Road Safety Market Synopsis

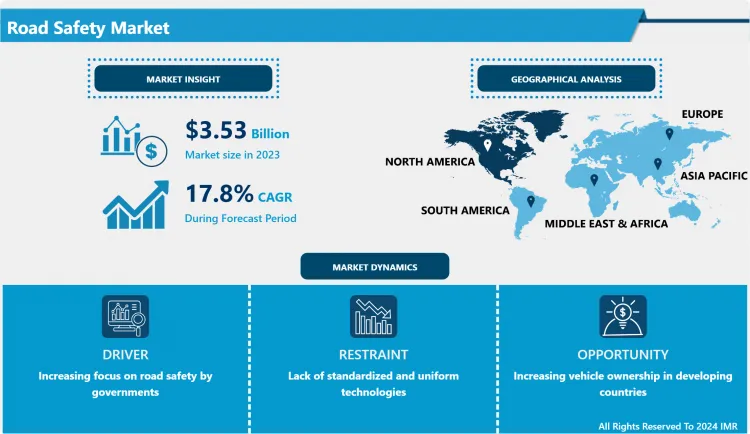

Road Safety Market Size Was Valued at USD 3.53 Billion in 2023, and is Projected to Reach USD 15.44 Billion by 2032, Growing at a CAGR of 17.8% From 2024-2032.

Road Safety can be defined as the process that focuses on preventing deaths and injuries from occurring to the users of roads. This linked guide to the strategies, policies, and techniques for preventing the tendency of accidents, introducing and enhancing favorable infrastructure, enforcing traffic regulation, as well as creating awareness of appropriate traffic behavior.

- Road safety is a basic epidemiological problem which is relevant to every man, woman and child, and people of all social classes. Consequently due to the increase in the number of vehicles on the road, higher speeds and the complicated traffic conditions has resulted into increased accidents and related fatalities. Thus, governments and organizations all over the world are adopting the policies of road safety management. Some of these programs consist in build safer roads, trucks, car, and other models like better design of intersections and pedestrian crossings, improvement and added new safety features generated by technology as ABS and ESC.

- These are some of the measures that have been implemented in roads to enhance safety; it should be noted that apart from development of structures and technology, safety is greatly anchored on implementation of laws and regulations. This is accompanied by stiff measures regarding expressway offenses like rampant speeding, drink and drive incidences and disregarding belt-wearing rules. Efficient law enforcement is coordinated with the public awareness campaigns which inform drivers and pedestrians the necessity to obey traffic regulations and to apply defensive driving techniques. Road safety campaigns are the organized efforts to bring about a change in the beliefs and behavior of road users to reduce risk and promote safe practices; safe driving does not kill.

- Further, it has embraced the promotion of road safety for all the users which include, pedestrians, bicyclists, and motor cyclists who bear the brunt of traffic accidents. Other protective steps as the construction of bike lanes, pedestrian-only areas, and state legislation on the usage of helmets by the motor cyclists are significant for these groups’ safeguarding. As deduced in this paper, there is a need to come up with a team approach that involves governments, NGOs, as well as the private sector in the fight against road carnages. The cross sectional cooperation of engineering, enforcement, education and emergency response measures can help to achieve intended goals of minimizing road traffic crashes by reducing their numbers and possibly the severity.

Road Safety Market Trend Analysis

Digitalization and Advanced Technologies

- Digitalization or advanced technologies are posing a competitive threat to the existing road safety market as it led to the expansion of better and improved safety measures. The advancements technologies in artificial intelligence (AI), Internet of Things (IoT) and big data analytics have made safety systems integrated into roads smart and more interactive. The integration of AI interaction with traffic systems helps look at real-time data for the improvement of flow and the decrease in traffic congestions, on the other hand, IoT devices and sensors support the constant tracking of road conditions, behavior of vehicles, and the surrounding environment. That is why these innovations can help make the likelihood and prevention of an accident more precise and overall, make roads safer.

- On the same note, Self-driving cars and ADAS (Advanced Driver Assistance Systems) are transforming the facet of road safety. Features like adaptive cruise control, lane control, and autonomous emergency brake systems, minimize the driver’s contribution which often is a major factor contributing to the accident rate. The newest AIs and sensors in the automobiles can effectively reduce such risks even more by eradicating possibility of human error all together through self-driving automobiles. These are also among the most active technologies with continuous efforts towards the enhancement of the reliability of these technologies.

- Moreover, through digitalization, data collection and analysis of road traffic accidents is also improving which is vital for formulating strategic measures to reduce the death rate. Information from various sources such as traffic cameras, the social media, and connected vehicles can be analyzed in big data analytics to establish a correlation between accidents and other parameters. It can be noted that this has the positive effect of using data for better decision-making, which in turn leads to the adoption of measures that are oriented towards the prevention of particular safety risks. These insights can be used by governments and organizations that aim at improving the road and traffic safety for they design better roads, formulate better policies and reorient the public. Thus, the further growth of digitalization and advanced technologies contribute to the increasing market demand for Road Safety, which means the overall improvement of road safety for all categories of road users.

Improved Intelligent Transportation Systems (ITS)

- Advanced ITS creates a promising prospect for the road safety market since it implies the application of new technologies to optimize traffic and minimize crashes. ITS consists of technologies such as sensors, cameras, communication devices and data analysis relevant to traffic, weather conditions and any possible dangers on the road. Thus, ITS can forecast and avoid dangers, control traffic intensity, and response quickly to emergencies depending on the data accumulated from different sources. That proactive approach to traffic management goes hand in hand with the increase of road safety, decrease of traffic jams and thus – better utilization of the transport infrastructure.

- Besides, ITS allows for the application of advanced safety measures like smart traffic light signals, anti-collision systems underlining strict traffic signals and signs. Examples include adaptive traffic signals that change the timings of traffic lights depending on the traffic flow and signal violation likely effects of congestion, and/or unsafe driving patterns. Add-on systems installed in automobiles can range from notifying the drivers about potential dangers and taking action to avoid an accident. Several technologies in enforcement include speed cameras and red light cameras which assist in preventing driver’s behavior that endangers the lives of others as well as enforcing order when it comes to traffic laws. All these advancements help much in containing the rates of accidents and enhancing the safety of roads.

- Thus, the constant expansion of ITS still remains a decisive positive aspect for the market of road safety since it contributes to the appearance of new directions for changes and improvements. The ITS technologies’ specializing firms can introduce and offer various products and services pertinent to the growing demand for security in transportation systems. International and municipal authorities being aware of the potential of ITS on people’s lives and holding the potential to minimize economic losses coming from road accidents will most likely inject millions into the system. Also, insurance companies may analyze ITS data to make a more precise probability of the risks related to accidents and, thus, stimulate the usage of such systems by providing bonuses to ensure traffic safety. In this context, ITS constitutes a developmental revolution for improving safe driving, boosting the economy, and implementing sufficient transportation systems.

Road Safety Market Segment Analysis:

Road Safety Market Segmented based on Solution, and Service.

By Solution, Red Light & Speed Enforcement is expected to dominate the market during the forecast period

- The road safety market can be defined as a vital and evolving market that deals with the prevention of traffic accidents and the improvement of road safety. In this context, Red Light & Speed Enforcement segment is seen to carry the greatest market share among the available solutions. This segment includes the application of new technologies in the surveillance of the road systems primarily with an emphasis on violations of ‘’red light’ and cases of speeding cars. As for this segment, its global importance can be explained by the fact that it affects accidents influenced by speeding and red-light running, which play a role in increasing the mortality and injury rates for drivers and passengers.

- Red Light & Speed Enforcement solutions are preferably deployed in the regions that have concentrated traffic flow because the likelihood of crashes is greater in these locations. These systems incorporate several cameras and radar as well as sensors which aim and record the transgressors’ violations to help the police in enforcing fines and penalties. Solutions such as this have indeed been found to work in cutting down accident incidences since they are effective in changing the conductor’s behaviors to avoid violating traffic laws. These systems are also usually linked with real-time analytical systems, allowing the authorities to recognize the zones with increased risk and apply more stringent security measures.

- Several reasons have been cited to justify the growing utilization of the Red Light & Speed Enforcement solutions namely; Urbanization; Increase in the number of vehicles; Global awareness on safe roads. Today, societies and city’s administrations pour a lot of money into these technologies for the purpose of improving the traffic situation and making the streets safer for people. Besides, improvements in high-tech devices like artificial intelligence and machine learning have also stepped up the capabilities of these systems as highly useful tools for contemporary road safety solutions. Therefore, the current segment remains a leader in the promotion of high-quality products for road safety, which can directly affect the sphere of traffic law enforcement and accident avoidance.

By Service, Professional Services segment held the largest share

- The Professional Services have a commanding position in the service segment out of all the safety markets in the road safety context. Services are the general product solutions that firms offer to clients which include; consultancy, education, implementation and support services. Such services are crucial to the execution and running of roads safety interventions because these require adaptation to the specifics of clients’ needs as well as to ensure the technology is satisfactorily functioning.

- Professional Services are very important during the implementation stage of any road safety system. This involves providing sufficient evaluations to grasp the variations in traffic to reduce the dangers of any zone. The specialists explain where to focus on when choosing the right technologies and solutions and whether they meet the necessary standards concerning legislation and recommendations. IT integration services play an important role in bringing new technologies into the organizational environment to facilitate correct work and failure. Moreover, training services guarantee that the local authorities as well as the police officers are well acquainted with the new systems’ functions and usage as well as their maintenance hence the likelihood created for boosting the road safety standards.

- It is also due to the continued help and follow-up, despite the fact that Professional Services do not possess the largest market share. When it comes to Road safety system maintenance and upgrade, it is imperative to conduct this in the regular basis to allow functions. In case of necessity, the professional service providers are in a position to provide periodic inspection, software update, and problem diagnosis. This will enable the systems to run seamlessly obeying any changes that may be made on the traffic or safety constrains. Therefore, in the overall strategy of road safety, the constant use of professional services is useful for achieving long-term goals and thus, they are fundamental in the road safety market. Because the technology is constantly changing, there will always be a requirement for a professional with the expertise to implement and manage such sophisticated solutions, thus confirming the significance of the professional services’ segment in this field.

Road Safety Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America holds a major market share in the road safety market mainly due to the increased regulation and better government policies that focus on decreasing the number of death and accidents on the roads. Other federal agencies, which are involved in road safety management are, for instance, National Highway Traffic Safety Administration, and Federal Highway Administration where various elaborate rules on road safety are standards. These regulations require the incorporation of safety features in automobiles including; electronic stability control, anti-lock braking systems and advanced driver-assistance systems (ADAS). Moreover, the Vision Zero programs implemented by different countries’ municipalities desire to get rid of traffic fatalities and severe injuries, creating ideal conditions for the development of the road safety market.

- Technological development and high usage of modern and intelligent solutions for the road safety industry also have considerable impacts on the leading position of North America. The region is filled with many technological companies and research institutes who are striving towards the technological advancements of the traffic control systems, smart structures and vehicle security systems. Some of these developments include the use of smart technology traffic signals, traffic camera and live traffic control, and traffic accident response devices. The already increased percentage of smart and self-driving cars, which have the best safety systems and features, strengthen the region’s market position even more.

- Also, significant spending on infrastructure construction and upgrades support North America in the road safety market. Both federal and state governments ensure they use large amounts of money for the improvement of safer roads, bridges, and tunnels. Another important feature of these cooperation processes is the support and implementation of large national and international road safety projects. They entail that the infrastructure is well fitted with safety features like adequate signs and road markings, good lights, as well as efficient barriers hence enhancing safety driving and minimizing incidences of accidents.

Active Key Players in the Road Safety Market

- 3M (USA)

- Cubic Corporation (USA)

- Delta Plus Group (France)

- FLIR Systems (USA)

- Huawei Technologies (China)

- IDEMIA (France)

- Iteris, Inc. (USA)

- Jenoptik (Germany)

- Kapsch TrafficCom (Austria)

- Motorola Solutions (USA)

- Redflex Traffic Systems (Australia)

- Ricardo plc (UK)

- Sensys Gatso Group (Sweden)

- Siemens Mobility (Germany)

- Swarco AG (Austria)

- Tattile S.r.l. (Italy)

- Teledyne Technologies (USA)

- Thales Group (France)

- Verra Mobility (USA)

- VITRONIC (Germany), Other Key Players

|

Road Safety Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.53 Bn. |

|

Forecast Period 2023-34 CAGR: |

17.8 % |

Market Size in 2032: |

USD 15.44 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Service |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Road Safety Market by Solution (2018-2032)

4.1 Road Safety Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Red Light & Speed Enforcement

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Incident Detection & Response

4.5 Automatic Number/License Plate Recognition (ANPR/ALPR)

4.6 Others

Chapter 5: Road Safety Market by Service (2018-2032)

5.1 Road Safety Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Professional Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Managed Services

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Road Safety Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 3M (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CUBIC CORPORATION (USA)

6.4 DELTA PLUS GROUP (FRANCE)

6.5 FLIR SYSTEMS (USA)

6.6 HUAWEI TECHNOLOGIES (CHINA)

6.7 IDEMIA (FRANCE)

6.8 ITERIS INC. (USA)

6.9 JENOPTIK (GERMANY)

6.10 KAPSCH TRAFFICCOM (AUSTRIA)

6.11 MOTOROLA SOLUTIONS (USA)

6.12 REDFLEX TRAFFIC SYSTEMS (AUSTRALIA)

6.13 RICARDO PLC (UK)

6.14 SENSYS GATSO GROUP (SWEDEN)

6.15 SIEMENS MOBILITY (GERMANY)

6.16 SWARCO AG (AUSTRIA)

6.17 TATTILE S.R.L. (ITALY)

6.18 TELEDYNE TECHNOLOGIES (USA)

6.19 THALES GROUP (FRANCE)

6.20 VERRA MOBILITY (USA)

6.21 VITRONIC (GERMANY)

6.22 OTHER KEY PLAYERS

6.23

Chapter 7: Global Road Safety Market By Region

7.1 Overview

7.2. North America Road Safety Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Solution

7.2.4.1 Red Light & Speed Enforcement

7.2.4.2 Incident Detection & Response

7.2.4.3 Automatic Number/License Plate Recognition (ANPR/ALPR)

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size by Service

7.2.5.1 Professional Services

7.2.5.2 Managed Services

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Road Safety Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Solution

7.3.4.1 Red Light & Speed Enforcement

7.3.4.2 Incident Detection & Response

7.3.4.3 Automatic Number/License Plate Recognition (ANPR/ALPR)

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size by Service

7.3.5.1 Professional Services

7.3.5.2 Managed Services

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Road Safety Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Solution

7.4.4.1 Red Light & Speed Enforcement

7.4.4.2 Incident Detection & Response

7.4.4.3 Automatic Number/License Plate Recognition (ANPR/ALPR)

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size by Service

7.4.5.1 Professional Services

7.4.5.2 Managed Services

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Road Safety Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Solution

7.5.4.1 Red Light & Speed Enforcement

7.5.4.2 Incident Detection & Response

7.5.4.3 Automatic Number/License Plate Recognition (ANPR/ALPR)

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size by Service

7.5.5.1 Professional Services

7.5.5.2 Managed Services

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Road Safety Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Solution

7.6.4.1 Red Light & Speed Enforcement

7.6.4.2 Incident Detection & Response

7.6.4.3 Automatic Number/License Plate Recognition (ANPR/ALPR)

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size by Service

7.6.5.1 Professional Services

7.6.5.2 Managed Services

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Road Safety Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Solution

7.7.4.1 Red Light & Speed Enforcement

7.7.4.2 Incident Detection & Response

7.7.4.3 Automatic Number/License Plate Recognition (ANPR/ALPR)

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size by Service

7.7.5.1 Professional Services

7.7.5.2 Managed Services

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Road Safety Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.53 Bn. |

|

Forecast Period 2023-34 CAGR: |

17.8 % |

Market Size in 2032: |

USD 15.44 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Service |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Road Safety Market research report is 2024-2032.

3M (USA), Cubic Corporation (USA), Delta Plus Group (France), FLIR Systems (USA), Huawei Technologies (China), IDEMIA (France), Iteris, Inc. (USA), Jenoptik (Germany), Kapsch TrafficCom (Austria), Motorola Solutions (USA), Redflex Traffic Systems (Australia), Ricardo plc (UK), Sensys Gatso Group (Sweden), Siemens Mobility (Germany), Swarco AG (Austria), Tattile S.r.l. (Italy), Teledyne Technologies (USA), Thales Group (France), Verra Mobility (USA), VITRONIC (Germany) and Other Major Players.

The Road Safety Market is segmented into Services, Solutions, and region. By Solution, the market is categorized into Red Light & Speed Enforcement, Incident Detection & Response, Automatic Number/License Plate Recognition (ANPR/ALPR)and Others. By Service, the market is categorized into Professional Services and Managed Services. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Road safety on the other treats, is best understood as the all encompassing processes of precaution taken with an aim of reducing the probability of persons using the road to be killed or suffering from a serious injury. This is a broad topic that covers traffic law and order, implementation of laws, traffic physical structures and traffic information crusade. The objective of road safety is to reduce road accidents and improve the general safety of everyone who uses the road, whether as a driver or a rider, passenger, pedestrian or user of a bicycle.

Road Safety Market Size Was Valued at USD 3.53 Billion in 2023, and is Projected to Reach USD 15.44 Billion by 2032, Growing at a CAGR of 17.8% From 2024-2032.