Racing Drones Market Synopsis:

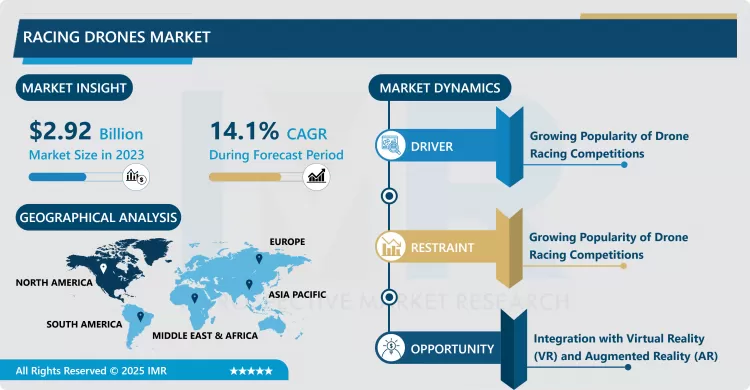

Racing Drones Market Size Was Valued at USD 2.92 Billion in 2023, and is Projected to Reach USD 9.57 Billion by 2032, Growing at a CAGR of 14.1% From 2024-2032.

The racing drones market comprises of designing, manufacturing and marketing drones for exclusive aerobatic performances and racing competes. These drones are features by their light build, modern and efficient airfoils, coupled with strong, powerful propulsion systems that allow them to fly at high speeds and with good maneuverability. Featuring first-person view (FPV) technology, racing drones also give pilots a live video feed to give them a sense of the race from cockpit viewpoint. The market has strong growth opportunities because of the rising global drone racing leagues, latest developments in drone technology, and a rise in popularity of recreational as well as professional drone racing around the world.

The racing drones market is in the growing phase all across the world due to the increasing competitions held through drones and advanced technologies in the drones. This work focused on racing drones, which are specially intended to be highly maneuverable and fast, as well as their uses for fun and professional racing competitions. The addition of high-definition cameras and the transmittal of signals simultaneously allows pilots and the audience the best view of the event that has popularized the sport in the current era. Furthermore, as market players in drones continue to invest more in research and development of their products, the up and coming drone racing leagues and events are always encouraging grounds for this market.

The regional market is led by North America due to the existence of several drone racing associations, favorable regulations, and high customers’ readiness to spend money on sophisticated technologies. At the same time, the Asia-Pacific region is proving to be profitable because the numbers of the gaming and tech-savvy population increase, as well as governmental actions stimulating drone development. It is also worth noting here that elements, including the frame, motor, and battery life which define a current generation of commercial drones, are progressively being improved to enhance their capability. Nonetheless, factors like steep regulations internationally and nationally, security issues, and the expensive nature of the highly developed unmanned aerial systems may act as thorns in the growth process. Still, the given market faces certain challenges but it is promising to grow constantly due to the constant technological advancements and soaring interest in drone races.

Racing Drones Market Trend Analysis:

Technological Advancements in Racing Drones

- Innovation in this product has led to changes in racing drones which want the producers to produce more improved models that can be used in racing events hence improving on their speed, flexibility and maneuverability all through. These drones boast modern day features like better cameras and real time transmission which offers better control to racers and closer look to the audiences on what a drone race is all about. Continued development of lightweight structures and designs has taken drones in addition to their competitive boasting propelling them at faster and competitive speed more especially during high stakes races. Such technical advancements are enhancing drone racing into a competitive event for professional racers as well as amateurs in the market.

- The social channel and video streaming services are credited for the momentum of drone racing. Currently, radio and television broadcasting of races and selected episodes has enabled racing lovers all around the globe to actually follow the race without physically attending such via the internet hence growing the sport’s audience base. Youtube and twitch have given drone racing leagues a vast audience that goes to millions while the social networking sites provide a platform to interact as well as share materials related to drone racing thus encouraging people to embrace the sport. This digital integration has helped not only to increase the audience engagement but also created additional sources of income for racer, leagues, or even for the growth of new sponsoring opportunities that stimulated the market growth exponentially.

Global Investments in Competitive Drone Racing

- Nowadays, increased and further more competitive drone racing leagues and competitions have attracted significant sponsorship funding, significant media interests, or significant technological suppliers and products. These investment are also helping the growth of the sport in a way that contributes to arranging important races, increasing quality of racing events and the greater number of spectators. It also sparked increased activity in terms of live-streaming services and broadcasting rights that deliver the events to drone racing enthusiasts all around the globe. Through increasing availability and popular interest, these advancements are dramatically raising awareness and interest for the sport and so establishing a firm groundwork for the racing drones market.

- As a result of this evolution, the creation of specific racing tracks and arenas of drones, and mostly in large cities is encouraging the setting up of local racing culture. Such spaces not only offer owners and rental spaces that allowed participants to train and compete but also become centers that connect professionals and breed ideas. The interest created through such initiatives also trends at the localized level widens up the demographic of the sport and in turn puts pressure on the drone manufacturing companies to come up with performance focused racing drones. Combined, such factors are opening up huge market opportunities and delivering steady expansion of racing drones’ industry.

Racing Drones Market Segment Analysis:

Racing Drones Market Segmented on the basis of Drone Type, Application, and Region.

By Drone Type, RTF segment is expected to dominate the market during the forecast period

- Different from other UAVs, RTF drones are readily available for use; the user does not have to fix them and make a lot of complex configurations. These come assembled for use with a flight controller, transmitter, and receiver incorporated into the drone design that labels them as very easy to fly. As for intended audiences, this user-friendly design will suit those who barely know how to actually fly a drone or do not need the complicated capabilities of an advanced device. RTF drones are suitable for different uses including, cinematography, recreational flying, and testing new technologies in drone operation. It is especially important for them because flight simulation enables users to concentrate more on the act of flying and not on details. Therefore, for a beginner to be in a position to enjoy the various benefits of drones, then RTF drones would be the best bet for them.

- For instance, RTF drones are appropriate for hobby use, professional photography and videography, as well as occasional flying enthusiasts who aim for an easy to fly drone with high reliability. These integrated features are designed to make users ready for flying within the shortest grabbing time. These drones are also quite appropriate for those that probably do not possess all that much technical know-how, but want to find out about the various applications of drones. That is why at RTF drones the focus is on making flying as simple as possible so that the emphasis is put on the user and the unique perspectives they can achieve without dwelling on complex setup and constant adjustments. From aerial photography to just flying for fun, RTF drones provide an excellent way of transitioning of everyone into flying unmanned aerial vehicles.

By Application, Rotor Cross segment expected to held the largest share

- Rotary cross drones or multi rotors or quad/quadcopter drones are aerodynamically built and are more tactical in movements. They outcompete fellow automobiles in racing events since they involve speed, accuracy and manoeuverability. These drones are created to fly at rather high velocities and maneuver through rather demanding tracks, and other propitious circumstances. Compared to other kinds of drones, rotor cross drones have sturdy and lightweight structures coupled with powerful motors so the types of aerial stunts that will be included in the performance are flips and synchronized sharp turns. Most of those come with the FPV or First Person View cameras where pilots get to enjoy the flight like they are inside the cockpit. It is an exciting flying sensation much desired in the drone racing world where pilots not only race but also control the drones.

- Rotor cross drones are preferred by drone racers because they allow the flyer to perform even more impressive stunts in the air. These type of drones are built in a way that they can be quickly maneuvered with ease and in ways that need quick and sharp movements. Lightweight frames, strong motors, and FPV camera work together to provide pilots with capabilities for maneuvering through tricky courses. Rotor cross drones are not only flying devices but rather a sport through which people use skills and tools fighting in the air and many of these people would love to use high speed drones that pose a challenge.

Racing Drones Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The Racing Drones market is expanding massively in the region of North America especially the United States and Canada due to increment in the number of drone racing leagues and competitions. There is a good presence of big drone manufacturers in the region, this has led to research and development of drones best suited for racing. Permissive legal frameworks that enable recreational drones to be flown have promoted these events as a favorable environment for market development. The rise in actual users of drone and persons participating in the drone racing events contributes towards the demand for better and even enhanced performance drones in the market. The markets for drone sports interestingly are growing rapidly in the region mainly due to interest in the product and easy availability of quality equipment.

- Furthermore, there exists well established drone racing leagues, and racing events with large audiences and participants in North America for Racing Drones market. These event help to act as triggers for the industry to foster growth of better and advanced drone technologies that have higher performance. This availability of improved performance features like increased maneuverability and longer flying endurance coupled with stability has also gone along way in driving the interest of many enthusiasts in this sort of racing. Tapping into this trend, along with the technologically supporting infrastructures and the increasing number of Racing drone pilots in North America, designate this market as influential for the Racing Drones industry.

Active Key Players in the Racing Drones Market:

- Airjugar Technology Co. Ltd,

- Armattan Quads,

- Autel Robotics,

- BetaFPV,

- Caddx,

- DJI,

- Diatone,

- EMAX,

- eachine,

- Fat Shark,

- GEPRC,

- Guangzhou Walkera Technology CO. LTD,

- Holybro,

- Hubsan,

- iFlight

- Other Active Players

Key Industry Developments in the Racing Drones Market:

- In December 2024, Autel Robotics announced that its EVO Nano series had achieved the coveted C0 certification, marking a significant milestone in compliance with the European Drone Regulation (EU) 2019/945 (R945). This certification set the stage for enhanced operational capabilities and greater freedom for users.

|

Racing Drones Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.92 Billion |

|

Forecast Period 2024-32 CAGR: |

14.1% |

Market Size in 2032: |

USD 9.57 Billion |

|

|

By Drone Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Racing Drones Market by Drone Type (2018-2032)

4.1 Racing Drones Market Snapshot and Growth Engine

4.2 Market Overview

4.3 RTF

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 BNF

4.5 ATF

Chapter 5: Racing Drones Market by Application (2018-2032)

5.1 Racing Drones Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Rotor Cross

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Drag Racing

5.5 Time Trial

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Racing Drones Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AIRJUGAR TECHNOLOGY CO. LTD

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ARMATTAN QUADS

6.4 AUTEL ROBOTICS

6.5 BETAFPV

6.6 CADDX

6.7 DJI

6.8 DIATONE

6.9 EMAX

6.10 EACHINE

6.11 FAT SHARK

6.12 GEPRC

6.13 GUANGZHOU WALKERA TECHNOLOGY CO. LTD

6.14 HOLYBRO

6.15 HUBSAN

6.16 AND IFLIGHT

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Racing Drones Market By Region

7.1 Overview

7.2. North America Racing Drones Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Drone Type

7.2.4.1 RTF

7.2.4.2 BNF

7.2.4.3 ATF

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Rotor Cross

7.2.5.2 Drag Racing

7.2.5.3 Time Trial

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Racing Drones Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Drone Type

7.3.4.1 RTF

7.3.4.2 BNF

7.3.4.3 ATF

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Rotor Cross

7.3.5.2 Drag Racing

7.3.5.3 Time Trial

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Racing Drones Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Drone Type

7.4.4.1 RTF

7.4.4.2 BNF

7.4.4.3 ATF

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Rotor Cross

7.4.5.2 Drag Racing

7.4.5.3 Time Trial

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Racing Drones Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Drone Type

7.5.4.1 RTF

7.5.4.2 BNF

7.5.4.3 ATF

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Rotor Cross

7.5.5.2 Drag Racing

7.5.5.3 Time Trial

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Racing Drones Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Drone Type

7.6.4.1 RTF

7.6.4.2 BNF

7.6.4.3 ATF

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Rotor Cross

7.6.5.2 Drag Racing

7.6.5.3 Time Trial

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Racing Drones Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Drone Type

7.7.4.1 RTF

7.7.4.2 BNF

7.7.4.3 ATF

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Rotor Cross

7.7.5.2 Drag Racing

7.7.5.3 Time Trial

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Racing Drones Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.92 Billion |

|

Forecast Period 2024-32 CAGR: |

14.1% |

Market Size in 2032: |

USD 9.57 Billion |

|

|

By Drone Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Racing Drones Market research report is 2024-2032.

Airjugar Technology Co. Ltd, Armattan Quads, Autel Robotics, BetaFPV, Caddx, DJI, Diatone, EMAX, eachine, Fat Shark, GEPRC, Guangzhou Walkera Technology CO. LTD, Holybro, Hubsan, and iFlight and Other Active Players.

The Racing Drones Market is segmented into By Drone Type, By Application and region. By Drone Type, the market is categorized into RTF, BNF, and ATF. By Application, the market is categorized into Rotor Cross, Drag Racing, and Time Trial. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The racing drones market encompasses the development, production, and sale of high-performance unmanned aerial vehicles (UAVs) specifically designed for competitive drone racing. These drones are characterized by their lightweight construction, advanced aerodynamics, and powerful propulsion systems, enabling them to achieve high speeds and exceptional maneuverability. Equipped with first-person view (FPV) technology, racing drones provide pilots with real-time video feeds for immersive control during races. The market is driven by the growing popularity of drone racing leagues, advancements in drone technology, and increasing interest in recreational and professional drone racing activities worldwide.

Racing Drones Market Size Was Valued at USD 2.92 Billion in 2023, and is Projected to Reach USD 9.57 Billion by 2032, Growing at a CAGR of 14.1% From 2024-2032.