Sulfasalazine Market Synopsis:

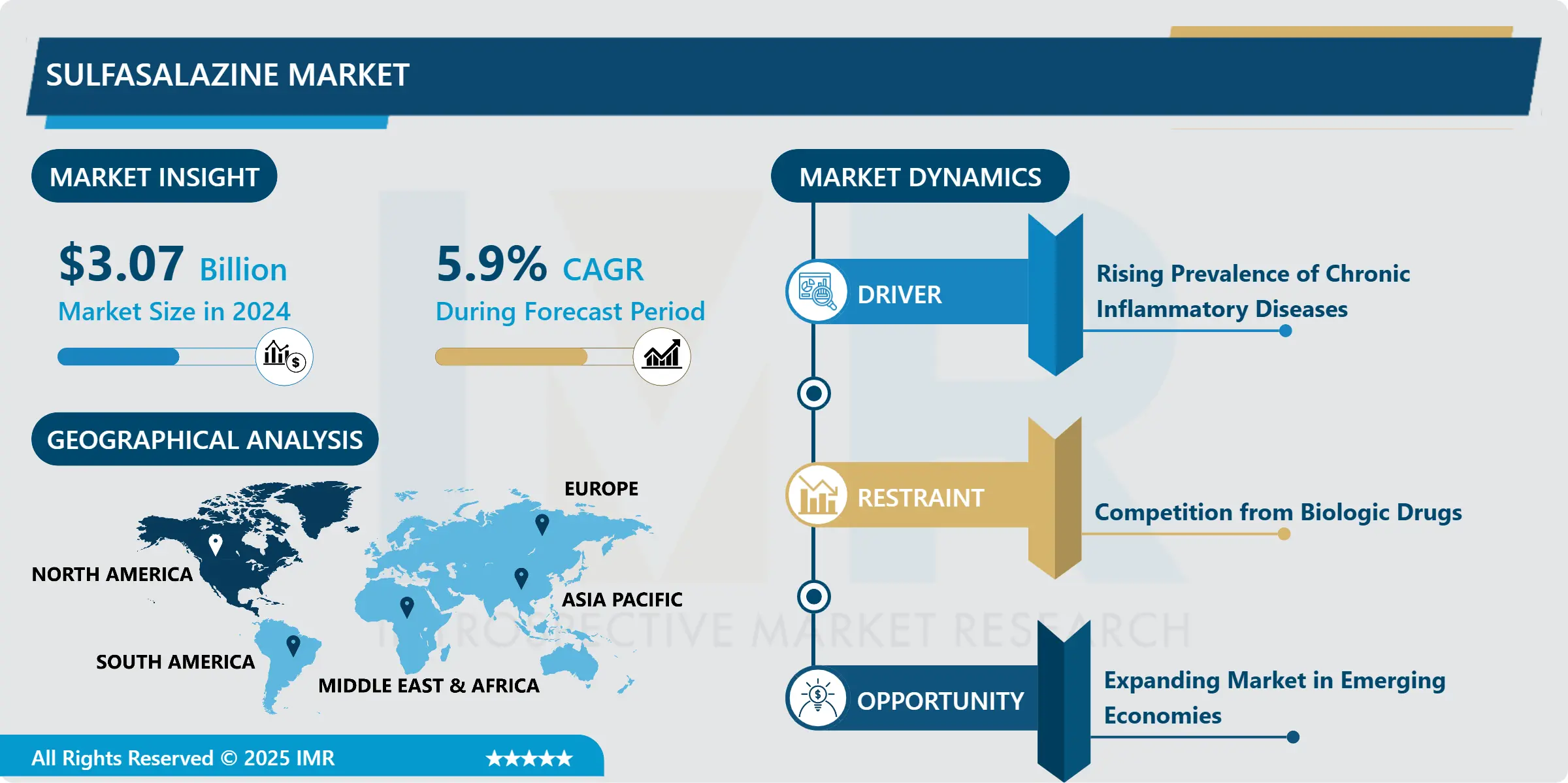

Sulfasalazine Market Size Was Valued at USD 3.07 Billion in 2024, and is Projected to Reach USD 5.77 Billion by 2035, Growing at a CAGR of 5.9% From 2025-2035.

Sulfasalazine belongs to a group of drugs termed Disease Modifying Anti-Rheumatic Drugs, DMARDs and is prescribed for the treatment of rheumatoid arthritis and the inflammatory bowel diseases, IBD: ulcerative colitis and Crohn’s disease. It achieves this through suppression of inflammation markers as well as down regulation of the immune system and prevention of more tissue damage related to the conditions. Sulfasalazine is available as oral tablets and powder for injections.

Currently, the largest driving force behind the Sulfasalazine market is the growing rates of chronic inflammatory diseases such as rheumatoid arthritis and IBD worldwide. This medication has enjoyed widespread use over the years because it helps to regulate inflammation and reduce the occurrence of symptoms in diseases including ulcerative colitis and Crohn’s disease. Because of their composition, which consists of an antibiotic (sulfapyridine) and a 5-aminosalicylic acid – sulfasalazine is used for the relief of symptoms, decrease in inflammatory processes, and increase in the patients’ quality of life.

Important driving forces contributing to the market include the rising inflammation diseases awareness, enhancement in the availability of accessible cheap treatment products, and continuous research about new formulations and other treatment options. The need to take chronic diseases as a core function of the global healthcare industry continues to rise and hence sulfasalazine has maintained its importance in clinical practice guidelines for both RA and IBD. Further, the increasing establishment of new pharmaceutical structures in various emerging market countries offers opportunities for growth.

Secondly, the market is experiencing a rise in patients who are looking for chronic care. The environmental controlling factors demonstrate that as the current generation of patients continues aging, chronic diseases treatments such as sulfasalazine will continue to be popular. We forecast that an increasing number of patients requiring treatment and the development of healthcare technologies will post a steady growth trajectory for the sulfasalazine industry. On the other hand, threat from newer biologic therapy entrants and increased generics may pose threats.

Sulfasalazine Market Trend Analysis:

Rising Preference for Generic Medications

- Another important trend which we identified in the market is decreasing role of brand drugs and increasing role of generics in consumption. When patents on branded sulfasalazine formulations are set to expire, there has been introduction of generic brands to bring down overall costs when purchasing the formulation to both patients and healthcare providers. This is because they are cheaper than brand names without hurting the therapeutic benefits that are achieved. This seems to be the general trend more especially with health systems the world over facing pressure to contain healthcare costs thus promoting for the neo form account.

- The generic sulfasalazine drugs in the market today are much cheaper than branded ones because of the many benefits that cuts across the entire manufactures, suppliers and consumers in markets with many numbers of patients and lack of many expensive branded medication drugs. These generic options are expected to continue to have significant market coverage in the future years. Further, the cost of sulfasalazine shall continually reduce, making a treatment option reachable to the unreached population of the emerging market that is still reluctant to incur the high cost of a treatment plan.

Expanding Market in Emerging Economies

- The current research also identified that there are further possibilities in the developing countries such as Asia-Pacific, Latin America as well as Middle eastern countries for sulfasalazine market. Due to the enhancement of the health care facilities and availability of the drugs the concerned medications like sulfasalazine are in great demand. It is essential to understand that these chronic illnesses, rheumatoid arthritis, chronic IBDs, are increasingly common in these areas, and will contribute to market growth.

- In addition, there is a higher acceptance of healthcare technologies, improved health management of chronic diseases, and rising disposables income that is triggering growth in the sulfasalazine market across these regions. By combining with local distribution partners and offsetting high development costs, pharmaceuticals are targeting increased penetration of emerging markets.

Sulfasalazine Market Segment Analysis:

Sulfasalazine Market Segmented on The Basis of Type, Application, Distribution Channel, End User, and Region.

By Type, Oral Tablets segment is expected to dominate the market during the forecast period

- The market for the sulfasalazine can also be classified on the basis of types such as oral tablet and injections. Oral tablets are the most common form of sulfasalazine because they are easy to use, can be easily administered, and affordable. The preferred route of administration is oral because most patients require continuing therapy for conditions such as rheumatoid arthritis and inflammatory bowel disease. They come in different dosage forms although the oral form is particularly recommended for outpatient treatments.

- While injectable forms of sulfasalazine are not very popular, they are used occasionally under certain circumstances, such as allergies to oral preparations or situations requiring onset of therapy effect. The injectable formulation may be marketed and distributed for use in Hospitals where it will be administrated by qualified personnel. Hence, injectable sulfasalazine, though is available for patients who want to avoid tableted preparations, is a much less popular choice worldwide as it concerns the oral tableted preparations that predominate the global market.

By Application, Rheumatoid Arthritis segment expected to held the largest share

- Sulfasalazine is mainly prescribed for the treatment of rheumatoid arthritis and inflammatory bowel diseases, ultracema colitis and Crohn’s disease. Sulfasalazine is prescribed to patients diagnosed with rheumatoid arthritis where it serves as a DMARD – an agent that slows disease development and inflammation. The market for sulfasalazine in rheumatoid arthritis is currently influenced by the increasing rate of the disease and the requirements for the effective long term treatment. This drug is routinely used in the management of RA patients as a component of a combination therapy of DMARDs for better performance.

- Anti-inflammatory/rimase agents are widely used, such as sulfasalazine, to control the manifestations, treatment of acute episodes, and to avoid relapses in patients with IBD, including ulcerative colitis and Crohn’s disease. Globalization, higher growth in IBD incidence, particularly in the developed countries, has increased demand for effective therapeutic agents such as sulfasalazine. Rising understanding and screening of IBD is also likely to drive the growth of sulfasalazine in this application since the former drives the latter.

Sulfasalazine Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America has the largest share in the consumption of sulfasalazine due to the increased incidence of chronic inflammation disorders like rheumatoid arthritis and IBD. Easy access to health care, high health spending and availability of better forms of medication have favoured the use of this drug in this part of the world. Also, variations that include both the brand name and the generic one of this medication make it easily available to a large number of clients.

- The market is further backed by rising healthcare consciousness, need for better treatment, and the constantly raising elderly population, which is likely to succumb to inflammatory diseases. North America is anticipated to remain the largest market for sulfasalazine due to stability and constant progressions in aspects such as medical science, health care sector, and the systems of manufacturing API.

Active Key Players in the Sulfasalazine Market

- Pfizer (USA)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sun Pharmaceutical Industries Ltd. (India)

- Novartis International AG (Switzerland)

- GlaxoSmithKline PLC (UK)

- AbbVie Inc. (USA)

- Sanofi S.A. (France)

- Eli Lilly and Company (USA)

- Mylan N.V. (USA)

- Johnson & Johnson (USA)

- Bristol-Myers Squibb Company (USA)

- Amgen Inc. (USA), and Other Active Players

|

Sulfasalazine Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.07 Billion |

|

Forecast Period 2025-35 CAGR: |

5.9% |

Market Size in 2035: |

USD 5.77 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sulfasalazine Market by Type (2018-2035)

4.1 Sulfasalazine Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Oral Tablets

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Injectable

Chapter 5: Sulfasalazine Market by Application (2018-2035)

5.1 Sulfasalazine Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Rheumatoid Arthritis

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Inflammatory Bowel Disease (IBD)

5.5 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Sulfasalazine Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 PFIZER (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

6.4 SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA)

6.5 NOVARTIS INTERNATIONAL AG (SWITZERLAND)

6.6 GLAXOSMITHKLINE PLC (UK)

6.7 ABBVIE INC. (USA)

6.8 SANOFI S.A. (FRANCE)

6.9 ELI LILLY AND COMPANY (USA)

6.10 MYLAN N.V. (USA)

6.11 JOHNSON & JOHNSON (USA)

6.12 BRISTOL-MYERS SQUIBB COMPANY (USA)

6.13 AMGEN INC. (USA)

6.14 OTHER ACTIVE PLAYERS

Chapter 7: Global Sulfasalazine Market By Region

7.1 Overview

7.2. North America Sulfasalazine Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Oral Tablets

7.2.4.2 Injectable

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Rheumatoid Arthritis

7.2.5.2 Inflammatory Bowel Disease (IBD)

7.2.5.3 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Sulfasalazine Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Oral Tablets

7.3.4.2 Injectable

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Rheumatoid Arthritis

7.3.5.2 Inflammatory Bowel Disease (IBD)

7.3.5.3 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Sulfasalazine Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Oral Tablets

7.4.4.2 Injectable

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Rheumatoid Arthritis

7.4.5.2 Inflammatory Bowel Disease (IBD)

7.4.5.3 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Sulfasalazine Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Oral Tablets

7.5.4.2 Injectable

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Rheumatoid Arthritis

7.5.5.2 Inflammatory Bowel Disease (IBD)

7.5.5.3 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Sulfasalazine Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Oral Tablets

7.6.4.2 Injectable

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Rheumatoid Arthritis

7.6.5.2 Inflammatory Bowel Disease (IBD)

7.6.5.3 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Sulfasalazine Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Oral Tablets

7.7.4.2 Injectable

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Rheumatoid Arthritis

7.7.5.2 Inflammatory Bowel Disease (IBD)

7.7.5.3 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Sulfasalazine Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.07 Billion |

|

Forecast Period 2025-35 CAGR: |

5.9% |

Market Size in 2035: |

USD 5.77 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||