Nuclear Power Market Synopsis

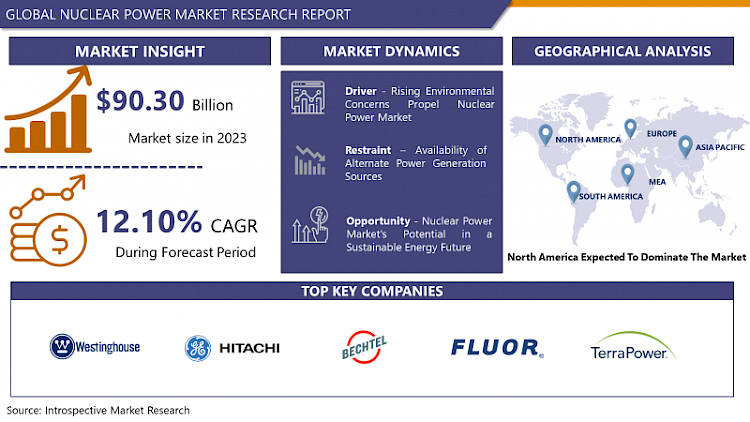

Nuclear Power Market Size Was Valued at USD 90.30 Billion in 2023 and is Projected to Reach USD 252.43 Billion by 2032, Growing at a CAGR of 12.10% From 2024-2032.

Governments and major energy firms are investing in the nuclear power energy industry in response to the rising demand for renewable energy and diminishing fossil fuel reserves. The global nuclear energy market is projected to rise at a significant pace as a result of the rising demand for energy that can meet the demand for new infrastructure without emitting carbon or negatively affecting the environment in other ways. Rather than selling energy directly to end consumers, many nuclear power plants sell to the wholesale market.

- Electric power transmission demand is measured by the amount of energy sold. Increased transmission demand leads to increased industry revenue. As the World Nuclear Association, 435 operating nuclear power plants are spread across in 31 countries globally. According to the Nuclear Energy Institute in the United States, an additional 71 reactors are under construction in 15 countries, the fastest pace of nuclear reactor construction in 25 years. The figures show that global economies are increasingly inclined to embrace nuclear energy as a feasible alternative to fossil fuels for power generation.

- Technological advancements in reactor designs, including small modular reactors (SMRs) and Generation IV reactors, have sparked renewed interest in nuclear power. SMRs offer enhanced safety features, cost-effectiveness, and flexibility in deployment, attracting attention for their potential to provide energy in remote areas or as a complement to renewable energy sources.

- Efforts to develop innovative solutions for nuclear waste disposal and recycling aim to address long-standing concerns regarding the environmental impact of nuclear power, potentially shaping the future landscape of the market. Despite challenges, nuclear power remains a significant player in the global energy mix, with ongoing developments shaping its future trajectory.

Nuclear Power Market Trend Analysis

Rising Environmental Concerns Propel Nuclear Power Market

- Amid intensifying global concerns about climate change and the urgent need to reduce carbon emissions, the nuclear power market is experiencing a resurgence driven by its potential as a low-carbon energy source. As countries grapple with the imperative to transition away from fossil fuels, nuclear power has re-emerged as a key contender in the quest for clean energy. Its ability to generate electricity without producing significant greenhouse gas emissions positions it as a crucial component of a diversified and sustainable energy portfolio.

- The escalating environmental consciousness among nations and communities has underscored the importance of finding alternatives to traditional carbon-intensive energy sources. Nuclear power, with its capability to produce large amounts of electricity while emitting minimal greenhouse gases during operation, has gained renewed attention. This focus aligns with global commitments to combat climate change outlined in various international agreements, motivating countries to explore nuclear energy as part of their strategies to achieve carbon neutrality.

Nuclear Power Market's Potential in a Sustainable Energy Future

- The nuclear power market stands at the crossroads of shaping a sustainable energy future, offering significant potential and opportunities. As the world confronts the imperative of transitioning to cleaner energy sources, nuclear power emerges as a viable option to complement renewable energy technologies. Its capacity to generate large amounts of electricity consistently, without the carbon emissions associated with fossil fuels, positions it as a crucial asset in the pursuit of a low-carbon future.

- Innovations in reactor designs, particularly small modular reactors (SMRs) and Generation IV reactors, present opportunities for enhanced safety, reduced costs, and increased flexibility in deployment. These advancements pave the way for more versatile and scalable nuclear power solutions, which could serve diverse energy needs, especially in regions seeking reliable, low-carbon electricity. The global energy landscape offers opportunities for nuclear power expansion, particularly in emerging economies experiencing rapid urbanization and industrialization.

Nuclear Power Market Segment Analysis:

Nuclear Power Market Segmented on the basis of type, application, and end-users.

By Type, Pressurized Water Reactors (PWRs) segment is expected to dominate the market during the forecast period

- PWRs lies a sophisticated mechanism that utilizes water under high pressure as a primary coolant to transfer heat generated within the reactor core. This heat exchange process involves the transfer of thermal energy to a secondary loop containing water, which in turn generates steam. The produced steam is harnessed to power turbines, ultimately generating electricity. This closed-loop system ensures that the radioactive primary coolant does not come into direct contact with the turbine generators, contributing to the safety and reliability of PWR operations.

- The mature technology behind PWRs has undergone decades of refinement, making them a preferred choice for many nations seeking reliable and proven nuclear energy solutions. Their operational efficiency, coupled with a consistent safety record, has instilled confidence in utilizing PWRs as a significant contributor to global electricity generation.

By Application, Electric Power Generation segment held the largest share of 45% in 2022

- Electric power generation is the vital process of producing electricity to meet the world's growing energy demands. This multifaceted industry encompasses various methods, including fossil fuels, nuclear power, renewables like solar and wind, and emerging technologies. Fossil fuels, such as coal, natural gas, and oil, have historically dominated power generation due to their reliability and accessibility. However, the environmental impact of greenhouse gas emissions has spurred a shift towards cleaner energy sources.

- Renewable energy sources, notably solar and wind, have seen significant growth in recent years. Advances in technology have made these sources more economically viable, promoting their integration into the energy mix. Solar panels convert sunlight into electricity, while wind turbines harness the kinetic energy from the wind, providing sustainable alternatives with minimal environmental impact. Moreover, nuclear power continues to play a role in electricity generation, offering low-carbon energy through controlled nuclear reactions.

Nuclear Power Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North American nuclear power, while the United States boasts the lion's share with 93 operational reactors and a combined net capacity of 95.8 GWe, Canada and Mexico also play significant roles in the region's nuclear energy landscape. Canada operates 19 reactors, primarily concentrated in Ontario, contributing 13.6 GWe to the country's electricity generation, representing about 13.6% of its total. On the other hand, Mexico's nuclear footprint is more modest, with two operational reactors totaling 1.6 GWe, accounting for approximately 4.5% of the nation's electricity production.

Nuclear Power Market Top Key Players:

- Westinghouse Electric Company (U.S.)

- GE Hitachi Nuclear Energy (U.S)

- Bechtel (U.S.)

- Fluor Corporation (U.S.

- TerraPower (U.S.)

- Kairos Power (U.S.)

- GE-Hitachi Nuclear Energy (U.S)

- X-energy (U.S.)

- Terrestrial Energy Inc. (Canada)

- CANDU Energy (Canada)

- Atomic Energy of Canada (Canada)

- EDF Group (France)

- Rosatom (Russia)

- Atomstroyexport (Russia)

- Siemens Energy (Germany)

- Framatome (France)

- Fortum (Finland)

- Mitsubishi Heavy Industries (Japan)

- Toshiba Energy Systems & Solutions Corporation (Japan)

- Nuclear Power Corporation of India Limited (India)

- larsen and toubro (l&t) (India)

- Bharat Heavy Electricals (India)

- Korea Electric Power Corporation (South Korea)

- Nucleoeléctrica Argentina S.A (Argentina)

- China National Nuclear Corporation (China)

Key Industry Developments in the Nuclear Power Market:

- In April 2024, BWX Technologies, Inc. announced a C$80 million investment to expand its Cambridge manufacturing plant by 25% to 280,000 square feet. This includes C$30 million for advanced manufacturing equipment. The expansion will enhance capacity, improve productivity, and create over 200 long-term jobs. President of Commercial Operations, John MacQuarrie emphasized the expansion's role in supporting global nuclear energy projects and addressing climate change, energy security, and independence.

- In October 2023, NuScale Power secures a landmark contract to supply reactor internals for the VOYAGER small modular reactor (SMR) demonstration project, heralding a significant leap forward in nuclear energy innovation. This collaboration marks a pivotal moment in advancing SMR technology, showcasing its potential to revolutionize global energy production with enhanced safety, efficiency, and adaptability.

- In November 2023, GE Hitachi Nuclear Energy Breaking ground in nuclear innovation, the unveiling of the BWRX-300 SMR design marks a watershed moment in the realm of boiling water reactors. This next-generation design boasts unparalleled safety enhancements and streamlined construction methods, positioning it as a frontrunner in the evolution of nuclear power technology, promising safer and more efficient energy production for the future.

|

Global Nuclear Power Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 90.30 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.10% |

Market Size in 2032: |

USD 252.43 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

Rising Environmental Concerns Propel Nuclear Power Market |

||

|

Key Market Restraints: |

Availability of Alternate Power Generation Sources |

||

|

Key Opportunities: |

Nuclear Power Market's Potential in a Sustainable Energy Future |

||

|

Companies Covered in the report: |

Westinghouse Electric Company, GE Hitachi Nuclear Energy, Bechtel, Fluor Corporation, Exelon Corporation and Other Major Players. |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- NUCLEAR POWER MARKET BY TYPE (2017-2032)

- NUCLEAR POWER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PRESSURIZED WATER REACTOR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BOILER WATER REACTOR

- PRESSURIZED HEAVY WATER REACTOR

- GAS COOLED REACTOR

- NUCLEAR POWER MARKET BY APPLICATION (2017-2032)

- NUCLEAR POWER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ELECTRIC POWER GENERATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INDUSTRIAL

- MEDICAL

- FOOD & AGRICULTURE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Nuclear Power Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- WESTINGHOUSE ELECTRIC COMPANY

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- GE Hitachi Nuclear Energy

- Bechtel

- Fluor Corporation

- Exelon Corporation

- TerraPower

- Kairos Power

- GE-Hitachi Nuclear Energy

- X-energy

- Terrestrial Energy Inc.

- CANDU Energy

- Atomic Energy of Canada

- EDF Group

- Rosatom

- Atomstroyexport

- Siemens Energy

- Framatome

- Fortum

- Mitsubishi Heavy Industries

- Toshiba Energy Systems & Solutions Corporation

- Nuclear Power Corporation of India Limited

- Larsen and Toubro (L&T)

- Bharat Heavy Electricals

- COMPETITIVE LANDSCAPE

- GLOBAL NUCLEAR POWER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Nuclear Power Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 90.30 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.10% |

Market Size in 2032: |

USD 252.43 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

Rising Environmental Concerns Propel Nuclear Power Market |

||

|

Key Market Restraints: |

Availability of Alternate Power Generation Sources |

||

|

Key Opportunities: |

Nuclear Power Market's Potential in a Sustainable Energy Future |

||

|

Companies Covered in the report: |

Westinghouse Electric Company, GE Hitachi Nuclear Energy, Bechtel, Fluor Corporation, Exelon Corporation and Other Major Players. |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. NUCLEAR POWER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. NUCLEAR POWER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. NUCLEAR POWER MARKET COMPETITIVE RIVALRY

TABLE 005. NUCLEAR POWER MARKET THREAT OF NEW ENTRANTS

TABLE 006. NUCLEAR POWER MARKET THREAT OF SUBSTITUTES

TABLE 007. NUCLEAR POWER MARKET BY TYPE

TABLE 008. PRESSURIZED WATER REACTOR (PWR) MARKET OVERVIEW (2016-2028)

TABLE 009. BOILER WATER REACTOR (BWR) MARKET OVERVIEW (2016-2028)

TABLE 010. PRESSURIZED HEAVY WATER REACTOR (PHWR) MARKET OVERVIEW (2016-2028)

TABLE 011. GAS COOLED REACTOR (GCR) MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. NUCLEAR POWER MARKET BY APPLICATION

TABLE 014. ELECTRIC POWER GENERATION MARKET OVERVIEW (2016-2028)

TABLE 015. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 016. MEDICAL MARKET OVERVIEW (2016-2028)

TABLE 017. FOOD & AGRICULTURE MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA NUCLEAR POWER MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA NUCLEAR POWER MARKET, BY APPLICATION (2016-2028)

TABLE 021. N NUCLEAR POWER MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE NUCLEAR POWER MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE NUCLEAR POWER MARKET, BY APPLICATION (2016-2028)

TABLE 024. NUCLEAR POWER MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC NUCLEAR POWER MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC NUCLEAR POWER MARKET, BY APPLICATION (2016-2028)

TABLE 027. NUCLEAR POWER MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA NUCLEAR POWER MARKET, BY TYPE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA NUCLEAR POWER MARKET, BY APPLICATION (2016-2028)

TABLE 030. NUCLEAR POWER MARKET, BY COUNTRY (2016-2028)

TABLE 031. SOUTH AMERICA NUCLEAR POWER MARKET, BY TYPE (2016-2028)

TABLE 032. SOUTH AMERICA NUCLEAR POWER MARKET, BY APPLICATION (2016-2028)

TABLE 033. NUCLEAR POWER MARKET, BY COUNTRY (2016-2028)

TABLE 034. CHINA NATIONAL NUCLEAR COOPERATION (CNNC): SNAPSHOT

TABLE 035. CHINA NATIONAL NUCLEAR COOPERATION (CNNC): BUSINESS PERFORMANCE

TABLE 036. CHINA NATIONAL NUCLEAR COOPERATION (CNNC): PRODUCT PORTFOLIO

TABLE 037. CHINA NATIONAL NUCLEAR COOPERATION (CNNC): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. LARSEN AND TOUBRO (L&T): SNAPSHOT

TABLE 038. LARSEN AND TOUBRO (L&T): BUSINESS PERFORMANCE

TABLE 039. LARSEN AND TOUBRO (L&T): PRODUCT PORTFOLIO

TABLE 040. LARSEN AND TOUBRO (L&T): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. NIAEP ASC: SNAPSHOT

TABLE 041. NIAEP ASC: BUSINESS PERFORMANCE

TABLE 042. NIAEP ASC: PRODUCT PORTFOLIO

TABLE 043. NIAEP ASC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. WESTINGHOUSE ELECTRIC COMPANY: SNAPSHOT

TABLE 044. WESTINGHOUSE ELECTRIC COMPANY: BUSINESS PERFORMANCE

TABLE 045. WESTINGHOUSE ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 046. WESTINGHOUSE ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. ATOMIC ENERGY OF CANADA: SNAPSHOT

TABLE 047. ATOMIC ENERGY OF CANADA: BUSINESS PERFORMANCE

TABLE 048. ATOMIC ENERGY OF CANADA: PRODUCT PORTFOLIO

TABLE 049. ATOMIC ENERGY OF CANADA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. BHARAT HEAVY ELECTRICALS: SNAPSHOT

TABLE 050. BHARAT HEAVY ELECTRICALS: BUSINESS PERFORMANCE

TABLE 051. BHARAT HEAVY ELECTRICALS: PRODUCT PORTFOLIO

TABLE 052. BHARAT HEAVY ELECTRICALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. GE HITACHI: SNAPSHOT

TABLE 053. GE HITACHI: BUSINESS PERFORMANCE

TABLE 054. GE HITACHI: PRODUCT PORTFOLIO

TABLE 055. GE HITACHI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. KEPCO: SNAPSHOT

TABLE 056. KEPCO: BUSINESS PERFORMANCE

TABLE 057. KEPCO: PRODUCT PORTFOLIO

TABLE 058. KEPCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. MITSUBISHI HEAVY INDUSTRIES: SNAPSHOT

TABLE 059. MITSUBISHI HEAVY INDUSTRIES: BUSINESS PERFORMANCE

TABLE 060. MITSUBISHI HEAVY INDUSTRIES: PRODUCT PORTFOLIO

TABLE 061. MITSUBISHI HEAVY INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. BRUCE POWER: SNAPSHOT

TABLE 062. BRUCE POWER: BUSINESS PERFORMANCE

TABLE 063. BRUCE POWER: PRODUCT PORTFOLIO

TABLE 064. BRUCE POWER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. CEZ GROUP: SNAPSHOT

TABLE 065. CEZ GROUP: BUSINESS PERFORMANCE

TABLE 066. CEZ GROUP: PRODUCT PORTFOLIO

TABLE 067. CEZ GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. NUKEM: SNAPSHOT

TABLE 068. NUKEM: BUSINESS PERFORMANCE

TABLE 069. NUKEM: PRODUCT PORTFOLIO

TABLE 070. NUKEM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 071. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 072. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 073. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. NUCLEAR POWER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. NUCLEAR POWER MARKET OVERVIEW BY TYPE

FIGURE 012. PRESSURIZED WATER REACTOR (PWR) MARKET OVERVIEW (2016-2028)

FIGURE 013. BOILER WATER REACTOR (BWR) MARKET OVERVIEW (2016-2028)

FIGURE 014. PRESSURIZED HEAVY WATER REACTOR (PHWR) MARKET OVERVIEW (2016-2028)

FIGURE 015. GAS COOLED REACTOR (GCR) MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. NUCLEAR POWER MARKET OVERVIEW BY APPLICATION

FIGURE 018. ELECTRIC POWER GENERATION MARKET OVERVIEW (2016-2028)

FIGURE 019. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 020. MEDICAL MARKET OVERVIEW (2016-2028)

FIGURE 021. FOOD & AGRICULTURE MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA NUCLEAR POWER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE NUCLEAR POWER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC NUCLEAR POWER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA NUCLEAR POWER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA NUCLEAR POWER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Nuclear Power Market research report is 2024-2032.

Westinghouse Electric Company, GE Hitachi Nuclear Energy, Bechtel, Fluor Corporation, Exelon Corporation, TerraPower, Kairos Power, GE-Hitachi Nuclear Energy, X-energy, Terrestrial Energy Inc., CANDU Energy, Atomic Energy of Canada, EDF Group, Rosatom, Atomstroyexport, Siemens Energy, Framatome, Fortum, Mitsubishi Heavy Industries, Toshiba Energy Systems & Solutions Corporation, Nuclear Power Corporation of India Limited, Larsen and Toubro (L&T),Bharat Heavy Electricals, Korea Electric Power Corporation, Nucleoeléctrica Argentina S.A, China National Nuclear Corporation and Other Major Players.

The Nuclear Power Market is segmented into Type, Application, and Region. By Type, the market is categorized into Pressurized Water Reactor (PWR), Boiler Water Reactor (BWR), Pressurized Heavy Water Reactor (PHWR), Gas Cooled Reactor (GCR), and Others. By Application, the market is categorized into Electric Power Generation, Industrial, Medical, Food & Agriculture, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Nuclear power is an efficient and clean way of boiling water to create steam, which turns turbines to produce electricity. Nuclear power plants utilize low-enriched uranium fuel for electricity production through a process called fission.

Nuclear Power Market Size Was Valued at USD 90.30 Billion in 2023 and is Projected to Reach USD 252.43 Billion by 2032, Growing at a CAGR of 12.10% From 2024-2032.