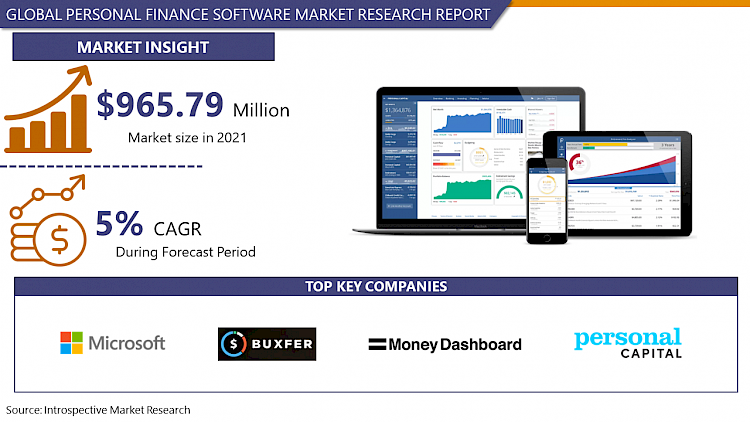

Market Overview

Global Personal Finance Software Market was valued at USD 965.79 million in 2021 and is expected to reach USD 1,358.96 million by the year 2028, at a CAGR of 5%.

Personal finance software is finance management application that simplifies the process of managing finances and improves financial stability by reducing financial mistakes. Web-based and mobile-based personal finance software’s are available in the market, offering customized services to the user. Personal financing means knowing budget planning, balancing a checkbook, calculating funds for major purchases, savings for retirement, planning for taxes, purchase insurance, and investments. For a better future financial plan, personal finance software can assist the user to manage its finances. Different software’s are available for different goals according to the need of the individual. Some software is ideal for budgeting, some are good for investing, and others are right for debt tracking and savings goals. This versatility helps to attract customers thereby, boosting the growth of the personal finance market. According to Statista in 2021, Envestnet MoneyGuidePro was the most popular financial planning software worldwide. Envestnet MoneyGuidePro holds 37% of financial planning and advisory companies globally.

Major Key Players for Personal Finance Software Market

- Buxfer

- Quicken

- The Infinite Kind

- YNAB

- Alzex software

- Microsoft

- Doxo

- Personal Capital

- Money Dashboard

- Prosper Funding

- PocketSmith

- CountAbout

- Finicity

- Moneyspire

- CoinKeeper

- BankTree Software

Market Dynamics and Factors

The personal finance software market is driven by the wide digital services and smartphone applications that are used to handle personal finance software. Personal finance apps will improve financial literacy and reduce uncertainty. Personal finance software is simple to store and archive and various programs can be used on a PC or mobile. This software assists with debt reduction, budget management, and even providing financial advice as an added service. Additionally, technological advances in new product growth and the availability of free and low-cost applications are driving the demand for the personal finance software market. Mint, Wesabe, and Geezeo are examples of web-based money management programs. However, the lack of awareness among the people about financial management and related software hampers the growth of the personal finance software market.

Personal Finance Software Market Report Highlight

- By product type, the mobile-based software segment is expected to have the maximum market share in personal finance software during the projected period. The increasing smartphone penetration and the growing demand for effective financial solutions propel the segment’s growth.

- By end-user, the small business segment is predicted to expand the most in the personal finance software market during the forecast year. Personal finance software can track all the liabilities and assets effectively in a balance sheet of a small business boosting the growth of the market.

- By region, North America is expected to dominate the personal finance software market, during the projected period. The presence of major players and the rapid adoption of cutting-edge technology supports the growth of the personal finance software market in North America.

Key Industry Development

- In July 2020, MoneyGuide announced that MoneyGuide and Envestnet Analytics have teamed up to provide free plan analytics to clients of MoneyGuide. This new service, which will be incorporated into MoneyGuide, will analyze planned utilization, key metrics, and update patterns.

- In October 2021, eMoney Advisor, a leading provider of technology solutions and services that help people talk about money, announced the launch of its new mobile app. The client-led financial planning and wellness app, which is offered through retirement plan advisors, is designed to introduce basic financial planning principles while also encouraging long-term behavioral changes to assist users in achieving their goals in engaging and actionable ways.

Personal Finance Software Market Segmentation

By Product Type

- Web-based Software

- Mobile-based Software

By End-User

- Small Business

- Individual

For this report, Introspective Market Research has segmented the Personal Finance Software Market based on region:

Regional Outlook (Revenue in USD Million; Volume in Units, 2022-2028)

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Turkey

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Vietnam

- Thailand

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- Iran

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of LATAM