Powered Smart Card Market Synopsis:

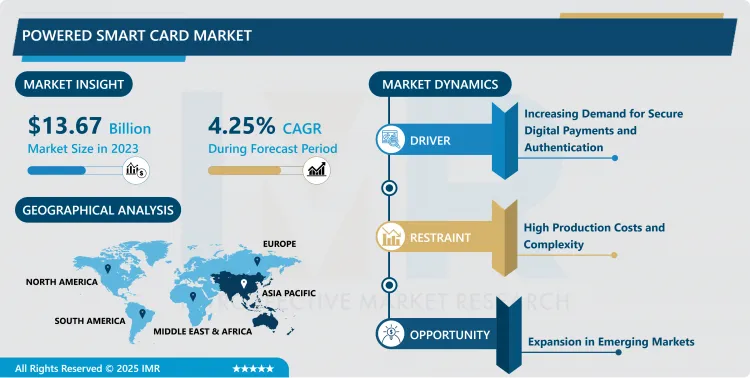

Powered Smart Card Market Size Was Valued at USD 13.67 Billion in 2023, and is Projected to Reach USD 19.88 Billion by 2032, Growing at a CAGR of 4.25% From 2024-2032.

A Powered Smart Card is a superior brand of smart card with built-in power source like battery or energy converter in addition to passive smart card’s functionalities. These cards have the ability to compute, enable encryption, enable operation of applications, and employ interactions with all sorts of devices in a fashion that does not involve recharging from an external power source. Mobile and powered smart card schemes are applied in different areas such as security access systems and applications, payment, identification, and even health care, so it is seen that mobile and powered smart card is a fast-developing segment in the grand total of smart cards.

Powered Smart Card is another sub-sector of smart card that is growing immensely faster than the other sectors within the smart card market due to the demands for better security, no contact card, additional features in the sectors of banking, health, and government. The current application developments include contactless interfaces, voice and fingerprint recognition, encrypted interactions, and energy scavenging technology; this gives them superior performance to smart cards. Contactless smart cards are mostly used in applications that call for more, or permanent connection like in identification systems, web-based purchases etc.

In the last few years, there has been a growing necessity for implementing more complex data protection and authorization in the market. Due to this realization, industries are now adopting powered smart cards for feature delivery since they are more secure, reliable, and efficient than passive smart cards. The availability of biometric such as fingerprint identification, NFC or RFID has further expanded on the usefulness of the models. Furthermore, with the adoption of digital transformation across governments and enterprises demanding an increased usage of secured smart digital identity, powered smart cards have found their market, leading to higher adopt utilisation both in public as well as in private sectors.

Powered Smart Card Market Trend Analysis:

Advancement in Biometric Authentication Integration

- Another significant development across the Powered Smart Card market is seen with the enhanced uses of the biometric authentication systems. Many of the powered smart cards have built-in fingerprint scanner, face recognition and even the iris scan, making the technology even more secure. This has been so driven by the need for more secure and easier to use methods of identification especially in important areas such as in banking, security at borders or in health facilities. These cards are capable of providing fast and quite secure methods of identifying its users through the use of biometric data instead of the physical Personal Identification Numbers or passwords. : This trend is also following the global trending in seeking digital identity solutions since BI METRIC pass through higher degrees of security as compared to identity theft and frauds.

- The integration of the biometric technology with the powered smart card is a major revolution in the realisation of identity verification and authentication. Therefore, industries like the banking and financial, government and healthcare sectors are eyeing on these high-end solutions primarily for strengthening up their protection measures and, at the same time, to make the client interfaces more appealing and intuitive. This trend is believed to rise in the ensuing years as the technology is expected to become cheaper and common in the market hence increasing the probability of organizations incorporating powered smart cards within their organizations.

Rising Demand for Contactless Payment Systems

- The continuous growth of uses of contactless payment systems is creating a vast opportunity for the market of powered smart cards globally. By understanding key user needs consumers who are looking for faster, safer and easier payment solutions with more flexibility requirements are already coming out powered smart cards as an enabling technology of these innovations. That they mitigate direct contact with other people’s hands by handling of items such as money, make them a versatile tool in the payment system. As discussed above, powered smart cards are a unique innovative payment solution for consumer and business to continue making payments, but with ease and customer convenience as the main focus.

- Such are the driving forces that include transition to cashless cultures, popularity of smart devices and mobile application for paying, and safety concerns of the functions of traditional payment systems. Another benefit is that powered smart cards could be fully immersed with these digital payment environments as these possess high end security and particularly have the ability to process complex commands hence making the transactions to be secure, fast and convenient. In addition, as the volume of digital payments grows in international markets, these rising intelligent cards will bring huge market development opportunities.

Powered Smart Card Market Segment Analysis:

Powered Smart Card Market is Segmented on the basis of Type, Application, Component, and Region

By Type, Contact Cards segment is expected to dominate the market during the forecast period

- The Powered Smart Card market is segmented into three main types: Smart Cards are of three types – Contact Cards, Contactless Cards and Dual Interface Cards. The traditional smart cards are called Contact Cards which can only be communicated with if physically touching a reader. These cards are employed in systems that require the protection of transferred information and this includes; Banking sectors, access control systems, governmental identification application. Contact cards are very safe and efficient but seem to have certain drawbacks because their usage involves the insertion of that card into a reader.

- In contrast, Contactless Cards are easier and quicker to use; they scan a reader through Radio Frequency Identity (RFID) without touching it. This kind of card is getting used widely in fields like; public transport payment systems, retail payments and for access in some areas since they take less time to process and are easy to use. Interchangeable type of cards, that is, the cards, which operate on the basis of both contact and contactless systems, are used to perform the operations using either a specific method depending on the current conditions or the circumstances. These cards offer flexibility and high demand for use in tasks that demand both security and easy access such as payment, identification and health care. The idea of cards with two interfaces is becoming more popular because such cards are universal and can be used in various sectors of our economy.

By Application, Retail segment expected to held the largest share

- Powered smart cards are used extensively in the Banking & Financial Services sector because they offer a secure payment mechanism, identification and transactions authorization. Industry: The power smart cards in credit and debit cards and in secure online transactions. As people’s awareness of data loss and scams grows, these cards offer better protection and physiological identifiers than conventional credit cards. Besides, there is an increased use of payments that do not involve contact, and this has created high demand for powered smart card in this sector.

- Therefore, in the Government & Healthcare sectors in particular the powered smart cards find themselves elegant at use in digital identity, access and even healthcare data management. Governments are increasingly adopting these cards for national ID systems, e-passports, along with other identification documents because of their high security and full compatibility with any services. Smart cards applied to healthcare as identification media of patient, access of electronic health records, and secure transaction in medical systems through the use of powered smart cards. Powered smart cards are also being adopted by such segments as Telecom & IT through customer identification for security, Retail through cards as gifts with identification and security features, and Transport through smart cards used in fare systems. These cards provide instant, effective and efficient ways to handle user data, payment and enhancing the quality of services in multiple applications. The flexibility of using powered smart cards in these industries is rapidly expanding their consumption globally.

Powered Smart Card Market Regional Insights:

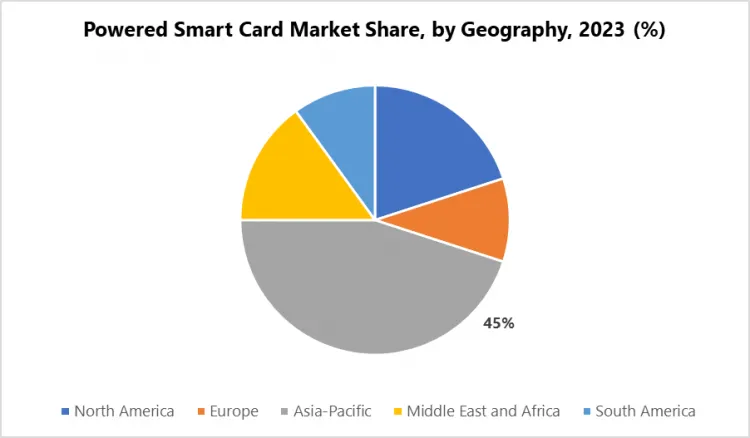

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Looking for the current Powered Smart Card market in 2023, the Asia-Pacific region is expected to dominate the Powered Smart Card market, in terms of market share. It has been seen that some of the major factors having favourable impact on the region include: digitalization of payments, growing need for better authentication solutions, and manufacturing of gadgets in countries such as China, Japan, South Korea. In addition, there has been a rising trend in utilizing powered smart cards in government applications including - national identification systems and it based applications like the districts health information systems have added feather to the region’s hat.

- The Asia-Pacific region may account for 40% to 45% of the Global Market in 2023 owing to the rising use of contactless payment industries, government support networks for digital identity solutions, and the growing necessity of secure access control solutions for healthcare, banking, and telecommunications industries. Moreover, the power holding houses of the superior companies along with the investments on the innovative biometric technologies are also contribute the Asia-Pacific’s dominant position in the powered smart card market.

Active Key Players in the Powered Smart Card Market

- Gemalto (Netherlands)

- Giesecke+Devrient (Germany)

- HID Global (USA)

- Infineon Technologies (Germany)

- Ingenico Group (France)

- Inside Secure (France)

- IDEX Biometrics (Norway)

- NXP Semiconductors (Netherlands)

- Oberthur Technologies (France)

- On Track Innovations (Israel)

- Panasonic Corporation (Japan)

- Samsung Electronics (South Korea)

- Thales Group (France)

- Watch data Technologies (China)

- Wuxi XDC (China) and Other Active Players

Key Industry Developments of Powered Smart Card Market

- In August 2024, Mastercard collaborated with boAt, India’s leading wearables brand, to introduce tap and pay functionality on its smartwatches, aiming to democratize contactless payments and enhance user experience. Through Crest Pay, boAt’s official payment application, Mastercard cardholders could seamlessly tokenize their existing debit and credit cards from supported banks to enable tap and pay. This feature allowed transactions up to INR 5,000 without a PIN using POS devices, providing greater convenience for daily purchases. Powered by Mastercard’s device tokenization with cryptograms, the collaboration ensured fast and highly secure payment experiences for users.

- In October 2024, General Motors Co and Barclays U.S. Consumer Bank announced they had entered into a long-term partnership agreement, making Barclays the exclusive issuer of the GM Rewards Mastercard and the GM Business Mastercard in the United States starting in summer 2025. GM, holding the largest customer base among automakers in the United States, led the industry in loyalty for nine consecutive years, according to S&P Global Mobility. These strengths contributed to the success of GM’s credit card portfolio, launched in 1992, establishing it as one of the nation’s longest-running cobrand credit card programs with millions of dedicated customers.

|

Global Powered Smart Card Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.67 Billion |

|

Forecast Period 2024-32 CAGR: |

4.25 % |

Market Size in 2032: |

USD 19.88 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Powered Smart Card Market by Type (2018-2032)

4.1 Powered Smart Card Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Contact Cards

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Contactless Cards

4.5 Dual-Interface Cards

Chapter 5: Powered Smart Card Market by Application (2018-2032)

5.1 Powered Smart Card Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Banking & Financial Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Government & Healthcare

5.5 Telecom & IT

5.6 Retail

5.7 Transport

Chapter 6: Powered Smart Card Market by Component (2018-2032)

6.1 Powered Smart Card Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Microcontrollers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Memory Chips

6.5 Display Modules

6.6 Biometric Sensors

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Powered Smart Card Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 GEMALTO (NETHERLANDS)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GIESECKE+DEVRIENT (GERMANY)

7.4 HID GLOBAL (USA)

7.5 INFINEON TECHNOLOGIES (GERMANY)

7.6 INGENICO GROUP (FRANCE)

7.7 INSIDE SECURE (FRANCE)

7.8 IDEX BIOMETRICS (NORWAY)

7.9 NXP SEMICONDUCTORS (NETHERLANDS)

7.10 OBERTHUR TECHNOLOGIES (FRANCE)

7.11 ON TRACK INNOVATIONS (ISRAEL)

7.12 PANASONIC CORPORATION (JAPAN)

7.13 SAMSUNG ELECTRONICS (SOUTH KOREA)

7.14 THALES GROUP (FRANCE)

7.15 WATCH DATA TECHNOLOGIES (CHINA)

7.16 WUXI XDC (CHINA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Powered Smart Card Market By Region

8.1 Overview

8.2. North America Powered Smart Card Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Contact Cards

8.2.4.2 Contactless Cards

8.2.4.3 Dual-Interface Cards

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Banking & Financial Services

8.2.5.2 Government & Healthcare

8.2.5.3 Telecom & IT

8.2.5.4 Retail

8.2.5.5 Transport

8.2.6 Historic and Forecasted Market Size by Component

8.2.6.1 Microcontrollers

8.2.6.2 Memory Chips

8.2.6.3 Display Modules

8.2.6.4 Biometric Sensors

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Powered Smart Card Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Contact Cards

8.3.4.2 Contactless Cards

8.3.4.3 Dual-Interface Cards

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Banking & Financial Services

8.3.5.2 Government & Healthcare

8.3.5.3 Telecom & IT

8.3.5.4 Retail

8.3.5.5 Transport

8.3.6 Historic and Forecasted Market Size by Component

8.3.6.1 Microcontrollers

8.3.6.2 Memory Chips

8.3.6.3 Display Modules

8.3.6.4 Biometric Sensors

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Powered Smart Card Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Contact Cards

8.4.4.2 Contactless Cards

8.4.4.3 Dual-Interface Cards

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Banking & Financial Services

8.4.5.2 Government & Healthcare

8.4.5.3 Telecom & IT

8.4.5.4 Retail

8.4.5.5 Transport

8.4.6 Historic and Forecasted Market Size by Component

8.4.6.1 Microcontrollers

8.4.6.2 Memory Chips

8.4.6.3 Display Modules

8.4.6.4 Biometric Sensors

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Powered Smart Card Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Contact Cards

8.5.4.2 Contactless Cards

8.5.4.3 Dual-Interface Cards

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Banking & Financial Services

8.5.5.2 Government & Healthcare

8.5.5.3 Telecom & IT

8.5.5.4 Retail

8.5.5.5 Transport

8.5.6 Historic and Forecasted Market Size by Component

8.5.6.1 Microcontrollers

8.5.6.2 Memory Chips

8.5.6.3 Display Modules

8.5.6.4 Biometric Sensors

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Powered Smart Card Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Contact Cards

8.6.4.2 Contactless Cards

8.6.4.3 Dual-Interface Cards

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Banking & Financial Services

8.6.5.2 Government & Healthcare

8.6.5.3 Telecom & IT

8.6.5.4 Retail

8.6.5.5 Transport

8.6.6 Historic and Forecasted Market Size by Component

8.6.6.1 Microcontrollers

8.6.6.2 Memory Chips

8.6.6.3 Display Modules

8.6.6.4 Biometric Sensors

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Powered Smart Card Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Contact Cards

8.7.4.2 Contactless Cards

8.7.4.3 Dual-Interface Cards

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Banking & Financial Services

8.7.5.2 Government & Healthcare

8.7.5.3 Telecom & IT

8.7.5.4 Retail

8.7.5.5 Transport

8.7.6 Historic and Forecasted Market Size by Component

8.7.6.1 Microcontrollers

8.7.6.2 Memory Chips

8.7.6.3 Display Modules

8.7.6.4 Biometric Sensors

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Powered Smart Card Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.67 Billion |

|

Forecast Period 2024-32 CAGR: |

4.25 % |

Market Size in 2032: |

USD 19.88 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Powered Smart Card Market research report is 2024-2032.

Gemalto (Netherlands), Giesecke+Devrient (Germany), HID Global (USA), Infineon Technologies (Germany), Ingenico Group (France), Inside Secure (France), IDEX Biometrics (Norway), NXP Semiconductors (Netherlands), Oberthur Technologies (France), On Track Innovations (Israel), Panasonic Corporation (Japan), Samsung Electronics (South Korea), Thales Group (France), Watch data Technologies (China), Wuxi XDC (China) and Other Active Players.

The Powered Smart Card Market is segmented into Type, Application, By Component and region. By Type, the market is categorized into Contact Cards, Contactless Cards, Dual-Interface Cards), Application, the market is categorized into (Banking & Financial Services, Government & Healthcare, Telecom & IT, Retail, Transport), By Component, the market is categorized into (Microcontrollers, Memory Chips, Display Modules, Biometric Sensors. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

A Powered Smart Card is a superior brand of smart card with built-in power source like battery or energy converter in addition to passive smart card’s functionalities. These cards have the ability to compute, enable encryption, enable operation of applications, and employ interactions with all sorts of devices in a fashion that does not involve recharging from an external power source. Mobile and powered smart card schemes are applied in different areas such as security access systems and applications, payment, identification, and even health care, so it is seen that mobile and powered smart card is a fast-developing segment in the grand total of smart cards.

Powered Smart Card Market Size Was Valued at USD 13.67 Billion in 2023, and is Projected to Reach USD 19.88 Billion by 2032, Growing at a CAGR of 4.25% From 2024-2032.