Global Sensors Market Synopsis

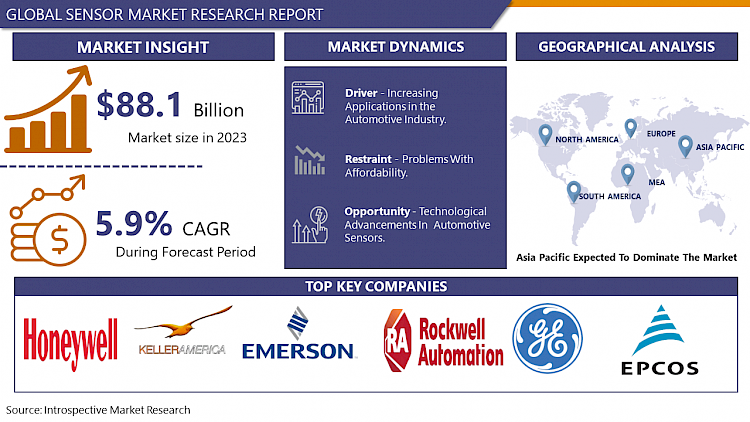

Global Sensors Market Size Was Valued at USD 88.1 Billion in 2023 and is Projected to Reach USD 147.58 Billion by 2032, Growing at a CAGR of 5.9 % From 2024-2032.

Sensors are devices that detect changes in the source or environment, collect signals, and plan a response accordingly. Various sources can be used, such as light, temperature, movement pressure, etc. Through innovative sensor technologies, a wide range of applications are used in lifestyle, healthcare, and fitness.

- A widely recognized sensor is the microphone, which transforms sound waves into an electrical signal suitable for amplification, transmission, recording, and replication.

- We employ sensors in our daily lives. The ordinary mercury thermometer is an extremely ancient form of sensor used to measure temperature. Mercury detects the temperature changes which are stored in the closed tube-like structure.

- Numerous factors, including the growing need for consumer electronics, surveillance cameras, indoor navigation applications, high-accuracy motion sensors in video games, and the increasing uptake of green energy technologies, are driving the expansion of the sensor industry. The market is expanding as a result of a greater emphasis being placed on the research and development of new goods. Significant factors driving the growth of the sensors market include the Internet of Things (IoT) and improved image sensors utilized in a variety of applications, such as gas sensors, cameras, etc.

- An essential component of the Internet of Things (IoT) is sensors. Through them, an ecosystem for gathering and analyzing data on a particular environment may be established, facilitating easier and more effective monitoring, management, and control. IoT sensors are utilized in a variety of situations, including homes, fields, cars, aircraft, and factories. The physical and logical worlds are connected by sensors, which serve as the eyes and ears of a computing infrastructure that gathers, processes, and interprets sensor data.

Global Sensors Market Trend Analysis

Increasing Applications in the Automotive Industry

- Increasing focus on automotive safety regulations and standards because of the global mandate to integrate safety features such as collision avoidance systems, lane departure warning systems, and adaptive cruise control into vehicles. These systems depend heavily on a variety of sensors, including LiDAR, radar, ultrasound, and cameras, to accurately detect the vehicle's surroundings and respond to potential threats in real-time.

- The growing applications in the automobile industry are a major driver of the current opportunity rise in the sensor market. Sensors are becoming more and more necessary as cars get smarter and more self-sufficient. These sensors are essential for enabling a range of autonomous driving functions and advanced driver assistance systems (ADAS), which improve passenger and driver safety and comfort.

Problems With Affordability

- high costs for maintenance and installation, and the need for huge amounts of money to establish and maintain an integrated, self-monitoring, sustainable, and adaptable network of smart sensors harms the market.

Technological Advancements In Automotive Sensors

- The car industry has seen significant growth in recent decades toward autonomous driving systems, with sensors emerging as essential components. Light detection and ranging (LIDAR) sensors have proven essential for reaching complete autonomy, despite their original expensive cost.

- Radar technology advancements have significantly improved sensor capabilities, allowing sensor fusion systems to perceive the surroundings in more detail. The demand for sophisticated sensors in future autonomous vehicles is expected to increase as manufacturers look for dependable, high-performing, and cost-effective solutions.

- The growth of the automobile industry is improving sensor dependability and opening up new growth opportunities in several other areas. Applications for sensors are becoming more and more varied, ranging from environmental monitoring and wearable technology to biomedicine and healthcare. This expanding range highlights the critical role that sensors play in tackling new issues like climate change and satisfying the changing requirements of contemporary

Global Sensors Market Segment Analysis:

Global Sensors Market Segmented based on type and end-users.

By Type, The Global Sensor Image Sensor Segment Is Expected To Dominate The Market During The Forecast Period.

- The sensor market is predicted to be dominated by the image sensor sector. The widespread application of image sensors in numerous industries, such as consumer electronics, automotive, healthcare, security, and surveillance, is a major factor in their supremacy. Sophisticated image sensors are being developed in consumer electronics because of the demand for high-quality cameras in smartphones, tablets, and digital cameras. The digital camera market is always growing as new features and improvements to image quality are introduced. Improved low-light capabilities, faster-focusing speeds, and higher resolution are highly desired by both professionals and consumers.

- By adding image sensors to advanced driver-assistance systems (ADAS) for functions like lane departure warning, parking assistance, and collision avoidance, the automotive industry increases consumer demand.

By End Users, The Automobile Sensor Segment Held The Largest Share In 2023

- The market is believed to be dominated by the automobile category. The increasing usage of sensors in cars for a range of functions, such as safety, efficiency, comfort, and legal compliance, is what's driving this domination. This tendency is accelerated by the automobile industry's push for advanced driver-assistance systems (ADAS), electric vehicles (EVs), and self-driving cars.

- With the rise in popularity of the Internet of Things (IoT) and connected services like smart cars, sensors are becoming more and more crucial to data collection. Predictive maintenance, car diagnostics, remote monitoring, and integrated entertainment systems are some of these services. Sensors gather information on the condition of the vehicle, usage patterns, and driving habits to offer owners and operators of automobiles useful insights and customized services.

- For features like lane departure alerts, parking assistance, collision detection, and electric vehicle battery management, sensors are necessary. The automotive sector is expected to continue being a major driver of the Sensors Market because of the continuous advancements in automotive technology and the growing customer desire for safer, more efficient automobiles.

Global Sensors Market Regional Insights:

Asia Pacific Is Expected To Dominate The Market Over The Forecast Period.

- The Asia-Pacific region is anticipated to lead the global sensors market due in large part to its affordable shipping costs, which attract manufacturers and distributors to locate their operations there. It is anticipated that the region's decreasing production costs will fuel additional market expansion for sensors.

- Asia-Pacific emerges as a major participant as businesses look for affordable manufacturing solutions because of its competitive advantages in supply chain infrastructure and production efficiency. During the projected period, the sensors market in the region is expected to witness substantial expansion due to the combined influence of these factors.

Global Sensor's Key Players

- Honeywell International Inc. (U.S.)

- Keller America, Inc. (U.S)

- Rockwell Automation Co. Ltd. (U.S.)

- General Electric Company (U.S.)

- Raytek Corporation (U.S.)

- PCB Piezotronics, Inc. (U.S.)

- Banner Engineering Corp. (U.S.)

- Merit Sensor Systems (U.S.)

- STS Sensors (Switzerland)

- TE Connectivity (Switzerland)

- SIEMENS AG (Germany)

- WIKA Alexander Wiegand & Co. (Germany)

- EPCOS AG (Germany)

- First Sensor Technology (Germany)

- Balluff (India)

- Hans TURCK & Co. (Germany)

- Pepperl+Fuchs (Germany)

- SICK AG (Germany)

- Di-soric Industrie-electronic & Co. (Germany)

- Sensortechnics (Germany)

- Ahlborn Mess- und Regelungstechnik (Germany)

- Proxitron (Germany)

- Christian Bürkert & Co. KG (Germany)

- Infineon Technologies AG (Germany)

- Emerson Electric Co. (Missouri)

Key Industry Developments In The Global Sensors Market:

- In March 2024: Siemens will purchase ebm-papst's industrial drive technology division. To strengthen its position in factory automation and digitization, Siemens intends to purchase ebm-papst's business. By doing this, Siemens Xcelerator's range is increased, and ebm-papst's mechatronic systems and fan knowledge are tapped upon.

- In Oct 2023: Emerson declared that it had completed the $8.2 billion equity valuation of its purchase of NI, a top supplier of software-connected automated test and measurement equipment. By acquiring NI, Emerson strengthens its position as a leader in automation globally and increases its potential to profit from significant secular trends including nearshoring, digital transformation, sustainability, and decarbonization.

|

Global Global Sensors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2030 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 88.1 Bn. |

|

Forecast Period 2024-30 CAGR: |

5.9 % |

Market Size in 2030: |

USD 131.6 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

Honeywell International Inc. (U.S.), Keller America, Inc. (U.S.), Emerson Electric Co. (Missouri), Rockwell Automation Co. Ltd. (U.S.), General Electric Company (U.S.) and Other Major Players. |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat of New Entrants

- Threat of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- GLOBAL SENSORS MARKET BY TYPE (2017-2030)

- GLOBAL SENSORS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IMAGE SENSOR

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017-2030F)

- Historic and Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- SPEED SENSOR

- BIOSENSORS

- OPTICAL SENSORS

- PRESSURE SENSOR

- TEMPERATURE SENSOR

- TOUCH SENSOR

- GLOBAL SENSORS MARKET BY SEGMENT END-USER (2017-2030)

- GLOBAL SENSORS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017-2030F)

- Historic and Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- AEROSPACE & DEFENSE

- ELECTRONICS

- HEALTHCARE INDUSTRIAL IT & TELECOM

- GLOBAL SENSORS MARKET BY TECHNOLOGY (2017-2030)

- GLOBAL SENSORS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CMOS

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017-2030F)

- Historic and Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- MEMS

- NEMS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- GLOBAL SENSORS Market Share by Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HONEYWELL INTERNATIONAL INC. (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves and Recent Developments

- SWOT Analysis

- KELLER AMERICA, INC. (U.S)

- ROCKWELL AUTOMATION CO. LTD. (U.S.)

- GENERAL ELECTRIC COMPANY (U.S.)

- RAYTEK CORPORATION (U.S.)

- PCB PIEZOTRONICS, INC. (U.S.)

- BANNER ENGINEERING CORP. (U.S.)

- MERIT SENSOR SYSTEMS (U.S.)

- STS SENSORS (SWITZERLAND)

- TE CONNECTIVITY (SWITZERLAND)

- SIEMENS AG (GERMANY)

- WIKA ALEXANDER WIEGAND & CO. (GERMANY)

- EPCOS AG (GERMANY)

- FIRST SENSOR TECHNOLOGY (BERLIN)

- BALLUFF (INDIA)

- HANS TURCK & CO. (GERMANY)

- PEPPERL+FUCHS (GERMANY)

- SICK AG (Germany)

- DI-SORIC INDUSTRIE-ELECTRONIC & CO. (GERMANY)

- SENSORTECHNICS (GERMANY)

- AHLBORN MESS- UND REGELUNGSTECHNIK (GERMANY)

- PROXITRON (GERMANY)

- CHRISTIAN BÜRKERT & CO. KG (GERMANY)

- INFINEON TECHNOLOGIES AG (GERMANY)

- EMERSON ELECTRIC CO. (MISSOURI)

- COMPETITIVE LANDSCAPE

- GLOBAL SENSORS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors and Opportunities

- Key Manufacturers

- Historic and Forecasted Market Size by Segment1

- Historic and Forecasted Market Size by Segment2

- Historic and Forecasted Market Size by Segment3

- Historic and Forecasted Market Size by Segment4

- Historic and Forecasted Market Size by Segment5

- Historic and Forecasted Market Size by Segment6

- Historic and Forecasted Market Size by Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors and Opportunities

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors and Opportunities

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors and Opportunities

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors and Opportunities

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors and Opportunities

- Key Manufacturers

- Historic and Forecasted Market Size by Segments

- Historic and Forecasted Market Size by Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Global Sensors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2030 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 88.1 Bn. |

|

Forecast Period 2024-30 CAGR: |

5.9 % |

Market Size in 2030: |

USD 131.6 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

Honeywell International Inc. (U.S.), Keller America, Inc. (U.S.), Emerson Electric Co. (Missouri), Rockwell Automation Co. Ltd. (U.S.), General Electric Company (U.S.) and Other Major Players. |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SENSORS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SENSORS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SENSORS MARKET COMPETITIVE RIVALRY

TABLE 005. SENSORS MARKET THREAT OF NEW ENTRANTS

TABLE 006. SENSORS MARKET THREAT OF SUBSTITUTES

TABLE 007. SENSORS MARKET BY SOLUTION

TABLE 008. HARDWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 010. SENSORS MARKET BY APPLICATION

TABLE 011. CONNECTED CARS MARKET OVERVIEW (2016-2028)

TABLE 012. SMARTPHONES MARKET OVERVIEW (2016-2028)

TABLE 013. LAPTOPS MARKET OVERVIEW (2016-2028)

TABLE 014. M2M MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. SENSORS MARKET BY VERTICAL

TABLE 017. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 018. CONSUMER ELECTRONICS MARKET OVERVIEW (2016-2028)

TABLE 019. ENERGY & UTILITIES MARKET OVERVIEW (2016-2028)

TABLE 020. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA SENSORS MARKET, BY SOLUTION (2016-2028)

TABLE 023. NORTH AMERICA SENSORS MARKET, BY APPLICATION (2016-2028)

TABLE 024. NORTH AMERICA SENSORS MARKET, BY VERTICAL (2016-2028)

TABLE 025. N SENSORS MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE SENSORS MARKET, BY SOLUTION (2016-2028)

TABLE 027. EUROPE SENSORS MARKET, BY APPLICATION (2016-2028)

TABLE 028. EUROPE SENSORS MARKET, BY VERTICAL (2016-2028)

TABLE 029. SENSORS MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC SENSORS MARKET, BY SOLUTION (2016-2028)

TABLE 031. ASIA PACIFIC SENSORS MARKET, BY APPLICATION (2016-2028)

TABLE 032. ASIA PACIFIC SENSORS MARKET, BY VERTICAL (2016-2028)

TABLE 033. SENSORS MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA SENSORS MARKET, BY SOLUTION (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA SENSORS MARKET, BY APPLICATION (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA SENSORS MARKET, BY VERTICAL (2016-2028)

TABLE 037. SENSORS MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA SENSORS MARKET, BY SOLUTION (2016-2028)

TABLE 039. SOUTH AMERICA SENSORS MARKET, BY APPLICATION (2016-2028)

TABLE 040. SOUTH AMERICA SENSORS MARKET, BY VERTICAL (2016-2028)

TABLE 041. SENSORS MARKET, BY COUNTRY (2016-2028)

TABLE 042. HONEYWELL INTERNATIONAL INC. (US): SNAPSHOT

TABLE 043. HONEYWELL INTERNATIONAL INC. (US): BUSINESS PERFORMANCE

TABLE 044. HONEYWELL INTERNATIONAL INC. (US): PRODUCT PORTFOLIO

TABLE 045. HONEYWELL INTERNATIONAL INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. DENSO CORPORATION (JAPAN): SNAPSHOT

TABLE 046. DENSO CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 047. DENSO CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 048. DENSO CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. OMNIVISION (US): SNAPSHOT

TABLE 049. OMNIVISION (US): BUSINESS PERFORMANCE

TABLE 050. OMNIVISION (US): PRODUCT PORTFOLIO

TABLE 051. OMNIVISION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. ALPHA MOS (FRANCE): SNAPSHOT

TABLE 052. ALPHA MOS (FRANCE): BUSINESS PERFORMANCE

TABLE 053. ALPHA MOS (FRANCE): PRODUCT PORTFOLIO

TABLE 054. ALPHA MOS (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. AMETEK INC. (US): SNAPSHOT

TABLE 055. AMETEK INC. (US): BUSINESS PERFORMANCE

TABLE 056. AMETEK INC. (US): PRODUCT PORTFOLIO

TABLE 057. AMETEK INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ALPHASENSE INC. (US): SNAPSHOT

TABLE 058. ALPHASENSE INC. (US): BUSINESS PERFORMANCE

TABLE 059. ALPHASENSE INC. (US): PRODUCT PORTFOLIO

TABLE 060. ALPHASENSE INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. BORGWARNER INC. (US): SNAPSHOT

TABLE 061. BORGWARNER INC. (US): BUSINESS PERFORMANCE

TABLE 062. BORGWARNER INC. (US): PRODUCT PORTFOLIO

TABLE 063. BORGWARNER INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. FIGARO ENGINEERING INC. (JAPAN): SNAPSHOT

TABLE 064. FIGARO ENGINEERING INC. (JAPAN): BUSINESS PERFORMANCE

TABLE 065. FIGARO ENGINEERING INC. (JAPAN): PRODUCT PORTFOLIO

TABLE 066. FIGARO ENGINEERING INC. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. EMERSON ELECTRIC CO. (US): SNAPSHOT

TABLE 067. EMERSON ELECTRIC CO. (US): BUSINESS PERFORMANCE

TABLE 068. EMERSON ELECTRIC CO. (US): PRODUCT PORTFOLIO

TABLE 069. EMERSON ELECTRIC CO. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. GENERAL ELECTRIC COMPANY (US): SNAPSHOT

TABLE 070. GENERAL ELECTRIC COMPANY (US): BUSINESS PERFORMANCE

TABLE 071. GENERAL ELECTRIC COMPANY (US): PRODUCT PORTFOLIO

TABLE 072. GENERAL ELECTRIC COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. INDUSTRIAL SCIENTIFIC (US): SNAPSHOT

TABLE 073. INDUSTRIAL SCIENTIFIC (US): BUSINESS PERFORMANCE

TABLE 074. INDUSTRIAL SCIENTIFIC (US): PRODUCT PORTFOLIO

TABLE 075. INDUSTRIAL SCIENTIFIC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. SAMSUNG (SOUTH KOREA): SNAPSHOT

TABLE 076. SAMSUNG (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 077. SAMSUNG (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 078. SAMSUNG (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. TELEDYNE MONITOR LABS (TML) (US): SNAPSHOT

TABLE 079. TELEDYNE MONITOR LABS (TML) (US): BUSINESS PERFORMANCE

TABLE 080. TELEDYNE MONITOR LABS (TML) (US): PRODUCT PORTFOLIO

TABLE 081. TELEDYNE MONITOR LABS (TML) (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. STMICROELECTRONICS (SWITZERLAND): SNAPSHOT

TABLE 082. STMICROELECTRONICS (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 083. STMICROELECTRONICS (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 084. STMICROELECTRONICS (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. NXP SEMICONDUCTORS (NETHERLANDS): SNAPSHOT

TABLE 085. NXP SEMICONDUCTORS (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 086. NXP SEMICONDUCTORS (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 087. NXP SEMICONDUCTORS (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. INFINEON TECHNOLOGIES AG (GERMANY): SNAPSHOT

TABLE 088. INFINEON TECHNOLOGIES AG (GERMANY): BUSINESS PERFORMANCE

TABLE 089. INFINEON TECHNOLOGIES AG (GERMANY): PRODUCT PORTFOLIO

TABLE 090. INFINEON TECHNOLOGIES AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. QUALCOMM TECHNOLOGIES INC. (US): SNAPSHOT

TABLE 091. QUALCOMM TECHNOLOGIES INC. (US): BUSINESS PERFORMANCE

TABLE 092. QUALCOMM TECHNOLOGIES INC. (US): PRODUCT PORTFOLIO

TABLE 093. QUALCOMM TECHNOLOGIES INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. MICROCHIP TECHNOLOGY INC. (US): SNAPSHOT

TABLE 094. MICROCHIP TECHNOLOGY INC. (US): BUSINESS PERFORMANCE

TABLE 095. MICROCHIP TECHNOLOGY INC. (US): PRODUCT PORTFOLIO

TABLE 096. MICROCHIP TECHNOLOGY INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. TEXAS INSTRUMENTS INCORPORATED (US): SNAPSHOT

TABLE 097. TEXAS INSTRUMENTS INCORPORATED (US): BUSINESS PERFORMANCE

TABLE 098. TEXAS INSTRUMENTS INCORPORATED (US): PRODUCT PORTFOLIO

TABLE 099. TEXAS INSTRUMENTS INCORPORATED (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. BOSCH SENSORTEC GMBH (GERMANY): SNAPSHOT

TABLE 100. BOSCH SENSORTEC GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 101. BOSCH SENSORTEC GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 102. BOSCH SENSORTEC GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. JOHNSON CONTROLS (IRELAND): SNAPSHOT

TABLE 103. JOHNSON CONTROLS (IRELAND): BUSINESS PERFORMANCE

TABLE 104. JOHNSON CONTROLS (IRELAND): PRODUCT PORTFOLIO

TABLE 105. JOHNSON CONTROLS (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. SONY SEMICONDUCTOR SOLUTIONS CORPORATION (JAPAN): SNAPSHOT

TABLE 106. SONY SEMICONDUCTOR SOLUTIONS CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 107. SONY SEMICONDUCTOR SOLUTIONS CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 108. SONY SEMICONDUCTOR SOLUTIONS CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 109. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 110. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 111. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SENSORS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SENSORS MARKET OVERVIEW BY SOLUTION

FIGURE 012. HARDWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 014. SENSORS MARKET OVERVIEW BY APPLICATION

FIGURE 015. CONNECTED CARS MARKET OVERVIEW (2016-2028)

FIGURE 016. SMARTPHONES MARKET OVERVIEW (2016-2028)

FIGURE 017. LAPTOPS MARKET OVERVIEW (2016-2028)

FIGURE 018. M2M MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. SENSORS MARKET OVERVIEW BY VERTICAL

FIGURE 021. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 022. CONSUMER ELECTRONICS MARKET OVERVIEW (2016-2028)

FIGURE 023. ENERGY & UTILITIES MARKET OVERVIEW (2016-2028)

FIGURE 024. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA SENSORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE SENSORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC SENSORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA SENSORS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA SENSORS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Global Sensors Market research report is 2024-2032.

Honeywell International Inc. (U.S.), Keller America, Inc. (U.S.), Emerson Electric Co. (Missouri), Rockwell Automation Co. Ltd. (U.S.), General Electric Company (U.S.)and Other Major Players.

The Global Sensors Market is segmented into Type, by end user, and region. By Type, the market is categorized into Speed Sensors, Image Sensors, Biosensors, Optical Sensors, Pressure Sensor, Temperature Sensor, and Touch Sensor. By App, the market is categorized into XXX. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A sensor is an apparatus that receives input from the external world and processes it. Light, heat, motion, moisture, pressure, and a variety of other environmental phenomena can all be used as inputs.

Global Sensors Market Size Was Valued at USD 88.1 Billion in 2023 and is Projected to Reach USD 147.58 Billion by 2032, Growing at a CAGR of 5.9 % From 2024-2032.