Phosphates for Animal Feed or Nutrition Market Synopsis

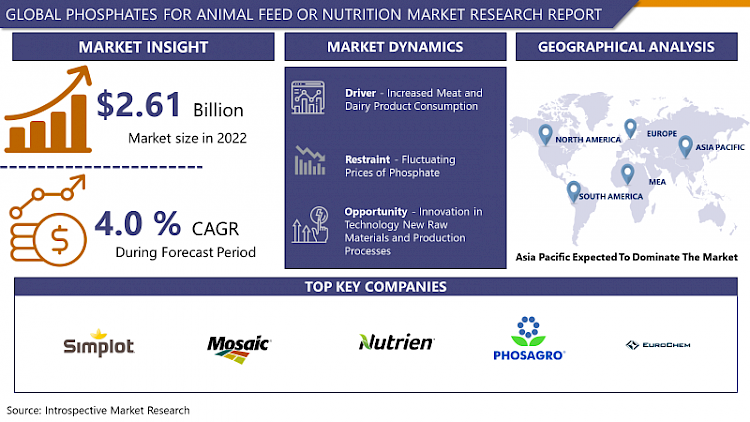

Global Phosphates for Animal Feed or Nutrition Market Size Was Valued at USD 2.61 Billion in 2022, and is Projected to Reach USD 3.57 Billion by 2030, Growing at a CAGR of 4.0 % From 2023-2030

Phosphates utilized in animal feed or nutrition are vital compounds that actively contribute to the comprehensive health and growth of livestock. They are essential in facilitating bone formation, metabolic processes, and overall well-being. Compounds like Monocalcium Phosphate serve as essential elements in feed formulations, guaranteeing efficient nutrient utilization and elevating the productivity of animals in both the agricultural and livestock sectors

- The utilization of phosphates in animal feed or nutrition is diverse and crucial for sustaining the health and productivity of livestock. Phosphates, such as Monocalcium Phosphate, are extensively incorporated into feed formulations to provide essential phosphorus and calcium. These compounds actively contribute to bone development, metabolic processes, and overall growth across various animal species. The precise integration of phosphates ensures a well-balanced diet for animals, meeting their nutritional requirements and fostering optimal health.

- Phosphates enhance the bioavailability of essential nutrients, facilitating efficient absorption in the digestive systems of animals. in preventing nutritional deficiencies, ultimately enhancing the quality of animal products like meat and dairy. Additionally, phosphates contribute to addressing environmental concerns by reducing phosphorus excretion in animal waste, aligning with sustainable farming practices.

- The future demand for phosphates in animal feed or nutrition is expected to witness steady growth. With the global population on the rise and dietary preferences shifting towards protein-rich diets, there will be an increasing need for efficient and sustainable animal farming. Phosphates, given their crucial role in enhancing animal nutrition, are poised to play a central role in meeting this demand. Ongoing advancements in agricultural practices and an increasing awareness of the importance of animal welfare further emphasize the potential for sustained and growing demand for phosphates in the foreseeable future.'

Phosphates for Animal Feed or Nutrition Market Trend Analysis:

Increased Meat and Dairy Product Consumption

- The expansion of the Phosphates for Animal Feed or Nutrition market is significantly propelled by the increasing consumer demand for meat and dairy products. The surge in meat and dairy consumption, particularly in developing regions, actively fuels the market's growth due to the rising preference for protein-rich diets. This dietary shift serves as a primary catalyst, fostering a robust market for phosphates that play an indispensable role in enhancing animal nutrition.

- A crucial factor contributing to the growth of the Phosphates for Animal Feed or Nutrition market is these compounds' pivotal role in fostering livestock health. Phosphates actively contribute to the development of strong bones and teeth in animals, ensuring their overall well-being. Moreover, phosphates positively impact metabolic processes, actively promoting efficient nutrient utilization. This aspect sustains the growing demand for quality animal products, highlighting the indispensable nature of phosphates in animal nutrition.

- In the dynamic landscape of agriculture and livestock, the flourishing Phosphates for Animal Feed or Nutrition market is driven by the escalating need for improved feed formulations. Market participants are actively responding to the heightened demand for specialized feed additives that optimize animal nutrition. This proactive approach not only addresses current market requirements but also positions phosphates as crucial components shaping the future trajectory of animal feed and nutrition.

Innovation in Technology New Raw Materials and Production Processes

- The growth of the Phosphates for Animal Feed or Nutrition market is experiencing significant momentum driven by technological innovation, the introduction of new raw materials, and advancements in production processes. Technological breakthroughs are actively creating opportunities for improved efficiency and effectiveness in phosphate manufacturing. These innovations contribute to a streamlined production cycle, positively impacting the market's overall growth as stakeholders leverage cutting-edge solutions to meet evolving demands.

- The introduction of new raw materials plays a pivotal role in transforming the landscape of the Phosphates for Animal Feed or Nutrition market. Actively exploring and incorporating alternative sources contribute to diversifying the raw material base, ensuring a sustainable and resilient supply chain. This strategic shift not only addresses environmental concerns but also fosters market growth by creating opportunities for novel formulations, aligning with the dynamic needs of the animal feed and nutrition sector.

- The phosphates for the Animal Feed or Nutrition market is the continuous evolution of production processes. Embracing and implementing efficient manufacturing techniques actively enhances the market's competitiveness and responsiveness. This proactive approach not only meets the current demand for phosphates but positions the industry to capitalize on future opportunities, showcasing the sector's adaptability and commitment to ongoing improvement.

Phosphates for Animal Feed or Nutrition Market Segment Analysis:

Phosphates for Animal Feed or Nutrition Market Segmented on the basis of Type, Form, and Livestock

By Livestock, Poultry segment is expected to dominate the market during the forecast period

- The Poultry segment's dominance in propelling the growth of the Phosphates for Animal Feed or Nutrition market can be attributed to various factors. The active expansion of the poultry industry, driven by increasing consumer demand for poultry products, boosts the requirement for enhanced animal nutrition. Phosphates play a pivotal role in promoting the health and growth of poultry, thereby contributing to the productivity of the sector.

- The adaptability and efficiency of phosphates in poultry feed formulations actively contribute to their prominence. These compounds play a crucial role in supporting bone development, metabolic functions, and overall well-being in poultry. As the poultry industry continues to witness expansion and intensification, the demand for phosphates in animal feed formulations experiences a significant rise, solidifying the Poultry segment as a key driver in shaping the growth trajectory of the Phosphates for Animal Feed or Nutrition market.

By Type, Monocalcium Phosphate segment held the largest share of 43.50% in 2022

- The leading share of the Monocalcium Phosphate segment in driving the growth of the Phosphates for Animal Feed or Nutrition market. its prevalence in animal feed formulations stems from the versatility and effectiveness of Monocalcium Phosphate in providing essential phosphorus and calcium for livestock. This segment actively fulfills the nutritional requirements of various animals, significantly contributing to their overall health and productivity.

- The ease of integration into feed formulations and the bioavailability of nutrients make Monocalcium Phosphate a preferred choice for manufacturers. Its active role in supporting bone development and metabolic functions in animals positions it as a crucial component in the animal nutrition landscape. The consistent demand for efficient and reliable phosphate sources in animal feed formulations underscores the dominance of the Monocalcium Phosphate segment, establishing it as a key contributor to the market's substantial share.

Phosphates for Animal Feed or Nutrition Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The leading role of Asia Pacific in driving the growth of the Phosphates for Animal Feed or Nutrition market can be attributed to several crucial factors. The region is actively witnessing a growing demand for meat and dairy products, driven by an expanding population and rising disposable incomes. This increased demand for animal products amplifies the necessity for enhanced animal nutrition, with phosphates being essential in meeting these evolving requirements.

- The proactive adoption of advanced agricultural practices and a rising awareness of the importance of animal nutrition in various countries across the Asia Pacific contribute to the region's prominence in the market. As the agriculture and livestock sectors undergo modernization, there is a heightened emphasis on optimizing feed formulations, with phosphates being integral to this process. This dynamic landscape positions Asia Pacific at the forefront of the Phosphates for Animal Feed or Nutrition market's growth, underscoring its major influence on the direction of the industry.

Phosphates for Animal Feed or Nutrition Market Top Key Players:

- J. R. Simplot Company (US)

- Mosiac (US)

- Nutrien Ltd. (Canada)

- Phosagro (Russia)

- EuroChem Group (Switzerland)

- Elixir Group (Balkans)

- Prayon Group (Belgium)

- Yara International ASA (Norway)

- Fosfitalia Group (Italy)

- AB LIFOSA (Spain)

- Sinochem Group (China)

- WengFu Group Co., Ltd. (China)

- Reanjoy Laboratories (China)

- Sichuan Lomon Corporation (China)

- Tata Chemicals (India)

- Rotem (Turkey)

- OCP Group (North Africa)

- Phosphea (North Africa), and Other Major Players.

Key Industry Developments in the Phosphates for Animal Feed or Nutrition Market:

- In April 2022, PHOSPHEA unveiled a groundbreaking advancement in the world of phosphates with the introduction of HumIPHORA. This calcium humophosphate has secured its place in the European Animal Feed Register (008979-EN). Marking a pioneering entry into the market, Phosphea's HumIPHORA offers a high-quality phosphorus solution that enhances the efficient utilization of other nutrients, particularly plant-based phosphorus. Unlike conventional sources in the market, HumIPHORA diminishes the need for incorporating phosphate in formulations.

- In February 2022, EuroChem Group successfully concluded the acquisition of the Serra Salitre phosphate project in Brazil. This strategic move is poised to accelerate the development of phosphates, potentially leading to increased sales of animal feed phosphate in the upcoming years.

|

Global Phosphates for Animal Feed or Nutrition Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.61 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.0 % |

Market Size in 2030: |

USD 3.57 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET BY TYPE (2016-2030)

- PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MONOCALCIUM PHOSPHATE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DICALCIUM PHOSPHATE

- MONO-DICALCIUM PHOSPHATE

- TRICALCIUM PHOSPHATE

- DEFLUORINATED PHOSPHATE

- PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET BY FORM (2016-2030)

- PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POWDER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GRANULE

- PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET BY LIVESTOCK (2016-2030)

- PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POULTRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SWINE

- CATTLE

- AQUATIC ANIMALS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Phosphates for Animal Feed or Nutrition Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- J. R. SIMPLOT COMPANY (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MOSIAC (US)

- NUTRIEN LTD. (CANADA)

- PHOSAGRO (RUSSIA)

- EUROCHEM GROUP (SWITZERLAND)

- ELIXIR GROUP (BALKANS)

- PRAYON GROUP (BELGIUM)

- YARA INTERNATIONAL ASA (NORWAY)

- FOSFITALIA GROUP (ITALY)

- AB LIFOSA (SPAIN)

- SINOCHEM GROUP (CHINA)

- WENGFU GROUP CO., LTD. (CHINA)

- REANJOY LABORATORIES (CHINA)

- SICHUAN LOMON CORPORATION (CHINA)

- TATA CHEMICALS (INDIA)

- ROTEM (TURKEY)

- OCP GROUP (NORTH AFRICA)

- PHOSPHEA (NORTH AFRICA)

- COMPETITIVE LANDSCAPE

- GLOBAL PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Livestock

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Phosphates for Animal Feed or Nutrition Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.61 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.0 % |

Market Size in 2030: |

USD 3.57 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET COMPETITIVE RIVALRY

TABLE 005. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET THREAT OF NEW ENTRANTS

TABLE 006. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET THREAT OF SUBSTITUTES

TABLE 007. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET BY TYPE

TABLE 008. DICALCIUM PHOSPHATES MARKET OVERVIEW (2016-2028)

TABLE 009. MONOCALCIUM PHOSPHATES MARKET OVERVIEW (2016-2028)

TABLE 010. MONO-DICALCIUM PHOSPHATE MARKET OVERVIEW (2016-2028)

TABLE 011. TRICALCIUM PHOSPHATE MARKET OVERVIEW (2016-2028)

TABLE 012. DEFLUORINATED PHOSPHATE MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET BY APPLICATION

TABLE 015. POULTRY MARKET OVERVIEW (2016-2028)

TABLE 016. SWINE MARKET OVERVIEW (2016-2028)

TABLE 017. RUMINANTS MARKET OVERVIEW (2016-2028)

TABLE 018. AQUACULTURE MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY APPLICATION (2016-2028)

TABLE 022. N PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY APPLICATION (2016-2028)

TABLE 025. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY APPLICATION (2016-2028)

TABLE 028. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY APPLICATION (2016-2028)

TABLE 031. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY COUNTRY (2016-2028)

TABLE 032. SOUTH AMERICA PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY TYPE (2016-2028)

TABLE 033. SOUTH AMERICA PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY APPLICATION (2016-2028)

TABLE 034. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET, BY COUNTRY (2016-2028)

TABLE 035. MOSAIC COMPANY (US): SNAPSHOT

TABLE 036. MOSAIC COMPANY (US): BUSINESS PERFORMANCE

TABLE 037. MOSAIC COMPANY (US): PRODUCT PORTFOLIO

TABLE 038. MOSAIC COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. PHOSPHEA (FRANCE): SNAPSHOT

TABLE 039. PHOSPHEA (FRANCE): BUSINESS PERFORMANCE

TABLE 040. PHOSPHEA (FRANCE): PRODUCT PORTFOLIO

TABLE 041. PHOSPHEA (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. NUTRIEN LTD. (CANADA): SNAPSHOT

TABLE 042. NUTRIEN LTD. (CANADA): BUSINESS PERFORMANCE

TABLE 043. NUTRIEN LTD. (CANADA): PRODUCT PORTFOLIO

TABLE 044. NUTRIEN LTD. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. OCP GROUP (MOROCCO): SNAPSHOT

TABLE 045. OCP GROUP (MOROCCO): BUSINESS PERFORMANCE

TABLE 046. OCP GROUP (MOROCCO): PRODUCT PORTFOLIO

TABLE 047. OCP GROUP (MOROCCO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. YARA INTERNATIONAL ASA (NORWAY): SNAPSHOT

TABLE 048. YARA INTERNATIONAL ASA (NORWAY): BUSINESS PERFORMANCE

TABLE 049. YARA INTERNATIONAL ASA (NORWAY): PRODUCT PORTFOLIO

TABLE 050. YARA INTERNATIONAL ASA (NORWAY): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET OVERVIEW BY TYPE

FIGURE 012. DICALCIUM PHOSPHATES MARKET OVERVIEW (2016-2028)

FIGURE 013. MONOCALCIUM PHOSPHATES MARKET OVERVIEW (2016-2028)

FIGURE 014. MONO-DICALCIUM PHOSPHATE MARKET OVERVIEW (2016-2028)

FIGURE 015. TRICALCIUM PHOSPHATE MARKET OVERVIEW (2016-2028)

FIGURE 016. DEFLUORINATED PHOSPHATE MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET OVERVIEW BY APPLICATION

FIGURE 019. POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 020. SWINE MARKET OVERVIEW (2016-2028)

FIGURE 021. RUMINANTS MARKET OVERVIEW (2016-2028)

FIGURE 022. AQUACULTURE MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA PHOSPHATES FOR ANIMAL FEED OR NUTRITION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Phosphates for Animal Feed or Nutrition Market research report is 2023-2030

J. R. Simplot Company (US), Mosiac (US), Nutrien Ltd. (Canada), Phosagro (Russia), EuroChem Group (Switzerland), Elixir Group (Balkans), Prayon Group (Belgium), Yara International ASA (Norway), Fosfitalia Group (Italy), AB LIFOSA (Spain), Sinochem Group (China), WengFu Group Co., Ltd. (China), Reanjoy Laboratories (China), Sichuan Lomon Corporation (China), Tata Chemicals (India), Rotem (Turkey), OCP Group (North Africa), Phosphea (North Africa), and Other Major Players.

The Phosphates for Animal Feed or Nutrition Market is segmented into Type, Form, Livestock, and region. By Type, the market is categorized into Monocalcium Phosphate, Dicalcium Phosphate, Mono-Dicalcium Phosphate, Tricalcium Phosphate and Defluorinated Phosphate. By Form, the market is categorized into Powder and Granule. By Livestock, the market is categorized into Poultry, Swine, Cattle and Aquatic Animals. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Phosphates utilized in animal feed or nutrition are vital compounds that actively contribute to the comprehensive health and growth of livestock. They are essential in facilitating bone formation, metabolic processes, and overall well-being. Compounds like Monocalcium Phosphate serve as essential elements in feed formulations, guaranteeing efficient nutrient utilization and elevating the productivity of animals in both the agricultural and livestock sectors.

Global Phosphates for Animal Feed or Nutrition Market Size Was Valued at USD 2.61 Billion in 2022, and is Projected to Reach USD 3.57 Billion by 2030, Growing at a CAGR of 4.0 % From 2023-2030