Global Eco Fiber Market Overview

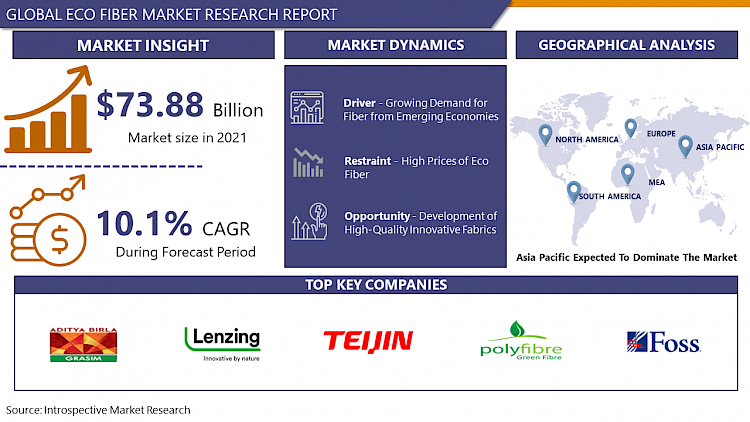

The Global Eco Fiber Market size is expected to grow from USD 81.56 billion in 2022 to USD 179.99 billion by 2030, at a CAGR of 10.4% during the forecast period (2023-2030).

Environmentally friendly fabrics are created from pesticide-free or chemical-free fibers. They are disease-free and naturally resistant to mold and fungus. Eco-friendly fibers include hemp, linen, bamboo, and ramie. Over the forecast period, rising worries about the detrimental effects of synthetic fibers on the environment are expected to support the Eco Fiber Market's growth. Designer clothes and textiles are increasingly using eco fibers. Over the forecast period, technological advances in the creation of eco fiber fabrics with an antimicrobial, hypoallergenic, insulating, UV resistant, highly breathable, and absorbent properties are likely to boost their relevance in the Eco Fiber Market. Factors propelling the textile business throughout the world include the fast-developing online fashion sector, increased disposable income, and the creation of high-quality novel textiles. Furthermore, the government's strict environmental rules have pushed local clothing producers to use greener raw materials and ecologically friendly processes. Therefore, the Eco-Fiber market expected substantial growth during the forecasted period.

Covid-19 Impact On Eco Fiber Market

Because of the temporary lockout of manufacturing facilities as a result of the COVID-19 pandemic, the textile sector has been significantly impacted, resulting in poor output and decreased product demand. Furthermore, limitations on import and export to and from the nation have wreaked havoc on the supply chain. The epidemic, on the other hand, has increased demand for PPE kits and masks, resulting in significant product consumption. For producing everyday masks, the restriction on synthetic fabric has switched to cotton and linen. Furthermore, the growth in consumer demand for health and hygiene products has raised the demand for the material during the pandemic, propelling the market forward.

Market Dynamics And Key Factors For Eco Fiber Market

Drivers:

Rising demand for sustainable clothing in the Fashion industry boosting the Eco-Fiber Market.

Factors propelling the textile business throughout the world include the fast-developing online fashion sector, increased disposable income, and the creation of high-quality novel textiles. Furthermore, the government's strict environmental rules have pushed local clothing producers to use greener raw materials and ecologically friendly processes. Eco fibers are ecologically friendly, and as a result, they are becoming more popular in textile materials. Eco fibers are created from a variety of materials, including hemp, flax, organic cotton, and bamboo, and are used to make garments. Organic cotton, for example, is gaining popularity as a sustainable alternative to conventional cotton on the worldwide market.

The increasing desire for comfort in everyday wear, technical developments in fashion textiles, and government controls on textile chemicals in developed areas are increasing demand for textile innovations, which will drive the market for eco fibers in the next years.

Restraints:

The market's restricting factors include the high cost of Eco Fiber and the low cost of replacements. Eco Fiber's overall cost is high because of the high expense of cultivating and manufacturing the product. Furthermore, replacements such as synthetic fibers, such as rayon, polyester, and nylon, are inexpensive and widely available, leading to a greater move toward synthetic fibers. Synthetic fibers are very simple to create, process, and utilize in most applications, reducing the need for this Fiber. The market's expansion is being stifled by all of these problems.

Opportunities:

In the Eco Fiber market, Banana fiber has made fair attention due to its eco-friendly application in fabric manufacturing. The banana fibers are good moisture absorbent, highly breathable, quickly dry with high tensile strength. The fiber length varies greatly depending on the precise source and treatment of the fiber during fiber extraction. If the fiber is removed from the full length of the sheaths, the average length ranges from 3 to 15 ft. Compared to cotton fiber the moisture regains percentage of banana fiber is high of about 11-15%. The banana fibers have higher water absorbency and water release properties compared to other fibers like cotton, jute, and flax, and lower crystallinity (19-24%) in the fiber structure. Therefore, in terms of innovative opportunities, Banana Fiber is expected to push the Eco Fiber Market.

Challenges:

The rising demand for synthetic fibers, which are less expensive than eco fiber, has become a stumbling block for eco fiber-based textiles. Synthetic fibers are well known for their use in general textiles, but they also play a critical role in key ends user industries such as healthcare, aerospace, food packaging, water purification, electronics, automotive, air filters, and others, thanks to technological advances in production methods and superior physical, chemical, and mechanical characteristics. Also, Synthetic fiber clothing is less expensive compared to organic and Eco-friendly materials. Furthermore, government subsidies to synthetic fiber facilities will have an impact on the eco fiber industry.

Market Segmentation

Segmentation Analysis of Eco Fiber Market:

By Type, Organic fiber is expected to dominate the Eco Fiber Market during the forecasted period. Organic fiber is predicted to increase at the quickest rate between 2021 and 2028, owing to a shift in customer preferences toward more environmentally friendly products. Organic cotton output increased to 239 KT in 2019, according to Textile Exchange, driving organic fiber sector growth. Manmade fibers such as rayon and lyocell, which are derived from cellulose and sugar, are included in the regenerated fiber sector. This sector dominated the market because of the low cost and ease of processing of the fibers. Because regenerated fiber offers better long-term sustainability features including comfort and fiber strength, it is in great demand.

By Source, Plant Cellulose is dominating the segment in Eco Fiber Market. Flax, jute, sisal, hemp, and kenaf are all plant-based fibers that have been employed in the production of biocomposites. Natural fibers have a high strength-to-weight ratio, are non-corrosive, have a high fracture toughness, are renewable, and are environmentally friendly, giving them distinct benefits over other materials. Scientists and researchers are interested in developing biocomposites by reinforcing natural fibers because of the environmental advantages and increased mechanical performance. Therefore, in the eco-friendly fiber market, plant-based fiber is expected to increase the market share during the forecasted period.

By Product, Lyocell Fiber is expected to be dominating in the Eco Fiber Market during the forecasted period. Lyocell is high-valued because it is completely biodegradable and compostable (when not combined with other synthetic fibers). Lyocell goods would only take a few months to disintegrate because they are made of wood, as opposed to other plastic-based objects, which might take up to 100 years to biodegrade. Eucalyptus trees are also one of Lyocell's most prevalent sources, and they tick all the appropriate criteria. Eucalyptus trees can grow practically everywhere, even on ground that is no longer suitable for food production. They grow swiftly and don't require any pesticides or watering. Cotton requires five times the amount of land as eucalyptus trees. Many nations perceive the chance to produce Lyocell Fiber and related products since the plantation of these trees is not location-specific. Hence, with the growing use of such new fiber, Eco Fiber Market is expected to grow during the forecasted period.

End-Use Industry, Clothing/Textile is dominating the segment in Eco Fiber Market which may be ascribed to the global fashion industry's growth. Fabric demand is soaring due to an increase in demand for various sorts of apparel, such as designer garments, casual wear, and formal dress, based on age groups. The desire to buy fancy brand items among the younger generation to keep up with trends is being fueled by the expanding economies of numerous major countries. The material is used to make curtains, table mats, napkins, and covers in the household & furnishings industry. The population's rising desire for these items is expected to propel the category forward.

Regional Analysis of Eco Fiber Market:

The Asia Pacific is dominating the Eco Fiber Market. The highly developed textile industries in China and India drive the market. Furthermore, due to high cotton output and low labor costs, businesses choose to establish manufacturing operations in China, India, Bangladesh, and Pakistan. Growing environmental concerns as a result of numerous chemicals used in textiles, as well as a big proportion of the population suffering from various ailments, are driving up demand for eco fibers in a variety of applications. Eco fibers are human-friendly and do not harm the environment throughout the manufacturing process. Tarpaulins, geotextiles, bags, carpets, and furniture materials are all examples of domestic applications for eco fibers. China mostly exports home goods to nations such as India, Pakistan, and Europe. Another area where demand for eco-friendly fibers has lately increased is the packaging. According to the Packing Industry Association of India, packaging is the fifth-largest industry in the Indian economy, rising at a rate of 22-25 percent each year (PIAI).

North America is the fastest growing region in Eco Fiber Market. Heat-set synthetics, finishing treatments, nanofibers, and thermo-forming are among the technological breakthroughs in the North American textiles sector that are expected to increase quickly, adding considerably to the market's total growth. High demand for fashion accessories, such as shoes, clothes, and handbags, is also expected to drive market expansion. Because of the growing need for textiles for filtration and separation applications, as well as protective garments, the textiles and apparel sector in North America is expected to increase significantly throughout the projected period. Textile demand is predicted to rise in response to the rising demand for environmentally friendly solutions in different industrial applications, increasing market development.

Players Covered In Eco Fiber Market are:

- LENZING AG

- Grasim Industries Limited

- TEIJIN LIMITED.

- Wellman Advanced Materials

- US Fibers

- David C. Poole Company Inc

- Foss Performance Materials

- Polyfibre Industries

- Shanghai Tenbro Bamboo Textile Co. Ltd

- Tangshan Sanyou Group Xingda Chemical Fibre Co.Ltd

- Pilipinas Ecofiber Corp.

- Enkev B.V.

- Esprit Global Image

- EnviroTextiles. LLC

- Hayleys Fibre

- Aquafil S.p.A.

- Greenfibres

- Bcomp Ltd.

- C&A Mode GmbH & Co. KG

- Inditex

Key Industry Developments In Eco Fiber Market

- June 2021 Lenzing & Catania – The Lenzing Group, a world's leading producer of wood-based specialty fibers, has teamed up with Orange Fiber, an Italian company that has patented the pulp production process for citrus by-products, to create the world's first TENCELTM labeled lyocell fiber made of orange and wood pulp.

- May 2021 – At the Lenzing location, the Lenzing Group developed and commissioned an air purification and sulfur recycling plant. The corporation invested approximately USD 55 million in the system, which cuts CO2 emissions by 15,000 tonnes.

- March 2021, Sateri has chosen to increase its Lyocell production capacity in China by 500,000 metric tonnes per year by the year 2025. Sateri expects the policy to aid in the establishment of sites across China's Jiangsu region, with development on a 100,000-ton facility in Changzhou already started.

|

Global Eco Fiber Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 81.56 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.4 % |

Market Size in 2030: |

USD 179.99 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Product |

|

||

|

By End-User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Source

3.3 By Product

3.4 By End Use Industry

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Eco Fiber Market by Type

5.1 Eco Fiber Market Overview Snapshot and Growth Engine

5.2 Eco Fiber Market Overview

5.3 Organic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Organic: Grographic Segmentation

5.4 Manmade/Regenerated

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Manmade/Regenerated: Grographic Segmentation

5.5 Recycled

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Recycled: Grographic Segmentation

5.6 Natural

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Natural: Grographic Segmentation

Chapter 6: Eco Fiber Market by Source

6.1 Eco Fiber Market Overview Snapshot and Growth Engine

6.2 Eco Fiber Market Overview

6.3 Animal Skin

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Animal Skin: Grographic Segmentation

6.4 Plant Cellulose

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Plant Cellulose: Grographic Segmentation

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Grographic Segmentation

Chapter 7: Eco Fiber Market by Product

7.1 Eco Fiber Market Overview Snapshot and Growth Engine

7.2 Eco Fiber Market Overview

7.3 Lyocell Fiber

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Lyocell Fiber: Grographic Segmentation

7.4 Polylactic Acid Fiber

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Polylactic Acid Fiber: Grographic Segmentation

7.5 Soybean Fiber

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Soybean Fiber: Grographic Segmentation

7.6 Regenerated Protein Fiber

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Regenerated Protein Fiber: Grographic Segmentation

7.7 Bamboo Fiber

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Bamboo Fiber: Grographic Segmentation

Chapter 8: Eco Fiber Market by End Use Industry

8.1 Eco Fiber Market Overview Snapshot and Growth Engine

8.2 Eco Fiber Market Overview

8.3 Textiles

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Textiles: Grographic Segmentation

8.4 Household & Furnishing

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Household & Furnishing: Grographic Segmentation

8.5 Manufacturing Industry

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Manufacturing Industry: Grographic Segmentation

8.6 Medical

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Medical: Grographic Segmentation

8.7 Automobiles

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2016-2028F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Automobiles: Grographic Segmentation

8.8 Others

8.8.1 Introduction and Market Overview

8.8.2 Historic and Forecasted Market Size (2016-2028F)

8.8.3 Key Market Trends, Growth Factors and Opportunities

8.8.4 Others: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Eco Fiber Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Eco Fiber Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Eco Fiber Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 LENZING AG

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 GRASIM INDUSTRIES LIMITED

9.4 TEIJIN LIMITED

9.5 WELLMAN ADVANCED MATERIALS

9.6 US FIBERS

9.7 DAVID C. POOLE COMPANY INC.

9.8 FOSS PERFORMANCE MATERIALS

9.9 POLYFIBRE INDUSTRIES

9.10 SHANGHAI TENBRO BAMBOO TEXTILE CO. LTD

9.11 TANGSHAN SANYOU GROUP XINGDA CHEMICAL FIBRE CO.LTD

9.12 PILIPINAS ECOFIBER CORP.

9.13 ENKEV B.V.

9.14 ESPRIT GLOBAL IMAGE

9.15 ENVIROTEXTILES LLC

9.16 HAYLEYS FIBRE

9.17 AQUAFIL S.P.A.

9.18 GREENFIBRES

9.19 BCOMP LTD.

9.20 C&A MODE GMBH & CO. KG

9.21 INDITEX

9.22 OTHER MAJOR PLAYERS

Chapter 10: Global Eco Fiber Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Organic

10.2.2 Manmade/Regenerated

10.2.3 Recycled

10.2.4 Natural

10.3 Historic and Forecasted Market Size By Source

10.3.1 Animal Skin

10.3.2 Plant Cellulose

10.3.3 Others

10.4 Historic and Forecasted Market Size By Product

10.4.1 Lyocell Fiber

10.4.2 Polylactic Acid Fiber

10.4.3 Soybean Fiber

10.4.4 Regenerated Protein Fiber

10.4.5 Bamboo Fiber

10.5 Historic and Forecasted Market Size By End Use Industry

10.5.1 Textiles

10.5.2 Household & Furnishing

10.5.3 Manufacturing Industry

10.5.4 Medical

10.5.5 Automobiles

10.5.6 Others

Chapter 11: North America Eco Fiber Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Organic

11.4.2 Manmade/Regenerated

11.4.3 Recycled

11.4.4 Natural

11.5 Historic and Forecasted Market Size By Source

11.5.1 Animal Skin

11.5.2 Plant Cellulose

11.5.3 Others

11.6 Historic and Forecasted Market Size By Product

11.6.1 Lyocell Fiber

11.6.2 Polylactic Acid Fiber

11.6.3 Soybean Fiber

11.6.4 Regenerated Protein Fiber

11.6.5 Bamboo Fiber

11.7 Historic and Forecasted Market Size By End Use Industry

11.7.1 Textiles

11.7.2 Household & Furnishing

11.7.3 Manufacturing Industry

11.7.4 Medical

11.7.5 Automobiles

11.7.6 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Eco Fiber Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Organic

12.4.2 Manmade/Regenerated

12.4.3 Recycled

12.4.4 Natural

12.5 Historic and Forecasted Market Size By Source

12.5.1 Animal Skin

12.5.2 Plant Cellulose

12.5.3 Others

12.6 Historic and Forecasted Market Size By Product

12.6.1 Lyocell Fiber

12.6.2 Polylactic Acid Fiber

12.6.3 Soybean Fiber

12.6.4 Regenerated Protein Fiber

12.6.5 Bamboo Fiber

12.7 Historic and Forecasted Market Size By End Use Industry

12.7.1 Textiles

12.7.2 Household & Furnishing

12.7.3 Manufacturing Industry

12.7.4 Medical

12.7.5 Automobiles

12.7.6 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Eco Fiber Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Organic

13.4.2 Manmade/Regenerated

13.4.3 Recycled

13.4.4 Natural

13.5 Historic and Forecasted Market Size By Source

13.5.1 Animal Skin

13.5.2 Plant Cellulose

13.5.3 Others

13.6 Historic and Forecasted Market Size By Product

13.6.1 Lyocell Fiber

13.6.2 Polylactic Acid Fiber

13.6.3 Soybean Fiber

13.6.4 Regenerated Protein Fiber

13.6.5 Bamboo Fiber

13.7 Historic and Forecasted Market Size By End Use Industry

13.7.1 Textiles

13.7.2 Household & Furnishing

13.7.3 Manufacturing Industry

13.7.4 Medical

13.7.5 Automobiles

13.7.6 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Eco Fiber Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Organic

14.4.2 Manmade/Regenerated

14.4.3 Recycled

14.4.4 Natural

14.5 Historic and Forecasted Market Size By Source

14.5.1 Animal Skin

14.5.2 Plant Cellulose

14.5.3 Others

14.6 Historic and Forecasted Market Size By Product

14.6.1 Lyocell Fiber

14.6.2 Polylactic Acid Fiber

14.6.3 Soybean Fiber

14.6.4 Regenerated Protein Fiber

14.6.5 Bamboo Fiber

14.7 Historic and Forecasted Market Size By End Use Industry

14.7.1 Textiles

14.7.2 Household & Furnishing

14.7.3 Manufacturing Industry

14.7.4 Medical

14.7.5 Automobiles

14.7.6 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Eco Fiber Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Organic

15.4.2 Manmade/Regenerated

15.4.3 Recycled

15.4.4 Natural

15.5 Historic and Forecasted Market Size By Source

15.5.1 Animal Skin

15.5.2 Plant Cellulose

15.5.3 Others

15.6 Historic and Forecasted Market Size By Product

15.6.1 Lyocell Fiber

15.6.2 Polylactic Acid Fiber

15.6.3 Soybean Fiber

15.6.4 Regenerated Protein Fiber

15.6.5 Bamboo Fiber

15.7 Historic and Forecasted Market Size By End Use Industry

15.7.1 Textiles

15.7.2 Household & Furnishing

15.7.3 Manufacturing Industry

15.7.4 Medical

15.7.5 Automobiles

15.7.6 Others

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Eco Fiber Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 81.56 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.4 % |

Market Size in 2030: |

USD 179.99 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Product |

|

||

|

By End-User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ECO FIBER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ECO FIBER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ECO FIBER MARKET COMPETITIVE RIVALRY

TABLE 005. ECO FIBER MARKET THREAT OF NEW ENTRANTS

TABLE 006. ECO FIBER MARKET THREAT OF SUBSTITUTES

TABLE 007. ECO FIBER MARKET BY TYPE

TABLE 008. ORGANIC MARKET OVERVIEW (2016-2028)

TABLE 009. MANMADE/REGENERATED MARKET OVERVIEW (2016-2028)

TABLE 010. RECYCLED MARKET OVERVIEW (2016-2028)

TABLE 011. NATURAL MARKET OVERVIEW (2016-2028)

TABLE 012. ECO FIBER MARKET BY SOURCE

TABLE 013. ANIMAL SKIN MARKET OVERVIEW (2016-2028)

TABLE 014. PLANT CELLULOSE MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. ECO FIBER MARKET BY PRODUCT

TABLE 017. LYOCELL FIBER MARKET OVERVIEW (2016-2028)

TABLE 018. POLYLACTIC ACID FIBER MARKET OVERVIEW (2016-2028)

TABLE 019. SOYBEAN FIBER MARKET OVERVIEW (2016-2028)

TABLE 020. REGENERATED PROTEIN FIBER MARKET OVERVIEW (2016-2028)

TABLE 021. BAMBOO FIBER MARKET OVERVIEW (2016-2028)

TABLE 022. ECO FIBER MARKET BY END USE INDUSTRY

TABLE 023. TEXTILES MARKET OVERVIEW (2016-2028)

TABLE 024. HOUSEHOLD & FURNISHING MARKET OVERVIEW (2016-2028)

TABLE 025. MANUFACTURING INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 026. MEDICAL MARKET OVERVIEW (2016-2028)

TABLE 027. AUTOMOBILES MARKET OVERVIEW (2016-2028)

TABLE 028. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 029. NORTH AMERICA ECO FIBER MARKET, BY TYPE (2016-2028)

TABLE 030. NORTH AMERICA ECO FIBER MARKET, BY SOURCE (2016-2028)

TABLE 031. NORTH AMERICA ECO FIBER MARKET, BY PRODUCT (2016-2028)

TABLE 032. NORTH AMERICA ECO FIBER MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 033. N ECO FIBER MARKET, BY COUNTRY (2016-2028)

TABLE 034. EUROPE ECO FIBER MARKET, BY TYPE (2016-2028)

TABLE 035. EUROPE ECO FIBER MARKET, BY SOURCE (2016-2028)

TABLE 036. EUROPE ECO FIBER MARKET, BY PRODUCT (2016-2028)

TABLE 037. EUROPE ECO FIBER MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 038. ECO FIBER MARKET, BY COUNTRY (2016-2028)

TABLE 039. ASIA PACIFIC ECO FIBER MARKET, BY TYPE (2016-2028)

TABLE 040. ASIA PACIFIC ECO FIBER MARKET, BY SOURCE (2016-2028)

TABLE 041. ASIA PACIFIC ECO FIBER MARKET, BY PRODUCT (2016-2028)

TABLE 042. ASIA PACIFIC ECO FIBER MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 043. ECO FIBER MARKET, BY COUNTRY (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA ECO FIBER MARKET, BY TYPE (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA ECO FIBER MARKET, BY SOURCE (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA ECO FIBER MARKET, BY PRODUCT (2016-2028)

TABLE 047. MIDDLE EAST & AFRICA ECO FIBER MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 048. ECO FIBER MARKET, BY COUNTRY (2016-2028)

TABLE 049. SOUTH AMERICA ECO FIBER MARKET, BY TYPE (2016-2028)

TABLE 050. SOUTH AMERICA ECO FIBER MARKET, BY SOURCE (2016-2028)

TABLE 051. SOUTH AMERICA ECO FIBER MARKET, BY PRODUCT (2016-2028)

TABLE 052. SOUTH AMERICA ECO FIBER MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 053. ECO FIBER MARKET, BY COUNTRY (2016-2028)

TABLE 054. LENZING AG: SNAPSHOT

TABLE 055. LENZING AG: BUSINESS PERFORMANCE

TABLE 056. LENZING AG: PRODUCT PORTFOLIO

TABLE 057. LENZING AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. GRASIM INDUSTRIES LIMITED: SNAPSHOT

TABLE 058. GRASIM INDUSTRIES LIMITED: BUSINESS PERFORMANCE

TABLE 059. GRASIM INDUSTRIES LIMITED: PRODUCT PORTFOLIO

TABLE 060. GRASIM INDUSTRIES LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. TEIJIN LIMITED: SNAPSHOT

TABLE 061. TEIJIN LIMITED: BUSINESS PERFORMANCE

TABLE 062. TEIJIN LIMITED: PRODUCT PORTFOLIO

TABLE 063. TEIJIN LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. WELLMAN ADVANCED MATERIALS: SNAPSHOT

TABLE 064. WELLMAN ADVANCED MATERIALS: BUSINESS PERFORMANCE

TABLE 065. WELLMAN ADVANCED MATERIALS: PRODUCT PORTFOLIO

TABLE 066. WELLMAN ADVANCED MATERIALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. US FIBERS: SNAPSHOT

TABLE 067. US FIBERS: BUSINESS PERFORMANCE

TABLE 068. US FIBERS: PRODUCT PORTFOLIO

TABLE 069. US FIBERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. DAVID C. POOLE COMPANY INC.: SNAPSHOT

TABLE 070. DAVID C. POOLE COMPANY INC.: BUSINESS PERFORMANCE

TABLE 071. DAVID C. POOLE COMPANY INC.: PRODUCT PORTFOLIO

TABLE 072. DAVID C. POOLE COMPANY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. FOSS PERFORMANCE MATERIALS: SNAPSHOT

TABLE 073. FOSS PERFORMANCE MATERIALS: BUSINESS PERFORMANCE

TABLE 074. FOSS PERFORMANCE MATERIALS: PRODUCT PORTFOLIO

TABLE 075. FOSS PERFORMANCE MATERIALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. POLYFIBRE INDUSTRIES: SNAPSHOT

TABLE 076. POLYFIBRE INDUSTRIES: BUSINESS PERFORMANCE

TABLE 077. POLYFIBRE INDUSTRIES: PRODUCT PORTFOLIO

TABLE 078. POLYFIBRE INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. SHANGHAI TENBRO BAMBOO TEXTILE CO. LTD: SNAPSHOT

TABLE 079. SHANGHAI TENBRO BAMBOO TEXTILE CO. LTD: BUSINESS PERFORMANCE

TABLE 080. SHANGHAI TENBRO BAMBOO TEXTILE CO. LTD: PRODUCT PORTFOLIO

TABLE 081. SHANGHAI TENBRO BAMBOO TEXTILE CO. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. TANGSHAN SANYOU GROUP XINGDA CHEMICAL FIBRE CO.LTD: SNAPSHOT

TABLE 082. TANGSHAN SANYOU GROUP XINGDA CHEMICAL FIBRE CO.LTD: BUSINESS PERFORMANCE

TABLE 083. TANGSHAN SANYOU GROUP XINGDA CHEMICAL FIBRE CO.LTD: PRODUCT PORTFOLIO

TABLE 084. TANGSHAN SANYOU GROUP XINGDA CHEMICAL FIBRE CO.LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. PILIPINAS ECOFIBER CORP.: SNAPSHOT

TABLE 085. PILIPINAS ECOFIBER CORP.: BUSINESS PERFORMANCE

TABLE 086. PILIPINAS ECOFIBER CORP.: PRODUCT PORTFOLIO

TABLE 087. PILIPINAS ECOFIBER CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. ENKEV B.V.: SNAPSHOT

TABLE 088. ENKEV B.V.: BUSINESS PERFORMANCE

TABLE 089. ENKEV B.V.: PRODUCT PORTFOLIO

TABLE 090. ENKEV B.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. ESPRIT GLOBAL IMAGE: SNAPSHOT

TABLE 091. ESPRIT GLOBAL IMAGE: BUSINESS PERFORMANCE

TABLE 092. ESPRIT GLOBAL IMAGE: PRODUCT PORTFOLIO

TABLE 093. ESPRIT GLOBAL IMAGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. ENVIROTEXTILES LLC: SNAPSHOT

TABLE 094. ENVIROTEXTILES LLC: BUSINESS PERFORMANCE

TABLE 095. ENVIROTEXTILES LLC: PRODUCT PORTFOLIO

TABLE 096. ENVIROTEXTILES LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. HAYLEYS FIBRE: SNAPSHOT

TABLE 097. HAYLEYS FIBRE: BUSINESS PERFORMANCE

TABLE 098. HAYLEYS FIBRE: PRODUCT PORTFOLIO

TABLE 099. HAYLEYS FIBRE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. AQUAFIL S.P.A.: SNAPSHOT

TABLE 100. AQUAFIL S.P.A.: BUSINESS PERFORMANCE

TABLE 101. AQUAFIL S.P.A.: PRODUCT PORTFOLIO

TABLE 102. AQUAFIL S.P.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. GREENFIBRES: SNAPSHOT

TABLE 103. GREENFIBRES: BUSINESS PERFORMANCE

TABLE 104. GREENFIBRES: PRODUCT PORTFOLIO

TABLE 105. GREENFIBRES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. BCOMP LTD.: SNAPSHOT

TABLE 106. BCOMP LTD.: BUSINESS PERFORMANCE

TABLE 107. BCOMP LTD.: PRODUCT PORTFOLIO

TABLE 108. BCOMP LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. C&A MODE GMBH & CO. KG: SNAPSHOT

TABLE 109. C&A MODE GMBH & CO. KG: BUSINESS PERFORMANCE

TABLE 110. C&A MODE GMBH & CO. KG: PRODUCT PORTFOLIO

TABLE 111. C&A MODE GMBH & CO. KG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. INDITEX: SNAPSHOT

TABLE 112. INDITEX: BUSINESS PERFORMANCE

TABLE 113. INDITEX: PRODUCT PORTFOLIO

TABLE 114. INDITEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 115. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 116. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 117. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ECO FIBER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ECO FIBER MARKET OVERVIEW BY TYPE

FIGURE 012. ORGANIC MARKET OVERVIEW (2016-2028)

FIGURE 013. MANMADE/REGENERATED MARKET OVERVIEW (2016-2028)

FIGURE 014. RECYCLED MARKET OVERVIEW (2016-2028)

FIGURE 015. NATURAL MARKET OVERVIEW (2016-2028)

FIGURE 016. ECO FIBER MARKET OVERVIEW BY SOURCE

FIGURE 017. ANIMAL SKIN MARKET OVERVIEW (2016-2028)

FIGURE 018. PLANT CELLULOSE MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. ECO FIBER MARKET OVERVIEW BY PRODUCT

FIGURE 021. LYOCELL FIBER MARKET OVERVIEW (2016-2028)

FIGURE 022. POLYLACTIC ACID FIBER MARKET OVERVIEW (2016-2028)

FIGURE 023. SOYBEAN FIBER MARKET OVERVIEW (2016-2028)

FIGURE 024. REGENERATED PROTEIN FIBER MARKET OVERVIEW (2016-2028)

FIGURE 025. BAMBOO FIBER MARKET OVERVIEW (2016-2028)

FIGURE 026. ECO FIBER MARKET OVERVIEW BY END USE INDUSTRY

FIGURE 027. TEXTILES MARKET OVERVIEW (2016-2028)

FIGURE 028. HOUSEHOLD & FURNISHING MARKET OVERVIEW (2016-2028)

FIGURE 029. MANUFACTURING INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 030. MEDICAL MARKET OVERVIEW (2016-2028)

FIGURE 031. AUTOMOBILES MARKET OVERVIEW (2016-2028)

FIGURE 032. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 033. NORTH AMERICA ECO FIBER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. EUROPE ECO FIBER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. ASIA PACIFIC ECO FIBER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. MIDDLE EAST & AFRICA ECO FIBER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. SOUTH AMERICA ECO FIBER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Eco Fiber Market research report is 2023-2030.

LENZING AG, Grasim Industries Limited., TEIJIN LIMITED., Wellman Advanced Materials, US Fibers, David C. Poole Company Inc, Foss Performance Materials, Polyfibre Industries, Shanghai Tenbro Bamboo Textile Co. Ltd, Tangshan Sanyou Group Xingda Chemical Fibre Co.Ltd, Pilipinas Ecofiber Corp., Enkev B.V., Esprit Global Image, EnviroTextiles. LLC, Hayleys Fibre, Aquafil S.p.A., Greenfibres, Bcomp Ltd., C&A Mode GmbH & Co. KG, Inditex, and other major players.

The Eco Fiber Market is segmented into Type, Source, Product, End-User Industry, and region. By Type, the market is categorized into Organic, Manmade/Regenerated, Recycled, and Natural. By Source, the market is categorized into Animal Skin, Plant Cellulose, and Others. By Product, the market is categorized into Lyocell Fiber, Polylactic Acid Fiber, Soybean Fiber, Regenerated Protein Fiber, and Bamboo Fiber. By End-User Industry, the market is categorized into Textiles, Household & Furnishing, Manufacturing Industry, Medical, Automobiles, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Environmentally friendly fabrics are created from pesticide-free or chemical-free fibers. They are disease-free and naturally resistant to mold and fungus. Eco-friendly fibers include hemp, linen, bamboo, and ramie. Over the forecast period, rising worries about the detrimental effects of synthetic fibers on the environment are expected to support the Eco Fiber Market's growth.

The Global Eco Fiber Market size is expected to grow from USD 81.56 billion in 2022 to USD 179.99 billion by 2030, at a CAGR of 10.4% during the forecast period (2023-2030).