Supplier Relationship Management (SRM) Software Market Synopsis

Global Supplier Relationship Management (SRM) Software Market Size Was Valued at USD 15.18 Billion in 2024 and is Projected to Reach USD 35.9 Billion by 2032, Growing at a CAGR of 11.36% From 2025-2032.

Supplier Relationship Management (SRM) software is a digital platform crafted to streamline and improve the management of interactions between a company and its suppliers. It empowers organizations to consolidate supplier information, foster communication, monitor performance, and collaborate efficiently with suppliers across the procurement journey. In essence, SRM software aims to enhance supplier relationships, boost operational efficiency, and optimize procurement processes.

Supplier Relationship Management (SRM) software is integral across various industries, providing manifold benefits and poised for substantial future growth in demand. Its primary role involves streamlining and elevating the management of supplier relationships throughout the procurement lifecycle. By furnishing a centralized hub for supplier data storage, facilitating communication, and monitoring performance metrics, SRM software empowers organizations to efficiently collaborate with suppliers, negotiate contracts, and uphold supply chain transparency and adherence to regulations.

It fosters stronger supplier relationships by enabling transparent communication, nurturing trust, and aligning objectives between buyers and suppliers. Furthermore, SRM software aids in optimizing supplier performance, pinpointing cost-saving prospects, and mitigating risks linked to supplier dependencies or disruptions. Additionally, by furnishing real-time insights into supplier activities and performance metrics, SRM software bolsters decision-making and facilitates proactive supplier management strategies.

With businesses increasingly recognizing the strategic significance of supplier relationships in driving operational efficiency and competitiveness, the adoption of SRM software is anticipated to soar. Factors such as globalization, intricate supply chains, and the imperative for supply chain resilience and sustainability fuel the requirement for advanced SRM solutions. Moreover, technological advancements, including artificial intelligence and predictive analytics, are expected to augment the capabilities of SRM software, rendering it indispensable for organizations aiming to optimize supplier relationships and secure a competitive edge in the market.

Supplier Relationship Management (SRM) Software Market Trend Analysis:

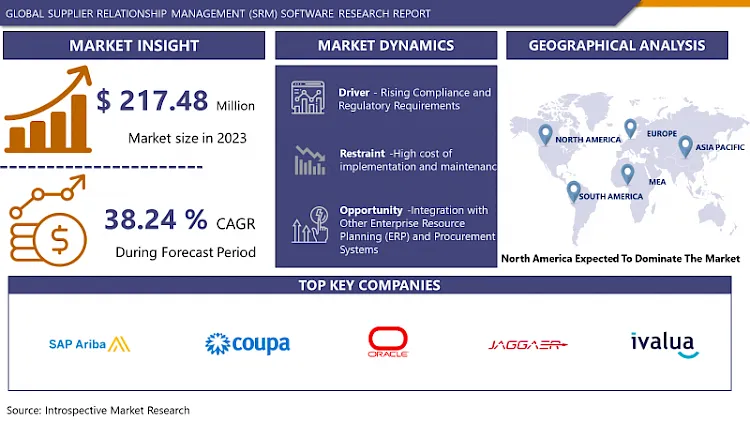

Rising Compliance and Regulatory Requirements

- The surge in compliance and regulatory requirements acts as a significant catalyst propelling the expansion of the Supplier Relationship Management (SRM) Software Market. With regulatory frameworks tightening across industries, businesses are under increasing pressure to ensure adherence to diverse standards and regulations governing supplier relations and procurement procedures. SRM software emerges as a pivotal solution to navigate these intricate landscapes, offering functionalities to facilitate compliance, track related activities, and uphold comprehensive audit trails.

- The growing emphasis on transparency and accountability in supply chain operations further drives the demand for SRM software. Organizations face mandates to exhibit ethical sourcing practices, sustainable procurement approaches, and compliance with labor and environmental regulations. SRM software equips businesses with the necessary tools to monitor supplier performance, evaluate regulatory compliance, and mitigate risks associated with non-compliance. Through centralizing supplier data and automating compliance processes, SRM software empowers organizations to augment visibility into their supply chain operations and ensure alignment with regulatory mandates.

- The escalating globalization of supply chains and the interconnectivity of business operations amplify the intricacy of compliance management. With suppliers operating across diverse global regions, organizations encounter varying regulatory environments and cultural norms. SRM software addresses these challenges by offering functionalities to standardize compliance procedures, harmonize regulatory requirements, and facilitate cross-border collaboration with suppliers. As businesses prioritize risk mitigation and regulatory compliance in their procurement strategies, the demand for SRM software is poised to soar, driving innovation and reshaping the landscape of supplier relationship management.

Integration with Other Enterprise Resource Planning (ERP) and Procurement Systems

- Integration with other Enterprise Resource Planning (ERP) and procurement systems emerges as a pivotal driver propelling the growth of the Supplier Relationship Management (SRM) Software Market. In their quest to refine procurement operations and bolster efficiency, organizations place significant emphasis on seamlessly integrating SRM software with existing ERP and procurement systems. This amalgamation allows businesses to consolidate supplier data, streamline procurement workflows, and synchronize information across diverse departments, ensuring data management consistency and precision.

- The integration with ERP and procurement systems empowers organizations to harness the full potential of their data and analytics capabilities. By amalgamating supplier-related data from disparate sources into a unified platform, SRM software amplifies visibility into supplier performance, contract compliance, and spend analysis. This holistic perspective equips businesses to make informed decisions driven by data, pinpoint cost-saving opportunities, and effectively mitigate risks associated with supplier relationships.

- The seamless integration of SRM software with ERP and procurement systems fosters interoperability and enhances collaboration across distinct business functions. By facilitating real-time data exchange and workflow automation, integrated SRM solutions streamline supplier communication, accelerate order processing, and elevate procurement efficacy. As organizations prioritize interoperability and fluid data exchange between systems, the demand for SRM software integrated with ERP and procurement systems is poised to escalate, catalyzing innovation and redefining the landscape of supplier relationship management practices.

Supplier Relationship Management (SRM) Software Market Segment Analysis:

Supplier Relationship Management (SRM) Software Market Segmented on the basis of Deployment Mode, Enterprise Size, Industry Vertical and Region.

By Enterprise Size, Large Enterprise segment is expected to dominate the market during the forecast period

- The Large Enterprise segment is positioned to lead the expansion of the Supplier Relationship Management (SRM) Software Market. With their vast supplier networks and intricate procurement needs, large corporations are ideal candidates for adopting SRM software solutions to streamline supplier management processes. These entities frequently operate globally, engaging with numerous suppliers across diverse industries and geographies, necessitating robust tools for effective supplier relationship management.

- Furthermore, large enterprises prioritize efficiency and scalability, motivating them to adopt SRM software to optimize procurement operations. Through the utilization of SRM software, these organizations can centralize supplier data, monitor supplier performance, and ensure adherence to regulatory requirements. This empowers them to negotiate more favorable terms with suppliers, mitigate risks, and enhance operational efficiency across the procurement lifecycle. the dominance of the Large Enterprise segment is anticipated in the Supplier Relationship Management (SRM) Software Market, fueling innovation and reshaping supplier management practices.

By Deployment Mode, Cloud segment held the largest share in 2024

- The Cloud segment leads the growth of the Supplier Relationship Management (SRM) Software Market, boasting the largest market share. Cloud-based SRM solutions are increasingly favored due to their unmatched flexibility, scalability, and accessibility across organizations of varying sizes. By adopting a cloud-based deployment model, companies gain access to SRM software via web browsers, eliminating the need for costly on-premises hardware and infrastructure investments.

- Furthermore, cloud-based SRM software fosters seamless collaboration and data sharing among stakeholders, regardless of their physical location. This capability enables organizations to centralize supplier data, streamline communication channels, and improve visibility into supplier performance and relationships. Additionally, cloud-based solutions offer rapid deployment and effortless scalability, empowering businesses to swiftly adapt to evolving market conditions and expand their SRM initiatives as necessary. Consequently, the Cloud segment is positioned to sustain its dominance in the Supplier Relationship Management (SRM) Software Market, propelling innovation and reshaping the landscape of supplier management practices.

Supplier Relationship Management (SRM) Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is positioned to emerge as the primary region driving the expansion of the Supplier Relationship Management (SRM) Software market. With its well-established economy, advanced technological infrastructure, and widespread incorporation of digital solutions, North America provides an optimal setting for the proliferation of SRM software initiatives. The region's varied business landscape, spanning industries like manufacturing, healthcare, retail, and finance, fuels the demand for robust SRM software solutions aimed at optimizing supplier relationships and streamlining procurement processes.

- Moreover, North America fosters a culture of innovation and early technology adoption, which nurtures the development and adoption of cutting-edge SRM software solutions. Additionally, the region's stringent regulatory framework and emphasis on transparency and accountability in business operations further bolster the adoption of SRM software. As organizations across diverse sectors prioritize enhancing supplier relationships to improve operational efficiency and gain a competitive edge, the demand for SRM software in North America is expected to surge, solidifying its status as the leading region in the global Supplier Relationship Management (SRM) Software market.

Supplier Relationship Management (SRM) Software Market Top Key Players:

- SAP Ariba (United States)

- Coupa Software (United States)

- Oracle Corporation (United States)

- Jaggaer (United States)

- Ivalua Inc. (United States)

- GEP Worldwide (United States)

- Zycus Inc. (United States)

- IBM Corporation (United States)

- Tradeshift (United States)

- Epicor Software Corporation (United States)

- BirchStreet Systems (United States)

- Concord (United States)

- Icertis (United States)

- Exela Technologies (United States)

- Per Angusta (France)

- SynerTrade SA (France)

- Basware Corporation (Finland)

- Proactis Holdings (UK)

- Gatekeeper (UK)

- Pool4Tool (Austria)

- Other Active Players

Key Industry Developments in the Supplier Relationship Management (SRM) Software Market:

- In September 2023, Coupa Software, a leader in Business Spend Management (BSM), today announced new solutions to improve supply assurance and business continuity. As companies continue to wrestle with supply chain risks jeopardizing their business-critical revenue streams,

- In November 2022, JAGGAER announced that Gartner has positioned the company as a Leader in the Magic Quadrant for Supplier Risk Management. This is the fifth year in a row that JAGGAER has been named a Leader for its P2P suite.

|

Global Supplier Relationship Management (SRM) Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.18 Bn. |

|

Forecast Period 2025-32 CAGR: |

11.36% |

Market Size in 2032: |

USD 35.9 Bn. |

|

Segments Covered: |

By Deployment Mode |

|

|

|

By Enterprise Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Supplier Relationship Management (SRM) Software Market by Deployment Mode (2018-2032)

4.1 Supplier Relationship Management (SRM) Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 On-premise

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cloud

Chapter 5: Supplier Relationship Management (SRM) Software Market by Enterprise Size (2018-2032)

5.1 Supplier Relationship Management (SRM) Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Large Enterprise

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Small and Medium-sized Large Enterprises

Chapter 6: Supplier Relationship Management (SRM) Software Market by Industry Vertical (2018-2032)

6.1 Supplier Relationship Management (SRM) Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Manufacturing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Retail

6.5 Automotive

6.6 Transportation & Logistics

6.7 Telecom

6.8 BFSI

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Supplier Relationship Management (SRM) Software Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 UNILEVER (UNITED KINGDOM)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PROCTER & GAMBLE (UNITED STATES)

7.4 ADIMO ( KENYA)

7.5 AMOREPACIFIC CORPORATION (SOUTH KOREA)

7.6 CFEB SISLEY SAS ( FRANCE)

7.7 ELIZABETH ARDEN INC (UNITED STATES)

7.8 JOHNSON & JOHNSON (UNITED STATES)

7.9 LANCER SKINCARE (UNITED STATES)

7.10 L’ORÉAL S.A (FRANCE)

7.11 SHISEIDO (JAPAN)

7.12 OTHER KEY PLAYERS

7.13

Chapter 8: Global Supplier Relationship Management (SRM) Software Market By Region

8.1 Overview

8.2. North America Supplier Relationship Management (SRM) Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Deployment Mode

8.2.4.1 On-premise

8.2.4.2 Cloud

8.2.5 Historic and Forecasted Market Size by Enterprise Size

8.2.5.1 Large Enterprise

8.2.5.2 Small and Medium-sized Large Enterprises

8.2.6 Historic and Forecasted Market Size by Industry Vertical

8.2.6.1 Manufacturing

8.2.6.2 Retail

8.2.6.3 Automotive

8.2.6.4 Transportation & Logistics

8.2.6.5 Telecom

8.2.6.6 BFSI

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Supplier Relationship Management (SRM) Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Deployment Mode

8.3.4.1 On-premise

8.3.4.2 Cloud

8.3.5 Historic and Forecasted Market Size by Enterprise Size

8.3.5.1 Large Enterprise

8.3.5.2 Small and Medium-sized Large Enterprises

8.3.6 Historic and Forecasted Market Size by Industry Vertical

8.3.6.1 Manufacturing

8.3.6.2 Retail

8.3.6.3 Automotive

8.3.6.4 Transportation & Logistics

8.3.6.5 Telecom

8.3.6.6 BFSI

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Supplier Relationship Management (SRM) Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Deployment Mode

8.4.4.1 On-premise

8.4.4.2 Cloud

8.4.5 Historic and Forecasted Market Size by Enterprise Size

8.4.5.1 Large Enterprise

8.4.5.2 Small and Medium-sized Large Enterprises

8.4.6 Historic and Forecasted Market Size by Industry Vertical

8.4.6.1 Manufacturing

8.4.6.2 Retail

8.4.6.3 Automotive

8.4.6.4 Transportation & Logistics

8.4.6.5 Telecom

8.4.6.6 BFSI

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Supplier Relationship Management (SRM) Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Deployment Mode

8.5.4.1 On-premise

8.5.4.2 Cloud

8.5.5 Historic and Forecasted Market Size by Enterprise Size

8.5.5.1 Large Enterprise

8.5.5.2 Small and Medium-sized Large Enterprises

8.5.6 Historic and Forecasted Market Size by Industry Vertical

8.5.6.1 Manufacturing

8.5.6.2 Retail

8.5.6.3 Automotive

8.5.6.4 Transportation & Logistics

8.5.6.5 Telecom

8.5.6.6 BFSI

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Supplier Relationship Management (SRM) Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Deployment Mode

8.6.4.1 On-premise

8.6.4.2 Cloud

8.6.5 Historic and Forecasted Market Size by Enterprise Size

8.6.5.1 Large Enterprise

8.6.5.2 Small and Medium-sized Large Enterprises

8.6.6 Historic and Forecasted Market Size by Industry Vertical

8.6.6.1 Manufacturing

8.6.6.2 Retail

8.6.6.3 Automotive

8.6.6.4 Transportation & Logistics

8.6.6.5 Telecom

8.6.6.6 BFSI

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Supplier Relationship Management (SRM) Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Deployment Mode

8.7.4.1 On-premise

8.7.4.2 Cloud

8.7.5 Historic and Forecasted Market Size by Enterprise Size

8.7.5.1 Large Enterprise

8.7.5.2 Small and Medium-sized Large Enterprises

8.7.6 Historic and Forecasted Market Size by Industry Vertical

8.7.6.1 Manufacturing

8.7.6.2 Retail

8.7.6.3 Automotive

8.7.6.4 Transportation & Logistics

8.7.6.5 Telecom

8.7.6.6 BFSI

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Supplier Relationship Management (SRM) Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.18 Bn. |

|

Forecast Period 2025-32 CAGR: |

11.36% |

Market Size in 2032: |

USD 35.9 Bn. |

|

Segments Covered: |

By Deployment Mode |

|

|

|

By Enterprise Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

_SOFTWARE_MARKET.webp)