Organic Foods and Beverages Market Synopsis

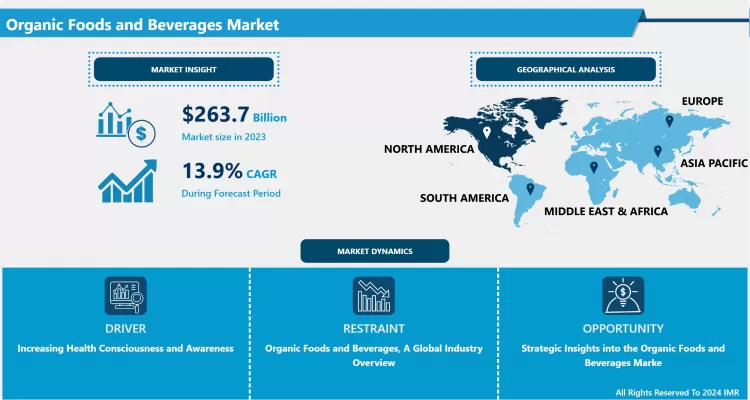

Organic Foods and Beverages Market Size is Valued at USD 263.70 Billion in 2023, and is Projected to Reach USD 746.96 Billion by 2032, Growing at a CAGR of 13.90% From 2024-2032.

The Organic Foods and Beverages Market is the industry that deals with the production, distribution, and sale of foods and beverages that are naturally grown and prepared without the application of chemicals, hormones, steroids, or GMOs. This market is made up of people who are interested in organic and natural products, mostly for health conscious and ecological reasons and are willing to pay a little extra for such products. It entails all the products like fruits and vegetables, dairy products, processed foods, meat products, beverages, and other related products sold in supermarkets, specialty stores, and online markets.

- Organic foods and beverages market is mainly propelled by the rising awareness of the healthy diet, which has made the consumption of organic products popular. The consumers are getting conscious of the health implications inherent in conventional foods because of pesticides, hormones and such other chemical inputs. This awareness has shifted consumer perception to organic foods considered healthier and safer in comparison to other commercial foods. Furthermore, increased customers’ disposable income in the developing countries has made more consumers to afford to purchase the costly organic products thus fostering the growth of the market.

- Furthermore, the government policies and standards encouraging organic farming and organic certification has greatly bolstered the market growth. Different countries have put in place measures to promote organic farming, including offering of bonuses, grants and certification schemes to farmers to promote the practice. Moreover, the rising popularity of the organic products across the supermarkets, hypermarkets and online retail stores also makes it easier for the consumer to access such products thus boosting the market growth.

Organic Foods and Beverages Market Trend Analysis

The Rise of Organic, Trends and Growth in Foods and Beverages

- The global market for organic foods and beverages is currently on the rise and this growth can be attributed to the growing awareness of individuals on the health benefits of organic foods. There is a trend toward healthier products as the customers are starting to pay attention to the quality of products they consume and turning to natural and organic foods and drinks. This trend is more so evident in the developed countries of the world especially in regions like North America and Europe where consumers are well informed about organic produce. Moreover, the increase in disposable income in the emerging economies is another factor that is helping to fuel the growth of the organic foods and beverages market due to the consumers’ willingness to spend more on their health and on products that are friendly to the environment.

- The other common trend that has been observed in the OF&B market is the diversification of the product portfolio by manufacturers. The range of organic products is also being expanded by various companies to address the different needs and wants of people. This is also in new product categories like organic snacks, convenience foods and beverages with enhanced functional properties. Also, the rising procurement of organic products from traditional retail outlets and e-commerce channels is also contributing to the market expansion. Since consumers are more aware of the organic products and the products are easily available across the world, the market of the organic foods and beverages is likely to expand in the future years.

The Organic Advantage, Capitalizing on Consumer Trends in Foods and Beverages

- The opportunity for growth in organic foods and beverages cannot be underestimated given the growing consumer consciousness in areas such as healthy living, environmental conservation, and sustainability, and humane treatment of animals. Consumers are purchasing the organic products in order to achieve better health outcomes as the products are said to contain higher nutrients and lesser pesticide content. This trend is further supported by the increasing trend in the consumption of organic and minimally processed foods. Also, the expansion of the internet and e-commerce, as well as the increasing popularity of online grocery stores, has contributed to the availability of organic food for consumers and boosted the organic market.

- In addition, government support for organic farming and various policies set forth to encourage its use also contribute to the growth of the market. New product launches, flavors, and packaging also serve as key strategies adopted by manufacturers to meet the changing consumer demands, which acts as a positive driver for the market. The global market of organic foods and beverages is anticipated to sustain its growth in the future, particularly in the regions of North America and Europe, where consumers show a high level of concern towards purchasing organic products.

Organic Foods and Beverages Market Segment Analysis:

Organic Foods and Beverages Market Segmented on the basis of product type, By Packaging and Distribution channel.

By Product Type, Organic Fruits & Vegetables segment is expected to dominate the market during the forecast period

- The organic foods and beverages market is categorized into several major product types that include organic fruits and vegetables, dairy products, processed organically meats, poultry and sea foods, frozen foods and others like breads and baked products and organic beverages like coffee, tea, juices, etc. All the mentioned categories present certain potential and possibilities for the development and advancement of the organic industry. Organic fruits and vegetables are popular among consumers due to their health qualities and the method that is used in farming them. Organic dairy products are usually perceived to be of high quality and are produced from animals that are raised in a natural environment.

- Labelled organic meats, poultry, and sea foods have been preferred by consumers who want to have their protein products sourced sustainably and ethically. Organic frozen and processed foods are also easily available, and the quality and environmental effects of such foods are not compromised. People prefer organic bread and bakery products because of the natural constituents used and the quality of production. Last but not least, the consumption of organic beverages satisfies the demands of consumer with healthy consciousness who are in search of organic products to replace the conventional beverages.

By Packaging type, Semi-Rigid Packaging segment held the largest share in 2024

- The organic foods and beverages market also encompasses packaging types, which are flexible packaging, rigid packaging, and semi-rigid packaging types. A flexible packaging type which includes the pouches and the bags is convenient and is used for the products like the snacks and the beverages. Bottles and jars are other types of rigid packaging that offers strength and protection to the contents and are frequently used for holding sauces and condiments. Flexible rigid packaging, such as trays and clamshells, is more flexible than the rigid packaging, but it is slightly more rigid than the flexible packaging, and it is suitable for products such as fruits and vegetables. Each type of packaging has its benefits, and they are used depending on the nature of the product and the customers.

Organic Foods and Beverages Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American organic foods and beverages market is rapidly growing due to the enhanced knowledge of the health benefits of organic products and the changing trends in agriculture that favor the use of organic products. Organic fruits and vegetables, dairy products and beverages are largely consumed in the region and the United States has the largest market share. There is also an increase in the market size in Canada and Mexico due to shifting consumer preferences and government policies that encourage the use of organic farming.

- In North America, supermarkets and hypermarkets remain the largest outlet for organic products with specialty stores and online sales coming second. The market of the region can be described as having a high concentration of organic food and beverage players which are well established in the market in addition to the influx of new players in the market who are coming up with new organic products in the market. As consumers in the North American region become increasingly conscious of environmental concerns as well as personal and family health, the market for organic foods and beverages is likely to maintain its upward trend in the near future.

Active Key Players in the Organic Foods and Beverages Market

- Hain Celestial (United States)

- Whole Foods Market L.P. (United States)

- Dole Food Company, Inc. (United States)

- Dairy Farmers of America, Inc. (United States)

- General Mills Inc. (United States)

- Danone (France)

- United Natural Foods, Inc. (United States)

- Gujarat Cooperative Milk Marketing Federation (Amul) (India)

- The Hershey Company (United States)

- Amy's Kitchen, Inc. (United States)

- Organic Valley (United States)

- Conagra Brands, Inc. (United States)

- Nestlé (Switzerland)

- Eden Foods (United States)

- SunOpta (Canada), Others Key Players.

Organic Foods and Beverages Market Scope:

|

Global Organic Foods and Beverages Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 263.70 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.90 % |

Market Size in 2032: |

USD 746.96 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging Type |

|

||

|

By Distribution channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Organic Foods and Beverages Market by Product Type (2018-2032)

4.1 Organic Foods and Beverages Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Organic Fruits & Vegetables

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Organic Dairy Products

4.5 Organic Meat

4.6 Poultry

4.7 and Seafood

4.8 Organic Frozen and Processed Foods

4.9 Organic Bread and Bakery Products

4.10 Organic Beverages (Coffee

4.11 Tea

4.12 Juices

4.13 Others)

Chapter 5: Organic Foods and Beverages Market by Packaging Type (2018-2032)

5.1 Organic Foods and Beverages Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Flexible Packaging

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Rigid Packaging

5.5 Semi-Rigid Packaging

Chapter 6: Organic Foods and Beverages Market by Distribution channel (2018-2032)

6.1 Organic Foods and Beverages Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarkets/Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Convenience Stores

6.5 Online Retail

6.6 Specialty Stores

6.7 Others (Farmers' Markets

6.8 Organic Shops)

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Organic Foods and Beverages Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 HAIN CELESTIAL (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 WHOLE FOODS MARKET L.P. (UNITED STATES)

7.4 DOLE FOOD COMPANY INC. (UNITED STATES)

7.5 DAIRY FARMERS OF AMERICA INC. (UNITED STATES)

7.6 GENERAL MILLS INC. (UNITED STATES)

7.7 DANONE (FRANCE)

7.8 UNITED NATURAL FOODS INC. (UNITED STATES)

7.9 GUJARAT COOPERATIVE MILK MARKETING FEDERATION (AMUL) (INDIA)

7.10 THE HERSHEY COMPANY (UNITED STATES)

7.11 AMY'S KITCHEN INC. (UNITED STATES)

7.12 ORGANIC VALLEY (UNITED STATES)

7.13 CONAGRA BRANDS INC. (UNITED STATES)

7.14 NESTLÉ (SWITZERLAND)

7.15 EDEN FOODS (UNITED STATES)

7.16 SUNOPTA (CANADA)

7.17 OTHERS KEY PLAYERS.

Chapter 8: Global Organic Foods and Beverages Market By Region

8.1 Overview

8.2. North America Organic Foods and Beverages Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Organic Fruits & Vegetables

8.2.4.2 Organic Dairy Products

8.2.4.3 Organic Meat

8.2.4.4 Poultry

8.2.4.5 and Seafood

8.2.4.6 Organic Frozen and Processed Foods

8.2.4.7 Organic Bread and Bakery Products

8.2.4.8 Organic Beverages (Coffee

8.2.4.9 Tea

8.2.4.10 Juices

8.2.4.11 Others)

8.2.5 Historic and Forecasted Market Size by Packaging Type

8.2.5.1 Flexible Packaging

8.2.5.2 Rigid Packaging

8.2.5.3 Semi-Rigid Packaging

8.2.6 Historic and Forecasted Market Size by Distribution channel

8.2.6.1 Supermarkets/Hypermarkets

8.2.6.2 Convenience Stores

8.2.6.3 Online Retail

8.2.6.4 Specialty Stores

8.2.6.5 Others (Farmers' Markets

8.2.6.6 Organic Shops)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Organic Foods and Beverages Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Organic Fruits & Vegetables

8.3.4.2 Organic Dairy Products

8.3.4.3 Organic Meat

8.3.4.4 Poultry

8.3.4.5 and Seafood

8.3.4.6 Organic Frozen and Processed Foods

8.3.4.7 Organic Bread and Bakery Products

8.3.4.8 Organic Beverages (Coffee

8.3.4.9 Tea

8.3.4.10 Juices

8.3.4.11 Others)

8.3.5 Historic and Forecasted Market Size by Packaging Type

8.3.5.1 Flexible Packaging

8.3.5.2 Rigid Packaging

8.3.5.3 Semi-Rigid Packaging

8.3.6 Historic and Forecasted Market Size by Distribution channel

8.3.6.1 Supermarkets/Hypermarkets

8.3.6.2 Convenience Stores

8.3.6.3 Online Retail

8.3.6.4 Specialty Stores

8.3.6.5 Others (Farmers' Markets

8.3.6.6 Organic Shops)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Organic Foods and Beverages Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Organic Fruits & Vegetables

8.4.4.2 Organic Dairy Products

8.4.4.3 Organic Meat

8.4.4.4 Poultry

8.4.4.5 and Seafood

8.4.4.6 Organic Frozen and Processed Foods

8.4.4.7 Organic Bread and Bakery Products

8.4.4.8 Organic Beverages (Coffee

8.4.4.9 Tea

8.4.4.10 Juices

8.4.4.11 Others)

8.4.5 Historic and Forecasted Market Size by Packaging Type

8.4.5.1 Flexible Packaging

8.4.5.2 Rigid Packaging

8.4.5.3 Semi-Rigid Packaging

8.4.6 Historic and Forecasted Market Size by Distribution channel

8.4.6.1 Supermarkets/Hypermarkets

8.4.6.2 Convenience Stores

8.4.6.3 Online Retail

8.4.6.4 Specialty Stores

8.4.6.5 Others (Farmers' Markets

8.4.6.6 Organic Shops)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Organic Foods and Beverages Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Organic Fruits & Vegetables

8.5.4.2 Organic Dairy Products

8.5.4.3 Organic Meat

8.5.4.4 Poultry

8.5.4.5 and Seafood

8.5.4.6 Organic Frozen and Processed Foods

8.5.4.7 Organic Bread and Bakery Products

8.5.4.8 Organic Beverages (Coffee

8.5.4.9 Tea

8.5.4.10 Juices

8.5.4.11 Others)

8.5.5 Historic and Forecasted Market Size by Packaging Type

8.5.5.1 Flexible Packaging

8.5.5.2 Rigid Packaging

8.5.5.3 Semi-Rigid Packaging

8.5.6 Historic and Forecasted Market Size by Distribution channel

8.5.6.1 Supermarkets/Hypermarkets

8.5.6.2 Convenience Stores

8.5.6.3 Online Retail

8.5.6.4 Specialty Stores

8.5.6.5 Others (Farmers' Markets

8.5.6.6 Organic Shops)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Organic Foods and Beverages Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Organic Fruits & Vegetables

8.6.4.2 Organic Dairy Products

8.6.4.3 Organic Meat

8.6.4.4 Poultry

8.6.4.5 and Seafood

8.6.4.6 Organic Frozen and Processed Foods

8.6.4.7 Organic Bread and Bakery Products

8.6.4.8 Organic Beverages (Coffee

8.6.4.9 Tea

8.6.4.10 Juices

8.6.4.11 Others)

8.6.5 Historic and Forecasted Market Size by Packaging Type

8.6.5.1 Flexible Packaging

8.6.5.2 Rigid Packaging

8.6.5.3 Semi-Rigid Packaging

8.6.6 Historic and Forecasted Market Size by Distribution channel

8.6.6.1 Supermarkets/Hypermarkets

8.6.6.2 Convenience Stores

8.6.6.3 Online Retail

8.6.6.4 Specialty Stores

8.6.6.5 Others (Farmers' Markets

8.6.6.6 Organic Shops)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Organic Foods and Beverages Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Organic Fruits & Vegetables

8.7.4.2 Organic Dairy Products

8.7.4.3 Organic Meat

8.7.4.4 Poultry

8.7.4.5 and Seafood

8.7.4.6 Organic Frozen and Processed Foods

8.7.4.7 Organic Bread and Bakery Products

8.7.4.8 Organic Beverages (Coffee

8.7.4.9 Tea

8.7.4.10 Juices

8.7.4.11 Others)

8.7.5 Historic and Forecasted Market Size by Packaging Type

8.7.5.1 Flexible Packaging

8.7.5.2 Rigid Packaging

8.7.5.3 Semi-Rigid Packaging

8.7.6 Historic and Forecasted Market Size by Distribution channel

8.7.6.1 Supermarkets/Hypermarkets

8.7.6.2 Convenience Stores

8.7.6.3 Online Retail

8.7.6.4 Specialty Stores

8.7.6.5 Others (Farmers' Markets

8.7.6.6 Organic Shops)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Organic Foods and Beverages Market Scope:

|

Global Organic Foods and Beverages Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 263.70 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.90 % |

Market Size in 2032: |

USD 746.96 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Packaging Type |

|

||

|

By Distribution channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Organic Foods and Beverages Market research report is 2024-2032.

Hain Celestial (United States), Whole Foods Market L.P. (United States), Dole Food Company, Inc. (United States), Dairy Farmers of America, Inc. (United States), General Mills Inc. (United States), Danone (France), United Natural Foods, Inc. (United States), Gujarat Cooperative Milk Marketing Federation (Amul) (India), The Hershey Company (United States), Amy's Kitchen, Inc. (United States), Organic Valley (United States), Conagra Brands, Inc. (United States), Nestlé (Switzerland), Eden Foods (United States), SunOpta (Canada) and Other Major Players.

The Organic Foods and Beverages Market is segmented into by Product Type (Organic Fruits & Vegetables, Organic Dairy Products, Organic Meat, Poultry, and Seafood, Organic Frozen and Processed Foods, Organic Bread and Bakery Products, Organic Beverages), by Packaging (Flexible Packaging, Rigid Packaging, Semi-Rigid Packaging), Distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Pol and ; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherland; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Organic Foods and Beverages Market is the industry that deals with the production, distribution, and sale of foods and beverages that are naturally grown and prepared without the application of chemicals, hormones, steroids, or GMOs. This market is made up of people who are interested in organic and natural products, mostly for health conscious and ecological reasons and are willing to pay a little extra for such products. It entails all the products like fruits and vegetables, dairy products, processed foods, meat products, beverages, and other related products sold in supermarkets, specialty stores, and online markets.

Organic Foods and Beverages Market Size is Valued at USD 263.70 Billion in 2024, and is Projected to Reach USD 746.96 Billion by 2032, Growing at a CAGR of 13.90% From 2024-2032.