Global Online Food Ordering Market Overview

The Online Food Ordering Market is expected to grow at a significant growth rate over the analysis period 2022-2028, considering base year as 2021.

Online food ordering is the process that people carry out for ordering food, from a website or other mobile application. The product depends on consumers' preferences restaurants are delivering a variety of food items for Breakfast, lunch, and dinner, and they offers all kind of food and beverages. People can able to order ready-to-eat food direct from a home kitchen, restaurant, or independent people, and also these online application offers delivery of food that has not been specially prepared for direct consumption or groceries e.g., frozen products, vegetables direct from a farm, fruits, and snacks. Pizza is the first food that is delivered online from Pizza Hut in 1994. Moreover, increasing mobile phone penetration in the world is the main reason for the increasing rate of online food ordering. The rising number of smartphone and internet users supports the demand for online food delivery platforms that ultimately contributes to the growth of the market. For instance, as per the research study, in 2020, the Indian online food delivery market was worth around 2.9 billion U.S. dollars.

Market Dynamics And Factors For Online Food Ordering Market

Drivers:

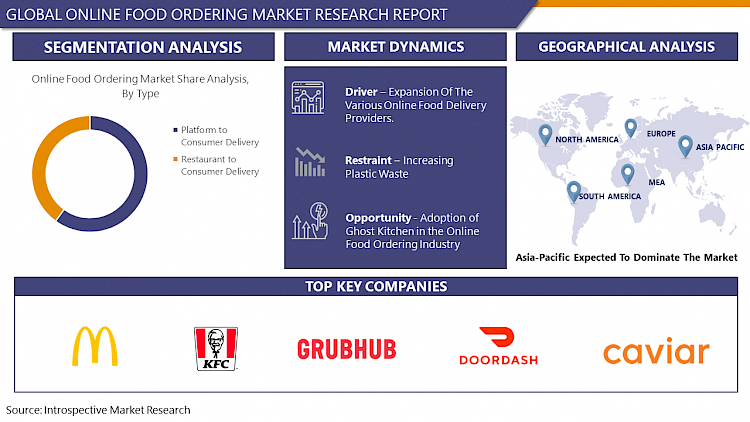

Expansion of The Various Online Food Delivery Providers

There are several online platforms available for people to order food. Online food delivery platforms like Zomato, Swiggy, Uber Eats, and others. For Instance, in August 2021, Zomato and Swiggy dominated the market with about 70% each in India. Other apps like included Uber Eats and Food Panda are also popular in India. UberEats was the most popular food delivery app in the United Kingdom (UK) in 2021 with nearly six million downloads. This shows the increasing volume of online orders and users. Along with this food, delivery providers are offering extra services like cash back, vouchers, and quick delivery. Additionally, this food delivery provider is using smart AI and smart technology in food delivery platforms for customer convenience this expansion of online food providers is expected to provide large growth to the market.

Restraints:

Increasing Plastic Waste

Although this service is so widely used and as most people purchase meals online for convenience, the market for online food ordering is constantly expanding. But this results in the overuse of plastic and a significant amount of environmentally hazardous plastic garbage production. Food should be delivered in high-quality boxes, plates, utensils, and wrapping made of plastic rather than paper, which produces a lot of trash. For instance, the Chinese meal delivery market processes more than 16 billion orders annually, yet more than 80% of the country's eateries that specialize in food delivery only use plastic packaging. In addition to adding to landfill garbage, this results in air pollution due to the manufacture of plastic packaging. This has a negative impact on the market during the projection period.

Opportunities:

Adoption of Ghost Kitchen in the Online Food Ordering Industry

As online food ordering is increasing day by day the food providers are converting their 20 to 40% business online. To meet these increasing demand of customer for both online and offline food delivery, restaurants have an opportunity to establish ghost kitchens or cloud kitchens. This concept can fill the need for inexpensive kitchen space to feed the increased volume of online food ordering. A ghost kitchen is purposefully built for delivery-only and has separate areas for storage space, stoves, and refrigeration. This build-up is giving opportunities to the online food ordering market to serve more people or to offer services to a large population. As these kitchens are often located in less populated areas of a city, and also have parking areas for the vehicles. Additionally, Ghost kitchens also allow restaurants to create their brand restaurants that exist only online and generate revenue by getting online orders.

Segmentation Analysis Of Online Food Ordering Market

By Type, the platform-to-consumer delivery segment dominates the overall market growth of online food ordering in the past few years and is expected to continue its dominance over the forecast period. The growing adoption and increasing popularity of different food delivery platform apps such as Zomato, UberEats, Deliveroo, and Grubhub across the globe are contributing to the market growth of online food ordering. Most of the people are using these platforms for quick and quality services. Moreover, this platform includes number of restaurants that provide a variety of food items so individuals get more choices and options for ordering food. Additionally, the platforms are offering brands that have their presence in online food delivery like Dominoes, Pizza Hut, and McDonald’s. These are some brands that have their own application for food ordering but they are also present on this platform. These advantages provided by platforms help in the increase in the platform-to-consumer delivery segment due to this the segment are expected to grow rapidly in the upcoming years.

By Payment Mode, the online banking segment is expecting maximum market share in online food ordering during the projected period. Online banking includes the payment process by using online payment platforms such as phone pay, Google pay, and others. This is mostly used payment mode in recent years due to the penetration of mobile phones and the internet. Also, this is a downloadable, easy-to-use, and quick mode of payment transactions. Online baking also provides security to the payments. It is the most popular and convenient way of transection that provides security services. As a result, the online banking segment is expected to grow rapidly in the analysis period and highly contribute to the growth of the online food ordering market.

Regional Analysis Of Online Food Ordering Market

Asia-Pacific is the major dominating region for Online Food Ordering. Rising consumer interest and a better understanding of the technology are supporting the growth of the market. Additionally, Increasing need for quick and easy services due to workloads and hectic life style, people are so busy and getting less time for cooking and cleaning so they are most likely to order food from different restaurants by using online food. Also, there is a huge population in the Asia Pacific region which provides a large consumer base for this food ordering sector. This region consists of countries like China, Japan, and India, These are densely populated countries and are in the developing phase so the adoption of smartphones and technology is high in this region. For instance, over the last decade, its market size has grown nearly 40-fold, reaching 121.06 billion in 2021. As of the end of 2021, almost 53 present of internet users in China had used online food delivery services. These are some of the major driving factors responsible for the growth of online food ordering in this region

The North American region is the second dominant and fast-growing region for Online Food Ordering. This market is estimated to be driven by the rise in consumer demand for home delivery and convenience food due to their busy lifestyles. Further, the rapidly increasing food processing industry in the region, along with the growing business and industrialization has a direct influence on the functional online food ordering in the region owing to the high use of mobile phones, the internet, and applications. Additionally, the region includes the growing retail food industry, high per capita income, and increasing population that help in the rise of spending on food delivery. This gives significant expansion in the spending on food and revenue of food delivery applications.

Europe is the leading region in the online food ordering sector. This region is consisting of well-developed countries such as Germany, the U.K., and France. The people who live in these countries are highly educated and employed which shows the high spending capacity of people in that region. So this region is positively contributing to the online food ordering market revenue. Additionally, this region consists of the strong presence of key players like Takeaway.com Group B.V., Roofoods Limited (Deliveroo), and Delivery Hero SE in the market. The public in this region ordered food online on across all areas surveyed, from developing to suburban and urban areas so the demand for this market is increasing continuously in the Europe region.

Covid 19 Impact On Online Food Ordering Market

The Covid-19 pandemic shows a positive impact on the Online Food Ordering market as the adoption of online food delivery platforms increased as millions of people are being restricted to stay home to stop the penetration of the virus. The online food platform became one of the main protagonists during the COVID-19 pandemic. The online food delivery service providers have witnessed a significant increase in revenue and online orders owing to the increased consumer demand for online food delivery due to restrictions. The restaurants, fast food centres, and different food chains used online food delivery platforms to facilitate both delivery and take-out during the outbreak which contributes to the growth of the market.

Players Covered In Online Food Ordering Market

- McDonalds (US)

- KFC (US)

- GrubHub (US)

- Swiggy (US)

- MEITUAN (China)

- Uber Eats (California)

- DoorDash (US)

- Caviar (California)

- Zomato (US)

- Subway (US)

- Pizza hut (US)

- Starbucks (US)

- Burger King (US)

- Domino’s Pizza (US)

- Dunkin Donuts (US)

- Dairy Queen (Minnesota)

- Papa John’s (US)

- Wendy’s (US)

- Just Eat (UK)

- Takeaway (Netherlands)

- Alibaba Group (China) and other major players.

Key Industry Development In The Online Food Ordering Market

In January 2020, Zomato, an Indian food delivery services company, has acquired Indian operations of Uber Eats for $350 million in an all-stock transaction. The combined entity of Zomato and Uber Eats India is expected to corner more than a 50-55% market share in terms of the number and value of orders. Uber Eats is an online food delivery services vertical of Uber, a US-based ride-hailing company.

In September 2020, Olo, one of the leading foods ordering platform for the restaurant industry announced that it Serve, it’s completely refreshed ordering experience, is available for all customers leveraging the Olo platform to serve diners.

|

Global Online Food Ordering Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD XX Mn. |

|

Forecast Period 2022-28 CAGR: |

XX% |

Market Size in 2028: |

USD XX Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Payment Mode |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Payment Mode

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Online Food Ordering Market by Type

5.1 Online Food Ordering Market Overview Snapshot and Growth Engine

5.2 Online Food Ordering Market Overview

5.3 Platform to Consumer Delivery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Platform to Consumer Delivery: Grographic Segmentation

5.4 Restaurant to Consumer Delivery

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Restaurant to Consumer Delivery: Grographic Segmentation

Chapter 6: Online Food Ordering Market by Payment Mode

6.1 Online Food Ordering Market Overview Snapshot and Growth Engine

6.2 Online Food Ordering Market Overview

6.3 Online Banking

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Online Banking: Grographic Segmentation

6.4 Net Banking

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Net Banking: Grographic Segmentation

6.5 Cash on delivery

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Cash on delivery: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Online Food Ordering Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Online Food Ordering Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Online Food Ordering Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 MCDONALDS

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 KFC

7.4 GRUBHUB

7.5 SWIGGY

7.6 MEITUAN

7.7 UBER EATS

7.8 DOORDASH

7.9 CAVIAR

7.10 ZOMATO

7.11 SUBWAY

7.12 PIZZA HUT

7.13 STARBUCKS

7.14 BURGER KING

7.15 DOMINO’S PIZZA

7.16 DUNKIN DONUTS

7.17 DAIRY QUEEN

7.18 PAPA JOHN’S

7.19 WENDY’S

7.20 JUST EAT

7.21 TAKEAWAY

7.22 ALIBABA GROUP

7.23 OTHER MAJOR PLAYERS

Chapter 8: Global Online Food Ordering Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Platform to Consumer Delivery

8.2.2 Restaurant to Consumer Delivery

8.3 Historic and Forecasted Market Size By Payment Mode

8.3.1 Online Banking

8.3.2 Net Banking

8.3.3 Cash on delivery

Chapter 9: North America Online Food Ordering Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Platform to Consumer Delivery

9.4.2 Restaurant to Consumer Delivery

9.5 Historic and Forecasted Market Size By Payment Mode

9.5.1 Online Banking

9.5.2 Net Banking

9.5.3 Cash on delivery

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Online Food Ordering Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Platform to Consumer Delivery

10.4.2 Restaurant to Consumer Delivery

10.5 Historic and Forecasted Market Size By Payment Mode

10.5.1 Online Banking

10.5.2 Net Banking

10.5.3 Cash on delivery

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Online Food Ordering Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Platform to Consumer Delivery

11.4.2 Restaurant to Consumer Delivery

11.5 Historic and Forecasted Market Size By Payment Mode

11.5.1 Online Banking

11.5.2 Net Banking

11.5.3 Cash on delivery

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Online Food Ordering Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Platform to Consumer Delivery

12.4.2 Restaurant to Consumer Delivery

12.5 Historic and Forecasted Market Size By Payment Mode

12.5.1 Online Banking

12.5.2 Net Banking

12.5.3 Cash on delivery

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Online Food Ordering Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Platform to Consumer Delivery

13.4.2 Restaurant to Consumer Delivery

13.5 Historic and Forecasted Market Size By Payment Mode

13.5.1 Online Banking

13.5.2 Net Banking

13.5.3 Cash on delivery

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Online Food Ordering Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data : |

2016 to 2020 |

Market Size in 2021: |

USD XX Mn. |

|

Forecast Period 2022-28 CAGR: |

XX% |

Market Size in 2028: |

USD XX Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Payment Mode |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ONLINE FOOD ORDERING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ONLINE FOOD ORDERING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ONLINE FOOD ORDERING MARKET COMPETITIVE RIVALRY

TABLE 005. ONLINE FOOD ORDERING MARKET THREAT OF NEW ENTRANTS

TABLE 006. ONLINE FOOD ORDERING MARKET THREAT OF SUBSTITUTES

TABLE 007. ONLINE FOOD ORDERING MARKET BY TYPE

TABLE 008. PLATFORM TO CONSUMER DELIVERY MARKET OVERVIEW (2016-2028)

TABLE 009. RESTAURANT TO CONSUMER DELIVERY MARKET OVERVIEW (2016-2028)

TABLE 010. ONLINE FOOD ORDERING MARKET BY PAYMENT MODE

TABLE 011. ONLINE BANKING MARKET OVERVIEW (2016-2028)

TABLE 012. NET BANKING MARKET OVERVIEW (2016-2028)

TABLE 013. CASH ON DELIVERY MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA ONLINE FOOD ORDERING MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA ONLINE FOOD ORDERING MARKET, BY PAYMENT MODE (2016-2028)

TABLE 016. N ONLINE FOOD ORDERING MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE ONLINE FOOD ORDERING MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE ONLINE FOOD ORDERING MARKET, BY PAYMENT MODE (2016-2028)

TABLE 019. ONLINE FOOD ORDERING MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC ONLINE FOOD ORDERING MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC ONLINE FOOD ORDERING MARKET, BY PAYMENT MODE (2016-2028)

TABLE 022. ONLINE FOOD ORDERING MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA ONLINE FOOD ORDERING MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA ONLINE FOOD ORDERING MARKET, BY PAYMENT MODE (2016-2028)

TABLE 025. ONLINE FOOD ORDERING MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA ONLINE FOOD ORDERING MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA ONLINE FOOD ORDERING MARKET, BY PAYMENT MODE (2016-2028)

TABLE 028. ONLINE FOOD ORDERING MARKET, BY COUNTRY (2016-2028)

TABLE 029. MCDONALDS: SNAPSHOT

TABLE 030. MCDONALDS: BUSINESS PERFORMANCE

TABLE 031. MCDONALDS: PRODUCT PORTFOLIO

TABLE 032. MCDONALDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. KFC: SNAPSHOT

TABLE 033. KFC: BUSINESS PERFORMANCE

TABLE 034. KFC: PRODUCT PORTFOLIO

TABLE 035. KFC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. GRUBHUB: SNAPSHOT

TABLE 036. GRUBHUB: BUSINESS PERFORMANCE

TABLE 037. GRUBHUB: PRODUCT PORTFOLIO

TABLE 038. GRUBHUB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. SWIGGY: SNAPSHOT

TABLE 039. SWIGGY: BUSINESS PERFORMANCE

TABLE 040. SWIGGY: PRODUCT PORTFOLIO

TABLE 041. SWIGGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. MEITUAN: SNAPSHOT

TABLE 042. MEITUAN: BUSINESS PERFORMANCE

TABLE 043. MEITUAN: PRODUCT PORTFOLIO

TABLE 044. MEITUAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. UBER EATS: SNAPSHOT

TABLE 045. UBER EATS: BUSINESS PERFORMANCE

TABLE 046. UBER EATS: PRODUCT PORTFOLIO

TABLE 047. UBER EATS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. DOORDASH: SNAPSHOT

TABLE 048. DOORDASH: BUSINESS PERFORMANCE

TABLE 049. DOORDASH: PRODUCT PORTFOLIO

TABLE 050. DOORDASH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. CAVIAR: SNAPSHOT

TABLE 051. CAVIAR: BUSINESS PERFORMANCE

TABLE 052. CAVIAR: PRODUCT PORTFOLIO

TABLE 053. CAVIAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ZOMATO: SNAPSHOT

TABLE 054. ZOMATO: BUSINESS PERFORMANCE

TABLE 055. ZOMATO: PRODUCT PORTFOLIO

TABLE 056. ZOMATO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. SUBWAY: SNAPSHOT

TABLE 057. SUBWAY: BUSINESS PERFORMANCE

TABLE 058. SUBWAY: PRODUCT PORTFOLIO

TABLE 059. SUBWAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. PIZZA HUT: SNAPSHOT

TABLE 060. PIZZA HUT: BUSINESS PERFORMANCE

TABLE 061. PIZZA HUT: PRODUCT PORTFOLIO

TABLE 062. PIZZA HUT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. STARBUCKS: SNAPSHOT

TABLE 063. STARBUCKS: BUSINESS PERFORMANCE

TABLE 064. STARBUCKS: PRODUCT PORTFOLIO

TABLE 065. STARBUCKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. BURGER KING: SNAPSHOT

TABLE 066. BURGER KING: BUSINESS PERFORMANCE

TABLE 067. BURGER KING: PRODUCT PORTFOLIO

TABLE 068. BURGER KING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. DOMINO’S PIZZA: SNAPSHOT

TABLE 069. DOMINO’S PIZZA: BUSINESS PERFORMANCE

TABLE 070. DOMINO’S PIZZA: PRODUCT PORTFOLIO

TABLE 071. DOMINO’S PIZZA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. DUNKIN DONUTS: SNAPSHOT

TABLE 072. DUNKIN DONUTS: BUSINESS PERFORMANCE

TABLE 073. DUNKIN DONUTS: PRODUCT PORTFOLIO

TABLE 074. DUNKIN DONUTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. DAIRY QUEEN: SNAPSHOT

TABLE 075. DAIRY QUEEN: BUSINESS PERFORMANCE

TABLE 076. DAIRY QUEEN: PRODUCT PORTFOLIO

TABLE 077. DAIRY QUEEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. PAPA JOHN’S: SNAPSHOT

TABLE 078. PAPA JOHN’S: BUSINESS PERFORMANCE

TABLE 079. PAPA JOHN’S: PRODUCT PORTFOLIO

TABLE 080. PAPA JOHN’S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. WENDY’S: SNAPSHOT

TABLE 081. WENDY’S: BUSINESS PERFORMANCE

TABLE 082. WENDY’S: PRODUCT PORTFOLIO

TABLE 083. WENDY’S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. JUST EAT: SNAPSHOT

TABLE 084. JUST EAT: BUSINESS PERFORMANCE

TABLE 085. JUST EAT: PRODUCT PORTFOLIO

TABLE 086. JUST EAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. TAKEAWAY: SNAPSHOT

TABLE 087. TAKEAWAY: BUSINESS PERFORMANCE

TABLE 088. TAKEAWAY: PRODUCT PORTFOLIO

TABLE 089. TAKEAWAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. ALIBABA GROUP: SNAPSHOT

TABLE 090. ALIBABA GROUP: BUSINESS PERFORMANCE

TABLE 091. ALIBABA GROUP: PRODUCT PORTFOLIO

TABLE 092. ALIBABA GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 093. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 094. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 095. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ONLINE FOOD ORDERING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ONLINE FOOD ORDERING MARKET OVERVIEW BY TYPE

FIGURE 012. PLATFORM TO CONSUMER DELIVERY MARKET OVERVIEW (2016-2028)

FIGURE 013. RESTAURANT TO CONSUMER DELIVERY MARKET OVERVIEW (2016-2028)

FIGURE 014. ONLINE FOOD ORDERING MARKET OVERVIEW BY PAYMENT MODE

FIGURE 015. ONLINE BANKING MARKET OVERVIEW (2016-2028)

FIGURE 016. NET BANKING MARKET OVERVIEW (2016-2028)

FIGURE 017. CASH ON DELIVERY MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA ONLINE FOOD ORDERING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE ONLINE FOOD ORDERING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC ONLINE FOOD ORDERING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA ONLINE FOOD ORDERING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA ONLINE FOOD ORDERING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Online Food Ordering research report is 2022-2028.

Food Panda(US), Swiggy (US), Subway (US), Zomato (US) Just Eat (UK), DoorDash (US) and other major players.

The Online Food Ordering is segmented into Type, Payment Mode and region. By Type, the market is categorized into Platform to Consumer Delivery and Restaurant to Consumer Delivery, By Payment Mode the market is categorized into Online Banking, Net Banking and Cash on Delivery. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Online food ordering is the process that people carried out for ordering food, from a website or other mobile application.

The Online Food Ordering Market is expected to grow at a significant growth rate over the analysis period 2022-2028, considering base year as 2021.