Global Clinical Alarm Management Market Overview

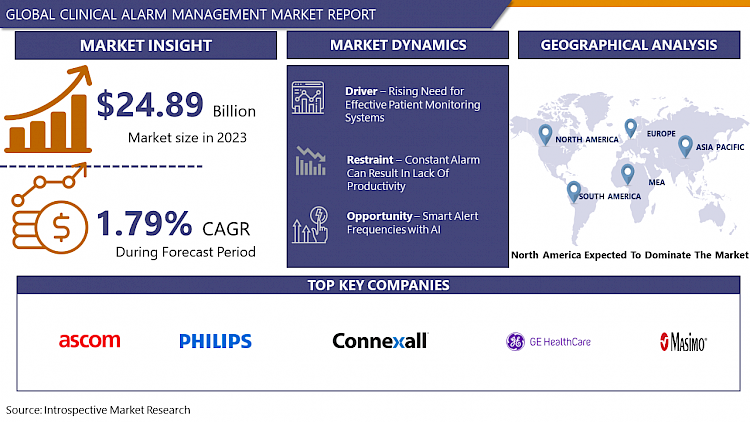

Global Clinical Alarm Management Market Size Was Valued at USD 24.89 Billion In 2023 And Is Projected to Reach USD 29.21 Billion By 2032, Growing at A CAGR of 1.79% From 2024 To 2032.

Alarm systems that are integrated into or attached to medical equipment and monitoring systems are triggered by physiological changes in the patient, changes in monitored data, or system issues. Over a short period, technological advancements in hospitals have accelerated significantly. These advancements have brought with them complex and complicated monitoring systems, many of which include built-in audio alerts. These clinical alarms are designed to notify the clinician when a patient's condition deviates from a present "normal" state. They are a critical tool for increasing patient safety by providing information that necessitates a response or awareness on the part of the operator. The market's expansion is fueled by the rising need for clinical decision support tools, central monitoring systems, mobility solutions, clinical alarm reporting software, and alarm auditing software among the world's elderly population. Global demand is expected to be driven by factors such as the rapid implementation of big data analytics, expanding need for clinical alarm management systems, and the increasing acceptance of clinical decision support technologies. During the anticipated period, the clinical alarm management system is expected to increase at an exponential rate.

Market Dynamics and Factors of Clinical Alarm Management Market

Drivers:

Need for Effective Patient Monitoring Systems Propelling the Clinical Alarm Management Market

Increased awareness among healthcare practitioners in enhancing patient safety utilizing sophisticated technologies such as mHealth and alert management systems is due to the rise in the incidence of chronic illnesses paired with longer hospital stays. In addition, the industry is predicted to rise as government and private healthcare providers increase their investments in healthcare infrastructure Systems that are not adequately controlled or standardized may cause a false alert, putting the patient's health in danger. According to the OECD's Health at a Glance 2019 report, about one-third of persons aged 15 and up in 27 OECD countries reported living with two or more chronic diseases, such as cancer, heart attack, stroke, chronic respiratory issues, and diabetes. Chronic illnesses affect about one in every two people in Germany and Finland. The primary reasons driving the relevant category in the market researched are the rising incidence of chronic illnesses and the growing geriatric population globally. According to the Globe Ageing Population study, there were roughly 703 million persons aged 65 and more in the world in 2019. Over the next three decades, the number of people aged 65 and above is predicted to more than treble, reaching 1.5 billion by 2050. Hearing loss, cataracts, refractive errors, back and neck discomfort and osteoarthritis, chronic obstructive pulmonary disease, diabetes, depression, and dementia are all common among the elderly. This reflects an increase in the need for equipment used in illness diagnosis, treatment, monitoring, and management.

Restraints:

Alarm Fatigue Remains A Major Restraining Factor In The Clinical Alarm Management Market

Alarm fatigue is a major restraining factor in the clinical alarm management market. Constant alarm interrupts the workday of a nurse which can cause a lack of productivity and focus on one patient. This huge industry-wide issue is generally caused by the misuse of alarms in clinical settings, rather than a lack of training. Every change in a patient's state triggers a new set of alarm functions, some of which may or may not apply to a nurse's duties. The sheer number of alerts interrupting nurses' work is overwhelming. Alarm fatigue remains despite a strong foundation in patient management and regular refresher training.

Opportunities:

Smart Alert Frequencies With AI Possess Great Opportunities

The market's opportunity might be a crucial move from just decreasing the alert frequency to more meaningful outcome measurements. Outcomes such as reaction time to genuine patient alarms or simulated alarms injected into real patient care environments, in addition to alarm rates, maybe stronger indications of whether the overall alarm response system is operating well. The use of AI in alarm identification and management can be revolutionary to optimize the response time. To measure patient outcomes, larger, multisite studies are required. A higher-quality evidence-base for the expanding number of potential alarm management therapies will help future alarm management QI projects. The majority of alarm management interventions have largely focused on filtering out non-actionable alarms. There has been far less attention on ensuring that the nurse who receives the notice is accessible to respond to the alert, which is a great potential for future development.

Challenge

False Alarms, Slow Response Time, And System Malfunction Are The Primary Challenges In The Market

False alarms have also been a source of concern, causing an unneeded commotion among healthcare workers. This is expected to raise the focus on correct clinical alarm system deployment at hospitals and COVID 19 healthcare facilities. The vast majority of alerts in hospitals are non-actionable, with about 5-13 percent being actionable. Caregiver desensitization and alert fatigue are exacerbated by these non-actionable alarms. It's still difficult to distinguish between non-actionable and actionable alarms. Also, Shortage of hospital staff, Worn-out nurses, on the other hand, are more prone to alarm fatigue which can delay the response time for the alarm which is a challenging factor for the Clinical Alarm Management Market

Segmentation Analysis Of Clinical Alarm Management Market :

By Product, the Nurse call systems segment is anticipated to dominate the Clinical Alarm Management Market. Product advances are driven by wireless technology and automation, as well as the desire to optimize clinical workflow and minimize operational costs for the healthcare facility while making the most use of available resources, are all reasons that have contributed to this huge share. The technical advancements made possible by fiber optic technology have helped the nurse call system placed in hospital rooms in particular. Nurse call systems, which allow patients to request help, are an important aspect of hospital care. When a patient utilizes the nurse call system, a message is sent to the physicians and nurses right away, alerting them to which patient in which room requires help. Most significantly, the call system aids in the prompt delivery of treatment to patients via the fast fiber-optic network. Increasing investment in wireless technologies and IP-based nurse call systems is also expected to drive market expansion throughout the forecast period.

By Offering, Solution segment is expected to dominate the Clinical Alarm Management Market. This is due to the increasing use of linked care technology in healthcare, as well as initiatives by major corporations and the desire to prevent alert fatigue. Over the projected period, the market is expected to be driven by the need to decrease adverse patient events, false/ nuisance alarms, and comply with regulatory obligations. Due to initiatives by public and private health institutions, increased service offerings by major market participants, and a growing desire to minimize threats to patient safety, the services segment is expected to grow at the quickest rate throughout the projection period, fueling the segment expansion in the future years.

By End User, Clinics and hospital segments dominate the Clinical Alarm Management Market. Because of an increase in patient flow, an increase in emergencies, and the use of advanced clinical alarm management technologies. Clinical alarms were created with the best of intentions in mind to notify doctors of patient crises or changes in condition. Alarms are built into most bedside medical devices, including monitors, infusion pumps, and ventilators, however, due to a lack of compatibility among these devices, several noises per patient room are common. The number of clinical alerts per patient each day, depending on the hospital unit, might result in thousands of alarm signals on each unit and tens of thousands throughout the hospital. Because of the rising number of old-age institutions and increased awareness about the relevance of clinical alarm management systems in these facilities, the long-term care facilities category is expected to expand at the quickest pace over the projection period which is expected to boost overall Clinical Alarm Management Market.

Regional Analysis Of Clinical Alarm Management Market

North America is expected to be dominating the Clinical Alarm Management Market. The United States has created cutting-edge healthcare infrastructure. Key businesses like Medtronic, GE Healthcare, Connexall, Vocera, and others have set up shop in the United States. As a result, the presence of such important vendors in the country generates demand for the clinical alarm management market. In addition, the presence of significant market players in the area, such as GE Healthcare, Ascom, and Koninklijke Philips N.V., is projected to boost the market growth. Also, the US government have implemented various regulation regarding standards regarding the hardware and software used in the clinical alarm management system. Alarms are now handled in a variety of medical device standards in one form or another. The sole targeted alarm standard, IEC 60601-1-8, which sets general standards for alarm systems, is intended to be applied to all medical equipment having alarms. This standard, among other things, specifies visual and audio alarm signal features that may be used to prioritize the degree of urgency for all alerting devices. As a result of the increased importance of delivering high-quality healthcare. Increasing incidences of alarm fatigue, as well as a favorable regulatory environment in the United States and Canada, are driving market expansion in this area.

Europe is a highly lucrative region for the Clinical Alarm Management Market. European countries have high-end healthcare infrastructure and response toward public health and safety. Europe's healthcare sector is driven by emerging technology integration in the hospitals and clinics which makes them sophisticated healthcare service providers in the market. The United Kingdom is expected to be one of the most appealing markets. In England, for example, eight new hospitals with highly advanced equipment and clinical alarm and response management system opened in 2021. By 2030, the UK government plans to build 40 similar hospitals across the country. It contributes to the improvement and transformation of NHS services and the NHS for local communities. As a result, the need for clinical alarm management is fueled by strict government regulations and support for the country's healthcare sector's development.

Covid-19 Impact Analysis On Clinical Alarm Management Market

The COVID-19 pandemic is still transforming the growth of numerous economies, and the outbreak's immediate impact is variable. While certain industries may experience a demand reduction, many other markets will remain unaffected and exhibit great development prospects. Clinical alarm management is one industry that could benefit from the COVID 19 pandemic, owing to a large number of patients who will be admitted to hospitals as a result of the infection. It is critical and mandatory to keep track of patient's health and to provide proper and effective treatment to patients at healthcare facilities. According to the findings of a research study published in August 2020 titled "Curbing COVID-19-Related Alert Fatigue," 85 percent to 99 percent of alarms received each day at clinical facilities do not require clinical action, and COVID-19 adds to the urgency of reducing such nuisance alerts to protect the health and safety of respiratory therapists or nurses who investigate alarms in person while wearing personal protective equipment (PPE), which is also still in use. Clinical Alarm Management systems are predicted to make a difference in the health care industry, which is projected to drive the market.

Top Key Players Analyzed In Clinical Alarm Management Market

- Ascom Holdings

- Baxter International Inc.

- Bernoulli Enterprise Inc.

- Capsule Technologie (Subsidiary of Qualcomm Life Inc.)

- Connexall

- Dragerwerk AG

- Extension Healthcare

- GE Healthcare

- Koninklijke Philips N.V.

- Masimo

- Medtronic

- Mindray Medical International Limited

- Mobile Heartbeat (Subsidiary of Hospital Corporation of America)

- Spok Inc. (Subsidiary of Spok Holdings Inc.)

- Vocera Communications and other major players.

Key Industry Developments in Clinical Alarm Management Market

- In June 2023, Ascom and Niels-Stensen-Kliniken Group signed a contract to support the installation of the Ascom smart alarming system solution and IP-DECT infrastructure. The project is worth more than 1 million Swiss francs, including services.

- In April 2023, Koninklijke Philips N.V. and Northwell Health entered a seven-year agreement to help the health system standardize patient monitoring, enhance patient care, and improve patient outcomes while driving interoperability and data innovation.

|

Global Clinical Alarm Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.89 Bn. |

|

Forecast Period 2024-32 CAGR: |

1.79 % |

Market Size in 2032: |

USD 29.21 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Offering |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product

3.2 By Offering

3.3 By End User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Clinical Alarm Management Market by Product

4.1 Clinical Alarm Management Market Overview Snapshot and Growth Engine

4.2 Clinical Alarm Management Market Overview

4.3 Nurse Call Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Nurse Call Systems: Grographic Segmentation

4.4 Physiological Monitors

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Physiological Monitors: Grographic Segmentation

4.5 Bed Alarms

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Bed Alarms: Grographic Segmentation

4.6 EMR Integration Systems

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 EMR Integration Systems: Grographic Segmentation

4.7 Ventilators

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size (2016-2028F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Ventilators: Grographic Segmentation

4.8 Others

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size (2016-2028F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Others: Grographic Segmentation

Chapter 5: Clinical Alarm Management Market by Offering

5.1 Clinical Alarm Management Market Overview Snapshot and Growth Engine

5.2 Clinical Alarm Management Market Overview

5.3 Solutions

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Solutions: Grographic Segmentation

5.4 Services

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Services: Grographic Segmentation

Chapter 6: Clinical Alarm Management Market by End User

6.1 Clinical Alarm Management Market Overview Snapshot and Growth Engine

6.2 Clinical Alarm Management Market Overview

6.3 Hospitals and Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals and Clinics: Grographic Segmentation

6.4 Long-Term Care Centers and Ambulatory Care Centers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Long-Term Care Centers and Ambulatory Care Centers: Grographic Segmentation

6.5 Home Care Settings

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Home Care Settings: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Clinical Alarm Management Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Clinical Alarm Management Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Clinical Alarm Management Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 ASCOM HOLDINGS

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 BAXTER INTERNATIONAL INC.

7.4 BERNOULLI ENTERPRISE INC.

7.5 CAPSULE TECHNOLOGIE (SUBSIDIARY OF QUALCOMM LIFE INC.)

7.6 CONNEXALL

7.7 DRAGERWERK AG

7.8 EXTENSION HEALTHCARE

7.9 GE HEALTHCARE

7.10 KONINKLIJKE PHILIPS N.V.

7.11 MASIMO

7.12 MEDTRONIC

7.13 MINDRAY MEDICAL INTERNATIONAL LIMITED

7.14 MOBILE HEARTBEAT (SUBSIDIARY OF HOSPITAL CORPORATION OF AMERICA)

7.15 SPOK INC. (SUBSIDIARY OF SPOK HOLDINGS INC.)

7.16 VOCERA COMMUNICATIONS

Chapter 8: Global Clinical Alarm Management Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Product

8.2.1 Nurse Call Systems

8.2.2 Physiological Monitors

8.2.3 Bed Alarms

8.2.4 EMR Integration Systems

8.2.5 Ventilators

8.2.6 Others

8.3 Historic and Forecasted Market Size By Offering

8.3.1 Solutions

8.3.2 Services

8.4 Historic and Forecasted Market Size By End User

8.4.1 Hospitals and Clinics

8.4.2 Long-Term Care Centers and Ambulatory Care Centers

8.4.3 Home Care Settings

Chapter 9: North America Clinical Alarm Management Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Product

9.4.1 Nurse Call Systems

9.4.2 Physiological Monitors

9.4.3 Bed Alarms

9.4.4 EMR Integration Systems

9.4.5 Ventilators

9.4.6 Others

9.5 Historic and Forecasted Market Size By Offering

9.5.1 Solutions

9.5.2 Services

9.6 Historic and Forecasted Market Size By End User

9.6.1 Hospitals and Clinics

9.6.2 Long-Term Care Centers and Ambulatory Care Centers

9.6.3 Home Care Settings

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Clinical Alarm Management Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Product

10.4.1 Nurse Call Systems

10.4.2 Physiological Monitors

10.4.3 Bed Alarms

10.4.4 EMR Integration Systems

10.4.5 Ventilators

10.4.6 Others

10.5 Historic and Forecasted Market Size By Offering

10.5.1 Solutions

10.5.2 Services

10.6 Historic and Forecasted Market Size By End User

10.6.1 Hospitals and Clinics

10.6.2 Long-Term Care Centers and Ambulatory Care Centers

10.6.3 Home Care Settings

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Clinical Alarm Management Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product

11.4.1 Nurse Call Systems

11.4.2 Physiological Monitors

11.4.3 Bed Alarms

11.4.4 EMR Integration Systems

11.4.5 Ventilators

11.4.6 Others

11.5 Historic and Forecasted Market Size By Offering

11.5.1 Solutions

11.5.2 Services

11.6 Historic and Forecasted Market Size By End User

11.6.1 Hospitals and Clinics

11.6.2 Long-Term Care Centers and Ambulatory Care Centers

11.6.3 Home Care Settings

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Clinical Alarm Management Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product

12.4.1 Nurse Call Systems

12.4.2 Physiological Monitors

12.4.3 Bed Alarms

12.4.4 EMR Integration Systems

12.4.5 Ventilators

12.4.6 Others

12.5 Historic and Forecasted Market Size By Offering

12.5.1 Solutions

12.5.2 Services

12.6 Historic and Forecasted Market Size By End User

12.6.1 Hospitals and Clinics

12.6.2 Long-Term Care Centers and Ambulatory Care Centers

12.6.3 Home Care Settings

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Clinical Alarm Management Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product

13.4.1 Nurse Call Systems

13.4.2 Physiological Monitors

13.4.3 Bed Alarms

13.4.4 EMR Integration Systems

13.4.5 Ventilators

13.4.6 Others

13.5 Historic and Forecasted Market Size By Offering

13.5.1 Solutions

13.5.2 Services

13.6 Historic and Forecasted Market Size By End User

13.6.1 Hospitals and Clinics

13.6.2 Long-Term Care Centers and Ambulatory Care Centers

13.6.3 Home Care Settings

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Clinical Alarm Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.89 Bn. |

|

Forecast Period 2024-32 CAGR: |

1.79 % |

Market Size in 2032: |

USD 29.21 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Offering |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CLINICAL ALARM MANAGEMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CLINICAL ALARM MANAGEMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CLINICAL ALARM MANAGEMENT MARKET COMPETITIVE RIVALRY

TABLE 005. CLINICAL ALARM MANAGEMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. CLINICAL ALARM MANAGEMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. CLINICAL ALARM MANAGEMENT MARKET BY PRODUCT

TABLE 008. NURSE CALL SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 009. PHYSIOLOGICAL MONITORS MARKET OVERVIEW (2016-2028)

TABLE 010. BED ALARMS MARKET OVERVIEW (2016-2028)

TABLE 011. EMR INTEGRATION SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 012. VENTILATORS MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. CLINICAL ALARM MANAGEMENT MARKET BY OFFERING

TABLE 015. SOLUTIONS MARKET OVERVIEW (2016-2028)

TABLE 016. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 017. CLINICAL ALARM MANAGEMENT MARKET BY END USER

TABLE 018. HOSPITALS AND CLINICS MARKET OVERVIEW (2016-2028)

TABLE 019. LONG-TERM CARE CENTERS AND AMBULATORY CARE CENTERS MARKET OVERVIEW (2016-2028)

TABLE 020. HOME CARE SETTINGS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA CLINICAL ALARM MANAGEMENT MARKET, BY PRODUCT (2016-2028)

TABLE 022. NORTH AMERICA CLINICAL ALARM MANAGEMENT MARKET, BY OFFERING (2016-2028)

TABLE 023. NORTH AMERICA CLINICAL ALARM MANAGEMENT MARKET, BY END USER (2016-2028)

TABLE 024. N CLINICAL ALARM MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE CLINICAL ALARM MANAGEMENT MARKET, BY PRODUCT (2016-2028)

TABLE 026. EUROPE CLINICAL ALARM MANAGEMENT MARKET, BY OFFERING (2016-2028)

TABLE 027. EUROPE CLINICAL ALARM MANAGEMENT MARKET, BY END USER (2016-2028)

TABLE 028. CLINICAL ALARM MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC CLINICAL ALARM MANAGEMENT MARKET, BY PRODUCT (2016-2028)

TABLE 030. ASIA PACIFIC CLINICAL ALARM MANAGEMENT MARKET, BY OFFERING (2016-2028)

TABLE 031. ASIA PACIFIC CLINICAL ALARM MANAGEMENT MARKET, BY END USER (2016-2028)

TABLE 032. CLINICAL ALARM MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA CLINICAL ALARM MANAGEMENT MARKET, BY PRODUCT (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA CLINICAL ALARM MANAGEMENT MARKET, BY OFFERING (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA CLINICAL ALARM MANAGEMENT MARKET, BY END USER (2016-2028)

TABLE 036. CLINICAL ALARM MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA CLINICAL ALARM MANAGEMENT MARKET, BY PRODUCT (2016-2028)

TABLE 038. SOUTH AMERICA CLINICAL ALARM MANAGEMENT MARKET, BY OFFERING (2016-2028)

TABLE 039. SOUTH AMERICA CLINICAL ALARM MANAGEMENT MARKET, BY END USER (2016-2028)

TABLE 040. CLINICAL ALARM MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 041. ASCOM HOLDINGS: SNAPSHOT

TABLE 042. ASCOM HOLDINGS: BUSINESS PERFORMANCE

TABLE 043. ASCOM HOLDINGS: PRODUCT PORTFOLIO

TABLE 044. ASCOM HOLDINGS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. BAXTER INTERNATIONAL INC.: SNAPSHOT

TABLE 045. BAXTER INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 046. BAXTER INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 047. BAXTER INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. BERNOULLI ENTERPRISE INC.: SNAPSHOT

TABLE 048. BERNOULLI ENTERPRISE INC.: BUSINESS PERFORMANCE

TABLE 049. BERNOULLI ENTERPRISE INC.: PRODUCT PORTFOLIO

TABLE 050. BERNOULLI ENTERPRISE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. CAPSULE TECHNOLOGIE (SUBSIDIARY OF QUALCOMM LIFE INC.): SNAPSHOT

TABLE 051. CAPSULE TECHNOLOGIE (SUBSIDIARY OF QUALCOMM LIFE INC.): BUSINESS PERFORMANCE

TABLE 052. CAPSULE TECHNOLOGIE (SUBSIDIARY OF QUALCOMM LIFE INC.): PRODUCT PORTFOLIO

TABLE 053. CAPSULE TECHNOLOGIE (SUBSIDIARY OF QUALCOMM LIFE INC.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. CONNEXALL: SNAPSHOT

TABLE 054. CONNEXALL: BUSINESS PERFORMANCE

TABLE 055. CONNEXALL: PRODUCT PORTFOLIO

TABLE 056. CONNEXALL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. DRAGERWERK AG: SNAPSHOT

TABLE 057. DRAGERWERK AG: BUSINESS PERFORMANCE

TABLE 058. DRAGERWERK AG: PRODUCT PORTFOLIO

TABLE 059. DRAGERWERK AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. EXTENSION HEALTHCARE: SNAPSHOT

TABLE 060. EXTENSION HEALTHCARE: BUSINESS PERFORMANCE

TABLE 061. EXTENSION HEALTHCARE: PRODUCT PORTFOLIO

TABLE 062. EXTENSION HEALTHCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. GE HEALTHCARE: SNAPSHOT

TABLE 063. GE HEALTHCARE: BUSINESS PERFORMANCE

TABLE 064. GE HEALTHCARE: PRODUCT PORTFOLIO

TABLE 065. GE HEALTHCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. KONINKLIJKE PHILIPS N.V.: SNAPSHOT

TABLE 066. KONINKLIJKE PHILIPS N.V.: BUSINESS PERFORMANCE

TABLE 067. KONINKLIJKE PHILIPS N.V.: PRODUCT PORTFOLIO

TABLE 068. KONINKLIJKE PHILIPS N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. MASIMO: SNAPSHOT

TABLE 069. MASIMO: BUSINESS PERFORMANCE

TABLE 070. MASIMO: PRODUCT PORTFOLIO

TABLE 071. MASIMO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. MEDTRONIC: SNAPSHOT

TABLE 072. MEDTRONIC: BUSINESS PERFORMANCE

TABLE 073. MEDTRONIC: PRODUCT PORTFOLIO

TABLE 074. MEDTRONIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. MINDRAY MEDICAL INTERNATIONAL LIMITED: SNAPSHOT

TABLE 075. MINDRAY MEDICAL INTERNATIONAL LIMITED: BUSINESS PERFORMANCE

TABLE 076. MINDRAY MEDICAL INTERNATIONAL LIMITED: PRODUCT PORTFOLIO

TABLE 077. MINDRAY MEDICAL INTERNATIONAL LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. MOBILE HEARTBEAT (SUBSIDIARY OF HOSPITAL CORPORATION OF AMERICA): SNAPSHOT

TABLE 078. MOBILE HEARTBEAT (SUBSIDIARY OF HOSPITAL CORPORATION OF AMERICA): BUSINESS PERFORMANCE

TABLE 079. MOBILE HEARTBEAT (SUBSIDIARY OF HOSPITAL CORPORATION OF AMERICA): PRODUCT PORTFOLIO

TABLE 080. MOBILE HEARTBEAT (SUBSIDIARY OF HOSPITAL CORPORATION OF AMERICA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. SPOK INC. (SUBSIDIARY OF SPOK HOLDINGS INC.): SNAPSHOT

TABLE 081. SPOK INC. (SUBSIDIARY OF SPOK HOLDINGS INC.): BUSINESS PERFORMANCE

TABLE 082. SPOK INC. (SUBSIDIARY OF SPOK HOLDINGS INC.): PRODUCT PORTFOLIO

TABLE 083. SPOK INC. (SUBSIDIARY OF SPOK HOLDINGS INC.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. VOCERA COMMUNICATIONS: SNAPSHOT

TABLE 084. VOCERA COMMUNICATIONS: BUSINESS PERFORMANCE

TABLE 085. VOCERA COMMUNICATIONS: PRODUCT PORTFOLIO

TABLE 086. VOCERA COMMUNICATIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CLINICAL ALARM MANAGEMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CLINICAL ALARM MANAGEMENT MARKET OVERVIEW BY PRODUCT

FIGURE 012. NURSE CALL SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 013. PHYSIOLOGICAL MONITORS MARKET OVERVIEW (2016-2028)

FIGURE 014. BED ALARMS MARKET OVERVIEW (2016-2028)

FIGURE 015. EMR INTEGRATION SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 016. VENTILATORS MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. CLINICAL ALARM MANAGEMENT MARKET OVERVIEW BY OFFERING

FIGURE 019. SOLUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 020. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 021. CLINICAL ALARM MANAGEMENT MARKET OVERVIEW BY END USER

FIGURE 022. HOSPITALS AND CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 023. LONG-TERM CARE CENTERS AND AMBULATORY CARE CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 024. HOME CARE SETTINGS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA CLINICAL ALARM MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE CLINICAL ALARM MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC CLINICAL ALARM MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA CLINICAL ALARM MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA CLINICAL ALARM MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Clinical Alarm Management Market research report is 2024-2032.

Ascom Holdings, Baxter International Inc., Stryker, GE Healthcare, Medtronic, Koninklijke Philips N.V., and Other major players.

The Clinical Alarm Management Market is segmented into Product, Offering, End-user, and Region. By Product, the market is categorized into Nurse Call Systems, Physiological Monitors, Bed Alarms, EMR Integration Systems, Ventilators, and Others. By Offering, the market is categorized into Solutions, and Services. By End-user, the market is categorized into Hospitals and Clinics, Long-Term Care Centers and Ambulatory Care Centers, and Home Care Settings. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Alarm systems that are integrated into or attached to medical equipment and monitoring systems are triggered by physiological changes in the patient, changes in monitored data, or system issues.

Global Clinical Alarm Management Market Size Was Valued at USD 24.89 Billion In 2023 And Is Projected to Reach USD 29.21 Billion By 2032, Growing at A CAGR of 1.79% From 2024 To 2032.