Global Online Food Ordering System Market Overview

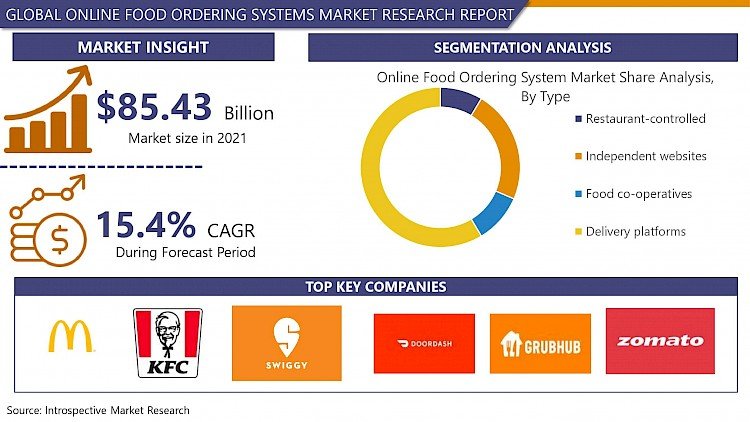

The Global Online Food Ordering System Market size is expected to grow from USD 36.26 billion in 2022 to USD 116.44 billion by 2030, at a CAGR of 15.7% during the forecast period (2023-2030).

Online food ordering is the procedure carried out by people for ordering food, from a different website or other mobile application. An online food ordering system allows businesses to manage orders that are placed by the customer using the internet for delivery or takeaway. Customers search, find a digital menu, on an app or website, and place and pay for their order online. After placing order venues receive the order details via their chosen online food ordering system and then produce the order ready for delivery or customer pickup. An online ordering and delivery system provides a complete sales channel for the restaurant. The restaurant gets the most benefit from this online ordering system they can use it as a tool for generating more profits and managing their restaurant in a better way. It also allows owners of the restaurant to save the cost of labor and restaurant space needed for sitting and serving customers. Moreover, increasing mobile phone and internet penetration in the world is the factor that helps to enhance the rate of online food ordering. The rising number of smartphone and internet users supports the increasing demand for online food ordering and helps to increase the market for online food ordering systems.

Market Dynamics Of Online Food Ordering System Market

Drivers:

Fast, Easy, and Comfortable Mode of Getting Food

Customers are choosing to order food through an online ordering system because it’s an easy way all the things are at their fingertips. Most people use mobile phones or desktops for ordering food. Anyone with a smartphone can order food online from the restaurant. Additionally, Millennials are most likely to use this system; they are the most important target audience for this market. Over 97% of Millennials use their phones for just surfing and ordering food online falls right into the same broad category. Moreover, according to Statista, 43% of people order food online through the system mainly due to they don’t feel like cooking the meal. This large population is actively searching for restaurants online to order food by using an online food ordering system. The fast, easy and comfortable service provided by the system and vendors to the customer is expected to provide large growth to the online food ordering system market during the projected period.

Restraints:

Online Food Ordering Creating Lot of Waste

The online food ordering system market is continuously witnessing growth due to the tremendous popularity of this service. Several people are ordering food for convenience daily. Due to this, the use of plastic packaging is increased and it resulted in large plastic waste creation which is showing an adverse effect on the environment. Food is delivered in good quality packages, boxes, plastic plates, spoons, and plastic paper raping by vendors which creates a lot of waste. For instance, in China, the food delivery industry received more than 16 billion orders in a year, and more than 80 percent of the food delivery restaurants in China offered only plastic packaging which contributes to a lot of waste formation.

Opportunities:

Advancement in Menu Engineering Helps Systems to Create Strong and Convincing Visual Appearance of Product

Menu Engineering refers to combining restaurant menu design tips with menu psychology to stimulate and encourage clients the customer to spend more on food. In online food ordering customers buy products according to their hunger and most of the time customers buy a product that does not satisfy their hunger but because of just their convincing visual appearance customers buy those products. Menu Engineering gives design tips to craft a deeply persuasive menu that will stimulate the customer into ordering more food. Additionally, the first bite is with the eye, so encouraging customers to go online and go through the entire menu when they’re hungry contributes to ordering more food than they normally order on the phone or food ordering system. Hungry customers order much more food online and bigger and higher orders give a significantly larger stream of revenue to the ventures. The more concentrated menu and visually appealing products provide an opportunity to enhance the online food ordering system market.

Market Segmentation Of Online Food Ordering System Market

By Type, the delivery platforms segment dominates the overall market growth of the online food ordering system market in the past few years and is expected to continue its dominance over the forecast period. The growing adoption of different food delivery platform apps such as Zomato, UberEats, Deliveroo, and Grubhub across the globe is contributing to the growth of the online food ordering system market. These apps are like Uber Eats or Deliveroo gives more exposure to restaurants. The people who don’t know the location of the restaurant and facilities provided by them like takeaway services are displayed on this delivery platform which helps to enhance the customer's purchasing rate. Additionally, the large population on this platform provides a broad audience of potential customers directly to the restaurant. It’s a quick and easy way to start the business with this delivery platform and people are taking this opportunity to expand their business which also boosts the growth of the online food ordering system market during the projected period.

By Application, the B2C segment is expecting maximum market share in the online food ordering system market during the projected period. A large population is using this system through different platforms like restaurant-controlled, independent websites, food co-operatives, and delivery platforms. For instance, as of the end of 2021, almost 53% of internet users in China had used online food delivery services. The huge customer base for these platforms due to the advantages provided by platforms helps increase the platform-to-consumer delivery that helps to propel the growth of the business-to-customer segment and ultimately supports the growth of the online food ordering system market.

Regional Analysis Of Online Food Ordering System Market

Asia-Pacific is the dominating region for online food ordering systems during the forecasted period. Rising consumer interest, adoption of new technology, and also better understanding of the technology are propelling the growth of the market. Additionally, with the increasing requirement for quick and easy services due to hectic working hours, people are so busy nowadays that they have no time for cooking and cleaning so most people are ordering food from different restaurants by using online food ordering platforms. Also, there is a huge population in the Asia Pacific region which shows the large consumer base for this food ordering sector which ultimately increases the growth of the online food ordering system market. In addition to this, this region consists of countries like China, Japan, and India, These are densely populated countries and are in the developing phase so the adoption of smartphones and technology is high in this region. Due to this, the online food ordering system market is expanding in the Asia Pacific region.

The North American region is the second dominant and fast-growing region for online food ordering systems during the projected period. The market growth in this region is driven by the rise in consumer demand for home delivery due to their busy lifestyles. Additionally, the rapidly increasing food processing industry in the region, along with the growing business and industrialization has a direct influence on the functional online food ordering in the region. Moreover, the high disposable income of individuals helps in the rise of spending on food delivery. This gives a significant increase in the spending on food and gets higher revenue for food delivery applications. This entire factor is helping in the growth of the online food ordering system during the forecasted period.

Europe is one of the leading regions in the online food ordering system sector during the analysis period. This region includes well-developed countries such as Germany, the U.K., and France. The population in this region is highly educated and employed which indicates the high spending capacity of the individual in the region. So this region is positively contributing to the online food ordering system market. Additionally, this region consists of the strong presence of key players, and the public in this region ordered food online on across all areas like from developing to suburban and urban areas these factors are contributing to the increasing growth of this market in the Europe region.

Covid-19 Impact Analysis On Online Food Ordering System Market

The Covid-19 pandemic shows a positive impact on the online food ordering system market as the adoption of online food delivery platforms increased as millions of people are being restricted to stay home to stop the penetration of the virus. The online food platform became one of the main protagonists during the COVID-19 pandemic. Online food delivery service providers have witnessed a significant increase in revenue and online orders owing to the increased consumer demand for online food delivery due to restrictions. The restaurants, fast food centers, and different food chains used online food delivery platforms to facilitate both delivery and take-out during the outbreak which contributes to the growth of the market.

Top Key Players Covered In Online Food Ordering System Market

- McDonalds (US)

- KFC (US)

- GrubHub (US)

- Swiggy (US)

- MEITUAN (China)

- Uber Eats (California)

- DoorDash (US)

- Caviar (California)

- Zomato (US)

- Subway (US)

- Pizza hut(US)

- Starbucks (US)

- Burger King (US)

- Domino’s Pizza (US)

- Dunkin Donuts (US)

- Dairy Queen (Minnesota)

- Papa John’s (US)

- Wendy’s (US)

- Just Eat (UK)

- Takeaway (Netherlands)

- Alibaba Group (China) and other major players.

Key Industry Development In The Online Food Ordering System Market

In December 2020, Restaurant Marketing Services launched Online Ordering System and Food App was intentionally designed to cater to Restaurant owners to turn people into food customers.

In September 2020, Amazon launched its food delivery service, called Amazon Food, in select parts of Bangalore India.

|

Global Online Food Ordering System Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data : |

2017 to 2022 |

Market Size in 2022: |

USD 36.26 Bn. |

|

Forecast Period 2023-30 CAGR: |

15.7% |

Market Size in 2030: |

USD 116.44 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Online Food Ordering System Market by Type

5.1 Online Food Ordering System Market Overview Snapshot and Growth Engine

5.2 Online Food Ordering System Market Overview

5.3 Restaurant-controlled

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Restaurant-controlled: Grographic Segmentation

5.4 Independent websites

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Independent websites: Grographic Segmentation

5.5 Food co-operatives

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Food co-operatives: Grographic Segmentation

5.6 Delivery platforms

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Delivery platforms: Grographic Segmentation

Chapter 6: Online Food Ordering System Market by Application

6.1 Online Food Ordering System Market Overview Snapshot and Growth Engine

6.2 Online Food Ordering System Market Overview

6.3 B2B

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 B2B: Grographic Segmentation

6.4 B2C

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 B2C: Grographic Segmentation

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Online Food Ordering System Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Online Food Ordering System Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Online Food Ordering System Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 MCDONALDS

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 KFC

7.4 GRUBHUB

7.5 SWIGGY

7.6 MEITUAN

7.7 UBER EATS

7.8 DOORDASH

7.9 CAVIAR

7.10 ZOMATO

7.11 SUBWAY

7.12 PIZZA HUT

7.13 STARBUCKS

7.14 BURGER KING

7.15 DOMINO’S PIZZA

7.16 DUNKIN DONUTS

7.17 DAIRY QUEEN

7.18 PAPA JOHN’S

7.19 WENDY’S

7.20 JUST EAT

7.21 TAKEAWAY

7.22 ALIBABA GROUP

7.23 OTHER MAJOR PLAYERS

Chapter 8: Global Online Food Ordering System Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Restaurant-controlled

8.2.2 Independent websites

8.2.3 Food co-operatives

8.2.4 Delivery platforms

8.3 Historic and Forecasted Market Size By Application

8.3.1 B2B

8.3.2 B2C

8.3.3 Others

Chapter 9: North America Online Food Ordering System Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Restaurant-controlled

9.4.2 Independent websites

9.4.3 Food co-operatives

9.4.4 Delivery platforms

9.5 Historic and Forecasted Market Size By Application

9.5.1 B2B

9.5.2 B2C

9.5.3 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Online Food Ordering System Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Restaurant-controlled

10.4.2 Independent websites

10.4.3 Food co-operatives

10.4.4 Delivery platforms

10.5 Historic and Forecasted Market Size By Application

10.5.1 B2B

10.5.2 B2C

10.5.3 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Online Food Ordering System Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Restaurant-controlled

11.4.2 Independent websites

11.4.3 Food co-operatives

11.4.4 Delivery platforms

11.5 Historic and Forecasted Market Size By Application

11.5.1 B2B

11.5.2 B2C

11.5.3 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Online Food Ordering System Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Restaurant-controlled

12.4.2 Independent websites

12.4.3 Food co-operatives

12.4.4 Delivery platforms

12.5 Historic and Forecasted Market Size By Application

12.5.1 B2B

12.5.2 B2C

12.5.3 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Online Food Ordering System Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Restaurant-controlled

13.4.2 Independent websites

13.4.3 Food co-operatives

13.4.4 Delivery platforms

13.5 Historic and Forecasted Market Size By Application

13.5.1 B2B

13.5.2 B2C

13.5.3 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Online Food Ordering System Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data : |

2017 to 2022 |

Market Size in 2022: |

USD 36.26 Bn. |

|

Forecast Period 2023-30 CAGR: |

15.7% |

Market Size in 2030: |

USD 116.44 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ONLINE FOOD ORDERING SYSTEM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ONLINE FOOD ORDERING SYSTEM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ONLINE FOOD ORDERING SYSTEM MARKET COMPETITIVE RIVALRY

TABLE 005. ONLINE FOOD ORDERING SYSTEM MARKET THREAT OF NEW ENTRANTS

TABLE 006. ONLINE FOOD ORDERING SYSTEM MARKET THREAT OF SUBSTITUTES

TABLE 007. ONLINE FOOD ORDERING SYSTEM MARKET BY TYPE

TABLE 008. RESTAURANT-CONTROLLED MARKET OVERVIEW (2016-2028)

TABLE 009. INDEPENDENT WEBSITES MARKET OVERVIEW (2016-2028)

TABLE 010. FOOD CO-OPERATIVES MARKET OVERVIEW (2016-2028)

TABLE 011. DELIVERY PLATFORMS MARKET OVERVIEW (2016-2028)

TABLE 012. ONLINE FOOD ORDERING SYSTEM MARKET BY APPLICATION

TABLE 013. B2B MARKET OVERVIEW (2016-2028)

TABLE 014. B2C MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA ONLINE FOOD ORDERING SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA ONLINE FOOD ORDERING SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 018. N ONLINE FOOD ORDERING SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE ONLINE FOOD ORDERING SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE ONLINE FOOD ORDERING SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 021. ONLINE FOOD ORDERING SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC ONLINE FOOD ORDERING SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC ONLINE FOOD ORDERING SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 024. ONLINE FOOD ORDERING SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA ONLINE FOOD ORDERING SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA ONLINE FOOD ORDERING SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 027. ONLINE FOOD ORDERING SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA ONLINE FOOD ORDERING SYSTEM MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA ONLINE FOOD ORDERING SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 030. ONLINE FOOD ORDERING SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 031. MCDONALDS: SNAPSHOT

TABLE 032. MCDONALDS: BUSINESS PERFORMANCE

TABLE 033. MCDONALDS: PRODUCT PORTFOLIO

TABLE 034. MCDONALDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. KFC: SNAPSHOT

TABLE 035. KFC: BUSINESS PERFORMANCE

TABLE 036. KFC: PRODUCT PORTFOLIO

TABLE 037. KFC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. GRUBHUB: SNAPSHOT

TABLE 038. GRUBHUB: BUSINESS PERFORMANCE

TABLE 039. GRUBHUB: PRODUCT PORTFOLIO

TABLE 040. GRUBHUB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. SWIGGY: SNAPSHOT

TABLE 041. SWIGGY: BUSINESS PERFORMANCE

TABLE 042. SWIGGY: PRODUCT PORTFOLIO

TABLE 043. SWIGGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. MEITUAN: SNAPSHOT

TABLE 044. MEITUAN: BUSINESS PERFORMANCE

TABLE 045. MEITUAN: PRODUCT PORTFOLIO

TABLE 046. MEITUAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. UBER EATS: SNAPSHOT

TABLE 047. UBER EATS: BUSINESS PERFORMANCE

TABLE 048. UBER EATS: PRODUCT PORTFOLIO

TABLE 049. UBER EATS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. DOORDASH: SNAPSHOT

TABLE 050. DOORDASH: BUSINESS PERFORMANCE

TABLE 051. DOORDASH: PRODUCT PORTFOLIO

TABLE 052. DOORDASH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. CAVIAR: SNAPSHOT

TABLE 053. CAVIAR: BUSINESS PERFORMANCE

TABLE 054. CAVIAR: PRODUCT PORTFOLIO

TABLE 055. CAVIAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ZOMATO: SNAPSHOT

TABLE 056. ZOMATO: BUSINESS PERFORMANCE

TABLE 057. ZOMATO: PRODUCT PORTFOLIO

TABLE 058. ZOMATO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SUBWAY: SNAPSHOT

TABLE 059. SUBWAY: BUSINESS PERFORMANCE

TABLE 060. SUBWAY: PRODUCT PORTFOLIO

TABLE 061. SUBWAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. PIZZA HUT: SNAPSHOT

TABLE 062. PIZZA HUT: BUSINESS PERFORMANCE

TABLE 063. PIZZA HUT: PRODUCT PORTFOLIO

TABLE 064. PIZZA HUT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. STARBUCKS: SNAPSHOT

TABLE 065. STARBUCKS: BUSINESS PERFORMANCE

TABLE 066. STARBUCKS: PRODUCT PORTFOLIO

TABLE 067. STARBUCKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. BURGER KING: SNAPSHOT

TABLE 068. BURGER KING: BUSINESS PERFORMANCE

TABLE 069. BURGER KING: PRODUCT PORTFOLIO

TABLE 070. BURGER KING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. DOMINO’S PIZZA: SNAPSHOT

TABLE 071. DOMINO’S PIZZA: BUSINESS PERFORMANCE

TABLE 072. DOMINO’S PIZZA: PRODUCT PORTFOLIO

TABLE 073. DOMINO’S PIZZA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. DUNKIN DONUTS: SNAPSHOT

TABLE 074. DUNKIN DONUTS: BUSINESS PERFORMANCE

TABLE 075. DUNKIN DONUTS: PRODUCT PORTFOLIO

TABLE 076. DUNKIN DONUTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. DAIRY QUEEN: SNAPSHOT

TABLE 077. DAIRY QUEEN: BUSINESS PERFORMANCE

TABLE 078. DAIRY QUEEN: PRODUCT PORTFOLIO

TABLE 079. DAIRY QUEEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. PAPA JOHN’S: SNAPSHOT

TABLE 080. PAPA JOHN’S: BUSINESS PERFORMANCE

TABLE 081. PAPA JOHN’S: PRODUCT PORTFOLIO

TABLE 082. PAPA JOHN’S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. WENDY’S: SNAPSHOT

TABLE 083. WENDY’S: BUSINESS PERFORMANCE

TABLE 084. WENDY’S: PRODUCT PORTFOLIO

TABLE 085. WENDY’S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. JUST EAT: SNAPSHOT

TABLE 086. JUST EAT: BUSINESS PERFORMANCE

TABLE 087. JUST EAT: PRODUCT PORTFOLIO

TABLE 088. JUST EAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. TAKEAWAY: SNAPSHOT

TABLE 089. TAKEAWAY: BUSINESS PERFORMANCE

TABLE 090. TAKEAWAY: PRODUCT PORTFOLIO

TABLE 091. TAKEAWAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. ALIBABA GROUP: SNAPSHOT

TABLE 092. ALIBABA GROUP: BUSINESS PERFORMANCE

TABLE 093. ALIBABA GROUP: PRODUCT PORTFOLIO

TABLE 094. ALIBABA GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 095. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 096. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 097. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ONLINE FOOD ORDERING SYSTEM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ONLINE FOOD ORDERING SYSTEM MARKET OVERVIEW BY TYPE

FIGURE 012. RESTAURANT-CONTROLLED MARKET OVERVIEW (2016-2028)

FIGURE 013. INDEPENDENT WEBSITES MARKET OVERVIEW (2016-2028)

FIGURE 014. FOOD CO-OPERATIVES MARKET OVERVIEW (2016-2028)

FIGURE 015. DELIVERY PLATFORMS MARKET OVERVIEW (2016-2028)

FIGURE 016. ONLINE FOOD ORDERING SYSTEM MARKET OVERVIEW BY APPLICATION

FIGURE 017. B2B MARKET OVERVIEW (2016-2028)

FIGURE 018. B2C MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA ONLINE FOOD ORDERING SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE ONLINE FOOD ORDERING SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC ONLINE FOOD ORDERING SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA ONLINE FOOD ORDERING SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA ONLINE FOOD ORDERING SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Online Food Ordering System Market research report is 2023-2030.

Food Panda(US), Swiggy (US), Subway (US), Zomato (US) Just Eat (UK), DoorDash (US) and other major players.

The Online Food Ordering System market is segmented into Type, Application and region. By Type, the market is categorized into Restaurant-controlled, Independent websites, Food co-operatives, Delivery platforms, By Application the market is categorized into B2B, B2C, Other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An online food ordering system allows business to manage orders that are placed by customer using internet for delivery or takeaway. Customers search, find a digital menu, on an app or website and place and pay for their order online.

The Global Online Food Ordering System Market size is expected to grow from USD 36.26 billion in 2022 to USD 116.44 billion by 2030, at a CAGR of 15.7% during the forecast period (2023-2030).