Personal Finance Software Market Overview

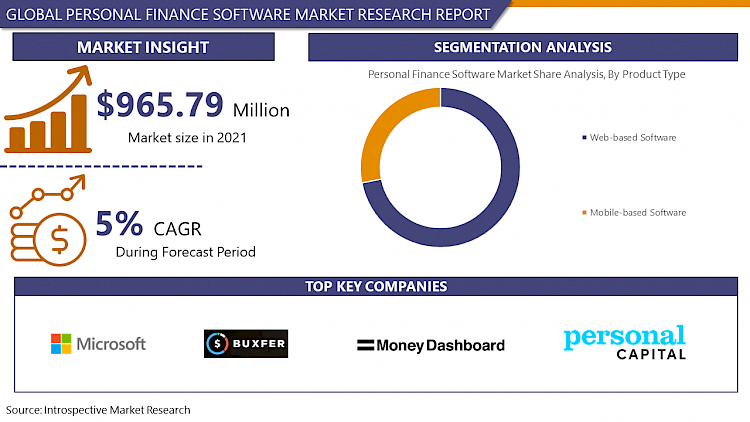

Global Personal Finance Software Market Size Was Valued at USD 1.01 Billion In 2022 And Is Projected to Reach USD 1.49 Billion By 2030, Growing at A CAGR of 5.0% From 2023 To 2030.

Personal finance software is a tool that integrates and extracts a user's financial data in order to achieve a desired analytical performance for better financial planning. This software tool accepts a wide range of financial data and can be used for a number of tasks like financial transactions, bank records management, investment monitoring, budget management, portfolio management, and more.

Businesses are grappling with organizational problems as a result of the COVID-19 pandemic. To deal with this situation, many banks and financial institutions are offering new digital tools and techniques to their customers, with personal finance apps being one of the most common. Furthermore, the increase in online and mobile banking among end-users as a result of the pandemic offers growth opportunities for the personal finance software industry. Furthermore, several banks and fintech firms have launched a range of appealing banking strategies to inspire SMEs and customers to use Personal Finance Software tools, resulting in a multitude of business growth opportunities.

Personal Finance Software Market Dynamics

The personal finance software market is being driven by the wide availability of digital services and smartphone applications that can handle your Personal finance software. Personal finance apps will help you improve your financial literacy and reduce uncertainty. This Personal finance software is simple to store and archive and various programs can be used on your PC or on your mobile, with some of the more sophisticated ones assisting with debt reduction, budget management, and even providing financial advice as an added service. Technological advances in new product growth, as well as the availability of free and low-cost goods, as well as digital trends, are driving acceptance. Money-management and tax-preparation software are the two broad types of personal finance software. Quicken, Microsoft Money, and iCash are some of the most well-known money management programs. Mint, Wesabe, and Geezeo are examples of web-based money management programs.

The growing need to track and control customer profits, as well as the proliferation of mobile apps around the world, is moving Personal finance software market forward. Furthermore, Personal finance software market's growth is fueled by an increase in organizations' emphasis on digitizing their financial services and an increase in internet users around the world. However, the market's growth is hampered by security and enforcement problems in Personal finance software applications, as well as the availability of open-source finance software. Additionally, increased adoption of Personal finance software applications in developed economies is projected to provide lucrative market growth opportunities.

Market Segmentation

The Web-based Software Segment Is Accounted For The Highest Share In 2019

Personal finance software market is rising due to the high security offered by web-based Personal finance software applications, which are backed up by anti-virus and anti-malware solutions. The mobile-based apps segment, on the other hand, is expected to rise at the fastest pace during the forecast era, owing to the increased adoption of mobile phones around the world and the increased penetration of smartphones in various industries.

Geographical Outlook Of The Market

North America dominated the personal finance software market growth in 2019 and is predicted to continue to do so throughout the forecast period. The presence of major players and the rapid adoption of cutting-edge technology are two major factors driving Personal finance software market's growth in this area. However, due to booming IT infrastructure and major investments from private and public players in the region, Asia-Pacific is expected to rise at a significant rate during the forecast era.

Key Vendors in Personal Finance Software market are :

- BUXFER

- Quicken

- The Infinite Kind

- YNAB

- Alzex software

- Microsoft

- Doxo

- Personal Capital

- Money Dashboard

- Prosper Funding

- PocketSmith

- CountAbout

- Finicity

- Moneyspire

- CoinKeeper

- BankTree Software and other major players.

These players have implemented several strategies to boost their market penetration and strengthen their position in the global market.

|

Global Personal Finance Software Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 1.01 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.0% |

Market Size in 2030: |

USD 1.49 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By End-Use

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Personal Finance Software Market by Type

5.1 Personal Finance Software Market Overview Snapshot and Growth Engine

5.2 Personal Finance Software Market Overview

5.3 Web-based Software

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Web-based Software: Grographic Segmentation

5.4 Mobile-based Software

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Mobile-based Software: Grographic Segmentation

Chapter 6: Personal Finance Software Market by End-Use

6.1 Personal Finance Software Market Overview Snapshot and Growth Engine

6.2 Personal Finance Software Market Overview

6.3 Small Businesses Users

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Small Businesses Users: Grographic Segmentation

6.4 Individual Consumers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Individual Consumers: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Personal Finance Software Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Personal Finance Software Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Personal Finance Software Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 BUXFER

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 QUICKEN

7.4 THE INFINITE KIND

7.5 YNAB

7.6 ALZEX SOFTWARE

7.7 MICROSOFT

7.8 DOXO

7.9 PERSONAL CAPITAL

7.10 MONEY DASHBOARD

7.11 PROSPER FUNDING

7.12 POCKETSMITH

7.13 COUNTABOUT

7.14 FINICITY

7.15 MONEYSPIRE

7.16 COINKEEPER

7.17 BANKTREE SOFTWARE

7.18 OTHER MAJOR PLAYERS

Chapter 8: Global Personal Finance Software Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Web-based Software

8.2.2 Mobile-based Software

8.3 Historic and Forecasted Market Size By End-Use

8.3.1 Small Businesses Users

8.3.2 Individual Consumers

Chapter 9: North America Personal Finance Software Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Web-based Software

9.4.2 Mobile-based Software

9.5 Historic and Forecasted Market Size By End-Use

9.5.1 Small Businesses Users

9.5.2 Individual Consumers

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Personal Finance Software Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Web-based Software

10.4.2 Mobile-based Software

10.5 Historic and Forecasted Market Size By End-Use

10.5.1 Small Businesses Users

10.5.2 Individual Consumers

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Personal Finance Software Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Web-based Software

11.4.2 Mobile-based Software

11.5 Historic and Forecasted Market Size By End-Use

11.5.1 Small Businesses Users

11.5.2 Individual Consumers

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Personal Finance Software Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Web-based Software

12.4.2 Mobile-based Software

12.5 Historic and Forecasted Market Size By End-Use

12.5.1 Small Businesses Users

12.5.2 Individual Consumers

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Personal Finance Software Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Web-based Software

13.4.2 Mobile-based Software

13.5 Historic and Forecasted Market Size By End-Use

13.5.1 Small Businesses Users

13.5.2 Individual Consumers

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Personal Finance Software Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2021 |

Market Size in 2022: |

USD 1.01 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.0% |

Market Size in 2030: |

USD 1.49 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PERSONAL FINANCE SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PERSONAL FINANCE SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PERSONAL FINANCE SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. PERSONAL FINANCE SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. PERSONAL FINANCE SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. PERSONAL FINANCE SOFTWARE MARKET BY TYPE

TABLE 008. WEB-BASED SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 009. MOBILE-BASED SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 010. PERSONAL FINANCE SOFTWARE MARKET BY END-USE

TABLE 011. SMALL BUSINESSES USERS MARKET OVERVIEW (2016-2028)

TABLE 012. INDIVIDUAL CONSUMERS MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA PERSONAL FINANCE SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA PERSONAL FINANCE SOFTWARE MARKET, BY END-USE (2016-2028)

TABLE 015. N PERSONAL FINANCE SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE PERSONAL FINANCE SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE PERSONAL FINANCE SOFTWARE MARKET, BY END-USE (2016-2028)

TABLE 018. PERSONAL FINANCE SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC PERSONAL FINANCE SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC PERSONAL FINANCE SOFTWARE MARKET, BY END-USE (2016-2028)

TABLE 021. PERSONAL FINANCE SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA PERSONAL FINANCE SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA PERSONAL FINANCE SOFTWARE MARKET, BY END-USE (2016-2028)

TABLE 024. PERSONAL FINANCE SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA PERSONAL FINANCE SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA PERSONAL FINANCE SOFTWARE MARKET, BY END-USE (2016-2028)

TABLE 027. PERSONAL FINANCE SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 028. BUXFER: SNAPSHOT

TABLE 029. BUXFER: BUSINESS PERFORMANCE

TABLE 030. BUXFER: PRODUCT PORTFOLIO

TABLE 031. BUXFER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. QUICKEN: SNAPSHOT

TABLE 032. QUICKEN: BUSINESS PERFORMANCE

TABLE 033. QUICKEN: PRODUCT PORTFOLIO

TABLE 034. QUICKEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. THE INFINITE KIND: SNAPSHOT

TABLE 035. THE INFINITE KIND: BUSINESS PERFORMANCE

TABLE 036. THE INFINITE KIND: PRODUCT PORTFOLIO

TABLE 037. THE INFINITE KIND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. YNAB: SNAPSHOT

TABLE 038. YNAB: BUSINESS PERFORMANCE

TABLE 039. YNAB: PRODUCT PORTFOLIO

TABLE 040. YNAB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. ALZEX SOFTWARE: SNAPSHOT

TABLE 041. ALZEX SOFTWARE: BUSINESS PERFORMANCE

TABLE 042. ALZEX SOFTWARE: PRODUCT PORTFOLIO

TABLE 043. ALZEX SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. MICROSOFT: SNAPSHOT

TABLE 044. MICROSOFT: BUSINESS PERFORMANCE

TABLE 045. MICROSOFT: PRODUCT PORTFOLIO

TABLE 046. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. DOXO: SNAPSHOT

TABLE 047. DOXO: BUSINESS PERFORMANCE

TABLE 048. DOXO: PRODUCT PORTFOLIO

TABLE 049. DOXO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. PERSONAL CAPITAL: SNAPSHOT

TABLE 050. PERSONAL CAPITAL: BUSINESS PERFORMANCE

TABLE 051. PERSONAL CAPITAL: PRODUCT PORTFOLIO

TABLE 052. PERSONAL CAPITAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. MONEY DASHBOARD: SNAPSHOT

TABLE 053. MONEY DASHBOARD: BUSINESS PERFORMANCE

TABLE 054. MONEY DASHBOARD: PRODUCT PORTFOLIO

TABLE 055. MONEY DASHBOARD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. PROSPER FUNDING: SNAPSHOT

TABLE 056. PROSPER FUNDING: BUSINESS PERFORMANCE

TABLE 057. PROSPER FUNDING: PRODUCT PORTFOLIO

TABLE 058. PROSPER FUNDING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. POCKETSMITH: SNAPSHOT

TABLE 059. POCKETSMITH: BUSINESS PERFORMANCE

TABLE 060. POCKETSMITH: PRODUCT PORTFOLIO

TABLE 061. POCKETSMITH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. COUNTABOUT: SNAPSHOT

TABLE 062. COUNTABOUT: BUSINESS PERFORMANCE

TABLE 063. COUNTABOUT: PRODUCT PORTFOLIO

TABLE 064. COUNTABOUT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. FINICITY: SNAPSHOT

TABLE 065. FINICITY: BUSINESS PERFORMANCE

TABLE 066. FINICITY: PRODUCT PORTFOLIO

TABLE 067. FINICITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. MONEYSPIRE: SNAPSHOT

TABLE 068. MONEYSPIRE: BUSINESS PERFORMANCE

TABLE 069. MONEYSPIRE: PRODUCT PORTFOLIO

TABLE 070. MONEYSPIRE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. COINKEEPER: SNAPSHOT

TABLE 071. COINKEEPER: BUSINESS PERFORMANCE

TABLE 072. COINKEEPER: PRODUCT PORTFOLIO

TABLE 073. COINKEEPER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. BANKTREE SOFTWARE: SNAPSHOT

TABLE 074. BANKTREE SOFTWARE: BUSINESS PERFORMANCE

TABLE 075. BANKTREE SOFTWARE: PRODUCT PORTFOLIO

TABLE 076. BANKTREE SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 077. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 078. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 079. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PERSONAL FINANCE SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PERSONAL FINANCE SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. WEB-BASED SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. MOBILE-BASED SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 014. PERSONAL FINANCE SOFTWARE MARKET OVERVIEW BY END-USE

FIGURE 015. SMALL BUSINESSES USERS MARKET OVERVIEW (2016-2028)

FIGURE 016. INDIVIDUAL CONSUMERS MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA PERSONAL FINANCE SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE PERSONAL FINANCE SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC PERSONAL FINANCE SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA PERSONAL FINANCE SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA PERSONAL FINANCE SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Personal Finance Software Market research report is 2023-2030.

BUXFER Inc.; Doxo Inc.; Microsoft Corporation; Money Dashboard; Moneyspire Inc.; Personal Capital Corporation; PocketSmith Ltd.; Quicken Inc.; The Infinite Kind Ltd.; You Need A Budget LLC and other major players.

The Personal Finance Software Market is segmented into Product Type, End User and region. By Product Type, the market is categorized into Web-based Software, Mobile-based Software. By End Use the market is categorized into Small Businesses Users, Individual Consumers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Personal finance software is a tool that integrates and extracts a user's financial data in order to achieve a desired analytical performance for better financial planning. This software tool accepts a wide range of financial data and can be used for a number of tasks like financial transactions, bank records management, investment monitoring, budget management, portfolio management, and more.

Global Personal Finance Software Market Size Was Valued at USD 1.01 Billion In 2022 And Is Projected to Reach USD 1.49 Billion By 2030, Growing at A CAGR of 5.0% From 2023 To 2030.