Reishi Extract Market Synopsis

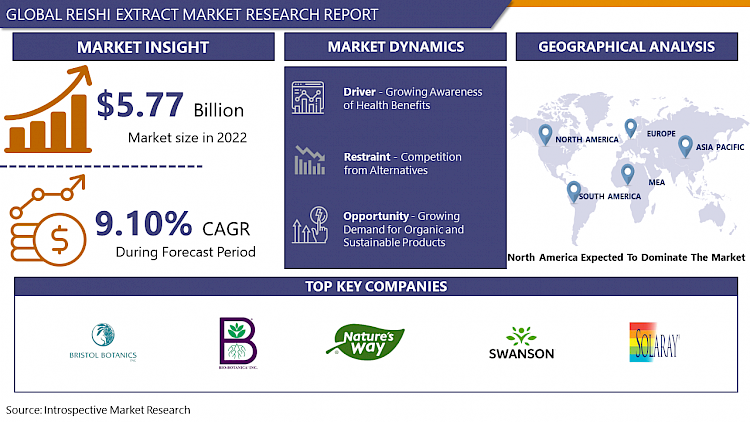

Reishi Extract Market Size Was Valued at USD 6.3 Billion in 2023 and is Projected to Reach USD 13.8 Billion by 2032, Growing at a CAGR of 9.10 % From 2024-2032.

Reishi extract is a concentrated form of bioactive compounds derived from the Reishi mushroom, renowned for its medicinal properties in traditional medicine. It contains polysaccharides, triterpenes, and other compounds known for their potential health benefits, including immune support, anti-inflammatory effects, and antioxidant properties. It is commonly consumed as a supplement or herbal remedy to enhance vitality and resilience.

- The Reishi Extract demand is growing due to increasing awareness of health benefits and rising demand for natural remedies. The market expansion is boosting towards natural and organic products. They play as the safer alternative to synthetic supplements. The rising prevalence of chronic diseases and lifestyle disorders drives interest in functional foods and supplements, where Reishi Extract finds application due to its purported health-promoting properties.

- Furthermore, scientific research validating the traditional uses of Reishi mushrooms and uncovering new potential health benefits.

- Despite the promising outlook, challenges such as limited availability of high-quality Reishi mushrooms, variations in extract potency, and regulatory hurdles may hinder market growth. However, ongoing research and technological advancements in extraction techniques offer opportunities for overcoming these challenges and further expanding the Reishi Extract market in the coming years.

Reishi Extract Market Trend Analysis

Growing Awareness of Health Benefits

- There is growing demand for the Reishi due to the increasing awareness of its potential health benefits. The awareness rising due to the long history of use in traditional Chinese medicine, media attention, anecdotal evidence, and ongoing scientific research. Traditional use of Reishi mushrooms in medicine has sparked interest in the product, while increased media coverage and publications highlighting its health benefits have piqued consumer interest.

- Reishi extract can create a positive perception, within communities. Scientific research is highlighting and fueling throughout the globe. The market expansion is growing as demand for Reishi extract products increase as health concerns in the consumer increase. Manufacturers are encouraged to develop new product formulations to cater to diverse consumer preferences and accessibility needs. Furthermore, premiumization of higher-quality, organic, and ethically sourced Reishi extract offerings is gaining purchase among consumers willing to pay a premium for natural health products.

Growing Demand for Organic and Sustainable Product

- The demand for organic and sustainable products is a significantly increasing as consumers become more environmentally conscious. There is a shift towards products produced sustainably and ethically. Reishi extract naturally come from Reishi mushrooms, growing as the sifting trend in regenerative agriculture, organic farming methods, and less environmental effect.

- Organic farming methods avoid synthetic pesticides, fertilizers, and genetically modified organisms, contributing to a cleaner and more sustainable agricultural system. Reishi mushrooms are grown on natural substrates like wood logs or sawdust, which have minimal environmental impact compared to conventional agricultural practices. Some producers prioritize regenerative agriculture practices, restoring soil health, enhancing biodiversity, and sequestering carbon.

- Companies that emphasize organic and sustainable sourcing can build trust and loyalty among consumers prioritize transparency and ethical business practices. By capitalizing on the growing demand for organic and sustainable products, key players in the Reishi Extract market can differentiate their offerings, attract environmentally conscious consumers, and contribute to a more sustainable future.

Reishi Extract Market Segment Analysis:

Reishi Extract Market Segmented based on Product Type, Form, End-User, and Distribution Channel.

By Product Type, Organic segment is expected to dominate the market during the forecast period

- Organic segment is derived from mushrooms cultivated without the use of synthetic pesticides, fertilizers, or genetically modified organisms. Consumers recognize organic products as safer, healthier, and more environmentally friendly, driving their preference for organic Reishi Extract over conventional alternatives.

- The organic segment growth is increased due to the consumer preference for natural, sustainably sourced products. The demand for organic segment is rising due to transparency and ethical sourcing practices. Consumers are considering for reassurance about the origins and production methods of the products they purchase. Manufacturers and suppliers are focusing on organic Reishi Extract are well-positioned to capitalize on this growing market trend in Organic production.

By Form, powder segment held the largest share of xx% in 2022

- The powder segment offers versatility and convenience, making it suitable for various applications across industries such as pharmaceuticals, nutraceuticals, food and beverages, and cosmetics.

- Reishi Extract in powder form is used in different products, including supplements, functional foods, beverages, and skincare formulations. Powdered Reishi Extract can be effortlessly blended into recipes, formulations, and manufacturing processes, allowing for precise dosage control and consistent product quality.

- Furthermore, powdered Reishi Extract offers enhanced shelf stability compared to other forms, such as liquid extracts or whole mushrooms, making it easier to store, transport, and distribute without its efficacy.

- Consumers are increasingly seeking powdered supplements and functional ingredients due to their convenience, portability, and ease of consumption is growing the dominance in the powder segment of the Reishi Extract market.

Reishi Extract Market Regional Insights:

North America is expected to Dominate the Market Over the Forecast period

- North America is leading the global market due to the rising health consciousness and a growing preference for organic, plant-based products. The region's advanced research and development infrastructure contributes to its dominance in the market.

- North America's robust scientific ecosystem is characterized by cutting-edge research institutions, biotechnology firms, and pharmaceutical companies, raises continuous innovation in Reishi extract formulation, extraction techniques, and product development. Collaborations between academia and industry accelerate the step of detection, driving the emergence of applications and enhanced formulations resonate with consumers.

- Stringent quality standards, testing protocols, and transparent labeling requirements trust in Reishi extract products, development consumer confidence and market growth. Strategic partnerships and market expansion are also being followed by North American companies.

- Partnerships with retailers, e-commerce platforms, and health-focused channels increase product visibility and accessibility, dynamic sales and market penetration. Targeted marketing initiatives leveraging social media, influencer endorsements, and educational campaigns with health-conscious consumers, strengthening North America's position as a key driver of Reishi extract market growth.

Reishi Extract Market Top Key Players:

- Nature's Way (USA)

- Solaray (USA)

- Fungi Perfecti (USA)

- Terrasoul Superfoods (USA)

- Swanson Vitamins (USA)

- Aloha Medicinals (USA)

- Mushroom Science (USA)

- Bio-Botanica Inc. (USA)

- Amax NutraSource Inc. (Canada)

- Dragon Herbs (USA)

- Cordycepsreishi Extracts (USA)

- Nammex (Canada)

- Bristol Botanicals Limited (United Kingdom)

- Hokkaido-reishi (Japan)

- Qingdao Dacon Trading Co. Ltd. (China)

- Xian Yuensun Biological Technology Co. Ltd. (China), and Other Major Players.

Key Industry Developments in the Reishi Extract Market:

- In November 2023, Bio-Botanica Inc. unveiled the findings of clinical trials demonstrating the efficacy of its proprietary botanical extract, Puresterol® (Pueraria mirifica), in reducing wrinkles. The trials, conducted by a third-party contract research organization (CRO), involved 21 subjects using Puresterol®-based serums twice daily for 28 days. Results showed significant reductions in crow's feet and forehead wrinkles, affirming the product's rejuvenating properties.

- In May 2023, SGS acquired a majority stake in Nutrasource Pharmaceutical and Nutraceutical Services Inc. and its subsidiaries (“Nutrasource”). Founded in 2001 and previously privately owned, Nutrasource was a global Contract Research Organization (CRO) in the nutraceutical and pharmaceutical industries, focusing on helping clients achieve compliance and gain market entry for health and wellness products.

|

Global Reishi Extract Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.10 % |

Market Size in 2032: |

USD 13.8 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Form |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- REISHI EXTRACT MARKET BY PRODUCT TYPE (2017-2032)

- REISHI EXTRACT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONVENTIONAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032)

- Historic And Forecasted Market Size in Volume (2017-2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ORGANIC

- REISHI EXTRACT MARKET BY FORM (2017-2032)

- REISHI EXTRACT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LIQUID

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032)

- Historic And Forecasted Market Size in Volume (2017-2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POWDER

- REISHI EXTRACT MARKET BY END-USER (2017-2032)

- REISHI EXTRACT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIETARY SUPPLEMENTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032)

- Historic And Forecasted Market Size in Volume (2017-2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOOD & BEVERAGES

- PHARMACEUTICAL

- COSMETICS & PERSONAL CARE

- REISHI EXTRACT MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- REISHI EXTRACT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ONLINE RETAIL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032)

- Historic And Forecasted Market Size in Volume (2017-2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OFFLINE RETAIL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Reishi Extract Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- NATURE'S WAY (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SOLARAY (USA)

- FUNGI PERFECTI (USA)

- TERRASOUL SUPERFOODS (USA)

- SWANSON VITAMINS (USA)

- ALOHA MEDICINALS (USA)

- MUSHROOM SCIENCE (USA)

- BIO-BOTANICA INC. (USA)

- AMAX NUTRASOURCE INC. (CANADA)

- DRAGON HERBS (USA)

- CORDYCEPSREISHI EXTRACTS (USA)

- NAMMEX (CANADA)

- BRISTOL BOTANICALS LIMITED (UNITED KINGDOM)

- HOKKAIDO-REISHI (JAPAN)

- QINGDAO DACON TRADING CO. LTD. (CHINA)

- XIAN YUENSUN BIOLOGICAL TECHNOLOGY CO. LTD. (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL REISHI EXTRACT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Reishi Extract Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.10 % |

Market Size in 2032: |

USD 13.8 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Form |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. REISHI EXTRACT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. REISHI EXTRACT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. REISHI EXTRACT MARKET COMPETITIVE RIVALRY

TABLE 005. REISHI EXTRACT MARKET THREAT OF NEW ENTRANTS

TABLE 006. REISHI EXTRACT MARKET THREAT OF SUBSTITUTES

TABLE 007. REISHI EXTRACT MARKET BY TYPE

TABLE 008. PHARMACEUTICAL GRADE MARKET OVERVIEW (2016-2028)

TABLE 009. FOOD GRADE MARKET OVERVIEW (2016-2028)

TABLE 010. INDUSTRIAL GRADE MARKET OVERVIEW (2016-2028)

TABLE 011. REISHI EXTRACT MARKET BY APPLICATION

TABLE 012. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

TABLE 013. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 014. PERSONAL CARE MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA REISHI EXTRACT MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA REISHI EXTRACT MARKET, BY APPLICATION (2016-2028)

TABLE 018. N REISHI EXTRACT MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE REISHI EXTRACT MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE REISHI EXTRACT MARKET, BY APPLICATION (2016-2028)

TABLE 021. REISHI EXTRACT MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC REISHI EXTRACT MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC REISHI EXTRACT MARKET, BY APPLICATION (2016-2028)

TABLE 024. REISHI EXTRACT MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA REISHI EXTRACT MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA REISHI EXTRACT MARKET, BY APPLICATION (2016-2028)

TABLE 027. REISHI EXTRACT MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA REISHI EXTRACT MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA REISHI EXTRACT MARKET, BY APPLICATION (2016-2028)

TABLE 030. REISHI EXTRACT MARKET, BY COUNTRY (2016-2028)

TABLE 031. NATURE'S WAY: SNAPSHOT

TABLE 032. NATURE'S WAY: BUSINESS PERFORMANCE

TABLE 033. NATURE'S WAY: PRODUCT PORTFOLIO

TABLE 034. NATURE'S WAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. SOLARAY: SNAPSHOT

TABLE 035. SOLARAY: BUSINESS PERFORMANCE

TABLE 036. SOLARAY: PRODUCT PORTFOLIO

TABLE 037. SOLARAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. FUNGI PERFECTI: SNAPSHOT

TABLE 038. FUNGI PERFECTI: BUSINESS PERFORMANCE

TABLE 039. FUNGI PERFECTI: PRODUCT PORTFOLIO

TABLE 040. FUNGI PERFECTI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. TERRASOUL SUPERFOODS: SNAPSHOT

TABLE 041. TERRASOUL SUPERFOODS: BUSINESS PERFORMANCE

TABLE 042. TERRASOUL SUPERFOODS: PRODUCT PORTFOLIO

TABLE 043. TERRASOUL SUPERFOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. SWANSON VITAMINS: SNAPSHOT

TABLE 044. SWANSON VITAMINS: BUSINESS PERFORMANCE

TABLE 045. SWANSON VITAMINS: PRODUCT PORTFOLIO

TABLE 046. SWANSON VITAMINS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. ALOHA MEDICINALS: SNAPSHOT

TABLE 047. ALOHA MEDICINALS: BUSINESS PERFORMANCE

TABLE 048. ALOHA MEDICINALS: PRODUCT PORTFOLIO

TABLE 049. ALOHA MEDICINALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. MUSHROOM SCIENCE: SNAPSHOT

TABLE 050. MUSHROOM SCIENCE: BUSINESS PERFORMANCE

TABLE 051. MUSHROOM SCIENCE: PRODUCT PORTFOLIO

TABLE 052. MUSHROOM SCIENCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. AMAX NUTRASOURCE INC.: SNAPSHOT

TABLE 053. AMAX NUTRASOURCE INC.: BUSINESS PERFORMANCE

TABLE 054. AMAX NUTRASOURCE INC.: PRODUCT PORTFOLIO

TABLE 055. AMAX NUTRASOURCE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. BIO-BOTANICA INC.: SNAPSHOT

TABLE 056. BIO-BOTANICA INC.: BUSINESS PERFORMANCE

TABLE 057. BIO-BOTANICA INC.: PRODUCT PORTFOLIO

TABLE 058. BIO-BOTANICA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. BRISTOL BOTANICALS LIMITED: SNAPSHOT

TABLE 059. BRISTOL BOTANICALS LIMITED: BUSINESS PERFORMANCE

TABLE 060. BRISTOL BOTANICALS LIMITED: PRODUCT PORTFOLIO

TABLE 061. BRISTOL BOTANICALS LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. DRAGON HERBS: SNAPSHOT

TABLE 062. DRAGON HERBS: BUSINESS PERFORMANCE

TABLE 063. DRAGON HERBS: PRODUCT PORTFOLIO

TABLE 064. DRAGON HERBS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. HOKKAIDO-REISHI: SNAPSHOT

TABLE 065. HOKKAIDO-REISHI: BUSINESS PERFORMANCE

TABLE 066. HOKKAIDO-REISHI: PRODUCT PORTFOLIO

TABLE 067. HOKKAIDO-REISHI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CORDYCEPSREISHI EXTRACTS: SNAPSHOT

TABLE 068. CORDYCEPSREISHI EXTRACTS: BUSINESS PERFORMANCE

TABLE 069. CORDYCEPSREISHI EXTRACTS: PRODUCT PORTFOLIO

TABLE 070. CORDYCEPSREISHI EXTRACTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. NAMMEX: SNAPSHOT

TABLE 071. NAMMEX: BUSINESS PERFORMANCE

TABLE 072. NAMMEX: PRODUCT PORTFOLIO

TABLE 073. NAMMEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. QINGDAO DACON TRADING CO. LTD.: SNAPSHOT

TABLE 074. QINGDAO DACON TRADING CO. LTD.: BUSINESS PERFORMANCE

TABLE 075. QINGDAO DACON TRADING CO. LTD.: PRODUCT PORTFOLIO

TABLE 076. QINGDAO DACON TRADING CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. XIAN YUENSUN BIOLOGICAL TECHNOLOGY CO. LTD.: SNAPSHOT

TABLE 077. XIAN YUENSUN BIOLOGICAL TECHNOLOGY CO. LTD.: BUSINESS PERFORMANCE

TABLE 078. XIAN YUENSUN BIOLOGICAL TECHNOLOGY CO. LTD.: PRODUCT PORTFOLIO

TABLE 079. XIAN YUENSUN BIOLOGICAL TECHNOLOGY CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. REISHI EXTRACT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. REISHI EXTRACT MARKET OVERVIEW BY TYPE

FIGURE 012. PHARMACEUTICAL GRADE MARKET OVERVIEW (2016-2028)

FIGURE 013. FOOD GRADE MARKET OVERVIEW (2016-2028)

FIGURE 014. INDUSTRIAL GRADE MARKET OVERVIEW (2016-2028)

FIGURE 015. REISHI EXTRACT MARKET OVERVIEW BY APPLICATION

FIGURE 016. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 017. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 018. PERSONAL CARE MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA REISHI EXTRACT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE REISHI EXTRACT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC REISHI EXTRACT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA REISHI EXTRACT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA REISHI EXTRACT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Reishi Extract Market research report is 2024-2032.

Nature's Way (USA), Solaray (USA), Fungi Perfecti (USA), Terrasoul Superfoods (USA), Swanson Vitamins (USA), Aloha Medicinals (USA), Mushroom Science (USA), Bio-Botanica Inc. (USA), Amax NutraSource Inc. (Canada), Dragon Herbs (USA), Cordycepsreishi Extracts (USA), Nammex (Canada), Bristol Botanicals Limited (United Kingdom), Hokkaido-reishi (Japan), Qingdao Dacon Trading Co. Ltd. (China), Xian Yuensun Biological Technology Co. Ltd. (China), and Other Major Players.

The Reishi Extract Market is segmented into Product Type, Form, End-User, Distribution Channel, and region. By Product Type, the market is categorized into Conventional, and Organic. By Form, the market is categorized into Liquid, and Powder. By End-User, the market is categorized into Dietary Supplements, Food & Beverages, Pharmaceutical, and Cosmetics & Personal Care. By Distribution Channel, the market is categorized into Online Retail, and Offline Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Reishi extract is a concentrated form of bioactive compounds derived from the Reishi mushroom, renowned for its medicinal properties in traditional medicine. It contains polysaccharides, triterpenes, and other compounds known for their potential health benefits, including immune support, anti-inflammatory effects, and antioxidant properties. It is commonly consumed as a supplement or herbal remedy to enhance vitality and resilience.

Reishi Extract Market Size Was Valued at USD 6.3 Billion in 2023 and is Projected to Reach USD 13.8 Billion by 2032, Growing at a CAGR of 9.10 % From 2024-2032.