Oral & Dental Probiotics Market Synopsis

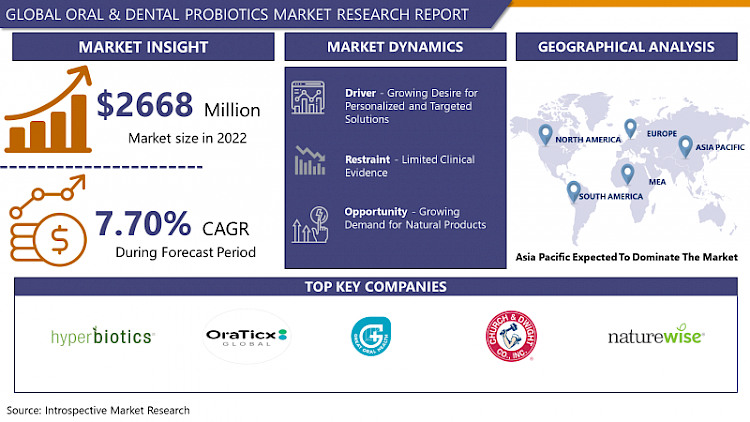

Global Oral & Dental Probiotics Market Size Was Valued at USD 2668 Million in 2022, and is Projected to Reach USD 5601.05 Million by 2030, Growing at a CAGR of 7.70% From 2023-2030.

Specialized oral and dental probiotics comprise carefully formulated blends of beneficial bacteria, such as Lactobacillus and Bifidobacterium strains. Their purpose is to foster a harmonious microorganism balance within the oral cavity and to promote optimal oral hygiene.

- Innovative formulations of oral and dental probiotics feature beneficial bacteria, particularly strains of Lactobacillus and Bifidobacterium, carefully designed to cultivate a balanced microbial environment within the oral cavity. These probiotics find application in various oral care products, including toothpaste, mouthwash, and supplements. Their role in oral care revolves around sustaining a well-balanced microbiome, effectively preventing the overgrowth of harmful bacteria linked to dental problems such as cavities and gum diseases. Their mechanism involves hindering the colonization of pathogenic bacteria, thereby fostering a healthier oral ecosystem.

- The advantages of integrating oral and dental probiotics into daily hygiene routines are noteworthy. These probiotics play a role in preventing dental caries by generating antimicrobial substances and supporting the remineralization of tooth enamel. Furthermore, they contribute to gum health by mitigating inflammation and promoting optimal immune responses. Addressing bad breath concerns, probiotics tackle the root cause of odour-producing bacteria. As a natural and complementary approach to traditional oral care, these probiotics provide a means of sustaining overall oral health and hygiene. Consistent use serves as a valuable addition to oral care practices, promoting a proactive and preventive approach to dental wellness.

Oral & Dental Probiotics Market Trend Analysis:

Growing Desire for Personalized and Targeted Solutions

- The increasing demand for personalized and targeted solutions in oral care is a significant factor driving the expansion of the Oral and Dental Probiotics market. Consumers are more inclined towards customized approaches to address their specific oral health needs, recognizing the limitations of one-size-fits-all solutions. This trend aligns with the broader shift towards personalized healthcare, where individuals prioritize products that closely align with their unique health goals and preferences.

- The adaptability of Oral and Dental Probiotics in meeting diverse oral health requirements adds to their attractiveness as personalized solutions. Whether it's preventing cavities, addressing gum diseases, or tackling bad breath, consumers value the targeted benefits offered by probiotic formulations. Manufacturers are responding to this demand by creating a variety of oral probiotic products, including toothpaste, mouthwash, and supplements, each tailored to address specific oral concerns. This emphasis on customization enhances consumer engagement and loyalty, contributing to the market's growth.

- Furthermore, the increasing awareness of the connection between oral health and overall well-being is driving the demand for personalized oral care solutions. Consumers understand that maintaining a healthy oral microbiome not only contributes to dental health but also impacts systemic health. As this awareness deepens, the preference for oral probiotics as a personalized and preventive measure is anticipated to fuel sustained growth in the Oral and Dental Probiotics market.

Growing Demand for Natural Products

- The increasing preference for natural products has emerged as a significant opportunity for the growth of the oral and dental probiotics market. Consumers are increasingly searching for oral care alternatives that align with their inclination towards natural and sustainable solutions. This shift in consumer behavior is fueled by a heightened awareness of potential adverse effects linked to certain synthetic ingredients commonly found in traditional oral care products. Consequently, there is a growing preference for products that leverage the benefits of natural components, with oral and dental probiotics emerging as a promising choice.

- Probiotics, derived from beneficial bacteria such as Lactobacillus and Bifidobacterium, provide a natural approach to oral health by fostering a balanced microbial environment in the mouth. The market is responding to this demand by developing probiotic-based toothpaste, mouthwash, and supplements. These products not only aim to prevent common dental issues but also address consumer concerns regarding the long-term impact of chemical-laden oral care products. With an increasing emphasis on overall well-being and preventive healthcare, the demand for natural oral and dental probiotics is anticipated to experience significant growth, driven by consumers seeking effective and nature-derived solutions.

- The opportunity to meet the demand for natural oral care products extends beyond individual preferences. It aligns with broader trends in the health and wellness sector, where consumers actively seek products that resonate with their holistic approach to self-care.

Oral & Dental Probiotics Market Segment Analysis:

Oral & Dental Probiotics Market Segmented on the basis of Type, Formulation, Application End-User and Distribution Channel

By Type, Mouthwash segment is expected to dominate the market during the forecast period

- The mouthwash sector is predicted to establish its dominance in the Oral & Dental Probiotics market, primarily due to its ease of use and direct application to oral care routines. Mouthwashes incorporating probiotics present a focused approach to addressing oral concerns such as dental caries, gum diseases, and halitosis. There is a growing consumer preference for daily oral care products that are both effective and user-friendly, and probiotic-infused mouthwashes cater to this demand. The liquid formulation of these mouthwashes facilitates thorough coverage of the oral cavity, reaching areas that may pose challenges for other oral care items.

- Moreover, the incorporation of probiotics in mouthwashes indicates a proactive shift toward preventive oral healthcare, appealing to individuals seeking to improve their overall oral hygiene practices. This trend is expected to gain momentum with increasing awareness of the advantages of probiotics and their positive influence on the oral microbiome, positioning the mouthwash segment at the forefront of the Oral & Dental Probiotics market.

By Formulation, Capsules segment held the largest share of 43.20% in 2022

- The capsules category has emerged as the predominant force in the Oral & Dental Probiotics market, securing the largest market share. This dominance can be attributed to various factors, including consumer preference for a convenient and easily consumable form of probiotics. Capsules provide a hassle-free way to incorporate probiotics into daily oral health routines, catering to individuals seeking a simple and portable solution. The encapsulation of probiotics ensures stability and efficacy, protecting the live bacteria from external factors that could compromise their potency.

- Additionally, capsules enable precise dosing, allowing users to maintain consistent probiotic intake for optimal oral care. As awareness of the vital role of oral microbiota in overall health increases, it is anticipated that the capsules segment will continue to lead in the Oral & Dental Probiotics market, meeting the preferences of a diverse range of consumers prioritizing both convenience and effectiveness in their oral health regimen.

Oral & Dental Probiotics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is positioned to lead the Oral & Dental Probiotics market, showcasing robust growth and dominance in the foreseeable future. This projected dominance is driven by factors such as the region's growing population, rising disposable income, and an increasing awareness of preventive healthcare practices. Economic development in Asia Pacific has led to heightened consumer awareness of oral hygiene, resulting in an increased demand for innovative dental products, particularly those infused with probiotics.

- Additionally, the cultural emphasis on traditional medicine and holistic health practices in many Asian countries aligns well with the utilization of probiotics for oral well-being. The presence of key players in the market, combined with proactive government initiatives promoting oral health, further establishes Asia Pacific as a leader in shaping the evolving landscape of the Oral & Dental Probiotics market.

Oral & Dental Probiotics Market Top Key Players:

- Hyperbiotics (U.S.)

- OraTicx (U.S.)

- Great Oral Health (U.S.)

- Church & Dwight Co., Inc. (Therabreath) (U.S.)

- NatureWise (U.S.)

- Swanson (U.S.)

- Jarrow Formulas, Inc. (U.S.)

- Revitin (U.S.)

- Dessert Essence (U.S.)

- Burst (U.S.)

- Riven (U.S.)

- ProDentim (U.S.)

- Designs for Health, Inc. (U.S.)

- Luvbiotics (UK)

- Pure Research Restore Limited (UK)

- Gallinee (UK)

- BioGaia AB (Sweden)

- Blis Probiotics (New Zealand), and Other Major Players

Key Industry Developments in the Oral & Dental Probiotics Market:

- In January 2023, Oragenics, Inc., a renowned developer of innovative antibiotics and oral care probiotics. ProBioraPlus, launched, is a mint-flavored tablet featuring a patented blend of three probiotic strains designed to naturally support gum and tooth health, freshen breath, and enhance teeth whitening. This product is readily available both online and in select retail outlets. Oragenics, Inc. asserts that ProBioraPlus has distinguished as the sole oral care probiotic product containing the same beneficial bacteria found in healthy oral environments.

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2668 Mn. |

|

Forecast Period 2023-30 CAGR: |

7.70% |

Market Size in 2030: |

USD 5601.05 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ORAL & DENTAL PROBIOTICS MARKET BY TYPE (2016-2030)

- ORAL & DENTAL PROBIOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TOOTHPASTE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MOUTHWASH

- SUPPLEMENTS

- ORAL & DENTAL PROBIOTICS MARKET BY FORMULATION (2016-2030)

- ORAL & DENTAL PROBIOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CAPSULES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LOZENGES

- POWDERS

- CHEWING GUMS

- ORAL & DENTAL PROBIOTICS MARKET BY APPLICATION (2016-2030)

- ORAL & DENTAL PROBIOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DENTAL CARIES PREVENTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GUM DISEASE MANAGEMENT

- BAD BREATH CONTROL

- ORTHODONTIC CARE

- ORAL & DENTAL PROBIOTICS MARKET BY END-USER (2016-2030)

- ORAL & DENTAL PROBIOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ADULTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CHILDREN

- ORAL & DENTAL PROBIOTICS MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- ORAL & DENTAL PROBIOTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PHARMACIES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- E-COMMERCE

- DENTAL CLINICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Oral & Dental Probiotics Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HYPERBIOTICS (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ORATICX (U.S.)

- GREAT ORAL HEALTH (U.S.)

- CHURCH & DWIGHT CO., INC. (THERABREATH) (U.S.)

- NATUREWISE (U.S.)

- SWANSON (U.S.)

- JARROW FORMULAS, INC. (U.S.)

- REVITIN (U.S.)

- DESSERT ESSENCE (U.S.)

- BURST (U.S.)

- RIVEN (U.S.)

- PRODENTIM (U.S.)

- DESIGNS FOR HEALTH, INC. (U.S.)

- LUVBIOTICS (UK)

- PURE RESEARCH RESTORE LIMITED (UK)

- GALLINEE (UK)

- BIOGAIA AB (SWEDEN)

- BLIS PROBIOTICS (NEW ZEALAND)

- COMPETITIVE LANDSCAPE

- GLOBAL ORAL & DENTAL PROBIOTICS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Formulation

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2668 Mn. |

|

Forecast Period 2023-30 CAGR: |

7.70% |

Market Size in 2030: |

USD 5601.05 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ORAL & DENTAL PROBIOTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ORAL & DENTAL PROBIOTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ORAL & DENTAL PROBIOTICS MARKET COMPETITIVE RIVALRY

TABLE 005. ORAL & DENTAL PROBIOTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. ORAL & DENTAL PROBIOTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. ORAL & DENTAL PROBIOTICS MARKET BY TYPE

TABLE 008. POWDER MARKET OVERVIEW (2016-2028)

TABLE 009. CHEWABLE TABLETS MARKET OVERVIEW (2016-2028)

TABLE 010. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 011. ORAL & DENTAL PROBIOTICS MARKET BY APPLICATION

TABLE 012. CHILD MARKET OVERVIEW (2016-2028)

TABLE 013. ADULT MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA ORAL & DENTAL PROBIOTICS MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA ORAL & DENTAL PROBIOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 016. N ORAL & DENTAL PROBIOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE ORAL & DENTAL PROBIOTICS MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE ORAL & DENTAL PROBIOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 019. ORAL & DENTAL PROBIOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC ORAL & DENTAL PROBIOTICS MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC ORAL & DENTAL PROBIOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 022. ORAL & DENTAL PROBIOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA ORAL & DENTAL PROBIOTICS MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA ORAL & DENTAL PROBIOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 025. ORAL & DENTAL PROBIOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA ORAL & DENTAL PROBIOTICS MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA ORAL & DENTAL PROBIOTICS MARKET, BY APPLICATION (2016-2028)

TABLE 028. ORAL & DENTAL PROBIOTICS MARKET, BY COUNTRY (2016-2028)

TABLE 029. NOW FOODS: SNAPSHOT

TABLE 030. NOW FOODS: BUSINESS PERFORMANCE

TABLE 031. NOW FOODS: PRODUCT PORTFOLIO

TABLE 032. NOW FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. HYPERBIOTICS: SNAPSHOT

TABLE 033. HYPERBIOTICS: BUSINESS PERFORMANCE

TABLE 034. HYPERBIOTICS: PRODUCT PORTFOLIO

TABLE 035. HYPERBIOTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. ORAGENICS: SNAPSHOT

TABLE 036. ORAGENICS: BUSINESS PERFORMANCE

TABLE 037. ORAGENICS: PRODUCT PORTFOLIO

TABLE 038. ORAGENICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. LIFE EXTENSION: SNAPSHOT

TABLE 039. LIFE EXTENSION: BUSINESS PERFORMANCE

TABLE 040. LIFE EXTENSION: PRODUCT PORTFOLIO

TABLE 041. LIFE EXTENSION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. LALLEMAND: SNAPSHOT

TABLE 042. LALLEMAND: BUSINESS PERFORMANCE

TABLE 043. LALLEMAND: PRODUCT PORTFOLIO

TABLE 044. LALLEMAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ORAL & DENTAL PROBIOTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ORAL & DENTAL PROBIOTICS MARKET OVERVIEW BY TYPE

FIGURE 012. POWDER MARKET OVERVIEW (2016-2028)

FIGURE 013. CHEWABLE TABLETS MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 015. ORAL & DENTAL PROBIOTICS MARKET OVERVIEW BY APPLICATION

FIGURE 016. CHILD MARKET OVERVIEW (2016-2028)

FIGURE 017. ADULT MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA ORAL & DENTAL PROBIOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE ORAL & DENTAL PROBIOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC ORAL & DENTAL PROBIOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA ORAL & DENTAL PROBIOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA ORAL & DENTAL PROBIOTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Oral & Dental Probiotics Market research report is 2023-2030.

Hyperbiotics (U.S.), OraTicx (U.S.), Great Oral Health (U.S.), Church & Dwight Co., Inc. (Therabreath) (U.S.), NatureWise (U.S.), Swanson (U.S.), Jarrow Formulas, Inc. (U.S.), Revitin (U.S.), Dessert Essence (U.S.), Burst (U.S.), Riven (U.S.), ProDentim (U.S.), Designs for Health, Inc. (U.S.), Luvbiotics (UK), Pure Research Restore Limited (UK), Gallinee (UK), BioGaia AB (Sweden), Blis Probiotics (New Zealand)and Other Major Players.

The Oral & Dental Probiotics Market is segmented into Type, Formulation, Application, End-User, Distribution Channel, and Region. By Type, the market is categorized into Toothpaste, Mouthwash, and Supplements. By Formulation, the market is categorized into Capsules, Lozenges, Powders, and Chewing Gums. By Application, the market is categorized into Dental Caries Prevention, Gum Disease Management, Bad Breath Control, and Orthodontic Care. By End-User, the market is categorized into Adults and Children. By Distribution Channel, the market is categorized into Pharmacies, Supermarkets and Hypermarkets, E-commerce, and Dental Clinics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.)

Specialized oral and dental probiotics comprise carefully formulated blends of beneficial bacteria, such as Lactobacillus and Bifidobacterium strains. Their purpose is to foster a harmonious microorganism balance within the oral cavity and to promote optimal oral hygiene.

Global Oral & Dental Probiotics Market Size Was Valued at USD 2668 Million in 2022, and is Projected to Reach USD 5601.05 Million by 2030, Growing at a CAGR of 7.70% From 2023-2030.