PVC Film for Medical Market Synopsis

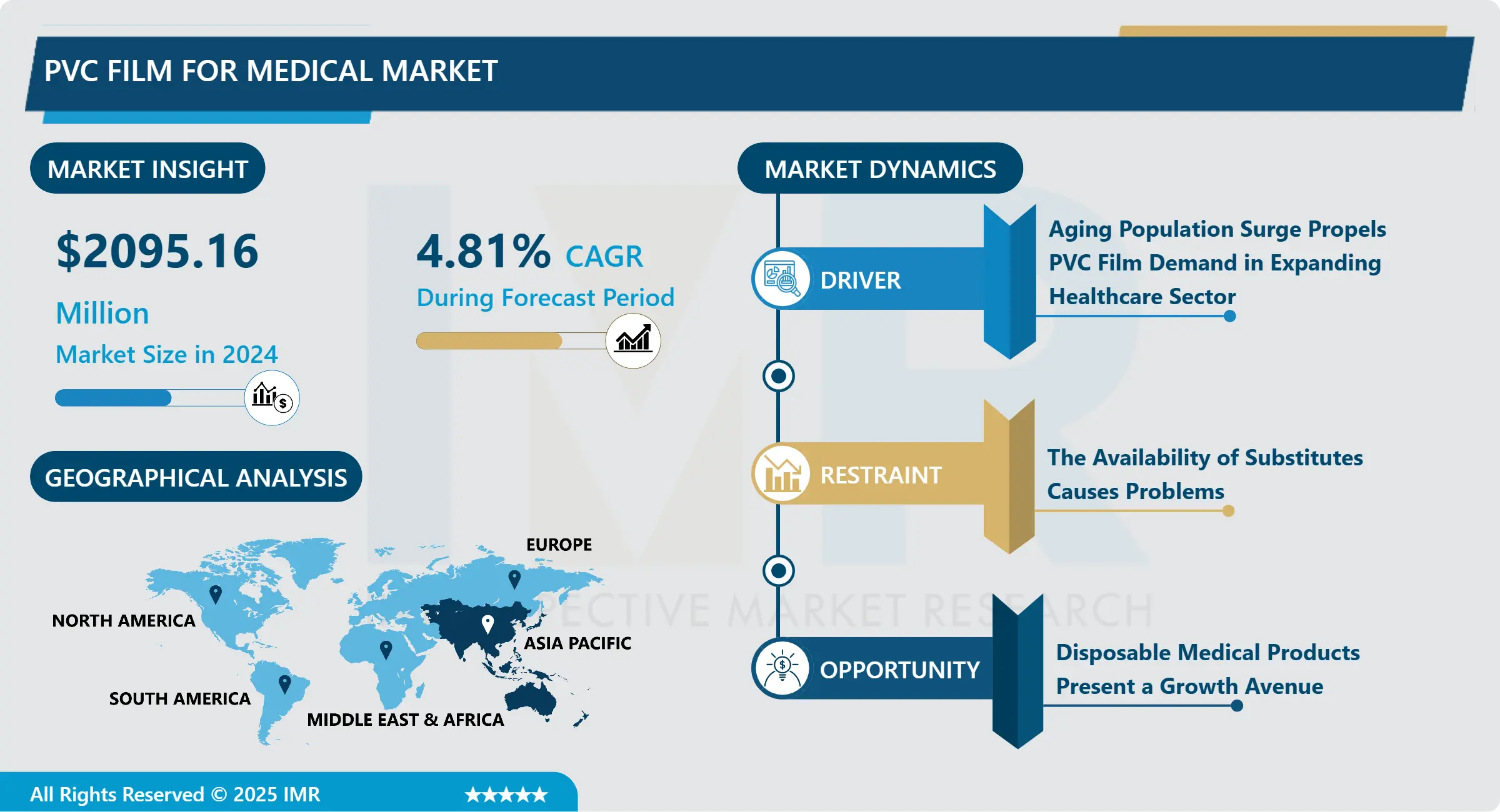

PVC Film for Medical Market Size Was Valued at USD 2095.16 Million in 2024, and is Projected to Reach USD 3050.98 Million by 2032, Growing at a CAGR of 4.81% From 2025-2032.

Plastics, which are referred to as synthetic resins, are categorized into two groups: thermosetting resins and thermoplastic resins. PVC is a thermoplastic polymer, alongside polyethylene (PE), polystyrene (PS), and polypropylene (PP). PVC consists of 57% chlorine and 43% carbon, which mainly comes from oil or gas through ethylene. The production of PVC utilizes fewer non-renewable materials like oil or natural gas compared to other plastics, which makes it a more resource-efficient option.

Plastics like PE, PP, PET, and PS, on the other hand, rely completely on oil or gas. PVC is currently the third most commodity plastic in the world, following polyethylene and polypropylene. The attributes of PVC, including affordability, ease of processing or recycling, and remarkable durability, have established it as the preferred material across various industries like IT, transportation, textiles, construction, and healthcare.

Plastics, referred to as synthetic resins, are categorized into two varieties: thermosetting resins and thermoplastic resins. PVC is a thermoplastic polymer, alongside polyethylene (PE), polystyrene (PS), and polypropylene (PP). PVC consists of 57% chlorine and 43% carbon, which mainly comes from oil or gas through ethylene. The production of PVC utilizes less non-renewable resources, like oil or natural gas, compared to other plastics, thereby making it a more resource-efficient plastic.

PVC Film for Medical Market Trend Analysis

Aging Population Surge Propels PVC Film Demand in Expanding Healthcare Sector

- The worldwide trend of population aging is greatly impacting multiple sectors, particularly the healthcare field. As individuals globally are aging and the percentage of elderly people in the population grows, the need for healthcare services and products is increasing dramatically. This demographic change is driving the growth of the healthcare sector to meet the specific requirements of an older population, which entails increased medical visits, management of chronic illnesses, and long-term care options. Specifically, the healthcare industry needs to adjust to offer specialized services and cutting-edge medical technologies that can improve the quality of life for senior citizens, consequently spurring significant increases in healthcare spending worldwide.

- A crucial factor aiding the growth of the healthcare sector is the application of PVC (polyvinyl chloride) film in the medical field. PVC film is an essential material utilized in numerous medical applications, such as blood bags, IV containers, and medical tubing. With the rise in the aging population, the need for these medical products also grows. PVC film is appreciated for its robustness, adaptability, and affordability, making it a perfect choice for creating disposable medical devices vital for ensuring clean and effective healthcare settings. The increasing population of elderly individuals needing regular medical treatments highlights the significance of PVC film in maintaining a dependable provision of medical disposables.

- The healthcare industry is rapidly expanding, as evidenced by the steady growth in the annual value of the medical devices market worldwide. From 2021 to 2024, the market is projected to grow from $536 billion to $648.7 billion. This upward trend underscores the increasing demand for advanced medical technologies and devices. For the PVC film market in the medical sector, this growth presents significant opportunities. PVC films are widely used in medical applications due to their versatility, durability, and cost-effectiveness. They are commonly found in products such as blood bags, IV containers, and medical tubing. As the demand for medical devices increases, the need for high-quality PVC films is also expected to rise.

Disposable Medical Products Present a Growth Avenue

- The growing occurrence of chronic illnesses, along with an expanding elderly population, is leading to substantial demand for single-use medical goods created from PVC films. Products like IV bags, catheters, and blood bags are crucial for managing chronic illnesses that necessitate regular medical treatment. According to the US Department of Health and Human Services, around 129 million Americans suffer from at least one significant chronic illness, with numerous people managing several health issues. This trend highlights the essential demand for trustworthy and safe medical products to assist in continuous treatment and care.

- The increasing recognition of hygiene and infection prevention methods in healthcare environments heightens the demand for disposable medical items. PVC films are especially beneficial because of their strength, adaptability, and affordability, rendering them a perfect option for disposable medical products. Infections and complications arising from chronic illnesses greatly affect the US healthcare system, with approximately 90% of the yearly $4.1 trillion healthcare spending linked to the management of these conditions. The emphasis on stopping healthcare-associated infections underscores the significance of top-notch disposable items that reduce contamination risks.

Global PVC Film for Medical Market Segment Analysis:

Global PVC Film for Medical Market is segmented on the basis of Product Type, Application, End-User, and Region

By Product Type, Flexible segment is expected to dominate the market during the forecast period

-

Flexible PVC film is an essential substance in the medical sector, valued for its versatility and various attributes that enable its use in numerous applications. Fundamentally, it is a type of PVC plastic designed for use in medical settings. Flexible PVC film is easily bendable and moldable, in contrast to rigid PVC film, enabling it to adapt to different medical device designs. Its widespread use as a vital medical instrument is due to its adaptability and durability against punctures and chemicals. Flexible PVC film is an essential component in the medical sector, valued for its versatility and various attributes that enable its use in multiple applications. Essentially, it is a type of PVC plastic designed for medical uses. Flexible PVC film can be easily manipulated and, unlike rigid PVC film, enabling it to fit various designs of medical devices.

-

The remarkable characteristics of rigid PVC film, such as its ease of sterilization using gamma radiation, ethylene oxide, and electron beam methods, are vital in the medical PVC film sector. The necessity to manufacture IV bags, blood bags, medical tubing, catheters, surgical drapes, and sterile packaging is driven by its ability to maintain structural strength and transparency while ensuring sterility. The film's excellent barrier properties, long-lasting nature, and resistance to chemicals the stringent requirements necessary for medical applications, enhancing safety for patients and healthcare professionals alike.

By Application, Bags segment held the largest share in 2024

-

Medical PVC bags are pliable receptacles crafted from PVC film, selected for its strength, adaptability, and chemical non-reactivity. These bags are mainly utilized for holding IV fluids and medications because they can endure sterilization procedures and keep the contents sterile until they are needed. They are available in multiple sizes and designs to fit various volumes and kinds of fluids utilized in medical therapies. The versatility of PVC film allows for the production of medical bags that meet rigorous healthcare regulations. Custom printing aids in accurate labeling, facilitating the proper management of medication. Efficient inventory management in healthcare facilities is achievable through adequate storage capacity.

-

The PVC film used for medical bags is crucial in healthcare as it offers necessary sterile packaging for various medical uses. Its application in the storage and administration of intravenous fluids, pharmaceutical solutions, blood products, enteral nutrition, dialysis fluids, and contrast agents guarantees the sterility and integrity of contents vital for patient safety and effective treatment procedures. This resilient and adaptable material, frequently paired with polycarbonate components for reliable closures, endures intense sterilization procedures, rendering it essential in hospitals, clinics, and medical facilities globally. As the need for dependable, sterile packaging options increases, the PVC film market keeps expanding.

Global PVC Film for Medical DICAL Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The APAC area plays a vital role in the pharmaceutical sector and medical PVC film market because of diverse healthcare needs and growing economies. The pharmaceutical industry in the Asia Pacific region is experiencing significant growth, fueled by rising healthcare expenditures, enhanced accessibility to healthcare services, and the growing prevalence of chronic illnesses. Key countries like China, Japan, India, and South Korea are leading players in the sector, achieving notable advancements in biotechnology and drug production capabilities. The growing demand for innovative medical packaging options, like PVC films, aligns with this growth. PVC films are crucial for sterile medical packaging due to their flexibility, strength, and capacity to form barriers.

- The market for medical PVC film in APAC is expanding consistently, as stringent regulations promote the adoption of safe and sanitary packaging materials in healthcare environments. Producers are developing innovative designs to satisfy specific requirements in diverse regions, such as the demand for heat resistance in tropical locales and versatility for multiple medical applications. The expansion of this market is also driven by increasing healthcare infrastructure investments and an expanding medical tourism sector in countries like Thailand, Singapore, and Malaysia. The relationship between producing pharmaceuticals and packaging for medical uses is essential.

Global PVC Film for Medical Market Active Players:

- C.I. TAKIRON CORPORATION (Japan)

- RENOLIT GROUP (Germany)

- NANYA PLASTICS CORPORATION (China)

- DUNMORE (U.S)

- WIICARE (U.S)

- TEKRA LLC (Germany)

- BILCARE LIMITED (India)

- OCCIDENTAL PETROLEUM CORPORATION (U.S)

- TEKNI-PLEX, INC (India)

- UNIWORTH ENTERPRISES LLP (U.S)

- TRUE PHARMACIA (India)

- TEKNOR APEX (U.S)

- ACHILLES (UK)

- PRESCO (U.S)

- FENGCHEN GROUP CO., LTD (China)

- KLÖCKNER PENTAPLAST (England)

- SHANDONG TOP LEADER PLASTIC PACKING CO., LTD (U.S)

- ADAMS PLASTIC INC (China)

- Other Active Players.

Key Industry Developments in the Global PVC Film for Medical Market:

- In March 2024, Winpak, a global leader in packaging solutions, announced the launch of its WINSPEED Pouch Stock Program, which aimed to simplify and accelerate the packaging process for medical device manufacturers in North America. The program provided immediate access to a selection of high-quality, pre-stocked medical pouches, enabling customers to minimize lead times and expedite product development. By offering these ready-to-use pouches, Winpak significantly reduced the time required for packaging, thereby enhancing efficiency for medical device manufacturers. This initiative was part of Winpak's ongoing commitment to delivering innovative and practical solutions to the healthcare industry.

- In April 2024, Dunmore announced a partnership with ICEYE, providing multilayer insulation film for Synthetic Aperture Radar (SAR) satellites. ICEYE has the largest constellation of SAR satellites, with monitoring capabilities for any location on Earth. ICEYE is now using Dunmore’s MO 18046 multilayer insulation film as protective MLI on the antenna of these satellites. SAR satellites encounter many potential hazards. The atomic oxygen in the earth’s atmosphere at low earth orbit (LEO) is highly reactive and can damage satellites.

|

Global PVC Film for Medical Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2095.16 Mn. |

|

Forecast Period 2025-32 CAGR: |

4.81% |

Market Size in 2032: |

USD 3050.98 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: PVC Film for Medical Market by Product Type (2018-2032)

4.1 PVC Film for Medical Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Rigid

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Flexible

4.5 Blown

Chapter 5: PVC Film for Medical Market by Application (2018-2032)

5.1 PVC Film for Medical Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Bags

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Tubing

5.5 Blister Packaging

5.6 Others (Disposable Glove

5.7 Equipment Covers

5.8 Catheters)

Chapter 6: PVC Film for Medical Market by

End-User (2018-2032)

6.1 PVC Film for Medical Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospital

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Diagnostic Centers

6.5 Pharmaceutical Companies

6.6 Others (Laboratories

6.7 Ambulatory Surgical Centers (Ascs)

6.8 Veterinary Clinics)

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 PVC Film for Medical Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CLUB CAR (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 YAMAHA GOLF-CAR COMPANY (US)

7.4 BINTELLI ELECTRIC VEHICLES (US)

7.5 ELIO MOTORS INC. (US)

7.6 POLARIS INC. (US)

7.7 TEXTRON INC. (US)

7.8 TESLA INC. (US)

7.9 ELECTRAMECCANICA VEHICLES CORP. (CANADA)

7.10 RENAULT TWIZY (FRANCE)

7.11 BAYERISCHE MOTOREN WERKE AG (GERMANY)

7.12 MERCEDES BENZ GROUP AG (GERMANY)

7.13 BMW GROUP (GERMANY)

7.14 VOLKSWAGEN GROUP (GERMANY)

7.15 ITALCAR INDUSTRIAL SRL (ITALY)

7.16 MICROLINO AG (SWITZERLAND)

7.17 SUZHOU EAGLE ELECTRIC VEHICLE MANUFACTURING COLTD (CHINA)

7.18 BYD COMPANY LTD. (CHINA)

7.19 G H VARLEY PTY LTD. (AUSTRALIA)

7.20 HYUNDAI MOTOR CO. (SOUTH KOREA)

7.21 MAHINDRA AND MAHINDRA LTD. (INDIA)

7.22 PMV ELECTRIC PVT. LTD. (INDIA)

7.23 NISSAN MOTOR CORPORATION (JAPAN)

7.24

Chapter 8: Global PVC Film for Medical Market By Region

8.1 Overview

8.2. North America PVC Film for Medical Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Rigid

8.2.4.2 Flexible

8.2.4.3 Blown

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Bags

8.2.5.2 Tubing

8.2.5.3 Blister Packaging

8.2.5.4 Others (Disposable Glove

8.2.5.5 Equipment Covers

8.2.5.6 Catheters)

8.2.6 Historic and Forecasted Market Size by

End-User

8.2.6.1 Hospital

8.2.6.2 Diagnostic Centers

8.2.6.3 Pharmaceutical Companies

8.2.6.4 Others (Laboratories

8.2.6.5 Ambulatory Surgical Centers (Ascs)

8.2.6.6 Veterinary Clinics)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe PVC Film for Medical Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Rigid

8.3.4.2 Flexible

8.3.4.3 Blown

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Bags

8.3.5.2 Tubing

8.3.5.3 Blister Packaging

8.3.5.4 Others (Disposable Glove

8.3.5.5 Equipment Covers

8.3.5.6 Catheters)

8.3.6 Historic and Forecasted Market Size by

End-User

8.3.6.1 Hospital

8.3.6.2 Diagnostic Centers

8.3.6.3 Pharmaceutical Companies

8.3.6.4 Others (Laboratories

8.3.6.5 Ambulatory Surgical Centers (Ascs)

8.3.6.6 Veterinary Clinics)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe PVC Film for Medical Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Rigid

8.4.4.2 Flexible

8.4.4.3 Blown

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Bags

8.4.5.2 Tubing

8.4.5.3 Blister Packaging

8.4.5.4 Others (Disposable Glove

8.4.5.5 Equipment Covers

8.4.5.6 Catheters)

8.4.6 Historic and Forecasted Market Size by

End-User

8.4.6.1 Hospital

8.4.6.2 Diagnostic Centers

8.4.6.3 Pharmaceutical Companies

8.4.6.4 Others (Laboratories

8.4.6.5 Ambulatory Surgical Centers (Ascs)

8.4.6.6 Veterinary Clinics)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific PVC Film for Medical Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Rigid

8.5.4.2 Flexible

8.5.4.3 Blown

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Bags

8.5.5.2 Tubing

8.5.5.3 Blister Packaging

8.5.5.4 Others (Disposable Glove

8.5.5.5 Equipment Covers

8.5.5.6 Catheters)

8.5.6 Historic and Forecasted Market Size by

End-User

8.5.6.1 Hospital

8.5.6.2 Diagnostic Centers

8.5.6.3 Pharmaceutical Companies

8.5.6.4 Others (Laboratories

8.5.6.5 Ambulatory Surgical Centers (Ascs)

8.5.6.6 Veterinary Clinics)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa PVC Film for Medical Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Rigid

8.6.4.2 Flexible

8.6.4.3 Blown

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Bags

8.6.5.2 Tubing

8.6.5.3 Blister Packaging

8.6.5.4 Others (Disposable Glove

8.6.5.5 Equipment Covers

8.6.5.6 Catheters)

8.6.6 Historic and Forecasted Market Size by

End-User

8.6.6.1 Hospital

8.6.6.2 Diagnostic Centers

8.6.6.3 Pharmaceutical Companies

8.6.6.4 Others (Laboratories

8.6.6.5 Ambulatory Surgical Centers (Ascs)

8.6.6.6 Veterinary Clinics)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America PVC Film for Medical Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Rigid

8.7.4.2 Flexible

8.7.4.3 Blown

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Bags

8.7.5.2 Tubing

8.7.5.3 Blister Packaging

8.7.5.4 Others (Disposable Glove

8.7.5.5 Equipment Covers

8.7.5.6 Catheters)

8.7.6 Historic and Forecasted Market Size by

End-User

8.7.6.1 Hospital

8.7.6.2 Diagnostic Centers

8.7.6.3 Pharmaceutical Companies

8.7.6.4 Others (Laboratories

8.7.6.5 Ambulatory Surgical Centers (Ascs)

8.7.6.6 Veterinary Clinics)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global PVC Film for Medical Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2095.16 Mn. |

|

Forecast Period 2025-32 CAGR: |

4.81% |

Market Size in 2032: |

USD 3050.98 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :