Stereo Audio Codecs Market Synopsis

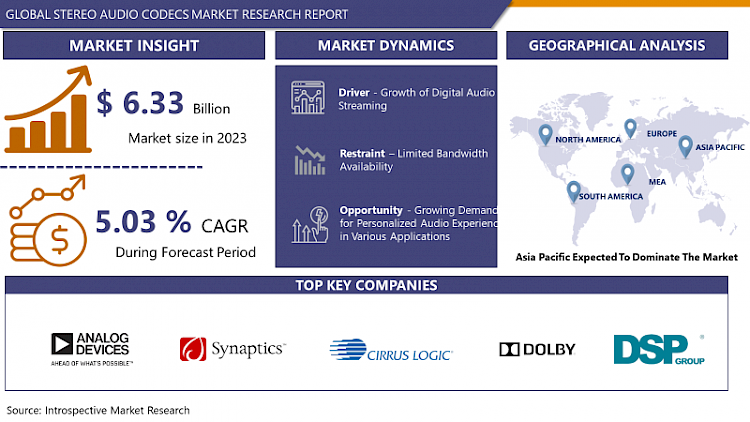

Global Stereo Audio Codecs Market Size Was Valued at USD 6.33 Billion in 2023 and is Projected to Reach USD 9.38 Billion by 2032, Growing at a CAGR of 5.03% From 2023-2032.

Stereo audio codecs encode and decode digital audio signals to produce stereo sound. They compress audio data to optimize storage and transmission without compromising quality. These codecs are essential in music streaming, video conferencing, and multimedia entertainment systems.

- Stereo audio codecs, essential elements in digital audio processing, have diverse applications spanning various industries. They facilitate efficient transmission of high-fidelity stereo audio in music streaming, ensuring uninterrupted listening experiences globally. Additionally, in video conferencing setups, stereo codecs enable clear and immersive audio communication, boosting collaboration and productivity in remote meetings. Their integration into multimedia entertainment systems enhances the delivery of surround sound experiences, enriching the enjoyment of movies, games, and virtual reality content.

- They efficiently compress audio data while preserving quality, resulting in compact file sizes ideal for storage and transmission. Moreover, these codecs support a wide array of audio formats and bitrates, ensuring compatibility with various playback devices and platforms. Ongoing advancements in codec technology further enhance audio fidelity, reducing latency and enhancing overall performance in real-time applications.

- The future demand for stereo audio codecs appears promising, driven by the proliferation of digital audio content and the expansion of online streaming services. With consumers increasingly seeking high-quality audio experiences across multiple devices, the necessity for efficient audio compression and transmission solutions is expected to rise. Additionally, emerging technologies like 5G networks and immersive audio formats are poised to accelerate the adoption of stereo codecs in next-generation multimedia applications, fostering further innovation and market growth.

Stereo Audio Codecs Market Trend Analysis:

Growth of Digital Audio Streaming

- The rapid expansion of the stereo audio codecs market is largely driven by the exponential rise of digital audio streaming. As consumers increasingly turn to online platforms for accessing music, podcasts, and other audio content, the need for top-notch audio reproduction becomes increasingly vital. Stereo audio codecs are instrumental in this scenario, facilitating efficient compression and transmission of audio data across the internet, thereby ensuring a smooth streaming experience for users worldwide.

- Furthermore, the widespread adoption of smartphones, tablets, and smart speakers has further bolstered the demand for stereo audio codecs. These devices serve as primary conduits for accessing digital audio content, underscoring the necessity for optimized audio compression technologies to deliver immersive sound experiences. Additionally, the advent of high-speed internet connectivity and the widespread uptake of streaming services have democratized access to audio content, fostering a broad and diverse market for stereo audio codecs catering to various consumer demographics.

- Moreover, ongoing advancements in audio codec technology continuously refine audio fidelity and efficiency, propelling further growth in the market. Manufacturers are persistently innovating to create codecs capable of delivering superior sound quality while minimizing bandwidth requirements, thereby addressing the evolving demands of the digital audio streaming landscape. With the escalating demand for high-quality audio streaming experiences driven by consumer preferences for convenience, accessibility, and immersive audio content, the stereo audio codecs market is poised for sustained expansion in the foreseeable future.

Growing Demand for Personalized Audio Experiences in Various Applications

- The rising need for customized audio experiences across various sectors offers a significant growth opportunity for the stereo audio codecs market. In segments like music streaming, podcasting, and gaming, there's a growing demand for tailored audio content that aligns with individual preferences. Stereo audio codecs play a crucial role by facilitating efficient compression and transmission of high-fidelity audio data, ensuring seamless delivery of personalized experiences to users worldwide.

- Additionally, the proliferation of mobile devices and smart technologies has intensified the desire for personalized audio experiences. With the emergence of smartphones, tablets, and wearables, consumers expect audio content to adapt seamlessly to their dynamic lifestyles. Stereo audio codecs optimize audio data for different playback devices, ensuring consistent and immersive experiences across various platforms.

- Furthermore, the integration of artificial intelligence and machine learning introduces novel avenues for delivering personalized audio content. Through the analysis of user preferences, behaviors, and listening habits, AI-driven audio platforms can curate customized playlists, recommendations, and audio enhancements tailored to individual users. This presents a unique opportunity for stereo audio codecs to evolve and adapt to the ever-changing landscape of personalized audio experiences, fostering innovation and market expansion. As the demand for personalized audio continues to rise across diverse sectors, the stereo audio codecs market is well-positioned to capitalize on this trend and expand its global presence.

Stereo Audio Codecs Market Segment Analysis:

Stereo Audio Codecs Market Segmented on the basis of Type, Component, and Application

By Component, Hardware segment is expected to dominate the market during the forecast period

- The hardware segment is expected to lead the growth of the stereo audio codecs market. With technology advancing and a rising demand for high-quality audio solutions, hardware components play a crucial role in meeting consumer expectations. Hardware-based stereo audio codecs provide robust performance and reliability, serving various applications across industries like automotive, consumer electronics, and telecommunications. Their capability to deliver superior sound quality, low power consumption, and compatibility with a wide range of devices positions them as the primary drivers of market expansion.

- Moreover, the hardware segment's dominance is fueled by continuous innovations in semiconductor technology. This enables manufacturers to create more efficient and compact audio codec solutions. With companies striving to improve their product offerings and remain competitive, investments in research and development for hardware-based solutions remain a priority. This proactive approach ensures that the hardware segment maintains its leading position in the stereo audio codecs market, addressing the evolving needs of consumers and industries while fostering overall market growth.

By Application, Headphone, Headset, and Wearable Devices segment held the largest share of 53.76% in 2022

- The headphone, headset, and wearable devices segment has emerged as the primary driver of growth in the stereo audio codecs market, capturing the largest share. This dominance stems from the increasing adoption of headphones, headsets, and wearable audio devices across diverse consumer demographics. As consumers seek immersive audio experiences for both leisure and professional use, the demand for high-quality audio codecs integrated into these devices has seen a significant surge. Furthermore, advancements in wireless connectivity technologies, such as Bluetooth, have contributed to the widespread adoption of stereo audio codecs in headphones, headsets, and wearable devices.

- Additionally, the continuous evolution of audio technology has reinforced the dominance of this segment. Integration of advanced features like noise cancellation, voice assistant support, and personalized sound profiles further solidifies its position. Manufacturers are actively investing in research and development efforts to enhance the performance and functionality of stereo audio codecs within these devices, ensuring their continued dominance in the market. As consumer preferences lean towards portable and immersive audio solutions, the headphone, headset, and wearable devices segment is expected to maintain its substantial share and propel further growth in the stereo audio codecs market.

Stereo Audio Codecs Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is positioned to lead the region in the growth of the stereo audio codecs market. The region benefits from a swiftly expanding consumer electronics sector and rising disposable incomes, driving the demand for top-notch audio solutions. Nations like China, Japan, South Korea, and India are experiencing notable strides in technology adoption, spurring the integration of stereo audio codecs across various applications, including smartphones, tablets, automotive infotainment systems, and smart home devices.

- Furthermore, Asia Pacific boasts numerous key players in the consumer electronics realm and prominent semiconductor manufacturers. This dynamic ecosystem encourages innovation and collaboration, facilitating the advancement of state-of-the-art audio technologies and products. Additionally, government initiatives geared towards promoting digitalization and technological progress further propel the expansion of the stereo audio codecs market in the region. Consequently, Asia Pacific is anticipated to uphold its dominant position in the stereo audio codecs market, meeting the evolving audio demands of consumers and industries throughout the region.

Stereo Audio Codecs Market Top Key Players:

- Analog Devices (U.S.)

- Synaptics (U.S.)

- Cirrus Logic (U.S.)

- Dolby Laboratories (U.S.)

- DSP Group (U.S.)

- Knowles (U.S.)

- Maxim Integrated (U.S.)

- Texas Instruments (U.S.)

- Analog Devices (U.S.)

- ON Semiconductor (U.S.)

- Silicon Laboratories (U.S.)

- Infineon Technologies (Germany)

- Fraunhofer IIS (Germany)

- STMicroelectronics (Switzerland)

- Technicolor (France)

- Dialog Semiconductor (UK)

- NXP Semiconductors (Netherlands)

- Realtek Semiconductor Corp (Taiwan)

- Asahi Kasei Microdevices (Japan)

- Rohm (Japan), and Other Major Players

Key Industry Developments in the Stereo Audio Codecs Market:

- In February 2024, Cirrus Logic Intel, and Microsoft unveiled a collaborative effort on a fresh PC reference design. This design showcased Cirrus Logic's advanced audio and power technologies alongside Intel's upcoming client processor, known as Lunar Lake. The partnership aimed to enhance laptops with a more immersive audio experience while simultaneously curbing heat generation, prolonging battery life, and facilitating the creation of sleeker, more compact designs. This initiative underscored a commitment to delivering "cool, quiet, and high-performance" PCs, promising users an optimized computing experience with superior audio quality and improved efficiency.

- In April 2023, Microsoft Corp. and Epic expanded their enduring strategic partnership on Monday, unveiling plans to integrate generative AI into healthcare by merging Azure OpenAI Service1 with Epic’s renowned electronic health record (EHR) software. This collaboration marked an extension of their longstanding alliance, aimed at empowering organizations to deploy Epic environments on the Microsoft Azure cloud platform. Leveraging the scale and capabilities of Azure OpenAI Service, the integration promised to enhance healthcare solutions with advanced AI capabilities, further solidifying the collaboration's commitment to driving innovation and improving patient care through the convergence of technology and healthcare expertise.

|

Global Stereo Audio Codecs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.33 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.03% |

Market Size in 2032: |

USD 9.38 Bn. |

|

Segments Covered: |

By Type |

|

|

|

|

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- STEREO AUDIO CODECS MARKET BY TYPE (2017 – 2032)

- STEREO AUDIO CODECS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ANALOG

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIGITAL

- STEREO AUDIO CODECS MARKET BY COMPONENT (2017 – 2032)

- STEREO AUDIO CODECS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HARDWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOFTWARE

- STEREO AUDIO CODECS MARKET BY APPLICATION (2017 – 2032)

- STEREO AUDIO CODECS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MOBILE PHONE & TABLET

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MUSIC & MEDIA DEVICES AND HOME THEATRE

- TELEVISION & GAMING CONSOLE

- AUTOMOTIVE INFOTAINMENT

- HEADPHONE, HEADSET, AND WEARABLE DEVICES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Stereo Audio Codecs Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ANALOG DEVICES (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SYNAPTICS (U.S.)

- CIRRUS LOGIC (U.S.)

- DOLBY LABORATORIES (U.S.)

- DSP GROUP (U.S.)

- KNOWLES (U.S.)

- MAXIM INTEGRATED (U.S.)

- TEXAS INSTRUMENTS (U.S.)

- ANALOG DEVICES (U.S.)

- ON SEMICONDUCTOR (U.S.)

- SILICON LABORATORIES (U.S.)

- INFINEON TECHNOLOGIES (GERMANY)

- FRAUNHOFER IIS (GERMANY)

- STMICROELECTRONICS (SWITZERLAND)

- TECHNICOLOR (FRANCE)

- DIALOG SEMICONDUCTOR (UK)

- NXP SEMICONDUCTORS (NETHERLANDS)

- REALTEK SEMICONDUCTOR CORP (TAIWAN)

- ASAHI KASEI MICRODEVICES (JAPAN)

- ROHM (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL STEREO AUDIO CODECS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Stereo Audio Codecs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.33 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.03% |

Market Size in 2032: |

USD 9.38 Bn. |

|

Segments Covered: |

By Type |

|

|

|

|

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. STEREO AUDIO CODECS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. STEREO AUDIO CODECS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. STEREO AUDIO CODECS MARKET COMPETITIVE RIVALRY

TABLE 005. STEREO AUDIO CODECS MARKET THREAT OF NEW ENTRANTS

TABLE 006. STEREO AUDIO CODECS MARKET THREAT OF SUBSTITUTES

TABLE 007. STEREO AUDIO CODECS MARKET BY TYPE

TABLE 008. ANALOG MARKET OVERVIEW (2016-2028)

TABLE 009. DIGITAL MARKET OVERVIEW (2016-2028)

TABLE 010. STEREO AUDIO CODECS MARKET BY APPLICATION

TABLE 011. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 012. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 013. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA STEREO AUDIO CODECS MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA STEREO AUDIO CODECS MARKET, BY APPLICATION (2016-2028)

TABLE 016. N STEREO AUDIO CODECS MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE STEREO AUDIO CODECS MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE STEREO AUDIO CODECS MARKET, BY APPLICATION (2016-2028)

TABLE 019. STEREO AUDIO CODECS MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC STEREO AUDIO CODECS MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC STEREO AUDIO CODECS MARKET, BY APPLICATION (2016-2028)

TABLE 022. STEREO AUDIO CODECS MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA STEREO AUDIO CODECS MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA STEREO AUDIO CODECS MARKET, BY APPLICATION (2016-2028)

TABLE 025. STEREO AUDIO CODECS MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA STEREO AUDIO CODECS MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA STEREO AUDIO CODECS MARKET, BY APPLICATION (2016-2028)

TABLE 028. STEREO AUDIO CODECS MARKET, BY COUNTRY (2016-2028)

TABLE 029. SYNAPTICS(US): SNAPSHOT

TABLE 030. SYNAPTICS(US): BUSINESS PERFORMANCE

TABLE 031. SYNAPTICS(US): PRODUCT PORTFOLIO

TABLE 032. SYNAPTICS(US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. DIALOG SEMICONDUCTOR (UK): SNAPSHOT

TABLE 033. DIALOG SEMICONDUCTOR (UK): BUSINESS PERFORMANCE

TABLE 034. DIALOG SEMICONDUCTOR (UK): PRODUCT PORTFOLIO

TABLE 035. DIALOG SEMICONDUCTOR (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. ASAHI KASEI MICRODEVICES (JAPAN): SNAPSHOT

TABLE 036. ASAHI KASEI MICRODEVICES (JAPAN): BUSINESS PERFORMANCE

TABLE 037. ASAHI KASEI MICRODEVICES (JAPAN): PRODUCT PORTFOLIO

TABLE 038. ASAHI KASEI MICRODEVICES (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. CIRRUS LOGIC(US): SNAPSHOT

TABLE 039. CIRRUS LOGIC(US): BUSINESS PERFORMANCE

TABLE 040. CIRRUS LOGIC(US): PRODUCT PORTFOLIO

TABLE 041. CIRRUS LOGIC(US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. KNOWLES(US): SNAPSHOT

TABLE 042. KNOWLES(US): BUSINESS PERFORMANCE

TABLE 043. KNOWLES(US): PRODUCT PORTFOLIO

TABLE 044. KNOWLES(US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. STMICROELECTRONICS (SWITZERLAND): SNAPSHOT

TABLE 045. STMICROELECTRONICS (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 046. STMICROELECTRONICS (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 047. STMICROELECTRONICS (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. TEXAS INSTRUMENTS (US): SNAPSHOT

TABLE 048. TEXAS INSTRUMENTS (US): BUSINESS PERFORMANCE

TABLE 049. TEXAS INSTRUMENTS (US): PRODUCT PORTFOLIO

TABLE 050. TEXAS INSTRUMENTS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ANALOG DEVICES(US): SNAPSHOT

TABLE 051. ANALOG DEVICES(US): BUSINESS PERFORMANCE

TABLE 052. ANALOG DEVICES(US): PRODUCT PORTFOLIO

TABLE 053. ANALOG DEVICES(US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ON SEMICONDUCTOR(US): SNAPSHOT

TABLE 054. ON SEMICONDUCTOR(US): BUSINESS PERFORMANCE

TABLE 055. ON SEMICONDUCTOR(US): PRODUCT PORTFOLIO

TABLE 056. ON SEMICONDUCTOR(US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. INFINEON TECHNOLOGIES(GERMANY): SNAPSHOT

TABLE 057. INFINEON TECHNOLOGIES(GERMANY): BUSINESS PERFORMANCE

TABLE 058. INFINEON TECHNOLOGIES(GERMANY): PRODUCT PORTFOLIO

TABLE 059. INFINEON TECHNOLOGIES(GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ROHM(JAPAN): SNAPSHOT

TABLE 060. ROHM(JAPAN): BUSINESS PERFORMANCE

TABLE 061. ROHM(JAPAN): PRODUCT PORTFOLIO

TABLE 062. ROHM(JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. NXP SEMICONDUCTORS(NETHERLANDS): SNAPSHOT

TABLE 063. NXP SEMICONDUCTORS(NETHERLANDS): BUSINESS PERFORMANCE

TABLE 064. NXP SEMICONDUCTORS(NETHERLANDS): PRODUCT PORTFOLIO

TABLE 065. NXP SEMICONDUCTORS(NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SILICON LABORATORIES (US): SNAPSHOT

TABLE 066. SILICON LABORATORIES (US): BUSINESS PERFORMANCE

TABLE 067. SILICON LABORATORIES (US): PRODUCT PORTFOLIO

TABLE 068. SILICON LABORATORIES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. STEREO AUDIO CODECS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. STEREO AUDIO CODECS MARKET OVERVIEW BY TYPE

FIGURE 012. ANALOG MARKET OVERVIEW (2016-2028)

FIGURE 013. DIGITAL MARKET OVERVIEW (2016-2028)

FIGURE 014. STEREO AUDIO CODECS MARKET OVERVIEW BY APPLICATION

FIGURE 015. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 016. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 017. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA STEREO AUDIO CODECS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE STEREO AUDIO CODECS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC STEREO AUDIO CODECS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA STEREO AUDIO CODECS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA STEREO AUDIO CODECS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Stereo Audio Codecs Market research report is 2024-2032.

Analog Devices (U.S.), Synaptics (U.S.), Cirrus Logic (U.S.), Dolby Laboratories (U.S.), DSP Group (U.S.), Knowles (U.S.), Maxim Integrated (U.S.), Texas Instruments (U.S.), Analog Devices (U.S.), ON Semiconductor (U.S.), Silicon Laboratories (U.S.), Infineon Technologies (Germany), Fraunhofer IIS (Germany), STMicroelectronics (Switzerland), Technicolor (France), Dialog Semiconductor (UK), NXP Semiconductors (Netherlands), Realtek Semiconductor Corp (Taiwan), Asahi Kasei Microdevices (Japan), Rohm (Japan), and Other Major Players.

The Stereo Audio Codecs Market is segmented into Type, Component, Application, and region. By Type, the market is categorized into Analog and Digital. By Component, the market is categorized into Hardware and Software. By Application, the market is categorized into Mobile Phone & Tablet, Music & Media Devices and Home Theatre, Television & Gaming Console Automotive Infotainment, and Headphone, Headset, & Wearable Devices. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Stereo audio codecs encode and decode digital audio signals to produce stereo sound. They compress audio data to optimize storage and transmission without compromising quality. These codecs are essential in music streaming, video conferencing, and multimedia entertainment systems.

Global Stereo Audio Codecs Market Size Was Valued at USD 6.33 Billion in 2023 and is Projected to Reach USD 9.38 Billion by 2032, Growing at a CAGR of 5.03% From 2023-2032.