Property & Casualty Insurance Market Synopsis

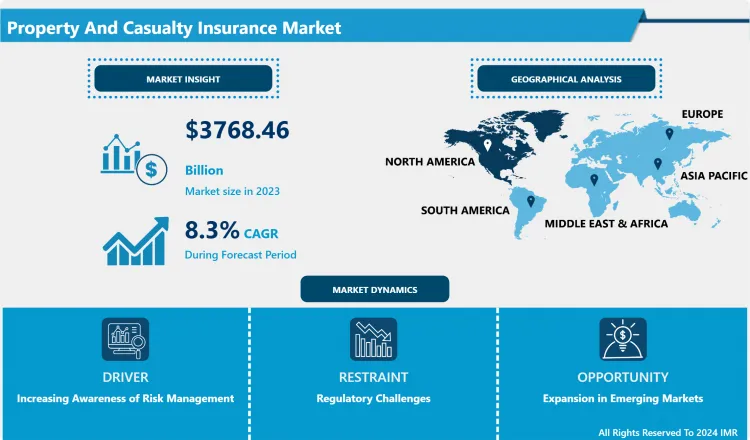

Casualty Insurance Market Property & Size Was Valued at USD 3,768.46 Billion in 2023, and is Projected to Reach USD 7,723.60 Billion by 2032, Growing at a CAGR of 8.30% From 2024-2032.

The Property and Casualty Insurance Market defines different insurance products that prevent people and companies from losing their money due to losses in property, liability, or other types of incidents. Automobile insurance safeguards things like vehicles and property insurance safeguards things like houses while casualty insurance does cover bodily injury to other people or their property.

- The Property and Casualty (P&C) Insurance Market could be identified as one of the essential and commonly demanded segments of the global insurance market that provides protection from specific risks for people and businesses. Obviously, the type of products it offers include homeowners insurance, auto insurance, commercial property insurance and general liability. I have had the opportunities to attend management courses in economics and finance; it is formulated to facilitate risk management especially issues such as natural disasters, accidents, theft and lawsuits that expose businesses to great expense.

- The market for P&C insurance has continued to grow in the more recent past due to improving consumer consciousness therefore the increasing infrastructure in urban areas and frequent cases of natural calamities as a result of climate change. Soft factors such as real life IT factors including artificial intelligence and big data analytics have influenced underwriting since insurers are able to assess risks and their packages. Furthermore, the global COVID-19 pandemic forced individuals recognize insurance as the best way to reduce the financial risks and therefore increased the demand for the P&C insurance products.

- On a geographical distribution basis, various trends are observed in the market. North America could be considered to have significantly big share of this market tying with Europe because of the existence of highly developed insurance companies and effective regulation. On the other hand, Asia-Pacific and Latin American countries are being rapidly transformed with increasing disposable income of the populace, growing urbanization and the rising demand for insurance among the burgeoning middle class populace. It also points to further risks and potential for growth as insurer’s navigate the new era of consumers and regulatory frameworks.

Property & Casualty Insurance Market Trend Analysis

Digital Transformation in P&C Insurance

- The Property and Casualty Insurance Market is being transformed vastly by digital contents. The primary reasons market players stand to benefit from integration of digital technologies into the industry include. Social media policy purchase to mobile claims settlement: technology makes the services faster and more responsive to a consumer that is more sophisticated than before. Artificial intelligence is adopted by insurers to analyze customer information and improve the insurance risk evaluation and product personalization.

- The trend towards online venues also fosters a higher amount of rivalry as well. There is a new generation of Insurtechs that is pitching disruptive innovation in the way traditional insurance is done. Such companies tend to combine customer oriented solutions where insurance products are offered in response to demand rather than put forward as an advise and leverage the potential of big data for more accurate risk pricing. Thus in the process of the developing markets adapting to the digital world, the old guards in the insurance sector will have to strive to capture new market in a very short span so as to ensure that they maintain the loyalty of customers.

Expansion in Emerging Markets

- Current position: The global Property and Casualty Insurance Market has a favorable prospect for growth in emerging markets. With America and Pacific Asian countries and Latin America and Africa still walking the path of development, the need for insurance products will be needed. Currently, new urban development and proliferating populace densification in buildings such as residential and commercial buildings provide a conducive atmosphere for property insurance. Furthermore, increased customer knowledge of the necessity of having financial security against potential risk is fueling the demand for casualty insurance including liability insurance for organizations.

- Moreover, due to the growth of middle class in the said regions, there is a buoyant market for many kinds of insurance. This is a great opportunity for insurers to expand and fortify their solutions to specific markets. The formation of specific policies that relate to threats within a specific region, and including cultural and regulatory issues will contribute to improved market access and future sustainability. Such a move can also extend opportunities for expansion because insurers can rely on existing networks of local partners.

Property & Casualty Insurance Market Segment Analysis:

Property & Casualty Insurance Market Segmented based on Product Type, Distribution Channel, and End User.

By Product Type, Homeowners Insurance segment is expected to dominate the market during the forecast period

- The Property & Casualty Insurance Market as a segment of the insurance industry comprises numerous products focused on specific consumers and business needs. The product, homeowners insurance, as always maintains the primary purpose of ensuring that property owners are safeguarded against loss of homes among other things through such calamities as fire, theft, and natural disasters among others relating to the homes and the contents. Tenants themselves are taking more and more insurance policies, namely renters insurance which offers protection personal property and the holder’s legal responsibilities, a perfect example for growing trends in urbanism. Further, condo insurance insures owners of condominiums and the belongings inside the condo as well as improvements which the owner makes while landlord insurance shields the owners of rental properties from possible losses including liability suits and lost rent. Other product types are specialized additional coverage for the second homes, valuable belongings and other similar needs, pointing out the existence of the market’s versatility in serving diverse customer needs.

- Organization of the Property & Casualty Insurance Market by product type also reveals changes in the market due to demographic factors, economic changes, and new risks that negatively impact the market. Newer on-demand labour and rising rental markets have enhanced the need for both renters and landlords’ insurance and, on the other hand, natural catastrophes consistently emphasize the necessity of homeowners and condominium insurance. Consumers of insurance also have benefited from such changes in focus that includes usage based insurance and better and more improved insuretech platforms. Another factor that has influenced the development of the market as penetration intensifies, is the constantly evolving needs of the buying public through wordliness to insurance products translating into risk management tools, with the insurance service providers having to accustom themselves to the changing market place and embrace technological imperatives in order to deliver good quality service to the market in order to meet its demands satisfactorily.

By Distribution Channel , Tied Agents and Branches segment held the largest share in 2023

- The Property & Casualty Insurance Market has been mainly divided based on distribution channels here; distribution channel forms one of the most important components of insurance industry. Some of major distribution channels are tied agents and branch offices, brokers, and others. Tied agents and branches work directly for insurance firms, and as a result, they transact business from their respective firms only. This kind of model is advantageous to consumer who wants uncomplicated face-to-face service since agents usually have detailed knowledge about the company’s products due to the commission they receive for every sale they make. The flipside of this is that it takes away the consumer freedom to, say, search for better coverage or even models on pricing from other insurance companies.

- Brokers, on the other hand are in a unique category and they are not affiliated to a particular insurance company. It also means they can provide clients with more insurance products from a variety of insurance companies, and help their clients make the right decision on choosing policies to purchase. In its broadest sense, brokers are of significant help due to their ability in assessing the market and their capability to purchase directly from some sources specific desirable merchandise at some only right price and then again resell it. Other distribution channels such as internet and sale through insurers are emerging as the use of technology, becomes an increasingly more popular option among buyers. Direct access to insurance products also targets specific customers who prefer instant solutions offered by technologies making it another path to market accessibility. In total, these varied distribution channels increase the competitive pressure within the Property & Casualty Insurance Market and thus enable customers more choice and improvements in the service provision.

Property & Casualty Insurance Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America continue to be the largest market in the Property and Casualty Insurance Market mainly because of the United States which has a highly developed insurance system. The country has a good and developed structure of insurance organizations and agents or brokers through which people may get an access to different types of P&C insurance. The model of regulation in the United States is to promote a free market competition leading to the development and availability of new forms of insurances.

- Furthermore, the degree of disposable income among the consumers and the businesses in North America remains high thus making for the general demand for the insurance cover. Continued rise in the economy has made people and businesses in North America for instance to explore programs in P&C insurance market as they discover the need to protect their assets and reduce on risk factors. The continuous improvements in the technology and customer relations of this sector also improve the market experience and draw clientele as well as investment interest.

Active Key Players in the Property & Casualty Insurance Market

- State Farm Insurance (USA)

- Allstate (USA)

- Liberty Mutual (USA)

- Progressive Corporation (USA)

- Travelers Insurance (USA)

- Chubb Limited (Switzerland)

- Zurich Insurance Group (Switzerland)

- AIG (American International Group) (USA)

- AXA (France)

- Berkshire Hathaway (USA)

- Others Key Player

Key Industry Developments in the Property & Casualty Insurance Market

- In July 2023, Allianz Global Corporate & Specialty (AGCS) and the commercial insurance business of local Allianz Property & Casualty (P&C) entities have announced a merger, consolidating their operations under the name "Allianz Commercial." This unified entity will provide insurance solutions for mid-sized businesses, large enterprises, and specialty risks

- In November 2023, Chubb, launched a new media insurance product for customers in the UK Concurrently, Chubb has rebranded its current UK Technology Industry Practice to the Technology and Media Practice, aligning with its updated focus. The media insurance offering encompasses customizable coverages that include cyber, media liability, terrorism, casualty, property, and legal expenses. Clients have the flexibility to opt for specific covers that suit their individual needs. Additionally, the product provides various value-added services, such as a complimentary legal advice helpline staffed by experienced media lawyers. This product is aimed at middle-market and multinational media companies, as well as consultants in advertising, graphic design, public relations, brand development, encompassing magazines, newspaper, radio, and television.

- In November 2023, Futuristic Underwriters LLC, announced the public launch of its services committed to mitigating risks and enhancing profitability for insurers, agents, and insured parties. Futuristic Underwriters aims to provide innovative solutions to address challenges within various sectors, including manufacturers/distributors, contractors, professional service organizations, real estate, auto, and other property and casualty lines.

- In November 2023, One Inc., and J.P. Morgan, announced their partnership to serve the insurance sector. This partnership empowers insurance carriers to utilize J.P. Morgan's extensive liquidity and payment capabilities within One Inc.'s digital platform for claim payouts, thereby enhancing the digitization and enriching the overall claims experience. Through this partnership, the combined expertise of both organizations in the insurance industry is leveraged, enabling insurers to provide comprehensive end-to-end solutions for a wide range of payment requirements in the Property and Casualty (P&C) insurance claims process.

|

Property & Casualty Insurance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3768.46 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.30% |

Market Size in 2032: |

USD 7,723.60 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Property & Casualty Insurance Market by Product Type (2018-2032)

4.1 Property & Casualty Insurance Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Homeowners Insurance

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Renters Insurance

4.5 Condo Insurance

4.6 Landlord Insurance

4.7 Others

Chapter 5: Property & Casualty Insurance Market by Distribution Channel (2018-2032)

5.1 Property & Casualty Insurance Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tied Agents and Branches

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Brokers

5.5 Others

Chapter 6: Property & Casualty Insurance Market by End User (2018-2032)

6.1 Property & Casualty Insurance Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Individuals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Governments

6.5 Businesses

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Property & Casualty Insurance Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 STATE FARM INSURANCE (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALLSTATE (USA)

7.4 LIBERTY MUTUAL (USA)

7.5 PROGRESSIVE CORPORATION (USA)

7.6 TRAVELERS INSURANCE (USA)

7.7 CHUBB LIMITED (SWITZERLAND)

7.8 ZURICH INSURANCE GROUP (SWITZERLAND)

7.9 AIG (AMERICAN INTERNATIONAL GROUP) (USA)

7.10 AXA (FRANCE)

7.11 BERKSHIRE HATHAWAY (USA)

7.12 OTHERS KEY PLAYER

Chapter 8: Global Property & Casualty Insurance Market By Region

8.1 Overview

8.2. North America Property & Casualty Insurance Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Homeowners Insurance

8.2.4.2 Renters Insurance

8.2.4.3 Condo Insurance

8.2.4.4 Landlord Insurance

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Distribution Channel

8.2.5.1 Tied Agents and Branches

8.2.5.2 Brokers

8.2.5.3 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Individuals

8.2.6.2 Governments

8.2.6.3 Businesses

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Property & Casualty Insurance Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Homeowners Insurance

8.3.4.2 Renters Insurance

8.3.4.3 Condo Insurance

8.3.4.4 Landlord Insurance

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Distribution Channel

8.3.5.1 Tied Agents and Branches

8.3.5.2 Brokers

8.3.5.3 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Individuals

8.3.6.2 Governments

8.3.6.3 Businesses

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Property & Casualty Insurance Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Homeowners Insurance

8.4.4.2 Renters Insurance

8.4.4.3 Condo Insurance

8.4.4.4 Landlord Insurance

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Distribution Channel

8.4.5.1 Tied Agents and Branches

8.4.5.2 Brokers

8.4.5.3 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Individuals

8.4.6.2 Governments

8.4.6.3 Businesses

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Property & Casualty Insurance Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Homeowners Insurance

8.5.4.2 Renters Insurance

8.5.4.3 Condo Insurance

8.5.4.4 Landlord Insurance

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Distribution Channel

8.5.5.1 Tied Agents and Branches

8.5.5.2 Brokers

8.5.5.3 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Individuals

8.5.6.2 Governments

8.5.6.3 Businesses

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Property & Casualty Insurance Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Homeowners Insurance

8.6.4.2 Renters Insurance

8.6.4.3 Condo Insurance

8.6.4.4 Landlord Insurance

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Distribution Channel

8.6.5.1 Tied Agents and Branches

8.6.5.2 Brokers

8.6.5.3 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Individuals

8.6.6.2 Governments

8.6.6.3 Businesses

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Property & Casualty Insurance Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Homeowners Insurance

8.7.4.2 Renters Insurance

8.7.4.3 Condo Insurance

8.7.4.4 Landlord Insurance

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Distribution Channel

8.7.5.1 Tied Agents and Branches

8.7.5.2 Brokers

8.7.5.3 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Individuals

8.7.6.2 Governments

8.7.6.3 Businesses

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Property & Casualty Insurance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3768.46 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.30% |

Market Size in 2032: |

USD 7,723.60 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Property & Casualty Insurance Market research report is 2024-2032.

State Farm Insurance (USA),Allstate (USA),Liberty Mutual (USA),Progressive Corporation (USA).Travelers Insurance (USA),Chubb Limited (Switzerland),Zurich Insurance Group (Switzerland),and Other Major Players.

The Property & Casualty Insurance Market is segmented into Product Type , Distribution Channel ,End User and Region.By Product Type , the market is categorized into Homeowners Insurance,Renters Insurance,Condo Insurance,Landlord Insurance,Others.By Distribution Channel , the market is categorized into Tied Agents and Branches, Brokers,Others. By End-user , the market is categorized into Individuals, Governments, Businesses. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Polyurethane additives are chemical compounds incorporated into polyurethane formulations to enhance their properties or performance. These additives can modify various aspects such as flexibility, durability, resistance to heat or chemicals, and color stability. Common types include surfactants, catalysts, and stabilizers, each playing a specific role in improving the final product's characteristics and application suitability.

Property & Casualty Insurance Market Property & Size Was Valued at USD 3,768.46 Billion in 2023, and is Projected to Reach USD 7,723.60 Billion by 2032, Growing at a CAGR of 8.30% From 2024-2032.