Global North America Social Robots Market Overview

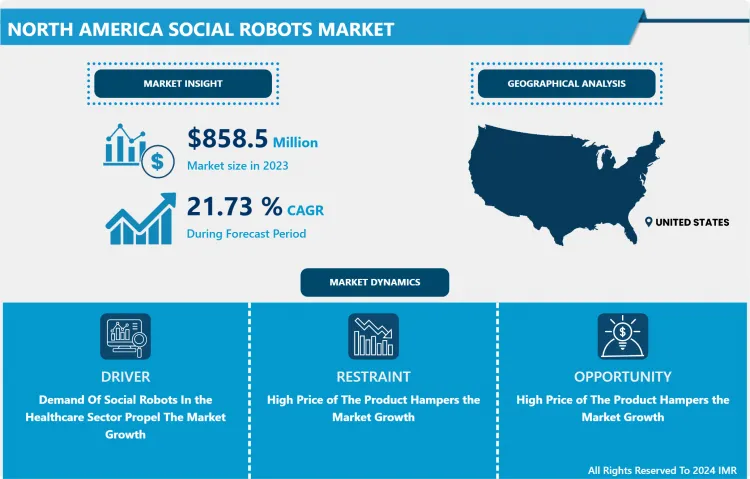

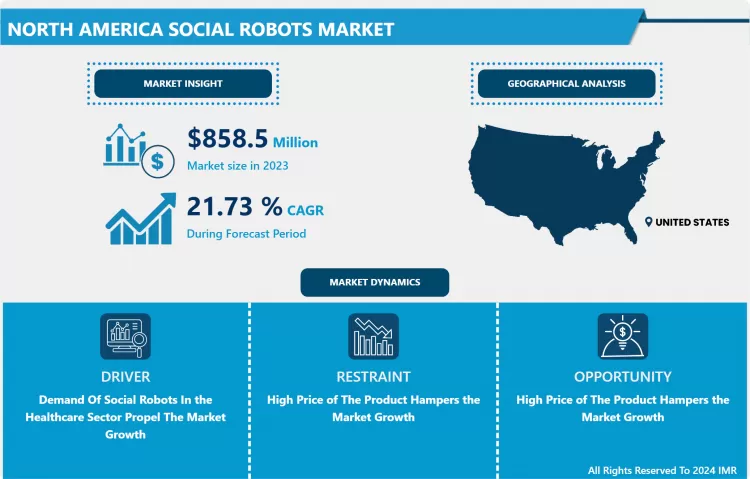

The North America Social Robots Market size was valued at USD 858.5 Million in 2023 and is projected to reach USD 5038.7 Million by 2032, registering a CAGR of 21.73 % from 2023 to 2032.

Social robots are physically personified autonomous robots that interact with people socially and naturally. They are made up of drivetrains, bodies, frames, manipulators, and control systems. They are frequently utilized to carry out tasks including greeting, lifting and transporting objects, and providing customer service in shopping centers, businesses, and private settings. In addition to being utilized for employee training, medical screening, recruitment, teaching aid, and travel concierge, social robots can be managed remotely. They contribute to the creation of a pleasing, engaging, and meaningful interactive environment for kids as well as improved safety, speed, and productivity.

As a result, social robots are widely used in a variety of sectors, including entertainment, healthcare, and education. Because it enhances social connection and promotes collaboration among young children, the use of robotics in education is perfect for engagement in classrooms. Students with impairments can gain additional advantages from using robots for play and study. Due to such applications, the North American market is generating huge demand for social robots and is expected to dominate during the forecasted period.

Market Dynamics And Factors For North America Social Robots Market

Drivers:

Demand Of Social Robots In the Healthcare Sector Propel The Market Growth.

One of the primary factors fostering a favorable view of the market is the healthcare sector's significant growth on a global scale. Hospitals and healthcare facilities frequently use social robots to aid in the treatment of illnesses like cerebral palsy. For instance, A Texas hospital will begin using Moxi, as part of the launch of Diligent Robotics' first product, a hospital robot assistant called Moxi, out of beta and into the market. Diligent Robotics is an AI company that creates socially intelligent robots that assist people with their jobs. Additionally, the banking, financial services, and insurance (BFSI) sector's significant product use are helping the market expand. Social robots are used by BFSI institutions for tasks including tutoring, customer service, and answering banking questions. Additionally, several technological developments, including the incorporation of artificial intelligence (AI) and machine learning (ML) solutions, are boosting market expansion. These technologies help the robots navigate, recognize objects, and interact on their own. In keeping with this, the market growth is being positively impacted by the rising product demand in public services. Traffic control, telepresence, monitoring, queue management, and ensuring social distance are all handled by social robots.

Restraints:

High Price of The Product Hampers the Market Growth

The cost of purchasing a social robot is one drawback of them. One of the most sophisticated social robots available is the Nao robot, which costs about $16,000. Although social robots might be one of the best tools for working with kids who have autism, parents, schools, or therapy providers might not have the money to buy one. However, the less expensive social robots would not be as useful as the more expensive, more sophisticated ones. The opportunity would be lost to children with autism.

Opportunity:

Integration of Progressive Technologies in Social Robots

As artificially intelligent agents providing customer assistance, social robots are gaining traction in a variety of service industries. They have also been used successfully in a variety of contexts. Virtual reality-driven robots have a noticeably better level of acceptance and demand for therapeutic and educational uses, according to Shariati et al. Social robots have also been offered as companions for children and the elderly as a result of shifting societal patterns. Additionally, social robots have benefited households with autistic members. Additionally, the banking, financial services, and insurance (BFSI) sector's significant product use are helping the market expand. Social robots are used by BFSI institutions for tasks including tutoring, customer service, and answering banking questions. In keeping with this, the market growth is being positively impacted by the rising product demand in public services. Traffic control, telepresence, monitoring, queue management, and ensuring social distance are all handled by social robots. The market is expected to increase as a result of several other factors, such as the expanding demand for automation and digitalization across industries and the extensive product use in the education sector as peer tutors or tutors.

Segmentation Analysis of the North America Social Robots Market

By Technology, Context Awareness is expected to dominate the Social Robots Market. One of the key elements of social robots is to recognize the context and operate or respond accordingly. The context-aware technology will be helpful indifferent scenarios that can boost the demand for social robots. These robots are increasingly used in educational settings where it is thought that their social traits and embodiment are advantageous. They may potentially be used as regulatory tools in the future. Social robots might make a good platform for an awareness tool because of how they can quickly call attention to themselves during group activities and communicate using the normal channels of communication. During the work session, participants would have the chance to control their behavior. They also appear to be inherently harder to ignore than a dashboard shown on a tablet. Therefore, self-acting technology like context awareness can revolutionize the North America Social Robots Market.

By End User Industry, Healthcare Segment is expected to dominate the North America Social Robots Market. Healthcare settings are seeing an increase in the development, testing, and adoption of social robots. The need for mobility assistance devices is being driven by the rising population of the elderly and disabled worldwide. The World Health Organization (WHO) predicts that by 2020, there will be more adults aged 60 and older than children under the age of five. In addition, it is anticipated that the percentage of people over 60 in the world will nearly double, from 12% to 22%, between 2015 and 2050. Additionally, it is predicted that over 1 billion individuals would have a disability by the year 2020. This equates to around 15% of the world's population, with up to 190 million (3.8%) persons aged 15 and older experiencing substantial functional challenges and frequently needing medical attention.

Regional Analysis of the North America Social Robots Market

The United States dominates the North America Social Robots Market. The expansion of cutting-edge technologies like artificial intelligence, augmented reality, and others in many end-user industries open up new possibilities for the employment of social robots. The number of U.S. healthcare leaders who have already implemented technology like AI in their clinical workflow is 84%, up from 37% in 2018, according to a July 2020 survey by Intel. Numerous educational institutions in the area have adopted social robots because they attract students' attention. Eight Abii robots are being used by pupils at two Charleston County School District (CCSD) schools, according to an announcement made in April 2021 by Van Robotics, a US-based provider of tutoring robots that sells its robots in 30 US states. The robots are made to provide one-on-one assistance to pupils in grades 1 through 6 in need. Each student has a different login, and the robots offer individualized training. The robots can also recognize children's attention spans and help them focus again by singing and dancing. The robots have aided in capturing pupils' interest and improving their perception of them as friends. Due to the fast-increasing public demand to meet societal needs, the region's aging population is also placing stress on the healthcare system.

Canada is the second prominent market for social robot market. The Canadian market is highly adaptive to emerging technologies. To provide door-to-door robot delivery services in Vancouver, British Columbia, Pizza Hut Canada has teamed with Serve Robotics. Selected Vancouver residents who ordered through the Pizza Hut app during a two-week test program may have their food brought right to their homes by a robot. Apart from commercial use, the general consumer also tends to spend on technologically advanced gadgets which are likely to fuel the demand for North America Social Robots Market

Covid-19 Impact Analysis on North America Social Robots Market

Social robots now have rich economic options thanks to the COVID-19 pandemic epidemic. These robotic solutions can fill in the gaps that isolation leaves behind, particularly for lonely older persons, to lessen loneliness, depression, and other harmful repercussions of isolation. This element would promote the development of companion robots globally. Different industrial and service robot types will be impacted differently by the COVID-19 epidemic. Due to a decline in investments in important sectors including the automotive and metals and machinery industries, traditional industrial robots are anticipated to be most negatively impacted. Collaborative robots, on the other hand, are not anticipated to be as impacted because their market is expanding and they are used in a wider range of industries. Service robots are anticipated to be significantly impacted. There will be a constant need for these robots during the pandemic because drones, AGVs, disinfecting robots, and telepresence robots are already frequently used for tasks like temperature monitoring, personal help, and automated delivery. However, because of the decline in disposable cash brought on by the pandemic, consumer-based service robots will be significantly impacted.

Top Key Players Covered In North America Social Robots Market

- Blue Ocean Robotics ApS

- BotsAndUs Ltd.

- Camanio AB

- Double Robotics Inc.

- Embodied Inc.

- Furhat Robotics AB

- Happy SAS

- Hanson Robotics Ltd.

- Aerobics Social Robotics SLL

- Intuition Robotics Ltd.

- Kinova Inc.

- Knightscope Inc.

- KOMPAI Robotics

- Matia Robotics (US) Inc.

- Motorika USA and Other Major Players.

Key Industry Development In The North America Social Robots Market

In November 2024, Collaborative Robotics (Cobot), founded by the team behind Amazon Robotics' global success, proudly unveils Proxie, a groundbreaking collaborative robot (cobot) designed to tackle demanding material handling tasks with ease. Proxie combines advanced AI, mobility, and modular manipulation with refined situational awareness for seamless human-robot collaboration.

|

North America Social Robots Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 858.5Mn. |

|

Forecast Period 2024-32 CAGR: |

21.73% |

Market Size in 2032: |

USD 5038.7 Mn. |

|

|

By Technology |

|

|

|

By End Users Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: North America Social Robots Market by Technology (2018-2032)

4.1 North America Social Robots Market Snapshot and Growth Engine

4.2 Market Overview

4.3 ML

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 NLP

4.5 Computer Vision

4.6 Context Awareness

4.7 Others

Chapter 5: North America Social Robots Market by End Users Industry (2018-2032)

5.1 North America Social Robots Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Healthcare

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Education

5.5 Media and Entertainment

5.6 Retail

5.7 BFSI

5.8 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 North America Social Robots Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 INTEL (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Operating Business Segments

6.2.5 Product Portfolio

6.2.6 Business Performance

6.2.7 Recent News & Development

6.2.8 SWOT Analysis

6.3 AMD (US)

6.4 BROADCOM (US)

6.5 MICRON (US)

6.6 QUALCOMM (US)

6.7 TEXAS INSTRUMENTS (US)

6.8 NVIDIA (US)

6.9 NXP (NETHERLANDS)

6.10 ANALOG DEVICES (US)

6.11 KNERON (US)

6.12 AMBARELLA (US)

6.13 SYNAPTICS (US)

6.14 INFINEON (GERMANY)

6.15 STMICROELECTRONICS (SWITZERLAND)

6.16 SYNAPTICS (US)

6.17 SAMSUNG (SOUTH KOREA)

6.18 SK HYNIX (SOUTH KOREA)

6.19 RENESAS (JAPAN)

6.20 TSMC (TAIWAN)

6.21 MEDIATEK (TAIWAN)

6.22 HISILICON (CHINA)

Chapter 7:North America Social Robots Market Analysis, Insights and Forecast, 2016-2028

7.1 Market Overview

7.2 Key Market Trends, Growth Factors and Opportunities

7.3 Key Players

7.4 Historic and Forecasted Market Size by Technology

7.4.1 ML

7.4.2 NLP

7.4.3 Computer Vision

7.4.4 Context Awareness

7.4.5 Others

7.5 Historic and Forecasted Market Size by End Users Industry

7.5.1 Healthcare

7.5.2 Education

7.5.3 Media and Entertainment

7.5.4 Retail

7.5.5 BFSI

7.5.6 Others

7.6 Historic and Forecast Market Size by Country

7.6.1 U.S.

7.6.2 Canada

7.6.3 Mexico

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Conclusion

Chapter 9 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

North America Social Robots Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 858.5Mn. |

|

Forecast Period 2024-32 CAGR: |

21.73% |

Market Size in 2032: |

USD 5038.7 Mn. |

|

|

By Technology |

|

|

|

By End Users Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the North America Social Robots Market research report is 2024-2032.

Blue Ocean Robotics ApS, BotsAndUs Ltd., Camanio AB,Double Robotics Inc.,Embodied Inc.,Furhat Robotics AB,Happy SAS,Hanson Robotics Ltd.,Aerobics Social Robotics SLL,Intuition Robotics Ltd.,Kinova Inc.,Knightscope Inc.,KOMPAI Robotics,Matia Robotics (US) Inc.,Motorika USA and other major players.

The North America Social Robots Market is segmented into Technology, End User Industry and region. By Technology, the market is categorized into ML, NLP, Computer Vision, Context Awareness, Others. By End User Industry, the market is categorized into Healthcare, Education, Media and Entertainment, Retail, BFSI, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico).

A social robot is an autonomous machine that interacts and communicates with people or other physical agents through the adoption of social norms and behaviors appropriate to its position. A social robot is physically embodied, just like other robots.

The North America Social Robots Market size was valued at USD 858.5 Million in 2023 and is projected to reach USD 5038.7 Million by 2032, registering a CAGR of 21.73 % from 2023 to 2032.