Street Sweeper Market Synopsis

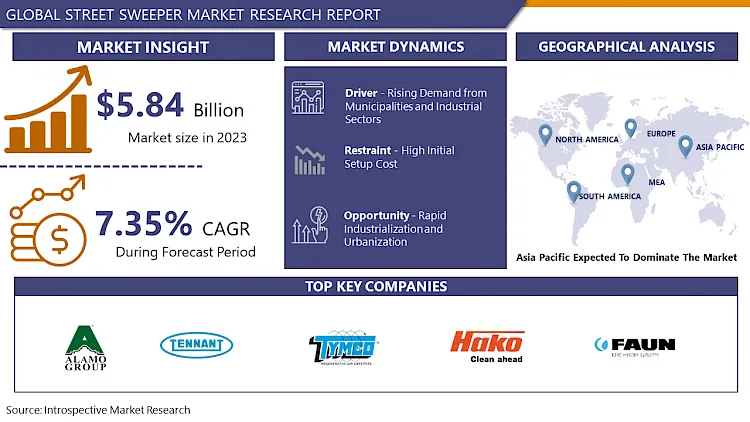

Street Sweeper Market Size Was Valued at USD 5.84 Billion in 2023 and is Projected to Reach USD 11.06 Billion by 2032, Growing at a CAGR of 7.35 % From 2024-2032.

The street sweeper market is a vital segment within the broader cleaning equipment industry, addressing the growing demand for efficient and environmentally friendly solutions to maintain public spaces.

- Street sweepers are crucial in keeping roads, parking lots, and other paved areas clean by removing debris, dust, and litter. As urbanization continues, the need for advanced and specialized street-sweeping equipment has surged, leading to innovations in technology, power sources, and application-specific features.

- The street sweeper market has witnessed notable trends driven by the convergence of technological advancements and sustainability concerns. The integration of smart technologies, such as sensors and data analytics, has enhanced the precision and efficiency of street-sweeping operations. Moreover, there is a notable shift towards cleaner energy sources, with electric-powered sweepers gaining traction as environmentally conscious municipalities and businesses seek to reduce carbon footprints in public maintenance activities.

Street Sweeper Market Trend Analysis

Rising Demand from Municipalities and Industrial Sectors

- The rising demand for street sweepers from municipalities can be attributed to the increasing urbanization and the consequent need for effective municipal services. As cities expand, the volume of road traffic and footfall rises, leading to a higher accumulation of debris and pollutants. Municipalities are investing in advanced street sweeper technologies to address these challenges efficiently. Modern sweepers equipped with smart features, such as real-time monitoring and data analytics, allow municipalities to optimize cleaning schedules, reduce operational costs, and enhance overall urban hygiene.

- Industrial sectors increasingly recognize the importance of maintaining clean and debris-free environments within their facilities. The demand for street sweepers in industrial settings arises from the need to comply with safety and environmental regulations, ensuring that work areas remain free from debris that could pose hazards or compromise production processes. Street sweepers designed for industrial applications are equipped to handle larger spaces, heavy-duty debris, and specific cleanliness standards.

Rapid Industrialization and Urbanization

- The rapidity of industrialization worldwide presents a significant opportunity for the street sweeper market. As industrial zones expand and manufacturing activities intensify, the need for efficient and specialized street-sweeping solutions becomes paramount. Industrial areas are prone to the accumulation of various types of debris, including dust, pollutants, and industrial waste. Street sweepers designed to address the unique challenges of industrial environments are in high demand.

- The ongoing global trend of urbanization, marked by the migration of populations from rural to urban areas, creates a substantial opportunity for the street sweeper market. Urban centers face increasing challenges in managing waste and maintaining clean public spaces. The higher population density, vehicular traffic, and commercial activities contribute to the accumulation of litter and pollutants on streets and roads. Municipalities and urban planners recognize the importance of efficient street sweeping in enhancing the overall quality of urban life.

Street Sweeper Market Segment Analysis:

Street Sweeper Market Segmented on the basis of type, Power Source, and application.

By Type, Mechanical broom sweeper segment is expected to dominate the market during the forecast period

- Mechanical broom sweepers are anticipated to dominate the street sweeper market primarily due to their high efficiency and versatility. These sweepers are equipped with robust mechanical brooms that effectively sweep and collect debris from the road surface. The mechanical broom technology allows for thorough and precise cleaning, making it suitable for a wide range of street cleaning applications. Whether it's removing dirt, dust, leaves, or larger debris, mechanical broom sweepers excel in maintaining clean and debris-free streets.

- Mechanical broom sweepers in the street sweeper market is their cost-effectiveness and ease of maintenance. These sweepers often come with a simpler mechanical design compared to other types, leading to lower manufacturing and maintenance costs. Municipalities and cleaning services are inclined towards solutions that offer effective cleaning without substantial financial burdens. The straightforward design of mechanical broom sweepers not only reduces initial acquisition costs but also minimizes the expenses associated with ongoing maintenance.

By Application, Urban Road segment held the largest share of 48.2% in 2022

- The dominance of street sweepers in the urban road segment is primarily driven by the high population density and increased vehicular traffic in urban areas. Urban roads are characterized by heavy traffic flow, leading to higher accumulation of debris, litter, and pollutants. Municipalities and city planners prioritize the cleanliness of urban roads not only for aesthetic reasons but also for environmental and health considerations.

- Urban areas often face more significant environmental and aesthetic challenges, with pollution and litter being key concerns. The visual appeal of urban roads is crucial for creating a positive and healthy living environment. Street sweepers are essential in addressing these concerns by maintaining cleanliness and enhancing the overall aesthetic appeal of urban roads.

Street Sweeper Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific's dominance in the street sweeper market can be attributed to the region's rapid urbanization and extensive infrastructure development. As countries in this region experience substantial population growth and increasing urbanization, the demand for efficient and advanced street-sweeping solutions has risen significantly. The expansion of cities and the development of new infrastructure create a pressing need for effective street cleaning to maintain cleanliness and environmental hygiene.

- The Asia Pacific region faces growing concerns related to environmental pollution and air quality, prompting governments to implement stringent environmental regulations. Street sweepers play a crucial role in mitigating pollution by removing dust, debris, and pollutants from road surfaces, preventing them from entering the air and water systems. As environmental awareness and regulatory pressures increase, there is a heightened focus on adopting advanced street sweeper technologies to meet these standards.

Street Sweeper Market Top Key Players:

- Elgin(United States)

- Alamo Group (United States)

- Tennant(United States)

- TYMCO (United States)

- Madvac Exprolink (Canada)

- Hako (Germany)

- FAUN (Germany)

- Alfred Kärcher (Germany)

- FAYAT GROUP (France)

- Bucher Johnston (Switzerland)

- Aebi Schmidt (Switzerland)

- Boschung (Switzerland)

- Global Sweeper (India)

- KATO (Japan)

- ZOOMLION (China)

- FULONGMA (China)

- AEROSUN (China)

- Hengrun Tech (China)

- Yantai Haide (China)

- Hubei Chengli (China)

- Henan Senyuan (China)

- Tianjin Sweeper (China)

- Beijing Tianlutong (China)

- Yangzhou Shengda (China)

Key Industry Developments in the Street Sweeper Market:

- In April 2023, Tennant introduced an innovative street-sweeping program driven by data analytics, revolutionizing the efficiency of route planning and significantly curbing fuel consumption. This ground-breaking initiative not only leads to substantial cost savings for municipalities but also represents a strategic resource optimization, showcasing Tennant's commitment to environmentally conscious and economically viable solutions for urban maintenance.

- In January 2023, Hako unveiled a versatile sweeper that addresses the dual challenge of dust and leaves, making it an ideal solution for comprehensive cleaning of parks and sidewalks. This innovative product showcases Hako's commitment to providing multifunctional cleaning solutions, ensuring effective and efficient maintenance of outdoor spaces. With its unique capabilities, this sweeper from Hako sets a new standard in urban cleanliness, offering municipalities and maintenance professionals a reliable tool for tackling diverse debris in public areas.

|

Global Street Sweeper Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.84 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.35% |

Market Size in 2032: |

USD 11.06 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Power Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- STREET SWEEPER MARKET BY TYPE (2016-2032)

- STREET SWEEPER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MECHANICAL BROOM SWEEPER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2032F)

- Historic And Forecasted Market Size in Volume (2016 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REGENERATIVE AIR SWEEPER

- VACUUM SWEEPER

- STREET SWEEPER MARKET BY POWER SOURCE (2016-2032)

- STREET SWEEPER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIESEL-POWERED SWEEPERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2032F)

- Historic And Forecasted Market Size in Volume (2016 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ELECTRIC-POWERED SWEEPERS

- STREET SWEEPER MARKET BY APPLICATION (2016-2032)

- STREET SWEEPER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- URBAN ROAD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2032F)

- Historic And Forecasted Market Size in Volume (2016 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HIGHWAY

- AIRPORT

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- STREET SWEEPER Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ELGIN

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ALAMO GROUP

- TENNANT

- TYMCO

- MADVAC EXPROLINK

- HAKO

- FAUN

- ALFRED KÄRCHER

- FAYAT GROUP

- BUCHER JOHNSTON

- AEBI SCHMIDT

- BOSCHUNG

- GLOBAL SWEEPER

- KATO

- ZOOMLION

- FULONGMA

- AEROSUN

- HENGRUN TECH

- YANTAI HAIDE

- HUBEI CHENGLI

- HENAN SENYUAN

- TIANJIN SWEEPER

- BEIJING TIANLUTONG

- YANGZHOU SHENGDA

- COMPETITIVE LANDSCAPE

- GLOBAL STREET SWEEPER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By POWER SOURCE

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

Potential Market Strategies

|

Global Street Sweeper Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.84 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.35% |

Market Size in 2032: |

USD 11.06 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Power Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Street Sweeper Market research report is 2024-2032.

Elgin, Alamo Group, Tennant, TYMCO, Madvac Exprolink, Hako, FAUN, Alfred Kärcher, FAYAT GROUP, Bucher Johnston, Aebi Schmidt, Boschung, Global Sweeper, KATO, ZOOMLION, FULONGMA, AEROSUN, Hengrun Tech, Yantai Haide, Hubei Chengli, Henan Senyuan, Tianjin Sweeper, Beijing Tianlutong, Yangzhou Shengda and Other Major Players.

The Street Sweeper Market is segmented into Type, Power Source, Application, and region. By Type, the market is categorized into Mechanical Broom Sweeper, Regenerative-Air Sweeper, and Vacuum Sweeper. By Power Source, the market is categorized into Diesel-Powered Sweepers and Electric-Powered Sweepers. By Application, the market is categorized into Urban Roads, Highway, Airport, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The street sweeper market is a vital segment within the broader cleaning equipment industry, addressing the growing demand for efficient and environmentally friendly solutions to maintain public spaces.

Street Sweeper Market Size Was Valued at USD 5.84 Billion in 2023 and is Projected to Reach USD 11.06 Billion by 2032, Growing at a CAGR of 7.35 % From 2024-2032.