Global Bioinformatics Market Overview

The Bioinformatics Market size is expected to grow from USD 20.59 Billion in 2023 to USD 56.73 Billion by 2032, at a CAGR of 11.92% during the forecast period.

In the context of genetics and genomics, bioinformatics is a subfield of biology that makes use of computers to collect, store, analyze, and disseminate biological data and information. Examples of this kind of data and information include the sequences of DNA and amino acids, as well as any annotations that are associated with those sequences. The study of bioinformatics encompasses not only biological research that incorporates the use of computer programming as a component of its technique but also unique analysis "pipelines" that are utilized several times, most notably in the field of genomics. The analysis of single nucleotide polymorphisms and the identification of candidate genes are both common applications of bioinformatics (SNPs).

It is anticipated that the global market for bioinformatics will experience significant expansion as a result of an increase in the demand for integrated data, an increase in the demand for nucleic acid and protein sequencing as a result of a decrease in the cost of sequencing, and an increase in the number of applications of proteomics and genomics. This is all expected to contribute to the growth of the market. In addition, it is anticipated that initiatives from both public and private organizations, as well as discoveries and advancements in pharmaceutical research, will contribute to the expansion of the market over the course of the period that is projected.

Market Dynamics And Factors For Bioinformatics Market

Drivers:

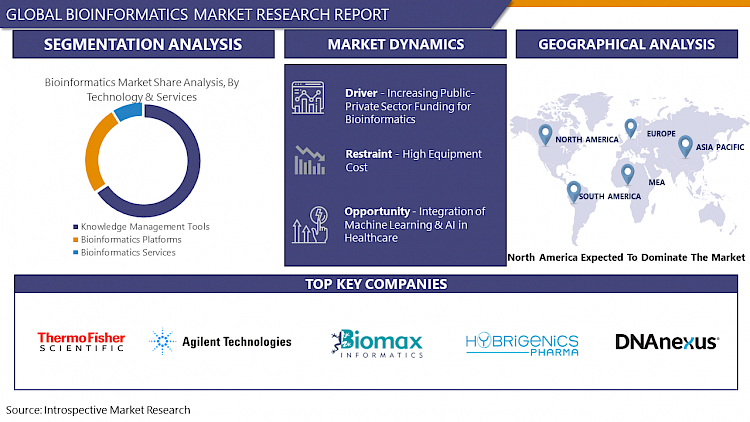

- Increasing Public-Private Sector Funding for Bioinformatics

Restraints:

- High Equipment Cost

Opportunity:

- Integration of Machine Learning & AI in Healthcare

Regional Analysis in Bioinformatics Market

North America is expected to have the maximum market share during the forthcoming year. This is because there has been an increase in the use of more advanced technology, in addition to an increase in the demand for improved bioinformatics tools, which are essential in the process of drug research and development. It is anticipated that the market in LAMEA will expand at the rate that is highest over the course of the forecast period. This is due to the fact that recent advancements in genomics and proteomics produce enormous amounts of data that need to be evaluated and managed. In addition, the region's research activities are gradually expanding, but the bioinformatics industry is still in its infant stages. As a consequence of this, each of these factors contributes to the growth of the market.

Top Key Players Covered In Bioinformatics Market

- Agilent Technologies Inc. (United States)

- Biomax Informatics Ag (Germany)

- Hybrigenics (France)

- Lumenogix (India)

- Dnanexus, Inc. (United States)

- Genedata Ag (Switzerland)

- Intrexon Bioinformatics Germany Gmbh (Germany)

- Illumina Inc. (United States)

- Perkinelmer Inc. (United States)

- Qiagen N.V. (Germany)

- Seven Bridges Genomics Inc. (United States)

- Thermo Fisher Scientific Inc. (United States), and Other Major Players

Key Industry Development In The Bioinformatics Market

- In January 2022, Thermo Fisher completed the acquisition of PeproTech on December 30 2021 for a total cash purchase price of approximately US$ 1 85 billion PeproTech is a privately held provider of bioscience reagents known as recombinant proteins including cytokines and growth factors. Recombinant proteins are used in the development and manufacturing of cell and gene therapies, as well as in broader cell culture applications, especially for use in cellular research modeis

- In May 2022, Bruker Corporation and TOFWERK AG announced a strategic partnership for high-speed ultra-sensitive applied and industrial analytical solutions, in conjunction with a Bruker minority investment in TOFWERK the partnership provides a basis for technology collaborations to advance instrument capabilities and for the development of novel analytical applications where high speed and ultra-sensitivity matter.

|

Global Bioinformatics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.92% |

Market Size in 2032: |

USD 56.73 Bn. |

|

Segments Covered: |

By Technology & Services |

|

|

|

By Application |

|

||

|

By Sector |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Technology & Services

3.2 By Application

3.3 By Sectors

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Bioinformatics Market by Technology & Services

5.1 Bioinformatics Market Overview Snapshot and Growth Engine

5.2 Bioinformatics Market Overview

5.3 Knowledge Management Tools

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Knowledge Management Tools: Geographic Segmentation

5.4 Bioinformatics Platforms

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Bioinformatics Platforms: Geographic Segmentation

5.5 Bioinformatics Services

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Bioinformatics Services: Geographic Segmentation

Chapter 6: Bioinformatics Market by Application

6.1 Bioinformatics Market Overview Snapshot and Growth Engine

6.2 Bioinformatics Market Overview

6.3 Metabolomics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Metabolomics: Geographic Segmentation

6.4 Molecular Phylogenetics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Molecular Phylogenetics: Geographic Segmentation

6.5 Transcriptomics

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Transcriptomics: Geographic Segmentation

6.6 Proteomics

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Proteomics: Geographic Segmentation

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation

Chapter 7: Bioinformatics Market by Sectors

7.1 Bioinformatics Market Overview Snapshot and Growth Engine

7.2 Bioinformatics Market Overview

7.3 Medical Bioinformatics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Medical Bioinformatics: Geographic Segmentation

7.4 Animal Bioinformatics

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Animal Bioinformatics: Geographic Segmentation

7.5 Agriculture Bioinformatics

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Agriculture Bioinformatics: Geographic Segmentation

7.6 Academics

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Academics: Geographic Segmentation

7.7 Others

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Others: Geographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Bioinformatics Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Bioinformatics Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Bioinformatics Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 AGILENT TECHNOLOGIES INC. (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 BIOMAX INFORMATICS AG (GERMANY)

8.4 HYBRIGENICS (FRANCE)

8.5 LUMENOGIX (INDIA)

8.6 DNANEXUS INC. (UNITED STATES)

8.7 GENEDATA AG (SWITZERLAND)

8.8 INTREXON BIOINFORMATICS GERMANY GMBH (GERMANY)

8.9 ILLUMINA INC. (UNITED STATES)

8.10 PERKINELMER INC. (UNITED STATES)

8.11 QIAGEN N.V. (GERMANY)

8.12 SEVEN BRIDGES GENOMICS INC. (UNITED STATES)

8.13 THERMO FISHER SCIENTIFIC INC. (UNITED STATES)

8.14 OTHER MAJOR PLAYERS

Chapter 9: Global Bioinformatics Market Analysis, Insights and Forecast, 2017-2032

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Technology & Services

9.2.1 Knowledge Management Tools

9.2.2 Bioinformatics Platforms

9.2.3 Bioinformatics Services

9.3 Historic and Forecasted Market Size By Application

9.3.1 Metabolomics

9.3.2 Molecular Phylogenetics

9.3.3 Transcriptomics

9.3.4 Proteomics

9.3.5 Others

9.4 Historic and Forecasted Market Size By Sectors

9.4.1 Medical Bioinformatics

9.4.2 Animal Bioinformatics

9.4.3 Agriculture Bioinformatics

9.4.4 Academics

9.4.5 Others

Chapter 10: North America Bioinformatics Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Technology & Services

10.4.1 Knowledge Management Tools

10.4.2 Bioinformatics Platforms

10.4.3 Bioinformatics Services

10.5 Historic and Forecasted Market Size By Application

10.5.1 Metabolomics

10.5.2 Molecular Phylogenetics

10.5.3 Transcriptomics

10.5.4 Proteomics

10.5.5 Others

10.6 Historic and Forecasted Market Size By Sectors

10.6.1 Medical Bioinformatics

10.6.2 Animal Bioinformatics

10.6.3 Agriculture Bioinformatics

10.6.4 Academics

10.6.5 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Bioinformatics Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Technology & Services

11.4.1 Knowledge Management Tools

11.4.2 Bioinformatics Platforms

11.4.3 Bioinformatics Services

11.5 Historic and Forecasted Market Size By Application

11.5.1 Metabolomics

11.5.2 Molecular Phylogenetics

11.5.3 Transcriptomics

11.5.4 Proteomics

11.5.5 Others

11.6 Historic and Forecasted Market Size By Sectors

11.6.1 Medical Bioinformatics

11.6.2 Animal Bioinformatics

11.6.3 Agriculture Bioinformatics

11.6.4 Academics

11.6.5 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Bioinformatics Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Technology & Services

12.4.1 Knowledge Management Tools

12.4.2 Bioinformatics Platforms

12.4.3 Bioinformatics Services

12.5 Historic and Forecasted Market Size By Application

12.5.1 Metabolomics

12.5.2 Molecular Phylogenetics

12.5.3 Transcriptomics

12.5.4 Proteomics

12.5.5 Others

12.6 Historic and Forecasted Market Size By Sectors

12.6.1 Medical Bioinformatics

12.6.2 Animal Bioinformatics

12.6.3 Agriculture Bioinformatics

12.6.4 Academics

12.6.5 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Bioinformatics Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Technology & Services

13.4.1 Knowledge Management Tools

13.4.2 Bioinformatics Platforms

13.4.3 Bioinformatics Services

13.5 Historic and Forecasted Market Size By Application

13.5.1 Metabolomics

13.5.2 Molecular Phylogenetics

13.5.3 Transcriptomics

13.5.4 Proteomics

13.5.5 Others

13.6 Historic and Forecasted Market Size By Sectors

13.6.1 Medical Bioinformatics

13.6.2 Animal Bioinformatics

13.6.3 Agriculture Bioinformatics

13.6.4 Academics

13.6.5 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Bioinformatics Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Technology & Services

14.4.1 Knowledge Management Tools

14.4.2 Bioinformatics Platforms

14.4.3 Bioinformatics Services

14.5 Historic and Forecasted Market Size By Application

14.5.1 Metabolomics

14.5.2 Molecular Phylogenetics

14.5.3 Transcriptomics

14.5.4 Proteomics

14.5.5 Others

14.6 Historic and Forecasted Market Size By Sectors

14.6.1 Medical Bioinformatics

14.6.2 Animal Bioinformatics

14.6.3 Agriculture Bioinformatics

14.6.4 Academics

14.6.5 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Bioinformatics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.92% |

Market Size in 2032: |

USD 56.73 Bn. |

|

Segments Covered: |

By Technology & Services |

|

|

|

By Application |

|

||

|

By Sector |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BIOINFORMATICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BIOINFORMATICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BIOINFORMATICS MARKET COMPETITIVE RIVALRY

TABLE 005. BIOINFORMATICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BIOINFORMATICS MARKET THREAT OF SUBSTITUTES

TABLE 007. BIOINFORMATICS MARKET BY TECHNOLOGY & SERVICES

TABLE 008. KNOWLEDGE MANAGEMENT TOOLS MARKET OVERVIEW (2016-2028)

TABLE 009. BIOINFORMATICS PLATFORMS MARKET OVERVIEW (2016-2028)

TABLE 010. BIOINFORMATICS SERVICES MARKET OVERVIEW (2016-2028)

TABLE 011. BIOINFORMATICS MARKET BY APPLICATION

TABLE 012. METABOLOMICS MARKET OVERVIEW (2016-2028)

TABLE 013. MOLECULAR PHYLOGENETICS MARKET OVERVIEW (2016-2028)

TABLE 014. TRANSCRIPTOMICS MARKET OVERVIEW (2016-2028)

TABLE 015. PROTEOMICS MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. BIOINFORMATICS MARKET BY SECTORS

TABLE 018. MEDICAL BIOINFORMATICS MARKET OVERVIEW (2016-2028)

TABLE 019. ANIMAL BIOINFORMATICS MARKET OVERVIEW (2016-2028)

TABLE 020. AGRICULTURE BIOINFORMATICS MARKET OVERVIEW (2016-2028)

TABLE 021. ACADEMICS MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA BIOINFORMATICS MARKET, BY TECHNOLOGY & SERVICES (2016-2028)

TABLE 024. NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION (2016-2028)

TABLE 025. NORTH AMERICA BIOINFORMATICS MARKET, BY SECTORS (2016-2028)

TABLE 026. N BIOINFORMATICS MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE BIOINFORMATICS MARKET, BY TECHNOLOGY & SERVICES (2016-2028)

TABLE 028. EUROPE BIOINFORMATICS MARKET, BY APPLICATION (2016-2028)

TABLE 029. EUROPE BIOINFORMATICS MARKET, BY SECTORS (2016-2028)

TABLE 030. BIOINFORMATICS MARKET, BY COUNTRY (2016-2028)

TABLE 031. ASIA PACIFIC BIOINFORMATICS MARKET, BY TECHNOLOGY & SERVICES (2016-2028)

TABLE 032. ASIA PACIFIC BIOINFORMATICS MARKET, BY APPLICATION (2016-2028)

TABLE 033. ASIA PACIFIC BIOINFORMATICS MARKET, BY SECTORS (2016-2028)

TABLE 034. BIOINFORMATICS MARKET, BY COUNTRY (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA BIOINFORMATICS MARKET, BY TECHNOLOGY & SERVICES (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA BIOINFORMATICS MARKET, BY APPLICATION (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA BIOINFORMATICS MARKET, BY SECTORS (2016-2028)

TABLE 038. BIOINFORMATICS MARKET, BY COUNTRY (2016-2028)

TABLE 039. SOUTH AMERICA BIOINFORMATICS MARKET, BY TECHNOLOGY & SERVICES (2016-2028)

TABLE 040. SOUTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION (2016-2028)

TABLE 041. SOUTH AMERICA BIOINFORMATICS MARKET, BY SECTORS (2016-2028)

TABLE 042. BIOINFORMATICS MARKET, BY COUNTRY (2016-2028)

TABLE 043. AGILENT TECHNOLOGIES INC. (UNITED STATES): SNAPSHOT

TABLE 044. AGILENT TECHNOLOGIES INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 045. AGILENT TECHNOLOGIES INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 046. AGILENT TECHNOLOGIES INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. BIOMAX INFORMATICS AG (GERMANY): SNAPSHOT

TABLE 047. BIOMAX INFORMATICS AG (GERMANY): BUSINESS PERFORMANCE

TABLE 048. BIOMAX INFORMATICS AG (GERMANY): PRODUCT PORTFOLIO

TABLE 049. BIOMAX INFORMATICS AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. HYBRIGENICS (FRANCE): SNAPSHOT

TABLE 050. HYBRIGENICS (FRANCE): BUSINESS PERFORMANCE

TABLE 051. HYBRIGENICS (FRANCE): PRODUCT PORTFOLIO

TABLE 052. HYBRIGENICS (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. LUMENOGIX (INDIA): SNAPSHOT

TABLE 053. LUMENOGIX (INDIA): BUSINESS PERFORMANCE

TABLE 054. LUMENOGIX (INDIA): PRODUCT PORTFOLIO

TABLE 055. LUMENOGIX (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. DNANEXUS INC. (UNITED STATES): SNAPSHOT

TABLE 056. DNANEXUS INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 057. DNANEXUS INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 058. DNANEXUS INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. GENEDATA AG (SWITZERLAND): SNAPSHOT

TABLE 059. GENEDATA AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 060. GENEDATA AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 061. GENEDATA AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. INTREXON BIOINFORMATICS GERMANY GMBH (GERMANY): SNAPSHOT

TABLE 062. INTREXON BIOINFORMATICS GERMANY GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 063. INTREXON BIOINFORMATICS GERMANY GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 064. INTREXON BIOINFORMATICS GERMANY GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ILLUMINA INC. (UNITED STATES): SNAPSHOT

TABLE 065. ILLUMINA INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 066. ILLUMINA INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 067. ILLUMINA INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. PERKINELMER INC. (UNITED STATES): SNAPSHOT

TABLE 068. PERKINELMER INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 069. PERKINELMER INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 070. PERKINELMER INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. QIAGEN N.V. (GERMANY): SNAPSHOT

TABLE 071. QIAGEN N.V. (GERMANY): BUSINESS PERFORMANCE

TABLE 072. QIAGEN N.V. (GERMANY): PRODUCT PORTFOLIO

TABLE 073. QIAGEN N.V. (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. SEVEN BRIDGES GENOMICS INC. (UNITED STATES): SNAPSHOT

TABLE 074. SEVEN BRIDGES GENOMICS INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 075. SEVEN BRIDGES GENOMICS INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 076. SEVEN BRIDGES GENOMICS INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. THERMO FISHER SCIENTIFIC INC. (UNITED STATES): SNAPSHOT

TABLE 077. THERMO FISHER SCIENTIFIC INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 078. THERMO FISHER SCIENTIFIC INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 079. THERMO FISHER SCIENTIFIC INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 080. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 081. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 082. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BIOINFORMATICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BIOINFORMATICS MARKET OVERVIEW BY TECHNOLOGY & SERVICES

FIGURE 012. KNOWLEDGE MANAGEMENT TOOLS MARKET OVERVIEW (2016-2028)

FIGURE 013. BIOINFORMATICS PLATFORMS MARKET OVERVIEW (2016-2028)

FIGURE 014. BIOINFORMATICS SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 015. BIOINFORMATICS MARKET OVERVIEW BY APPLICATION

FIGURE 016. METABOLOMICS MARKET OVERVIEW (2016-2028)

FIGURE 017. MOLECULAR PHYLOGENETICS MARKET OVERVIEW (2016-2028)

FIGURE 018. TRANSCRIPTOMICS MARKET OVERVIEW (2016-2028)

FIGURE 019. PROTEOMICS MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. BIOINFORMATICS MARKET OVERVIEW BY SECTORS

FIGURE 022. MEDICAL BIOINFORMATICS MARKET OVERVIEW (2016-2028)

FIGURE 023. ANIMAL BIOINFORMATICS MARKET OVERVIEW (2016-2028)

FIGURE 024. AGRICULTURE BIOINFORMATICS MARKET OVERVIEW (2016-2028)

FIGURE 025. ACADEMICS MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA BIOINFORMATICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE BIOINFORMATICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC BIOINFORMATICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA BIOINFORMATICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA BIOINFORMATICS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Bioinformatics Market research report is 2024-2032.

Agilent Technologies Inc. (United States), Biomax Informatics Ag (Germany), Hybrigenics (France), Lumenogix (India), Dnanexus Inc. (United States), Genedata Ag (Switzerland), Intrexon Bioinformatics Germany Gmbh (Germany), Illumina Inc. (United States), Perkinelmer Inc. (United States), Qiagen N.V. (Germany), Seven Bridges Genomics Inc. (United States), Thermo Fisher Scientific Inc. (United States), and Other Major Players

The Bioinformatics Market has been segmented into Technology & Services, Application, Sector, and region. By Technology & Services, the market is categorized into Knowledge Management Tools, Bioinformatics Platforms, and Bioinformatics Services. By Application, the market is categorized into Metabolomics, Molecular Phylogenetics, Transcriptomics, Proteomics, Chemoinformatic, Genomics, and Others. By sector, the market is categorized into Medical Bioinformatics, Animal Bioinformatics, Agriculture Bioinformatics, Academics, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Bioinformatics, as related to genetics and genomics, is a scientific subdiscipline that involves using computer technology to collect, store, analyze and disseminate biological data and information, such as DNA and amino acid sequences or annotations about those sequences. Bioinformatics includes biological studies that use computer programming as part of their methodology, as well as specific analysis "pipelines" that are repeatedly used, particularly in the field of genomics. Common uses of bioinformatics include the identification of candidate genes and single nucleotide polymorphisms (SNPs). Often, such identification is made with the aim of better understanding the genetic basis of disease, unique adaptations, desirable properties (esp. in agricultural species), or differences between populations.

The Bioinformatics Market size is expected to grow from USD 20.59 Billion in 2023 to USD 56.73 Billion by 2032, at a CAGR of 11.92% during the forecast period.