Port Logistic Market Synopsis

Port Logistic Market Size Was Valued at USD 1626 Million in 2022, and is Projected to Reach USD 2312 Million by 2030, Growing at a CAGR of 4.5 % From 2023-2030.

The administration and coordination of numerous tasks involved in moving commodities and cargo through a port are referred to as port logistics. It includes all aspects of the handling, storing, and transportation of products inside the port region, including their planning, organization, and implementation.

- The major goal of port logistics is to make sure that commodities are transported smoothly and efficiently between the port and other sites as well as between the port and other types of transportation, including trucks, ships, and trains. Port authorities, shipping firms, goods forwarders, customs agents, and logistic service providers are just a few of the numerous parties involved.

- The physical infrastructure and tools needed for cargo handling are included in this, including docks, quays, container terminals, warehouses, cranes, forklifts, and storage yards. The architecture and design of the port's physical infrastructure are key factors in maximizing cargo flow.

- Agreement with customs laws and completion of the required paperwork for the passage of goods are both part of port logistics. This covers duty payments, import/export paperwork, customs inspections, and adherence to laws governing international trade.

- Coordination of transportation efforts to convey commodities from the port to their final destinations is a component of port logistics. This might entail setting up deliveries through trucks, trains, or linking to other forms of transportation.

Port Logistic Market Trend Analysis

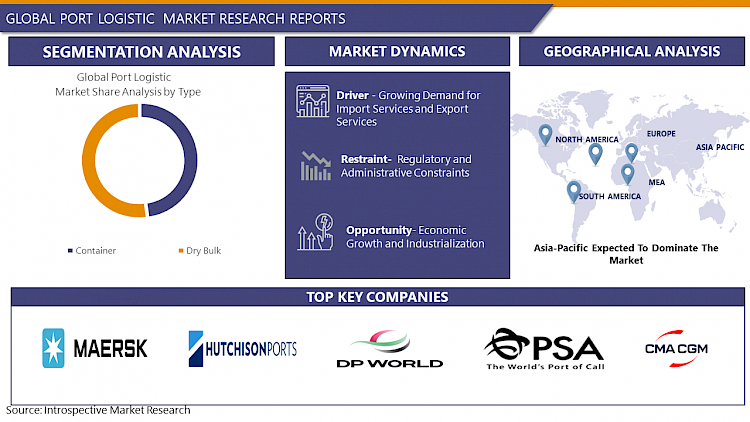

Growing Demand for Import Services and Export Services

- International trade has been growing steadily, driven by factors such as globalization, market liberalization, and the expansion of supply chains. As a result, there is an increasing need for efficient port logistics services to handle the growing volume of imports and exports. Rapid economic growth in emerging markets has led to increased industrial production and trade activities. As countries develop their manufacturing sectors and seek access to global markets, the demand for import and export services rises, requiring robust port logistics infrastructure.

- The rise of e-commerce has transformed the retail landscape, facilitating cross-border trade on a large scale. Due to the ability of businesses to sell and transport goods globally due to e-commerce platforms, effective port logistics are required to manage the movement of commodities from manufacturing facilities to consumer markets. With various manufacturing stages dispersed across several nations, global supply chains have grown more complicated. This specialization calls for the flawless coordination and synchronization of logistical activities at port facilities, such as shipping, warehousing, and customs clearance.

- Companies are often relocating manufacturing bases to take advantage of lower production costs and favorable trade policies. The movement of raw materials, components, and completed goods between production facilities and consumer markets must be handled by effective port logistics due to the change in manufacturing and sourcing patterns. To increase port capacity and capabilities, governments and port authorities are investing in infrastructure development. To increase efficiency and handle rising import and export volumes, this includes the creation of integrated logistics parks, the expansion and upgrading of port infrastructure, and the use of cutting-edge technology.

Economic Growth and Industrialization is an Opportunities for the Port Logistic market

- International trade has been growing steadily, driven by factors such as globalization, market liberalization, and the expansion of supply chains. As a result, there is an increasing need for efficient port logistics services to handle the growing volume of imports and exports. Rapid economic growth in emerging markets has led to increased industrial production and trade activities. As countries develop their manufacturing sectors and seek access to global markets, the demand for import and export services rises, requiring robust port logistics infrastructure.

- The rise of e-commerce has transformed the retail landscape, facilitating cross-border trade on a large scale. Due to the ability of businesses to sell and transport goods globally due to e-commerce platforms, effective port logistics are required to manage the movement of commodities from manufacturing facilities to consumer markets. With various manufacturing stages dispersed across several nations, global supply chains have grown more complicated. This specialization calls for the flawless coordination and synchronization of logistical activities at port facilities, such as shipping, warehousing, and customs clearance.

- Companies are often relocating manufacturing bases to take advantage of lower production costs and favorable trade policies. The movement of raw materials, components, and completed goods between production facilities and consumer markets must be handled by effective port logistics due to the change in manufacturing and sourcing patterns. To increase port capacity and capabilities, governments and port authorities are investing in infrastructure development. To increase efficiency and handle rising import and export volumes, this includes the creation of integrated logistics parks, the expansion and upgrading of port infrastructure, and the use of cutting-edge technology.

Port Logistic Market Segment Analysis:

Port Logistic Market Segmented on the basis of Type, and Distribution Channel.

By Type, Dry Bulk segment is expected to dominate the market during the forecast period

- Dry bulk commodities include various raw materials, such as coal, iron ore, grain, fertilizers, minerals, and bulk liquids like petroleum and chemicals. These commodities are essential for industries such as construction, manufacturing, agriculture, and energy production. The transportation of these bulk goods requires specialized port logistics to handle the loading, unloading, storage, and distribution of these commodities efficiently.

- The transportation of dry bulk commodities requires ports to have appropriate infrastructure to accommodate large vessels and handle bulk cargo efficiently. Deep-water berths, sufficient storage areas, conveyor systems, and specialized machinery like cranes, grabs, and loaders are all necessities for ports. The market for port logistics is boosted by investments made in port infrastructure expansion to handle dry bulk cargo.

- Dry bulk cargoes present unique challenges in terms of handling and storage. These goods need the appropriate stacking and storage facilities and are often emptied via grabs, suction systems, or conveyor belts. To reduce cargo loss, avoid contamination, and maintain the quality of the bulk commodities during transit and storage, port logistics providers must provide effective handling procedures.

By Distribution Channel, Export Services held the largest share of 67% in 2022

- Export services encompass a wide range of activities within the port logistics framework, including cargo handling, documentation, customs clearance, and transportation coordination. Port facilities that prioritize and specialize in export services have become crucial nodes in the global supply chain, facilitating the seamless movement of goods from manufacturers to international markets.

- The dominance of export services within the distribution channel can be attributed to several factors. As businesses expand their reach across borders, the need for reliable and agile export logistics becomes paramount. Advancements in technology have played a pivotal role in enhancing the efficiency and visibility of export services, offering real-time tracking and data analytics for better decision-making.

- The strategic positioning of ports that prioritize export services has contributed to their prominence, serving as strategic hubs that connect diverse regions. This dominance is likely to persist as the global economy continues to evolve, emphasizing the pivotal role of export services in shaping the future of the port logistics market.

Port Logistic Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific has been experiencing rapid economic growth and industrialization for several decades. Countries like China, Japan, India, and South Korea have witnessed significant industrial development, leading to increased production and trade activities. This robust economic growth generates a high demand for port logistics services to facilitate the import and export of goods.

- Asia Pacific is home to a large population, including emerging middle-class consumers. This growing consumer base drives domestic consumption and demand for imported goods. Port logistics providers play a crucial role in managing the flow of goods from production centers to consumer markets, ensuring efficient distribution and timely delivery.

- Asia Pacific is well situated as a significant intersection between the East and the West. It acts as a hub for international commerce lines, connecting continents like Europe, the Americas, and Africa with quickly expanding Asian markets. Due to its advantageous geographic location, Asia Pacific serves as a major center for transshipment and distribution operations, which increases demand for port logistics services.

Port Logistic Market Top Key Players:

- Maersk Line(Denmark)

- CMA CGM Group (France)

- Hamburger Hafen und Logistik AG (Germany)

- MSC Mediterranean Shipping Company (Switzerland)

- Hapag-Lloyd AG (Germany)

- Hutchison Ports (Hong Kong)

- DP World (United Arab Emirates)

- PSA International (Singapore)

- COSCO Shipping Ports (China)

- Shanghai International Port Group (China)

- Port of Singapore Authority (Singapore)

- Evergreen Marine Corporation (Taiwan)

Key Industry Developments in the Port Logistic Market:

- In January 2023, Maersk Announced a focus on cybersecurity in its supply chain operations, acknowledging the rising threat of cyberattacks targeting logistics.

- In March 2023, DP World Partnered with Virgin Hyperloop One to explore the potential of hyperloop technology for cargo transportation.

|

Global Port Logistic Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1626 Mn. |

|

Forecast Period 2023-32 CAGR: |

4.5 % |

Market Size in 2032: |

USD 2312 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PORT LOGISTIC MARKET BY TYPE (2016-2030)

- PORT LOGISTIC MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONTAINER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DRY BULK

- PORT LOGISTIC MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- PORT LOGISTIC MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IMPORT SERVICES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- EXPORT SSERVICES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- PORT LOGISTIC Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- MAERSK LINE (DENMARK)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves and Recent Developments

- SWOT Analysis

- CMA CGM GROUP (FRANCE)

- HAMBURGER HAFEN UND LOGISTIK AG (GERMANY)

- MSC MEDITERRANEAN SHIPPING COMPANY (SWITZERLAND)

- HAPAG-LLOYD AG (GERMANY)

- HUTCHISON PORTS (HONG KONG)

- DP WORLD (UNITED ARAB EMIRATES)

- PSA INTERNATIONAL (SINGAPORE)

- COSCO SHIPPING PORTS (CHINA)

- SHANGHAI INTERNATIONAL PORT GROUP (CHINA)

- PORT OF SINGAPORE AUTHORITY (SINGAPORE)

- EVERGREEN MARINE CORPORATION (TAIWAN)

- COMPETITIVE LANDSCAPE

- GLOBAL PORT LOGISTIC MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Port Logistic Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1626 Mn. |

|

Forecast Period 2023-32 CAGR: |

4.5 % |

Market Size in 2032: |

USD 2312 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PORT LOGISTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PORT LOGISTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PORT LOGISTICS MARKET COMPETITIVE RIVALRY

TABLE 005. PORT LOGISTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. PORT LOGISTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. PORT LOGISTICS MARKET BY TYPE

TABLE 008. CONTAINER MARKET OVERVIEW (2016-2030)

TABLE 009. DRY BULKS MARKET OVERVIEW (2016-2030)

TABLE 010. PORT LOGISTICS MARKET BY DISTRIBUTION CHANNEL

TABLE 011. IMPORT SERVICES MARKET OVERVIEW (2016-2030)

TABLE 012. EXPORT SERVICES MARKET OVERVIEW (2016-2030)

TABLE 013. NORTH AMERICA PORT LOGISTICS MARKET, BY TYPE (2016-2030)

TABLE 014. NORTH AMERICA PORT LOGISTICS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 015. N PORT LOGISTICS MARKET, BY COUNTRY (2016-2030)

TABLE 016. EASTERN EUROPE PORT LOGISTICS MARKET, BY TYPE (2016-2030)

TABLE 017. EASTERN EUROPE PORT LOGISTICS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 018. PORT LOGISTICS MARKET, BY COUNTRY (2016-2030)

TABLE 019. WESTERN EUROPE PORT LOGISTICS MARKET, BY TYPE (2016-2030)

TABLE 020. WESTERN EUROPE PORT LOGISTICS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 021. PORT LOGISTICS MARKET, BY COUNTRY (2016-2030)

TABLE 022. ASIA PACIFIC PORT LOGISTICS MARKET, BY TYPE (2016-2030)

TABLE 023. ASIA PACIFIC PORT LOGISTICS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 024. PORT LOGISTICS MARKET, BY COUNTRY (2016-2030)

TABLE 025. MIDDLE EAST & AFRICA PORT LOGISTICS MARKET, BY TYPE (2016-2030)

TABLE 026. MIDDLE EAST & AFRICA PORT LOGISTICS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 027. PORT LOGISTICS MARKET, BY COUNTRY (2016-2030)

TABLE 028. SOUTH AMERICA PORT LOGISTICS MARKET, BY TYPE (2016-2030)

TABLE 029. SOUTH AMERICA PORT LOGISTICS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 030. PORT LOGISTICS MARKET, BY COUNTRY (2016-2030)

TABLE 031. A.P. MOLLER-MAERSK (DENMARK): SNAPSHOT

TABLE 032. A.P. MOLLER-MAERSK (DENMARK): BUSINESS PERFORMANCE

TABLE 033. A.P. MOLLER-MAERSK (DENMARK): PRODUCT PORTFOLIO

TABLE 034. A.P. MOLLER-MAERSK (DENMARK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. HUTCHISON PORTS (HONG KONG): SNAPSHOT

TABLE 035. HUTCHISON PORTS (HONG KONG): BUSINESS PERFORMANCE

TABLE 036. HUTCHISON PORTS (HONG KONG): PRODUCT PORTFOLIO

TABLE 037. HUTCHISON PORTS (HONG KONG): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. DP WORLD (UNITED ARAB EMIRATES): SNAPSHOT

TABLE 038. DP WORLD (UNITED ARAB EMIRATES): BUSINESS PERFORMANCE

TABLE 039. DP WORLD (UNITED ARAB EMIRATES): PRODUCT PORTFOLIO

TABLE 040. DP WORLD (UNITED ARAB EMIRATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. PSA INTERNATIONAL (SINGAPORE): SNAPSHOT

TABLE 041. PSA INTERNATIONAL (SINGAPORE): BUSINESS PERFORMANCE

TABLE 042. PSA INTERNATIONAL (SINGAPORE): PRODUCT PORTFOLIO

TABLE 043. PSA INTERNATIONAL (SINGAPORE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. CMA CGM GROUP (FRANCE): SNAPSHOT

TABLE 044. CMA CGM GROUP (FRANCE): BUSINESS PERFORMANCE

TABLE 045. CMA CGM GROUP (FRANCE): PRODUCT PORTFOLIO

TABLE 046. CMA CGM GROUP (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. MSC MEDITERRANEAN SHIPPING COMPANY (SWITZERLAND): SNAPSHOT

TABLE 047. MSC MEDITERRANEAN SHIPPING COMPANY (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 048. MSC MEDITERRANEAN SHIPPING COMPANY (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 049. MSC MEDITERRANEAN SHIPPING COMPANY (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. COSCO SHIPPING PORTS (CHINA): SNAPSHOT

TABLE 050. COSCO SHIPPING PORTS (CHINA): BUSINESS PERFORMANCE

TABLE 051. COSCO SHIPPING PORTS (CHINA): PRODUCT PORTFOLIO

TABLE 052. COSCO SHIPPING PORTS (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. HAMBURGER HAFEN UND LOGISTIK AG (GERMANY): SNAPSHOT

TABLE 053. HAMBURGER HAFEN UND LOGISTIK AG (GERMANY): BUSINESS PERFORMANCE

TABLE 054. HAMBURGER HAFEN UND LOGISTIK AG (GERMANY): PRODUCT PORTFOLIO

TABLE 055. HAMBURGER HAFEN UND LOGISTIK AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. SHANGHAI INTERNATIONAL PORT GROUP (CHINA): SNAPSHOT

TABLE 056. SHANGHAI INTERNATIONAL PORT GROUP (CHINA): BUSINESS PERFORMANCE

TABLE 057. SHANGHAI INTERNATIONAL PORT GROUP (CHINA): PRODUCT PORTFOLIO

TABLE 058. SHANGHAI INTERNATIONAL PORT GROUP (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. PORT OF SINGAPORE AUTHORITY (SINGAPORE): SNAPSHOT

TABLE 059. PORT OF SINGAPORE AUTHORITY (SINGAPORE): BUSINESS PERFORMANCE

TABLE 060. PORT OF SINGAPORE AUTHORITY (SINGAPORE): PRODUCT PORTFOLIO

TABLE 061. PORT OF SINGAPORE AUTHORITY (SINGAPORE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. MAERSK LINE (DENMARK): SNAPSHOT

TABLE 062. MAERSK LINE (DENMARK): BUSINESS PERFORMANCE

TABLE 063. MAERSK LINE (DENMARK): PRODUCT PORTFOLIO

TABLE 064. MAERSK LINE (DENMARK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. EVERGREEN MARINE CORPORATION (TAIWAN): SNAPSHOT

TABLE 065. EVERGREEN MARINE CORPORATION (TAIWAN): BUSINESS PERFORMANCE

TABLE 066. EVERGREEN MARINE CORPORATION (TAIWAN): PRODUCT PORTFOLIO

TABLE 067. EVERGREEN MARINE CORPORATION (TAIWAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. HAPAG-LLOYD AG (GERMANY): SNAPSHOT

TABLE 068. HAPAG-LLOYD AG (GERMANY): BUSINESS PERFORMANCE

TABLE 069. HAPAG-LLOYD AG (GERMANY): PRODUCT PORTFOLIO

TABLE 070. HAPAG-LLOYD AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 071. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 072. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 073. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PORT LOGISTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PORT LOGISTICS MARKET OVERVIEW BY TYPE

FIGURE 012. CONTAINER MARKET OVERVIEW (2016-2030)

FIGURE 013. DRY BULKS MARKET OVERVIEW (2016-2030)

FIGURE 014. PORT LOGISTICS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 015. IMPORT SERVICES MARKET OVERVIEW (2016-2030)

FIGURE 016. EXPORT SERVICES MARKET OVERVIEW (2016-2030)

FIGURE 017. NORTH AMERICA PORT LOGISTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 018. EASTERN EUROPE PORT LOGISTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 019. WESTERN EUROPE PORT LOGISTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 020. ASIA PACIFIC PORT LOGISTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 021. MIDDLE EAST & AFRICA PORT LOGISTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 022. SOUTH AMERICA PORT LOGISTICS MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Port Logistic Market research report is 2023-2030.

A.P. Moller-Maersk (Denmark), Hutchison Ports (Hong Kong), DP World (United Arab Emirates), PSA International (Singapore), CMA CGM Group (France), MSC Mediterranean Shipping Company (Switzerland), COSCO Shipping Ports (China), Hamburger Hafen und Logistik AG (Germany), Shanghai International Port Group (China), Port of Singapore Authority (Singapore), Maersk Line (Denmark), Evergreen Marine Corporation (Taiwan), Hapag-Lloyd AG (Germany), and Other Major Players.

The Port Logistic Market is segmented into Type, Distribution Channel, and Region. The market is categorized as Container, Dry Bulk. By Distribution Channel, the market is categorized into Import Services, Export Services. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The administration and coordination of numerous tasks involved in moving commodities and cargo through a port are referred to as port logistics. It includes all aspects of the handling, storing, and transportation of products inside the port region, including their planning, organization, and implementation.

Port Logistic Market Size Was Valued at USD 1626 Million in 2022, and is Projected to Reach USD 2312 Million by 2030, Growing at a CAGR of 4.5 % From 2023-2030.