Space Mining Market Synopsis

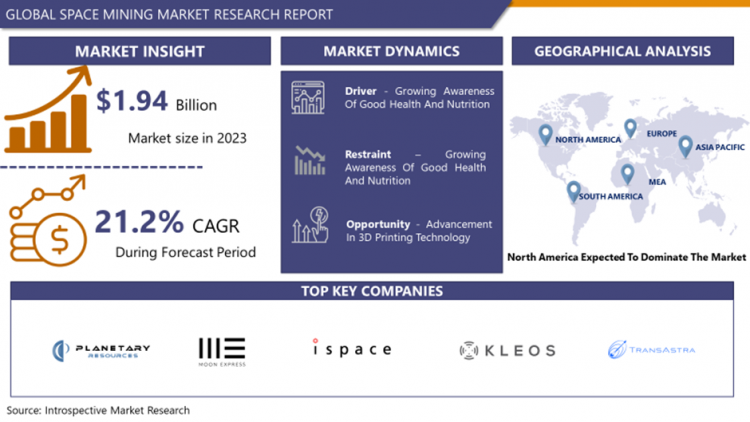

The Global Space Mining Market size is expected to grow from USD 1.94 Billion in 2023 to USD 10.95 Billion by 2032, at a CAGR of 21.2% during the forecast period (2024-2032).

- Space mining, also known as asteroid mining or extra-terrestrial resource utilization, is a futuristic concept and emerging industry that involves the exploration, extraction, and utilization of valuable minerals, metals, and other resources from celestial bodies such as asteroids, the Moon, and potentially other planets or moons in our solar system. This innovative field envisions a future where humans and robotic systems work together to harness the vast resources available in space, with the ultimate goal of addressing resource scarcity on Earth, supporting space exploration, and enabling the colonization of other celestial bodies.

- The fundamental premise of space mining is to tap into the abundant and diverse resources found in space, which can be used for various purposes, including sustaining human life and furthering scientific research. These resources may include water ice, precious metals like platinum and gold, rare minerals, and even gases like helium-3, which has potential applications in advanced energy generation.

The Space Mining Market Trend Analysis

Growing Awareness Of Good Health And Nutrition

- Nutraceuticals are products derived from food sources that offer health benefits beyond basic nutrition. They include dietary supplements, functional foods, and beverages that provide specific health benefits, such as improving digestion, boosting immunity, enhancing cognitive function, and promoting overall well-being in life.

- Consumers are increasingly looking for ways to prevent health issues rather than just treating them after they arise. Space Mining is seen as a proactive approach to health management, offering a way to maintain optimal health and prevent the development of certain diseases people are becoming more conscious of the ingredients in the products they consume. They are seeking natural and organic Space Mining that is free from artificial additives, preservatives, and genetically modified organisms (GMOs).

- Space Mining is often formulated with functional ingredients such as vitamins, minerals, antioxidants, probiotics, omega-3 fatty acids, and herbal extracts. These ingredients are chosen for their specific health benefits and advancements in technology, Companies are able to offer personalized nutraceutical solutions based on individual health needs and goals. This customization can involve supplement rules and personalized nutrition plans.

Advancement in 3D Printing Technology

- The advancement in 3D printing technology presents a remarkable opportunity for the space mining market, offering innovative solutions to overcome some of the industry's most significant challenges and enhancing the feasibility and sustainability of extra-terrestrial resource utilization.

- One of the primary advantages of 3D printing, also known as additive manufacturing, in the context of space mining is the potential to fabricate complex and customized components in space itself. Traditional manufacturing relies on transporting pre-made parts from Earth to space, incurring significant costs and logistical challenges. With 3D printing, raw materials sourced from asteroids or lunar regolith can be used to produce tools, spare parts, and even entire structures directly on-site, reducing the need for costly payloads from Earth.

- 3D printing can contribute to resource efficiency in space mining operations. By utilizing locally sourced materials, such as metals and minerals from asteroids or the Moon, 3D printers can minimize waste and optimize the use of available resources. This approach aligns with the sustainability goals of space mining, where minimizing environmental impact and conserving resources are paramount.

- Another critical aspect is the adaptability and versatility of 3D printing technology. Space environments are harsh and unpredictable, and missions may encounter unforeseen challenges. With 3D printers on hand, space mining missions can rapidly manufacture specialized tools or equipment to address unexpected issues, reducing mission downtime and enhancing overall mission resilience.

Space Mining Market Segmentation Analysis

Space Mining Market segments cover the Phase, Asteroid Type, and Application. By Application, the construction segment is Anticipated to Dominate the Market Over the Forecast period.

- Construction is emerging as the dominating application in the space mining market, signaling a fundamental shift in the way we envision extraterrestrial resource utilization. While space mining is often associated with the extraction of valuable minerals and resources from celestial bodies, its role in construction is gaining prominence due to the critical role it plays in establishing sustainable habitats and infrastructure beyond Earth.

- One of the primary factor for construction's dominance in the space mining market is its pivotal role in establishing human presence in space. As we explore the possibility of long-term human missions to the Moon, Mars, and even beyond, the need for suitable living and working spaces becomes increasingly evident. Space mining provides the necessary resources for building habitats, such as lunar or Martian bases, which can serve as safe havens for astronauts and researchers. These habitats must be constructed using locally sourced materials to reduce the need for resource-intensive shipments from Earth, making space mining a crucial enabler of these ambitious goals.

Space Mining Market Regional Analysis

North America is dominating the Market Over the Forecast Period.

- North America has emerged as the dominant segment in the space mining market. With a robust space industry infrastructure, including renowned space agencies like NASA and private companies such as SpaceX, the region has taken a leading role in shaping the future of space resource exploration and utilization. The United States, in particular, has made significant investments in space mining technology and research, attracting both domestic and international players to collaborate and invest in this burgeoning sector.

- North America's dominance can be attributed to its advanced technological capabilities, financial resources, and a favorable regulatory environment that encourages innovation and entrepreneurship in the space sector. Moreover, the region's emphasis on public-private partnerships has accelerated the development of space mining initiatives, creating a conducive ecosystem for companies to thrive.

COVID-19 Impact Analysis on Space Mining Market

The COVID-19 pandemic has left a significant impact on the space mining market, shaping the trajectory of this emerging industry in several ways. In the immediate aftermath of the pandemic's outbreak, space mining faced significant disruptions.

The closure of manufacturing facilities, supply chain interruptions, and travel restrictions hindered the progress of ongoing space mining missions and research initiatives. These setbacks led to delays in planned launches and pushed back the timeline for achieving operational space mining ventures. However, the pandemic also revealed the vulnerabilities of Earth's resource supply chain. It highlighted the need for resource diversification and resilience, prompting governments and private entities to consider space mining as a viable solution. As a result, some investors and space agencies reaffirmed their commitment to space mining projects, recognizing them as essential for mitigating future resource scarcity risks.

Space Mining Market Key Player

- Deep Space Industries (US)

- Planetary Resources (US)

- Moon Express (US)

- ispace (Japan)

- Asteroid Mining Corporation (UK)

- Shackleton Energy Company (SEC, US)

- Kleos Space (Luxembourg)

- TransAstra (US)

- OffWorld (US)

- SpaceFab.US (US)

- National Aeronautics and Space Administration (NASA, US)

- European Space Agency (France)

- Japan Aerospace Exploration Agency (Japan)

- China National Space Administration (China)

- Russian Federal Space Agency (Russia) and Other Major Players

Key Industry Developments in the Space Mining Market

In December 2023, Planetary Resources revealed their innovative Asteroid Prospector Craft, equipped with AI-powered technology for resource identification on asteroids. This significant advancement demonstrates their commitment to pioneering the field of asteroid resource mapping and detection.

In August 2023, NASA proudly announced a significant advancement in In-Situ Resource Utilization (ISRU) technology for asteroid resource exploitation. This milestone underscores NASA's commitment to developing innovative methods for harnessing resources from asteroids.

In November 2023, Deep Space Industries (DSI) announced its collaboration with a leading aerospace manufacturer to create and deploy refillable spacecraft dedicated to asteroid mining. This partnership marks a significant step in the development of sustainable and efficient technologies for asteroid resource extraction.

|

Space Mining Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1621.40 Mn. |

|

Forecast Period 2024-32 CAGR: |

21% |

Market Size in 2032: |

USD 7450.29 Mn. |

|

Segments Covered: |

By Phase |

|

|

|

By Asteroid Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SPACE MINING MARKET BY PHASE (2017-2032)

- SPACE MINING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SPACECRAFT DESIGN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LAUNCH

- OPERATION

- SPACE MINING MARKET BY ASTEROID TYPE (2017-2032)

- SPACE MINING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TYPE C

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TYPE S

- TYPE M

- OTHERS

- SPACE MINING MARKET BY APPLICATION (2017-2032)

- SPACE MINING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSTRUCTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RESOURCE HARVESTING

- 3D PRINTING

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- SPACE MINING Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DEEP SPACE INDUSTRIES (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- PLANETARY RESOURCES (US)

- MOON EXPRESS (US)

- ISPACE (JAPAN)

- ASTEROID MINING CORPORATION (UK)

- SHACKLETON ENERGY COMPANY (US)

- KLEOS SPACE (LUXEMBOURG)

- TRANSASTRA (US)

- OFFWORLD (US)

- SPACEFAB.US (US)

- NATIONAL AERONAUTICS AND SPACE ADMINISTRATION (NASA, US)

- EUROPEAN SPACE AGENCY (FRANCE)

- JAPAN AEROSPACE EXPLORATION AGENCY (JAPAN)

- CHINA NATIONAL SPACE ADMINISTRATION (CHINA)

- RUSSIAN FEDERAL SPACE AGENCY (RUSSIA)

- COMPETITIVE LANDSCAPE

- GLOBAL SPACE MINING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Phase

- Historic And Forecasted Market Size By Asteroid Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Space Mining Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1621.40 Mn. |

|

Forecast Period 2024-32 CAGR: |

21% |

Market Size in 2032: |

USD 7450.29 Mn. |

|

Segments Covered: |

By Phase |

|

|

|

By Asteroid Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SPACE MINING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SPACE MINING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SPACE MINING MARKET COMPETITIVE RIVALRY

TABLE 005. SPACE MINING MARKET THREAT OF NEW ENTRANTS

TABLE 006. SPACE MINING MARKET THREAT OF SUBSTITUTES

TABLE 007. SPACE MINING MARKET BY PHASE

TABLE 008. SPACECRAFT DESIGN MARKET OVERVIEW (2016-2030)

TABLE 009. LAUNCH MARKET OVERVIEW (2016-2030)

TABLE 010. OPERATION MARKET OVERVIEW (2016-2030)

TABLE 011. SPACE MINING MARKET BY ASTEROID TYPE

TABLE 012. TYPE C MARKET OVERVIEW (2016-2030)

TABLE 013. TYPE S MARKET OVERVIEW (2016-2030)

TABLE 014. TYPE M MARKET OVERVIEW (2016-2030)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 016. SPACE MINING MARKET BY APPLICATION

TABLE 017. CONSTRUCTION MARKET OVERVIEW (2016-2030)

TABLE 018. RESOURCE HARVESTING MARKET OVERVIEW (2016-2030)

TABLE 019. 3D PRINTING MARKET OVERVIEW (2016-2030)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 021. NORTH AMERICA SPACE MINING MARKET, BY PHASE (2016-2030)

TABLE 022. NORTH AMERICA SPACE MINING MARKET, BY ASTEROID TYPE (2016-2030)

TABLE 023. NORTH AMERICA SPACE MINING MARKET, BY APPLICATION (2016-2030)

TABLE 024. N SPACE MINING MARKET, BY COUNTRY (2016-2030)

TABLE 025. EASTERN EUROPE SPACE MINING MARKET, BY PHASE (2016-2030)

TABLE 026. EASTERN EUROPE SPACE MINING MARKET, BY ASTEROID TYPE (2016-2030)

TABLE 027. EASTERN EUROPE SPACE MINING MARKET, BY APPLICATION (2016-2030)

TABLE 028. SPACE MINING MARKET, BY COUNTRY (2016-2030)

TABLE 029. WESTERN EUROPE SPACE MINING MARKET, BY PHASE (2016-2030)

TABLE 030. WESTERN EUROPE SPACE MINING MARKET, BY ASTEROID TYPE (2016-2030)

TABLE 031. WESTERN EUROPE SPACE MINING MARKET, BY APPLICATION (2016-2030)

TABLE 032. SPACE MINING MARKET, BY COUNTRY (2016-2030)

TABLE 033. ASIA PACIFIC SPACE MINING MARKET, BY PHASE (2016-2030)

TABLE 034. ASIA PACIFIC SPACE MINING MARKET, BY ASTEROID TYPE (2016-2030)

TABLE 035. ASIA PACIFIC SPACE MINING MARKET, BY APPLICATION (2016-2030)

TABLE 036. SPACE MINING MARKET, BY COUNTRY (2016-2030)

TABLE 037. MIDDLE EAST & AFRICA SPACE MINING MARKET, BY PHASE (2016-2030)

TABLE 038. MIDDLE EAST & AFRICA SPACE MINING MARKET, BY ASTEROID TYPE (2016-2030)

TABLE 039. MIDDLE EAST & AFRICA SPACE MINING MARKET, BY APPLICATION (2016-2030)

TABLE 040. SPACE MINING MARKET, BY COUNTRY (2016-2030)

TABLE 041. SOUTH AMERICA SPACE MINING MARKET, BY PHASE (2016-2030)

TABLE 042. SOUTH AMERICA SPACE MINING MARKET, BY ASTEROID TYPE (2016-2030)

TABLE 043. SOUTH AMERICA SPACE MINING MARKET, BY APPLICATION (2016-2030)

TABLE 044. SPACE MINING MARKET, BY COUNTRY (2016-2030)

TABLE 045. DEEP SPACE INDUSTRIES (US): SNAPSHOT

TABLE 046. DEEP SPACE INDUSTRIES (US): BUSINESS PERFORMANCE

TABLE 047. DEEP SPACE INDUSTRIES (US): PRODUCT PORTFOLIO

TABLE 048. DEEP SPACE INDUSTRIES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. PLANETARY RESOURCES (US): SNAPSHOT

TABLE 049. PLANETARY RESOURCES (US): BUSINESS PERFORMANCE

TABLE 050. PLANETARY RESOURCES (US): PRODUCT PORTFOLIO

TABLE 051. PLANETARY RESOURCES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. MOON EXPRESS (US): SNAPSHOT

TABLE 052. MOON EXPRESS (US): BUSINESS PERFORMANCE

TABLE 053. MOON EXPRESS (US): PRODUCT PORTFOLIO

TABLE 054. MOON EXPRESS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. ISPACE (JAPAN): SNAPSHOT

TABLE 055. ISPACE (JAPAN): BUSINESS PERFORMANCE

TABLE 056. ISPACE (JAPAN): PRODUCT PORTFOLIO

TABLE 057. ISPACE (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ASTEROID MINING CORPORATION (UK): SNAPSHOT

TABLE 058. ASTEROID MINING CORPORATION (UK): BUSINESS PERFORMANCE

TABLE 059. ASTEROID MINING CORPORATION (UK): PRODUCT PORTFOLIO

TABLE 060. ASTEROID MINING CORPORATION (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SHACKLETON ENERGY COMPANY (SEC: SNAPSHOT

TABLE 061. SHACKLETON ENERGY COMPANY (SEC: BUSINESS PERFORMANCE

TABLE 062. SHACKLETON ENERGY COMPANY (SEC: PRODUCT PORTFOLIO

TABLE 063. SHACKLETON ENERGY COMPANY (SEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. US): SNAPSHOT

TABLE 064. US): BUSINESS PERFORMANCE

TABLE 065. US): PRODUCT PORTFOLIO

TABLE 066. US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. KLEOS SPACE (LUXEMBOURG): SNAPSHOT

TABLE 067. KLEOS SPACE (LUXEMBOURG): BUSINESS PERFORMANCE

TABLE 068. KLEOS SPACE (LUXEMBOURG): PRODUCT PORTFOLIO

TABLE 069. KLEOS SPACE (LUXEMBOURG): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. TRANSASTRA (US): SNAPSHOT

TABLE 070. TRANSASTRA (US): BUSINESS PERFORMANCE

TABLE 071. TRANSASTRA (US): PRODUCT PORTFOLIO

TABLE 072. TRANSASTRA (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. OFFWORLD (US): SNAPSHOT

TABLE 073. OFFWORLD (US): BUSINESS PERFORMANCE

TABLE 074. OFFWORLD (US): PRODUCT PORTFOLIO

TABLE 075. OFFWORLD (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. SPACEFAB.US (US): SNAPSHOT

TABLE 076. SPACEFAB.US (US): BUSINESS PERFORMANCE

TABLE 077. SPACEFAB.US (US): PRODUCT PORTFOLIO

TABLE 078. SPACEFAB.US (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. NATIONAL AERONAUTICS AND SPACE ADMINISTRATION (NASA: SNAPSHOT

TABLE 079. NATIONAL AERONAUTICS AND SPACE ADMINISTRATION (NASA: BUSINESS PERFORMANCE

TABLE 080. NATIONAL AERONAUTICS AND SPACE ADMINISTRATION (NASA: PRODUCT PORTFOLIO

TABLE 081. NATIONAL AERONAUTICS AND SPACE ADMINISTRATION (NASA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. US): SNAPSHOT

TABLE 082. US): BUSINESS PERFORMANCE

TABLE 083. US): PRODUCT PORTFOLIO

TABLE 084. US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. EUROPEAN SPACE AGENCY (ESA: SNAPSHOT

TABLE 085. EUROPEAN SPACE AGENCY (ESA: BUSINESS PERFORMANCE

TABLE 086. EUROPEAN SPACE AGENCY (ESA: PRODUCT PORTFOLIO

TABLE 087. EUROPEAN SPACE AGENCY (ESA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. FRANCE): SNAPSHOT

TABLE 088. FRANCE): BUSINESS PERFORMANCE

TABLE 089. FRANCE): PRODUCT PORTFOLIO

TABLE 090. FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. JAPAN AEROSPACE EXPLORATION AGENCY (JAXA: SNAPSHOT

TABLE 091. JAPAN AEROSPACE EXPLORATION AGENCY (JAXA: BUSINESS PERFORMANCE

TABLE 092. JAPAN AEROSPACE EXPLORATION AGENCY (JAXA: PRODUCT PORTFOLIO

TABLE 093. JAPAN AEROSPACE EXPLORATION AGENCY (JAXA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. JAPAN): SNAPSHOT

TABLE 094. JAPAN): BUSINESS PERFORMANCE

TABLE 095. JAPAN): PRODUCT PORTFOLIO

TABLE 096. JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. CHINA NATIONAL SPACE ADMINISTRATION (CNSA: SNAPSHOT

TABLE 097. CHINA NATIONAL SPACE ADMINISTRATION (CNSA: BUSINESS PERFORMANCE

TABLE 098. CHINA NATIONAL SPACE ADMINISTRATION (CNSA: PRODUCT PORTFOLIO

TABLE 099. CHINA NATIONAL SPACE ADMINISTRATION (CNSA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. CHINA): SNAPSHOT

TABLE 100. CHINA): BUSINESS PERFORMANCE

TABLE 101. CHINA): PRODUCT PORTFOLIO

TABLE 102. CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. RUSSIAN FEDERAL SPACE AGENCY (ROSCOSMOS: SNAPSHOT

TABLE 103. RUSSIAN FEDERAL SPACE AGENCY (ROSCOSMOS: BUSINESS PERFORMANCE

TABLE 104. RUSSIAN FEDERAL SPACE AGENCY (ROSCOSMOS: PRODUCT PORTFOLIO

TABLE 105. RUSSIAN FEDERAL SPACE AGENCY (ROSCOSMOS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. RUSSIA): SNAPSHOT

TABLE 106. RUSSIA): BUSINESS PERFORMANCE

TABLE 107. RUSSIA): PRODUCT PORTFOLIO

TABLE 108. RUSSIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 109. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 110. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 111. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SPACE MINING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SPACE MINING MARKET OVERVIEW BY PHASE

FIGURE 012. SPACECRAFT DESIGN MARKET OVERVIEW (2016-2030)

FIGURE 013. LAUNCH MARKET OVERVIEW (2016-2030)

FIGURE 014. OPERATION MARKET OVERVIEW (2016-2030)

FIGURE 015. SPACE MINING MARKET OVERVIEW BY ASTEROID TYPE

FIGURE 016. TYPE C MARKET OVERVIEW (2016-2030)

FIGURE 017. TYPE S MARKET OVERVIEW (2016-2030)

FIGURE 018. TYPE M MARKET OVERVIEW (2016-2030)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 020. SPACE MINING MARKET OVERVIEW BY APPLICATION

FIGURE 021. CONSTRUCTION MARKET OVERVIEW (2016-2030)

FIGURE 022. RESOURCE HARVESTING MARKET OVERVIEW (2016-2030)

FIGURE 023. 3D PRINTING MARKET OVERVIEW (2016-2030)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 025. NORTH AMERICA SPACE MINING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. EASTERN EUROPE SPACE MINING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. WESTERN EUROPE SPACE MINING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 028. ASIA PACIFIC SPACE MINING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 029. MIDDLE EAST & AFRICA SPACE MINING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 030. SOUTH AMERICA SPACE MINING MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Space Mining Market research report is 2024-2032.

Deep Space Industries (US); Planetary Resources (US); Moon Express (US); ispace (Japan); Asteroid Mining Corporation (UK); Shackleton Energy Company (SEC, US); Kleos Space (Luxembourg); TransAstra (US); OffWorld (US); SpaceFab.US (US); National Aeronautics and Space Administration (NASA, US); European Space Agency (ESA, France); Japan Aerospace Exploration Agency (JAXA, Japan); China National Space Administration (CNSA, China); and Russian Federal Space Agency (ROSCOSMOS, Russia).

The Space Mining Market is segmented into Phase, Asteroid Type, Application, and region. By Phase, the market is categorized into Spacecraft Design, Launch, Operation. By Asteroid Type, the market is categorized into Type C, Type S, Type M, Others. By Application, the market is categorized into Construction, Resource Harvesting, 3D Printing, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Space mining, also known as asteroid mining or extra-terrestrial resource utilization, is a futuristic concept and emerging industry that involves the exploration, extraction, and utilization of valuable minerals, metals, and other resources from celestial bodies such as asteroids, the Moon, and potentially other planets or moons in our solar system. This innovative field envisions a future where humans and robotic systems work together to harness the vast resources available in space, with the ultimate goal of addressing resource scarcity on Earth, supporting space exploration, and enabling the colonization of other celestial bodies.

The Global Space Mining Market size is expected to grow from USD 1.94 Billion in 2023 to USD 10.95 Billion by 2032, at a CAGR of 21.2% during the forecast period (2024-2032).