Global Moringa Tea Market Overview

The Moringa Tea Market is expected to grow at a significant growth rate, and the analysis period is 2022-2028, considering the base year as 2021.

Moringa tea is primarily prepared from the leaves of a plant called Moringa Oleifera and is now gaining popularity as a superfood with double protein as in milk, more than seven times vitamin C as compared to oranges, three times potassium than in bananas, and four times the vitamin A content than in carrots. The superfood has had its usage for centuries due to its nutritive and medicinal properties along with the health benefits that it provides. Owing to the rapid surge in awareness about its numerous health benefits, 13 species of Moringa are cultivated in other tropical and sub-tropical regions such as Africa, Islands in the Pacific and the Caribbean, Asia, and South America. Moringa tea prepared by brewing moringa leaves has a rare combination of and quercetin & kaempferol plant hormones. This combination of flavonoids is useful in relieving inflammation and preventing the buildup of cholesterol in the body, which further adds to the market growth. According to CDC, about 38% of Americans have high cholesterol thus, creating lucrative opportunity for the growth of Moringa tea market during the forecasted period.

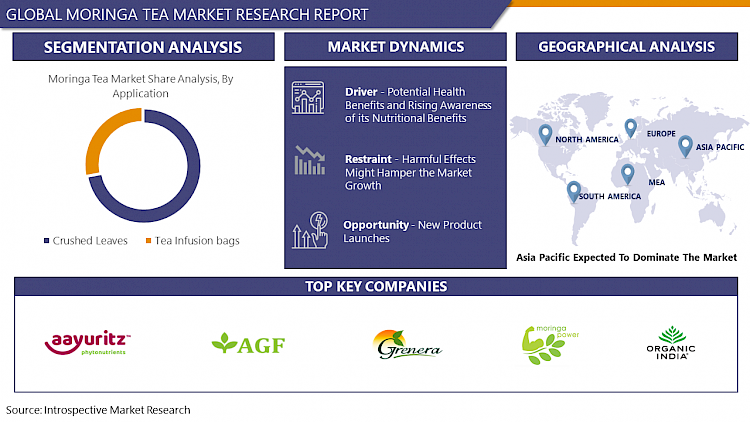

Market Dynamics And Factors For Moringa Tea Market

Drivers:

Potential Health Benefits and Rising Awareness of its Nutritional Benefits

Along with increasing health-related disorders, the awareness regarding the potential nutritional benefits of moringa tea is also rising. According to the USDA, raw moringa tea leaves carry 25 essential vitamins & minerals. It is a significant source of vitamin C (ascorbic acid), vitamin A, and vitamin B6. The leaves of the moringa plant have large amounts of essential nutrients such as beta-carotene and amino acids. For example, 100 grams of moringa leaves contain around 9 grams of protein. It is also an excellent source of vitamins & minerals. For instance, in 21 grams of chopped fresh moringa leaves, there are 2 grams of Protein, 19% Vitamin B6 of RDA, 12% Vitamin C, 11% Iron, 11% Riboflavin (B2), 9% Vitamin A (from beta-carotene), and 8% of Magnesium. In addition to vitamin C and beta-carotene, the presence of antioxidants in moringa tea such as Quercetin which helps in lowering blood pressure, and Chlorogenic acid which helps in moderating the blood sugar levels thus, driving the market development over the analysis period.

Consumption of moringa tea offers potential health benefits due to which the growth is surging rapidly. High levels of free radicals may cause oxidative stress, which is associated with chronic diseases like heart disease and type 2 diabetes. Several antioxidant plant compounds have been found in the leaves of Moringa oleifera. The surge in health-conscious consumers and tea drinkers has led to the popularity of moringa tea in the global market. Moringa tea's nutritional value, in addition to being caffeine-free, makes it different from other tea products on the market. Moringa tea has a potent immune system booster and it helps to fight off sickness, and infections, and even speed up the healing of wounds. Besides combating liver damage, heart disease, and diabetes, these compounds also fight chronic inflammation. The tea is also widely consumed as it helps alleviate symptoms of anxiety, depression, and fatigue by balancing the serotonin and dopamine levels, which are crucial in mood regulation and pain perception. All such factors henceforth are anticipated to drive the moringa tea market growth.

Restraints:

Harmful Effects Might Hamper the Market Growth

Despite numerous potential benefits, moringa tea has some side effects that can be harmful to the human body. Moringa tea if taken in large quantities, might exhibit laxative properties, which can further lead to upset stomachs, nausea, and heartburn. These factors might impede the growth of the moringa tea market. Further, breastfeeding women are also kept away from the consumption of moringa tea as there is no such evidence that states that ingredients in moringa tea are safe for infants. Although moringa leaves are known to reduce the heart rate lowering blood pressure effectively, they also can become dangerous when taken in combination with other medicines that lower blood pressure, thus hampering the market growth. Moringa can potentially interact with some of the medications for diabetes and thyroid as well, and consumption of moringa tea before consulting a doctor under such medical condition may harm the health of consumers. Additionally, large consumption can lead to organ and genotoxic damage thereby, increasing chances of developing cancer. These factors are anticipated to hinder the moringa tea market development during the projected period.

Opportunity:

New Product Launches

Moringa tea is itself a value-added product, and introducing new flavors or substances effective for human health can offer profitable opportunities for the market players. New products that exhibit enhanced capabilities are majorly developed by key market players. Leading companies are also strengthening their R&D in making new moringa tea products with improved taste and flavor. Further, to serve the growing demand for organic food and beverages, as well as healthy and nutrition-rich foods, manufacturers are engaged in launching tea with organically grown moringa leaves. Efforts by the manufacturers are projected to offer potential opportunities for the market expansion. Major companies are strategically focusing on launching innovative health-promoting moringa tea products to suffice the growing demand among consumers. Companies such as Organic India, Grenera Nutrients Pvt. Ltd., Asia Botanicals Sdn Bhd, and others are focused on the launch of new moringa tea products to expand the market and contribute to the overall growth. For instance, in August 2022, Davidson’s introduced yet sustainably introduced a new line of moringa teas to the market. The new blends include Moringa Chai, Moringa Chamomile Lavendar, Moringa Ginger Lemon, Moringa Hibiscus Watermelon, Moringa Mango Peach, Moringa Mint Sage, Moringa Pure Leaves, and Moringa Strawberry Rose. Moreover, in March 2020, Typhoo Tea Limited, a U.K.-based tea manufacturer in India, launched three new organic herbal teas - Purifying Super Greens, Digestive Power Seeds, and Immunity-boosting Three Tulsi. The purifying super greens consist of organic moringa and a blend of other ingredients to offer holistic purifying benefits. Such effective product launches are expected to contribute to the expansion of the moringa tea market over the forecast period.

Segmentation Analysis Of the Moringa Tea Market

By Nature, organic segment is expected to have the highest share of the moringa tea market. Organic food products usually offer more potential health benefits than that conventional products, and along with the rising awareness, the organic nature of moringa tea is witnessing huge demand. Organic tea is also beneficial as it does not include any use of chemicals like fertilizers, or pesticides that can harm human health. It also benefits human health multiple times more than the regular ones due to its natural compounds. Health-conscious consumers, especially, gym-going people, people suffering from certain chronic diseases, or diabetes, and others prefer organic tea to boost their immunity, henceforth, contributing to the segment growth of the moringa tea market.

By Form, the crushed leaves segment is anticipated to dominate the market during the projected timeframe. Loose-leaf or crushed leaves form of tea provides far superior tea quality as compared to tea bags and thus is the primary reason for the dominance of this segment. Even low-quality tea leaves that are in crushed form offer a better flavor and aroma, as well as more nutrients than any standard tea bag. Crushed leaves also provide the consumers with the choice to prepare and consume the tea according to their needs, whereas, in tea bags, the amount is fixed which is usually around 1-3 grams. However, due to the ease and convenience of consumption, the tea bag segment is expected to witness rapid growth.

By Distribution Channels, the offline segment set to lead the growth of the moringa tea market. The ease and convenience of shopping provided by offline retailers such as the presence of varied product aisles, discounts and offers on bulk purchases, numerous options to choose products, and a one-stop shopping center under the same roof are the major factors responsible for the huge growth of this segment. The specialty stores are growing rapidly as they provide the customers with a wide range of other nutritional and health-care products, which consumers can purchase along with their dietary supplements. Further, the easy availability of tea from leading brands and the presence of specialists who assist consumers in buying such products contribute to the growth of the offline segment.

Regional Analysis Of Moringa Tea Market

The Asia Pacific holds the largest market share for the moringa tea market and is projected to dominate the growth in the foreseeable years. The abundant availability of moringa trees in the Asia Pacific region along with the large-scale consumption of its products like pods and leaves in India, Japan, and other countries all together contributes to the regional growth of the moringa tea market. Proponents of Ayurveda and natural therapies are also fostering the wide cultivation of moringa trees in the Asia Pacific region. Large volume export of moringa tea to the Western countries with an intent to serve their large population is further fuelling the moringa tea market in the Asia Pacific region.

India is the largest producer of Moringa with an annual production of 2.2 million tonnes of tender fruits from a total area of 43,600 ha leading to maximum productivity of around 51 tonnes per ha. Among the different states in India, Andhra Pradesh is the leading state in both production & area (15,665 ha), followed by Tamil Nadu (13042 ha) and Karnataka (10,280 ha). In other states, it occupies an area of 4,613 ha. The significant increase in the R&D sector for introducing innovative possible products paves profitable opportunities for the moringa tea market to flourish in the Asia Pacific region. Moreover, the government in this region, especially in India, is highlighting the advantages of moringa products by organizing awareness campaigns, and providing beneficial subsidies which are further estimated to boost the market. For instance, the National Bank for Agriculture and Rural Development offers subsidies to farmers all across the nation, while the government of Tamil Nadu state is also contributing by providing subsidies to farmers for the cultivation of this herb. All such factors thus lead to the moringa tea market in the Asia Pacific region.

Europe is expected to witness the fastest growth in the moringa tea market over the upcoming years. The region is also studied to generate immense growth opportunities for Moringa Tea, with Germany contributing the maximum. The European moringa tea market is majorly driven by the huge export of moringa tea to other countries across the world. The European region is also perceiving rapid growth due to the increasing popularity of nutritional supplements among health-conscious consumers. Developed countries like Germany, the U.K., Netherlands, and Italy are among the major nutritional supplements market in the region along with much more awareness about the product. Growing demand for Moringa tea in the European region due to awareness such as promotes weight loss, helps in food digestion, prevents diseases, provides nourishment, and improves skin health drives the market growth. Further, the major inclination of consumers toward maintaining a balanced diet coupled with health and fitness trends is anticipated to offer fast growth opportunities.

Covid-19 Impact Analysis On Moringa Tea Market

The global outbreak of Covid-19 has led to serious implications in every economic sector. However, along with the increasing positive cases, the demand for healthy and sustainable food products was increased. During the pandemic, the sales of traditional, healthy, and staple food items were observed to be significantly grown. Frozen non-veg food, eggs, pulses, flour, fruits& vegetables, healthy tea, and whole grains experienced increased demand. Whereas, nonessential products such as pastries, cheese, milkshakes, packaged foods, coffee, chocolates, sweets, and other bakery products have experienced a decline in their sale. The moringa tea market has not been severely affected as other processed food, but the imposed lockdown across various countries hampered the production and supply chain of moringa tea manufacturers. Later, in the post-pandemic era, as the economies planned to revive their operations, the demand for moringa tea is presumed to increase as consumers are becoming more aware of the health benefits of moringa tea, and are buying food products through online retailers. With all these factors, it can be considered that in post-pandemic times, the demand for moringa tea will grow rapidly.

Top Key Players Covered In Moringa Tea Market

- Aayuritz Phytonutrients Pvt. Ltd

- Ancient Greenfields Pvt Ltd.

- Asia Botanicals Sdn Bhd

- Bio moringa Oleifera Gmbh

- Earth Expo Company

- Green Earth Products Pvt. Ltd.

- Grenera

- Kuli Kuli

- Rootalive

- Philippine Moringa

- Rainforest Herbs

- Organic India

- Earth Expo Company

- Genius Nature Herbs, and other major players.

Key Industry Development In The Moringa Tea Market

In May 2022, Organic India launched a new and exciting variety of tea like Tulsi Detox Kahwa and infusions such as Peppermint Refresh, Moringa hibiscus, and Simply Chamomile. Each of the newly launched products has a unique taste and significance built into it. The Peppermint combined with Tulsi will make the consumers feel refreshed and rejuvenated. Moringa is packed with several nutrients that are the goodness of several ayurvedic herbs essential for immunity building.

In May 2020, Green Provisions introduced moringa iced tea that is significantly prepared from high-quality moringa leaves. It is a premium iced tea along with a convenient bottled pack. The great-tasting drink is available in 16oz bottles and is all-natural, organic, caffeine-free, and has no high fructose corn syrup. The iced tea is made with 100% brewed Moringa leaves which have won praise for its 46 antioxidants and 96 nutrients and can boost the immune system, safely.

|

Global Moringa Tea Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD XXX Bn. |

|

Forecast Period 2022-28 CAGR: |

XX% |

Market Size in 2028: |

USD XXX Bn. |

|

Segments Covered: |

By Nature |

|

|

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Nature

3.2 By Form

3.3 By Distribution Channels

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Moringa Tea Market by Nature

5.1 Moringa Tea Market Overview Snapshot and Growth Engine

5.2 Moringa Tea Market Overview

5.3 Conventional

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Conventional: Grographic Segmentation

5.4 Organic

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Organic: Grographic Segmentation

Chapter 6: Moringa Tea Market by Form

6.1 Moringa Tea Market Overview Snapshot and Growth Engine

6.2 Moringa Tea Market Overview

6.3 Crushed Leaves

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Crushed Leaves: Grographic Segmentation

6.4 Tea Infusion Bags

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Tea Infusion Bags: Grographic Segmentation

Chapter 7: Moringa Tea Market by Distribution Channels

7.1 Moringa Tea Market Overview Snapshot and Growth Engine

7.2 Moringa Tea Market Overview

7.3 Online

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Online: Grographic Segmentation

7.4 Offline

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Offline: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Moringa Tea Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Moringa Tea Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Moringa Tea Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 AAYURITZ PHYTONUTRIENTS PVT. LTD

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 ANCIENT GREENFIELDS PVT LTD.

8.4 ASIA BOTANICALS SDN BHD

8.5 BIO MORINGA OLEIFERA GMBH

8.6 EARTH EXPO COMPANY

8.7 GREEN EARTH PRODUCTS PVT. LTD.

8.8 GRENERA

8.9 KULI KULI

8.10 ROOTALIVE

8.11 PHILIPPINE MORINGA

8.12 RAINFOREST HERBS

8.13 ORGANIC INDIA

8.14 EARTH EXPO COMPANY

8.15 GENIUS NATURE HERBS

8.16 OTHER MAJOR PLAYERS

Chapter 9: Global Moringa Tea Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Nature

9.2.1 Conventional

9.2.2 Organic

9.3 Historic and Forecasted Market Size By Form

9.3.1 Crushed Leaves

9.3.2 Tea Infusion Bags

9.4 Historic and Forecasted Market Size By Distribution Channels

9.4.1 Online

9.4.2 Offline

Chapter 10: North America Moringa Tea Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Nature

10.4.1 Conventional

10.4.2 Organic

10.5 Historic and Forecasted Market Size By Form

10.5.1 Crushed Leaves

10.5.2 Tea Infusion Bags

10.6 Historic and Forecasted Market Size By Distribution Channels

10.6.1 Online

10.6.2 Offline

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Moringa Tea Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Nature

11.4.1 Conventional

11.4.2 Organic

11.5 Historic and Forecasted Market Size By Form

11.5.1 Crushed Leaves

11.5.2 Tea Infusion Bags

11.6 Historic and Forecasted Market Size By Distribution Channels

11.6.1 Online

11.6.2 Offline

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Moringa Tea Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Nature

12.4.1 Conventional

12.4.2 Organic

12.5 Historic and Forecasted Market Size By Form

12.5.1 Crushed Leaves

12.5.2 Tea Infusion Bags

12.6 Historic and Forecasted Market Size By Distribution Channels

12.6.1 Online

12.6.2 Offline

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Moringa Tea Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Nature

13.4.1 Conventional

13.4.2 Organic

13.5 Historic and Forecasted Market Size By Form

13.5.1 Crushed Leaves

13.5.2 Tea Infusion Bags

13.6 Historic and Forecasted Market Size By Distribution Channels

13.6.1 Online

13.6.2 Offline

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Moringa Tea Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Nature

14.4.1 Conventional

14.4.2 Organic

14.5 Historic and Forecasted Market Size By Form

14.5.1 Crushed Leaves

14.5.2 Tea Infusion Bags

14.6 Historic and Forecasted Market Size By Distribution Channels

14.6.1 Online

14.6.2 Offline

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Moringa Tea Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD XXX Bn. |

|

Forecast Period 2022-28 CAGR: |

XX% |

Market Size in 2028: |

USD XXX Bn. |

|

Segments Covered: |

By Nature |

|

|

|

By Form |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MORINGA TEA MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MORINGA TEA MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MORINGA TEA MARKET COMPETITIVE RIVALRY

TABLE 005. MORINGA TEA MARKET THREAT OF NEW ENTRANTS

TABLE 006. MORINGA TEA MARKET THREAT OF SUBSTITUTES

TABLE 007. MORINGA TEA MARKET BY NATURE

TABLE 008. CONVENTIONAL MARKET OVERVIEW (2016-2028)

TABLE 009. ORGANIC MARKET OVERVIEW (2016-2028)

TABLE 010. MORINGA TEA MARKET BY FORM

TABLE 011. CRUSHED LEAVES MARKET OVERVIEW (2016-2028)

TABLE 012. TEA INFUSION BAGS MARKET OVERVIEW (2016-2028)

TABLE 013. MORINGA TEA MARKET BY DISTRIBUTION CHANNELS

TABLE 014. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 015. OFFLINE MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA MORINGA TEA MARKET, BY NATURE (2016-2028)

TABLE 017. NORTH AMERICA MORINGA TEA MARKET, BY FORM (2016-2028)

TABLE 018. NORTH AMERICA MORINGA TEA MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 019. N MORINGA TEA MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE MORINGA TEA MARKET, BY NATURE (2016-2028)

TABLE 021. EUROPE MORINGA TEA MARKET, BY FORM (2016-2028)

TABLE 022. EUROPE MORINGA TEA MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 023. MORINGA TEA MARKET, BY COUNTRY (2016-2028)

TABLE 024. ASIA PACIFIC MORINGA TEA MARKET, BY NATURE (2016-2028)

TABLE 025. ASIA PACIFIC MORINGA TEA MARKET, BY FORM (2016-2028)

TABLE 026. ASIA PACIFIC MORINGA TEA MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 027. MORINGA TEA MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA MORINGA TEA MARKET, BY NATURE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA MORINGA TEA MARKET, BY FORM (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA MORINGA TEA MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 031. MORINGA TEA MARKET, BY COUNTRY (2016-2028)

TABLE 032. SOUTH AMERICA MORINGA TEA MARKET, BY NATURE (2016-2028)

TABLE 033. SOUTH AMERICA MORINGA TEA MARKET, BY FORM (2016-2028)

TABLE 034. SOUTH AMERICA MORINGA TEA MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 035. MORINGA TEA MARKET, BY COUNTRY (2016-2028)

TABLE 036. AAYURITZ PHYTONUTRIENTS PVT. LTD: SNAPSHOT

TABLE 037. AAYURITZ PHYTONUTRIENTS PVT. LTD: BUSINESS PERFORMANCE

TABLE 038. AAYURITZ PHYTONUTRIENTS PVT. LTD: PRODUCT PORTFOLIO

TABLE 039. AAYURITZ PHYTONUTRIENTS PVT. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. ANCIENT GREENFIELDS PVT LTD.: SNAPSHOT

TABLE 040. ANCIENT GREENFIELDS PVT LTD.: BUSINESS PERFORMANCE

TABLE 041. ANCIENT GREENFIELDS PVT LTD.: PRODUCT PORTFOLIO

TABLE 042. ANCIENT GREENFIELDS PVT LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ASIA BOTANICALS SDN BHD: SNAPSHOT

TABLE 043. ASIA BOTANICALS SDN BHD: BUSINESS PERFORMANCE

TABLE 044. ASIA BOTANICALS SDN BHD: PRODUCT PORTFOLIO

TABLE 045. ASIA BOTANICALS SDN BHD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BIO MORINGA OLEIFERA GMBH: SNAPSHOT

TABLE 046. BIO MORINGA OLEIFERA GMBH: BUSINESS PERFORMANCE

TABLE 047. BIO MORINGA OLEIFERA GMBH: PRODUCT PORTFOLIO

TABLE 048. BIO MORINGA OLEIFERA GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. EARTH EXPO COMPANY: SNAPSHOT

TABLE 049. EARTH EXPO COMPANY: BUSINESS PERFORMANCE

TABLE 050. EARTH EXPO COMPANY: PRODUCT PORTFOLIO

TABLE 051. EARTH EXPO COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. GREEN EARTH PRODUCTS PVT. LTD.: SNAPSHOT

TABLE 052. GREEN EARTH PRODUCTS PVT. LTD.: BUSINESS PERFORMANCE

TABLE 053. GREEN EARTH PRODUCTS PVT. LTD.: PRODUCT PORTFOLIO

TABLE 054. GREEN EARTH PRODUCTS PVT. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. GRENERA: SNAPSHOT

TABLE 055. GRENERA: BUSINESS PERFORMANCE

TABLE 056. GRENERA: PRODUCT PORTFOLIO

TABLE 057. GRENERA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. KULI KULI: SNAPSHOT

TABLE 058. KULI KULI: BUSINESS PERFORMANCE

TABLE 059. KULI KULI: PRODUCT PORTFOLIO

TABLE 060. KULI KULI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ROOTALIVE: SNAPSHOT

TABLE 061. ROOTALIVE: BUSINESS PERFORMANCE

TABLE 062. ROOTALIVE: PRODUCT PORTFOLIO

TABLE 063. ROOTALIVE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. PHILIPPINE MORINGA: SNAPSHOT

TABLE 064. PHILIPPINE MORINGA: BUSINESS PERFORMANCE

TABLE 065. PHILIPPINE MORINGA: PRODUCT PORTFOLIO

TABLE 066. PHILIPPINE MORINGA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. RAINFOREST HERBS: SNAPSHOT

TABLE 067. RAINFOREST HERBS: BUSINESS PERFORMANCE

TABLE 068. RAINFOREST HERBS: PRODUCT PORTFOLIO

TABLE 069. RAINFOREST HERBS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. ORGANIC INDIA: SNAPSHOT

TABLE 070. ORGANIC INDIA: BUSINESS PERFORMANCE

TABLE 071. ORGANIC INDIA: PRODUCT PORTFOLIO

TABLE 072. ORGANIC INDIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. EARTH EXPO COMPANY: SNAPSHOT

TABLE 073. EARTH EXPO COMPANY: BUSINESS PERFORMANCE

TABLE 074. EARTH EXPO COMPANY: PRODUCT PORTFOLIO

TABLE 075. EARTH EXPO COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. GENIUS NATURE HERBS: SNAPSHOT

TABLE 076. GENIUS NATURE HERBS: BUSINESS PERFORMANCE

TABLE 077. GENIUS NATURE HERBS: PRODUCT PORTFOLIO

TABLE 078. GENIUS NATURE HERBS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 079. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 080. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 081. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MORINGA TEA MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MORINGA TEA MARKET OVERVIEW BY NATURE

FIGURE 012. CONVENTIONAL MARKET OVERVIEW (2016-2028)

FIGURE 013. ORGANIC MARKET OVERVIEW (2016-2028)

FIGURE 014. MORINGA TEA MARKET OVERVIEW BY FORM

FIGURE 015. CRUSHED LEAVES MARKET OVERVIEW (2016-2028)

FIGURE 016. TEA INFUSION BAGS MARKET OVERVIEW (2016-2028)

FIGURE 017. MORINGA TEA MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 018. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 019. OFFLINE MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA MORINGA TEA MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE MORINGA TEA MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC MORINGA TEA MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA MORINGA TEA MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA MORINGA TEA MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Moringa Tea Market research report is 2022-2028.

Aayuritz Phytonutrients Pvt. Ltd, Ancient Greenfields Pvt Ltd., Asia Botanicals Sdn Bhd, Bio moringa Oleifera Gmbh, Earth Expo Company, Green Earth Products Pvt. Ltd., Grenera, Kuli Kuli, Rootalive, Philippine Moringa, Rainforest Herbs, Organic India, Earth Expo Company, Genius Nature Herbs, and Other Major Players.

The Moringa Tea Market is segmented into nature, form, distribution channels, and region. By Nature, the market is categorized into conventional and organic. By Form, the market is categorized into Crushed Leaves and Tea Infusion Bags. By Distribution channels, the market is categorized into Online and Offline. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Moringa tea is primarily prepared from the leaves of a plant called Moringa Oleifera and is now gaining popularity as a superfood with double protein as in milk, more than seven times vitamin C, as compared to oranges, three times potassium than in bananas, and four times the vitamin A content than in carrots.

The Moringa Tea Market is expected to grow at a significant growth rate, and the analysis period is 2022-2028, considering the base year as 2021.