Global Organic Cocoa Market Synopsis

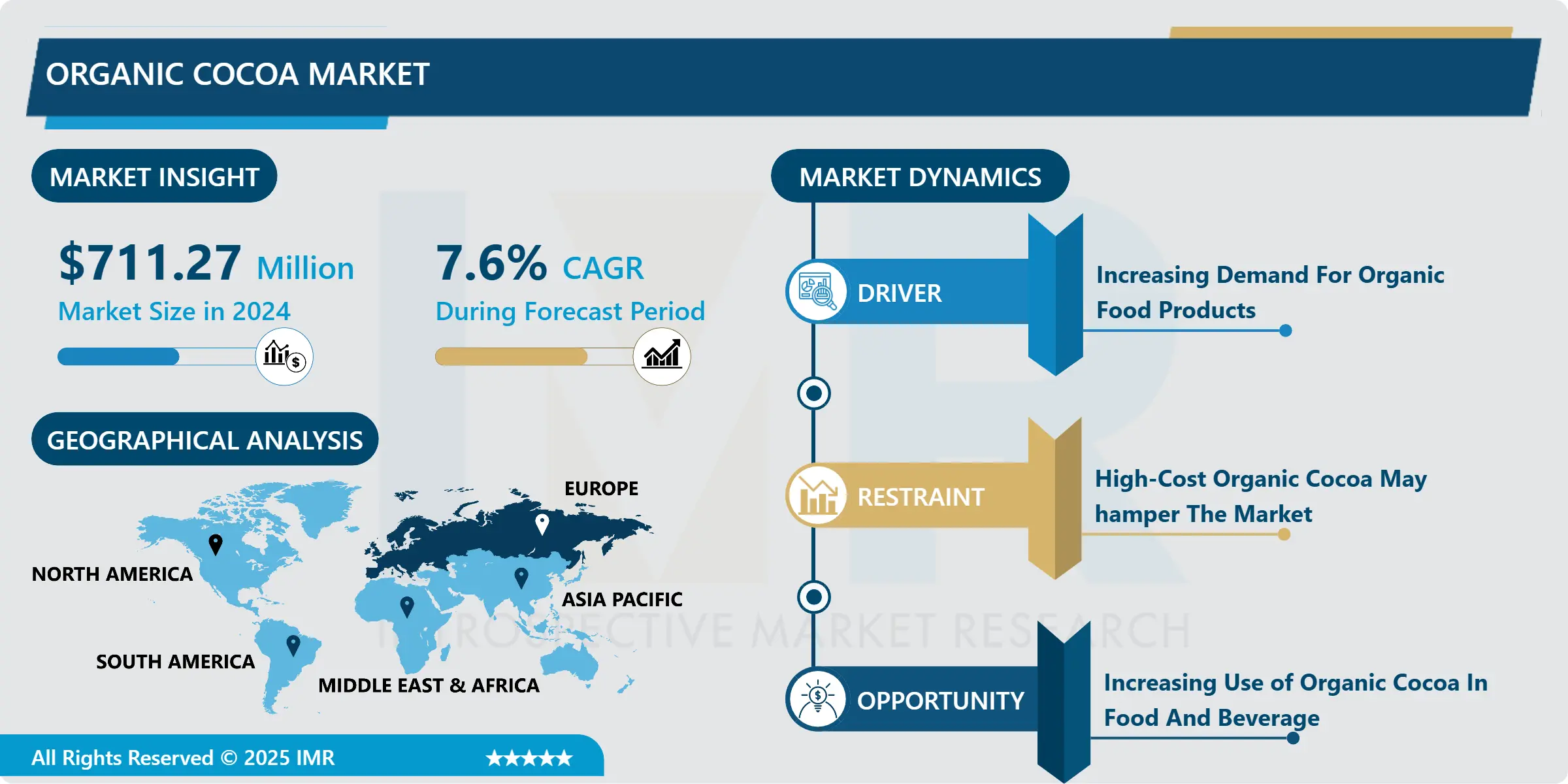

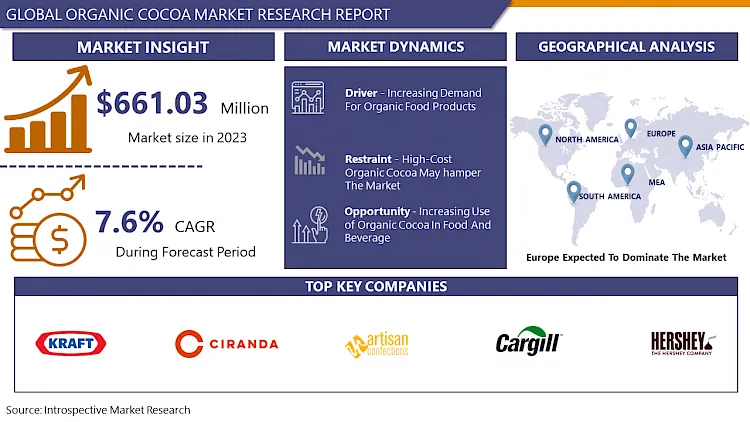

The Global Organic Cocoa Market Size Is Expected to Grow from USD 711.27 Million In 2024 To USD 1278.01 Million By 2032, At A CAGR of 7.6% During the Forecast Period (2025-2032).

Organic cocoa is grown and produced using farming methods, production processes, and with ingredients that comply with USDA organic standards. It must be grown or produced without the use of pesticides, herbicides, synthetic fertilizers, or genetically modified organisms.

The fruit tree that yields cocoa beans, the cacao tree, is a delicate plant that can be challenging to farm. They are extremely vulnerable to disease and insects, and they need the ideal ratio of sunlight, air, shade, water, and nutrients.

Different methods are used in cocoa farming by organic farmers. Since all artificial pesticides, fungicides, and fertilizers are prohibited by organic regulations, cocoa farmers must rely on developing integrated pest management strategies and sustainable agricultural practices to protect their crops.

To avoid pests and disease, organic cocoa farmers work to establish a healthy ecosystem between plants and animals. This frequently entails using cover crops to diversify their crop. Cover crops shade the delicate cocoa trees while also improving the soil, giving the farmer another source of income, and boosting ecosystem biodiversity.

Cocoa has been found to improve cognitive function and memory. Cocoa has been found to increase blood flow to the brain. Cocoa could prevent age?related cognitive impairment and forgetfulness.

The Global Organic Cocoa Market Trend Analysis

Global Organic Cocoa Market Drivers- Increasing Demand for Organic Food Products

- The demand for organic food increased during the COVID-19 pandemic as consumers thought they were healthier and better for immunity. However, the demand for organic food is also growing consistently in all other respects.

- In the last decade, there has been an increase in awareness among people about other positive effects of organic products One of the main reasons to eat organic food is that it does not contain dangerous chemicals and pollutants, as some chemicals have been linked to cancer and other serious health issues. Customers have started to realize that eating organic food also helps them feel more energetic and fit.

- Cocoa powder is rich in theobromine, which helps to reduce inflammation and can protect you from diseases such as heart disease, cancer, and diabetes. Since cocoa is rich in phytonutrients but low in fat and sugar, the calories you get from cocoa powder will be packed with healthy chemicals.

- Organic cocoa contains a healthy amount of caffeine. This helps to boost energy and fight fatigue. Not only does it have a good amount of caffeine, but it contains magnesium as well. Two tablespoons of cocoa powder have about 14% of the body’s daily value of Magnesium. Magnesium has been found to keep the body energized naturally. Thus, the above benefits that organic cocoa gives are responsible for the growth of the market.

Global Organic Cocoa Market Opportunities- Increasing Use of Organic Cocoa In Food And Beverage

- A highly concentrated powder used in beverages and as a flavoring agent, cocoa is made from chocolate liquor, a paste made from the cacao fruit's cocoa beans. The main component of chocolate and chocolate-based treats is cocoa.

- The fluid paste, or liquor, that is used to make cocoa powder and chocolate are derived from the cocoa bean. Direct sales of chocolate include baking chocolate, cocoa in packages, and solid bars for eating. Additionally, confectioners use it as a coating for candy bars, boxed chocolates, and bulk chocolate, and bakers and manufacturers of bakery goods use it as a coating for a variety of cookies and cakes.

- Organic cocoa powders, chocolate liquor, and blends of the two are used in bulk to flavor various food products and to provide flavors in such “chocolate” products as syrups, toppings, chocolate milk, prepared cake mixes, and pharmaceuticals.

- One of the most adored flavors in the world is cocoa. It almost has the potential to become addictive. Smoothies, coffee, and oatmeal all taste great with the rich, intense flavor of cocoa powder. Even savory cocoa sauces are frequently made by people to serve with meat. In addition to its fantastic flavor, cocoa powder has a lot of other advantages. The health benefits of cocoa are truly remarkable owing to these various features organic cocoa is used in different foods and has been creating the lucrative opportunities over the forecast period.

Segmentation Analysis Of The Global Organic Cocoa Market

Global Organic Cocoa market segments cover the Type, Application, and Distribution Channel. By application, Food and Beverages segment is Anticipated to Dominate the Market Over the Forecast period.

- Natural cocoa has a strong chocolate flavor and is light in color and slightly acidic. When baking soda is called for in a recipe, natural cocoa is frequently used. Natural cocoa and baking soda combine to produce a leavening effect that causes the batter to rise during baking because baking soda is an alkali.

- Cakes, ice cream, dairy drinks, and biscuits all use cocoa powder as a flavoring. In addition to being used as a flavor, it is also used to make coatings for frozen desserts or confectioners. The beverage industry uses cocoa powder as well, for making chocolate milk, for instance.

- Chocolate liquor is created by fermenting, drying, roasting, and cracking the beans. The nibs are then ground to remove about 75% of the cocoa butter, leaving behind the dark brown paste. The mass is ground into powder after re-drying (unsweetened cocoa). To balance the natural acidity of Dutch cocoa, an alkali is applied. Unsweetened baking cocoa comes in two varieties: Both are made by partially defatting chocolate liquor and removing almost all of the cocoa butter before being ground into powder.

Regional Analysis of The Global Organic Cocoa Market

Europe Expected to Dominate the Market Over the Forecast period.

- All price points of organic chocolate are offered in Europe, from budget supermarket brands to high-end, premium goods. It is anticipated that demand for organic cocoa will increase over the coming years, primarily due to consumer interest in health and wellness and concerns about the sustainability in this region.

- The largest market for cocoa in the world is Europe, which is also the second-largest market for organic goods. The demand for organic products among consumers is growing, as is the importation of organic cocoa beans into Europe. The growing interest in healthy living and growing concern for sustainability issues are the main factors driving demand for organic products.

- One of the factors driving up demand for organic goods in Europe is the rising interest in healthy living. Additionally, the COVID-19 crisis increased demand for organic products by raising consumer awareness of quality and health. Consumers think organic food is safer and healthier than the conventional fare.

- According to ITC Trade Map, EU-28 imported an estimated 2.0 million tonnes of cocoa beans in 2020. European Commission data show that total EU-28 imports of organic cocoa beans amounted to 76,000 tonnes that year, representing 3.9% of total cocoa bean imports. Organic cocoa bean imports by EU-28 registered 16% growth from 2019 when the share of organic cocoa beans amounted to 2.9% of total cocoa bean imports.

- There is an increasingly large market for organic cocoa in Europe, as supermarkets have expanded and diversified their range of organic products. These factors were responsible for the increased market of cocoa in Europe.

Top Key Players Covered in The Global Organic Cocoa Market

- Kraft Foods Inc. (U.S.)

- Ciranda (U.S.)

- Blommer Chocolate Company (U.S.)

- Artisan Confections Company (U.S.)

- InterNatural Foods LLC (U.S.)

- Wilmor Publishing Corp (U.S.)

- Olam International Limited (Singapore)

- Barry Callebaut AG (Switzerland)

- Tradin Organic Agriculture B.V. (Netherlands)

- Conacado AgroIndustrial S.A. (Dominican Republic)

- Cargill, Inc. (U.S.)

- Pascha Chocolate Co. (U.S.)

- Guan Chong Berhad (Malaysia)

- The Hershey Company (U.S.)

- Jindal Cocoa (India), and Other Active Players.

Key Industry Developments in the Global Organic Cocoa Market

- In April 2024, With the demand for even more sustainable global confectionery products expected to rise, Cargill announced a new commercial partnership with Voyage Foods to scale up and deliver delicious, healthy, and particularly more sustainable alternatives to cocoa-based products, along with nut spreads without their traditional ingredients - peanuts and hazelnuts. Cargill became the exclusive B2B global distributor for Voyage Foods, expanding its traditional chocolate portfolio to bring more sustainable alternatives for cocoa-based products to its customers for the very first time.

- In September 2023, Barry Callebaut Group, the world’s leading manufacturer of high-quality chocolate and cocoa products, announced BC Next Level a strategic investment program aimed at unlocking the full potential of Barry Callebaut. This initiative is designed to pave the way for the next decade of sustainable growth by bringing Barry Callebaut closer to markets and customers while fostering simplicity and digitization.

|

Global Organic Cocoa Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 711.27 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.6% |

Market Size in 2032: |

USD 1278.01 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Organic Cocoa Market by Type (2018-2032)

4.1 Organic Cocoa Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cocoa Butter

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cocoa Liquor

4.5 Cocoa Powder

Chapter 5: Organic Cocoa Market by Application (2018-2032)

5.1 Organic Cocoa Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food & Beverages

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pharmaceutical

5.5 Personal Care

5.6 Others

Chapter 6: Organic Cocoa Market by Distribution Channel (2018-2032)

6.1 Organic Cocoa Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Direct

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Indirect

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Organic Cocoa Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 INVACARE CORPORATION (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GRAHAM-FIELD HEALTH PRODUCTS INC (U.S.)

7.4 KARMAN HEALTHCARE(U.S.)

7.5 QUANTUM REHAB (U.S.)

7.6 OSTRICH MOBILITY INSTRUMENTS PVT. LTD. (INDIA)

7.7 OTTOBOCK SE (GERMANY)

7.8 PRIDE MOBILITY PRODUCTS CORP. (U.S.)

7.9 MEDLINE (U.S.)

7.10 SUNRISE MEDICAL LLC (GERMANY)

7.11 CAREX HEALTH BRANDS INC. (U.S.)

7.12 MEYRA GROUP GMBH (POLAND)

7.13 LEVO AG (SWITZERLAND)

7.14 SEATING MATTERS (CANADA)

7.15 NUMOTION (U.S.)

7.16 MAGIC MOBILITY PVT LTD. (AUSTRALIA)

Chapter 8: Global Organic Cocoa Market By Region

8.1 Overview

8.2. North America Organic Cocoa Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Cocoa Butter

8.2.4.2 Cocoa Liquor

8.2.4.3 Cocoa Powder

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Food & Beverages

8.2.5.2 Pharmaceutical

8.2.5.3 Personal Care

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Direct

8.2.6.2 Indirect

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Organic Cocoa Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Cocoa Butter

8.3.4.2 Cocoa Liquor

8.3.4.3 Cocoa Powder

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Food & Beverages

8.3.5.2 Pharmaceutical

8.3.5.3 Personal Care

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Direct

8.3.6.2 Indirect

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Organic Cocoa Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Cocoa Butter

8.4.4.2 Cocoa Liquor

8.4.4.3 Cocoa Powder

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Food & Beverages

8.4.5.2 Pharmaceutical

8.4.5.3 Personal Care

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Direct

8.4.6.2 Indirect

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Organic Cocoa Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Cocoa Butter

8.5.4.2 Cocoa Liquor

8.5.4.3 Cocoa Powder

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Food & Beverages

8.5.5.2 Pharmaceutical

8.5.5.3 Personal Care

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Direct

8.5.6.2 Indirect

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Organic Cocoa Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Cocoa Butter

8.6.4.2 Cocoa Liquor

8.6.4.3 Cocoa Powder

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Food & Beverages

8.6.5.2 Pharmaceutical

8.6.5.3 Personal Care

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Direct

8.6.6.2 Indirect

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Organic Cocoa Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Cocoa Butter

8.7.4.2 Cocoa Liquor

8.7.4.3 Cocoa Powder

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Food & Beverages

8.7.5.2 Pharmaceutical

8.7.5.3 Personal Care

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Direct

8.7.6.2 Indirect

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Organic Cocoa Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 711.27 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.6% |

Market Size in 2032: |

USD 1278.01 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||