Tax Management Market Synopsis

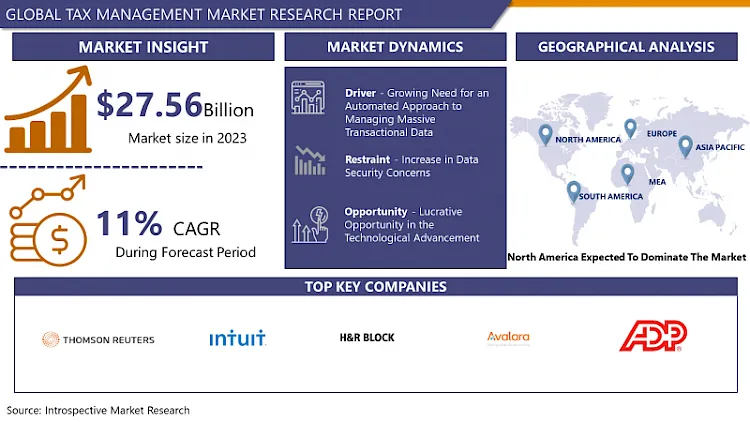

The Tax Management Market size is estimated at 30.59 billion USD in 2024 and is expected to reach 70.5 billion USD by 2032, growing at a CAGR of 11% during the forecast period (2025-2032)

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc.

Increasing demand for tax recordkeeping solutions is expected to be a key factor driving revenue growth in the global tax management market over the forecast period. Record keeping is a crucial strategy for most businesses when it comes to storing essential tax documents, and tax software can facilitate this process.

Using cloud-based tax software, businesses can store tax information from prior years in a secure manner on cloud storage. Using such a solution, businesses can gain immediate access to the essential tax information for any fiscal year.

Increasing demand for tax calculation software with high precision and few errors are anticipated to contribute to the expansion of the global tax management market over the forecast period. Taxpayers are aware that even a minor error in their tax estimates will result in significant penalties, interest, and other costs.

When taxpayers calculate their taxes by hand, the likelihood of an error increases significantly. If they file their tax return manually, they are solely responsible for compiling and correctly filing sensitive tax information across multiple forms.

The Tax Management Market Trend Analysis

Tax Management Market Driversrowing Need for an Automated Approach to Managing Massive Transactional Data

- Due to the constant globalization and proliferation of e-businesses, there has been an ongoing need for a platform that enables enterprises to conduct business across countries, trading zones, and multiple interaction channels. With increasing digitization, corporate tax and IT departments aim to find more partners and satisfy specific customer needs.

- Tax Management Software aids businesses in enhancing the reporting and administration of ever-changing transaction tax laws and regulations. This software for Tax Management can handle and manage compliance reports and meet tax filing-requirement deadlines without imposing an unnecessary burden or requiring excessive manual labor.

- Moreover, the taxation ecosystem's constant evolution exacerbates the difficulty of implementing effective strategies for gathering, processing, and analyzing data that is typically difficult to obtain from standard financial reporting. Globally, this has contributed to the expansion of this market.

- A Tax Management Software aids financial institutions and businesses in analyzing the massive amount of data collected by monetary transactions and aids businesses in making informed decisions. Tax and customs authorities collect information from Value-Added Tax (VAT) and Goods and Services Tax (GST) payers via their financial transactions.

- Moreover, tax administrations are processing and analyzing collected indirect tax financial data electronically. This software allows tax administrators to use data extracted from taxpayers' systems to conduct VAT/GST audits. Thus, the adoption of data analytics solutions to improve eVAT/GST compliance is regarded as an emerging growth driver for the market for tax management.

Lucrative Opportunity in the Technological Advancement

- In the market for tax management software, technological advancement is a key trend gaining popularity. To strengthen their market position, the leading companies in the tax management software sector are concentrating on developing technologically advanced products. For instance, in 2021 Wolters Kluwer N.V., a Dutch information services company, introduced the cloud-based CCH AxcessTM Validate expert solution, which uses blockchain technology to expedite banking confirmations for CPA firm auditors.

- Its blockchain-enabled workflow provides firms with the simplicity, speed, and trust that auditors require in today's environment, reducing the authorization portion of the auditing process to less than 5 minutes. These technological advancements will make operations easier and quicker to complete.

- Avalara Inc., an American software company, acquired DAVO Technologies LLC for an undisclosed sum in April 2021. With this acquisition, Avalara anticipates assisting DAVO teams and products in critical areas, such as small business compliance requirements and partner synergies, and advancing its mission to become the universal cloud compliance platform for businesses of all sizes.

- DAVO Technologies LLC is a U.S.-based company that automates the daily and ongoing sales tax requirements for emerging small businesses.

- Therefore, the implementation of advanced technologies offers the opportunity for the tax management market

Segmentation Analysis Of The Tax Management Market

Tax Management Market segments cover the Component, Deployment Mode, Tax Type, and Organization Size. By Component, the Services segment is Anticipated to Dominate the Market Over the Forecast period.

- With the increasing adoption of tax management software across major industries, organizations have a greater need for supporting services. Services play a crucial role in assisting businesses across all industries to maximize their use of tax management software. Tax management services consist of consulting, integration and deployment, training, and support and maintenance.

- These services are being adopted by businesses to improve their tax management procedures. Consulting services assist a business in selecting the tax management software that best meets its specific needs.

- These services advise end users and assist them in integrating and deploying software that is configured to their specifications. In addition, they help determine the type of integration required by organizations to meet their tax demand. In addition, they assist businesses at every stage of software usage.

Regional Analysis of The Tax Management Market

North America is Expected to Dominate the Market Over the Forecast period.

- The United States and Canada are anticipated to generate the most revenue for the North American tax management market. The adoption of tax management solutions offers advantages such as reduced tax deductions, simple tax calculations, time savings, automatic tax filing, and error reduction.

- The developed economies of North America have been adopting tax management solutions at a greater rate than other nations around the world. Avalara, ADP, Intuit, and H&R Block are the most prominent tax management vendors in North America.

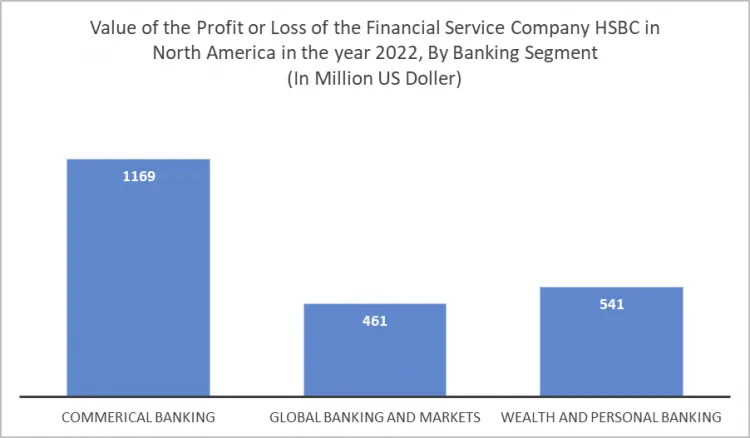

- The growing banking services in North America also support the market growth of Tax management. The following figure shows the value of the profit or loss of the Financial service company HSBC in North America in the year 2022, by banking segment.

- Henceforth, the growing financial services will strengthen the market growth. They have adopted a variety of business strategies to bolster their existing product portfolios and expand their geographic footprint in the tax management market.

Top Key Players Covered in The Tax Management Market

- Thomson Reuters (Canada)

- Intuit (US)

- H&R Block (US)

- Avalara (US)

- Wolters Kluwer NV (Netherlands)

- Automatic Data Processing (US)

- TaxSlayer (US)

- Taxback International (Ireland)

- TaxCloud (US)

- Drake Enterprises (US)

- Canopy Tax (US)

- TaxJar (US)

- Webgility (US)

- LOVAT Software (UK)

- SafeSend (US)

- EXEMPTAX (US)

- Sales Tax DataLINK (US)

- Shoeboxed (US)

- SAXTAX (US), and Other Active Players.

Key Industry Developments in the Tax Management Market

- In September 2023, H&R Block's AI Assistant Unveiled virtual assistant guides users through their tax returns, answering questions, providing personalized recommendations, and identifying potential tax benefits.

- In July 2023, Intuit's TurboTax AI launched platform leverages AI to automate tasks like data entry, expense categorization, and deduction identification, simplifying tax filing for individuals and small businesses.

- In May 2023, TaxJar's Global Sales Tax Engine Launched cloud-based platform automates sales tax calculations and filing compliance for businesses selling across multiple states and countries.

|

Global Tax Management Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 30.59 Bn. |

|

Forecast Period 2024-2032 CAGR: |

11% |

Market Size in 2032: |

USD 70.5 Bn |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Mode |

|

||

|

By Tax Type |

|

||

|

By Organization Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Tax Management Market by Component (2018-2032)

4.1 Tax Management Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Tax Management Market by Deployment Mode (2018-2032)

5.1 Tax Management Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 On-Premises

Chapter 6: Tax Management Market by Tax Type (2018-2032)

6.1 Tax Management Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Indirect Tax

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Direct Tax

Chapter 7: Tax Management Market by Organization Size (2018-2032)

7.1 Tax Management Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Small & Medium-sized Enterprises (SMEs)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Large Enterprises

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Tax Management Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 FINOLEX INDUSTRIES LTD (INDIA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ADVANCED DRAINAGE SYSTEMS INC. (US)

8.4 CHINA LESSO GROUP HOLDINGS LTD. (CHINA)

8.5 POLYPIPE PLC (UK)

8.6 NATIONAL PIPE AND PLASTICS INC. (US)

8.7 IPEX INC (CANADA)

8.8 AVIENT CORPORATION (US)

8.9 ASTRAL POLYTECHNIK LIMITED (INDIA)

8.10 PMC SPECIALTIES GROUP (US)

8.11 WESTLAKE CHEMICAL CORPORATION (US)

8.12 CHEMPLAST SANMAR LIMITED (INDIA)

8.13 EASTMAN CHEMICAL COMPANY (U.S.)

8.14 SEKISUI CHEMICAL CO. LTD. (JAPAN)

8.15 FORMOSA PLASTICS CORPORATION (TAIWAN)

8.16 TESSENDERLO GROUP (BELGIUM)

8.17 ORBIA ADVANCE CORPORATION S.A.B. DE C.V. (MEXICO)

8.18 ALIAXIS GROUP S.A. (BELGIUM)

8.19 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

8.20 AND OTHER MAJOR PLAYERS

Chapter 9: Global Tax Management Market By Region

9.1 Overview

9.2. North America Tax Management Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Software

9.2.4.2 Services

9.2.5 Historic and Forecasted Market Size by Deployment Mode

9.2.5.1 Cloud

9.2.5.2 On-Premises

9.2.6 Historic and Forecasted Market Size by Tax Type

9.2.6.1 Indirect Tax

9.2.6.2 Direct Tax

9.2.7 Historic and Forecasted Market Size by Organization Size

9.2.7.1 Small & Medium-sized Enterprises (SMEs)

9.2.7.2 Large Enterprises

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Tax Management Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Software

9.3.4.2 Services

9.3.5 Historic and Forecasted Market Size by Deployment Mode

9.3.5.1 Cloud

9.3.5.2 On-Premises

9.3.6 Historic and Forecasted Market Size by Tax Type

9.3.6.1 Indirect Tax

9.3.6.2 Direct Tax

9.3.7 Historic and Forecasted Market Size by Organization Size

9.3.7.1 Small & Medium-sized Enterprises (SMEs)

9.3.7.2 Large Enterprises

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Tax Management Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Software

9.4.4.2 Services

9.4.5 Historic and Forecasted Market Size by Deployment Mode

9.4.5.1 Cloud

9.4.5.2 On-Premises

9.4.6 Historic and Forecasted Market Size by Tax Type

9.4.6.1 Indirect Tax

9.4.6.2 Direct Tax

9.4.7 Historic and Forecasted Market Size by Organization Size

9.4.7.1 Small & Medium-sized Enterprises (SMEs)

9.4.7.2 Large Enterprises

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Tax Management Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Software

9.5.4.2 Services

9.5.5 Historic and Forecasted Market Size by Deployment Mode

9.5.5.1 Cloud

9.5.5.2 On-Premises

9.5.6 Historic and Forecasted Market Size by Tax Type

9.5.6.1 Indirect Tax

9.5.6.2 Direct Tax

9.5.7 Historic and Forecasted Market Size by Organization Size

9.5.7.1 Small & Medium-sized Enterprises (SMEs)

9.5.7.2 Large Enterprises

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Tax Management Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Software

9.6.4.2 Services

9.6.5 Historic and Forecasted Market Size by Deployment Mode

9.6.5.1 Cloud

9.6.5.2 On-Premises

9.6.6 Historic and Forecasted Market Size by Tax Type

9.6.6.1 Indirect Tax

9.6.6.2 Direct Tax

9.6.7 Historic and Forecasted Market Size by Organization Size

9.6.7.1 Small & Medium-sized Enterprises (SMEs)

9.6.7.2 Large Enterprises

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Tax Management Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Software

9.7.4.2 Services

9.7.5 Historic and Forecasted Market Size by Deployment Mode

9.7.5.1 Cloud

9.7.5.2 On-Premises

9.7.6 Historic and Forecasted Market Size by Tax Type

9.7.6.1 Indirect Tax

9.7.6.2 Direct Tax

9.7.7 Historic and Forecasted Market Size by Organization Size

9.7.7.1 Small & Medium-sized Enterprises (SMEs)

9.7.7.2 Large Enterprises

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Tax Management Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 30.59 Bn. |

|

Forecast Period 2024-2032 CAGR: |

11% |

Market Size in 2032: |

USD 70.5 Bn |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Mode |

|

||

|

By Tax Type |

|

||

|

By Organization Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||