Software for Guide Surgery Market Synopsis

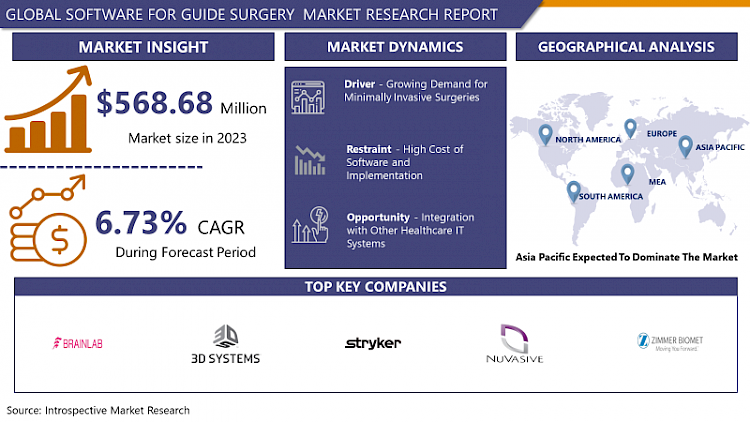

Software for Guide Surgery Market Size Was Valued at USD 568.68 Million in 2023 and is Projected to Reach USD 1021.99 Million by 2032, Growing at a CAGR of 6.73% From 2024-2032.

Software actively guides surgeons during procedures, offering real-time instructions for enhanced precision. It provides step-by-step guidance throughout the surgery, ensuring accuracy and efficiency. Equipped with intuitive interfaces and interactive features, the software empowers surgeons to confidently navigate complex procedures, ultimately leading to improved patient outcomes.

The Guide Surgery software transforms surgical procedures by providing real-time guidance to surgeons, thereby enhancing precision and efficiency in the operating room. Its usage extends across various medical specialties, including neurosurgery and orthopedics, facilitating surgeons' navigation through intricate procedures. Through integration with surgical equipment and imaging systems, the software delivers dynamic visual cues and step-by-step instructions, ensuring optimal patient outcomes.

- It mitigates the risk of human error by furnishing surgeons with precise guidance throughout the procedure, reducing the likelihood of complications. Secondly, it enhances surgical efficiency by streamlining workflow and cutting down procedure durations, enabling more surgeries to be performed with heightened accuracy. Furthermore, the software fosters improved communication among surgical teams, promoting collaboration and synchronization in the operating theater.

- The demand for Guide Surgery software is expected to surge. Surgeons increasingly acknowledge the significance of augmented guidance systems in enhancing patient outcomes and curbing healthcare expenses. Furthermore, as the software evolves to integrate artificial intelligence and machine learning algorithms, its capabilities will expand, driving further demand among healthcare providers seeking innovative solutions for superior surgical performance.

Software for Guide Surgery Market Trend Analysis:

Growing Demand for Minimally Invasive Surgeries

- The surging demand for minimally invasive surgeries acts as a crucial catalyst propelling the rapid expansion of the software for the guide surgery market. With patients and healthcare providers increasingly favoring minimally invasive procedures for their manifold benefits such as reduced post-operative discomfort, shorter hospital stays, and expedited recovery periodsthe necessity for sophisticated software solutions to augment procedural precision and effectiveness grows exponentially.

- Software for guide surgery assumes a pivotal role in facilitating minimally invasive procedures by furnishing surgeons with real-time guidance and support throughout the surgical process. Seamlessly integrating with surgical equipment and imaging systems, these software platforms provide dynamic visual cues and systematic instructions, empowering surgeons to navigate intricate anatomical structures with heightened accuracy. As the demand for minimally invasive techniques continues its upward trajectory, the imperative for advanced software solutions capable of optimizing surgical outcomes becomes increasingly pronounced.

- Furthermore, the relentless pursuit of enhanced patient outcomes and refined surgical precision propels the software for guide the surgery market forward. Leveraging state-of-the-art technologies such as artificial intelligence and machine learning algorithms, these software platforms continually adapt to meet the evolving demands of surgeons and healthcare institutions. The market stands poised for substantial growth, fueled by ongoing innovation and its indispensable role in supporting the expanding domain of minimally invasive surgeries.

Integration with Other Healthcare IT Systems

- The integration with other healthcare IT systems emerges as a significant opportunity driving the burgeoning growth of the guide surgery software market. With the rising adoption of comprehensive electronic health record (EHR) and health information exchange (HIE) systems in healthcare institutions, the seamless incorporation of guide surgery software enhances interoperability and data-sharing capabilities. This integration facilitates the smooth transmission of patient information, surgical plans, and imaging data, streamlining the surgical workflow and optimizing patient care delivery.

- Additionally, integrating with other healthcare IT systems enhances the efficiency and accuracy of surgical procedures by granting surgeons access to a wealth of real-time patient data and diagnostic information. Through integration with picture archiving and communication systems (PACS) and radiology information systems (RIS), guide surgery software empowers surgeons to visualize and analyze medical images during surgery, facilitating informed decision-making and precise interventions.

- Moreover, the integration of guide surgery software with electronic medical record (EMR) systems presents opportunities for improved documentation and post-operative care. Seamless integration enables automated documentation of surgical procedures and outcomes, ensuring accurate and comprehensive patient records. Furthermore, integration with telemedicine platforms enables remote consultation and collaboration among surgeons, broadening access to specialized care and expertise. integration with other healthcare IT systems not only enhances the functionality of guide surgery software but also enhances overall surgical workflow efficiency and patient outcomes.

Software for Guide Surgery Market Segment Analysis:

Software for Guide Surgery Market Segmented on the basis of Surgery Type, Delivery Model, Technology size, Application, and End-User.

By Delivery Model, Cloud-Based segment is expected to dominate the market during the forecast period

- The Cloud-Based segment is positioned to become the primary driver behind the expansion of the Software for the Guide Surgery Market. With the rising integration of cloud computing technologies across diverse sectors, notably healthcare, there's a notable surge in demand for cloud-based solutions catering to guide surgery needs. Cloud-based software boasts key advantages like scalability, adaptability, and ease of access, rendering it an appealing choice for healthcare entities in pursuit of cutting-edge surgical guidance platforms.

- Moreover, cloud-based guide surgery software facilitates seamless collaboration and data exchange among surgeons and medical professionals dispersed across different locations. This facilitates instantaneous access to surgical blueprints, patient records, and imaging data, ultimately heightening surgical accuracy and operational efficiency. Additionally, cloud-based solutions incorporate enhanced security protocols, safeguarding patient data confidentiality and integrity. Consequently, the Cloud-Based segment is anticipated to commandeer the software for guide surgery market, buoyed by escalating demand for innovative, scalable, and user-friendly surgical guidance solutions within the healthcare landscape.

By Surgery Type, Orthopedics segment held the largest share of 44.33% in 2022

- The Orthopedics segment has emerged as the leading force driving the expansion of the Software for Guide Surgery Market, commanding the largest share. Orthopedic surgeries, spanning from joint replacements to spinal procedures, demand meticulous planning and execution to achieve optimal patient results. Consequently, there is a burgeoning need for sophisticated software solutions capable of furnishing real-time guidance and support to orthopedic surgeons throughout these intricate interventions.

- Tailored specifically for orthopedic procedures, these software platforms seamlessly integrate with imaging systems and surgical apparatus, providing dynamic visual cues and systematic instructions. By assisting surgeons in maneuvering through complex anatomical structures with heightened precision, these software solutions play a pivotal role in augmenting surgical outcomes and mitigating the risk of complications. Moreover, the sustained dominance of the orthopedic segment in the software for guide surgery market is anticipated, propelled by continuous advancements in orthopedic surgical methodologies and the escalating adoption of technology-driven solutions aimed at elevating surgical accuracy and efficacy.

Software for Guide Surgery Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is poised to emerge as the primary region propelling the expansion of the Software for Guide Surgery Market. With a burgeoning population, escalating healthcare spending, and rapid technological advancements, countries throughout the Asia Pacific region are experiencing heightened demand for sophisticated healthcare solutions, notably surgical guidance software. Moreover, the increasing prevalence of chronic ailments and orthopedic conditions, combined with the rising adoption of minimally invasive surgical procedures, further drives the need for innovative software solutions capable of optimizing surgical accuracy and efficacy.

- Moreover, supportive government initiatives aimed at fostering healthcare infrastructure development and the integration of digital health technologies are fostering a conducive environment for the Software for Guide Surgery Market's growth in Asia Pacific. Additionally, the presence of prominent market players expanding their footprint and forging strategic partnerships with local healthcare providers further accelerates market expansion in the region. Consequently, Asia Pacific is positioned to lead the Software for Guide Surgery Market, offering substantial growth prospects for market participants in the foreseeable future.

Software for Guide Surgery Market Top Key Players:

- Stryker Corporation (U.S.)

- Zimmer Biomet Holdings, Inc. (U.S.)

- Intuitive Surgical, Inc. (U.S.)

- Globus Medical, Inc. (U.S.)

- DePuy Synthes Companies (Johnson & Johnson) (U.S.)

- NuVasive, Inc. (U.S.)

- Accuray Incorporated (U.S.)

- CONMED Corporation (U.S.)

- GE Healthcare (U.S.)

- 3D Systems Corporation (U.S.)

- B. Braun Melsungen AG (Germany)

- Brainlab AG (Germany)

- Siemens Healthcare Private Limited (Germany)

- Medtronic (Ireland)

- Smith & Nephew plc (UK)

- Renishaw plc (UK)

- Elekta AB (Sweden)

- Materialise NV (Belgium)

- Medtronic (Israel)

- Olympus Corporation (Japan)

- Canon Medical Systems Corporation (Japan)

Key Industry Developments in the Software for Guide Surgery Market:

- In January 8, 2024, GE HealthCare announced an agreement to acquire MIM Software, a global provider of medical imaging analysis and AI solutions. This move aligns with GE HealthCare’s precision care strategy, aiming to enhance its digital solutions across care pathways. The acquisition underscores GE HealthCare’s commitment to integrating medical imaging products for more precise and connected care. MIM Software's capabilities are expected to drive innovation across various care areas.

- In September 2023, 3D Systems submitted a signed merger agreement to Stratasys, proposing an alternative to the latter's planned merger with Desktop Metal. The agreement, filed with the SEC, offers Stratasys shareholders a "superior alternative" and urges them to reject the Desktop Metal deal at the General Meeting. 3D Systems asserts its offer provides enhanced financial performance and long-term growth opportunities.

|

Global Software for Guide Surgery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 568.68 Mn. |

|

Forecast Period 2023-30 CAGR: |

6.73% |

Market Size in 2032 : |

USD 1021.99 Mn. |

|

Segments Covered: |

By Surgery Type |

|

|

|

By Technology |

|

||

|

By Delivery Model |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SOFTWARE FOR GUIDE SURGERY MARKET BY SURGERY TYPE (2017-2030)

- SOFTWARE FOR GUIDE SURGERY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BRAIN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPINE

- ORTHOPEDICS

- ENT

- CARDIOVASCULAR

- SOFTWARE FOR GUIDE SURGERY MARKET BY TECHNOLOGY (2017-2030)

- SOFTWARE FOR GUIDE SURGERY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GUIDED SURGERY (IGS)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ROBOT-ASSISTED SURGERY (RAS)

- SOFTWARE FOR GUIDE SURGERY MARKET BY DELIVERY MODEL (2017-2030)

- SOFTWARE FOR GUIDE SURGERY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD-BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISE

- SOFTWARE FOR GUIDE SURGERY MARKET BY APPLICATION (2017-2030)

- SOFTWARE FOR GUIDE SURGERY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PREOPERATIVE PLANNING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INTRAOPERATIVE GUIDANCE

- POSTOPERATIVE ASSESSMENT

- SOFTWARE FOR GUIDE SURGERY MARKET BY END-USER (2017-2030)

- SOFTWARE FOR GUIDE SURGERY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AMBULATORY SURGICAL CENTERS

- CLINICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Software for Guide Surgery Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- STRYKER CORPORATION (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ZIMMER BIOMET HOLDINGS, INC (U.S.)

- INTUITIVE SURGICAL, INC. (U.S.)

- GLOBUS MEDICAL, INC. (U.S.)

- DEPUY SYNTHES COMPANIES (JOHNSON & JOHNSON) (U.S.)

- NUVASIVE, INC. (U.S.)

- ACCURAY INCORPORATED (U.S.)

- CONMED CORPORATION (U.S.)

- GE HEALTHCARE (U.S.)

- 3D SYSTEMS CORPORATION (U.S.)

- B. BRAUN MELSUNGEN AG (GERMANY)

- BRAINLAB AG (GERMANY)

- SIEMENS HEALTHCARE PRIVATE LIMITED (GERMANY)

- MEDTRONIC (IRELAND)

- SMITH & NEPHEW PLC (UK)

- RENISHAW PLC (UK)

- ELEKTA AB (SWEDEN)

- MATERIALISE NV (BELGIUM)

- MEDTRONIC (ISRAEL)

- OLYMPUS CORPORATION (JAPAN)

- CANON MEDICAL SYSTEMS CORPORATION (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL SOFTWARE FOR GUIDE SURGERY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Surgery Type

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Delivery Model

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Software for Guide Surgery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 568.68 Mn. |

|

Forecast Period 2023-30 CAGR: |

6.73% |

Market Size in 2032 : |

USD 1021.99 Mn. |

|

Segments Covered: |

By Surgery Type |

|

|

|

By Technology |

|

||

|

By Delivery Model |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SOFTWARE FOR GUIDE SURGERY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SOFTWARE FOR GUIDE SURGERY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SOFTWARE FOR GUIDE SURGERY MARKET COMPETITIVE RIVALRY

TABLE 005. SOFTWARE FOR GUIDE SURGERY MARKET THREAT OF NEW ENTRANTS

TABLE 006. SOFTWARE FOR GUIDE SURGERY MARKET THREAT OF SUBSTITUTES

TABLE 007. SOFTWARE FOR GUIDE SURGERY MARKET BY TYPE

TABLE 008. WINDOWS MARKET OVERVIEW (2016-2028)

TABLE 009. MAC OS MARKET OVERVIEW (2016-2028)

TABLE 010. SOFTWARE FOR GUIDE SURGERY MARKET BY APPLICATION

TABLE 011. DENTAL CLINIC MARKET OVERVIEW (2016-2028)

TABLE 012. HOSPITAL MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA SOFTWARE FOR GUIDE SURGERY MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA SOFTWARE FOR GUIDE SURGERY MARKET, BY APPLICATION (2016-2028)

TABLE 016. N SOFTWARE FOR GUIDE SURGERY MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE SOFTWARE FOR GUIDE SURGERY MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE SOFTWARE FOR GUIDE SURGERY MARKET, BY APPLICATION (2016-2028)

TABLE 019. SOFTWARE FOR GUIDE SURGERY MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC SOFTWARE FOR GUIDE SURGERY MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC SOFTWARE FOR GUIDE SURGERY MARKET, BY APPLICATION (2016-2028)

TABLE 022. SOFTWARE FOR GUIDE SURGERY MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA SOFTWARE FOR GUIDE SURGERY MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA SOFTWARE FOR GUIDE SURGERY MARKET, BY APPLICATION (2016-2028)

TABLE 025. SOFTWARE FOR GUIDE SURGERY MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA SOFTWARE FOR GUIDE SURGERY MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA SOFTWARE FOR GUIDE SURGERY MARKET, BY APPLICATION (2016-2028)

TABLE 028. SOFTWARE FOR GUIDE SURGERY MARKET, BY COUNTRY (2016-2028)

TABLE 029. BLUESKYBIO: SNAPSHOT

TABLE 030. BLUESKYBIO: BUSINESS PERFORMANCE

TABLE 031. BLUESKYBIO: PRODUCT PORTFOLIO

TABLE 032. BLUESKYBIO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. PRODIGIDENT: SNAPSHOT

TABLE 033. PRODIGIDENT: BUSINESS PERFORMANCE

TABLE 034. PRODIGIDENT: PRODUCT PORTFOLIO

TABLE 035. PRODIGIDENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. EXOCAD: SNAPSHOT

TABLE 036. EXOCAD: BUSINESS PERFORMANCE

TABLE 037. EXOCAD: PRODUCT PORTFOLIO

TABLE 038. EXOCAD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. 3D DIAGNOSTIX: SNAPSHOT

TABLE 039. 3D DIAGNOSTIX: BUSINESS PERFORMANCE

TABLE 040. 3D DIAGNOSTIX: PRODUCT PORTFOLIO

TABLE 041. 3D DIAGNOSTIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. 3SHAPE: SNAPSHOT

TABLE 042. 3SHAPE: BUSINESS PERFORMANCE

TABLE 043. 3SHAPE: PRODUCT PORTFOLIO

TABLE 044. 3SHAPE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. SMART: SNAPSHOT

TABLE 045. SMART: BUSINESS PERFORMANCE

TABLE 046. SMART: PRODUCT PORTFOLIO

TABLE 047. SMART: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. MEDIA LAB INC: SNAPSHOT

TABLE 048. MEDIA LAB INC: BUSINESS PERFORMANCE

TABLE 049. MEDIA LAB INC: PRODUCT PORTFOLIO

TABLE 050. MEDIA LAB INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. CARESTREAM DENTAL: SNAPSHOT

TABLE 051. CARESTREAM DENTAL: BUSINESS PERFORMANCE

TABLE 052. CARESTREAM DENTAL: PRODUCT PORTFOLIO

TABLE 053. CARESTREAM DENTAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. NEOSS: SNAPSHOT

TABLE 054. NEOSS: BUSINESS PERFORMANCE

TABLE 055. NEOSS: PRODUCT PORTFOLIO

TABLE 056. NEOSS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. PLANMECA OY: SNAPSHOT

TABLE 057. PLANMECA OY: BUSINESS PERFORMANCE

TABLE 058. PLANMECA OY: PRODUCT PORTFOLIO

TABLE 059. PLANMECA OY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. 360IMAGING: SNAPSHOT

TABLE 060. 360IMAGING: BUSINESS PERFORMANCE

TABLE 061. 360IMAGING: PRODUCT PORTFOLIO

TABLE 062. 360IMAGING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. GUIDEMIA: SNAPSHOT

TABLE 063. GUIDEMIA: BUSINESS PERFORMANCE

TABLE 064. GUIDEMIA: PRODUCT PORTFOLIO

TABLE 065. GUIDEMIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SWISSMEDA AG: SNAPSHOT

TABLE 066. SWISSMEDA AG: BUSINESS PERFORMANCE

TABLE 067. SWISSMEDA AG: PRODUCT PORTFOLIO

TABLE 068. SWISSMEDA AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. CYBERMED INC: SNAPSHOT

TABLE 069. CYBERMED INC: BUSINESS PERFORMANCE

TABLE 070. CYBERMED INC: PRODUCT PORTFOLIO

TABLE 071. CYBERMED INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. DENTSPLY SIRONA: SNAPSHOT

TABLE 072. DENTSPLY SIRONA: BUSINESS PERFORMANCE

TABLE 073. DENTSPLY SIRONA: PRODUCT PORTFOLIO

TABLE 074. DENTSPLY SIRONA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. ANATOMAGE: SNAPSHOT

TABLE 075. ANATOMAGE: BUSINESS PERFORMANCE

TABLE 076. ANATOMAGE: PRODUCT PORTFOLIO

TABLE 077. ANATOMAGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. NOBEL BIOCARE: SNAPSHOT

TABLE 078. NOBEL BIOCARE: BUSINESS PERFORMANCE

TABLE 079. NOBEL BIOCARE: PRODUCT PORTFOLIO

TABLE 080. NOBEL BIOCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. DENTAL WINGS GMBH: SNAPSHOT

TABLE 081. DENTAL WINGS GMBH: BUSINESS PERFORMANCE

TABLE 082. DENTAL WINGS GMBH: PRODUCT PORTFOLIO

TABLE 083. DENTAL WINGS GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. DENTALSLICE: SNAPSHOT

TABLE 084. DENTALSLICE: BUSINESS PERFORMANCE

TABLE 085. DENTALSLICE: PRODUCT PORTFOLIO

TABLE 086. DENTALSLICE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. C-DENTAL: SNAPSHOT

TABLE 087. C-DENTAL: BUSINESS PERFORMANCE

TABLE 088. C-DENTAL: PRODUCT PORTFOLIO

TABLE 089. C-DENTAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. STRAUMANNGROUP: SNAPSHOT

TABLE 090. STRAUMANNGROUP: BUSINESS PERFORMANCE

TABLE 091. STRAUMANNGROUP: PRODUCT PORTFOLIO

TABLE 092. STRAUMANNGROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SOFTWARE FOR GUIDE SURGERY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SOFTWARE FOR GUIDE SURGERY MARKET OVERVIEW BY TYPE

FIGURE 012. WINDOWS MARKET OVERVIEW (2016-2028)

FIGURE 013. MAC OS MARKET OVERVIEW (2016-2028)

FIGURE 014. SOFTWARE FOR GUIDE SURGERY MARKET OVERVIEW BY APPLICATION

FIGURE 015. DENTAL CLINIC MARKET OVERVIEW (2016-2028)

FIGURE 016. HOSPITAL MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA SOFTWARE FOR GUIDE SURGERY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE SOFTWARE FOR GUIDE SURGERY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC SOFTWARE FOR GUIDE SURGERY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA SOFTWARE FOR GUIDE SURGERY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA SOFTWARE FOR GUIDE SURGERY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Software for Guide Surgery Market research report is 2024-2032.

Stryker Corporation (U.S.), Zimmer Biomet Holdings, Inc. (U.S.), Intuitive Surgical, Inc. (U.S.), Globus Medical, Inc. (U.S.), DePuy Synthes Companies (Johnson & Johnson) (U.S.), NuVasive, Inc. (U.S.), Accuray Incorporated (U.S.), CONMED Corporation (U.S.), GE Healthcare (U.S.),3D Systems Corporation (U.S.), B. Braun Melsungen AG (Germany), Brainlab AG (Germany), Siemens Healthcare Private Limited (Germany), Medtronic (Ireland), Smith & Nephew plc (UK), Renishaw plc (UK), Elekta AB (Sweden), Materialise NV (Belgium), Medtronic (Israel), Olympus Corporation (Japan), Canon Medical Systems Corporation (Japan), and Other Major Players.

The Software for Guide Surgery Market is segmented into Surgery Type, Technology, Delivery Model, Application, End-User, and Region. By Surgery Type, the market is categorized into Brain, Spine, Orthopedics, ENT, and Cardiovascular. By Technology, the market is categorized into Guided Surgery (IGS) and robot-assisted Surgery (RAS). By Delivery Model, the market is categorized into Cloud-Based and on-premise. By Application, the market is categorized into Preoperative Planning, Intraoperative Guidance, and Postoperative Assessment. By End-User, the market is categorized into Hospitals, Ambulatory Surgical Centers, and Clinics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Software actively guides surgeons during procedures, offering real-time instructions for enhanced precision. It provides step-by-step guidance throughout the surgery, ensuring accuracy and efficiency. Equipped with intuitive interfaces and interactive features, the software empowers surgeons to confidently navigate complex procedures, ultimately leading to improved patient outcomes.

Software for Guide Surgery Market Size Was Valued at USD 568.68 Million in 2023 and is Projected to Reach USD 1021.99 Million by 2032, Growing at a CAGR of 6.73% From 2024-2032.