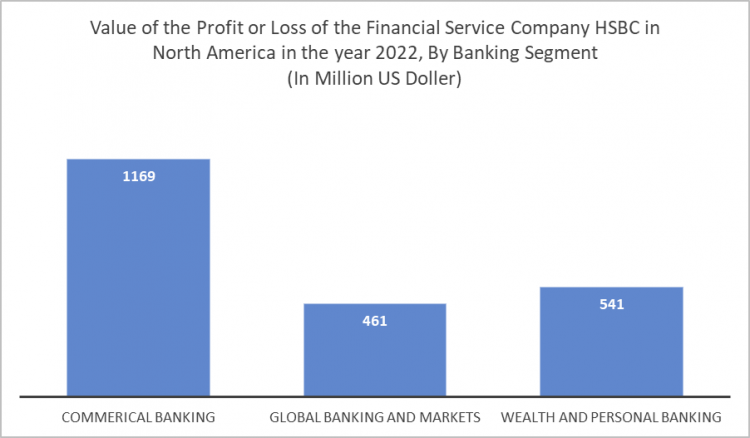

- The growing banking services in North America also support the market growth of Tax management. The following figure shows the value of the profit or loss of the Financial service company HSBC in North America in the year 2022, by banking segment.

- Henceforth, the growing financial services will strengthen the market growth. They have adopted a variety of business strategies to bolster their existing product portfolios and expand their geographic footprint in the tax management market.

Covid-19 Impact Analysis On Tax Management Market

COVID-19 has had a devastating impact on all global industries. The rapid expansion of business operations in the aftermath of the COVID-19 outbreak is anticipated to spur the adoption of software to calculate the current and frozen-year tax values. In addition, as a result of the coronavirus outbreak, changing taxation policies by various central governments are anticipated to increase the adoption of tax management software. During the COVID-19 outbreak, Saudi Arabia tripled the taxes on essential goods in 2020, from 5% to 15%.

Top Key Players Covered in The Tax Management Market

- Thomson Reuters (Canada)

- Intuit (US)

- H&R Block (US)

- Avalara (US)

- Wolters Kluwer NV (Netherlands)

- Automatic Data Processing (US)

- TaxSlayer (US)

- Taxback International (Ireland)

- TaxCloud (US)

- Drake Enterprises (US)

- Canopy Tax (US)

- TaxJar (US)

- Webgility (US)

- LOVAT Software (UK)

- SafeSend (US)

- EXEMPTAX (US)

- Sales Tax DataLINK (US)

- Shoeboxed (US)

- SAXTAX (US), and Other Major Players.

Key Industry Developments in the Tax Management Market

- In September 2023, H&R Block's AI Assistant Unveiled virtual assistant guides users through their tax returns, answering questions, providing personalized recommendations, and identifying potential tax benefits.

- In July 2023, Intuit's TurboTax AI launched platform leverages AI to automate tasks like data entry, expense categorization, and deduction identification, simplifying tax filing for individuals and small businesses.

- In May 2023, TaxJar's Global Sales Tax Engine Launched cloud-based platform automates sales tax calculations and filing compliance for businesses selling across multiple states and countries.

|

Global Tax Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.56 Bn. |

|

Forecast Period 2024-2032 CAGR: |

11% |

Market Size in 2032: |

USD 70.5Bn |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Mode |

|

||

|

By Tax Type |

|

||

|

By Organization Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Component

3.2 By Deployment Mode

3.3 By Tax Type

3.4 By Organization Size

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Tax Management Market by Component

5.1 Tax Management Market Overview Snapshot and Growth Engine

5.2 Tax Management Market Overview

5.3 Software

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Software: Geographic Segmentation

5.4 Servicesr

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Servicesr: Geographic Segmentation

Chapter 6: Tax Management Market by Deployment Mode

6.1 Tax Management Market Overview Snapshot and Growth Engine

6.2 Tax Management Market Overview

6.3 Cloud

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Cloud: Geographic Segmentation

6.4 On-Premises

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 On-Premises: Geographic Segmentation

Chapter 7: Tax Management Market by Tax Type

7.1 Tax Management Market Overview Snapshot and Growth Engine

7.2 Tax Management Market Overview

7.3 Indirect Tax

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Indirect Tax: Geographic Segmentation

7.4 Direct Tax

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Direct Tax: Geographic Segmentation

Chapter 8: Tax Management Market by Organization Size

8.1 Tax Management Market Overview Snapshot and Growth Engine

8.2 Tax Management Market Overview

8.3 Small & Medium-sized Enterprises (SMEs)

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Small & Medium-sized Enterprises (SMEs): Geographic Segmentation

8.4 Large Enterprises

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Large Enterprises: Geographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Tax Management Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Tax Management Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Tax Management Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 THOMSON REUTERS (CANADA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 INTUIT (US)

9.4 H&R BLOCK (US)

9.5 AVALARA (US)

9.6 WOLTERS KLUWER NV (NETHERLANDS)

9.7 AUTOMATIC DATA PROCESSING (US)

9.8 TAXSLAYER (US)

9.9 TAXBACK INTERNATIONAL (IRELAND)

9.10 TAXCLOUD (US)

9.11 DRAKE ENTERPRISES (US)

9.12 CANOPY TAX (US)

9.13 TAXJAR (US)

9.14 WEBGILITY (US)

9.15 LOVAT SOFTWARE (UK)

9.16 SAFESEND (US)

9.17 EXEMPTAX (US)

9.18 SALES TAX DATALINK (US)

9.19 SHOEBOXED (US)

9.20 SAXTAX (US)

9.21 OTHER MAJOR PLAYERS

Chapter 10: Global Tax Management Market Analysis, Insights and Forecast, 2017-2032

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Component

10.2.1 Software

10.2.2 Servicesr

10.3 Historic and Forecasted Market Size By Deployment Mode

10.3.1 Cloud

10.3.2 On-Premises

10.4 Historic and Forecasted Market Size By Tax Type

10.4.1 Indirect Tax

10.4.2 Direct Tax

10.5 Historic and Forecasted Market Size By Organization Size

10.5.1 Small & Medium-sized Enterprises (SMEs)

10.5.2 Large Enterprises

Chapter 11: North America Tax Management Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Component

11.4.1 Software

11.4.2 Servicesr

11.5 Historic and Forecasted Market Size By Deployment Mode

11.5.1 Cloud

11.5.2 On-Premises

11.6 Historic and Forecasted Market Size By Tax Type

11.6.1 Indirect Tax

11.6.2 Direct Tax

11.7 Historic and Forecasted Market Size By Organization Size

11.7.1 Small & Medium-sized Enterprises (SMEs)

11.7.2 Large Enterprises

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Tax Management Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Component

12.4.1 Software

12.4.2 Servicesr

12.5 Historic and Forecasted Market Size By Deployment Mode

12.5.1 Cloud

12.5.2 On-Premises

12.6 Historic and Forecasted Market Size By Tax Type

12.6.1 Indirect Tax

12.6.2 Direct Tax

12.7 Historic and Forecasted Market Size By Organization Size

12.7.1 Small & Medium-sized Enterprises (SMEs)

12.7.2 Large Enterprises

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Tax Management Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Component

13.4.1 Software

13.4.2 Servicesr

13.5 Historic and Forecasted Market Size By Deployment Mode

13.5.1 Cloud

13.5.2 On-Premises

13.6 Historic and Forecasted Market Size By Tax Type

13.6.1 Indirect Tax

13.6.2 Direct Tax

13.7 Historic and Forecasted Market Size By Organization Size

13.7.1 Small & Medium-sized Enterprises (SMEs)

13.7.2 Large Enterprises

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Tax Management Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Component

14.4.1 Software

14.4.2 Servicesr

14.5 Historic and Forecasted Market Size By Deployment Mode

14.5.1 Cloud

14.5.2 On-Premises

14.6 Historic and Forecasted Market Size By Tax Type

14.6.1 Indirect Tax

14.6.2 Direct Tax

14.7 Historic and Forecasted Market Size By Organization Size

14.7.1 Small & Medium-sized Enterprises (SMEs)

14.7.2 Large Enterprises

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Tax Management Market Analysis, Insights and Forecast, 2017-2032

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Component

15.4.1 Software

15.4.2 Servicesr

15.5 Historic and Forecasted Market Size By Deployment Mode

15.5.1 Cloud

15.5.2 On-Premises

15.6 Historic and Forecasted Market Size By Tax Type

15.6.1 Indirect Tax

15.6.2 Direct Tax

15.7 Historic and Forecasted Market Size By Organization Size

15.7.1 Small & Medium-sized Enterprises (SMEs)

15.7.2 Large Enterprises

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Tax Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.56 Bn. |

|

Forecast Period 2024-2032 CAGR: |

11% |

Market Size in 2032: |

USD 70.5Bn |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Mode |

|

||

|

By Tax Type |

|

||

|

By Organization Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TAX MANAGEMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TAX MANAGEMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TAX MANAGEMENT MARKET COMPETITIVE RIVALRY

TABLE 005. TAX MANAGEMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. TAX MANAGEMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. TAX MANAGEMENT MARKET BY COMPONENT

TABLE 008. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICESR MARKET OVERVIEW (2016-2028)

TABLE 010. TAX MANAGEMENT MARKET BY DEPLOYMENT MODE

TABLE 011. CLOUD MARKET OVERVIEW (2016-2028)

TABLE 012. ON-PREMISES MARKET OVERVIEW (2016-2028)

TABLE 013. TAX MANAGEMENT MARKET BY TAX TYPE

TABLE 014. INDIRECT TAX MARKET OVERVIEW (2016-2028)

TABLE 015. DIRECT TAX MARKET OVERVIEW (2016-2028)

TABLE 016. TAX MANAGEMENT MARKET BY ORGANIZATION SIZE

TABLE 017. SMALL & MEDIUM-SIZED ENTERPRISES (SMES) MARKET OVERVIEW (2016-2028)

TABLE 018. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA TAX MANAGEMENT MARKET, BY COMPONENT (2016-2028)

TABLE 020. NORTH AMERICA TAX MANAGEMENT MARKET, BY DEPLOYMENT MODE (2016-2028)

TABLE 021. NORTH AMERICA TAX MANAGEMENT MARKET, BY TAX TYPE (2016-2028)

TABLE 022. NORTH AMERICA TAX MANAGEMENT MARKET, BY ORGANIZATION SIZE (2016-2028)

TABLE 023. N TAX MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE TAX MANAGEMENT MARKET, BY COMPONENT (2016-2028)

TABLE 025. EUROPE TAX MANAGEMENT MARKET, BY DEPLOYMENT MODE (2016-2028)

TABLE 026. EUROPE TAX MANAGEMENT MARKET, BY TAX TYPE (2016-2028)

TABLE 027. EUROPE TAX MANAGEMENT MARKET, BY ORGANIZATION SIZE (2016-2028)

TABLE 028. TAX MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC TAX MANAGEMENT MARKET, BY COMPONENT (2016-2028)

TABLE 030. ASIA PACIFIC TAX MANAGEMENT MARKET, BY DEPLOYMENT MODE (2016-2028)

TABLE 031. ASIA PACIFIC TAX MANAGEMENT MARKET, BY TAX TYPE (2016-2028)

TABLE 032. ASIA PACIFIC TAX MANAGEMENT MARKET, BY ORGANIZATION SIZE (2016-2028)

TABLE 033. TAX MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA TAX MANAGEMENT MARKET, BY COMPONENT (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA TAX MANAGEMENT MARKET, BY DEPLOYMENT MODE (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA TAX MANAGEMENT MARKET, BY TAX TYPE (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA TAX MANAGEMENT MARKET, BY ORGANIZATION SIZE (2016-2028)

TABLE 038. TAX MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 039. SOUTH AMERICA TAX MANAGEMENT MARKET, BY COMPONENT (2016-2028)

TABLE 040. SOUTH AMERICA TAX MANAGEMENT MARKET, BY DEPLOYMENT MODE (2016-2028)

TABLE 041. SOUTH AMERICA TAX MANAGEMENT MARKET, BY TAX TYPE (2016-2028)

TABLE 042. SOUTH AMERICA TAX MANAGEMENT MARKET, BY ORGANIZATION SIZE (2016-2028)

TABLE 043. TAX MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 044. THOMSON REUTERS (CANADA): SNAPSHOT

TABLE 045. THOMSON REUTERS (CANADA): BUSINESS PERFORMANCE

TABLE 046. THOMSON REUTERS (CANADA): PRODUCT PORTFOLIO

TABLE 047. THOMSON REUTERS (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. INTUIT (US): SNAPSHOT

TABLE 048. INTUIT (US): BUSINESS PERFORMANCE

TABLE 049. INTUIT (US): PRODUCT PORTFOLIO

TABLE 050. INTUIT (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. H&R BLOCK (US): SNAPSHOT

TABLE 051. H&R BLOCK (US): BUSINESS PERFORMANCE

TABLE 052. H&R BLOCK (US): PRODUCT PORTFOLIO

TABLE 053. H&R BLOCK (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. AVALARA (US): SNAPSHOT

TABLE 054. AVALARA (US): BUSINESS PERFORMANCE

TABLE 055. AVALARA (US): PRODUCT PORTFOLIO

TABLE 056. AVALARA (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. WOLTERS KLUWER NV (NETHERLANDS): SNAPSHOT

TABLE 057. WOLTERS KLUWER NV (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 058. WOLTERS KLUWER NV (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 059. WOLTERS KLUWER NV (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. AUTOMATIC DATA PROCESSING (US): SNAPSHOT

TABLE 060. AUTOMATIC DATA PROCESSING (US): BUSINESS PERFORMANCE

TABLE 061. AUTOMATIC DATA PROCESSING (US): PRODUCT PORTFOLIO

TABLE 062. AUTOMATIC DATA PROCESSING (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. TAXSLAYER (US): SNAPSHOT

TABLE 063. TAXSLAYER (US): BUSINESS PERFORMANCE

TABLE 064. TAXSLAYER (US): PRODUCT PORTFOLIO

TABLE 065. TAXSLAYER (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. TAXBACK INTERNATIONAL (IRELAND): SNAPSHOT

TABLE 066. TAXBACK INTERNATIONAL (IRELAND): BUSINESS PERFORMANCE

TABLE 067. TAXBACK INTERNATIONAL (IRELAND): PRODUCT PORTFOLIO

TABLE 068. TAXBACK INTERNATIONAL (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. TAXCLOUD (US): SNAPSHOT

TABLE 069. TAXCLOUD (US): BUSINESS PERFORMANCE

TABLE 070. TAXCLOUD (US): PRODUCT PORTFOLIO

TABLE 071. TAXCLOUD (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. DRAKE ENTERPRISES (US): SNAPSHOT

TABLE 072. DRAKE ENTERPRISES (US): BUSINESS PERFORMANCE

TABLE 073. DRAKE ENTERPRISES (US): PRODUCT PORTFOLIO

TABLE 074. DRAKE ENTERPRISES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. CANOPY TAX (US): SNAPSHOT

TABLE 075. CANOPY TAX (US): BUSINESS PERFORMANCE

TABLE 076. CANOPY TAX (US): PRODUCT PORTFOLIO

TABLE 077. CANOPY TAX (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. TAXJAR (US): SNAPSHOT

TABLE 078. TAXJAR (US): BUSINESS PERFORMANCE

TABLE 079. TAXJAR (US): PRODUCT PORTFOLIO

TABLE 080. TAXJAR (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. WEBGILITY (US): SNAPSHOT

TABLE 081. WEBGILITY (US): BUSINESS PERFORMANCE

TABLE 082. WEBGILITY (US): PRODUCT PORTFOLIO

TABLE 083. WEBGILITY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. LOVAT SOFTWARE (UK): SNAPSHOT

TABLE 084. LOVAT SOFTWARE (UK): BUSINESS PERFORMANCE

TABLE 085. LOVAT SOFTWARE (UK): PRODUCT PORTFOLIO

TABLE 086. LOVAT SOFTWARE (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. SAFESEND (US): SNAPSHOT

TABLE 087. SAFESEND (US): BUSINESS PERFORMANCE

TABLE 088. SAFESEND (US): PRODUCT PORTFOLIO

TABLE 089. SAFESEND (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. EXEMPTAX (US): SNAPSHOT

TABLE 090. EXEMPTAX (US): BUSINESS PERFORMANCE

TABLE 091. EXEMPTAX (US): PRODUCT PORTFOLIO

TABLE 092. EXEMPTAX (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. SALES TAX DATALINK (US): SNAPSHOT

TABLE 093. SALES TAX DATALINK (US): BUSINESS PERFORMANCE

TABLE 094. SALES TAX DATALINK (US): PRODUCT PORTFOLIO

TABLE 095. SALES TAX DATALINK (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. SHOEBOXED (US): SNAPSHOT

TABLE 096. SHOEBOXED (US): BUSINESS PERFORMANCE

TABLE 097. SHOEBOXED (US): PRODUCT PORTFOLIO

TABLE 098. SHOEBOXED (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. SAXTAX (US): SNAPSHOT

TABLE 099. SAXTAX (US): BUSINESS PERFORMANCE

TABLE 100. SAXTAX (US): PRODUCT PORTFOLIO

TABLE 101. SAXTAX (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 102. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 103. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 104. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TAX MANAGEMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TAX MANAGEMENT MARKET OVERVIEW BY COMPONENT

FIGURE 012. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICESR MARKET OVERVIEW (2016-2028)

FIGURE 014. TAX MANAGEMENT MARKET OVERVIEW BY DEPLOYMENT MODE

FIGURE 015. CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 016. ON-PREMISES MARKET OVERVIEW (2016-2028)

FIGURE 017. TAX MANAGEMENT MARKET OVERVIEW BY TAX TYPE

FIGURE 018. INDIRECT TAX MARKET OVERVIEW (2016-2028)

FIGURE 019. DIRECT TAX MARKET OVERVIEW (2016-2028)

FIGURE 020. TAX MANAGEMENT MARKET OVERVIEW BY ORGANIZATION SIZE

FIGURE 021. SMALL & MEDIUM-SIZED ENTERPRISES (SMES) MARKET OVERVIEW (2016-2028)

FIGURE 022. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA TAX MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE TAX MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC TAX MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA TAX MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA TAX MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Tax Management Market research report is 2024 - 2032.

Thomson Reuters (Canada), Intuit (US), H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), Shoeboxed (US), SAXTAX (US), and other major players.

The Tax Management Market is segmented into Components, Deployment Mode, Tax Type, Organization Size, and region. By Component, the market is categorized into Software, Services. By Deployment Mode, the market is categorized into Cloud, On-Premises. By Tax Type, the market is categorized into Indirect Tax, Direct Tax. By Organization Size, the market is categorized into Small & Medium-sized Enterprises (SMEs), Large Enterprises. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc.

The Tax Management Market size is estimated at 27.56 billion USD in 2023 and is expected to reach 70.5 billion USD by 2032, growing at a CAGR of 11% during the forecast period (2024-2032)