Small Satellite Market Synopsis

Small Satellite Market Size Was Valued at USD 3.74 Billion in 2023, and is Projected to Reach USD 15.13 Billion by 2032, Growing at a CAGR of 16.8% From 2024-2032.

The small satellite is a disruptive technology in space industries. Traditionally, space industries were dominated by satellites which have thousands of kilograms and are bulky and expensive. Small satellites denote a new generation of miniaturized satellites that, by taking advantage of modern technologies (e.g., integrated circuits, digital signal processing, MEMS, and additive manufacturing), can achieve a significant reduction in volume, mass, development time, and cost of satellites.

- The launch of the first artificial Earth “small” satellite, Sputnik 1, triggered the space race in 1957. In the decades that followed, there was the development of increasingly larger satellites to provide reliable services from space over extended periods. Since then, with the increasing demand for radio-frequency spectrum and satellite-orbit usages and sustained growth of technological breakthroughs and innovation of space communication along with the booming capabilities in satellite manufacturing, a dramatic rise in the development of small satellites and systems has been witnessed, especially over the last ten years. The small satellite industry is experiencing an era of unprecedented change.

- During recent decades, small satellites, including CubeSats, NanoSats, MiniSats, and MicroSats, have undergone rapid developments, and are playing an increasingly larger role in exploration, technology demonstration, scientific research, and education. These miniature satellites provide a low-cost platform for missions, including planetary space exploration, Earth observations, fundamental Earth and space science, and developing precursor science instruments like laser communications and millimeter-wave communications for inter-satellite and inter-satellite links, and autonomous movement capabilities.

- The small Satellite also allows educators an inexpensive means to engage students in all phases of satellite development, operation, and exploitation through real-world, hands-on research and development experience on rideshare launch opportunities. Several miniaturized satellites can form spaceborne wireless sensor networks in space, which are also going to play an important role in the Internet of Space (IoS) of the future.

Typical Characteristics of Small Satellites

|

Denomination |

Mass (kg) |

Max. bus power (W) |

Max. dimensions (m) |

Development time (years) |

Orbit |

Mission duration (years) |

|

Minisatellite |

100-500 |

1 000 |

3-10 |

3-10 |

GEO MEO LEO HEO |

5-10 |

|

Microsatellite |

10-100 |

150 |

1-5 |

2-5 |

2-6 |

|

|

Nanosatellite |

1-10 |

20 |

0.1-1 |

1-3 |

LEO (HEO) |

1-3 |

|

Picosatellite |

0.1- 1 |

5 |

0.05-0.1 |

|||

|

Femto-satellite |

< 0.1 |

1 |

0.01-0.1 |

1 |

< 1 |

Small Satellite Market Trend Analysis

Rising Number of Space Exploration Missions

- Small spacecraft have been an integral part of space study, exploration, and commercialization since humankind’s first steps into low Earth orbit with Sputnik-1 and Explorer-1. With generally lower complexity and fewer payloads, small satellites can be produced at an increased cadence than larger ones. Rapid development in small satellites provides organizations with more agility in meeting requirements and adapting to new technologies for space exploration missions, these factors drive the growth of the small satellite market.

- For instance, the Department of Defense Operationally Responsive Space (ORS) program pursues small satellites to meet its primary goal to rapidly assemble, test, and launch satellites in support of warfighters. Rapid development can also drive costs down such that use of small satellites may allow more frequent space research missions and technology demonstrations.

- Small Satellites are Affordability, lower construction, launch, and operating costs, making remote sensing and space exploration more accessible to companies and organizations of all sizes. Also, relatively short development and launch times for small satellites allow for faster deployment of space missions. these factors booming the small satellite market.

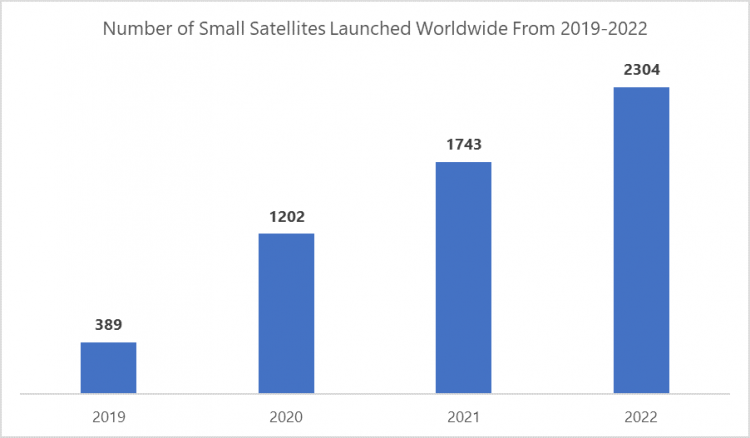

- As per the company database, the graph shows the growth in the launch of the small satellite. In 2022, the number of small satellites launched worldwide amounted to 2,304, which represented an increase of around 32.2 percent in comparison to the small satellite launched a year earlier. Nowadays small satellites are widely used in space exploration missions due to the various advantages of small satellites like lower cost, lower weight less time to launch, etc.

Growing Demand For Earth Observation

- Small satellites offer new opportunities to address the core observational requirements of both operational and research missions for earth observation. Small satellites, in particular single-sensor platforms, provide great architectural and programmatic flexibility. They offer attractive features with respect to design, observing strategy, faster "time to science" for new sensors, rapid technology infusion, replenishment of individual failed sensors, and robustness about budget and schedule uncertainties.

- Detailed data on environmental indicators including glacier melt, deforestation, sea level rise, and changes in land use can be obtained by small satellites outfitted with sophisticated instrumentation and high-resolution imaging sensors. For scientists, decision-makers, and environmentalists tackling climate-related issues in the future, this data is precious.

- Small satellites contribute to urban planning and infrastructure development by providing detailed mapping and monitoring of urban areas. They can track urban expansion, analyze transportation networks, monitor infrastructure assets such as roads, bridges, and buildings, and assess environmental impacts of urbanization. This information aids city planners, engineers, and policymakers in making informed decisions about land use, transportation, and sustainable development.

Small Satellite Market Segment Analysis:

Small Satellite Market is Segmented into type orbit, component, application, and end-users.

By Type, Minisatellite segment held the largest share of 42.36% in 2022

- Minisatellites are generally more affordable to design, build, and launch compared to larger satellites. Their smaller size means they require fewer materials and components, which reduces manufacturing and launch costs.

- With advancements in miniaturization of electronics and components, it's now possible to pack a lot of functionality into a small satellite. This allows minisatellites to perform a wide range of tasks despite their compact size.

- Minisatellites can often be developed and deployed much more quickly than larger satellites. This rapid development cycle is attractive to organizations looking to quickly demonstrate new technologies or conduct experiments in space.

- Minisatellites can be used for a variety of applications, including Earth observation, communications, scientific research, and technology demonstration. Their versatility makes them appealing to a wide range of users and industries.

- Minisatellites remain popular among public sector and Government agencies, with ROSCOSMOS, the Italian Defense Ministry, Israel Aerospace Industries Ltd, the National Space Organization (NSPO), and the United States Air Force (USAF) among others, for launching minisatellites for various applications.

By End-User, Commercial segment is expected to dominate the market during the forecast period

- Small satellites are used in the commercial sector widely for various purposes. Due to the expanding number of internet services and mobile users in 2022, the commercial category will hold the largest market share. The growing usage of small satellites for enemy surveillance is propelling the market forward. Commercial applications for small satellites include navigation, telecommunication, weather forecasting, and others.

- The commercial sector in the small satellite market is being driven by a surge in demand for cost-efficient solutions in Earth observation, communication, and data services. Smaller satellites present advantages in terms of lower launch expenses and quicker deployment, which are appealing to businesses aiming to leverage space-based opportunities while managing financial risks.

Small Satellite Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North American countries, particularly the United States, have a strong tradition of technological innovation and entrepreneurship. Many of the leading companies in the small satellite industry, such as SpaceX, Rocket Lab, and Planet Labs, are based in North America and have pushed the boundaries of what is possible with small satellite technology.

- For Instance: In June 2022, the U.S. Space Development Agency put its first spacecraft in orbit, the Laser Interconnect and Networking Communication System, and Mandrake II missions. These technology demonstrators are intended to advance the SDA toward its goal of proliferated low-Earth orbit — hundreds or thousands of LEO spacecraft for data relay and detection. In July, the SDA issued a request for proposals for 150 more data-relay satellites.

- The regulatory environment in North America, particularly in the United States, is relatively favorable to the development and deployment of small satellites. Government agencies like the Federal Communications Commission (FCC) and the National Aeronautics and Space Administration (NASA) have taken steps to streamline the regulatory process for small satellite operators, making it easier for companies to obtain the necessary licenses and permissions to launch and operate satellites.

- There is a growing demand for small satellite services and data across a wide range of industries, including agriculture, environmental monitoring, telecommunications, and defense. North American companies have been quick to capitalize on these opportunities and develop innovative solutions to meet the needs of customers.

Small Satellite Market Top Key Players:

- SpaceX (USA)

- Planet Labs (USA)

- Blue Origin (USA)

- OneWeb (UK)

- Spire Global (USA)

- Rocket Lab (USA/New Zealand)

- BlackSky (USA)

- Airbus Defense and Space (France)

- Lockheed Martin (USA)

- Northrop Grumman (USA)

- Boeing (USA)

- Surrey Satellite Technology Ltd (UK)

- ISRO (Indian Space Research Organisation) (India)

- Thales Alenia Space (France/Italy)

- Mitsubishi Electric Corporation (Japan)

- Ball Aerospace (USA)

- NanoRacks (USA)

- Axelspace Corporation (Japan)

- Virgin Orbit (USA)

- Terran Orbital (USA)

- AAC Clyde Space (Sweden)

- China Aerospace Science and Technology Corporation (China)

- GomSpace (Denmark)

- Clyde Space (UK)

- Tyvak Nano-Satellite Systems (USA), and Other Major Players

Key Industry Developments in the Small Satellite Market:

- In March 2024, Rocket Lab's Electron rocket successfully launched three collaborative research missions into low-Earth orbit from NASA's Wallops Island Flight Facility, including the Mola CubeSat mission led by NPS' SSAG. NPS' contributions, the terahertz imaging camera (TIC) and LED on-orbit payload (LOOP), aim to advance free-space optical communications for CubeSats, while New Zealand's Defense Science and Technology unit provided a radio transmitter. This marks a significant step forward in comms experimentation and international collaboration in space exploration.

- In March 2024, Startical tested its communication and air traffic surveillance systems on a NanoAvionics-built satellite, paving the way for the first space-based air traffic service constellation. The International Telecommunication Union's approval marks a significant step, allowing Startical to provide integrated space communication and surveillance services for air navigation worldwide. Utilizing a satellite from Kongsberg NanoAvionics, the project aims to assess VHF radio communication and ADS-B surveillance systems directly from space, with operations slated to begin in 2025.

- In September 2024, 23 companies showed interest in acquiring ISRO's Small Satellite Launch Vehicle technology, according to IN-SPACe Chairman Pawan K Goenka, terming it a "tremendous response". The autonomous agency under the Department of Space received the interest after floating an Expression of Interest in July. IN-SPACe aims to enable non-government entities to undertake space activities, with only one company set to acquire the SSLV technology.

|

Global Small Satellite Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.74 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.8% |

Market Size in 2032: |

USD 15.13 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Orbit |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By End- User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SMALL SATELLITE MARKET BY TYPE (2017-2032)

- SMALL SATELLITE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MINISATELLITE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MICROSATELLITE

- NANOSATELLITE

- PICO-SATELLITES

- FEMTOSATELLITES

- SMALL SATELLITE MARKET BY ORBIT (2017-2032)

- SMALL SATELLITE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LOW EARTH ORBIT (LEO)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MIDDLE EARTH ORBIT (MEO)

- GEOSTATIONARY EARTH ORBIT (GEO)

- SMALL SATELLITE MARKET BY COMPONENT (2017-2032)

- SMALL SATELLITE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STRUCTURES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PAYLOAD

- ELECTRIC POWER SYSTEM

- SOLAR PANEL AND ANTENNA SYSTEMS

- PROPULSION SYSTEMS

- SMALL SATELLITE MARKET BY APPLICATION (2017-2032)

- SMALL SATELLITE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EARTH OBSERVATION AND REMOTE SENSING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SATELLITE COMMUNICATION

- SCIENCE AND EXPLORATION

- MAPPING AND NAVIGATION

- SPACE OBSERVATION

- SMALL SATELLITE MARKET BY END-USER (2017-2030)

- SMALL SATELLITE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COMMERCIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ACADEMIC

- GOVERNMENT AND MILITARY

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- SMALL SATELLITE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SPACEX (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- PLANET LABS (USA)

- BLUE ORIGIN (USA)

- ONEWEB (UK)

- SPIRE GLOBAL (USA)

- ROCKET LAB (USA/NEW ZEALAND)

- BLACKSKY (USA)

- AIRBUS DEFENSE AND SPACE (FRANCE)

- LOCKHEED MARTIN (USA)

- NORTHROP GRUMMAN (USA)

- BOEING (USA)

- SURREY SATELLITE TECHNOLOGY LTD (UK)

- ISRO (INDIAN SPACE RESEARCH ORGANISATION) (INDIA)

- THALES ALENIA SPACE (FRANCE/ITALY)

- MITSUBISHI ELECTRIC CORPORATION (JAPAN)

- BALL AEROSPACE (USA)

- NANORACKS (USA)

- AXELSPACE CORPORATION (JAPAN)

- VIRGIN ORBIT (USA)

- TERRAN ORBITAL (USA)

- AAC CLYDE SPACE (SWEDEN)

- CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION (CHINA)

- GOMSPACE (DENMARK)

- CLYDE SPACE (UK)

- COMPETITIVE LANDSCAPE

- GLOBAL SMALL SATELLITE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Orbit

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End- User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Small Satellite Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.74 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.8% |

Market Size in 2032: |

USD 15.13 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Orbit |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By End- User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Small Satellite Market research report is 2024-2032.

SpaceX (USA), Planet Labs (USA), Blue Origin (USA), OneWeb (UK), Spire Global (USA), Rocket Lab (USA/New Zealand), BlackSky (USA), Airbus Defense and Space (France), Lockheed Martin (USA), Northrop Grumman (USA), Boeing (USA), Surrey Satellite Technology Ltd (UK), ISRO (Indian Space Research Organisation) (India), Thales Alenia Space (France/Italy), Mitsubishi Electric Corporation (Japan), Ball Aerospace (USA), NanoRacks (USA), Axelspace Corporation (Japan), Virgin Orbit (USA), Terran Orbital (USA), AAC Clyde Space (Sweden), China Aerospace Science and Technology Corporation (China), GomSpace (Denmark), Clyde Space (UK), Tyvak Nano-Satellite Systems (USA) and Other Major Players.

The Small Satellite Market is segmented into Type, Orbit, Component, Application, End-User, and region. By Type, the market is categorized into Minisatellite, Microsatellite, Nanosatellite, Pico-Satellites, and Femtosatellites. By Orbit, the market is categorized into Low Earth Orbit (LEO), Middle Earth Orbit (MEO), Geostationary Earth Orbit (GEO). By Component, the market is categorized into Structures, Payload, Electric Power Systems, Solar Panel and Antenna Systems, and Propulsion Systems. By Application, the market is categorized into Earth Observation and Remote Sensing, Satellite Communication, Science and Exploration, Mapping and Navigation, and Space Observation. By End-User, the market is categorized into Commercial, Academic, Government, and Military. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The small satellite is a disruptive technology in space industries. Traditionally, space industries were dominated by satellites which have thousands of kilograms and are bulky and expensive. Small satellites denote a new generation of miniaturized satellites that, by taking advantage of modern technologies (e.g., integrated circuits, digital signal processing, MEMS, and additive manufacturing), can achieve a significant reduction in volume, mass, development time, and cost of satellites.

Small Satellite Market Size Was Valued at USD 3.74 Billion in 2023, and is Projected to Reach USD 15.13 Billion by 2032, Growing at a CAGR of 16.8% From 2024-2032.