Paper Tubes and Cores Market Synopsis

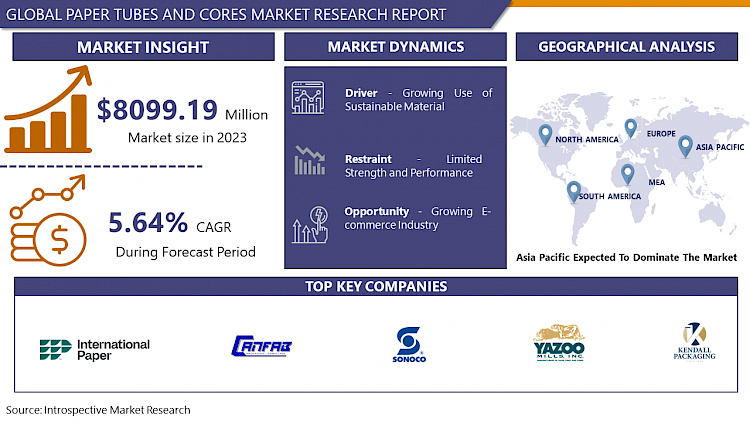

Paper Tubes and Cores Market Size Was Valued at USD 8099.19 Million in 2023, and is Projected to Reach USD 13270.8 Million by 2032, Growing at a CAGR of 5.64% From 2024-2032.

Paper tubes and cores are cylindrical products made from paperboard layers, providing structural support and stability for various industries. They are lightweight and eco-friendly alternatives to traditional materials. Created through spiral, parallel, and convolute winding processes, they contribute to efficient material handling, storage, and transportation, promoting sustainability and versatility in packaging and manufacturing solutions.

- Paper Tubes and Cores are a sustainable and cost-effective packaging solution that is lightweight, recyclable, and eco-friendly. They offer strong support for various materials, ensuring damage-free storage and transport. The market is characterized by an increasing emphasis on eco-friendly and biodegradable packaging solutions, driven by consumer preferences and industry practices. Technological advancements in manufacturing processes improve efficiency and product customization, meeting diverse industry needs.

- The demand for Paper Tubes and Cores is rising across various industries, including textiles, packaging, and manufacturing. The growth in e-commerce and the packaging industry fuels the need for efficient, lightweight, and environmentally friendly solutions. The construction industry's use of paper tubes in concrete formwork further expands the market. The Paper Tubes and Cores market is assured of sustained growth, driven by environmental considerations and evolving consumer preferences for green and recyclable packaging solutions.

Paper Tubes and Cores Market Trend Analysis

Growing Use of Sustainable Material

- The Paper Tubes and Cores market is growing due to the growing preference for sustainable materials. As environmental awareness increases, businesses and consumers are increasingly adopting eco-friendly practices. Paper tubes and cores, made from paperboard, are a preferred attractive choice for industries seeking to reduce their environmental impact, particularly in packaging. They meet strict environmental regulations and appeal to environmentally conscious consumers. The market is witnessing a transition as businesses recognize the economic and ecological benefits of adopting paper-based solutions, contributing to the global push for a more sustainable and circular economy. Paper tubes and cores are key players in the shift towards greener and more responsible packaging practices across various industries.

Growing E-commerce Industry

- As online retail continues to witness rapid growth globally, the demand for efficient and sustainable packaging solutions has surged. Paper Tubes and Cores offer a convincing solution to the unique packaging needs of E-commerce, providing lightweight, durable, and customizable options for the safe transport of various goods. E-commerce has necessitated packaging solutions that are cost-effective, environmentally sustainable, and practical.

- Paper Tubes and Cores are ideal for this, offering versatility in size and thickness to accommodate various products. E-commerce businesses are increasingly building eco-friendly alternatives to reduce packaging waste and carbon footprint. These products bring the evolving needs of the E-commerce sector. Paper Tubes and Cores help promote efficient and environmentally conscious packaging practices and play an essential for growing sustainable product use.

Paper Tubes and Cores Market Segment Analysis:

Paper Tubes and Cores Market Segmented Based on Type, Diameter, Material, and Application.

By Type, Paper Tubes segment is expected to dominate the market during the forecast period

- Paper Tubes and Cores are versatile and are used across various industries contributing to sustainable demand in the market. Industries such as textiles, paper and packaging, and construction utilize paper tubes for applications ranging from yarn winding and paper roll cores to concrete form tubes. The adaptability of paper tubes to different diameters, wall thicknesses, and lengths makes them suitable for diverse applications, solidifying their market position.

- The growing emphasis on sustainability further propels the Paper Tubes segment. With increasing awareness of environmental concerns, businesses are increasingly opting for eco-friendly packaging solutions. Paper tubes, being biodegradable and recyclable, align with these sustainability goals. The Paper Tubes segment is well-positioned to cater to this demand, making it a preferred choice for industries seeking both versatile and environmentally responsible packaging solutions, thus driving its dominance in the overall Paper Tubes and Cores market. The Paper Tubes are made from biodegradable and recyclable material. Businesses are increasingly using it to reduce waste and environmental concerns are contributing to the Paper Tubes and Cores market.

By Material, the Virgin Paperboard segment held the largest share of 62.9% in 2022

- Virgin Paperboard is made from fresh and untreated wood fibers and offers superior strength, rigidity, and purity compared to recycled alternatives. The quality consistency of virgin paperboard is preferred in industries where precision and performance are crucial for the support of delicate or heavy products. The demand for high-quality and durable packaging materials, especially in sectors like textiles, paper and printing, and industrial applications, is expected to drive the dominance of the Virgin Paperboard segment.

Paper Tubes and Cores Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific market is expected to dominate the Paper Tubes and Cores market due to the growth of end-use industries in countries like China, India, Japan, and South Korea. The packaging industry is expanding due to the e-commerce sector and increasing consumer demand for sustainable packaging solutions. Paper Tubes and Cores are cost-effective and eco-friendly alternatives are standing with these trends.

- Asia Pacific's manufacturing infrastructure and development initiatives are contributing to the adoption of various applications, including textiles and construction. The region's urbanization and population growth with environmentally responsible practices, is driving the demand for sustainable packaging solutions. The accessibility of raw materials and prominence on efficient and lightweight packaging in industries like electronics and consumer goods further contribute to the Asia Pacific as a dominant force in the market.

Paper Tubes and Cores Market Top Key Players:

- Sonoco (United States)

- International Paper (United States)

- CBT Cores (United States)

- Valley Industrial Products (United States)

- HBD Packaging (United States)

- Paper Tube Co. (United States)

- Yazoo Mills (United States)

- Ace Paper Tube (United States)

- Canfab Packaging Inc. (Canada)

- Core Products (United Kingdom)

- Kendell Packaging (United Kingdom)

- Moba Eurotubi (Switzerland)

- Mondi (Austria)

- Cylcore (Greece)

- Corenso (Finland)

- Smurfit Kappa (Ireland)

- Xingda International Holdings Ltd (China)

- Nippon Paper Industries Co., Ltd (Japan)

- Sappi (South Africa), and Other Major Players

Key Industry Developments in the Paper Tubes and Cores Market:

- In April 2024, International Paper and DS Smith Plc announced that they had reached an agreement on the terms of a recommended all-share combination, creating a global leader in sustainable packaging solutions. The terms of the Combination valued each DS Smith share at 415 pence per share, resulting in IP issuing 0.1285 shares for each DS Smith share. This led to pro forma ownership of 66.3 percent for IP shareholders and 33.7 percent for DS Smith shareholders, implying a transaction value of approximately $9.9 billion. The Combination was expected to close by the fourth quarter of 2024.

- In January 2024, Sonoco Products Company, one of the largest global sustainable packaging companies, announced that certain of its subsidiaries had entered into a definitive agreement to sell its Protective Solutions business to Black Diamond Capital Management, LLC (“Black Diamond”) for an estimated $80 million in cash. The transaction was subject to customary closing conditions and was expected to be completed in the first half of 2024. This sale resulted from Sonoco’s ongoing evaluation of its business portfolio and was consistent with its strategic and investment priorities.

|

Global Paper Tubes and Cores Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8099.19 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.64% |

Market Size in 2032: |

USD 13270.8 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Diameter |

|

||

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PAPER TUBES AND CORES MARKET BY TYPE (2017-2032)

- PAPER TUBES AND CORES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PAPER TUBES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PAPER CORES

- PAPER TUBES AND CORES MARKET BY DIAMETER (2017-2032)

- PAPER TUBES AND CORES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMALL DIAMETER TUBES AND CORES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDIUM DIAMETER TUBES AND CORES

- LARGE DIAMETER TUBES AND CORES

- PAPER TUBES AND CORES MARKET BY MATERIAL (2017-2032)

- PAPER TUBES AND CORES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- VIRGIN PAPERBOARD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RECYCLED PAPERBOARD

- PAPER TUBES AND CORES MARKET BY APPLICATION (2017-2032)

- PAPER TUBES AND CORES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PACKAGING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TEXTILES

- PAPER AND PRINTING INDUSTRY

- FOOD AND BEVERAGE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- PAPER TUBES AND CORES Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SONOCO (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- INTERNATIONAL PAPER (UNITED STATES)

- CBT CORES (UNITED STATES)

- VALLEY INDUSTRIAL PRODUCTS (UNITED STATES)

- HBD PACKAGING (UNITED STATES)

- PAPER TUBE CO. (UNITED STATES)

- YAZOO MILLS (UNITED STATES)

- ACE PAPER TUBE (UNITED STATES)

- CANFAB PACKAGING INC. (CANADA)

- CORE PRODUCTS (UNITED KINGDOM)

- KENDELL PACKAGING (UNITED KINGDOM)

- MOBA EUROTUBI (SWITZERLAND)

- MONDI (AUSTRIA)

- CYLCORE (GREECE)

- CORENSO (FINLAND)

- SMURFIT KAPPA (IRELAND)

- XINGDA INTERNATIONAL HOLDINGS LTD (CHINA)

- NIPPON PAPER INDUSTRIES CO., LTD (JAPAN)

- SAPPI (SOUTH AFRICA)

- COMPETITIVE LANDSCAPE

- GLOBAL PAPER TUBES AND CORES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Diameter

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

Potential Market Strategie

|

Global Paper Tubes and Cores Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8099.19 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.64% |

Market Size in 2032: |

USD 13270.8 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Diameter |

|

||

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PAPER TUBES AND CORES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PAPER TUBES AND CORES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PAPER TUBES AND CORES MARKET COMPETITIVE RIVALRY

TABLE 005. PAPER TUBES AND CORES MARKET THREAT OF NEW ENTRANTS

TABLE 006. PAPER TUBES AND CORES MARKET THREAT OF SUBSTITUTES

TABLE 007. PAPER TUBES AND CORES MARKET BY TYPE

TABLE 008. PAPER TUBES MARKET OVERVIEW (2016-2028)

TABLE 009. PAPER CORES MARKET OVERVIEW (2016-2028)

TABLE 010. PAPER TUBES AND CORES MARKET BY APPLICATION

TABLE 011. PAPER INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 012. TEXTILE INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA PAPER TUBES AND CORES MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA PAPER TUBES AND CORES MARKET, BY APPLICATION (2016-2028)

TABLE 016. N PAPER TUBES AND CORES MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE PAPER TUBES AND CORES MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE PAPER TUBES AND CORES MARKET, BY APPLICATION (2016-2028)

TABLE 019. PAPER TUBES AND CORES MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC PAPER TUBES AND CORES MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC PAPER TUBES AND CORES MARKET, BY APPLICATION (2016-2028)

TABLE 022. PAPER TUBES AND CORES MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA PAPER TUBES AND CORES MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA PAPER TUBES AND CORES MARKET, BY APPLICATION (2016-2028)

TABLE 025. PAPER TUBES AND CORES MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA PAPER TUBES AND CORES MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA PAPER TUBES AND CORES MARKET, BY APPLICATION (2016-2028)

TABLE 028. PAPER TUBES AND CORES MARKET, BY COUNTRY (2016-2028)

TABLE 029. SONOCO: SNAPSHOT

TABLE 030. SONOCO: BUSINESS PERFORMANCE

TABLE 031. SONOCO: PRODUCT PORTFOLIO

TABLE 032. SONOCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. CARAUSTAR INDUSTRIES: SNAPSHOT

TABLE 033. CARAUSTAR INDUSTRIES: BUSINESS PERFORMANCE

TABLE 034. CARAUSTAR INDUSTRIES: PRODUCT PORTFOLIO

TABLE 035. CARAUSTAR INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. SIGMAQ: SNAPSHOT

TABLE 036. SIGMAQ: BUSINESS PERFORMANCE

TABLE 037. SIGMAQ: PRODUCT PORTFOLIO

TABLE 038. SIGMAQ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. CALLENOR: SNAPSHOT

TABLE 039. CALLENOR: BUSINESS PERFORMANCE

TABLE 040. CALLENOR: PRODUCT PORTFOLIO

TABLE 041. CALLENOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. OX PAPER TUBE & CORE: SNAPSHOT

TABLE 042. OX PAPER TUBE & CORE: BUSINESS PERFORMANCE

TABLE 043. OX PAPER TUBE & CORE: PRODUCT PORTFOLIO

TABLE 044. OX PAPER TUBE & CORE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. VALK INDUSTRIES: SNAPSHOT

TABLE 045. VALK INDUSTRIES: BUSINESS PERFORMANCE

TABLE 046. VALK INDUSTRIES: PRODUCT PORTFOLIO

TABLE 047. VALK INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. RAE PRODUCTS: SNAPSHOT

TABLE 048. RAE PRODUCTS: BUSINESS PERFORMANCE

TABLE 049. RAE PRODUCTS: PRODUCT PORTFOLIO

TABLE 050. RAE PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. LCH PAPER TUBE AND CORE: SNAPSHOT

TABLE 051. LCH PAPER TUBE AND CORE: BUSINESS PERFORMANCE

TABLE 052. LCH PAPER TUBE AND CORE: PRODUCT PORTFOLIO

TABLE 053. LCH PAPER TUBE AND CORE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ALBERT EGER: SNAPSHOT

TABLE 054. ALBERT EGER: BUSINESS PERFORMANCE

TABLE 055. ALBERT EGER: PRODUCT PORTFOLIO

TABLE 056. ALBERT EGER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. PAPER TUBE & CORE: SNAPSHOT

TABLE 057. PAPER TUBE & CORE: BUSINESS PERFORMANCE

TABLE 058. PAPER TUBE & CORE: PRODUCT PORTFOLIO

TABLE 059. PAPER TUBE & CORE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. KONFIDA: SNAPSHOT

TABLE 060. KONFIDA: BUSINESS PERFORMANCE

TABLE 061. KONFIDA: PRODUCT PORTFOLIO

TABLE 062. KONFIDA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. CUSTOM TUBE: SNAPSHOT

TABLE 063. CUSTOM TUBE: BUSINESS PERFORMANCE

TABLE 064. CUSTOM TUBE: PRODUCT PORTFOLIO

TABLE 065. CUSTOM TUBE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. D & W PAPER TUBE: SNAPSHOT

TABLE 066. D & W PAPER TUBE: BUSINESS PERFORMANCE

TABLE 067. D & W PAPER TUBE: PRODUCT PORTFOLIO

TABLE 068. D & W PAPER TUBE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. PAPER TUBE & CORE CORPORATION: SNAPSHOT

TABLE 069. PAPER TUBE & CORE CORPORATION: BUSINESS PERFORMANCE

TABLE 070. PAPER TUBE & CORE CORPORATION: PRODUCT PORTFOLIO

TABLE 071. PAPER TUBE & CORE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. INTERNATIONAL PAPER CONVERTERS: SNAPSHOT

TABLE 072. INTERNATIONAL PAPER CONVERTERS: BUSINESS PERFORMANCE

TABLE 073. INTERNATIONAL PAPER CONVERTERS: PRODUCT PORTFOLIO

TABLE 074. INTERNATIONAL PAPER CONVERTERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. MOBA EUROTUBI: SNAPSHOT

TABLE 075. MOBA EUROTUBI: BUSINESS PERFORMANCE

TABLE 076. MOBA EUROTUBI: PRODUCT PORTFOLIO

TABLE 077. MOBA EUROTUBI: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PAPER TUBES AND CORES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PAPER TUBES AND CORES MARKET OVERVIEW BY TYPE

FIGURE 012. PAPER TUBES MARKET OVERVIEW (2016-2028)

FIGURE 013. PAPER CORES MARKET OVERVIEW (2016-2028)

FIGURE 014. PAPER TUBES AND CORES MARKET OVERVIEW BY APPLICATION

FIGURE 015. PAPER INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 016. TEXTILE INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA PAPER TUBES AND CORES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE PAPER TUBES AND CORES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC PAPER TUBES AND CORES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA PAPER TUBES AND CORES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA PAPER TUBES AND CORES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Paper Tubes and Cores Market research report is 2024-2032.

Sonoco (United States), International Paper (United States), CBT Cores (United States), Valley Industrial Products (United States), HBD Packaging (United States), Paper Tube Co. (United States), Yazoo Mills (United States), Ace Paper Tube (United States), Canfab Packaging Inc. (Canada), Core Products (United Kingdom), Kendell Packaging (United Kingdom), Moba Eurotubi (Switzerland), Mondi (Austria), Cylcore (Greece), Corenso (Finland), Smurfit Kappa (Ireland), and Other Major Players.

The Paper Tubes and Cores Market is segmented into Type, Diameter, Material, Application, and region. By Type, the market is categorized into Paper Tubes and Paper Cores. By Diameter, the market is categorized into Small Diameter Tubes and Cores, Medium Diameter Tubes and Cores, and Large Diameter Tubes and Cores. By Material, the market is categorized into Virgin Paperboard and Recycled Paperboard. By Application, the market is categorized into Packaging, Textiles, Paper and Printing Industry, and Food & Beverage. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Paper tubes and cores are cylindrical products made from paperboard layers, providing structural support and stability for various industries. They are lightweight and eco-friendly alternatives to traditional materials. Created through spiral, parallel, and convolute winding processes, they contribute to efficient material handling, storage, and transportation, promoting sustainability and versatility in packaging and manufacturing solutions.

Paper Tubes and Cores Market Size Was Valued at USD 8099.19 Million in 2023, and is Projected to Reach USD 13270.8 Million by 2032, Growing at a CAGR of 5.64% From 2024-2032.