Surgical Generators Market Synopsis

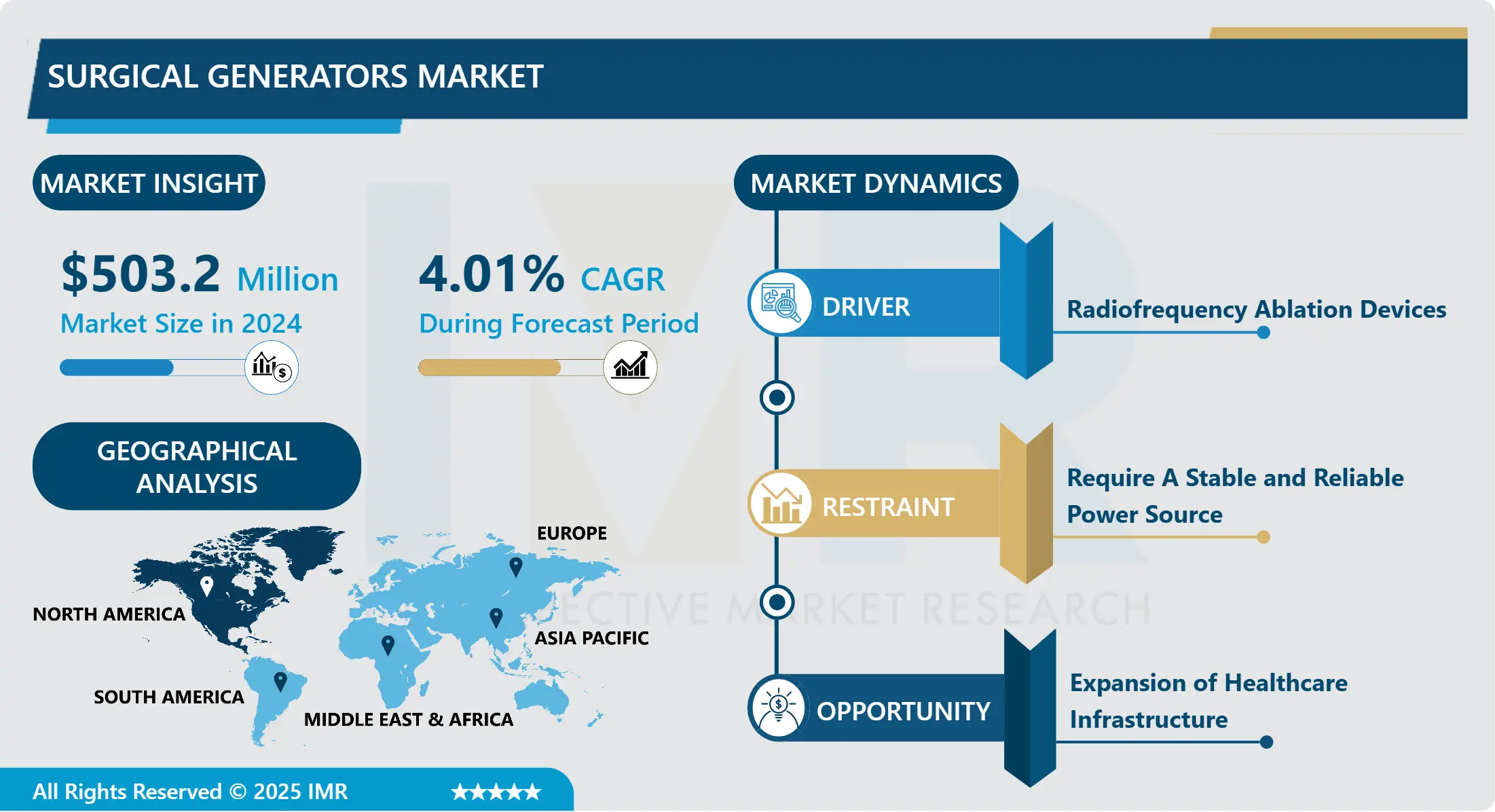

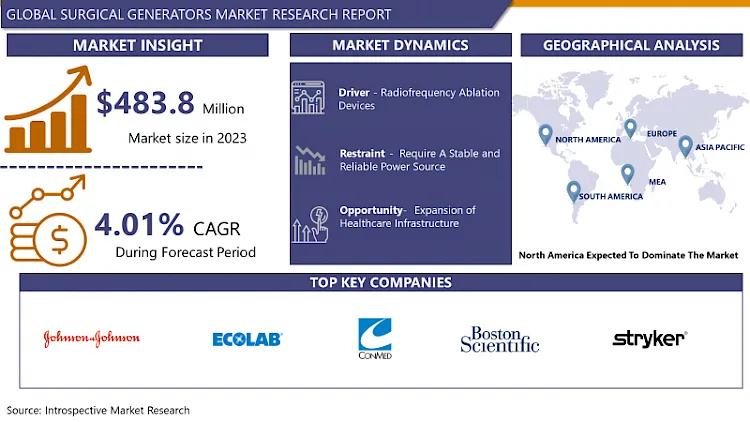

Surgical Generators Market Size Was Valued at USD 503.2 million in 2024, and is Projected to Reach USD 689.19 million by 2032, Growing at a CAGR of 4.01% From 2025-2032.

Surgical generators are medical devices used in surgical procedures to produce various types of energy such as electrical, radiofrequency, microwave, or ultrasonic energy. These devices are essential for cutting, coagulating, dissecting, or ablating tissue during surgery. They are designed to provide precise control and efficiency, allowing surgeons to perform procedures with greater accuracy and safety.

Surgical generators are devices used in various medical procedures to deliver electrical energy for cutting, coagulating, and sealing tissues. They are essential tools in surgical settings and find application in numerous procedures across different medical specialties. Surgical generators are primarily used in electrosurgery, a technique that uses high-frequency electrical currents to cut, coagulate, and seal tissue during surgical procedures. Surgical generators are often integrated into endoscopic devices for minimally invasive procedures such as laparoscopy, arthroscopy, and cystoscopy. They provide the necessary energy for cutting and coagulating tissues during these procedures.

Surgical generators are used in various ablation procedures to remove or destroy abnormal tissue growth, such as tumors or cardiac arrhythmias. Techniques like radiofrequency ablation (RFA), microwave ablation, and cryoablation rely on surgical generators to deliver energy to the target tissue. In plastic and reconstructive surgery, surgical generators are used for procedures. They help surgeons achieve precise results while minimizing damage to surrounding tissues. Surgical generators are used in gynecological procedures such as hysterectomy, ovarian cyst removal, and endometrial ablation. They facilitate the cutting and coagulation of tissues in the reproductive organs with precision and control.

Surgical generators play a crucial role in urological procedures. They help surgeons effectively manage bleeding and achieve hemostasis during these surgeries. In neurosurgical procedures, surgical generators are used for tasks such as tissue dissection, tumor removal, and pain management. As the population grows and ages, the number of surgeries performed increases, making surgical generators crucial in operating rooms. They enable advancements in surgical techniques, such as minimally invasive procedures and robotic surgery.

Surgical generators deliver precise energy to tissues, ensuring efficient cutting and coagulation while minimizing damage to surrounding structures. Healthcare regulations mandate the maintenance of up-to-date equipment, leading to demand for new models. Manufacturers continuously introduce new technologies to improve the performance, efficiency, and safety of surgical generators, attracting healthcare providers to stay competitive and enhance their surgical capabilities.

Surgical Generators Market Trend Analysis

Radiofrequency Ablation Devices

- The driver of Surgical Generators and Radiofrequency Ablation devices is responsible for operating and maintaining these specialized medical devices used in surgical procedures. They must be understanding of the equipment's functionality and be trained in its proper usage to ensure safe and effective operation. Set up the surgical generator and radiofrequency ablation devices before the procedure.

- The procedure includes connecting cables, calibrating settings, and ensuring all components are functioning properly. During the surgical procedure, the driver operates the surgical generator and radiofrequency ablation devices according to the surgeon's instructions. They must carefully monitor the equipment to ensure it is delivering the appropriate energy levels and achieving the desired results.

- In the event of any technical issues or malfunctions with the equipment, the driver must be able to troubleshoot and resolve the problem quickly to minimize disruption to the procedure. Regular maintenance and calibration of the surgical generator and radiofrequency ablation devices are essential to ensure their continued reliability and accuracy.

- Accurate record-keeping is crucial in the medical field, and the driver must maintain detailed documentation of equipment usage, procedures performed, and any maintenance or troubleshooting activities. The driver must adhere to all relevant regulations and guidelines governing the use of medical devices, including proper sterilization procedures and safety protocols.

Restraints

Require A Stable And Reliable Power Source

- Surgical generators require a stable power source to ensure consistent performance. Fluctuations in the power supply can disrupt the operation of the generator, leading to potential errors or inconsistencies in the surgical procedure. Sudden increases in voltage can damage the components of a surgical generator, leading to malfunctions or even complete failure. A stable power source is necessary to prevent these spikes and protect the equipment.

- Surgical generators often operate within specific frequency ranges to achieve optimal performance. Variations in the frequency of the power source can affect the output of the generator, potentially impacting the surgical procedure. Any interruption in the power supply, whether due to power outages or fluctuations, can disrupt the operation of a surgical generator. This can be particularly problematic during critical stages of a surgical procedure, emphasizing the need for a reliable power source.

Opportunity

Expansion Of Healthcare Infrastructure

- As healthcare systems grow and evolve, there is an increasing demand for advanced medical equipment to support surgical procedures. This expansion includes the construction of new hospitals, clinics, and healthcare facilities, as well as the upgrading of existing infrastructure with state-of-the-art technology.

- With the expansion of healthcare infrastructure, there is a need for surgical generators to power various medical devices used in surgical procedures. Surgical generators play a crucial role in providing the necessary energy for cutting, coagulating, and sealing tissues during surgeries, thereby enhancing the efficiency and precision of surgical interventions.

- As healthcare facilities strive to improve patient outcomes and enhance operational efficiency, there is a growing emphasis on investing in advanced medical equipment such as surgical generators. This presents a significant opportunity for manufacturers and suppliers of surgical generators to capitalize on the increasing demand driven by the expansion of healthcare infrastructure.

- The adoption of minimally invasive surgical techniques, which require specialized equipment including surgical generators, is also contributing to the growth of the market. These factors combined create a favorable environment for the expansion of the Surgical Generators market, presenting lucrative opportunities for companies operating in this space.

Challenges

Effectively Differentiating The Products

- The market for surgical generators is highly competitive, with numerous players offering similar products. The saturation makes it difficult for companies to stand out and differentiate their offerings. Many surgical generator products offer similar technological features and capabilities, making it challenging for companies to distinguish their products based on technology alone.

- Intense competition in the market can lead to pricing pressure, as companies may engage in price wars to gain market share. This can make it challenging for companies to differentiate their products based on price. Surgical generators are subject to stringent regulatory requirements, which can limit the extent to which companies can differentiate their products based on features or performance.

- Healthcare providers high expectations it comes to the performance, reliability, and safety of surgical generators. Continuously innovating and introducing new features or technologies that address unmet needs or improve the user experience can help companies differentiate their products. Providing comprehensive customer education and support services can help companies build loyalty and differentiate their products based on the level of service they offer.

Surgical Generators Market Segment Analysis:

Surgical Generators Market Segmented based on Product, End-users and Region.

By Product, Electrosurgical RF Generators segment is expected to dominate the market during the forecast period

- Electrosurgical RF Generators offer a wide range of functionalities, including cutting, coagulation, and tissue ablation. This versatility makes them suitable for various surgical procedures across different specialties, from general surgery to specialties like orthopedics, gynecology, and urology. These generators provide surgeons with precise control over the surgical process, allowing for accurate tissue cutting and coagulation. This level of control is essential for achieving optimal surgical outcomes while minimizing the risk of complications such as bleeding and tissue damage.

- Electrosurgical RF Generators are known for their efficiency in surgical procedures, helping to reduce operating times and improve overall surgical efficiency. This is particularly important in the healthcare landscape, where there is increasing pressure to enhance operating room productivity and reduce healthcare costs. Continuous advancements in technology led to the development of advanced Electrosurgical RF Generators with features such as tissue impedance monitoring, energy modulation, and integrated safety mechanisms.

- These technological innovations enhanced the performance and safety of these generators, contributing to their widespread adoption. Electrosurgical RF Generators used in surgical procedures for decades and have established a proven track record of safety and efficacy. This long history of use has instilled confidence among surgeons and healthcare providers, leading to their continued preference for the surgical setting.

By End User, Hospitals segment held the largest share in 2024

- Hospitals tend to have higher patient volumes compared to other healthcare facilities such as ambulatory surgery centers or specialty clinics. This higher patient volume translates to a greater demand for surgical procedures, thereby driving the need for surgical generators. Hospitals offer a wide range of surgical specialties, including general surgery, orthopedics, neurosurgery, cardiothoracic surgery, and more. Each specialty may require specific surgical procedures and techniques, often necessitating specialized surgical equipment like generators.

- Hospitals typically provide comprehensive healthcare services, including both elective and emergency surgeries. Hospitals need to maintain a wide array of surgical equipment to meet the needs of their patients. Surgical generators are essential tools used in various surgical procedures across different departments within hospitals. Hospitals often have larger budgets compared to other healthcare facilities, enabling them to invest in advanced medical technologies and equipment. This financial capability allows hospitals to procure high-quality surgical generators and upgrade their equipment regularly to ensure optimal patient care.

Surgical Generators Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America, particularly the United States boasts a highly developed healthcare infrastructure with modern hospitals, ambulatory surgery centers, and specialty clinics. These facilities are equipped with state-of-the-art surgical equipment, including generators, to meet the needs of patients. The region is at the forefront of technological innovation in healthcare. Companies based in North America, along with research institutions and medical device manufacturers, continually develop and introduce advanced surgical generators with innovative features and functionalities. This technological prowess drives demand for surgical generators in the region.

- North America has one of the highest healthcare expenditures globally, with substantial investments in medical equipment and technologies. The willingness of healthcare providers to invest in cutting-edge surgical equipment contributes to the dominance of the surgical generator market in the region. The aging population and increasing prevalence of chronic diseases in North America have led to a higher demand for surgical interventions. there is a growing need for surgical generators to support various surgical procedures across different medical specialties.

Surgical Generators Market Top Key Players:

- Johnson & Johnson (US)

- Ecolab Inc. (US)

- KLS Martin LP (US)

- ConMed Corporation (US)

- Boston Scientific Corporation (US)

- Stryker Corporation (US)

- Ethicon Inc. (US)

- CooperSurgical, Inc. (US)

- Kirwan Surgical Products LLC (US)

- Symmetry Surgical Inc. (US)

- Utah Medical Products, Inc. (US)

- Megadyne Medical Products Inc. (US)

- AngioDynamics, Inc. (US)

- Zimmer Biomet Holdings, Inc. (US)

- B. Braun Melsungen AG (Germany)

- ATMOS MedizinTechnik GmbH & Co. KG (Germany)

- Elekta AB (Sweden)

- Medtronic (Ireland)

- XcelLance Medical Technologies Pvt. Ltd. (India)

- Olympus Corporation (Japan)

- Other Active players

Key Industry Developments in the Surgical Generators Market:

- In November 2023, CooperCompanies announced the acquisition of select Cook Medical assets focused primarily on the obstetrics, doppler monitoring, and gynecology surgery markets. This acquisition is a fantastic strategic fit for CooperSurgical. “The acquired products are highly synergistic with CooperSurgical’s existing portfolio of medical devices and strengthen CooperSurgical’s position as a leading global fertility and women’s health company.”

- In November 2023, Boston Scientific Corporation announced a definitive agreement to acquire Apollo Endosurgery, Inc. The Apollo Endosurgery product portfolio includes devices used during endoluminal surgery (ELS) procedures to close gastrointestinal defects, manage gastrointestinal complications, and aid in weight loss for patients suffering from obesity. ELS provides a less-invasive alternative to open and laparoscopic surgery for patients with diseases in the gastrointestinal tract or morbid obesity while providing the potential for quicker recovery and minimizing the risks of surgical complications.

|

Global Surgical Generators Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

503.2 Mn |

|

Forecast Period 2025-32 CAGR: |

4.01% |

Market Size in 2032: |

689.19 Mn |

|

Segments Covered: |

By Product |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surgical Generators Market by Product (2018-2032)

4.1 Surgical Generators Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Electrosurgical RF Generators

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Electrocautery Generators

4.5 Ultrasonic Generators

4.6 Argon Plasma Coagulation Generators

Chapter 5: Surgical Generators Market by End User (2018-2032)

5.1 Surgical Generators Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ambulatory Surgery Centers

5.5 Specialty Clinics

5.6 Trauma Center

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Surgical Generators Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BARILLA GROUP (ITALY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DE CECCO (ITALY)

6.4 COLAVITA (ITALY)

6.5 BIONATURAE LLC(USA)

6.6 RUMMO (ITALY)

6.7 NUOVO PASTA (USA)

6.8 THE ONLY BEAN (USA)

6.9 GENERAL MILLS INC (USA)

6.10 NESTLÉ (SWITZERLAND)

6.11 GAROFALO (ITALY)

6.12 BANZA LLC (USA)

6.13 SEGGIANO LTD (UK)

6.14 OTHERS

6.15

Chapter 7: Global Surgical Generators Market By Region

7.1 Overview

7.2. North America Surgical Generators Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product

7.2.4.1 Electrosurgical RF Generators

7.2.4.2 Electrocautery Generators

7.2.4.3 Ultrasonic Generators

7.2.4.4 Argon Plasma Coagulation Generators

7.2.5 Historic and Forecasted Market Size by End User

7.2.5.1 Hospitals

7.2.5.2 Ambulatory Surgery Centers

7.2.5.3 Specialty Clinics

7.2.5.4 Trauma Center

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Surgical Generators Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product

7.3.4.1 Electrosurgical RF Generators

7.3.4.2 Electrocautery Generators

7.3.4.3 Ultrasonic Generators

7.3.4.4 Argon Plasma Coagulation Generators

7.3.5 Historic and Forecasted Market Size by End User

7.3.5.1 Hospitals

7.3.5.2 Ambulatory Surgery Centers

7.3.5.3 Specialty Clinics

7.3.5.4 Trauma Center

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Surgical Generators Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product

7.4.4.1 Electrosurgical RF Generators

7.4.4.2 Electrocautery Generators

7.4.4.3 Ultrasonic Generators

7.4.4.4 Argon Plasma Coagulation Generators

7.4.5 Historic and Forecasted Market Size by End User

7.4.5.1 Hospitals

7.4.5.2 Ambulatory Surgery Centers

7.4.5.3 Specialty Clinics

7.4.5.4 Trauma Center

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Surgical Generators Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product

7.5.4.1 Electrosurgical RF Generators

7.5.4.2 Electrocautery Generators

7.5.4.3 Ultrasonic Generators

7.5.4.4 Argon Plasma Coagulation Generators

7.5.5 Historic and Forecasted Market Size by End User

7.5.5.1 Hospitals

7.5.5.2 Ambulatory Surgery Centers

7.5.5.3 Specialty Clinics

7.5.5.4 Trauma Center

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Surgical Generators Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product

7.6.4.1 Electrosurgical RF Generators

7.6.4.2 Electrocautery Generators

7.6.4.3 Ultrasonic Generators

7.6.4.4 Argon Plasma Coagulation Generators

7.6.5 Historic and Forecasted Market Size by End User

7.6.5.1 Hospitals

7.6.5.2 Ambulatory Surgery Centers

7.6.5.3 Specialty Clinics

7.6.5.4 Trauma Center

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Surgical Generators Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product

7.7.4.1 Electrosurgical RF Generators

7.7.4.2 Electrocautery Generators

7.7.4.3 Ultrasonic Generators

7.7.4.4 Argon Plasma Coagulation Generators

7.7.5 Historic and Forecasted Market Size by End User

7.7.5.1 Hospitals

7.7.5.2 Ambulatory Surgery Centers

7.7.5.3 Specialty Clinics

7.7.5.4 Trauma Center

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Surgical Generators Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

503.2 Mn |

|

Forecast Period 2025-32 CAGR: |

4.01% |

Market Size in 2032: |

689.19 Mn |

|

Segments Covered: |

By Product |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||