Global Precision Agriculture Market Overview

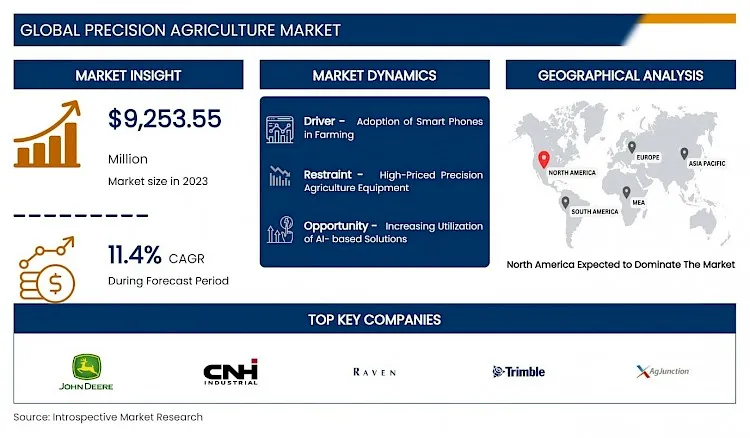

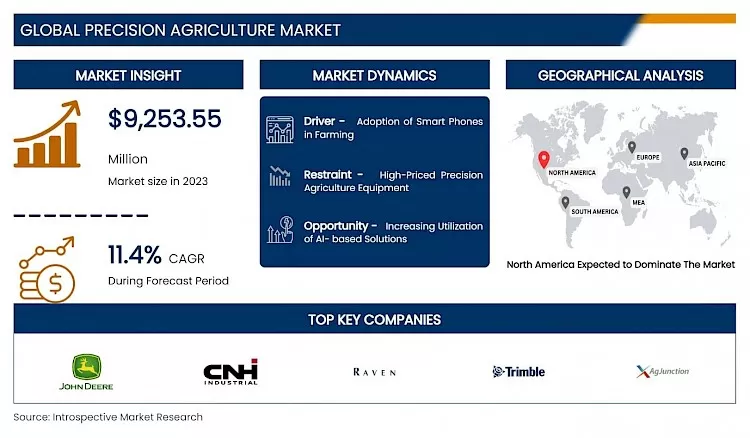

The global market for Precision Agriculture valued at USD 9,253.55 Million in 2023 is projected to reach a revised size of USD 24,449.79 Million by 2032, growing at a CAGR of 11.4% over the period 2024-2032.

The global precision agriculture market is experiencing rapid growth, driven by the increasing need for sustainable and efficient farming practices to meet the rising food demands of a growing population. This technology-driven approach involves the use of advanced tools like GPS, drones, sensors, and data analytics to optimize agricultural processes, enhance crop yields, and minimize resource consumption. The market is witnessing significant investments in research and development, leading to the emergence of innovative solutions.

Key factors driving market growth include the rising adoption of digital technologies in agriculture, increasing awareness about the benefits of precision farming, favorable government policies promoting agricultural modernization, and the growing emphasis on sustainable farming practices. As the industry matures, the focus is shifting towards data-driven decision making, artificial intelligence, and automation, promising further advancements in precision agriculture.

Market Dynamics And Factors For Precision Agriculture Market

Drivers:

Adoption of Smart Phones in Farming

The growing smartphone adoption has led to the development of software that are compatible on smartphone. Key manufacturers have introduced advanced applications that are compatible with any smartphone. Such applications enable farmers to monitor the field from the desired location and the data is stored in the cloud as a backup with the help of smartphone integration. Smartphones fulfil the basic requirements of the farmer as they support connectivity using USB, Bluetooth, and Wi-Fi. Thus, the rise in smartphone adoption has created lucrative opportunities for the precision agriculture market globally.

Advancement in technology and ease of use makes way for betterment in the facilities used in farming. One of the foremost dramatic changes in the use of mobile phones in agriculture is the systems for managing farms and the development of monitoring protocols. For instance, in December 2020, the survey carried out by the leading news agency-The Print, stated that farmers in India have highly adopted advanced technology and the use of a smartphone in agriculture has helped them gain nearly double output and income than other farmers. Thus, the rise in the adoption of smartphones for farming practices supports the market growth of precision agriculture.

Restraints:

High-Priced Precision Farming Equipment

The high prices that are associated with precision farming equipment limit the growth as the small-scale and low-income group farmers switch to other less-priced sources for farm practices. The technologies and equipment used in precision farming such as smart sensors, drones, VRT, GPS, guidance tools, GNSS, and receivers, are highly efficient but expensive. Besides, to set up and operate precision farming, trained and skilled personnel are highly required. Thus, in developing nations such as China, India, and Brazil, with limited resources for agricultural practices, many large-scale and small-scale growers choose traditional farming rather than executing new technology-based farming due to the high investment costs, which further inhibits the market growth of precision agriculture.

Opportunities:

Increasing Utilization of AI-based Solutions

Utilization of AI-based tools and applications helps farmers in accurate and controlled farm practices by providing the required information or appropriate guidance regarding the use of fertilizers, water management, crop rotation, pest control, and type of crop to be grown as per soil, nutrition management, and optimum planting. AI-based tools are used to control diseases and many types of pests on farms. They use satellite imagery and compare it with the historical data using specific AI algorithms so as to check the type of insect or whether any insect is landed on the farm. AI is also used in forecasting weather that helps farmers decide the type and variety of crop to be grown and monitor the soil nutrition level and soil quality. AI-based precision farming techniques help farmers monitor crops’ health which further results in a high-quality yield, and provides a lucrative opportunity for expansion in the global and local market.

Segmentation Analysis Of Precision Agriculture Market

By Component, the hardware segment is anticipated to lead the expansion of the precision agriculture market over the forecasted period. The hardware segment has been further segmented into sensing devices, antennas, automation and control systems, and access points. The hardware components such as automation and control systems, sensing devices, and drones play a vital role in helping farmers with crop plantation. For instance, the GIS guidance system is crucial for growers as it visualizes environmental conditions and agricultural workflow. In addition to this, the VRT technology also helps farmers in determining areas that need more pesticides and seeds thereby distributing them equally across the field.

By Technology, GPS-based technology segment is expected to have the highest share of the precision agriculture market. GPS-based Auto-guidance technology allows growers to reduce the overlapping of equipment and tractor passes, saving fuel, labor, time, and soil compaction. It also helps farmers in boosting productivity and expanding their farm operations. GPS-based systems also offer several benefits such as extending hours of operations, increasing yield and saving time, increasing application accuracy as well as enhancing operational safety which further helps in propelling the growth of this segment.

By Application, the yield monitoring segment is the dominating segment and is anticipated to continue its dominance over the forecast period. Yield monitoring helps the farmers to make accurate and profitable decisions about their fields. The segment is further divided into on-farm yield monitoring and off-farm yield monitoring. On-farm yield monitoring offers farmers for creating a historical spatial database as well as obtaining real-time information during harvest. This segment is further estimated to hold the largest share of the market for precision farming as it provides documentation of environmental compliance, equitable landlord negotiations, and track records for food safety.

Regional Analysis of Precision Agriculture Market

North America, particularly the United States, holds a dominant position in the global precision agriculture market. The region boasts a strong technological infrastructure, early adoption of precision farming practices, and a well-established agricultural sector. The presence of leading agricultural equipment manufacturers and technology providers has further solidified North America's leadership. Additionally, government support for agricultural innovation and research has fostered a conducive environment for the growth of precision agriculture in the region.

While North America remains the frontrunner, other regions are catching up rapidly. The Asia Pacific region, driven by countries like China and India, is experiencing substantial growth due to increasing agricultural challenges, rising demand for food, and government initiatives promoting technology adoption. Europe is also a significant market with a focus on sustainable agriculture and precision technologies.

Top Key Players Covered In Precision Agriculture Market

- AgJunction Inc. (Canada)

- Raven Industries Inc. (U.S)

- CNH Industrial N.V. (U.K)

- Deere & Company (U.S)

- Trimble, Inc. (U.S)

- Iteris Inc. (U.S)

- Topcon Corporation (Japan)

- PrecisionHawk (U.S)

- SenseFly (Cheseaux-sur-Lausanne)

- DICKEY-john (Auburn)

- SST Development Group, Inc. (U.S)

- Agribotix LLC (U.S), and other major players.

Key Industry Development In The Precision Agriculture Market

- In May 2024, The National Sorghum Producers (NSP) and Farmers Edge, a leading digital ag firm, are excited to unveil a new strategic partnership aimed at advancing sustainable farming practices for sorghum producers.

- In July 2023, Deere & Company has acquired Smart Apply, Inc. (US), a manufacturer of precision spraying equipment. This acquisition is expected to enhance the company’s focus on high-value crop dealers and clients while broadening its service offerings to address key challenges such as labor, input costs, and regulatory compliance.

- In March 2023, Case IH Agriculture announced a partnership with Agri Technovation to enhance farming accuracy. The Case IH AFS system provides farmers with exceptional precision in planting, spraying, and harvesting, while Agri Technovation offers thorough data analysis from planting through post-harvest.

|

Global Precision Agriculture Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9,253.55 Mn. |

|

Forecast Period 2024-32 CAGR: |

11.4% |

Market Size in 2032: |

USD 24,449.79 Mn. |

|

Segments Covered: |

By Component |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Precision Agriculture Market by Component (2018-2032)

4.1 Precision Agriculture Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

4.5 Services

Chapter 5: Precision Agriculture Market by Technology (2018-2032)

5.1 Precision Agriculture Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Remote sensing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 GPS/GNSS systems

5.5 Variable rate technology

5.6 Guidance software

5.7 Geomapping

Chapter 6: Precision Agriculture Market by Application (2018-2032)

6.1 Precision Agriculture Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Crop Management

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Weather Forecasting

6.5 Irrigation Management

6.6 Field Mapping

6.7 Yield Monitoring

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Precision Agriculture Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAYER AG

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CARGILL

7.4 SYNGENTA

7.5 DOW AGROSCIENCES

7.6 NUTRIEN

7.7 ADM (ARCHER DANIELS MIDLAND)

7.8 AGRI-TECH EAST

7.9 HELIAE DEVELOPMENT

7.10 SOIL CAPITAL

7.11 ECOVATIVE DESIGN

7.12 KELLOGG COMPANY

7.13 UNILEVER

7.14 DANONE

7.15 GENERAL MILLS

7.16 AGRIWEBB

7.17 PIVOT BIO

7.18 AGREENA

7.19 INDIGO AG

7.20 REGENERATIVE AGRICULTURE ALLIANCE

7.21 AND

Chapter 8: Global Precision Agriculture Market By Region

8.1 Overview

8.2. North America Precision Agriculture Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Component

8.2.4.1 Hardware

8.2.4.2 Software

8.2.4.3 Services

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Remote sensing

8.2.5.2 GPS/GNSS systems

8.2.5.3 Variable rate technology

8.2.5.4 Guidance software

8.2.5.5 Geomapping

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Crop Management

8.2.6.2 Weather Forecasting

8.2.6.3 Irrigation Management

8.2.6.4 Field Mapping

8.2.6.5 Yield Monitoring

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Precision Agriculture Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Component

8.3.4.1 Hardware

8.3.4.2 Software

8.3.4.3 Services

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Remote sensing

8.3.5.2 GPS/GNSS systems

8.3.5.3 Variable rate technology

8.3.5.4 Guidance software

8.3.5.5 Geomapping

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Crop Management

8.3.6.2 Weather Forecasting

8.3.6.3 Irrigation Management

8.3.6.4 Field Mapping

8.3.6.5 Yield Monitoring

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Precision Agriculture Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Component

8.4.4.1 Hardware

8.4.4.2 Software

8.4.4.3 Services

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Remote sensing

8.4.5.2 GPS/GNSS systems

8.4.5.3 Variable rate technology

8.4.5.4 Guidance software

8.4.5.5 Geomapping

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Crop Management

8.4.6.2 Weather Forecasting

8.4.6.3 Irrigation Management

8.4.6.4 Field Mapping

8.4.6.5 Yield Monitoring

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Precision Agriculture Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Component

8.5.4.1 Hardware

8.5.4.2 Software

8.5.4.3 Services

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Remote sensing

8.5.5.2 GPS/GNSS systems

8.5.5.3 Variable rate technology

8.5.5.4 Guidance software

8.5.5.5 Geomapping

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Crop Management

8.5.6.2 Weather Forecasting

8.5.6.3 Irrigation Management

8.5.6.4 Field Mapping

8.5.6.5 Yield Monitoring

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Precision Agriculture Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Component

8.6.4.1 Hardware

8.6.4.2 Software

8.6.4.3 Services

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Remote sensing

8.6.5.2 GPS/GNSS systems

8.6.5.3 Variable rate technology

8.6.5.4 Guidance software

8.6.5.5 Geomapping

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Crop Management

8.6.6.2 Weather Forecasting

8.6.6.3 Irrigation Management

8.6.6.4 Field Mapping

8.6.6.5 Yield Monitoring

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Precision Agriculture Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Component

8.7.4.1 Hardware

8.7.4.2 Software

8.7.4.3 Services

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Remote sensing

8.7.5.2 GPS/GNSS systems

8.7.5.3 Variable rate technology

8.7.5.4 Guidance software

8.7.5.5 Geomapping

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Crop Management

8.7.6.2 Weather Forecasting

8.7.6.3 Irrigation Management

8.7.6.4 Field Mapping

8.7.6.5 Yield Monitoring

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Precision Agriculture Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9,253.55 Mn. |

|

Forecast Period 2024-32 CAGR: |

11.4% |

Market Size in 2032: |

USD 24,449.79 Mn. |

|

Segments Covered: |

By Component |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Precision Agriculture Market research report is 2023-2030.

AgJunction Inc. (Canada), Raven Industries Inc. (U.S), CNH Industrial N.V. (U.K), Deere & Company (U.S), Trimble, Inc. (U.S), Iteris Inc. (U.S), Topcon Corporation (Japan), PrecisionHawk (U.S), SenseFly (Cheseaux-sur-Lausanne), DICKEY-john (Auburn), SST Development Group, Inc. (U.S), Agribotix LLC (U.S), and other major players.

The Precision Agriculture Market is segmented into Component, Technology, Application, and region. By Component, the market is categorized into Hardware, Software, and Services. By Technology, the market is categorized into Remote sensing, GPS/GNSS Systems, Variable Rate Technology, Guidance Software, and Geomapping. By Application, the market is categorized into Crop Management, Financial Management, Weather Forecasting, Person & Inventory Management, Irrigation, Field Mapping, Yield Monitoring, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Precision agriculture is an intelligent farming practice for agriculture management that uses information technology to ensure that soil and plants get everything they require for optimum health and productivity, and the utilization of precision agriculture effectively in the farms drives the market growth.

The global market for Precision Agriculture valued at USD 9,253.55 Million in 2023 is projected to reach a revised size of USD 24,449.79 Million by 2032, growing at a CAGR of 11.4% over the period 2024-2032.