Surface Mining Market Synopsis

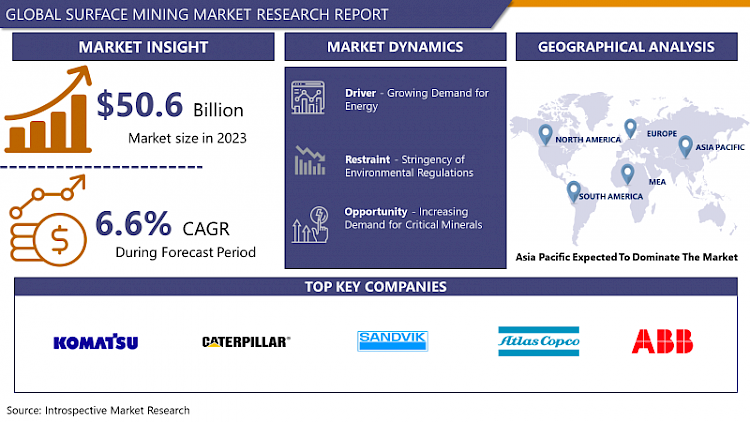

Surface Mining Market Size Was Valued at USD 50.6 Billion in 2023, and is Projected to Reach USD 89.9 Billion by 2032, Growing at a CAGR of 6.6% From 2024-2032.

Open pit mining refers to the extraction of minerals and ores in areas that are close to the surface of the earth. While, underground mining entails digging down to the mineral deposits after stripping off the overlying soil and rocks. Some of the methods used are open pit mining, strip mining and mountaintop mining which are specialized based on the kind of deposit and the geographical location. Open pit mining is preferred for its technical efficiency and low cost of extracting large quantities of material, which is good for materials such as coal, copper, and iron. But it results in various negative effects on the environment such as destruction of habitats, alteration of landscape and pollution which therefore requires proper management and restoration as a measure to control the impacts on the ecosystem.

- The surface mining market has demonstrated a steady growth in the past decade due to the rising need for minerals and metals that are used in construction, manufacturing, and power industries. Major subsectors in the market include the coal, metals, and non-metallic minerals industry; however, the coal mining industry still dominates the market because of its use in power production. The use of advanced technology in surface mining has ensured that the cost of mining is minimized and productivity is increased as well as the safety measures that have been put in place. Increase in the global population and urbanization, as well as industrialization, especially in the developing world, has also contributed to the growth of the market by increasing the need for mined materials.

- However, the surface mining market has some threats such as high regulatory norms for environment and rising awareness regarding the environmental effects of mining. Businesses are gradually implementing the sustainable management and development concept and are also participating in the funding of reclamation projects in mined out areas. Also, the fluctuations in the price of the commodities and other political instabilities in the world can affect the market in some ways. However, the surface mining market is expected to remain dynamic because of the ongoing infrastructural development and the ever-increasing demand for raw materials in different modern uses such as renewable energy systems and electric cars.

Surface Mining Market Trend Analysis

Increasing adoption of automation and digital technologies

- Some of the most popular technologies that are being implemented by companies include AI and machine learning, as well as the IoT. These technologies increase productivity, safety, and reliability because they allow real-time observation and evaluation, monitoring of equipment conditions and wear, and operation of machinery without human intervention. For instance, automated haul trucks, and drilling systems do not require the input of a human hence they can run for a long time without having to stop resulting in decreased operational costs and minimal exposure of humans to dangerous situations. At the same time, digital twins and simulation models are widely implemented to enhance mine planning and decision-making. It is deemed that such a trend toward digital transformation will further transform the surface mining environment and enhance the sustainability and competitiveness of the operation.

Increasing demand for critical minerals

- Another promising development in the surface mining market is to focus on the growth of demand for critical minerals utilized in renewable energy sources and EVs. Lithium, cobalt, nickel, and rare earth metals are crucial in developing batteries for electric cars, turbines, and solar panels. There is a growing demand for these minerals as the world shifts towards renewable energy solutions which are cleaner than the traditional fossil fuels. The emerging market for these resources means that surface mining operations that are capable of cost-effectively and at the same time, sustainably mining for these resources will be in a better position to reap big. To this end, organizations can conform to environmental standards by embracing modern technologies that will keep them on the right side of the law, and at the same time attract investors and consumers who are concerned with sustainability to increase their market share and dominance in this emerging market.

Surface Mining Market Segment Analysis:

Surface Mining Market Segmented on the basis of type and application.

By Type, Strip Mining segment is expected to dominate the market during the forecast period

- Out of all these types of surface mining, strip mining is expected to have the largest share in the global surface mining market in the forecast period for various reasons. Strip mining mostly involves the removal of large strips of overburden to access buried ore bodies and is particularly effective where the deposits being exploited such as coal and some minerals are flat or horizontally layered and are close to the surface. It is for these reasons that this method is quite appealing to mining firms especially those seeking to derive optimum production while minimizing cost.

- Similarly, the demand for coal is higher across the globe, particularly for electricity generation especially in the developing countries which contributes to the dominance of the strip mining segment. The growth in mining technology has continued to refine the possibilities of strip mining while at the same time increasing the efficiency and safety of the process while minimizing the negative effects on the land or environment and improving the rate of reclamation. New and better ways to implement strip mining are always in the works and as regulatory authorities adjust the legal and regulatory requirements on mining, it becomes clear that strip mining will remain relevant in the surface mining market.

By Application, Iron-Ore segment is expected to held the largest share

- Based on the type of application, the surface mining market can be broadly classified into categories of minerals such as iron ore and others and within this area the iron ore segment is predicted to have the largest market share. Iron ore is an integral input, particularly for steel, which is a basic requirement for infrastructure, vehicles and other manufactured goods. The integrated demand for steel, which also includes the growing Asian giants such as China and India support the iron ore segment as a large portion of the surface mining market.

- This is especially true for surface mining techniques since iron ore is usually found in large amounts and the techniques used are cheap and can easily manage the large scale that is usually associated with iron ore deposits. The increasing construction of new infrastructures and the upgrading of existing structures fired up the need for iron ore as well the improvement of equipment and technology in surface mining has enhanced efficiency and environmental effectiveness of the segment making the iron ore segment to continue dominating the market. It is believed that this trend will be sustained by the ongoing global industrialization and urbanization processes, which are likely to guarantee ongoing demand for iron ore and hence the continuation of surface mining in this segment.

Surface Mining Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- According to the analysis, Asia Pacific region has emerged as the most promising region for surface mining market over the forecast period on account of several factors. This area represents some of the largest mining nations such as China, India, and Australia, which possess considerable resources of coal, iron, copper, and other important minerals. The rapid industrialization and urbanization in these countries have created a huge market for raw materials’ demand to support infrastructure development, energy generation, and manufacturing industries.

- Also, an increase in government policies and investment in the mining activities of its domestic country also helps to foster the market growth in the Asia Pacific. For instance, the China BRI and India’s emphasis on domestic dependence for strategic metals greatly boost mining opportunities. Besides, by implementing and practicing sustainable mining techniques and the advancement of technology in mining, the efficiency of surface mining is increasing and the negative effects on the environment are decreasing, which makes the surface mining more sustainable and feasible. For the duration of the forecast period, therefore, the Asia Pacific region – and particularly the ASEAN nations – is expected to sustain its position as the leading global market for surface mining equipment, as countries in the region continue to upgrade their mining infrastructure and regulatory frameworks become increasingly favourable.

Active Key Players in the Surface Mining Market

- Komatsu Ltd (Japan)

- Caterpillar Inc (U.S.)

- Sandvik AB (Sweden)

- Atlas Copco AB (Sweden)

- ABB Ltd. (Switzerland)

- Hitachi Construction Machinery Co. Ltd (Japan)

- BHP Billiton (Australia)

- Vale S.A (Brazil)

- Cisco Systems Inc. (U.S.)

- Anglo American Plc. (U.K.)

- Freeport-McMoRan Inc. (U.S.), and Other key Players.

Global Surface Mining Market Scope:

|

Global Surface Mining Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 50.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 89.9 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SURFACE MINING MARKET BY TYPE (2017-2032)

- SURFACE MINING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STRIP MINING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TERRACE MINING

- OPEN-PIT MINING

- SURFACE MINING MARKET BY APPLICATION (2017-2032)

- SURFACE MINING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IRON-ORE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COAL

- COPPER ORE

- DIAMOND

- CHROMIUM

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Surface Mining Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- KOMATSU LTD (JAPAN)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CATERPILLAR INC (U.S.)

- SANDVIK AB (SWEDEN)

- ATLAS COPCO AB (SWEDEN)

- ABB LTD. (SWITZERLAND)

- HITACHI CONSTRUCTION MACHINERY CO. LTD (JAPAN)

- BHP BILLITON (AUSTRALIA)

- VALE S.A (BRAZIL)

- CISCO SYSTEMS INC. (U.S.)

- ANGLO AMERICAN PLC. (U.K.)

- FREEPORT-MCMORAN INC. (U.S.)

- COMPETITIVE LANDSCAPE

- GLOBAL SURFACE MINING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

Global Surface Mining Market Scope:

|

Global Surface Mining Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 50.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.6% |

Market Size in 2032: |

USD 89.9 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SURFACE MINING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SURFACE MINING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SURFACE MINING MARKET COMPETITIVE RIVALRY

TABLE 005. SURFACE MINING MARKET THREAT OF NEW ENTRANTS

TABLE 006. SURFACE MINING MARKET THREAT OF SUBSTITUTES

TABLE 007. SURFACE MINING MARKET BY MINERAL

TABLE 008. METALLIC ORE MARKET OVERVIEW (2016-2028)

TABLE 009. NON-METALLIC ORE MARKET OVERVIEW (2016-2028)

TABLE 010. COAL MINING MARKET OVERVIEW (2016-2028)

TABLE 011. SURFACE MINING MARKET BY MINING METHOD

TABLE 012. MOUNTAIN REMOVAL MINING MARKET OVERVIEW (2016-2028)

TABLE 013. OPEN PIT MINING MARKET OVERVIEW (2016-2028)

TABLE 014. STRIP MINING MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. SURFACE MINING MARKET BY END USER

TABLE 017. ELECTRIC POWER INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 018. METAL MARKET OVERVIEW (2016-2028)

TABLE 019. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA SURFACE MINING MARKET, BY MINERAL (2016-2028)

TABLE 022. NORTH AMERICA SURFACE MINING MARKET, BY MINING METHOD (2016-2028)

TABLE 023. NORTH AMERICA SURFACE MINING MARKET, BY END USER (2016-2028)

TABLE 024. N SURFACE MINING MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE SURFACE MINING MARKET, BY MINERAL (2016-2028)

TABLE 026. EUROPE SURFACE MINING MARKET, BY MINING METHOD (2016-2028)

TABLE 027. EUROPE SURFACE MINING MARKET, BY END USER (2016-2028)

TABLE 028. SURFACE MINING MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC SURFACE MINING MARKET, BY MINERAL (2016-2028)

TABLE 030. ASIA PACIFIC SURFACE MINING MARKET, BY MINING METHOD (2016-2028)

TABLE 031. ASIA PACIFIC SURFACE MINING MARKET, BY END USER (2016-2028)

TABLE 032. SURFACE MINING MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA SURFACE MINING MARKET, BY MINERAL (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA SURFACE MINING MARKET, BY MINING METHOD (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA SURFACE MINING MARKET, BY END USER (2016-2028)

TABLE 036. SURFACE MINING MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA SURFACE MINING MARKET, BY MINERAL (2016-2028)

TABLE 038. SOUTH AMERICA SURFACE MINING MARKET, BY MINING METHOD (2016-2028)

TABLE 039. SOUTH AMERICA SURFACE MINING MARKET, BY END USER (2016-2028)

TABLE 040. SURFACE MINING MARKET, BY COUNTRY (2016-2028)

TABLE 041. BHP BILLITON: SNAPSHOT

TABLE 042. BHP BILLITON: BUSINESS PERFORMANCE

TABLE 043. BHP BILLITON: PRODUCT PORTFOLIO

TABLE 044. BHP BILLITON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. RIO TINTO: SNAPSHOT

TABLE 045. RIO TINTO: BUSINESS PERFORMANCE

TABLE 046. RIO TINTO: PRODUCT PORTFOLIO

TABLE 047. RIO TINTO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. TECHNICA MINING: SNAPSHOT

TABLE 048. TECHNICA MINING: BUSINESS PERFORMANCE

TABLE 049. TECHNICA MINING: PRODUCT PORTFOLIO

TABLE 050. TECHNICA MINING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. GLENCORE: SNAPSHOT

TABLE 051. GLENCORE: BUSINESS PERFORMANCE

TABLE 052. GLENCORE: PRODUCT PORTFOLIO

TABLE 053. GLENCORE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. CHINA SHENHUA ENERGY: SNAPSHOT

TABLE 054. CHINA SHENHUA ENERGY: BUSINESS PERFORMANCE

TABLE 055. CHINA SHENHUA ENERGY: PRODUCT PORTFOLIO

TABLE 056. CHINA SHENHUA ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. VALE S.A.: SNAPSHOT

TABLE 057. VALE S.A.: BUSINESS PERFORMANCE

TABLE 058. VALE S.A.: PRODUCT PORTFOLIO

TABLE 059. VALE S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. COAL INDIA LIMITED: SNAPSHOT

TABLE 060. COAL INDIA LIMITED: BUSINESS PERFORMANCE

TABLE 061. COAL INDIA LIMITED: PRODUCT PORTFOLIO

TABLE 062. COAL INDIA LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. FREEPORT-MCMORAN: SNAPSHOT

TABLE 063. FREEPORT-MCMORAN: BUSINESS PERFORMANCE

TABLE 064. FREEPORT-MCMORAN: PRODUCT PORTFOLIO

TABLE 065. FREEPORT-MCMORAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. BARRICK GOLD CORPORATION: SNAPSHOT

TABLE 066. BARRICK GOLD CORPORATION: BUSINESS PERFORMANCE

TABLE 067. BARRICK GOLD CORPORATION: PRODUCT PORTFOLIO

TABLE 068. BARRICK GOLD CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. GOLDCORP INC.: SNAPSHOT

TABLE 069. GOLDCORP INC.: BUSINESS PERFORMANCE

TABLE 070. GOLDCORP INC.: PRODUCT PORTFOLIO

TABLE 071. GOLDCORP INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. REPAIR & MAINTENANCE: SNAPSHOT

TABLE 072. REPAIR & MAINTENANCE: BUSINESS PERFORMANCE

TABLE 073. REPAIR & MAINTENANCE: PRODUCT PORTFOLIO

TABLE 074. REPAIR & MAINTENANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. ANGLO AMERICAN: SNAPSHOT

TABLE 075. ANGLO AMERICAN: BUSINESS PERFORMANCE

TABLE 076. ANGLO AMERICAN: PRODUCT PORTFOLIO

TABLE 077. ANGLO AMERICAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. BAI GROUP LLC: SNAPSHOT

TABLE 078. BAI GROUP LLC: BUSINESS PERFORMANCE

TABLE 079. BAI GROUP LLC: PRODUCT PORTFOLIO

TABLE 080. BAI GROUP LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. PERENTI GLOBAL LIMITED: SNAPSHOT

TABLE 081. PERENTI GLOBAL LIMITED: BUSINESS PERFORMANCE

TABLE 082. PERENTI GLOBAL LIMITED: PRODUCT PORTFOLIO

TABLE 083. PERENTI GLOBAL LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. AMERICAN MINE SERVICES: SNAPSHOT

TABLE 084. AMERICAN MINE SERVICES: BUSINESS PERFORMANCE

TABLE 085. AMERICAN MINE SERVICES: PRODUCT PORTFOLIO

TABLE 086. AMERICAN MINE SERVICES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. MACMAHON: SNAPSHOT

TABLE 087. MACMAHON: BUSINESS PERFORMANCE

TABLE 088. MACMAHON: PRODUCT PORTFOLIO

TABLE 089. MACMAHON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. BCM INTERNATIONAL GROUP: SNAPSHOT

TABLE 090. BCM INTERNATIONAL GROUP: BUSINESS PERFORMANCE

TABLE 091. BCM INTERNATIONAL GROUP: PRODUCT PORTFOLIO

TABLE 092. BCM INTERNATIONAL GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. LAXYO: SNAPSHOT

TABLE 093. LAXYO: BUSINESS PERFORMANCE

TABLE 094. LAXYO: PRODUCT PORTFOLIO

TABLE 095. LAXYO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. MINING PLUS: SNAPSHOT

TABLE 096. MINING PLUS: BUSINESS PERFORMANCE

TABLE 097. MINING PLUS: PRODUCT PORTFOLIO

TABLE 098. MINING PLUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. GMS MINE: SNAPSHOT

TABLE 099. GMS MINE: BUSINESS PERFORMANCE

TABLE 100. GMS MINE: PRODUCT PORTFOLIO

TABLE 101. GMS MINE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. BANKS GROUP: SNAPSHOT

TABLE 102. BANKS GROUP: BUSINESS PERFORMANCE

TABLE 103. BANKS GROUP: PRODUCT PORTFOLIO

TABLE 104. BANKS GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. DAY GROUP: SNAPSHOT

TABLE 105. DAY GROUP: BUSINESS PERFORMANCE

TABLE 106. DAY GROUP: PRODUCT PORTFOLIO

TABLE 107. DAY GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SURFACE MINING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SURFACE MINING MARKET OVERVIEW BY MINERAL

FIGURE 012. METALLIC ORE MARKET OVERVIEW (2016-2028)

FIGURE 013. NON-METALLIC ORE MARKET OVERVIEW (2016-2028)

FIGURE 014. COAL MINING MARKET OVERVIEW (2016-2028)

FIGURE 015. SURFACE MINING MARKET OVERVIEW BY MINING METHOD

FIGURE 016. MOUNTAIN REMOVAL MINING MARKET OVERVIEW (2016-2028)

FIGURE 017. OPEN PIT MINING MARKET OVERVIEW (2016-2028)

FIGURE 018. STRIP MINING MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. SURFACE MINING MARKET OVERVIEW BY END USER

FIGURE 021. ELECTRIC POWER INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 022. METAL MARKET OVERVIEW (2016-2028)

FIGURE 023. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA SURFACE MINING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE SURFACE MINING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC SURFACE MINING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA SURFACE MINING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA SURFACE MINING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Surface Mining Market research report is 2024-2032.

Komatsu Ltd (Japan), Caterpillar Inc (U.S.), Sandvik AB (Sweden), Atlas Copco AB (Sweden), ABB Ltd. (Switzerland), and Other Major Players.

The Surface Mining Market is segmented into Type, Application, and region. By Type, the market is categorized into Strip Mining, Terrace Mining, and Open-Pit Mining. By Application, the market is categorized into Iron-Ore, Coal, Copper Ore, Diamond, Chromium, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Open pit mining refers to the extraction of minerals and ores in areas that are close to the surface of the earth. While, underground mining entails digging down to the mineral deposits after stripping off the overlying soil and rocks. Some of the methods used are open pit mining, strip mining and mountaintop mining which are specialized based on the kind of deposit and the geographical location. Open pit mining is preferred for its technical efficiency and low cost of extracting large quantities of material, which is good for materials such as coal, copper, and iron. But it results in various negative effects on the environment such as the destruction of habitats, alteration of landscape and pollution which therefore requires proper management and restoration as a measure to control the impacts on the ecosystem.

Surface Mining Market Size Was Valued at USD 50.6 Billion in 2023, and is Projected to Reach USD 89.9 Billion by 2032, Growing at a CAGR of 6.6% From 2024-2032.