Probiotics Market Synopsis

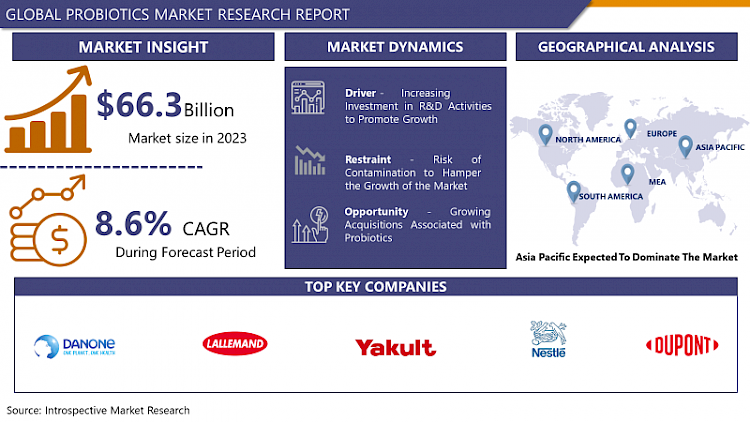

Probiotics Market Size Was Valued at USD 66.3 Billion in 2023, and is Projected to Reach USD 139.3 Billion by 2032, Growing at a CAGR of 8.6% From 2024-2032.

Probiotics are the living microorganisms of bacteria and yeast, which are helpful in maintaining a balance in the intestines of the human as well as animals. It helps the production of digestive acids as well as enzymes to ensure that digestion takes place well. It helps the good bacteria to avoid destruction from dangerous bacteria. It is worth noting that probiotics are also being used to cure mental diseases, digestive, and neurological illnesses. They also modulate the immune response and prevent oxidative breakdown of proteins and lipids, also eradicate infections within the body.

- The growing concern among the buyers to opt for preventive healthcare, coupled with the upsurge in the preference for organic and safe products that possess health benefits is expected to fuel the market’s growth. Some of the expected drivers for the growth of this market include; Several Government initiatives and the raising efforts of the associations & organizations to persuade the consumers to buy these products. For instance, NSM has launched a Probiotics Education Program (PEP) to ensure that customers are well informed of the health benefits of the product.

- Consumers are also changing their preferences by moving towards disease management diets which is also the reason why functional foods and nutraceuticals containing probiotics are increasingly being incorporated. The other demographic factors that have attributed to the use of probiotics as part of preventive measures in healthcare include rise in disposable income, better standard of living, and increase in population of elderly people. Thirdly, also, consumers have gained awareness of the value of the probiotics concerning the health of the digestive tract. At the present time, there are several genetically characterized strains of lactobacilli and bifidobacteria that can prevent infections affecting the gastrointestinal tract or manage similar disorders.

- One of the factors that have favored market growth is the higher demand that people have for natural products. The rising awareness among consumers regarding preventive health and the benefits of the probiotics bacteria are the key factors contributing to market growth. The market for probiotics has grown because functional foods that could help to improve health in addition to providing basic nutrients are becoming more popular.

- Most people nowadays are either obese or suffer from digestive disorders, gastroenteritis, candidiasis, yeast infections and many other illnesses. Given this, the market players have come up with probiotics products for use in handling such diseases. It is moderate when measured against the backdrop of the current market for probiotics; however, it is likely to increase in the near future.

Probiotics Market Trend Analysis

Rise in the Adoptation of Probiotics in Food and Beverage

- Probiotics are used popularly as a food supplement in the form of functional foods in food products and beverages and has positive effects on human gastrointestinal tract. For instance, a survey was done in 2021 by Habit Health and Nutrition, which is a nutrition tech company based in India to determine what people feel is missing in their diets, and what they need to do to improve their physical and mental health. Accordingly, as research reveals, more than 70% of people aim at improving their diet to boost health and immunity and reduce stress and anxiety. Therefore, increased customer preference for healthy food sustains the global probiotics market advancement.

Global Rise in the Demand of Immunity Boosting Probiotics Fortified Food

- Probiotics are a part of the dietary supplements that are useful in digestion and have a large number of advantages, including increased immune systems, gut health, weight loss, and prevention of obesity, etc. The awareness about the health benefits that it offers is expected to rise further in the coming years, and therefore propel the growth of the market. The increased awareness of people towards their health and well-being and the new-found concept of veganism is shifting the consumers towards eating plant-based food products, which is forecasted to fuel the sales of plant-based products. Consequently, numerous categories, including highly competitive leaders in the sector, are starting to develop plant-based probiotics to expand their audience. For instance, in August 2020, Chobani, an American Food Company, declared that they were introducing a new probiotic drink in the market. The new product is in four different flavors each containing natural herbs i. e. Lemon Ginger, Pineapple Turmeric, Peach Mint and Cherry Hibiscus Tea.

Probiotics Market Segment Analysis:

Probiotics Market is segmented based on Microbial Genus, Application and Distribution Channel.

By Application, Functional Food & Beverage segment is expected to dominate the market during the forecast period

- Currently functional foods and beverages have become an integral part of people’s diets and are proven to have possible positive impacts other than basic nutritional values. Today, the popularity of functional food and beverages is one of the most popular food trends in the world. Rising demand of natural and healthy products is also contributing to the product demand. The growing consciousness among the consumers about the healthy and balanced diet helping in disease prevention and controlling their overall health is likely to drive the market for those dietary supplements which cater to their needs.

By Microbial Genus, Lactobacillus segment held the largest share in 2023

- Lactobacillus was the highest utilized probiotics in the global market in 2022. Lactobacillus strains possess an inhibitory efficacy to suppress the growth of microorganisms and pathogens which are advantageous for shelf-life enhancement and augmentation of hygienic prominence of foods. Lactobacillus strain is helpful to humans due to their efficiency in combating enteric diseases in humans thus expected to help fuel product demand. Among all the products, yeast is expected to grow at the highest Compound Annual Growth Rate (CAGR) in the worldwide market. Saccharomyces boulardii is among the most popular yeasts used in the manufacture of probiotic beverages. It helps to maintain a healthy gut and acts as a barrier to prevent pathogenic microorganisms that can cause harm to the inner lining of the intestines. It also controls various aspects of the immune system, as well as maintaining the integrity of the gastrointestinal tract’s barrier. These include increasing product awareness that will in turn translate into increased product demand owing to the perceived benefits of these products.

Probiotics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific dominates the global market and is forecasted to have the largest share for the given period as well. This region has developed quite fast within the last one decade with china and Japan accounting for half of the sale in the region. Thus, the demand for probiotic products, especially for drinks in Japan and some CSHA countries will possibly remain to be rather high during the forthcoming years. For example, Yakult Honsha located in Japan argues that it sells 9,540 Yakult bottles daily in Japan. The rise in consumption of these brewed beers and other fermented drinks is anticipated to contribute to the growth of the regional markets.

Active Key Players in the Probiotics Market

- Danone S.A. (Paris, France)

- Lallemand Inc. (Canada)

- Yakult Honsha (Japan)

- Nestlé S.A. (Vevey, Switzerland)

- DuPont (Danisco A/S) (Delaware, United States)

- Chr. Hansen (Horsholm, Denmark)

- Kerry Inc. (Tralee, Ireland)

- Post Holdings, Inc. (Missouri)

- Pepsico, Inc. (New York, United States)

- Evolve Biosystems, Inc. (Davis, California)

- Other Key Players

Key Industry Developments in the Probiotics Market:

- In January 2024, BIO-CAT's collaboration with Caldic North America has facilitated the introduction of its exclusive probiotic strains and OPTIFEED-branded solutions into the North American pet food market. Through the partnership, BIO-CAT's pet probiotics became accessible to North American consumers, marking a significant expansion for the company. The agreement established a platform for BIO-CAT to showcase its innovative products, enhancing the diversity and quality of offerings in the pet food industry.

- In November 2023, Blue Aqua and SCD Probiotics partnered to construct a probiotics manufacturing plant in Singapore. The plant, with a focus on probiotics and enzymes customized for aquaculture and water treatment, produced and distributed microbial biochemical solutions for the global aquaculture market.

|

Global Probiotics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 66.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.6 % |

Market Size in 2032: |

USD 139.3 Bn. |

|

Segments Covered: |

By Microbial Genus |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PROBIOTICS MARKET BY MICROBIAL GENUS (2017-2032)

- PROBIOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LACTOBACILLUS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BIFIDOBACTERIUM

- YEAST

- PROBIOTICS MARKET BY APPLICATION (2017-2032)

- PROBIOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FUNCTIONAL FOOD AND BEVERAGE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIETARY SUPPLEMENT

- ANIMAL FEED

- PROBIOTICS MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- PROBIOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS/HYPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHARMACIES/HEALTH STORES

- CONVENIENCE STORES

- ONLINE RETAIL

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Luxury Goods Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DANONE S.A. (PARIS, FRANCE)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- LALLEMAND INC. (CANADA)

- YAKULT HONSHA (JAPAN)

- NESTLÉ S.A. (VEVEY, SWITZERLAND)

- DUPONT (DANISCO A/S) (DELAWARE, UNITED STATES)

- CHR. HANSEN (HORSHOLM, DENMARK)

- KERRY INC. (TRALEE, IRELAND)

- POST HOLDINGS, INC. (MISSOURI)

- PEPSICO, INC. (NEW YORK, UNITED STATES)

- EVOLVE BIOSYSTEMS, INC. (DAVIS, CALIFORNIA)

- COMPETITIVE LANDSCAPE

- GLOBAL PROBIOTICS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Microbial Genus

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Probiotics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 66.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.6 % |

Market Size in 2032: |

USD 139.3 Bn. |

|

Segments Covered: |

By Microbial Genus |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PROBIOTIC MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PROBIOTIC MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PROBIOTIC MARKET COMPETITIVE RIVALRY

TABLE 005. PROBIOTIC MARKET THREAT OF NEW ENTRANTS

TABLE 006. PROBIOTIC MARKET THREAT OF SUBSTITUTES

TABLE 007. PROBIOTIC MARKET BY FORM

TABLE 008. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 009. DRY MARKET OVERVIEW (2016-2028)

TABLE 010. PROBIOTIC MARKET BY INGREDIENT

TABLE 011. BACTERIA MARKET OVERVIEW (2016-2028)

TABLE 012. YEAST MARKET OVERVIEW (2016-2028)

TABLE 013. PROBIOTIC MARKET BY APPLICATION

TABLE 014. FOOD AND BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 015. DIETARY SUPPLEMENTS MARKET OVERVIEW (2016-2028)

TABLE 016. ANIMAL FEED MARKET OVERVIEW (2016-2028)

TABLE 017. PROBIOTIC MARKET BY FUNCTION

TABLE 018. REGULAR MARKET OVERVIEW (2016-2028)

TABLE 019. PREVENTIVE HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 020. PROBIOTIC MARKET BY END-USERS

TABLE 021. HUMAN AND ANIMAL MARKET OVERVIEW (2016-2028)

TABLE 022. PROBIOTIC MARKET BY DISTRIBUTION CHANNEL

TABLE 023. HYPERMARKET/SUPERMARKET MARKET OVERVIEW (2016-2028)

TABLE 024. PHARMACIES MARKET OVERVIEW (2016-2028)

TABLE 025. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 026. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 027. NORTH AMERICA PROBIOTIC MARKET, BY FORM (2016-2028)

TABLE 028. NORTH AMERICA PROBIOTIC MARKET, BY INGREDIENT (2016-2028)

TABLE 029. NORTH AMERICA PROBIOTIC MARKET, BY APPLICATION (2016-2028)

TABLE 030. NORTH AMERICA PROBIOTIC MARKET, BY FUNCTION (2016-2028)

TABLE 031. NORTH AMERICA PROBIOTIC MARKET, BY END-USERS (2016-2028)

TABLE 032. NORTH AMERICA PROBIOTIC MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 033. N PROBIOTIC MARKET, BY COUNTRY (2016-2028)

TABLE 034. EUROPE PROBIOTIC MARKET, BY FORM (2016-2028)

TABLE 035. EUROPE PROBIOTIC MARKET, BY INGREDIENT (2016-2028)

TABLE 036. EUROPE PROBIOTIC MARKET, BY APPLICATION (2016-2028)

TABLE 037. EUROPE PROBIOTIC MARKET, BY FUNCTION (2016-2028)

TABLE 038. EUROPE PROBIOTIC MARKET, BY END-USERS (2016-2028)

TABLE 039. EUROPE PROBIOTIC MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 040. PROBIOTIC MARKET, BY COUNTRY (2016-2028)

TABLE 041. ASIA PACIFIC PROBIOTIC MARKET, BY FORM (2016-2028)

TABLE 042. ASIA PACIFIC PROBIOTIC MARKET, BY INGREDIENT (2016-2028)

TABLE 043. ASIA PACIFIC PROBIOTIC MARKET, BY APPLICATION (2016-2028)

TABLE 044. ASIA PACIFIC PROBIOTIC MARKET, BY FUNCTION (2016-2028)

TABLE 045. ASIA PACIFIC PROBIOTIC MARKET, BY END-USERS (2016-2028)

TABLE 046. ASIA PACIFIC PROBIOTIC MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 047. PROBIOTIC MARKET, BY COUNTRY (2016-2028)

TABLE 048. MIDDLE EAST & AFRICA PROBIOTIC MARKET, BY FORM (2016-2028)

TABLE 049. MIDDLE EAST & AFRICA PROBIOTIC MARKET, BY INGREDIENT (2016-2028)

TABLE 050. MIDDLE EAST & AFRICA PROBIOTIC MARKET, BY APPLICATION (2016-2028)

TABLE 051. MIDDLE EAST & AFRICA PROBIOTIC MARKET, BY FUNCTION (2016-2028)

TABLE 052. MIDDLE EAST & AFRICA PROBIOTIC MARKET, BY END-USERS (2016-2028)

TABLE 053. MIDDLE EAST & AFRICA PROBIOTIC MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 054. PROBIOTIC MARKET, BY COUNTRY (2016-2028)

TABLE 055. SOUTH AMERICA PROBIOTIC MARKET, BY FORM (2016-2028)

TABLE 056. SOUTH AMERICA PROBIOTIC MARKET, BY INGREDIENT (2016-2028)

TABLE 057. SOUTH AMERICA PROBIOTIC MARKET, BY APPLICATION (2016-2028)

TABLE 058. SOUTH AMERICA PROBIOTIC MARKET, BY FUNCTION (2016-2028)

TABLE 059. SOUTH AMERICA PROBIOTIC MARKET, BY END-USERS (2016-2028)

TABLE 060. SOUTH AMERICA PROBIOTIC MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 061. PROBIOTIC MARKET, BY COUNTRY (2016-2028)

TABLE 062. ARIA FOODS: SNAPSHOT

TABLE 063. ARIA FOODS: BUSINESS PERFORMANCE

TABLE 064. ARIA FOODS: PRODUCT PORTFOLIO

TABLE 065. ARIA FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. LALLEMAND: SNAPSHOT

TABLE 066. LALLEMAND: BUSINESS PERFORMANCE

TABLE 067. LALLEMAND: PRODUCT PORTFOLIO

TABLE 068. LALLEMAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. DANONE: SNAPSHOT

TABLE 069. DANONE: BUSINESS PERFORMANCE

TABLE 070. DANONE: PRODUCT PORTFOLIO

TABLE 071. DANONE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. NESTLE S.A.: SNAPSHOT

TABLE 072. NESTLE S.A.: BUSINESS PERFORMANCE

TABLE 073. NESTLE S.A.: PRODUCT PORTFOLIO

TABLE 074. NESTLE S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. DANISCO: SNAPSHOT

TABLE 075. DANISCO: BUSINESS PERFORMANCE

TABLE 076. DANISCO: PRODUCT PORTFOLIO

TABLE 077. DANISCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. BIOGAIA AB: SNAPSHOT

TABLE 078. BIOGAIA AB: BUSINESS PERFORMANCE

TABLE 079. BIOGAIA AB: PRODUCT PORTFOLIO

TABLE 080. BIOGAIA AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. GENERAL MILLS INC.: SNAPSHOT

TABLE 081. GENERAL MILLS INC.: BUSINESS PERFORMANCE

TABLE 082. GENERAL MILLS INC.: PRODUCT PORTFOLIO

TABLE 083. GENERAL MILLS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. MOTHER DAIRY FRUITS AND VEGETABLES PVT LTD.: SNAPSHOT

TABLE 084. MOTHER DAIRY FRUITS AND VEGETABLES PVT LTD.: BUSINESS PERFORMANCE

TABLE 085. MOTHER DAIRY FRUITS AND VEGETABLES PVT LTD.: PRODUCT PORTFOLIO

TABLE 086. MOTHER DAIRY FRUITS AND VEGETABLES PVT LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. LIFEWAY FOODS INC.: SNAPSHOT

TABLE 087. LIFEWAY FOODS INC.: BUSINESS PERFORMANCE

TABLE 088. LIFEWAY FOODS INC.: PRODUCT PORTFOLIO

TABLE 089. LIFEWAY FOODS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. CHR HASEN HOLDING A/S: SNAPSHOT

TABLE 090. CHR HASEN HOLDING A/S: BUSINESS PERFORMANCE

TABLE 091. CHR HASEN HOLDING A/S: PRODUCT PORTFOLIO

TABLE 092. CHR HASEN HOLDING A/S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. YAKULT HONSHA CO. LTD: SNAPSHOT

TABLE 093. YAKULT HONSHA CO. LTD: BUSINESS PERFORMANCE

TABLE 094. YAKULT HONSHA CO. LTD: PRODUCT PORTFOLIO

TABLE 095. YAKULT HONSHA CO. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. CELL BIOTECH CO. LTD.: SNAPSHOT

TABLE 096. CELL BIOTECH CO. LTD.: BUSINESS PERFORMANCE

TABLE 097. CELL BIOTECH CO. LTD.: PRODUCT PORTFOLIO

TABLE 098. CELL BIOTECH CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. PROBIOTICAL S.P.A.: SNAPSHOT

TABLE 099. PROBIOTICAL S.P.A.: BUSINESS PERFORMANCE

TABLE 100. PROBIOTICAL S.P.A.: PRODUCT PORTFOLIO

TABLE 101. PROBIOTICAL S.P.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. KERRY GROUP PLC.: SNAPSHOT

TABLE 102. KERRY GROUP PLC.: BUSINESS PERFORMANCE

TABLE 103. KERRY GROUP PLC.: PRODUCT PORTFOLIO

TABLE 104. KERRY GROUP PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. EVOLVE BIOSYSTEM.: SNAPSHOT

TABLE 105. EVOLVE BIOSYSTEM.: BUSINESS PERFORMANCE

TABLE 106. EVOLVE BIOSYSTEM.: PRODUCT PORTFOLIO

TABLE 107. EVOLVE BIOSYSTEM.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. KEVITA INC.: SNAPSHOT

TABLE 108. KEVITA INC.: BUSINESS PERFORMANCE

TABLE 109. KEVITA INC.: PRODUCT PORTFOLIO

TABLE 110. KEVITA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. PROBI AB: SNAPSHOT

TABLE 111. PROBI AB: BUSINESS PERFORMANCE

TABLE 112. PROBI AB: PRODUCT PORTFOLIO

TABLE 113. PROBI AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 114. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 115. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 116. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PROBIOTIC MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PROBIOTIC MARKET OVERVIEW BY FORM

FIGURE 012. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 013. DRY MARKET OVERVIEW (2016-2028)

FIGURE 014. PROBIOTIC MARKET OVERVIEW BY INGREDIENT

FIGURE 015. BACTERIA MARKET OVERVIEW (2016-2028)

FIGURE 016. YEAST MARKET OVERVIEW (2016-2028)

FIGURE 017. PROBIOTIC MARKET OVERVIEW BY APPLICATION

FIGURE 018. FOOD AND BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 019. DIETARY SUPPLEMENTS MARKET OVERVIEW (2016-2028)

FIGURE 020. ANIMAL FEED MARKET OVERVIEW (2016-2028)

FIGURE 021. PROBIOTIC MARKET OVERVIEW BY FUNCTION

FIGURE 022. REGULAR MARKET OVERVIEW (2016-2028)

FIGURE 023. PREVENTIVE HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 024. PROBIOTIC MARKET OVERVIEW BY END-USERS

FIGURE 025. HUMAN AND ANIMAL MARKET OVERVIEW (2016-2028)

FIGURE 026. PROBIOTIC MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 027. HYPERMARKET/SUPERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 028. PHARMACIES MARKET OVERVIEW (2016-2028)

FIGURE 029. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 030. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 031. NORTH AMERICA PROBIOTIC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. EUROPE PROBIOTIC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. ASIA PACIFIC PROBIOTIC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. MIDDLE EAST & AFRICA PROBIOTIC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. SOUTH AMERICA PROBIOTIC MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Probiotics Market research report is 2024-2032.

Danone S.A. (Paris, France) Lallemand Inc. (Canada) Yakult Honsha (Japan) Nestlé S.A. (Vevey, Switzerland) DuPont (Danisco A/S) (Delaware, United States) Chr. Hansen (Horsholm, Denmark) Kerry Inc. (Tralee, Ireland) Post Holdings, Inc. (Missouri) Pepsico, Inc. (New York, United States) Evolve Biosystems, Inc. (Davis, California), and Other Major Players.

The Probiotics Market is segmented into microbial genus, application and distribution channel, and region. By microbial genus, the market is categorized into Lactobacillus, Bifidobacterium, and Yeast. By application, the market is categorized into functional foods & beverages, dietary supplements, and animal feed. By distribution channel, the market is categorized into supermarkets/hypermarkets, pharmacies/health stores, convenience stores, online retail, and others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Probiotics refers to beneficial bacteria for humans and animals that ensures balance of the Microbial community in the intestine. Probiotics ingredient boosts up the activity of the natural substances in the body such as acids and enzymes that are involved in digestion process. They can be ingested directly through tablets or capsules, and some may be taken as supplements.

Probiotics Market Size Was Valued at USD 66.3 Billion in 2023, and is Projected to Reach USD 139.3 Billion by 2032, Growing at a CAGR of 8.6% From 2024-2032.