Retail Automation Market Synopsis

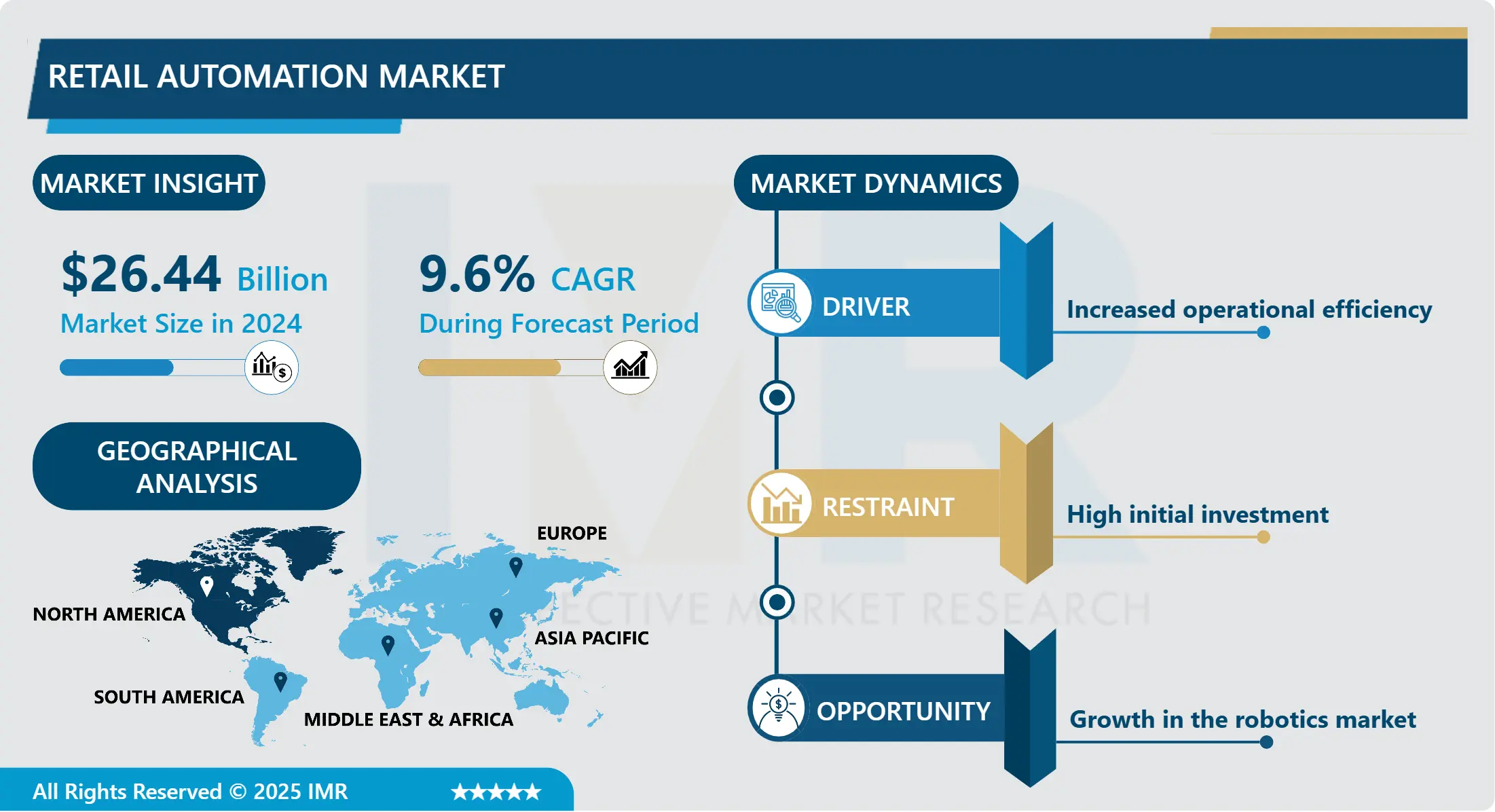

Retail Automation Market Size Was Valued at USD 26.44 Billion in 2024 and is Projected to Reach USD 55.05 Billion by 2032, Growing at a CAGR of 9.6% From 2025-2032.

Retail automation is rapidly disrupting the conventional retail industry by pioneering groundbreaking technologies such as artificial intelligence, machine learning, robotic systems and the IoT. The field that has been benefiting most from automation presently is the field of stock management. Some of the benefits are that re-ordering, stock checks, checks for use rates, and usage forecasts, can all be done automatically; reducing the chances of overstocking or running out of stock dramatically. It also eliminates time wasted in restocking shelves and other basic issues that might hamper the productivity of employees so that they can be able to provide their time to other pressing issues that may be more important.

Another major activity in the application of retail automation is the process of checkouts. Today, self-checkout machines and even mobile apps are offered in the stores which enable the customers to process their own payment and check out without the help of a cashier. In addition to keeping customers moving through the store and the thus check out points, it also strengthens the customer labor relationship for retailers. Furthermore, the consumer buying process can also be decision based on the sophisticated AI analyzes that are installed to tailor the customers’ shopping experience. Using credit data to monitor the buying pattern of customers, the retailers can provide personalized offers to the customers thereby increasing their level of satisfaction.

This can be seen in retail automation where client and customer relations are some of the main areas that have been touched on. It is now possible with the help of modern chatbots and virtual assistants to answer most of the frequently asked questions by customers, such as product features and availability, order status, returns policy, and problems. Such IT solutions can enable organizations to give an instant response, which the use of social media can help enhance the company’s profitability and solve numerous client complaints that do not require interaction with the live personnel. Also, back functions, for instance, financial and accountancy departments, payroll, supply chain management, among others, are being automated using the robotic process automation further enhancing operational effectiveness.

Last but not the least is the IoT devices used in the retail environments, which are providing a higher level of connectivity and data collection. Smart shelves, as an example, can facilitate inventory tracking regarding the commodity and control consumer traffic which is actually helpful in consumers’ habits analyzing. Thus, utilizing this data lay the foundation for employing the optimal store design, properly positioning the products, and designing impressive marketing campaigns. In summary, the increased implementation of automation in the retail context is leading to improved evolution of this industry as well as enabling the retails to work efficiently, improve customer experience as well as seek for the relevant competition in the world which is switching to digital form.

Retail Automation Market Trend Analysis

Retail Automation Market Growth Driver- Rise of e-commerce and omnichannel retail

- E-commerce as well as the omnichannel concept has played a major role in driving the retail automation market mainly on the premise of offering better and improved solutions that create better and efficient ways of executing the retail business. The e-commerce businesses must have sound automation related solutions to address requirements such as a high transactional volume in an organized manner, inventory control and management, customer engagements all in a flawless manner.

- Middleware technologies like inventory robots, robotic checkouts, and AI-powered self-services are imperative in managing the countless logistical complications and resolutions, as well as the client communications that are characteristic of today’s e-business environment. This trend is resulting into huge spending and adoption of various technologies hence enhancing and transforming the retail industry into an intelligent and interconnected retail world.

- When multiple shopping channels such as online stores, physical outlets and mobile apps. are in the operations, called omnichannel retail, the necessity of automation is even more apparent. Consumers expect not only one way of shopping, which essentially means an integration of single, omni, and multichannel strategies. The role of automation cannot be overemphasised in integrating inventory for the various channels, as well as timely and accurate stock update, order management and returns.

- The same are further used for specific and targeted marketing announcements and for the better management of supply chains to satisfy customers and increase organizational performance. Therefore, the implementation of retail automation technologies is growing due to factors evoked by omnichannel retailing.

- Furthermore, the dynamics that currently exist in the retail business environment are demanding more and even stimulating organizations to transform through automation. Automations are being used by retailers to decrease the operational cost, increase the efficiency and accuracy of the operations done. For instance, voice picking robots & robotic pickers and packers; automatic warehousing, etc. , that assist the retailers in handling large numbers of orders while maintaining accuracy and, on the other hand, automated customer services like chat bots enhance engagement. This evolution is therefore steadily making the e-commerce and omnichannel retailing concept accelerate the growth of the retail automation market which is all about technology’s driving force towards a change in the general retail philosophy and shopping experience.

Retail Automation Market Expansion Opportunity- Development of innovative retail formats

- Innovative retail formats have been acknowledged to impact the retail automation market more than anything else. On of the primary drivers is cashier less stores, for instance Amazon Go. They are making effective use of progressive solutions which include computer vision, sensor fusion and deep learning. Shoppers do not have to pay at the conventional cashier’s till point; they can enter the store, select their products, and exit the store. That enhances customers’ satisfaction by providing an opportunity to avoid waiting in queues and cuts most of the employees’ need, thus saving retailers’ money. This therefore mean that the need for retail automation solutions will rise in line with more retailers adopting such models.

- Another relatively new format of retail outlets that works to boost the market is the intelligent vending and automated kiosks. They have touch screens, sensorial panels as well as connectivity that enable a variety of products to be sold in small spaces. Another is convenience and hence they appeal to the expanding market need to go for products that are easy to purchase. Also, these automated retail points may be set up to run their operations at any time of the day and night without necessarily requiring the services of a human being. The incorporation of AI and IoT in these machines helps in providing the feature of recommended products and real-time pricing encouraging the sales and improving the overall customer experience.

- Also, the rising application of omnichannel retailing approaches is creating an demand for automation in stock and distribution at the similar time. Business people are integrating technological solutions to organizt their operations in a very efficient manner that includes; stock control, automated and real time stock status, and accurate order management across all the sales portals. With regards to technologies, robotic process automation (RPA), AMRs or the autonomous mobile robots, and warehouse management systems (WMS) are being used to improve functionality and minimize errors. This not only enhances the means for order management but also helps in increasing the turnover of times required to manufacture and supply the products. Thus, the market of retail automation remains promising as more and more retailers implement contemporary technologies in the sale of goods and services.

Retail Automation Market Segment Analysis:

Retail Automation Market Segmented based on Implementation, Product, End-use, and Region.

By Implementation, in-store is expected to dominate the market during the forecast period

- Concerning the segmentation of the Retail Automation Market by type, the in-store segment leads. Hence, it can be summarized that there are a number of factors that have helped shape this dominance, particularly pegged on the need to improve the consumer experience, operationality, and productivity. Various aspects of automation include self-checkout machines technologies, ESL, and touch screen kiosks, which have immensely changed the faces of retail interaction and management.

- Self-checkout systems are preferred more and more for they allow customers check out faster without the help of a cashier. Customers also find this as less time wastage as they are able to scan and pay for their goods themselves. As for the retailers, the use of self-checkout lowers the expenses connected with employees and allows the staff to perform more urgent assignments. This move toward automation is especially suitable nowadays because consumers are strictly pronounced when it comes to convenience and hassle-free shopping experience.

- Electronic shelf labels, ESLs and digital signage are the major trends in how retailers work with the pricing and promotions strategies. Real time ESLs allow for quick repricing, and cut out the need for frequent manual changes, and re-pricing distortions. This technology also enables retailer firms to respond to changes in the market as well as the competitive pricing strategies. Besides, digital signage supports the configured in-store marketing communication by offering real and appealing content, thereby increasing sales and brand image. Pros of in Store Automation Some of the changes that enhance the operation of stores also help in delivering consumer satisfaction in several ways.

- Last but not the least, the interactive kiosks and the other in-store automation solutions are proved to be very useful in delivering the personalized services and getting the enormous amount of insights on customers. They may include displaying inform¬ation about the products in store, making product suggestions and may even allow for pick-ups of online orders which makes them a merge of physical and online shopping. Mainly all these automated solutions assured that retailers can best comprehend the preference and actions of customers, which can optimally support the merchandisers in offering and promotion strategies. This shows that in store segment holds the major share in the Retail Automation Market denotes that the retail market is constantly changing, integrating more advanced techniques to bring better functioning to both sides – the customers and the shops.

By Product, Point-of-Sale (POS) segment held the largest share

- The Point-of-Sale (POS) segment is currently most dominant in the Retail Automation Market. This dominance is due to the fact that POS systems are extremely important in the retail context and enclose basic or even more advanced functions that are important for overall store management, transaction handling and customer servicing.

- POS systems are the place where all transactions are created and as such necessary in the retailers businesses. Such systems involve all matters to do with sales, returns, exchanges, and the many forms of payment, to give efficient check-outs for the customers. That is why such additional functions as mobile payments, contactless payments, and digital wallet have become the additional driver of POS systems’ popularity. The saving is registration time, queue time, and overall satisfaction level among the customers. Due to the possibility of POS systems to incorporate various approaches with the clients on payments and their capacity to process numerous orders, the automation of POS makes it a critical piece within the commercial market.

- POS systems provide extensive features in relation to inventory management, which are of vital importance when it comes to minimizing loss. Real time tracking and analysis of stock enables the retailers to keep relevant records of the inventory, probably order new stocks and ensure fewer cases of stock out. Besides, this functionality contributes to increasing the efficiency of the organization’s work and allows the customer to find what he or she is looking for in the store. Also, many retail POS systems now integrate with loyalty programs and customer relation management (CRM) applications; they basically help the retailers in collecting as well as managing essential client data to be put to use for personalized marketing and enhancing the strength of customer loyalty . The given functions as well as POS systems’ proficiency in inventory control and improved customer relations, thereby solidifying its leadership in the retail automation sector.

- Flexibility of POS systems allows its integration in different types of stores, starting from individual stores and ending with the multinational companies’ chains. This has made it easy for POS solutions to be hosted in the cloud hence providing retailers with real-time data of their various outlets to aid in decision making and centralizing operations. The first is that the systems are hosted on the internet, which also provides less expensive implementation, application of upgrades, and security, making cloud-based solutions ideal for the transformation of retailers’ businesses. This shows that there is constant development in POS technology and since it is crucial in managing retail transactions and general store operations this is why pos segment is still the leading segment in the retail automation.

Retail Automation Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- In this report we are going to have an analysis about why North America is leading the chart of retail automation market share. Firstly, the technological readiness of the region is extremely high, which is an excellent starting point for the introduction of modern solutions for retail automation. High-speed internet access, the extensive use of smartphones, and a well-developed system of companies that supply technologies for automation contribute to the culture of introducing automatically controlled means in retail companies. This technological readiness enables the firms to implement automation technologies like self-checks, inventory management and conditions, and even virtual assistants for customers and workers making retail lives easier.

- It is essential to explain that North America as a region attractive for investments has a highly digitalized population that prefers time-saving retailing services. The consumer base in the region is technologically sophisticated, using various aspects of technology in their everyday existence and turning to shopping that is easy, fast, and optimized to their requirements. Retailers automatically align their business strategies with the set consumer expectations by embracing automation technologies due to competition. The cultural preparedness as well as the willingness to adopt new technology aids in boosting the take-up of retail automation solutions in North America.

- Availability of large stores and wide and intense competition in North America force enhanced investment in automation technologies. Every year, retail giants like Walmart, Amazon and Target are actively involved in a process of searching and adopting new forms of automation in supply chains in order to achieved higher level of effectiveness, reduce expenses and delight their clients. By having these great amounts of invested capital and paying particular attention to the improvement of technology, such companies led the entire retail industy, including small players, into developing more automated systems. Thanks to the militant competition, which along with the positive attitudes of the government and stimuli towards increase of technologies, North America is at the strengthened leadership in the marketing of retail automation.

Active Key Players in the Retail Automation Market

- Axis Communications AB (Sweden)

- Cognex Corporation (United States)

- Datalogic S.p.A. (Italy)

- Diebold Nixdorf, Incorporated (United States)

- Epson America, Inc. (United States)

- First Data Corporation (United States)

- Fujitsu Limited (Japan)

- Hewlett-Packard Development Company, L.P. (United States)

- Honeywell International Inc. (United States)

- Kuka AG (Germany)

- NCR Corporation (United States)

- Nedap N.V. (Netherlands)

- Posiflex Technology, Inc. (Taiwan)

- Pricer AB (Sweden)

- SES-imagotag (France)

- Toshiba Global Commerce Solutions (United States)

- Vend Limited (New Zealand)

- Wincor Nixdorf International GmbH (Germany)

- Xiamen International Trade Group Corp. Ltd. (China)

- Zebra Technologies Corporation (United States)

- Other Active Players

|

Global Retail Automation Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 26.44 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.6% |

Market Size in 2032: |

USD 55.05 Bn. |

|

Segments Covered: |

By Implementation |

|

|

|

By Product |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Retail Automation Market by Implementation (2018-2032)

4.1 Retail Automation Market Snapshot and Growth Engine

4.2 Market Overview

4.3 In-store

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Warehouse

Chapter 5: Retail Automation Market by Product (2018-2032)

5.1 Retail Automation Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Point-of-Sale (POS)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 RFID & Barcode

5.5 Camera

5.6 Electronic Shelf Label

5.7 Warehouse Robotics

5.8 Others

Chapter 6: Retail Automation Market by End-use (2018-2032)

6.1 Retail Automation Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Single Item Stores

6.5 Supermarkets

6.6 Fuel Stations

6.7 Retail Pharmacies

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Retail Automation Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AXIS COMMUNICATIONS AB (SWEDEN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 COGNEX CORPORATION (UNITED STATES)

7.4 DATALOGIC S.P.A. (ITALY)

7.5 DIEBOLD NIXDORF INCORPORATED (UNITED STATES)

7.6 EPSON AMERICA INC. (UNITED STATES)

7.7 FIRST DATA CORPORATION (UNITED STATES)

7.8 FUJITSU LIMITED (JAPAN)

7.9 HEWLETT-PACKARD DEVELOPMENT COMPANY

7.10 L.P. (UNITED STATES)

7.11 HONEYWELL INTERNATIONAL INC. (UNITED STATES)

7.12 KUKA AG (GERMANY)

7.13 NCR CORPORATION (UNITED STATES)

7.14 NEDAP N.V. (NETHERLANDS)

7.15 POSIFLEX TECHNOLOGY INC. (TAIWAN)

7.16 PRICER AB (SWEDEN)

7.17 SES-IMAGOTAG (FRANCE)

7.18 TOSHIBA GLOBAL COMMERCE SOLUTIONS (UNITED STATES)

7.19 VEND LIMITED (NEW ZEALAND)

7.20 WINCOR NIXDORF INTERNATIONAL GMBH (GERMANY)

7.21 XIAMEN INTERNATIONAL TRADE GROUP CORP. LTD. (CHINA)

7.22 ZEBRA TECHNOLOGIES CORPORATION (UNITED STATES)

7.23 OTHER KEY PLAYERS

7.24

Chapter 8: Global Retail Automation Market By Region

8.1 Overview

8.2. North America Retail Automation Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Implementation

8.2.4.1 In-store

8.2.4.2 Warehouse

8.2.5 Historic and Forecasted Market Size by Product

8.2.5.1 Point-of-Sale (POS)

8.2.5.2 RFID & Barcode

8.2.5.3 Camera

8.2.5.4 Electronic Shelf Label

8.2.5.5 Warehouse Robotics

8.2.5.6 Others

8.2.6 Historic and Forecasted Market Size by End-use

8.2.6.1 Hypermarkets

8.2.6.2 Single Item Stores

8.2.6.3 Supermarkets

8.2.6.4 Fuel Stations

8.2.6.5 Retail Pharmacies

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Retail Automation Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Implementation

8.3.4.1 In-store

8.3.4.2 Warehouse

8.3.5 Historic and Forecasted Market Size by Product

8.3.5.1 Point-of-Sale (POS)

8.3.5.2 RFID & Barcode

8.3.5.3 Camera

8.3.5.4 Electronic Shelf Label

8.3.5.5 Warehouse Robotics

8.3.5.6 Others

8.3.6 Historic and Forecasted Market Size by End-use

8.3.6.1 Hypermarkets

8.3.6.2 Single Item Stores

8.3.6.3 Supermarkets

8.3.6.4 Fuel Stations

8.3.6.5 Retail Pharmacies

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Retail Automation Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Implementation

8.4.4.1 In-store

8.4.4.2 Warehouse

8.4.5 Historic and Forecasted Market Size by Product

8.4.5.1 Point-of-Sale (POS)

8.4.5.2 RFID & Barcode

8.4.5.3 Camera

8.4.5.4 Electronic Shelf Label

8.4.5.5 Warehouse Robotics

8.4.5.6 Others

8.4.6 Historic and Forecasted Market Size by End-use

8.4.6.1 Hypermarkets

8.4.6.2 Single Item Stores

8.4.6.3 Supermarkets

8.4.6.4 Fuel Stations

8.4.6.5 Retail Pharmacies

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Retail Automation Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Implementation

8.5.4.1 In-store

8.5.4.2 Warehouse

8.5.5 Historic and Forecasted Market Size by Product

8.5.5.1 Point-of-Sale (POS)

8.5.5.2 RFID & Barcode

8.5.5.3 Camera

8.5.5.4 Electronic Shelf Label

8.5.5.5 Warehouse Robotics

8.5.5.6 Others

8.5.6 Historic and Forecasted Market Size by End-use

8.5.6.1 Hypermarkets

8.5.6.2 Single Item Stores

8.5.6.3 Supermarkets

8.5.6.4 Fuel Stations

8.5.6.5 Retail Pharmacies

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Retail Automation Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Implementation

8.6.4.1 In-store

8.6.4.2 Warehouse

8.6.5 Historic and Forecasted Market Size by Product

8.6.5.1 Point-of-Sale (POS)

8.6.5.2 RFID & Barcode

8.6.5.3 Camera

8.6.5.4 Electronic Shelf Label

8.6.5.5 Warehouse Robotics

8.6.5.6 Others

8.6.6 Historic and Forecasted Market Size by End-use

8.6.6.1 Hypermarkets

8.6.6.2 Single Item Stores

8.6.6.3 Supermarkets

8.6.6.4 Fuel Stations

8.6.6.5 Retail Pharmacies

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Retail Automation Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Implementation

8.7.4.1 In-store

8.7.4.2 Warehouse

8.7.5 Historic and Forecasted Market Size by Product

8.7.5.1 Point-of-Sale (POS)

8.7.5.2 RFID & Barcode

8.7.5.3 Camera

8.7.5.4 Electronic Shelf Label

8.7.5.5 Warehouse Robotics

8.7.5.6 Others

8.7.6 Historic and Forecasted Market Size by End-use

8.7.6.1 Hypermarkets

8.7.6.2 Single Item Stores

8.7.6.3 Supermarkets

8.7.6.4 Fuel Stations

8.7.6.5 Retail Pharmacies

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Retail Automation Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 26.44 Bn. |

|

Forecast Period 2025-32 CAGR: |

9.6% |

Market Size in 2032: |

USD 55.05 Bn. |

|

Segments Covered: |

By Implementation |

|

|

|

By Product |

|

||

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||