Smart Building Market Synopsis

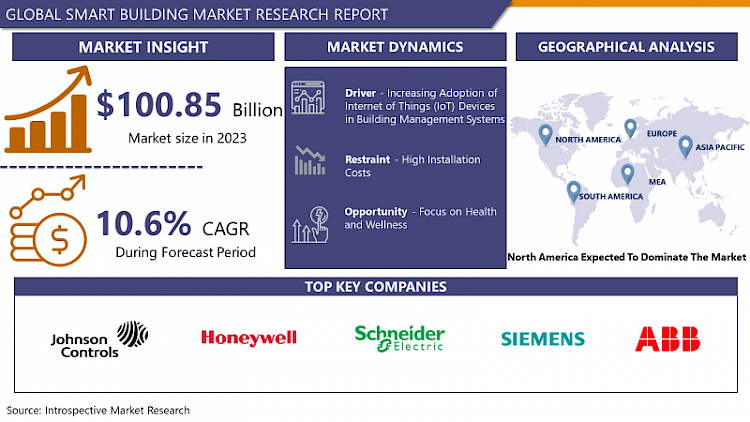

Smart Building Market Size Was Valued at USD 100.85 Billion in 2023 and is Projected to Reach USD 305.48 Billion by 2032, Growing at a CAGR of 10.6% From 2024-2032.

Smart building market is in high growth phase, due to which it’s increasing its usage of technology in the building operation and management to reduce energy consumption and to enable the occupants with better experiences. Smart building means the buildings which connected with IoT devices, AI and sophisticated data analysis to develop intelligent spaces. These technologies allow for the continuous supervision and management of systems like social, lighting, security, and HVAC and energy use in the building. The major forces that will drive market growth include the increased awareness for energy efficiency, the demand for better security networks, and the emergence of smart city programs. Smart infrastructure is an emerging concept that has attracted a lot of investment from governments and private players to meet sustainability agendas and decrease carbon footprints. Furthermore, technological advancement and its utilization in smart home devices are making consumer demand forces the CRE sector to adapt as well.

- Here the smart building market has also been classified by the component as solutions and services. Solutions include construction of building infrastructural, security and emergency, and efficient energy systems. The services segment that include smart building technologies installation, maintenance and management services is anticipated to lead this market because of the increasing smart building systems complexity and advanced technologies.

- However, another major growth enabler in the smart building market is the growing deployment of internet of things (IoT) devices and sensors. These devices allow for constant tracking of the status of a building, from temperature and occupancy, to air quality, thus helping prevent loss or damages and inform decision making. Moreover, the latest techniques in data analytics and machine learning algorithms make smart buildings gather and analyze huge data to discover trends, improve efficiency, and determine time-critical maintenance.

- Moreover, the proliferation of cloud computing and connectivity solutions has also played a crucial role in driving the smart building market forward. Cloud-based platforms provide the scalability and flexibility required to integrate diverse building systems and devices, enabling seamless communication and interoperability. This allows building operators to remotely monitor and manage their facilities, implement automated controls, and access actionable insights to improve overall efficiency and performance. Overall, as the demand for smart, connected buildings continues to rise, the smart building market is poised for further growth and innovation in the years to come.

Smart Building Market Trend Analysis

Integration of Artificial Intelligence (AI)

- AI algorithms analyze data from sensors embedded within building systems to predict potential equipment failures before they occur. By identifying patterns and anomalies in data, AI-powered predictive maintenance helps facility managers schedule maintenance activities proactively, minimizing downtime and reducing maintenance costs.

- AI enables smart buildings to optimize energy usage by analyzing real-time data on occupancy, weather conditions, and energy consumption patterns. AI algorithms can adjust heating, ventilation, and air conditioning (HVAC) systems, lighting controls, and other building systems dynamically to maximize energy efficiency while maintaining occupant comfort. This results in significant cost savings and reduces the environmental impact of building operations.

- AI-driven smart building systems can personalize the indoor environment based on individual preferences and behavior patterns. By leveraging data from occupancy sensors, temperature sensors, and feedback from occupants, AI algorithms can adjust lighting, temperature, and air quality settings to create comfortable and productive workspaces. This not only enhances occupant satisfaction but also boosts productivity and employee well-being.

Focus on Health and Wellness

- Smart buildings are integrating advanced ventilation systems equipped with high-efficiency particulate air (HEPA) filters and air quality sensors to ensure optimal indoor air quality. These systems continuously monitor and regulate air circulation, filtration, and humidity levels to minimize the presence of airborne pollutants and allergens, promoting a healthier indoor environment for occupants.

- Smart buildings are incorporating wellness technologies such as circadian lighting systems and biophilic design elements to enhance occupant well-being. Circadian lighting mimics the natural rhythm of daylight to regulate sleep-wake cycles and improve mood and productivity. Biophilic design integrates natural elements like greenery and natural light into building interiors, fostering a connection to nature and reducing stress levels among occupants.

- Smart building systems are leveraging data analytics and feedback mechanisms to provide insights into occupant behavior and preferences related to health and wellness. By analyzing data from wearable devices, occupancy sensors, and user feedback surveys, building operators can identify trends, assess the impact of wellness initiatives, and tailor building environments to better meet the needs of occupants. This data-driven approach enables continuous improvement in promoting health and wellness within smart buildings.

Smart Building Market Segment Analysis:

Smart Surfaces Market is Segmented on the basis of Application, Automation Type and Service

By Application, Commercial segment is expected to dominate the market during the forecast period.

- In the commercial sector, smart building technologies are primarily focused on improving energy efficiency, reducing operational costs, and enhancing occupant productivity. Features such as smart lighting, HVAC systems, and integrated building management systems are widely adopted. Additionally, commercial smart buildings often incorporate advanced security systems, including facial recognition and AI-driven surveillance, to ensure safety and streamline access control. The integration of IoT devices enables real-time monitoring and maintenance, reducing downtime and operational disruptions.

- In the residential sector, smart building technologies aim to enhance comfort, convenience, and security for homeowners. Smart home systems include smart thermostats, lighting controls, security cameras, and voice-activated assistants, all of which can be managed via smartphone apps or centralized hubs. Energy management is also a key focus, with solutions like smart meters and solar power integration helping residents monitor and reduce their energy consumption. The rise of home automation systems that integrate various smart devices into a cohesive ecosystem is making smart homes more accessible and user-friendly.

- The industrial sector leverages smart building technologies to optimize operational efficiency, safety, and sustainability in manufacturing and warehousing environments. Smart sensors and IoT devices are used to monitor equipment performance, track inventory, and ensure workplace safety. Automated systems, such as robotics and advanced HVAC controls, help streamline processes and reduce energy usage. Additionally, predictive maintenance powered by AI and machine learning minimizes downtime and extends the lifespan of critical machinery, enhancing overall productivity.

- Across all sectors, there is a growing trend toward integrating renewable energy sources and sustainable practices within smart buildings. Commercial, residential, and industrial smart buildings are increasingly incorporating solar panels, wind turbines, and energy storage solutions to reduce reliance on traditional energy sources. This shift towards sustainability is driven by regulatory pressures, cost savings, and a broader commitment to environmental responsibility. Moreover, the use of big data and analytics across these applications allows for continuous improvement in building performance, occupant satisfaction, and energy management.

By Automation Type, Energy Management segment held the largest share in 2023

- Automation in energy management is crucial for optimizing energy consumption and enhancing sustainability within smart buildings. Systems such as smart meters, automated lighting, and HVAC controls adjust energy use based on real-time data and occupancy patterns. These systems can significantly reduce energy waste and lower operational costs. Additionally, integrating renewable energy sources and energy storage solutions within the energy management framework enables buildings to achieve net-zero energy goals, contributing to environmental sustainability.

- Infrastructure management automation focuses on the efficient operation and maintenance of a building's physical assets. This includes systems for monitoring and managing elevators, water supply, heating and cooling systems, and other essential infrastructure components. Automated infrastructure management systems use sensors and IoT devices to provide real-time data on equipment status and performance, enabling predictive maintenance and reducing the risk of failures. This proactive approach extends the lifespan of building systems and enhances reliability.

- Automation in intelligent security systems enhances the safety and security of smart buildings. These systems incorporate advanced technologies such as AI-driven surveillance cameras, biometric access controls, and intrusion detection systems. Intelligent security systems can analyze video footage in real-time to identify potential threats and trigger automated responses, such as locking doors or alerting security personnel. Additionally, integration with other building systems allows for a coordinated response to security incidents, improving overall safety and reducing the risk of unauthorized access.

Smart Building Market Regional Insights:

North America to Make Notable Contributions Towards Overall Market Size

- North America, particularly the United States, is a hub for technological innovation and the adoption of cutting-edge smart building technologies. The region has a robust ecosystem of technology companies, startups, and research institutions that drive the development and deployment of advanced IoT devices, AI-driven systems, and automation solutions. This technological leadership positions North America at the forefront of the smart building market.

- Government regulations and policies in North America are increasingly focused on energy efficiency, sustainability, and smart infrastructure development. Programs and incentives, such as tax rebates for energy-efficient upgrades and grants for smart city initiatives, encourage the adoption of smart building technologies. These regulatory frameworks support market growth by providing financial and policy-driven incentives for building owners and operators to invest in smart solutions.

- There is a growing emphasis on reducing energy consumption and minimizing environmental impact in North America. Businesses and consumers alike are prioritizing sustainability, driving demand for smart building technologies that can optimize energy use and integrate renewable energy sources. The focus on achieving LEED (Leadership in Energy and Environmental Design) certification and other sustainability benchmarks further propels the adoption of smart building solutions in the region.

- Both the commercial and residential sectors in North America are experiencing significant uptake of smart building technologies. In the commercial sector, companies seek to enhance operational efficiency, improve occupant comfort, and reduce costs through smart building systems. The residential sector sees growing interest in smart home technologies that offer convenience, security, and energy savings. The widespread adoption across these sectors contributes substantially to the overall market growth in North America.

Active Key Players in the Smart Building Market

- Johnson Controls (U.S.)

- Honeywell (U.S.)

- Schneider (France)

- UTC (U.S.)

- Siemens (Germany)

- Ingersoll Rand (Trane)

- Azbil (Japan)

- ABB (Switzerland)

- Emerson (U.S.)

- Eaton (Ireland)

- Control4 Corporation (U.S.)

- Bosch (Germany)

- Panasonic (Japan)

- Delta Controls (Canada)

- Legrand (France)

- Cisco (U.S.)

- IBM (U.S.)

- Advantech (China)

- Current (GE)

- Others Key Players

|

Global Smart Surfaces Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 100.85 Bn. |

|

CAGR 2024-32: |

10.6% |

Market Size in 2032: |

USD 305.48 Bn. |

|

|

By Automation Type |

|

|

|

By Service |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

UTC (U.S.), Siemens(Germany),IngersollRand(Trane),Azbil (Japan),ABB(Switzerland),Emerson(U.S.),Eaton(Ireland),Control4Corporation (U.S.),Bosch(Germany),Panasonic(Japan),Delta Controls(Canada),Legrand(France),Cisco(U.S.),IBM (U.S.),Advantech (China),Current (GE) and Others Key Players

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SMART BUILDING MARKET BY AUTOMATION TYPE (2017-2032)

- SMART BUILDING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ENERGY MANAGEMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INFRASTRUCTURE MANAGEMENT

- NETWORK & COMMUNICATION MANAGEMENT

- INTELLIGENT SECURITY SYSTEMS

- SMART BUILDING MARKET BY SERVICE (2017-2032)

- SMART BUILDING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PROFESSIONAL SERVICES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MANAGED SERVICES

- SMART BUILDING MARKET BY APPLICATION (2017-2032)

- SMART BUILDING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COMMERCIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RESIDENTIAL

- INDUSTRIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Smart Building Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- JOHNSON CONTROLS (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HONEYWELL (U.S.)

- SCHNEIDER (FRANCE)

- UTC (U.S.)

- SIEMENS (GERMANY)

- INGERSOLL RAND (TRANE)

- AZBIL (JAPAN)

- ABB (SWITZERLAND)

- EMERSON (U.S.)

- EATON (IRELAND)

- CONTROL4 CORPORATION (U.S.)

- BOSCH (GERMANY)

- PANASONIC (JAPAN)

- DELTA CONTROLS (CANADA)

- LEGRAND (FRANCE)

- CISCO (U.S.)

- IBM (U.S.)

- ADVANTECH (CHINA)

- CURRENT (GE)

- COMPETITIVE LANDSCAPE

- GLOBAL SMART BUILDING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Automation Type

- Historic And Forecasted Market Size By Service

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Smart Surfaces Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 100.85 Bn. |

|

CAGR 2024-32: |

10.6% |

Market Size in 2032: |

USD 305.48 Bn. |

|

|

By Automation Type |

|

|

|

By Service |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

UTC (U.S.), Siemens(Germany),IngersollRand(Trane),Azbil (Japan),ABB(Switzerland),Emerson(U.S.),Eaton(Ireland),Control4Corporation (U.S.),Bosch(Germany),Panasonic(Japan),Delta Controls(Canada),Legrand(France),Cisco(U.S.),IBM (U.S.),Advantech (China),Current (GE) and Others Key Players

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SMART BUILDING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SMART BUILDING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SMART BUILDING MARKET COMPETITIVE RIVALRY

TABLE 005. SMART BUILDING MARKET THREAT OF NEW ENTRANTS

TABLE 006. SMART BUILDING MARKET THREAT OF SUBSTITUTES

TABLE 007. SMART BUILDING MARKET BY TYPE

TABLE 008. BUILDING MANAGEMENT SYSTEM (BMS) MARKET OVERVIEW (2016-2028)

TABLE 009. HEATING MARKET OVERVIEW (2016-2028)

TABLE 010. VENTILATING & AIR CONDITIONING (HVAC) MARKET OVERVIEW (2016-2028)

TABLE 011. LIGHTING CONTROL MARKET OVERVIEW (2016-2028)

TABLE 012. SECURITY & ACCESS CONTROL MARKET OVERVIEW (2016-2028)

TABLE 013. EMERGENCY ALARM & EVACUATION SYSTEM MARKET OVERVIEW (2016-2028)

TABLE 014. AUDIO & VISUAL EFFECTS MARKET OVERVIEW (2016-2028)

TABLE 015. ESCALATOR MARKET OVERVIEW (2016-2028)

TABLE 016. ELEVATOR MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. SMART BUILDING MARKET BY APPLICATION

TABLE 019. GOVERNMENT BUILDINGS MARKET OVERVIEW (2016-2028)

TABLE 020. RESIDENTIAL BUILDINGS MARKET OVERVIEW (2016-2028)

TABLE 021. COMMERCIAL BUILDING MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA SMART BUILDING MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA SMART BUILDING MARKET, BY APPLICATION (2016-2028)

TABLE 024. N SMART BUILDING MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE SMART BUILDING MARKET, BY TYPE (2016-2028)

TABLE 026. EUROPE SMART BUILDING MARKET, BY APPLICATION (2016-2028)

TABLE 027. SMART BUILDING MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC SMART BUILDING MARKET, BY TYPE (2016-2028)

TABLE 029. ASIA PACIFIC SMART BUILDING MARKET, BY APPLICATION (2016-2028)

TABLE 030. SMART BUILDING MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA SMART BUILDING MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA SMART BUILDING MARKET, BY APPLICATION (2016-2028)

TABLE 033. SMART BUILDING MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA SMART BUILDING MARKET, BY TYPE (2016-2028)

TABLE 035. SOUTH AMERICA SMART BUILDING MARKET, BY APPLICATION (2016-2028)

TABLE 036. SMART BUILDING MARKET, BY COUNTRY (2016-2028)

TABLE 037. JOHNSON CONTROLS: SNAPSHOT

TABLE 038. JOHNSON CONTROLS: BUSINESS PERFORMANCE

TABLE 039. JOHNSON CONTROLS: PRODUCT PORTFOLIO

TABLE 040. JOHNSON CONTROLS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. HONEYWELL: SNAPSHOT

TABLE 041. HONEYWELL: BUSINESS PERFORMANCE

TABLE 042. HONEYWELL: PRODUCT PORTFOLIO

TABLE 043. HONEYWELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. SCHNEIDER: SNAPSHOT

TABLE 044. SCHNEIDER: BUSINESS PERFORMANCE

TABLE 045. SCHNEIDER: PRODUCT PORTFOLIO

TABLE 046. SCHNEIDER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. UTC: SNAPSHOT

TABLE 047. UTC: BUSINESS PERFORMANCE

TABLE 048. UTC: PRODUCT PORTFOLIO

TABLE 049. UTC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. SIEMENS: SNAPSHOT

TABLE 050. SIEMENS: BUSINESS PERFORMANCE

TABLE 051. SIEMENS: PRODUCT PORTFOLIO

TABLE 052. SIEMENS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. INGERSOLL RAND (TRANE): SNAPSHOT

TABLE 053. INGERSOLL RAND (TRANE): BUSINESS PERFORMANCE

TABLE 054. INGERSOLL RAND (TRANE): PRODUCT PORTFOLIO

TABLE 055. INGERSOLL RAND (TRANE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. AZBIL: SNAPSHOT

TABLE 056. AZBIL: BUSINESS PERFORMANCE

TABLE 057. AZBIL: PRODUCT PORTFOLIO

TABLE 058. AZBIL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ABB: SNAPSHOT

TABLE 059. ABB: BUSINESS PERFORMANCE

TABLE 060. ABB: PRODUCT PORTFOLIO

TABLE 061. ABB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. EMERSON: SNAPSHOT

TABLE 062. EMERSON: BUSINESS PERFORMANCE

TABLE 063. EMERSON: PRODUCT PORTFOLIO

TABLE 064. EMERSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. UTC: SNAPSHOT

TABLE 065. UTC: BUSINESS PERFORMANCE

TABLE 066. UTC: PRODUCT PORTFOLIO

TABLE 067. UTC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. SIEMENS: SNAPSHOT

TABLE 068. SIEMENS: BUSINESS PERFORMANCE

TABLE 069. SIEMENS: PRODUCT PORTFOLIO

TABLE 070. SIEMENS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. BOSCH: SNAPSHOT

TABLE 071. BOSCH: BUSINESS PERFORMANCE

TABLE 072. BOSCH: PRODUCT PORTFOLIO

TABLE 073. BOSCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. PANASONIC: SNAPSHOT

TABLE 074. PANASONIC: BUSINESS PERFORMANCE

TABLE 075. PANASONIC: PRODUCT PORTFOLIO

TABLE 076. PANASONIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. DELTA CONTROLS: SNAPSHOT

TABLE 077. DELTA CONTROLS: BUSINESS PERFORMANCE

TABLE 078. DELTA CONTROLS: PRODUCT PORTFOLIO

TABLE 079. DELTA CONTROLS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. LEGRAND: SNAPSHOT

TABLE 080. LEGRAND: BUSINESS PERFORMANCE

TABLE 081. LEGRAND: PRODUCT PORTFOLIO

TABLE 082. LEGRAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. CISCO: SNAPSHOT

TABLE 083. CISCO: BUSINESS PERFORMANCE

TABLE 084. CISCO: PRODUCT PORTFOLIO

TABLE 085. CISCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. IBM: SNAPSHOT

TABLE 086. IBM: BUSINESS PERFORMANCE

TABLE 087. IBM: PRODUCT PORTFOLIO

TABLE 088. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. ADVANTECH: SNAPSHOT

TABLE 089. ADVANTECH: BUSINESS PERFORMANCE

TABLE 090. ADVANTECH: PRODUCT PORTFOLIO

TABLE 091. ADVANTECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 092. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 093. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 094. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SMART BUILDING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SMART BUILDING MARKET OVERVIEW BY TYPE

FIGURE 012. BUILDING MANAGEMENT SYSTEM (BMS) MARKET OVERVIEW (2016-2028)

FIGURE 013. HEATING MARKET OVERVIEW (2016-2028)

FIGURE 014. VENTILATING & AIR CONDITIONING (HVAC) MARKET OVERVIEW (2016-2028)

FIGURE 015. LIGHTING CONTROL MARKET OVERVIEW (2016-2028)

FIGURE 016. SECURITY & ACCESS CONTROL MARKET OVERVIEW (2016-2028)

FIGURE 017. EMERGENCY ALARM & EVACUATION SYSTEM MARKET OVERVIEW (2016-2028)

FIGURE 018. AUDIO & VISUAL EFFECTS MARKET OVERVIEW (2016-2028)

FIGURE 019. ESCALATOR MARKET OVERVIEW (2016-2028)

FIGURE 020. ELEVATOR MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. SMART BUILDING MARKET OVERVIEW BY APPLICATION

FIGURE 023. GOVERNMENT BUILDINGS MARKET OVERVIEW (2016-2028)

FIGURE 024. RESIDENTIAL BUILDINGS MARKET OVERVIEW (2016-2028)

FIGURE 025. COMMERCIAL BUILDING MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA SMART BUILDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE SMART BUILDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC SMART BUILDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA SMART BUILDING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA SMART BUILDING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Smart Building Market research report is 2024-2032.

Johnson Controls (U.S.), Honeywell (U.S.), Schneider (France),UTC (U.S.),Siemens (Germany),Ingersoll Rand (Trane),Azbil (Japan),ABB (Switzerland),Emerson (U.S.),Eaton (Ireland),Control4Corporation (U.S.),Bosch (Germany),Panasonic (Japan),Delta Controls (Canada),Legrand (France),Cisco (U.S.), IBM (U.S.),Advantech (China),Current (GE) and Others Key Players

The Smart Surfaces Market is segmented into by Application (Commercial, Residential, And Industrial), By Automation Type (Energy Management, Infrastructure Management, Network & Communication Management, And Intelligent Security Systems), By Service (Professional Services and Managed Services) and By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Smart building is an advanced structure that utilizes interconnected systems, sensors, and automation technologies to enhance its operations, improve energy efficiency, and provide superior occupant comfort and safety. These buildings leverage the Internet of Things (IoT) to collect and analyze data from various subsystems, such as lighting, HVAC, security, and energy management, enabling real-time monitoring, predictive maintenance, and optimized performance. By integrating these technologies, smart buildings aim to reduce operational costs, minimize environmental impact, and create a more responsive and adaptive environment for users.

Smart Building Market Size Was Valued at USD 100.85 Billion in 2023 and is Projected to Reach USD 305.48 Billion by 2032, Growing at a CAGR of 10.6% From 2024-2032.