Global Robo Advisory Market Overview

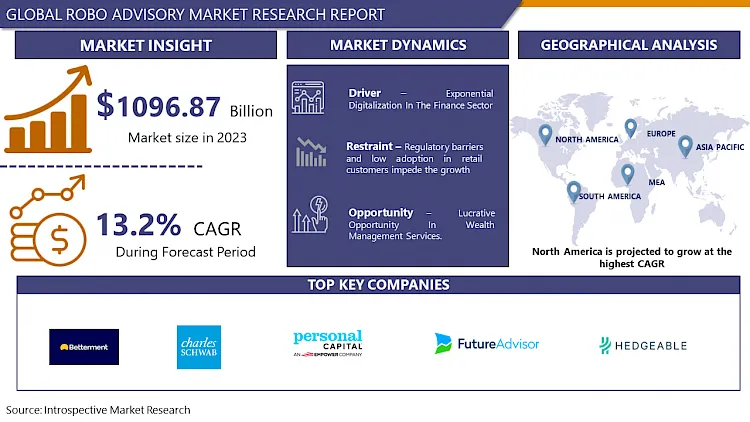

Global Robo Advisory market size was valued at USD 1096.87 Billion in 2023, and is projected to reach USD 3347.90 Billion by 2032, growing at a CAGR of 13.2% from 2024 to 2032.

The global robo-advisory market has been experiencing robust growth, driven by the increasing demand for affordable and accessible financial advisory services. Robo advisors are digital platforms that provide automated, algorithm-driven financial planning services with minimal human intervention. They typically collect information from clients about their financial situation and future goals through an online survey, and then use the data to offer advice and/or invest client assets. This innovation has democratized access to financial advice, making it available to a broader audience, including those with lower investable assets who traditionally might not have had access to financial advisors.

The cost-effectiveness of robo advisors compared to traditional financial advisory services. They typically charge lower fees, which appeals to cost-conscious investors. Furthermore, the ability to access and manage investments online offers a significant convenience factor, aligning with the growing preference for digital financial solutions. The scalability of robo-advisory platforms also allows providers to serve a larger number of clients efficiently, further enhancing their appeal in the market.

Technological advancements, particularly in artificial intelligence and machine learning, have significantly enhanced the capabilities of robo-advisors. These technologies enable more sophisticated portfolio management and personalized advice, improving the overall user experience. Additionally, the integration of robo advisors with other financial technologies (fintech) such as mobile banking apps and digital payment systems has created a more seamless financial ecosystem, contributing to the growing adoption of these services.

Market Dynamics And Factors For Robo Advisory Market

Drivers:

Exponential Digitalization In The Finance Sector.

- Rapid digitization in financial services, a movement in preference from traditional investment services to robot advising, and the need for cost-effective investment advisory are the primary reasons driving the worldwide Robo advisory market's growth. However, the Robo advising market's expansion is hampered by a lack of human competence. During the projection period, however, the untapped potential of emerging economies, as well as an increase in government support and efforts for robot advice, are projected to create a profitable opportunity for the robot advisory market to expand. Robo advising services have several benefits over traditional investing and advice methods, including high-quality and low-cost portfolios, tax-loss harvesting, and safe investments. Furthermore, the judgments made by Robo advising platforms are based on real-time information and current economic situations, removing credit risks and enabling consumer adoption. According to Corporate Vision Magazine, a massive increase of 3.1 percent in Robo advice sign-ups was recorded in the first quarter of 2020. Vanguard, for example, had a 14 % gain in assets and a 35 percent increase in customer numbers, while PensionBee saw a 14% increase in Robo advising.

Restraints:

Regulatory barriers and low adoption in retail customers impede the growth.

- A robot adviser must be programmed with investing goals and equipped to record and quantify the characteristics of each investor's risk profile to serve customers efficiently. The robot-adviser ecosystem must also include new controls and verification to meet the investment adviser's fiduciary obligation. Determining how to evaluate a software platform whose fiduciary duties are still ultimately held by people might be difficult for regulators. Regulatory restriction on highly liquid funds of assets can be a restraining factor for Robo advisers which may reduce the scope of consultation in certain areas. Also, clients moving from human-based to technology-based experiences face challenges such as limited adoption and increasing questions. Furthermore, the robot adviser platform's failure to better capture a client's risk tolerance than a human financial advisor may result in asset allocation mismatch or conflicts of interest based on fees.

Opportunity:

Integration of Smart Contracts in the Robo Advisory Sector

- Robo-advising services primarily comprise financial advisory services for people's finances. Due to the increased acceptance of digitalization across the investment business, along with the deployment of AI in robotics, Robo-advisers are fast replacing the gaps produced by human investment advisors, such as capability, capacity, and cost. Fintechs all across the world rely on a combination of technology and personal advice. They are fast developing Robo-advice services using AI and machine learning, which will provide accurate and transparent advisory services to ordinary investors, preventing them from making poor investing decisions.

Challenge:

Operational And Technological Challenges

- The IT control environment requires acceptable levels of integrity, security, resiliency, and capacity to play a more central role in the disposal of customers' assets. For example, a robot adviser platform's failure to respond to rising business volumes or inefficient capacity planning might result in revenue and client loss. If a company wants to use a vendor Robo-advisor platform, it must be aware of and manage the risks associated with the vendors. To avoid risks concerning consumer segmentation, business continuity planning, and IT governance, firms must build proper controls around their automated adviser environments. It's also crucial to avoid algorithm changes or tampering that might skew investment advice or lead the algorithm to take actions that aren't in the client's best interests. Finally, customer engagement is a major focus including Robo-advising is intended to improve the customer experience, but it can also introduce new issues.

Segmentation Analysis of Robo Advisory Market

- By Business Model, the Pure Robo Advisor segment dominates the Robo Advisory Market. The robot advisor is incorporated into the bank or financial firm’s business model, and rob advisor clients are also bank customers. It is not a separate legal entity nor an autonomous advisor, and it does not operate outside of the service offering. It is also known as a fully integrated robot advisory service that does not require human presence in any process which is the main objective of the Robo advisory services. Hence, most financial and investment firms aim to integrate such services to reduce human resources. For instance, Wealthify – UK's growing Robo advisory firm includes a fully integrated robot advisory service for its clientele. therefore, Pure Robo advisory services are expected to gain momentum during the forecasted period.

- By Service Provider, FinTech Robo Advisors dominates the Robo Advisory Market. Fintech software is already a part of the wealth management, financial planning, investing, and consultancy revolutions. In big data research, AI-powered apps are faster, produce more accurate findings, allow for remote operation, and are less expensive than skilled financial advisers in opulent offices. Robo-advisory software, by definition, is a digital platform that allows customers to access automated and algorithm-driven financial planning services with little or no human participation. The total value of assets handled by Robo-advisors is expected to exceed USD 8 trillion by 2020. Surprisingly, by 2025, the amount of assets under the care of Robo-advisory software is predicted to expand at a rate of about 19 percent each year. Hence, the fintech sector is expected to nurture the Robo advisory market during the forecasted period.

- By Service Type, the Comprehensive Wealth Advisory segment is expected to grow during the forecasted period. Traditional financial planning procedures are nothing like this new type of online asset management service system. Automated portfolio management is becoming more accessible, inexpensive, and convenient thanks to Robo-advisors. They can provide highly personalized services to meet the requirements, tastes, and modes of contact of each customer, and they can be expanded beyond the rich to appeal to mass affluent market segments as well. As a result, wealth management firms should think about how to best integrate Robo-advice services and capitalize on the new opportunities they present. There will always be investors who prefer human engagement over Robo-advice, but a solution that delivers both will succeed in the market.

- By End User, High Net Worth Individuals is anticipated to be dominating segment in the Robo Advisory Market. The segment is high driven by First-generation entrepreneurs who are more likely to possess the majority of wealth, have a higher risk appetite, and prefer to handle their funds. The investments from such individuals are based on perpetual returns over the years, therefore, while seeking such investment opportunities, Robo advisory can be tremendously beneficial as Robo advisors are well equipped with comprehensive knowledge and understating of the business model and best possible scenario for its client. For instance, Singapore’s OCBC Bank launched RoboInvest, a Robo-investment program aimed at youthful and tech-savvy investors, earlier this year. The service has been compared to choosing a playlist on a digital music service, with investors able to choose between 28 stocks and bond portfolios for an initial deposit of SGD 3,500. The next generation still wants to be in charge, but they're also open to seeking expert financial advice. In such a case, personalized advice services with hybrid Robo advisory services are expected to grow during the forecasted period.

Regional Analysis Of Robo Advisory Market

- A well-established financial technology (fintech) industry lays the foundation for this dominance. The presence of numerous prominent players like Betterment and Vanguard in the US fuels the growth of the Robo Advisory Market. These companies leverage cutting-edge technology to deliver automated and personalized investment advice, making it accessible to a wider audience at a lower cost compared to traditional human advisors.

- The high internet and smartphone penetration rates in North America create a fertile ground for Robo Advisory services. With easy access to online platforms, investors can conveniently set up and manage their investments through user-friendly Robo Advisor interfaces. A growing base of retail investors in North America is another contributing factor. As people become more interested in managing their finances, Robo Advisors offer an attractive option, particularly for those who may not have the capital for traditional wealth managers or the time to actively manage their investments themselves.

- Continuous innovation by North American financial institutions further strengthens their grip on the Robo Advisory Market. These institutions are constantly developing and refining their Robo Advisory services to cater to the evolving needs of investors. This ongoing development ensures that North America remains at the forefront of the Robo Advisory landscape.

Top Key Players Covered In Robo Advisory Market

- Betterment LLC

- Charles Schwab Corporation

- FutureAdvisor

- Hedgeable Inc

- Nutmeg

- Personal Capital

- SigFig Wealth Management

- Stash Invest

- Vanguard Personal Advisor

- Wealthfront Inc.

- WiseBanyan

Key Industry Development In The Robo Advisory Market

- In November 2023, WealthKernel, a wealthtech company specializing in digital investment services, announced a partnership with Bambu, a digital wealth technology provider. This collaboration introduced Bambu GO, a ready-to-use robo advisor technology tailored for financial institutions.

- In June 2023, Revolut, a global neobank and fintech company, launched a robo advisor in the U.S. to automate customer investment portfolios and simplify the investment process. The robo advisor allows users to invest in one of five portfolios aligned with their risk tolerance, with portfolios rebalanced monthly.

- In May 2022, HDFC Securities introduced HDFC Money, an investment platform utilizing robo-advisory services. This platform provides access to mutual fund schemes and various financial products without requiring a demat account.

- In February 2022, Betterment LLC announced the acquisition of Makara, an innovative cryptocurrency portfolio manager. This acquisition enabled Betterment LLC’s customers to invest in diversified crypto portfolios in addition to their existing investments

|

Global Robo Advisory Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1096.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.2% |

Market Size in 2032: |

USD 3347.90 Bn. |

|

Segments Covered: |

By Business Model |

|

|

|

By Service Provider |

|

||

|

By Service Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Robo Advisory Market by Business Model (2018-2032)

4.1 Robo Advisory Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pure Robo Advisors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hybrid Robo Advisors

Chapter 5: Robo Advisory Market by Service Provider (2018-2032)

5.1 Robo Advisory Market Snapshot and Growth Engine

5.2 Market Overview

5.3 FinTech Robo Advisors

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Banks

5.5 Traditional Wealth Managers

5.6 Others

Chapter 6: Robo Advisory Market by Service Type (2018-2032)

6.1 Robo Advisory Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Direct Plan-Based/Goal-Based

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Comprehensive Wealth Advisory

Chapter 7: Robo Advisory Market by End User (2018-2032)

7.1 Robo Advisory Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Retail Investor

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 High Net Worth Individuals

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Robo Advisory Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 THE A2 MILK COMPANY (NEW ZEALAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 GUJARAT CO-OPERATIVE MILK MARKETING FEDERATION LTD. (GCMMF) (INDIA)

8.4 GODREJ JERSEY (INDIA)

8.5 PROVILAC DAIRY FARMS PVT. LTD. (INDIA)

8.6 FREEDOM FOODS GROUP (AUSTRALIA)

8.7 VINAMILK (VIETNAM)

8.8 ERDEN CREAMERY PRIVATE LIMITED (INDIA)

8.9 NESTLE S.A. (SWITZERLAND)

8.10 VEDAAZ ORGANICS PVT. LTD. (INDIA)

8.11 RIPLEY FARMS (U.S.)

8.12 TAW RIVER DAIRY (UK)

8.13 URBAN FARMS MILK (INDIA)

8.14 AMUL (INDIA)

8.15 LION DAIRY & DRINKS (AUSTRALIA)

8.16

Chapter 9: Global Robo Advisory Market By Region

9.1 Overview

9.2. North America Robo Advisory Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Business Model

9.2.4.1 Pure Robo Advisors

9.2.4.2 Hybrid Robo Advisors

9.2.5 Historic and Forecasted Market Size by Service Provider

9.2.5.1 FinTech Robo Advisors

9.2.5.2 Banks

9.2.5.3 Traditional Wealth Managers

9.2.5.4 Others

9.2.6 Historic and Forecasted Market Size by Service Type

9.2.6.1 Direct Plan-Based/Goal-Based

9.2.6.2 Comprehensive Wealth Advisory

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Retail Investor

9.2.7.2 High Net Worth Individuals

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Robo Advisory Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Business Model

9.3.4.1 Pure Robo Advisors

9.3.4.2 Hybrid Robo Advisors

9.3.5 Historic and Forecasted Market Size by Service Provider

9.3.5.1 FinTech Robo Advisors

9.3.5.2 Banks

9.3.5.3 Traditional Wealth Managers

9.3.5.4 Others

9.3.6 Historic and Forecasted Market Size by Service Type

9.3.6.1 Direct Plan-Based/Goal-Based

9.3.6.2 Comprehensive Wealth Advisory

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Retail Investor

9.3.7.2 High Net Worth Individuals

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Robo Advisory Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Business Model

9.4.4.1 Pure Robo Advisors

9.4.4.2 Hybrid Robo Advisors

9.4.5 Historic and Forecasted Market Size by Service Provider

9.4.5.1 FinTech Robo Advisors

9.4.5.2 Banks

9.4.5.3 Traditional Wealth Managers

9.4.5.4 Others

9.4.6 Historic and Forecasted Market Size by Service Type

9.4.6.1 Direct Plan-Based/Goal-Based

9.4.6.2 Comprehensive Wealth Advisory

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Retail Investor

9.4.7.2 High Net Worth Individuals

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Robo Advisory Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Business Model

9.5.4.1 Pure Robo Advisors

9.5.4.2 Hybrid Robo Advisors

9.5.5 Historic and Forecasted Market Size by Service Provider

9.5.5.1 FinTech Robo Advisors

9.5.5.2 Banks

9.5.5.3 Traditional Wealth Managers

9.5.5.4 Others

9.5.6 Historic and Forecasted Market Size by Service Type

9.5.6.1 Direct Plan-Based/Goal-Based

9.5.6.2 Comprehensive Wealth Advisory

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Retail Investor

9.5.7.2 High Net Worth Individuals

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Robo Advisory Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Business Model

9.6.4.1 Pure Robo Advisors

9.6.4.2 Hybrid Robo Advisors

9.6.5 Historic and Forecasted Market Size by Service Provider

9.6.5.1 FinTech Robo Advisors

9.6.5.2 Banks

9.6.5.3 Traditional Wealth Managers

9.6.5.4 Others

9.6.6 Historic and Forecasted Market Size by Service Type

9.6.6.1 Direct Plan-Based/Goal-Based

9.6.6.2 Comprehensive Wealth Advisory

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Retail Investor

9.6.7.2 High Net Worth Individuals

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Robo Advisory Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Business Model

9.7.4.1 Pure Robo Advisors

9.7.4.2 Hybrid Robo Advisors

9.7.5 Historic and Forecasted Market Size by Service Provider

9.7.5.1 FinTech Robo Advisors

9.7.5.2 Banks

9.7.5.3 Traditional Wealth Managers

9.7.5.4 Others

9.7.6 Historic and Forecasted Market Size by Service Type

9.7.6.1 Direct Plan-Based/Goal-Based

9.7.6.2 Comprehensive Wealth Advisory

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Retail Investor

9.7.7.2 High Net Worth Individuals

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Robo Advisory Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1096.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.2% |

Market Size in 2032: |

USD 3347.90 Bn. |

|

Segments Covered: |

By Business Model |

|

|

|

By Service Provider |

|

||

|

By Service Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||