Sparkling Water Market Synopsis

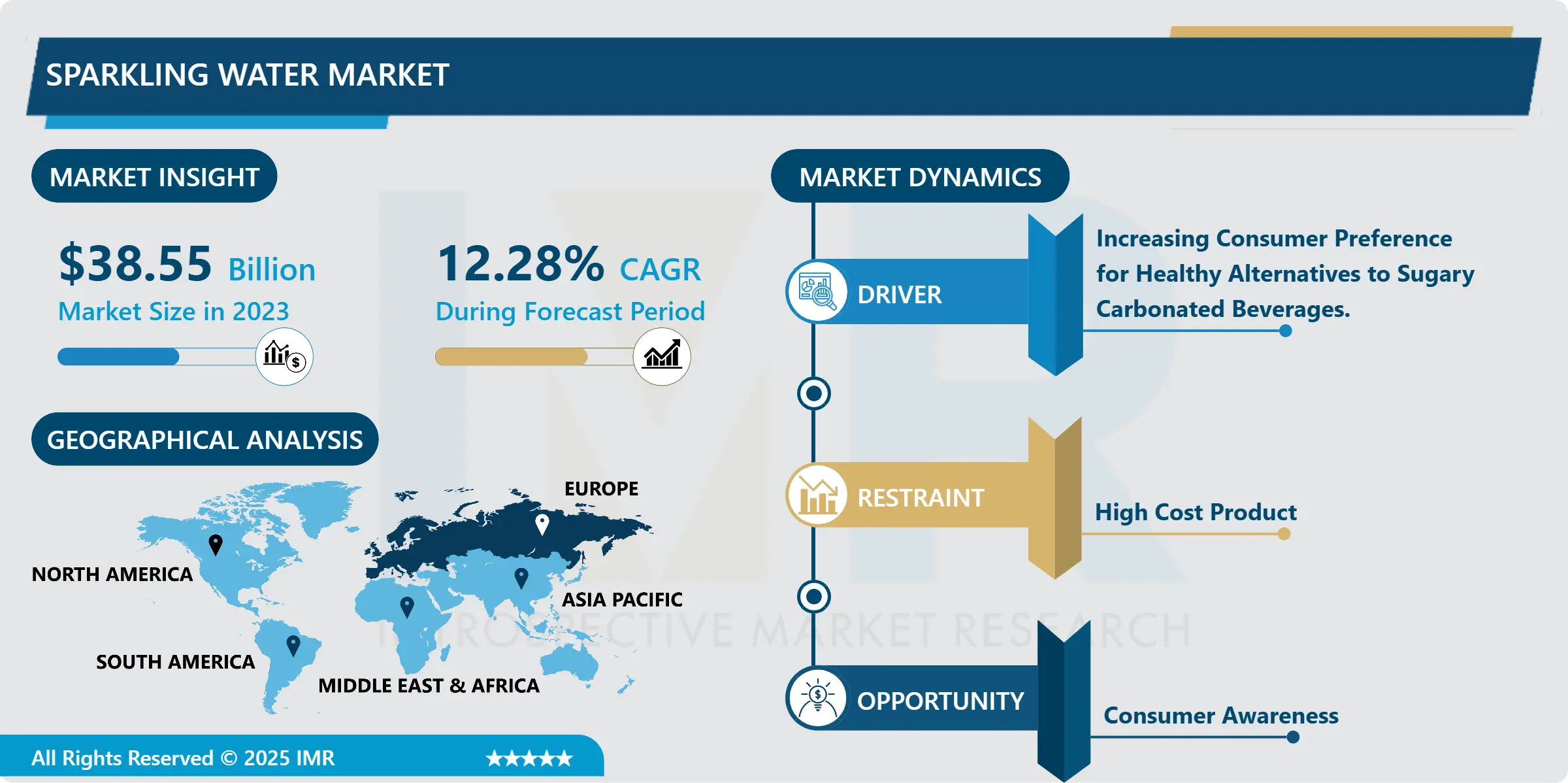

The Global Sparkling Water Market Size Was Valued at USD 38.55 Billion in 2023 and is Projected to Reach USD 109.33 Billion by 2032, Growing at a CAGR of 12.28 % From 2024-2032.

Sparkling water is seltzer water or carbonated water that has carbon dioxide bubbles in it. This gas may be natural, or it may be infused into still water. In some forms, it can be a refreshing and healthy alternative to soda.

Growing awareness regarding healthy lifestyles, people are switching to sparkling water due to the presence of a variety of minerals, including sodium, magnesium, and calcium, in the product. Sparkling water provides hydration, and it's a much better option than drinking regular soda or even diet soda, which does not provide adequate hydration. People find carbonated water more than still water can alleviate an upset stomach, bloating, or indigestion. Companies are launching new products in the market following the demand of health-conscious consumers.Home isolation orders have spurred the demand for bottled water of various kinds among households across the globe, including sparkling water.

According to the International Bottled Water Association bottled water businesses have boosted their production capacity to cater to this surge in demand, which, in turn, has benefited the market.As consumers are seeking sparkling water with added benefits, manufacturers are trying to launch new variants of the product with caffeine in it. Increasing the number of commercial advertisements for bottled water has been playing an important role in boosting brand visibility. These advertisements highlight the quality and hydration benefits of the product and also emphasize taste and convenience.The demand for bottled water has significantly grown owing to the rising demand for clean and healthy drinking water. Rapidly growing segment of the carbonated soft drink and bottled water categories in the United States.

Global Sparkling Water Market Trend Analysis

Increasing Consumer Preference for Healthy Alternatives to Sugary Carbonated Beverages.

- The market for carbonated beverages is booming. The market for such drinks or beverages has been predominantly focused on sugary drinks or drinks with a high number of calories. Scientifically it has been proved that inordinate consumption of sugary drinks heavily increases the likelihood of heart ailments and other diet-related diseases such as Diabetes. By taking the consumption of Pepsi and Coke many deaths are caused each year.

- The consumption of carbonated drinks has decreased by 15-20% over the last few years, whereas the market for non-fizzy drinks is expected to soar by 35% annually. Additionally, over 75% of the urban consumers prefer non-carbonated drinks.

- As the rural/urban population becomes more educated, the whole spectrum of young individuals is now shifting to a more disciplined diet regime with a high focus on healthy foods and drinks.

- Ultimately, awareness about healthy foods and drinks must be spread amongst the young, for they are the future of a healthy tomorrow. Healthy dietary practices will sustain for time to come, and the proof lies in the manufacturers of fizzy drinks themselves. We can see most of the big FMCG players coming out with healthy drinks such as 7up Revive, Fiesta, Tata Gluco Plus, Tata Water Plus, etc. The paper will investigate the psychological factors that drive the consumption of healthy drinks. The trend of consumer health preference is expected to drive the market growth of the sparkling water market during the forecast period.

Consumer Awareness

- Growing awareness regarding healthy lifestyles, people are switching to sparkling water due to the presence of a variety of minerals, including sodium, magnesium, and calcium, in the product. Sparkling water provides hydration, and it is a much better option than drinking regular soda or even diet soda, which does not provide adequate hydration. People find carbonated water more than still water can alleviate an upset stomach, bloating, or indigestion.

- Companies are launching new products in the market following the demand of health-conscious consumers. For instance: In 2021, Albertsons announced Soleil's private label line of sparkling water with new packaging and four new flavors, in the supermarket chain. The grocer is using designs created by seven artists for the packaging of the drinks, which now come in mango, raspberry lime, tangerine, and watermelon in addition to 13 existing varieties.

- In 2022, Sparkling Ice Beverages launched the new "Live in Full Flavor" advertising campaign that celebrates all of life's flavors and reminds consumers to drink it in and embrace little moments of joy in everyday life. This trend is expected to create lucrative opportunities in the upcoming years.

Regional Analysis of the Global Sparkling Water Market

Europe is expected to Dominate the Market over the Forecast period.

- Europe region is dominating the Global Sparkling Water Market. European countries were examining mineral composition. The median concentrations per mineral assorted greatly. The greatest variation in median mineral content was found for sodium and sulphates with levels ranging from 3.1 mg/l to 63.0 mg/l and 6.0 mg/l to 263.0 mg/l.

- Wide variation in the mineral content of bottled sparkling water from 126 brands that are commercially available across Europe such as Belgium, France, Germany, Greece, Italy, the Netherlands, Poland, Spain, Switzerland, and the United Kingdom. In each country, the two largest supermarket chains were visited to obtain raw data on the mineral composition of sparkling water by reading the ingredient labels on the bottles supplied by the manufacturers.

- Mineral composition of sparkling or carbonated bottled drinking water covering Europe. The high inclination of consumers towards functional beverages in Europe is driving the market for sparkling water in this region.

Restraining factor of Sparkling water

High-Cost Product

- Many expensive sparkling waters come from privately owned natural springs and may have distinct mineral compositions that could affect flavor such as ROI Mineral Water Nevas Water VOSS.

- Additionally, they may be naturally carbonated. However, the exact labeling differs from country to country. Unlike soda waters, sparkling mineral waters, from a well or natural spring, are extracted ready to drink, and then bottled. They are not manipulated during production and bottling, which makes them an exclusive and higher-quality product whose value lies in the unique flavor of the minerals they contain. Other expensive sparkling waters are imported, and shipping water across the globe costs money. High-cost products of sparkling water hampered the market growth over the forecast period.

Top Key Players of the Global Sparkling Water Market

- Private label (U.S)

- San Pellegrino (Italy)

- Sparkling Ice (Washington)

- La Croix (Florida)

- Polar Beverages. (U.S)

- Bubly (New York)

- Perrier. (France)

- Topo Chico (Mexico)

- Schweppes (Germany)

- Spindrift (South Africa)

- AHA (New York)

- Saratoga Sparkling Water (U.S)

- VOSS (New York)

- Nestle (Switzerland)

- PepsiCo (New York)

Key industry of Sparkling Water Market

- In October 2023, Bisleri International’s premium beverage brand, Vedica Himalayan Spring Water, is proud to announce the launch of its latest innovation: Vedica Himalayan Sparkling Water. Inspired by the natural purity of the Himalayas, this sparkling water combines effervescence with a perfectly balanced mineral composition, offering a refreshing and sophisticated drinking experience. With a focus on quality and authenticity, Vedica Himalayan Sparkling Water promises to elevate hydration with its crisp and invigorating taste, appealing to consumers seeking premium, natural, and effervescent refreshment.

- In May 2023, PepsiCo has introduced its popular no-sugar sparkling water, Bubly, to the Australian market, marking the first new beverage launch outside its core brands in 30 years. Initially launched in North America five years ago, Bubly offers a refreshing alternative with no artificial sweeteners, flavours, or calories. The drink comes in five vibrant flavours: pineapple, lime, blackberry, raspberry, and passionfruit.

|

Global Sparkling Water Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 38.55 Bn. |

|

Forecast Period 2023-32 CAGR: |

12.28 % |

Market Size in 2032: |

USD 109.33 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sparkling Water Market by Product Type (2018-2032)

4.1 Sparkling Water Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Natural

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Minerals

4.5 Caffeinated

Chapter 5: Sparkling Water Market by Packaging (2018-2032)

5.1 Sparkling Water Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bottled

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Canned

Chapter 6: Sparkling Water Market by Distribution Channel (2018-2032)

6.1 Sparkling Water Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarkets/Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Stores

6.5 E-Commerce

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Sparkling Water Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PK CHEM INDUSTRIES LTD. (CANADA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PRAVADA PRIVATE LABEL NAPLES (U.S)

7.4 ORATECH (U.S)

7.5 STEPAN CO. (U.S)

7.6 INNOVATIVE BODY SCIENCE (U.S)

7.7 SCOT DERMA (INDIA)

7.8 BIOPHAR LIFESCIENCES (INDIA)

7.9 VLCC PERSONAL CARE (INDIA)

7.10 CIPLA LIMITED (INDIA)

7.11 JOHNSON & JOHNSON SERVICES INC. (U.S)

7.12 UNILEVER PLC/NV (U.K)

7.13 NEW AVON COMPANY (U.K)

7.14 L'OREAL S.A. (FRANCE)

7.15 KAO GROUP (JAPAN)

7.16 COLGATE-PALMOLIVE COMPANY (NEW YORK)

7.17 SHISEIDO COLTD. (JAPAN)

7.18 BEIERSDORF AG (GERMANY)

7.19 THE PROCTER & GAMBLE COMPANY (OHIO)

7.20 ESTEE LAUDER (NEW YORK)

7.21 COSMAX (SOUTH KOREA)

Chapter 8: Global Sparkling Water Market By Region

8.1 Overview

8.2. North America Sparkling Water Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Natural

8.2.4.2 Minerals

8.2.4.3 Caffeinated

8.2.5 Historic and Forecasted Market Size by Packaging

8.2.5.1 Bottled

8.2.5.2 Canned

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Supermarkets/Hypermarkets

8.2.6.2 Specialty Stores

8.2.6.3 E-Commerce

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Sparkling Water Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Natural

8.3.4.2 Minerals

8.3.4.3 Caffeinated

8.3.5 Historic and Forecasted Market Size by Packaging

8.3.5.1 Bottled

8.3.5.2 Canned

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Supermarkets/Hypermarkets

8.3.6.2 Specialty Stores

8.3.6.3 E-Commerce

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Sparkling Water Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Natural

8.4.4.2 Minerals

8.4.4.3 Caffeinated

8.4.5 Historic and Forecasted Market Size by Packaging

8.4.5.1 Bottled

8.4.5.2 Canned

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Supermarkets/Hypermarkets

8.4.6.2 Specialty Stores

8.4.6.3 E-Commerce

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Sparkling Water Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Natural

8.5.4.2 Minerals

8.5.4.3 Caffeinated

8.5.5 Historic and Forecasted Market Size by Packaging

8.5.5.1 Bottled

8.5.5.2 Canned

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Supermarkets/Hypermarkets

8.5.6.2 Specialty Stores

8.5.6.3 E-Commerce

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Sparkling Water Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Natural

8.6.4.2 Minerals

8.6.4.3 Caffeinated

8.6.5 Historic and Forecasted Market Size by Packaging

8.6.5.1 Bottled

8.6.5.2 Canned

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Supermarkets/Hypermarkets

8.6.6.2 Specialty Stores

8.6.6.3 E-Commerce

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Sparkling Water Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Natural

8.7.4.2 Minerals

8.7.4.3 Caffeinated

8.7.5 Historic and Forecasted Market Size by Packaging

8.7.5.1 Bottled

8.7.5.2 Canned

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Supermarkets/Hypermarkets

8.7.6.2 Specialty Stores

8.7.6.3 E-Commerce

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Sparkling Water Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 38.55 Bn. |

|

Forecast Period 2023-32 CAGR: |

12.28 % |

Market Size in 2032: |

USD 109.33 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||