Ready-Mix Concrete Market Synopsis

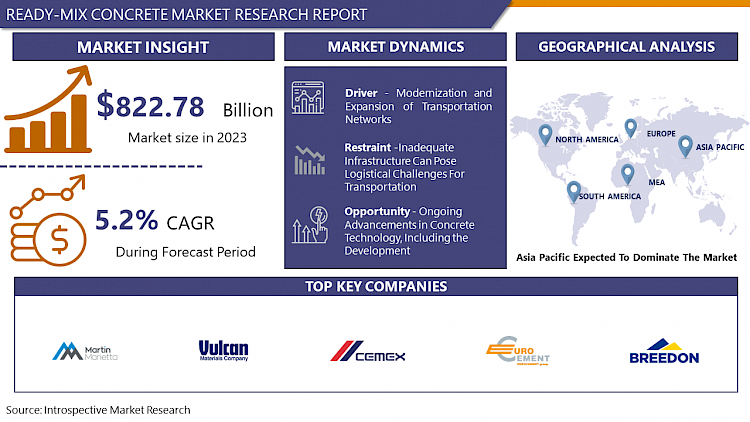

Ready-Mix Concrete Market Size Was Valued at USD 822.78 Billion in 2023 and is Projected to Reach USD 1298.45 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.

Ready-mix concrete is a type of concrete that is manufactured in a centralized plant according to a set recipe and then delivered to construction sites in a ready-to-use form. It is composed of cement, aggregates (such as sand and gravel), water, and additives, all mixed in precise proportions to meet specific project requirements. Ready-mix concrete offers several advantages, including consistency in quality, reduced labor and material waste, faster construction times, and enhanced durability and strength.

- Residential construction uses foundations, floors, and walls for sturdy foundations, while commercial construction uses office buildings, retail centers, hotels, and restaurants for structural elements. Infrastructure projects include roads, highways, bridges, tunnels, airports, warehouses, distribution centers, manufacturing plants, and power plants. Decorative concrete is used for creating decorative elements in architectural and landscaping projects, while precast concrete is used for manufacturing components off-site and assembled on-site.

- Repair and rehabilitation are used for repairing and rehabilitating existing concrete structures to extend their service life and enhance performance. Industrial construction includes warehouses, distribution centers, manufacturing plants, and power plants. Specialized applications include decorative concrete for architectural and landscaping projects, precast concrete for faster construction, and repair and rehabilitation for existing structures.

- Ready-mix concrete is a pre-mixed, ready-to-use concrete that eliminates the need for on-site mixing and batching, saving time, labor, and resources for construction projects. Its consistency and quality are ensured through precise mix designs, resulting in superior strength, durability, and performance. It also allows faster construction progress, reducing project timelines and minimizing downtime. Although initially higher than traditional on-site mixed concrete, the benefits of labor savings, reduced material waste, and improved construction efficiency often outweigh the additional expenses.

- Suppliers adhere to strict quality control measures to ensure consistency and reliability, reducing the risk of defects and structural failures. Ready-mix concrete can be customized to meet specific project requirements, making it suitable for residential foundations and large-scale infrastructure projects. It also involves rigorous safety protocols to protect workers and minimize risks of accidents or injuries. Some suppliers offer eco-friendly options with reduced carbon footprints and environmental impact.

Ready-Mix Concrete Market Trend Analysis

Modernization and Expansion of Transportation Networks

- The automotive industry is increasingly utilizing ready-mix concrete due to its versatility, durability, and cost-effectiveness. Concrete is used in manufacturing plants, assembly lines, warehouses, and logistics centers due to its durability and ability to support heavy machinery and equipment. Concrete floors and pavements are also widely used in automotive manufacturing facilities, providing a smooth and durable surface suitable for heavy traffic, vehicle movement, and equipment operation.

- The use of ready-mix concrete is favored in the automotive industry due to its environmental sustainability, as it emits fewer greenhouse gases and pollutants compared to alternative materials like steel or asphalt. Its rapid placement and curing capabilities expedite construction schedules, reducing downtime and maximizing productivity in automotive plants. Concrete's long service life and low maintenance requirements contribute to cost savings over the lifecycle of automotive facilities.

- Innovations in concrete technology, such as self-consolidating concrete (SCC), fiber-reinforced concrete, and high-performance concrete mixes, enhance the suitability of concrete for automotive applications, improving its strength, durability, and workability, enabling automotive manufacturers to achieve their design and performance requirements. Concrete is also used to construct structural components such as columns, beams, walls, and foundations, providing support for buildings, production lines, and storage areas.

Restraint

Inadequate Infrastructure Can Pose Logistical Challenges For Transportation

- The ready-mix concrete industry faces logistical challenges due to inadequate infrastructure. Poor road conditions, traffic congestion, limited access routes, weight restrictions, and seasonal challenges can all contribute to the challenges faced in transporting ready-mix concrete. In areas with inadequate infrastructure, roads may be poorly maintained or lack sufficient capacity to accommodate heavy trucks carrying ready-mix concrete. These conditions can slow down transportation, increase the risk of accidents, and disrupt delivery schedules.

- Traffic congestion in urban areas or high-population dense areas can cause delays, leading to project delays and increased costs for contractors and construction companies. Limited access routes can result in longer transportation times, higher fuel consumption, and increased wear and tear on vehicles, impacting the cost-effectiveness of concrete delivery.

- Weight restrictions on roads and bridges can limit the amount of concrete that can be transported in a single trip, increasing transportation costs and logistical complexity. Seasonal challenges, such as heavy rainfall, snow, or freezing temperatures, can further complicate the transportation of ready-mix concrete. Addressing inadequate infrastructure requires significant investment in road and transportation infrastructure upgrades and maintenance.

Opportunity

Ongoing Advancements in Concrete Technology, Including the Development

- Concrete technology advancements have revolutionized the construction industry by enhancing the strength, durability, and resistance to environmental factors. These advancements have led to the development of innovative mix designs, such as self-consolidating concrete (SCC), fiber-reinforced concrete, and high-performance concrete. These technologies also contribute to sustainability by using recycled aggregates, supplementary cementitious materials (SCMs), and advanced admixtures.

- The sustainable practices help meet the growing demand for eco-friendly construction materials and support green building initiatives. The durability and longevity of concrete structures are also enhanced by these technologies. By offering durable products, suppliers can address maintenance costs, lifecycle performance, and asset longevity concerns. Smart concrete solutions, such as self-healing concrete, sensor-integrated concrete, and 3D-printed concrete, offer enhanced functionality and performance optimization.

- The technologies can be incorporated into ready-mix concrete products to provide added value to customers seeking advanced construction solutions. Efficiency and productivity are also being improved through innovations in batching and mixing equipment, logistics optimization, automation, robotics, and accelerated curing techniques. These advancements can streamline operations, reduce costs, and enhance overall project efficiency.

Challenge

Quality Control Includes Variations in Raw Materials, Mixing Procedures

- The ready-mix concrete industry faces significant challenges in maintaining quality control, which includes managing variations in raw materials and mixing procedures. These variations can lead to inconsistencies in concrete performance, affecting properties such as strength, durability, workability, and setting time. To address these variations, producers must conduct regular testing and quality checks, which can be time-consuming and costly, especially when dealing with multiple suppliers and sources.

- Selecting suitable raw materials that meet quality specifications and performance requirements is essential but can be challenging in regions with limited availability or fluctuating market conditions. The mixing process plays a crucial role in determining the quality and consistency of ready-mix concrete, with variations in mixing procedures impacting concrete properties and performance. Maintaining consistency in mixing procedures across different batches and production facilities can be challenging, especially when using different equipment or operators.

- Quality control measures, such as establishing strict quality assurance protocols, conducting regular inspections and testing, and implementing process controls, are implemented to minimize variations. Meeting customer expectations and project specifications are critical in the ready-mix concrete industry, and managing variations in raw materials and mixing procedures can be challenging, especially in projects with stringent quality standards or complex design specifications.

Ready-Mix Concrete Market Segment Analysis:

Ready-Mix Concrete Market Segmented on the basis of type, and end-users.

By Type, Transit Mix Concrete segment is expected to dominate the market during the forecast period

- Transit Mix Concrete, or ready-mix concrete, is a cost-effective and efficient alternative to on-site mixing. It is produced under controlled conditions at a centralized batching plant, ensuring consistent quality and performance. The process eliminates labor-intensive mixing procedures and provides uniform properties, ensuring superior performance and durability in construction applications.

- Despite slightly higher initial costs, transit mix concrete offers significant time savings, reduced material wastage, and faster construction timelines. It can be customized to meet various project requirements, including strength grades, slump levels, and admixture specifications, making it suitable for residential and commercial buildings and infrastructure projects.

- Transit mix concrete production involves rigorous quality control measures, including regular testing of raw materials and in-process inspections, ensuring the concrete meets industry standards and regulatory requirements. This ensures the structural integrity and performance of the finished construction.

By End User, Construction segment held the largest share of 42.8% in 2023

- Ready-mix concrete is a versatile material used in various construction projects, including residential, commercial, infrastructure, and industrial. It is easy to use, as it is pre-mixed and delivered to the construction site, eliminating the need for on-site batching and mixing. Its consistency and quality are ensured by its production in controlled environments using precise proportions of aggregates, cement, water, and additives.

- The speed of construction is also improved by its direct pouring into formwork upon arrival on-site. Although it may have higher upfront costs, its benefits include labor savings, reduced material waste, and faster completion times. Suppliers adhere to stringent quality control measures to ensure consistency and performance. Additionally, many suppliers offer environmentally friendly options, such as low-carbon concrete mixes and recycled aggregates.

Ready-Mix Concrete Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is experiencing rapid urbanization, leading to increased demand for construction projects such as residential buildings, commercial complexes, infrastructure, and industrial facilities. Governments are investing heavily in infrastructure development to support economic growth and improve living standards. Large-scale projects like roads, bridges, railways, airports, and ports require substantial quantities of ready-mix concrete, driving market growth.

- The region's population growth, particularly in China and India, creates demand for housing, commercial spaces, educational institutions, and healthcare facilities. Government initiatives promoting infrastructure development, affordable housing, and sustainable urbanization stimulate construction activity, driving demand for ready-mix concrete.

- Technological advances, such as prefabricated and modular construction methods, rely on ready-mix concrete for efficiency, speed, and quality. Real estate investment remains robust, with residential and commercial real estate projects fueling demand for ready-mix concrete. The ready-mix concrete industry in the Asia Pacific benefits from well-developed supply chain networks and logistics infrastructure.

Ready-Mix Concrete Market Top Key Players:

- U.S. Concrete, Inc. (US)

- Martin Marietta Materials, Inc. (US)

- Vulcan Materials Company (US)

- CEMEX S.A.B. de C.V. (Mexico)

- Eurocement Group (Russia)

- HeidelbergCement AG (Germany)

- Breedon Group plc (UK)

- RMC Group plc (UK)

- Colas SA (France)

- Buzzi Unicem S.p.A. (Italy)

- LafargeHolcim Ltd. (Switzerland)

- CRH plc (Ireland)

- Anhui Conch Cement Company Limited (China)

- China National Building Material Company Limited (China)

- Dalmia Bharat Limited (India)

- UltraTech Cement Limited (India)

- Taiheiyo Cement Corporation (Japan)

- Siam Cement Group (Thailand)

- CEMEX Philippines Group of Companies (Philippines)

- Holcim Philippines, Inc. (Philippines)

- Semen Indonesia (Indonesia)

- Votorantim Cimentos S.A. (Brazil)

- Taiwan Cement Corporation (Taiwan), and other major players

Key Industry Developments in the Ready-Mix Concrete Market:

- In February 2024, Martin Marietta Materials, Inc. announced that on February 11, 2024, it entered into a definitive agreement to acquire 20 active aggregates operations in Alabama, South Carolina, South Florida, Tennessee, and Virginia from affiliates of Blue Water Industries LLC. these portfolio-optimizing the Company’s product mix, margin profile and durability through cycles, but also provide balance sheet flexibility for future acquisitive and organic growth.

- In June 2023, Buzzi SpA, through its wholly owned subsidiary Dyckerhoff GmbH entered into an agreement with CRH, a prominent player in the building materials sector, for the sale of selected operations in Eastern Europe. The transaction entails the sale of assets in Ukraine and the ready-mix concrete division in eastern Slovakia. The completion of the transaction in Ukraine is subject to securing the requisite regulatory approvals and is anticipated to take place in 2024. This strategic move aligns with Buzzi's ongoing efforts to optimize its business portfolio and enhance its operational focus

- In June 2021, Vulcan Materials Company, a leading producer of construction aggregates, and U.S. Concrete, Inc. a leading supplier of aggregates and ready-mixed concrete, announced that they have entered into a definitive merger agreement. Under the terms of the agreement. The transaction has been unanimously approved by the boards of directors of both companies and is expected to close. U.S. Concrete operates in large, attractive metropolitan areas that complement Vulcan's existing footprint. With 27 aggregate operations serving California, Texas, and the Northeast, the acquisition of U.S. Concrete's portfolio represents a natural addition to Vulcan's business.

|

Global Ready-Mix Concrete Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

822.78 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.2% |

Market Size in 2032: |

1298.45 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- READY-MIX CONCRETE MARKET BY TYPE (2017-2032)

- READY-MIX CONCRETE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TRANSIT MIX CONCRETE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CENTRAL MIX CONCRETE

- SHRINK MIX CONCRETE

- READY-MIX CONCRETE MARKET BY END USER (2017-2032)

- READY-MIX CONCRETE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONSTRUCTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TRANSPORTATION

- UTILITIES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Ready-Mix Concrete Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- U.S. CONCRETE, INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MARTIN MARIETTA MATERIALS, INC. (US)

- VULCAN MATERIALS COMPANY (US)

- CEMEX S.A.B. DE C.V. (MEXICO)

- EUROCEMENT GROUP (RUSSIA)

- HEIDELBERGCEMENT AG (GERMANY)

- BREEDON GROUP PLC (UK)

- RMC GROUP PLC (UK)

- COLAS SA (FRANCE)

- BUZZI UNICEM S.P.A. (ITALY)

- LAFARGEHOLCIM LTD. (SWITZERLAND)

- CRH PLC (IRELAND)

- ANHUI CONCH CEMENT COMPANY LIMITED (CHINA)

- CHINA NATIONAL BUILDING MATERIAL COMPANY LIMITED (CHINA)

- DALMIA BHARAT LIMITED (INDIA)

- ULTRATECH CEMENT LIMITED (INDIA)

- TAIHEIYO CEMENT CORPORATION (JAPAN)

- SIAM CEMENT GROUP (THAILAND)

- CEMEX PHILIPPINES GROUP OF COMPANIES (PHILIPPINES)

- HOLCIM PHILIPPINES, INC. (PHILIPPINES)

- SEMEN INDONESIA (INDONESIA)

- VOTORANTIM CIMENTOS S.A. (BRAZIL)

- TAIWAN CEMENT CORPORATION (TAIWAN)

- COMPETITIVE LANDSCAPE

- GLOBAL READY-MIX CONCRETE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Ready-Mix Concrete Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

822.78 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.2% |

Market Size in 2032: |

1298.45 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. READY MIX CONCRETE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. READY MIX CONCRETE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. READY MIX CONCRETE MARKET COMPETITIVE RIVALRY

TABLE 005. READY MIX CONCRETE MARKET THREAT OF NEW ENTRANTS

TABLE 006. READY MIX CONCRETE MARKET THREAT OF SUBSTITUTES

TABLE 007. READY MIX CONCRETE MARKET BY TYPE

TABLE 008. TRANSIT MIXED CONCRETE MARKET OVERVIEW (2016-2030)

TABLE 009. SHRINK MIXED CONCRETE MARKET OVERVIEW (2016-2030)

TABLE 010. CENTRAL MIXED CONCRETE MARKET OVERVIEW (2016-2030)

TABLE 011. READY MIX CONCRETE MARKET BY APPLICATION

TABLE 012. COMMERCIAL BUILDING MARKET OVERVIEW (2016-2030)

TABLE 013. INDUSTRIAL UTILITIES MARKET OVERVIEW (2016-2030)

TABLE 014. RESIDENTIAL BUILDINGS MARKET OVERVIEW (2016-2030)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 016. NORTH AMERICA READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 017. NORTH AMERICA READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 018. N READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 019. EASTERN EUROPE READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 020. EASTERN EUROPE READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 021. READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 022. WESTERN EUROPE READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 023. WESTERN EUROPE READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 024. READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 025. ASIA PACIFIC READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 026. ASIA PACIFIC READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 027. READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 028. MIDDLE EAST & AFRICA READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 029. MIDDLE EAST & AFRICA READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 030. READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 031. SOUTH AMERICA READY MIX CONCRETE MARKET, BY TYPE (2016-2030)

TABLE 032. SOUTH AMERICA READY MIX CONCRETE MARKET, BY APPLICATION (2016-2030)

TABLE 033. READY MIX CONCRETE MARKET, BY COUNTRY (2016-2030)

TABLE 034. ARKEMA (FRANCE): SNAPSHOT

TABLE 035. ARKEMA (FRANCE): BUSINESS PERFORMANCE

TABLE 036. ARKEMA (FRANCE): PRODUCT PORTFOLIO

TABLE 037. ARKEMA (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. SIKA AG (SWITZERLAND): SNAPSHOT

TABLE 038. SIKA AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 039. SIKA AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 040. SIKA AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. BASF SE (GERMANY): SNAPSHOT

TABLE 041. BASF SE (GERMANY): BUSINESS PERFORMANCE

TABLE 042. BASF SE (GERMANY): PRODUCT PORTFOLIO

TABLE 043. BASF SE (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. GCP APPLIED TECHNOLOGIES INC. (U.S.): SNAPSHOT

TABLE 044. GCP APPLIED TECHNOLOGIES INC. (U.S.): BUSINESS PERFORMANCE

TABLE 045. GCP APPLIED TECHNOLOGIES INC. (U.S.): PRODUCT PORTFOLIO

TABLE 046. GCP APPLIED TECHNOLOGIES INC. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. MAPEI S.P.A. (ITALY): SNAPSHOT

TABLE 047. MAPEI S.P.A. (ITALY): BUSINESS PERFORMANCE

TABLE 048. MAPEI S.P.A. (ITALY): PRODUCT PORTFOLIO

TABLE 049. MAPEI S.P.A. (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. KAO CORPORATION (JAPAN): SNAPSHOT

TABLE 050. KAO CORPORATION (JAPAN): BUSINESS PERFORMANCE

TABLE 051. KAO CORPORATION (JAPAN): PRODUCT PORTFOLIO

TABLE 052. KAO CORPORATION (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. M&I MATERIALS LIMITED (U.K): SNAPSHOT

TABLE 053. M&I MATERIALS LIMITED (U.K): BUSINESS PERFORMANCE

TABLE 054. M&I MATERIALS LIMITED (U.K): PRODUCT PORTFOLIO

TABLE 055. M&I MATERIALS LIMITED (U.K): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. DUPONT (U.S.): SNAPSHOT

TABLE 056. DUPONT (U.S.): BUSINESS PERFORMANCE

TABLE 057. DUPONT (U.S.): PRODUCT PORTFOLIO

TABLE 058. DUPONT (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SOLVAY (BELGIUM): SNAPSHOT

TABLE 059. SOLVAY (BELGIUM): BUSINESS PERFORMANCE

TABLE 060. SOLVAY (BELGIUM): PRODUCT PORTFOLIO

TABLE 061. SOLVAY (BELGIUM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. W. R. GRACE & CO.-CONN. (U.S.): SNAPSHOT

TABLE 062. W. R. GRACE & CO.-CONN. (U.S.): BUSINESS PERFORMANCE

TABLE 063. W. R. GRACE & CO.-CONN. (U.S.): PRODUCT PORTFOLIO

TABLE 064. W. R. GRACE & CO.-CONN. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. SETRAL CHEMIE GMBH (GERMANY): SNAPSHOT

TABLE 065. SETRAL CHEMIE GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 066. SETRAL CHEMIE GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 067. SETRAL CHEMIE GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. ENASPOL A.S (CZECH REPUBLIC): SNAPSHOT

TABLE 068. ENASPOL A.S (CZECH REPUBLIC): BUSINESS PERFORMANCE

TABLE 069. ENASPOL A.S (CZECH REPUBLIC): PRODUCT PORTFOLIO

TABLE 070. ENASPOL A.S (CZECH REPUBLIC): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. CAC ADMIXTURES (INDIA): SNAPSHOT

TABLE 071. CAC ADMIXTURES (INDIA): BUSINESS PERFORMANCE

TABLE 072. CAC ADMIXTURES (INDIA): PRODUCT PORTFOLIO

TABLE 073. CAC ADMIXTURES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. CHRYSO GROUP (FRANCE): SNAPSHOT

TABLE 074. CHRYSO GROUP (FRANCE): BUSINESS PERFORMANCE

TABLE 075. CHRYSO GROUP (FRANCE): PRODUCT PORTFOLIO

TABLE 076. CHRYSO GROUP (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. ASHLAND INC (U.S.): SNAPSHOT

TABLE 077. ASHLAND INC (U.S.): BUSINESS PERFORMANCE

TABLE 078. ASHLAND INC (U.S.): PRODUCT PORTFOLIO

TABLE 079. ASHLAND INC (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. RHEIN-CHEMOTECHNIK GMBH (GERMANY): SNAPSHOT

TABLE 080. RHEIN-CHEMOTECHNIK GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 081. RHEIN-CHEMOTECHNIK GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 082. RHEIN-CHEMOTECHNIK GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 083. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 084. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 085. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. READY MIX CONCRETE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. READY MIX CONCRETE MARKET OVERVIEW BY TYPE

FIGURE 012. TRANSIT MIXED CONCRETE MARKET OVERVIEW (2016-2030)

FIGURE 013. SHRINK MIXED CONCRETE MARKET OVERVIEW (2016-2030)

FIGURE 014. CENTRAL MIXED CONCRETE MARKET OVERVIEW (2016-2030)

FIGURE 015. READY MIX CONCRETE MARKET OVERVIEW BY APPLICATION

FIGURE 016. COMMERCIAL BUILDING MARKET OVERVIEW (2016-2030)

FIGURE 017. INDUSTRIAL UTILITIES MARKET OVERVIEW (2016-2030)

FIGURE 018. RESIDENTIAL BUILDINGS MARKET OVERVIEW (2016-2030)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 020. NORTH AMERICA READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 021. EASTERN EUROPE READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 022. WESTERN EUROPE READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. ASIA PACIFIC READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. MIDDLE EAST & AFRICA READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. SOUTH AMERICA READY MIX CONCRETE MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Ready-Mix Concrete Market research report is 2024-2032.

U.S. Concrete, Inc. (US), Martin Marietta Materials, Inc. (US), Vulcan Materials Company (US), CEMEX S.A.B. de C.V. (Mexico), Eurocement Group (Russia), HeidelbergCement AG (Germany), Breedon Group plc (UK), RMC Group plc (UK), Colas SA (France), Buzzi Unicem S.p.A. (Italy), LafargeHolcim Ltd. (Switzerland), CRH plc (Ireland), Anhui Conch Cement Company Limited (China), China National Building Material Company Limited (China), Dalmia Bharat Limited (India), UltraTech Cement Limited (India), Taiheiyo Cement Corporation (Japan), Siam Cement Group (Thailand), CEMEX Philippines Group of Companies (Philippines), Holcim Philippines, Inc. (Philippines), Semen Indonesia (Indonesia), Votorantim Cimentos S.A. (Brazil), Taiwan Cement Corporation (Taiwan), and Other Major Players.

The Ready-Mix Concrete Market is segmented into Type, End User, and region. By Type, the market is categorized into Transit Mix Concrete, Central Mix Concrete, and Shrink Mix Concrete. By End User, the market is categorized into Construction, Transportation, and Utilities. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The ready-mix concrete market refers to the global industry involved in the production, distribution, and sale of concrete that is prepared in a centralized plant and delivered in a plastic or unhardened state to construction sites. This type of concrete is commonly used in construction projects due to its convenience, consistency, and quality. Ready-mix concrete is manufactured according to specific mix designs, tailored to meet the requirements of various applications such as residential, commercial, infrastructure, and industrial construction.

Ready-Mix Concrete Market Size Was Valued at USD 822.78 Billion in 2023 and is Projected to Reach USD 1298.45 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.