Sustainable Pharmaceutical Packaging Market Synopsis

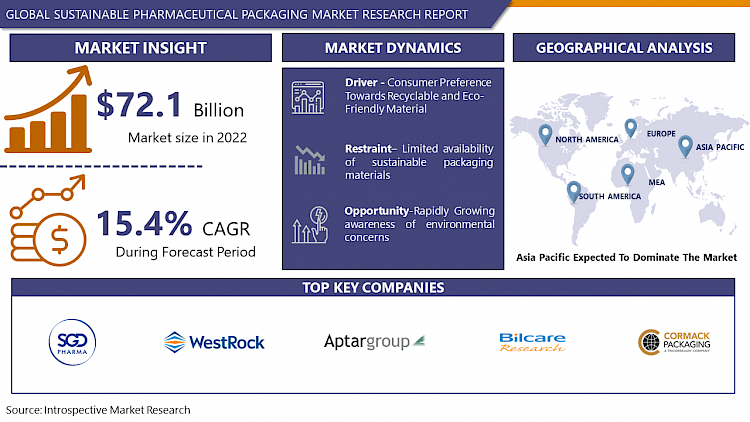

Global Sustainable Pharmaceutical Packaging Market size was valued at USD 72.1 billion in 2022 and is projected to reach USD 226.7 billion by 2030, growing at a CAGR of 15.4 % from 2023 to 2030.

The sustainable pharmaceutical packaging market refers to the segment of the pharmaceutical industry that focuses on creating environmentally friendly and socially responsible packaging solutions for pharmaceutical products.

- This market has emerged in response to growing concerns about the environmental impact of traditional packaging materials, such as plastic, and the pharmaceutical industry's commitment to reducing its carbon footprint. Sustainable pharmaceutical packaging aims to minimize waste, reduce energy consumption, and promote the use of recyclable and biodegradable materials in packaging design.

- There has been a significant growth in consumer preferences and regulatory requirements towards sustainable packaging solutions. Pharmaceutical companies are increasingly adopting eco-friendly packaging practices to meet these demands and enhance their brand image. Sustainable pharmaceutical packaging may include the use of recycled materials, reduced packaging size and weight, and innovative designs that minimize the need for excess packaging.

- The sustainable pharmaceutical packaging market represents a Crucial transformation in the pharmaceutical industry towards more responsible and eco-conscious practices. It reflects the industry's commitment to reducing its environmental footprint and addressing societal concerns about plastic waste and pollution. As consumers become more environmentally conscious and governments enact stricter regulations, the adoption of sustainable pharmaceutical packaging is expected to continue to grow, driving innovation and fostering a more sustainable future for the pharmaceutical sector. This market not only benefits the environment but also aligns with the industry's broader goals of improving public health and well-being.

The Sustainable Pharmaceutical Packaging Market Trend Analysis

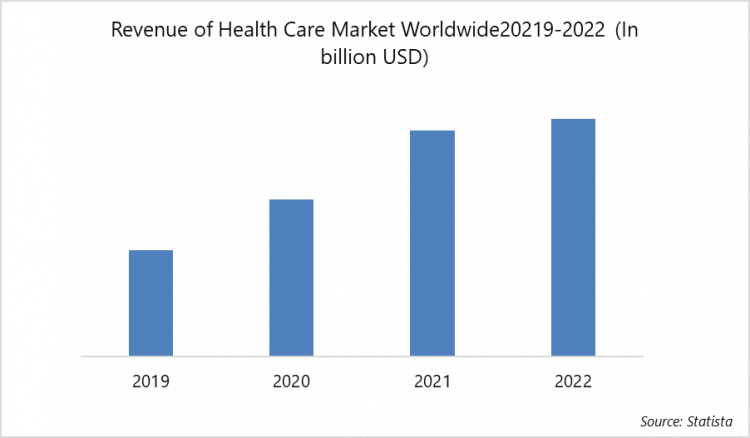

Growing Health Care Industry

- The healthcare industry is experiencing an unprecedented growth in demand for pharmaceutical products. With an aging population, increasing prevalence of chronic diseases, and global healthcare advancements, the need for medications and medical supplies is on the rise. This surge in demand directly translates into a greater requirement for pharmaceutical packaging. Sustainable packaging solutions become essential in meeting this demand while minimizing the environmental impact.

- Governments and regulatory bodies worldwide are increasingly emphasizing sustainability in pharmaceutical packaging. They are imposing stringent environmental regulations to curb plastic waste, reduce carbon emissions, and promote recycling. This regulatory pressure forces pharmaceutical companies to adopt sustainable packaging options to remain compliant and avoid fines or sanctions. many pharmaceutical companies are actively seeking eco-friendly packaging alternatives to align with these regulations and reduce their carbon footprint.

- Patients and healthcare providers are becoming more conscious of the environmental impact of pharmaceutical products, including their packaging. Pharmaceutical companies that embrace sustainable packaging can enhance their brand image, attract environmentally conscious consumers, and build long-term loyalty. This shift in consumer preferences is driving pharmaceutical companies to invest in eco-friendly packaging materials and practices to stay competitive in the market.

According to Statista, the above graph shows the growing healthcare industry revenue.

- The growing healthcare industry has led to a higher demand for pharmaceutical products, resulting in a greater need for sustainable packaging solutions to meet environmental and regulatory requirements.

Rapidly Growing awareness of environmental concerns

- The pharmaceutical industry is under increasing pressure to adopt sustainable practices. Traditional pharmaceutical packaging, often reliant on single-use plastics and energy-intensive manufacturing processes, has been a significant contributor to environmental degradation. This has led to the emergence of the sustainable pharmaceutical packaging market, which seeks to address these issues. Sustainable packaging options include biodegradable materials, recyclable packaging, reduced energy consumption during production, and innovative designs that minimize waste. Moreover, sustainable pharmaceutical packaging extends beyond materials to encompass responsible sourcing, efficient distribution, and end-of-life considerations.

- Rapidly growing awareness of environmental concerns has been a driving force behind the expansion of this market. Consumers and regulatory bodies are increasingly demanding eco-friendly alternatives in pharmaceutical packaging, prompting pharmaceutical companies to re-evaluate their packaging strategies. Furthermore, sustainability in pharmaceutical packaging not only aligns with corporate social responsibility goals but also presents opportunities for cost reduction through improved supply chain efficiency and reduced waste disposal costs. As a result, the industry is witnessing a shift towards sustainable practices and a growing demand for environmentally responsible packaging solutions.

- The Sustainable Pharmaceutical Packaging Market represents a crucial response to the pressing environmental issues associated with traditional pharmaceutical packaging. With the global awareness of environmental concerns on the rise, pharmaceutical companies are recognizing the need to adopt sustainable packaging practices to reduce their carbon footprint and plastic waste. This shift towards sustainability not only benefits the environment but also aligns with the expectations of consumers and regulators. As this market continues to evolve, it is likely to foster innovation and drive positive changes in the pharmaceutical industry, ultimately contributing to a more sustainable future.

Sustainable Pharmaceutical Packaging Market Segment Analysis

Sustainable Pharmaceutical Packaging Market segments cover the Material Type, End-Use Application, and Packaging Type. By Material Type Biodegradable Plastics segment is Anticipated to Dominate the Market Over the Forecast period.

- The pharmaceutical industry is under increasing pressure to adopt sustainable practices. Traditional pharmaceutical packaging, often reliant on single-use plastics and energy-intensive manufacturing processes, has been a significant contributor to environmental degradation. This has led to the emergence of the sustainable pharmaceutical packaging market, which seeks to address these issues. Sustainable packaging options include biodegradable materials, recyclable packaging, reduced energy consumption during production, and innovative designs that minimize waste. Moreover, sustainable pharmaceutical packaging extends beyond materials to encompass responsible sourcing, efficient distribution, and end-of-life considerations.

- Rapidly growing awareness of environmental concerns has been a driving force behind the expansion of this market. Consumers and regulatory bodies are increasingly demanding eco-friendly alternatives in pharmaceutical packaging, prompting pharmaceutical companies to re-evaluate their packaging strategies. Furthermore, sustainability in pharmaceutical packaging not only aligns with corporate social responsibility goals but also presents opportunities for cost reduction through improved supply chain efficiency and reduced waste disposal costs. As a result, the industry is witnessing a shift towards sustainable practices and a growing demand for environmentally responsible packaging solutions.

- The Sustainable Pharmaceutical Packaging Market represents a crucial response to the pressing environmental issues associated with traditional pharmaceutical packaging. With the global awareness of environmental concerns on the rise, pharmaceutical companies are recognizing the need to adopt sustainable packaging practices to reduce their carbon footprint and plastic waste. This shift towards sustainability not only benefits the environment but also aligns with the expectations of consumers and regulators. As this market continues to evolve, it is likely to foster innovation and drive positive changes in the pharmaceutical industry, ultimately contributing to a more sustainable future.

The Sustainable Pharmaceutical Packaging Market Regional Analysis

Asia Pacific is dominating the Market Over the Forecast Period.

- In Asia Pacific most countries have implemented strict environmental regulations and sustainability initiatives to combat pollution and promote eco-friendly practices. This includes regulations on packaging waste, recycling, and the use of environmentally friendly materials. Pharmaceutical companies operating in the region are compelled to adhere to these regulations, leading to a greater emphasis on sustainable packaging options. These regulations also encourage the adoption of sustainable packaging solutions to minimize the environmental impact of pharmaceutical products.

- Growing environmental awareness and changing consumer preferences have contributed significantly to the rise of sustainable packaging in Asia Pacific. Consumers are increasingly seeking products that are packaged in an environmentally responsible manner. As a result, pharmaceutical companies are under pressure to adopt sustainable packaging to meet consumer expectations and maintain brand reputation. This shift in consumer sentiment towards eco-friendly packaging has driven the pharmaceutical industry to invest in sustainable alternatives

- Asia Pacific is known for its cost-effective manufacturing capabilities, making it an attractive region for pharmaceutical companies looking to reduce production costs. Sustainable packaging materials and technologies have become more accessible and affordable in the region due to advancements in manufacturing processes and economies of scale. This cost-effectiveness has incentivized pharmaceutical companies to adopt sustainable packaging solutions, as they seek to balance environmental responsibility with cost savings.

COVID-19 Impact Analysis on Sustainable Pharmaceutical Packaging Market

The COVID-19 pandemic had a Versatile impact on the sustainable pharmaceutical packaging market. the pandemic Increased the global focus on healthcare and pharmaceuticals, leading to increased demand for pharmaceutical products, including vaccines, treatments, and other medications. This rise in demand, along with Increased awareness of health and safety, underscored the importance of secure and sustainable pharmaceutical packaging. On the other hand, disruptions in supply chains, workforce challenges, and economic uncertainties temporarily hindered the adoption of sustainable packaging solutions due to cost considerations and logistical challenges. However, the pandemic also highlighted the vulnerabilities of conventional supply chains, encouraging pharmaceutical companies to explore more resilient and sustainable packaging options for long-term security and environmental responsibility. As a result, the impact of COVID-19 on the sustainable pharmaceutical packaging market was a complex interplay between immediate challenges and a heightened long-term focus on sustainability.

Sustainable Pharmaceutical Packaging Market Top Key Players:

- AptarGroup

- SGD Pharma

- Cormack Packaging

- Westrock

- Körber Medipak Systems

- Billerudkorsnäs

- Sanner Gmbh

- Bilcare Limited

- Constantia Flexibles

- Bemis Company

- Inc.

- Comar

- Nelipak Healthcare Packaging

- Ecolean Ab

- Dupont

- Klockner Pentaplast

- Elopak

- Neopac

- Südpack AND Other Major Players.

Sustainable Pharmaceutical Packaging Market Key Industry Developments

- In January 2023, Amcor, a leading packaging company, announced its commitment to achieving net-zero greenhouse gas emissions by 2050. This includes plans to invest in recycled and renewable materials for its pharmaceutical packaging solutions.

- In February 2023, Sonoco acquired PMC Global, a leading manufacturer of paper-based pharmaceutical packaging solutions. This acquisition strengthens Sonoco's position in the sustainable packaging market and expands its product portfolio.

- In February 2023, Merck done partnership with Alpla, an Austrian plastic packaging giant, to develop and implement sustainable packaging solutions for its pharmaceutical products. This partnership focuses on reducing plastic waste and increasing the use of recycled materials

|

Sustainable Pharmaceutical Packaging Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 72.1 Bn. |

|

Forecast Period 2023-30 CAGR: |

15.4% |

Market Size in 2030: |

USD 226.7 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By End-Use Application |

|

||

|

By Packaging Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET BY MATERIAL TYPE (2016-2030)

- SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BIODEGRADABLE PLASTICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RECYCLED MATERIALS

- PAPER

- CARDBOARD

- SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET BY END-USE APPLICATION (2016-2030)

- SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PRESCRIPTION MEDICATIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OVER-THE-COUNTER (OTC) MEDICATIONS

- BIOPHARMACEUTICALS

- VACCINES

- CLINICAL TRIAL PACKAGING

- SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET BY PACKAGING TYPE (2016-2030)

- SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUSTAINABLE PHARMACEUTICAL PACKAGINGS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- JARS

- BLISTER PACKS

- SYRINGES AND VIALS

- POUCHES

- BAGS AMPOULES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- SUSTAINABLE PHARMACEUTICAL PACKAGING Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- APTARGROUP

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SGD PHARMA

- CORMACK PACKAGING

- WESTROCK

- KÖRBER MEDIPAK SYSTEMS

- BILLERUDKORSNÄS

- SANNER GMBH

- BILCARE LIMITED

- CONSTANTIA FLEXIBLES

- BEMIS COMPANY

- INC.

- COMAR

- NELIPAK HEALTHCARE PACKAGING

- ECOLEAN AB

- DUPONT

- KLOCKNER PENTAPLAST

- ELOPAK

- NEOPAC

- Südpack

- COMPETITIVE LANDSCAPE

- GLOBAL SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Material Type

- Historic And Forecasted Market Size By End-Use Application

- Historic And Forecasted Market Size By Packaging Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Sustainable Pharmaceutical Packaging Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 72.1 Bn. |

|

Forecast Period 2023-30 CAGR: |

15.4% |

Market Size in 2030: |

USD 226.7 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By End-Use Application |

|

||

|

By Packaging Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET COMPETITIVE RIVALRY

TABLE 005. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET THREAT OF SUBSTITUTES

TABLE 007. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET BY MATERIAL TYPE

TABLE 008. BIODEGRADABLE PLASTICS MARKET OVERVIEW (2016-2030)

TABLE 009. RECYCLED MATERIALS MARKET OVERVIEW (2016-2030)

TABLE 010. PAPER MARKET OVERVIEW (2016-2030)

TABLE 011. CARDBOARD MARKET OVERVIEW (2016-2030)

TABLE 012. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET BY END-USE APPLICATION

TABLE 013. PRESCRIPTION MEDICATIONS MARKET OVERVIEW (2016-2030)

TABLE 014. OVER-THE-COUNTER (OTC) MEDICATIONS MARKET OVERVIEW (2016-2030)

TABLE 015. BIOPHARMACEUTICALS MARKET OVERVIEW (2016-2030)

TABLE 016. VACCINES MARKET OVERVIEW (2016-2030)

TABLE 017. CLINICAL TRIAL PACKAGING MARKET OVERVIEW (2016-2030)

TABLE 018. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET BY PACKAGING TYPE

TABLE 019. BOTTLES & CONTAINERS MARKET OVERVIEW (2016-2030)

TABLE 020. BLISTER PACKS MARKET OVERVIEW (2016-2030)

TABLE 021. POUCHES & BAGS MARKET OVERVIEW (2016-2030)

TABLE 022. AMPOULES & VIALS MARKET OVERVIEW (2016-2030)

TABLE 023. NORTH AMERICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 024. NORTH AMERICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY END-USE APPLICATION (2016-2030)

TABLE 025. NORTH AMERICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE (2016-2030)

TABLE 026. N SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 027. EASTERN EUROPE SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 028. EASTERN EUROPE SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY END-USE APPLICATION (2016-2030)

TABLE 029. EASTERN EUROPE SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE (2016-2030)

TABLE 030. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 031. WESTERN EUROPE SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 032. WESTERN EUROPE SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY END-USE APPLICATION (2016-2030)

TABLE 033. WESTERN EUROPE SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE (2016-2030)

TABLE 034. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 035. ASIA PACIFIC SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 036. ASIA PACIFIC SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY END-USE APPLICATION (2016-2030)

TABLE 037. ASIA PACIFIC SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE (2016-2030)

TABLE 038. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 039. MIDDLE EAST & AFRICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 040. MIDDLE EAST & AFRICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY END-USE APPLICATION (2016-2030)

TABLE 041. MIDDLE EAST & AFRICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE (2016-2030)

TABLE 042. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 043. SOUTH AMERICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 044. SOUTH AMERICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY END-USE APPLICATION (2016-2030)

TABLE 045. SOUTH AMERICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE (2016-2030)

TABLE 046. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY (2016-2030)

TABLE 047. APTARGROUP: SNAPSHOT

TABLE 048. APTARGROUP: BUSINESS PERFORMANCE

TABLE 049. APTARGROUP: PRODUCT PORTFOLIO

TABLE 050. APTARGROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. SGD PHARMA: SNAPSHOT

TABLE 051. SGD PHARMA: BUSINESS PERFORMANCE

TABLE 052. SGD PHARMA: PRODUCT PORTFOLIO

TABLE 053. SGD PHARMA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. CORMACK PACKAGING: SNAPSHOT

TABLE 054. CORMACK PACKAGING: BUSINESS PERFORMANCE

TABLE 055. CORMACK PACKAGING: PRODUCT PORTFOLIO

TABLE 056. CORMACK PACKAGING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. WESTROCK: SNAPSHOT

TABLE 057. WESTROCK: BUSINESS PERFORMANCE

TABLE 058. WESTROCK: PRODUCT PORTFOLIO

TABLE 059. WESTROCK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. KÖRBER MEDIPAK SYSTEMS: SNAPSHOT

TABLE 060. KÖRBER MEDIPAK SYSTEMS: BUSINESS PERFORMANCE

TABLE 061. KÖRBER MEDIPAK SYSTEMS: PRODUCT PORTFOLIO

TABLE 062. KÖRBER MEDIPAK SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BILLERUDKORSNÄS: SNAPSHOT

TABLE 063. BILLERUDKORSNÄS: BUSINESS PERFORMANCE

TABLE 064. BILLERUDKORSNÄS: PRODUCT PORTFOLIO

TABLE 065. BILLERUDKORSNÄS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SANNER GMBH: SNAPSHOT

TABLE 066. SANNER GMBH: BUSINESS PERFORMANCE

TABLE 067. SANNER GMBH: PRODUCT PORTFOLIO

TABLE 068. SANNER GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. BILCARE LIMITED: SNAPSHOT

TABLE 069. BILCARE LIMITED: BUSINESS PERFORMANCE

TABLE 070. BILCARE LIMITED: PRODUCT PORTFOLIO

TABLE 071. BILCARE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. CONSTANTIA FLEXIBLES: SNAPSHOT

TABLE 072. CONSTANTIA FLEXIBLES: BUSINESS PERFORMANCE

TABLE 073. CONSTANTIA FLEXIBLES: PRODUCT PORTFOLIO

TABLE 074. CONSTANTIA FLEXIBLES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. BEMIS COMPANY: SNAPSHOT

TABLE 075. BEMIS COMPANY: BUSINESS PERFORMANCE

TABLE 076. BEMIS COMPANY: PRODUCT PORTFOLIO

TABLE 077. BEMIS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. INC.: SNAPSHOT

TABLE 078. INC.: BUSINESS PERFORMANCE

TABLE 079. INC.: PRODUCT PORTFOLIO

TABLE 080. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. COMAR: SNAPSHOT

TABLE 081. COMAR: BUSINESS PERFORMANCE

TABLE 082. COMAR: PRODUCT PORTFOLIO

TABLE 083. COMAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. NELIPAK HEALTHCARE PACKAGING: SNAPSHOT

TABLE 084. NELIPAK HEALTHCARE PACKAGING: BUSINESS PERFORMANCE

TABLE 085. NELIPAK HEALTHCARE PACKAGING: PRODUCT PORTFOLIO

TABLE 086. NELIPAK HEALTHCARE PACKAGING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. ECOLEAN AB: SNAPSHOT

TABLE 087. ECOLEAN AB: BUSINESS PERFORMANCE

TABLE 088. ECOLEAN AB: PRODUCT PORTFOLIO

TABLE 089. ECOLEAN AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. DUPONT: SNAPSHOT

TABLE 090. DUPONT: BUSINESS PERFORMANCE

TABLE 091. DUPONT: PRODUCT PORTFOLIO

TABLE 092. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. KLOCKNER PENTAPLAST: SNAPSHOT

TABLE 093. KLOCKNER PENTAPLAST: BUSINESS PERFORMANCE

TABLE 094. KLOCKNER PENTAPLAST: PRODUCT PORTFOLIO

TABLE 095. KLOCKNER PENTAPLAST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. ELOPAK: SNAPSHOT

TABLE 096. ELOPAK: BUSINESS PERFORMANCE

TABLE 097. ELOPAK: PRODUCT PORTFOLIO

TABLE 098. ELOPAK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. NEOPAC: SNAPSHOT

TABLE 099. NEOPAC: BUSINESS PERFORMANCE

TABLE 100. NEOPAC: PRODUCT PORTFOLIO

TABLE 101. NEOPAC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. SÜDPACK: SNAPSHOT

TABLE 102. SÜDPACK: BUSINESS PERFORMANCE

TABLE 103. SÜDPACK: PRODUCT PORTFOLIO

TABLE 104. SÜDPACK: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET OVERVIEW BY MATERIAL TYPE

FIGURE 012. BIODEGRADABLE PLASTICS MARKET OVERVIEW (2016-2030)

FIGURE 013. RECYCLED MATERIALS MARKET OVERVIEW (2016-2030)

FIGURE 014. PAPER MARKET OVERVIEW (2016-2030)

FIGURE 015. CARDBOARD MARKET OVERVIEW (2016-2030)

FIGURE 016. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET OVERVIEW BY END-USE APPLICATION

FIGURE 017. PRESCRIPTION MEDICATIONS MARKET OVERVIEW (2016-2030)

FIGURE 018. OVER-THE-COUNTER (OTC) MEDICATIONS MARKET OVERVIEW (2016-2030)

FIGURE 019. BIOPHARMACEUTICALS MARKET OVERVIEW (2016-2030)

FIGURE 020. VACCINES MARKET OVERVIEW (2016-2030)

FIGURE 021. CLINICAL TRIAL PACKAGING MARKET OVERVIEW (2016-2030)

FIGURE 022. SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET OVERVIEW BY PACKAGING TYPE

FIGURE 023. BOTTLES & CONTAINERS MARKET OVERVIEW (2016-2030)

FIGURE 024. BLISTER PACKS MARKET OVERVIEW (2016-2030)

FIGURE 025. POUCHES & BAGS MARKET OVERVIEW (2016-2030)

FIGURE 026. AMPOULES & VIALS MARKET OVERVIEW (2016-2030)

FIGURE 027. NORTH AMERICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 028. EASTERN EUROPE SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 029. WESTERN EUROPE SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 030. ASIA PACIFIC SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 031. MIDDLE EAST & AFRICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 032. SOUTH AMERICA SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Sustainable Pharmaceutical Packaging Market research report is 2023-2030.

AptarGroup, SGD Pharma, Cormack Packaging, Westrock, Körber Medipak Systems, Billerudkorsnäs, Sanner Gmbh, Bilcare Limited, Constantia Flexibles, Bemis Company, Inc., Comar, Nelipak Healthcare Packaging, Ecolean Ab, Dupont, Klockner Pentaplast, Elopak, Neopac, Südpack and Other Major Players.

The Sustainable Pharmaceutical Packaging Market is segmented into Material Type, End-Use Application, Packaging Type, and Region. By Material Type, the market is categorized into Biodegradable Plastics, Recycled Materials, Paper, And Cardboard. By End-Use Applications, the market is categorized into Prescription Medications, Over-The-Counter (OTC) Medications, Biopharmaceuticals, Vaccines, and Clinical Trial Packaging. By Packaging Type, the market is categorized into Bottles and containers, Blister Packs, Pouches and bags, Ampoules & Vials. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The sustainable pharmaceutical packaging market refers to the segment of the pharmaceutical industry that focuses on creating environmentally friendly and socially responsible packaging solutions for pharmaceutical products. This market has emerged in response to growing concerns about the environmental impact of traditional packaging materials, such as plastic, and the pharmaceutical industry's commitment to reducing its carbon footprint. Sustainable pharmaceutical packaging aims to minimize waste, reduce energy consumption, and promote the use of recyclable and biodegradable materials in packaging design.

Global Sustainable Pharmaceutical Packaging Market size was valued at USD 72.1 billion in 2022 and is projected to reach USD 226.7 billion by 2030, growing at a CAGR of 15.4 % from 2023 to 2030.