Nitrile Gloves Market Synopsis

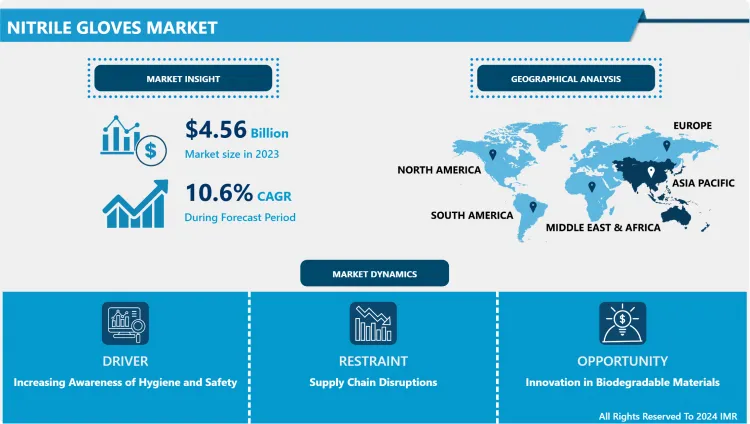

Nitrile Gloves Market Size Was Valued at USD 4,568.90 Million in 2023, and is Projected to Reach USD 11,313.78 Million by 2032, Growing at a CAGR of 10.60% From 2024-2032.

Nitrile gloves are additional a kind of an(unsigned) glove that is manufactured out of synthetic rubber, and more specifically, nitrile rubber or NBR. They are rather more durable compared to other types of gloves such as the latex and vinyl due to puncture resistance and resistance to chemicals and oil. Companies involved in industries such as health care, food, and automotive among others have embraced the use of nitrile gloves because of their efficiency in offering good barrier protection, flexibility, and comfort in use. These give protection from infectious materials and people using these gloves prefer them due to latex sensitization.

The nitrile gloves market has opened up to showing positive growth and undergoing changes in a number of years due to various factors including health issues and safety standards for working. Nitrile gloves that are made from synthetic rubber are also more popular than latex gloves because of their resistance to puncture and providing good barrier along with being free of allergens. This has led to increased adoption of Industry 4. 0 technologies across sectors such as healthcare, pharmaceutical, automotive, chemical, and food industry.

In the general health care arena, nitrile gloves cannot be overlooked as they are ever so useful especially in hospitals, clinics and the likes where people come with different ailments and thus the likelihood of being exposed to some form of infectious disease. The global COVID-19 pandemic has increasing the demand of nitrile gloves even further, to become an essential component of the contagious illness prevention protocols. Initially, these increases in need tested supply logistics as manufacturers sought to increase production capability to fulfill the greater levels.

Apart from the medical profession, industries like food processing and automotive industries have shifted to the use of nitrile gloves because of compliance to standards in handling or working and health consciousness. Chemical deterioration of nitrile gloves make them appropriate for touching different forms of substances, thus appropriate for use in industries where workers are exposed to chemicals.

That is why market dynamics also in measuring also depict geographical factors such as demand and supply. Some of the major regions that have favored nitrile gloves in the past include North America and Europe given the cautious attitude towards safety at the workplace and the protection of workers’ hands. This has particularly been witnessed over the last few years where the Asia-Pacific region has become a central hub for automobile production through better manufacturing cost and easy access to raw materials to countries such as Malaysia and Thailand.

Nitrile gloves market size inventory reveals that competition is moderately fragmented in nature as some players are from multinational, while others are from regional entities. Glove manufacturers and the clients of the top manufacturing firms have also emphasized on advancing the fundamental assessments of glove technology with more comfort, sturdiness, and the fine touch. Concerns about sustainability have also led to the efforts towards innovation of sustainable nitrile gloves in the market and have also pushed for work on some of the existing ways on how recycling could be enhanced.

From the market trends, it is possible to expect further continuous growth in the demand for nitrile gloves as there are constant developments in healthcare systems and increased focus on proper sanitation measures and enhanced standards of personal protection in the world. However, issues like variability in raw material prices, changes in laws, and policies targeting the environmental impact remain some of the concerns that both the manufacturers and stake holders face in future.

Further future growth of the nitrile gloves market share can be expected due to the dynamism of end consumers and advancement in technology. Succession strategies, joint venture, and mergers and acquisition are the probable game changers in the competition of the industry while legislation and societal strivings towards sustainability shall be the drivers of change in the market of the industry. The nitrile gloves are continuing to be competitive, innovative and adaptable to the changing needs of the different industries and regions as well as the global pandemics, developments in the industry and opportunities for market diversification.

Nitrile Gloves Market Trend Analysis

Increasing Demand Due to Healthcare Needs

- One of the strongest trends is that the production of nitrile gloves is rapidly growing because of the constant demand in the healthcare industry. This increase can be directly attributed to the superior properties of the gloves and their advantage over traditional natural latex products such as being natural latex free gloves, highly puncture resistant gloves and chemical resistant gloves. As knowledge about diseases and how they spread has increased and with extra emphasis on proper hand hygiene and infection control measures especially in the healthcare setting, appropriate PPE such as nitrile gloves has become even more necessary.

- Moreover, the COVID 19 has made this demand to increase all over the world where health care facilities and laboratories as well as health care workers use these gloves to minimize the contraction of different diseases. Besides healthcare, nitrile gloves are used in various other sectors such as food processing industries, pharmaceutical industries , automobile industries, and many more, all of which have been contributing to the surge in demand for nitrile gloves today. This is a factor boosting the demand as manufacturers increase production to suit these needs resulting to high competition. Given that the specifications and standards for gloves are subject to changes over time, quality and safety of gloves are essential in determining the purchase across various industries. In conclusion, the augmentation demand concerning nitrile gloves is therefore primarily a result of healthcare sector necessity for durable infection prevention and controlling, apart from various other industrial sectors that require protection as a primary principle.

Innovation in Biodegradable Materials

- The advancement in the market of biodegradable polymers for nitrile gloves is a promising emerging sector borne out of growing concerns about the use of rubber gloves that are synthetic and ill effects they may have on the environment. Manufacturers and researchers are also concentrating on making nitrile gloves, which still have the properties of normal nitrile gloves that they possess, but good enough to self degrade at the end of their life cycle. The important developments are thus; the development of biodegradable polymers which are generated from renewable resources such as plant or biodegradable synthetic polymers which degrade under certain conditions.

- These developments are expected to counter the problem of the current nitrile gloves, which are extremely hardy and have been found to be degrading in the environment and are not biodegradable thus contravening sustainable world practices. Furthermore, innovations are not only in material or composite sense but also include enhance manufacturing technologies, which decrease in carbon emissions and contribute to the global portfolio of biodegradable nitrile gloves. As the recent trends for green products become familiar to consumers and regulatory requirements are escalated, the innovation opportunities of biodegradable materials aimed at nitrile gloves remain high, which dynamics the future of disposable gloves market towards eco-friendlier options.

Nitrile Gloves Market Segment Analysis:

Nitrile Gloves Market Segmented based on Type, Product, and End-User.

By Type, Powdered segment is expected to dominate the market during the forecast period

- The market for nitrile gloves is primarily categorized into two types: with its normal and specialized forms, namely, powdered gloves and powder free gloves. Application of powdered nitrile gloves is normally associated with industries where frequent putting on and off of gloves is appropriate because the powder helps to reduce glove moisture and assists in glove donning. But, doubts about sensitization and cross-contamination especially in critical settings fostered a massive change towards powder-free nitrile gloves. These gloves are useful and preferred more especially in health facilities, hospitals, or any place involving high level of hygiene such as food processing industries.

- The powder free type provides the similar tactility and dexterity as the powder ones but with the related hazards of powders completely eliminated. The globalization of powder-free nitrile gloves has been pushed by regulators and increased concern for safe products, and more production capacity has been added by manufacturers to satisfy the increasing demand from the global market. Therefore, the market for nitrile gloves still keeps on growing with powder-free ones, being adopted more widely to different fields because of their enhanced safety feature and compatibility in many applications that require clean environments.

By Product , Disposable segment held the largest share in 2023

- Firstly the market for this product can be bifurcated into disposable and durable product market Temporary or disposable products currently absorbs a large segment of the global market for nitrile gloves. Nonsterile disposable nitrile gloves have remained the most popular ones for use in various sectors such as hospitals, research facilities, food processing lines, and cleaning services. The primary reason for their success is the lack of latex content, which helps to avoid severe allergies, and the greater resistance to chemical and punctures as compared to latex or vinyl gloves.

- Subsequently, the global demand for disposable nitrile gloves remained high due to higher adoption of hygiene products and growth in healthcare globally occasioned by the COVID 19 pandemic. In contrast, the durable nitrile version is used in manufacturing sectors that need keen protection for long hours against chemical and oil and mechanical irritants such as automotive, build, and manufacturing industries. They are relied upon because of their durability especially in harsh conditions especially at the workplace. Each segment enjoys constant enhancement in the material technology for enhanced comfort, fit and functional attributes of the protective devices for increased market acceptability for the protective wears of various types in different sectors across the global markets.

Nitrile Gloves Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The data also indicates that Asia Pacific is expected to triumph as the market leader in the Nitrile Gloves market over the course of the forecast period. The following factors explain the observed tendency: Firstly, Asia Pacific indeed consists of the major manufacturing regions in the world, specially Malaysia and Thailand, which are significant producers of nitrile gloves. These regions are able to effectively meet the increasing demand since they have functional supply networks, effective manufacturing capacity, and cheap labor. Second, rising concerns about safety and hygiene with products used in industries like healthcare, pharmaceuticals, food processing, automobiles etc. are also contribute to the greater use of nitrile gloves in the region. But even more, restrictive legislation in the field of workers’ safety and health together with more relaxed restrictions concerning the establishment of new production facilities in the emerging economies are the factors which are boosting the market even more.

- Moreover, the outbreak of CORONA Virus Disease (COVID-19) has led to increased protection measures like wearing of personal protective equipment (PPE), such as nitrile gloves, pushing the market onward into more growth in the Asia Pacific region. Hence, due to this aspect and many more, Asia Pacific is expected to sustain its domination in the nitrile gloves market – in terms of production and consumption – during the forecast period.

Active Key Players in the Nitrile Gloves Market

- Ansell Ltd - (Australia)

- Top Glove Corporation Bhd - (Malaysia)

- Hartalega Holdings Berhad - (Malaysia)

- Unigloves (UK) Limited - (United Kingdom)

- Adenna LLC - (USA)

- Kossan Rubber Industries Bhd - (Malaysia)

- Superior Gloves - (Canada)

- MCR Safety - (USA)

- Supermax Corporation Berhad - (Malaysia)

- Ammex Corporation - (USA)

- Cardinal Health - (USA)

- Medline Industries, Inc. - (USA)

- Globus (Shetland) Ltd. - (United Kingdom)

- Atlantic Safety Products, Inc. - (USA)

- MAPA Professional - (France)

- Other Key Players

Key Industry Developments in the Nitrile Gloves Market

- In January 2023, Unigloves (UK) Ltd. acquired the Derma Shield business. This acquisition is likely to help Unigloves (UK) Ltd. expand its product portfolio of hand and arm protection products.

- October 2024, Unigloves, a leading specialist in hand protection, and KluraLabs, innovators in antimicrobial solutions, partnered to launch the CrossGuard antimicrobial nitrile glove, the first of its kind to eliminate 99.99% of selected bacteria in just 60 seconds. This breakthrough was backed by third-party testing and was free from active ingredients.

|

Global Nitrile Gloves Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4,568.90 Mn. |

|

Forecast Period 2024-32 CAGR: |

10.60% |

Market Size in 2032: |

USD 11,313.78 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Nitrile Gloves Market by Type (2018-2032)

4.1 Nitrile Gloves Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Powdered

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Powder-free

Chapter 5: Nitrile Gloves Market by Product (2018-2032)

5.1 Nitrile Gloves Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Disposable

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Durable

Chapter 6: Nitrile Gloves Market by End-User (2018-2032)

6.1 Nitrile Gloves Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Oil & Gas

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Nitrile Gloves Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ANSELL LTD - (AUSTRALIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TOP GLOVE CORPORATION BHD - (MALAYSIA)

7.4 HARTALEGA HOLDINGS BERHAD - (MALAYSIA)

7.5 UNIGLOVES (UK) LIMITED - (UNITED KINGDOM)

7.6 ADENNA LLC - (USA)

7.7 KOSSAN RUBBER INDUSTRIES BHD - (MALAYSIA)

7.8 SUPERIOR GLOVES - (CANADA)

7.9 MCR SAFETY - (USA)

7.10 SUPERMAX CORPORATION BERHAD - (MALAYSIA)

7.11 AMMEX CORPORATION - (USA)

7.12 CARDINAL HEALTH - (USA)

7.13 MEDLINE INDUSTRIES INC. - (USA)

7.14 GLOBUS (SHETLAND) LTD. - (UNITED KINGDOM)

7.15 ATLANTIC SAFETY PRODUCTS INC. - (USA)

7.16 MAPA PROFESSIONAL - (FRANCE)

7.17 OTHER KEY PLAYERS

Chapter 8: Global Nitrile Gloves Market By Region

8.1 Overview

8.2. North America Nitrile Gloves Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Powdered

8.2.4.2 Powder-free

8.2.5 Historic and Forecasted Market Size by Product

8.2.5.1 Disposable

8.2.5.2 Durable

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Automotive

8.2.6.2 Oil & Gas

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Nitrile Gloves Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Powdered

8.3.4.2 Powder-free

8.3.5 Historic and Forecasted Market Size by Product

8.3.5.1 Disposable

8.3.5.2 Durable

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Automotive

8.3.6.2 Oil & Gas

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Nitrile Gloves Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Powdered

8.4.4.2 Powder-free

8.4.5 Historic and Forecasted Market Size by Product

8.4.5.1 Disposable

8.4.5.2 Durable

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Automotive

8.4.6.2 Oil & Gas

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Nitrile Gloves Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Powdered

8.5.4.2 Powder-free

8.5.5 Historic and Forecasted Market Size by Product

8.5.5.1 Disposable

8.5.5.2 Durable

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Automotive

8.5.6.2 Oil & Gas

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Nitrile Gloves Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Powdered

8.6.4.2 Powder-free

8.6.5 Historic and Forecasted Market Size by Product

8.6.5.1 Disposable

8.6.5.2 Durable

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Automotive

8.6.6.2 Oil & Gas

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Nitrile Gloves Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Powdered

8.7.4.2 Powder-free

8.7.5 Historic and Forecasted Market Size by Product

8.7.5.1 Disposable

8.7.5.2 Durable

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Automotive

8.7.6.2 Oil & Gas

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Nitrile Gloves Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4,568.90 Mn. |

|

Forecast Period 2024-32 CAGR: |

10.60% |

Market Size in 2032: |

USD 11,313.78 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||