Natural Soy Lecithin Market Synopsis

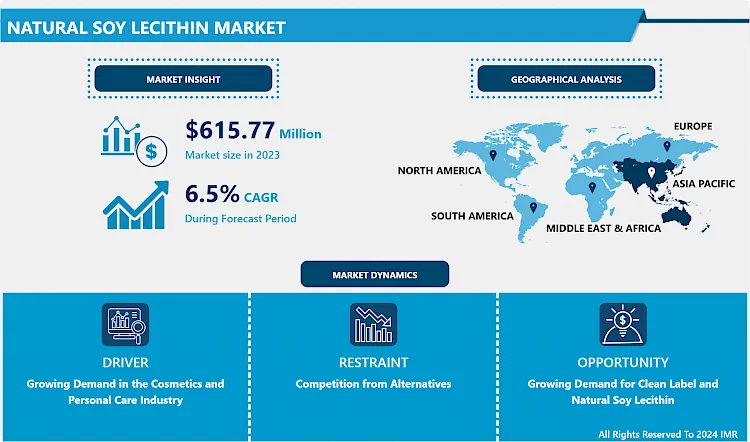

Global Natural Soy Lecithin Market Size Was Valued at USD 615.77 Million in 2023, and is Projected to Reach USD 1085.34 Million by 2032, Growing at a CAGR of 6.50% From 2024-2032.

Natural soy lecithin is a fatty substance extracted from soybeans. It's rich in phospholipids, including phosphatidylcholine and phosphatidylethanolamine, serving as an emulsifier and stabilizer in various food and industrial products. This versatile compound finds application in food processing, pharmaceuticals, and cosmetics, enhancing texture, shelf life, and dispersibility. It aids in fat metabolism and brain health due to its choline content. Its natural origin appeals to consumers seeking cleaner, plant-based ingredients.

The Natural Soy Lecithin market is witnessing steady growth driven by increasing consumer awareness about the benefits of natural ingredients and the rising demand for clean-label products. Soy lecithin, derived from soybeans, serves as an emulsifier, stabilizer, and antioxidant in various food and non-food applications.

Health-conscious consumers are favoring natural soy lecithin due to its non-GMO status and its rich source of phospholipids, which are essential for brain health and cell membrane integrity. Moreover, the versatility of soy lecithin in food applications such as chocolate, bakery, and confectionery products further propels its market growth.

The expanding food processing industry, particularly in regions like North America, Europe, and Asia Pacific, is driving the demand for natural soy lecithin as manufacturers seek healthier and more sustainable alternatives to synthetic additives.

Furthermore, technological advancements in extraction methods and increased focus on sustainable sourcing practices are enhancing the quality and purity of natural soy lecithin products, thus widening its application scope. The Natural Soy Lecithin market is poised for robust expansion, fueled by increasing consumer preference for natural ingredients, technological innovations, and the growing demand for healthier food and beverage options worldwide.

.webp)

Natural Soy Lecithin Market Trend Analysis

Growing Demand in the Cosmetics and Personal Care Industry

- The cosmetics and personal care industry is experiencing a surge in demand for natural ingredients due to increasing consumer awareness regarding health and environmental concerns. This shift is a major driving force behind the growth of the natural soy lecithin market.

- Consumers are becoming more conscious about the ingredients they apply to their skin, seeking products that are free from harmful chemicals and additives. Soy lecithin, derived from soybeans, is a naturally occurring emulsifier widely used in cosmetics and personal care products for its moisturizing and conditioning properties. Its natural origin appeals to consumers looking for sustainable and eco-friendly alternatives.

- The soy lecithin offers various benefits such as enhancing the texture and stability of formulations, which is particularly valuable in the cosmetics industry where product performance is crucial. Its versatility makes it a sought-after ingredient for a wide range of products including creams, lotions, shampoos, and makeup.

- As the demand for natural and organic cosmetics continues to grow, driven by consumer preferences for safer and more sustainable options, the natural soy lecithin market is poised to expand significantly to meet these evolving needs. This trend underscores the importance of natural ingredients in shaping the future of the cosmetics and personal care industry.

Growing Demand for Clean Label and Natural Soy Lecithin

- Consumers are increasingly prioritizing transparency and clean labeling in the foods and products they consume. As awareness about health and wellness continues to rise, there's a shift towards natural ingredients, free from synthetic additives and chemicals. Soy lecithin, derived from soybeans, is perceived as a natural and clean alternative in various industries such as food, pharmaceuticals, and cosmetics.

- Clean label products, including those containing natural soy lecithin, appeal to health-conscious consumers seeking wholesome options. Natural soy lecithin serves as a versatile emulsifier and stabilizer in food applications, replacing artificial additives while maintaining product quality and texture. Additionally, its natural origin aligns with the preferences of environmentally conscious consumers.

- Furthermore, the health benefits associated with soy lecithin, such as its role in supporting heart health and brain function, contribute to its popularity. This growing consumer preference for clean labels and natural ingredients propels the demand for soy lecithin in various end-use industries, thereby driving the growth of the natural soy lecithin market. As a result, manufacturers are increasingly focusing on developing clean-label products, thereby fueling the expansion of the natural soy lecithin market.

Natural Soy Lecithin Market Segment Analysis:

Natural Soy Lecithin Market Segmented based on Form, and Application.

By Application, Food and Beverage segment is expected to dominate the market during the forecast period

- Soy lecithin, derived from soybeans, is valued for its ability to enhance texture, improve shelf life, and maintain product consistency in food and beverage formulations. In the food industry, it is widely employed in bakery goods, chocolates, confectionery, dairy products, and convenience foods. Its natural origin and emulsifying properties make it a preferred ingredient for manufacturers aiming to meet consumer demand for clean-label products. Additionally, soy lecithin's functionality extends to beverage applications, where it is utilized in emulsified beverages, such as chocolate milk and nutritional drinks. With the rising consumer inclination towards healthier and natural ingredients, the demand for soy lecithin in the Food and Beverage segment is expected to continue its dominance in the market.

Natural Soy Lecithin Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific countries, particularly China and India, are major producers of soybeans, the primary source of soy lecithin. This proximity to raw materials ensures a steady and cost-effective supply, which gives them a competitive edge in the market.

- The increasing consumer awareness regarding the health benefits of natural ingredients has driven the demand for soy lecithin as a natural emulsifier and stabilizer in various food and beverage products. This growing health consciousness is particularly prevalent in Asia Pacific countries, where there is a strong emphasis on traditional medicine and natural remedies.

- The expanding food processing industry in the region, coupled with rising disposable incomes and changing dietary preferences, has led to a surge in the consumption of processed foods, which often contain soy lecithin as an ingredient.

- Furthermore, favorable government regulations and initiatives supporting the production and export of soy-based products have contributed to the dominance of the Asia Pacific region in the natural soy lecithin market. Overall, a combination of abundant raw materials, increasing demand for natural ingredients, and supportive regulatory environments has propelled Asia Pacific to the forefront of the natural soy lecithin market.

Natural Soy Lecithin Market Top Key Players:

- Cargill (United States)

- ADM (United States)

- Bunge (United States)

- Lucas Meyer (Canada)

- Danisco (Denmark)

- Lipoid (Switzerland)

- Denofa (Norway)

- Shankar Soya Concepts (India)

- Jiusan Group (China)

- Merya's Lecithin (China)

- Gushen Biological Technology (China)

- Shandong Bohi Industry (China)

- Siwei Phospholipid (China)

- Tianjin Hexiyuan Lecithin Technology (China)

- Beijing Yuan Hua Mei Lecithin Sci-Tech (China), and Other Major Players

Key Industry Development

- In August 2024, Bunge announced the expansion of its North American lecithin portfolio to include deoiled soybean lecithin in powdered and granulated formats. This addition enhanced the company’s offering, which already included a leading global range of crude, standard, and specialty lecithins derived from soybean, sunflower, and rapeseed. The new deoiled formats provided versatile, clean-label solutions for food and beverage manufacturers, aligning with industry demand for functional and non-GMO ingredients.

|

Natural Soy Lecithin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 615.77 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.5 % |

Market Size in 2032: |

USD 1085.34 Mn. |

|

Segments Covered: |

By Form |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Natural Soy Lecithin Market by Form (2018-2032)

4.1 Natural Soy Lecithin Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Liquid

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Solid

Chapter 5: Natural Soy Lecithin Market by Application (2018-2032)

5.1 Natural Soy Lecithin Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food and Beverage

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Nutritional Supplements

5.5 Animal Feed

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Natural Soy Lecithin Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 GOULDS PUMPS (XYLEM) (U.S)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 GORMAN-RUPP (U.S)

6.4 SCHLUMBERGER (U.S)

6.5 FLOWSERVE (U.S)

6.6 CRANE PUMPS & SYSTEMS (U.S.)

6.7 AZCUE PUMPS INC. (U.S)

6.8 FRANKLIN ELECTRIC (U.S.)

6.9 KSB (GERMANY)

6.10 EDUR PUMPENFABRIK EDUARD REDLIEN GMBH & CO. KG (GERMANY)

6.11 DAB PUMPS (ITALY)

6.12 LOWARA (XYLEM) (ITALY)

6.13 VARISCO S.R.L. (ITALY)

6.14 CALPEDA (ITALY)

6.15 BBA PUMPS (NETHERLANDS)

6.16 WEIR GROUP (SCOTLAND)

6.17 ANDRITZ GROUP (AUSTRIA)

6.18 JOHNSON PUMP (SWEDEN)

6.19 AXFLOW HOLDING AB (SWEDEN)

6.20 KIRLOSKAR BROTHERS (INDIA)

6.21 CROMPTON GREAVES LTD (INDIA)

6.22

Chapter 7: Global Natural Soy Lecithin Market By Region

7.1 Overview

7.2. North America Natural Soy Lecithin Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Form

7.2.4.1 Liquid

7.2.4.2 Solid

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Food and Beverage

7.2.5.2 Nutritional Supplements

7.2.5.3 Animal Feed

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Natural Soy Lecithin Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Form

7.3.4.1 Liquid

7.3.4.2 Solid

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Food and Beverage

7.3.5.2 Nutritional Supplements

7.3.5.3 Animal Feed

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Natural Soy Lecithin Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Form

7.4.4.1 Liquid

7.4.4.2 Solid

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Food and Beverage

7.4.5.2 Nutritional Supplements

7.4.5.3 Animal Feed

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Natural Soy Lecithin Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Form

7.5.4.1 Liquid

7.5.4.2 Solid

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Food and Beverage

7.5.5.2 Nutritional Supplements

7.5.5.3 Animal Feed

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Natural Soy Lecithin Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Form

7.6.4.1 Liquid

7.6.4.2 Solid

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Food and Beverage

7.6.5.2 Nutritional Supplements

7.6.5.3 Animal Feed

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Natural Soy Lecithin Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Form

7.7.4.1 Liquid

7.7.4.2 Solid

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Food and Beverage

7.7.5.2 Nutritional Supplements

7.7.5.3 Animal Feed

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Natural Soy Lecithin Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 615.77 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.5 % |

Market Size in 2032: |

USD 1085.34 Mn. |

|

Segments Covered: |

By Form |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||