Surgical Drapes Market Synopsis

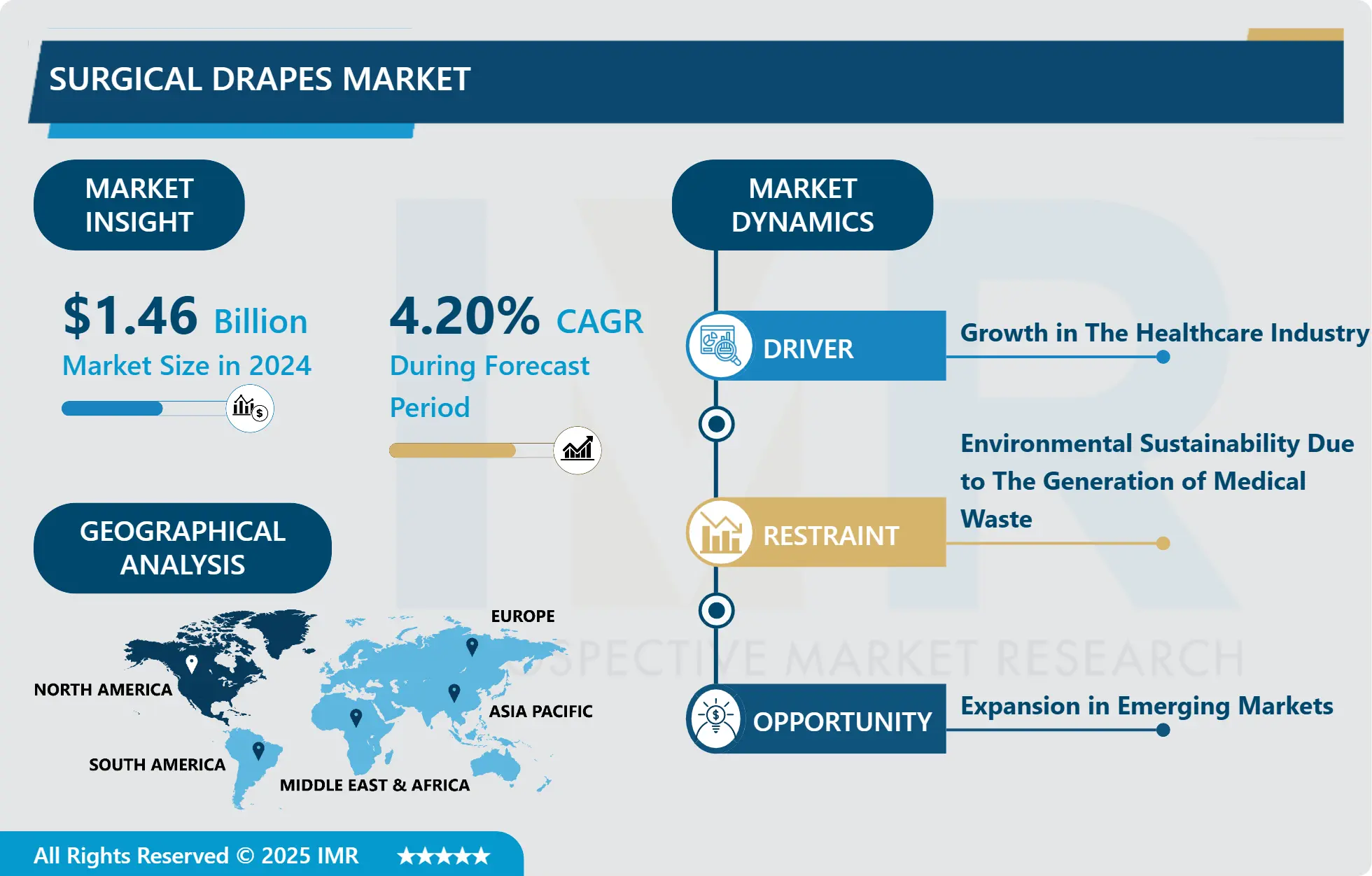

Surgical Drapes Market Size Was Valued at USD 1.46 Billion in 2024 and is Projected to Reach USD 2.03 Billion by 2032, Growing at a CAGR of 4.20% From 2025-2032

Surgical drapes are sterile coverings used to create a barrier between the surgical site and the surrounding environment during surgical procedures. They are made of non-woven or woven materials and are designed to prevent the transmission of microorganisms, maintain a sterile field, and protect the patient and surgical team from contamination. Surgical drapes come in various sizes and configurations to accommodate different types of surgeries and are an essential part of maintaining a sterile operating environment.

Surgical drapes are essential tools in medical procedures, providing a sterile barrier between the surgical site and non-sterile surfaces, reducing the risk of infections. They also help isolate the surgical site, allowing surgeons and medical staff to focus on the operation without interference from surrounding tissues or fluids. Drapes absorb or repel fluids, keeping the surgical field dry and visible, and preventing contamination. They also protect the surgical team from exposure to bloodborne pathogens. Surgical drapes are often made of soft, non-irritating materials, with features like adhesive edges or fenestrations to ensure proper positioning and access to the surgical site.

They also prevent cross-contamination between the patient and the surgical team or equipment. Surgical drapes are essential for creating a sterile barrier between the surgical site and non-sterile areas, preventing infections and minimizing contamination. They also contribute to patient safety by reducing the risk of contamination during procedures. Regulatory compliance with standards set by organizations like the CDC and WHO drives the demand for surgical drapes in healthcare facilities worldwide.

Surgical drapes are available in various sizes, shapes, and materials to accommodate different surgical procedures. High-quality drapes provide reliable barrier protection, fluid resistance, and durability, enhancing patient outcomes. Comfortable and non-irritating surgical drapes contribute to a positive surgical experience. The global surgical drapes market is driven by factors such as increasing surgical volumes, advancements in techniques, rising infection control awareness, and expanding healthcare infrastructure.

Surgical Drapes Market Trend Analysis- Growth in The Healthcare Industry

- The healthcare industry is experiencing a surge in surgical procedures due to factors like population growth, aging demographics, medical technology advancements, and chronic disease prevalence. This growth has led to a greater demand for surgical drapes to maintain sterile environments and prevent infections. The expansion of healthcare infrastructure, such as new hospitals, ambulatory surgical centers, and specialty clinics, is increased the demand for surgical supplies, including drapes.

- The rise in ambulatory surgery, which offers efficient and cost-effective alternatives, it also driven the demand for surgical drapes in these facilities. Advancements in surgical techniques, such as minimally invasive procedures like laparoscopy and robotic surgery, have expanded the scope of surgical interventions and increased the complexity of procedures. As a result, the demand for high-quality surgical drapes that meet stringent regulatory standards continues to grow.

- Surgical drapes play a critical role in maintaining a sterile field during surgery, thereby reducing the risk of surgical site infections (SSIs). With an increased focus on infection prevention and patient safety, the demand for high-quality surgical drapes that meet stringent regulatory standards continues to grow.

Surgical Drapes Market Restraints- Environmental Sustainability Due to The Generation Of Medical Waste

- Healthcare facilities are increasingly utilizing single-use surgical drapes, which contribute to environmental pollution through increased waste generation, particularly non-biodegradable materials like plastics and synthetic fibers. Proper disposal methods, such as incineration or landfilling, can have negative environmental impacts, including air pollution, greenhouse gas emissions, and soil contamination.

- The production of disposable drapes requires finite resources, energy, and water, further exacerbating sustainability concerns. Some drapes may contain chemicals or additives, posing risks to ecosystems, wildlife, and human health. The demand for eco-friendly alternatives has led to the exploration of reusable or recyclable drapes and biodegradable materials to reduce environmental impact and promote responsible waste management practices.

Surgical Drapes Market Opportunity - Expansion in Emerging Markets

- Emerging markets are experiencing rapid development in healthcare infrastructure, leading to a significant demand for surgical drapes to maintain sterility during procedures. With economic growth and improved healthcare access, there is a rise in traditional and minimally invasive surgeries, all of which require the use of surgical drapes. The demand for high-quality surgical drapes that comply with international standards for sterility and barrier protection is increasing, providing an opportunity for manufacturers to offer innovative products tailored to these markets.

- Cost-effective solutions are also being developed, while government initiatives and regulations are implementing guidelines to improve healthcare standards. Collaborations with local distributors, healthcare providers, and government agencies can facilitate market entry and expansion. Investing in education and training programs for healthcare professionals can increase awareness about proper surgical draping techniques and the benefits of using high-quality drapes, driving adoption rates and fostering long-term customer relationships.

Surgical Drapes Market Challenges- Competition from Alternative Solutions

- Hospitals and surgical centers are considering alternative infection control methods, such as antimicrobial coatings, UV disinfection systems, or disposable surgical garments, instead of relying solely on surgical drapes. These alternatives may offer comparable or superior protection against infections, impacting the demand for surgical drapes. Cost-effectiveness is another factor, as reusable drapes or advanced sterilization technology may be perceived as more cost-effective.

- Technological advancements, such as barrier materials and robotic surgery techniques, may introduce new alternatives to traditional surgical drapes. Environmental concerns and regulatory compliance could also drive healthcare facilities to seek alternatives to disposable products. To address these challenges, manufacturers in the surgical drapes market must innovate, emphasize the unique benefits of surgical drapes, adapt to customer preferences, and collaborate with healthcare providers to develop tailored solutions.

Surgical Drapes Market Segment Analysis:

Surgical Drapes Market Segmented based on type, material, and end-users.

By Type, Disposable segment is expected to dominate the market during the forecast period

- Disposable drapes are a popular choice in healthcare settings due to their ability to reduce cross-contamination and surgical site infections, saving time and resources. They are also cost-effective, as they eliminate the need for cleaning, sterilization, and inventory management associated with reusable drapes. Despite their initial cost, the overall cost of ownership is lower due to savings in labor, water, energy, and detergent expenses.

- Disposable drapes often align with regulatory guidelines and standards related to infection control and patient safety, attracting increased demand for high-quality products. Technological advancements have also contributed to the widespread adoption of disposable drapes in surgical settings.

By Application, Non-woven segment held the largest share of 60% in 2024

- Non-woven materials are sterile, ensuring a sterile environment in surgical settings without additional sterilization processes. They offer excellent barrier properties against microorganisms, fluids, and particulate matter, minimizing contamination risk. They are cost-effective, requiring less labor and energy during manufacturing and eliminating the need for reprocessing.

- Non-woven materials can be customized to meet specific surgical procedures, including fenestrations, adhesive edges, and fluid control capabilities. They are lightweight, breathable, and flexible, providing comfort and performance during surgeries. Their conformability ensures optimal coverage and protection throughout the procedure.

Surgical Drapes Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, particularly the United States and Canada, is a strong healthcare infrastructure, leading to a high demand for surgical procedures and the use of surgical drapes. The region's high healthcare spending, stringent regulatory standards, and large volume of surgical procedures contribute to its market dominance.

- Surgical drapes are essential for maintaining a sterile environment and preventing cross-contamination, aligning with the region's focus on patient safety. Technological advancements in materials, manufacturing processes, and design techniques further enhance the performance, safety, and usability of surgical drapes. The region's emphasis on infection control and prevention further solidifies its market dominance.

Surgical Drapes Market Top Key Players:

- M Company (US)

- Cardinal Health, Inc. (US)

- Aspen Surgical (US)

- Exact Medical (US)

- Guardian (US)

- Thermo Fisher Scientific Inc. (US)

- Steris Corporation (US)

- Ansell Healthcare Products LLC (US)

- Mölnlycke Health Care AB (Sweden)

- PAUL HARTMANN AG (Germany)

- Aspide Medical (Italy)

- Ahlstrom-Munksjö (Finland)

- Alan Medical (China)

- ATS Surgical Pvt. Ltd. (India)

- Amaryllis Healthcare (India)

- Pal Surgical Works (India)

- Surgeine Healthcare (India)

- Surgipro (India)

- Medicare Hygiene Limited (India)

- Priontex (South Africa), and Other Active Players

Key Industry Developments in the Surgical Drapes Market:

- In June 2023, BD a leading global medical technology company, announced a definitive agreement to sell its Surgical Instrumentation platform to STERIS. The divestiture will include V. Mueller™, Snowden-Pencer™ and Genesis™ branded products and three manufacturing facilities located in St. Louis, Mo., Cleveland, Ohio, and Tuttlingen, Germany.

- In March 2023, Cardinal Health (NYSE: CAH) today launched the first surgical incise drape using industry-leading antiseptic Chlorhexidine Gluconate (CHG). The drape features Avery Dennison's patented BeneHold™ CHG adhesive technology, which helps reduce the risk of surgical site contamination with organisms typically associated with surgical site infections (SSIs)

|

Global Surgical Drapes Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

1.46 Billion |

|

Forecast Period 2025-32 CAGR: |

4.20% |

Market Size in 2032: |

2.03 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surgical Drapes Market by Type (2018-2032)

4.1 Surgical Drapes Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Reusable

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Disposable

Chapter 5: Surgical Drapes Market by Material (2018-2032)

5.1 Surgical Drapes Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Woven

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Non-woven

Chapter 6: Surgical Drapes Market by End User (2018-2032)

6.1 Surgical Drapes Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Ambulatory Surgical Centers

6.6 Healthcare Institutes

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Surgical Drapes Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ETHICON INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BECTON

7.4 DICKINSON AND COMPANY (BD) (US)

7.5 INTEGRA LIFESCIENCES CORPORATION (US)

7.6 STRYKER CORPORATION (US)

7.7 ZIMMER BIOMET HOLDINGS INC. (US)

7.8 CONMED CORPORATION (US)

7.9 COOPERSURGICAL INC. (US)

7.10 ASPEN SURGICAL PRODUCTS INC. (US)

7.11 KARL STORZ ENDOSCOPY-AMERICA INC. (US)

7.12 SCANLAN INTERNATIONAL INC. (US)

7.13 WEXLER SURGICAL (US)

7.14 ROBOZ SURGICAL INSTRUMENT CO. (US)

7.15 FINE SCIENCE TOOLS (US)

7.16 MILLENNIUM SURGICAL CORP. (US)

7.17 SKLAR SURGICAL INSTRUMENTS (US)

7.18 GERMEDUSA INC. (US)

7.19 B. BRAUN MELSUNGEN AG (GERMANY)

7.20 KARL STORZ GMBH & CO. KG (GERMANY)

7.21 REDA INSTRUMENTE GMBH (GERMANY)

7.22 KLS MARTIN GROUP (GERMANY)

7.23 MEDTRONIC PLC (IRELAND)

7.24 SMITH & NEPHEW PLC (UK)

7.25 SURGICAL HOLDINGS (UK)

7.26 OLYMPUS CORPORATION (JAPAN)

7.27 TERUMO CORPORATION (JAPAN)

7.28

Chapter 8: Global Surgical Drapes Market By Region

8.1 Overview

8.2. North America Surgical Drapes Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Reusable

8.2.4.2 Disposable

8.2.5 Historic and Forecasted Market Size by Material

8.2.5.1 Woven

8.2.5.2 Non-woven

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Ambulatory Surgical Centers

8.2.6.4 Healthcare Institutes

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Surgical Drapes Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Reusable

8.3.4.2 Disposable

8.3.5 Historic and Forecasted Market Size by Material

8.3.5.1 Woven

8.3.5.2 Non-woven

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Ambulatory Surgical Centers

8.3.6.4 Healthcare Institutes

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Surgical Drapes Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Reusable

8.4.4.2 Disposable

8.4.5 Historic and Forecasted Market Size by Material

8.4.5.1 Woven

8.4.5.2 Non-woven

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Ambulatory Surgical Centers

8.4.6.4 Healthcare Institutes

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Surgical Drapes Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Reusable

8.5.4.2 Disposable

8.5.5 Historic and Forecasted Market Size by Material

8.5.5.1 Woven

8.5.5.2 Non-woven

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Ambulatory Surgical Centers

8.5.6.4 Healthcare Institutes

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Surgical Drapes Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Reusable

8.6.4.2 Disposable

8.6.5 Historic and Forecasted Market Size by Material

8.6.5.1 Woven

8.6.5.2 Non-woven

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Ambulatory Surgical Centers

8.6.6.4 Healthcare Institutes

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Surgical Drapes Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Reusable

8.7.4.2 Disposable

8.7.5 Historic and Forecasted Market Size by Material

8.7.5.1 Woven

8.7.5.2 Non-woven

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Ambulatory Surgical Centers

8.7.6.4 Healthcare Institutes

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Surgical Drapes Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

1.46 Billion |

|

Forecast Period 2025-32 CAGR: |

4.20% |

Market Size in 2032: |

2.03 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||