Olive Oil Market Synopsis

The Olive Oil Market size is estimated at 14.49 billion USD in 2024 and is expected to reach 17.11 billion USD by 2032, growing at a CAGR of 2.10% during the forecast period (2025-2032)

Olive oil is a liquid fat obtained by pressing whole olives (the fruit of Olea europaea family Oleaceae), a traditional tree crop of the Mediterranean Basin, and extracting the oil. It is commonly used in cooking, for frying foods, or as a salad dressing. It can also be found in some cosmetics, pharmaceuticals, soaps, and fuels for traditional oil lamps.

It also has additional uses in some religions. The olive is one of three core food plants in Mediterranean cuisine, together with wheat and grapes. Olive trees have been grown around the Mediterranean since the 8th millennium BC.

The growing demand from food industries is also driving the growth of the market. Compared to other cooking oils, olive oil has the unique potential to deliver a one-two punch to chronic and degenerative diseases from the potent polyphenol compounds found in extra virgin olive oil and the high percentage of monounsaturated fatty acids (MUFAs) found in all grades.

Increasing healthy diet awareness is also expected to impact the growth of the market positively. The health benefits of olive oil have been attributed to its antioxidant and anti-inflammatory properties. Observational studies have shown a link between lower risks of cardiovascular disease and some cancers.

.webp)

The Olive Oil Market Trend Analysis- Increasing Awareness About Health Benefits From olive oil

- Health advantages of olive oil abound. Healthy monounsaturated fats are abundant in olive oil. Saturated fat makes up about 14% of the oil, while polyunsaturated fats like omega-6 and omega-3 fatty acids make up 11% of it.

- A large review of studies in 841,000 people found that olive oil was the only source of monounsaturated fat associated with a reduced risk of stroke and heart disease. Extra virgin olive oil has numerous benefits for heart health. It lowers blood pressure, protects “bad” LDL cholesterol particles from oxidation, and improves the function of blood vessels. ?

- The demand for healthy edible oils increased in emerging economies like India during COVID-19 as olive fruit oil began to gain shelf space in Indian households for recreating restaurant-like gourmet experiences at home.

- The growing interest of individuals in raw, natural, and cold-pressed cooking oils as they are attributed to be safer and healthier in comparison to their processed counterparts has supported the market growth.

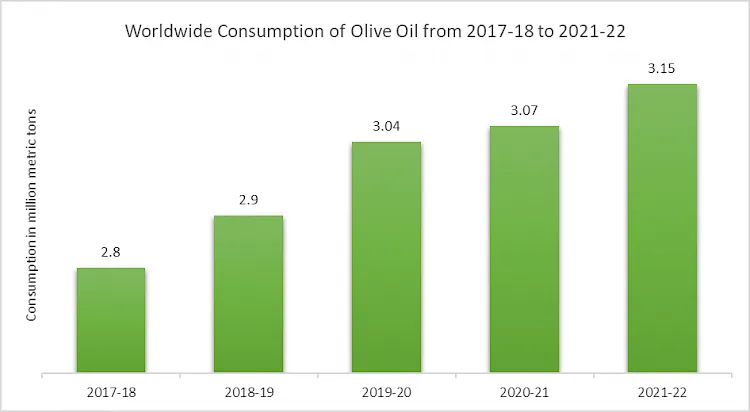

This statistic shows the consumption of olive oil worldwide from 2017/18 to 2021/22. In 2021/22, the global consumption volume of olive oil amounted to just under 3.15 million metric tons.

Increasing Use of Olive Oil in Aromatherapy and household

- The health benefits of olive oil make it an extremely attractive ingredient to use for cooking. Packed with polyphenols, amino acids, and healthy monounsaturated fats, olive oil can be a key factor not only in establishing a balanced diet but also in adding depth and flavor to food.

- Olive oil is pressed from olives growing in the Mediterranean region. In the pharmaceutical industry, it has also been used as a vehicle for oily suspensions for injections and topically as a demulcent and emollient in creams or ointments. In years past, it was used as a laxative.

- Olive oil has been used since ancient times as a cosmetic and to aid skin healing. The ancient Egyptians used it as an anti-wrinkle potion; the Romans used it as a moisturizer after bathing. To this day, olive oil is used widely in many countries to treat and prevent multiple skin conditions.

- Olive oil is used for therapeutic benefits. However, due to its wide health benefits, olive oil is mostly used in aromatherapy which is increasing the demand for olive oil. Thus, increasing use in aromatherapy and household and driving the Olive Oil Market.

Segmentation Analysis of The Olive Oil Market

Olive Oil market segments cover the Type, Application, Distribution Channel, and End-users. By Type, The Virgin segment is Anticipated to Dominate the Market Over the Forecast period.

- Virgin olive oil is obtained directly from the ripe fruit by mechanical procedures. It is the only consumed raw without the use of any solvents, so it keeps all its properties intact. Olive oil has excellent antioxidants such as polyphenols and vitamin E, which are lost if the oil is subjected to refining processes.

- Virgin olive oil is mostly used as a salad dressing and as an ingredient in salad dressings. It is also used with foods to be eaten cold. If uncompromised by heat, the flavor is stronger. It also can be used for sautéing.

- Virgin olive oil is a high-quality natural product obtained only by physical means. In addition to triacylglycerols, it contains nutritionally important polar and non-polar antioxidant phenols and other bioactive ingredients.

Regional Analysis of The Olive Oil Market

Europe is Expected to Dominate the Market Over the Forecast period.

- The market in Europe is further fueled by consumers' increased interest in healthy oils as a means of avoiding lifestyle-related health issues that can arise from their hectic lifestyles. As a result, enterprises intending to enter the worldwide olive oil sector find these regions to be the most enticing.

- Spain is the world’s largest producer of olive oil. According to the Food Information and Control Agency (AICA), Spain produced 1.3 million tonnes of olive oil in 2021, accounting for 42% of global olive oil production. Spain is also the largest olive oil exporter, with a share of 49% in 2021, followed by Greece (13%), Italy (11%), Tunisia (11%), and Portugal (10%).

- Europe is the largest importing region of olive oil in the world. In 2021, European imports of olive oil accounted for 86% of the world’s total value of olive oil imports. European imports of olive oil recorded a slight decrease of 4% compared to 2020. Most of the olive oil trade in Europe is produced in the region, mainly in Spain and Italy.

- European countries import most of their olive oil from other European countries (intra-European trade). In 2021, 13% of Europe’s imports of olive oil came from developing countries. The biggest share of intra-European trade consists of bulk olive oil blended by the largest olive oil companies before bottling. Significant volumes of bulk olive oil are not traded but only moved across borders by these companies for processing. For example, the leading European olive oil producer has facilities in both Spain and Italy, which exchange the company’s olive oil among them during processing.

- European olive oil consumption was estimated at 1.46 million tonnes in 2021, which is approximately half of the total world consumption. Italy and Spain are the largest consumers of olive oil in the EU, with annual consumptions of around 500,000 tonnes each, while Greece has the biggest EU per capita consumption, with around 12 kg per person per year.

Top Key Players Covered in The Olive Oil Market

- Borges International Group(Spain)

- Deoleo S.A. (Spain)

- EU Olive Oil (U.K.)

- Artajo oil(Spain)

- SALOV GROUP (Italy)

- Aceites Sandúa (Spain)

- Tucan Olive Oil Company (U.S.)

- Domenico Manca S.p.a (Italy)

- Minerva Foods(Greece)

- Olinexo S.L. (Spain)

- Nutrinveste SGPS (Portugal)

- Curation Foods (U.S.), and Other Active Players

Key Industry Developments in the Olive Oil Market

- In December2023: North American Olive Oil Association announced a new certification program for sustainable olive oil production practices, encouraging ethical and environmentally responsible sourcing.

- In December 2023, Brio Partnered with a leading medical research institute to launch a study investigating the potential of olive oil in managing cholesterol levels.

|

Global Olive Oil Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.49 Bn. |

|

Forecast Period 2025-2032 CAGR: |

2.10% |

Market Size in 2032: |

USD 17.11 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Olive Oil Market by Type (2018-2032)

4.1 Olive Oil Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Virgin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Refined

4.5 Others

Chapter 5: Olive Oil Market by Application (2018-2032)

5.1 Olive Oil Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food And Beverages

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pharmaceutical

5.5 Cosmetic And Personal Care

5.6 Aromatherapy

5.7 Others

Chapter 6: Olive Oil Market by Distribution Channel (2018-2032)

6.1 Olive Oil Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Supermarkets or Hypermarkets

6.5 Specialty Store

6.6 Others

Chapter 7: Olive Oil Market by End Users (2018-2032)

7.1 Olive Oil Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Food and Beverage

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Personal Care

7.5 Pharmaceuticals

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Olive Oil Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 KRAFT FOODS INC. (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CIRANDA (U.S.)

8.4 BLOMMER CHOCOLATE COMPANY (U.S.)

8.5 ARTISAN CONFECTIONS COMPANY (U.S.)

8.6 INTERNATURAL FOODS LLC (U.S.)

8.7 WILMOR PUBLISHING CORP (U.S.)

8.8 OLAM INTERNATIONAL LIMITED (SINGAPORE)

8.9 BARRY CALLEBAUT AG (SWITZERLAND)

8.10 TRADIN ORGANIC AGRICULTURE B.V. (NETHERLANDS)

8.11 CONACADO AGROINDUSTRIAL S.A. (DOMINICAN REPUBLIC)

8.12 CARGILL INC. (U.S.)

8.13 PASCHA CHOCOLATE CO. (U.S.)

8.14 GUAN CHONG BERHAD (MALAYSIA)

8.15 THE HERSHEY COMPANY (U.S.)

8.16 JINDAL COCOA (INDIA)

8.17

Chapter 9: Global Olive Oil Market By Region

9.1 Overview

9.2. North America Olive Oil Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Virgin

9.2.4.2 Refined

9.2.4.3 Others

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Food And Beverages

9.2.5.2 Pharmaceutical

9.2.5.3 Cosmetic And Personal Care

9.2.5.4 Aromatherapy

9.2.5.5 Others

9.2.6 Historic and Forecasted Market Size by Distribution Channel

9.2.6.1 Online

9.2.6.2 Supermarkets or Hypermarkets

9.2.6.3 Specialty Store

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size by End Users

9.2.7.1 Food and Beverage

9.2.7.2 Personal Care

9.2.7.3 Pharmaceuticals

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Olive Oil Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Virgin

9.3.4.2 Refined

9.3.4.3 Others

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Food And Beverages

9.3.5.2 Pharmaceutical

9.3.5.3 Cosmetic And Personal Care

9.3.5.4 Aromatherapy

9.3.5.5 Others

9.3.6 Historic and Forecasted Market Size by Distribution Channel

9.3.6.1 Online

9.3.6.2 Supermarkets or Hypermarkets

9.3.6.3 Specialty Store

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size by End Users

9.3.7.1 Food and Beverage

9.3.7.2 Personal Care

9.3.7.3 Pharmaceuticals

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Olive Oil Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Virgin

9.4.4.2 Refined

9.4.4.3 Others

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Food And Beverages

9.4.5.2 Pharmaceutical

9.4.5.3 Cosmetic And Personal Care

9.4.5.4 Aromatherapy

9.4.5.5 Others

9.4.6 Historic and Forecasted Market Size by Distribution Channel

9.4.6.1 Online

9.4.6.2 Supermarkets or Hypermarkets

9.4.6.3 Specialty Store

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size by End Users

9.4.7.1 Food and Beverage

9.4.7.2 Personal Care

9.4.7.3 Pharmaceuticals

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Olive Oil Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Virgin

9.5.4.2 Refined

9.5.4.3 Others

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Food And Beverages

9.5.5.2 Pharmaceutical

9.5.5.3 Cosmetic And Personal Care

9.5.5.4 Aromatherapy

9.5.5.5 Others

9.5.6 Historic and Forecasted Market Size by Distribution Channel

9.5.6.1 Online

9.5.6.2 Supermarkets or Hypermarkets

9.5.6.3 Specialty Store

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size by End Users

9.5.7.1 Food and Beverage

9.5.7.2 Personal Care

9.5.7.3 Pharmaceuticals

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Olive Oil Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Virgin

9.6.4.2 Refined

9.6.4.3 Others

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Food And Beverages

9.6.5.2 Pharmaceutical

9.6.5.3 Cosmetic And Personal Care

9.6.5.4 Aromatherapy

9.6.5.5 Others

9.6.6 Historic and Forecasted Market Size by Distribution Channel

9.6.6.1 Online

9.6.6.2 Supermarkets or Hypermarkets

9.6.6.3 Specialty Store

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size by End Users

9.6.7.1 Food and Beverage

9.6.7.2 Personal Care

9.6.7.3 Pharmaceuticals

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Olive Oil Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Virgin

9.7.4.2 Refined

9.7.4.3 Others

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Food And Beverages

9.7.5.2 Pharmaceutical

9.7.5.3 Cosmetic And Personal Care

9.7.5.4 Aromatherapy

9.7.5.5 Others

9.7.6 Historic and Forecasted Market Size by Distribution Channel

9.7.6.1 Online

9.7.6.2 Supermarkets or Hypermarkets

9.7.6.3 Specialty Store

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size by End Users

9.7.7.1 Food and Beverage

9.7.7.2 Personal Care

9.7.7.3 Pharmaceuticals

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Olive Oil Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 14.49 Bn. |

|

Forecast Period 2025-2032 CAGR: |

2.10% |

Market Size in 2032: |

USD 17.11 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||