Montan Wax Market Synopsis

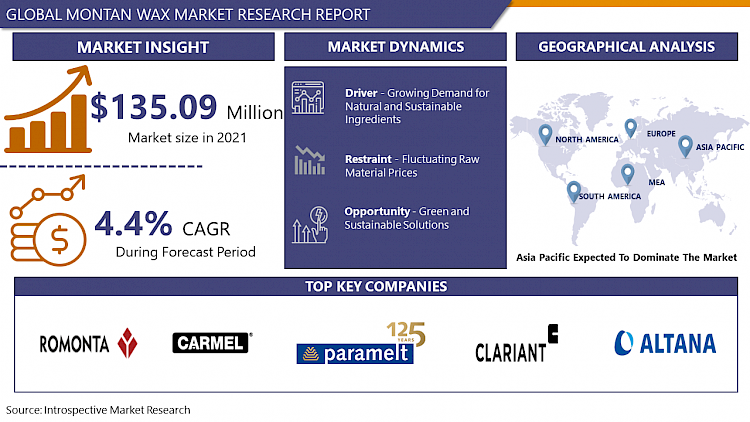

The Global Montan Wax Market size is expected to grow from USD 135.09 million in 2022 to USD 190.65 million by 2030, at a CAGR of 4.4% during the forecast period (2023-2030).

Montan wax, also known as lignite wax or OP wax, is a natural, high-quality wax derived from lignite, a type of soft coal. It is primarily composed of long-chain hydrocarbons and contains esters, free acids, and high molecular weight compounds. This wax is extracted through a complex refining process involving solvent extraction and purification methods.

- Applications of Montan wax span various industries. It is widely utilized in the production of polishes, coatings, and finishes for wood, leather, and automobiles due to its excellent gloss, water repellence, and protective properties. Additionally, it serves as an essential component in the formulation of inks, cosmetics, adhesives, and plastics, enhancing their texture, moisture resistance, and overall quality.

- In the market, there has been a growing demand for natural and sustainable raw materials. Montan wax aligns with these trends due to its renewable source and eco-friendly properties, leading to an increased interest among manufacturers seeking environmentally friendly alternatives. Moreover, its versatility across multiple industries has contributed to a steady demand, with ongoing research focused on enhancing its properties and exploring new applications.

- In short, Montan wax continues to be a valuable natural resource in various industrial sectors, and its market trends indicate a growing preference for sustainable and versatile materials.

Montan Wax Market Trend Analysis

Growing Demand for Natural and Sustainable Ingredients

- The escalating demand for natural and sustainable ingredients serves as a pivotal driver propelling the market growth of Montan wax. In an era characterized by heightened environmental consciousness and a shift toward eco-friendly solutions, industries across the spectrum are actively seeking alternatives to synthetic or petroleum-based materials. Montan wax, derived from lignite, emerges as an attractive option due to its natural origin and eco-friendly profile.

- Consumers increasingly prioritize products formulated with natural ingredients, driving manufacturers to incorporate Montan wax into various applications spanning cosmetics, coatings, pharmaceuticals, and more. Its renewable sourcing and biodegradable nature align with sustainability goals, appealing to both environmentally conscious consumers and regulatory initiatives promoting green practices.

- Moreover, Montan wax offers distinct advantages, including superior water repellency, gloss enhancement, and protective properties, meeting the performance requirements while fulfilling the demand for sustainable ingredients. This demand surge isn't merely a trend but a fundamental shift in consumer behavior and industry standards, compelling businesses to adapt their formulations and processes to meet these evolving preferences.

- As a result, the market for Montan wax experiences significant growth driven by the insistent need for natural, renewable, and sustainable ingredients across diverse industrial sectors, substantiating its position as a key player in the era of environmentally conscious manufacturing and consumption.

Green and Sustainable Solutions

- As global concerns about environmental impact intensify, industries are actively seeking alternatives that align with sustainability objectives. Montan wax, derived from natural lignite sources and biodegradable in nature, perfectly fits into this narrative of eco-friendly materials.

- The shift toward sustainable practices isn't merely a trend but a fundamental restructuring of consumer preferences and industry standards. Montan wax, with its inherent green attributes, meets the criteria for companies striving to reduce their ecological footprint. Its versatility, offering water repellence, gloss enhancement, and protective properties, positions it as a sustainable substitute for petroleum-based or synthetic materials in various applications.

- Moreover, businesses aiming to comply with stringent environmental regulations find Montan wax an attractive choice due to its renewable sourcing and environmentally benign characteristics. As consumer awareness grows regarding the ecological impact of products, there's an increasing demand for goods formulated with natural, biodegradable ingredients like Montan wax.

- This demand surge for green solutions not only enhances market opportunities but also fosters innovation and encourages investment in research and development to further optimize the properties and applications of Montan wax. As a result, Montan wax stands poised to thrive in a market propelled by the imperative for sustainable solutions across industries.

Montan Wax Market Segment Analysis:

Montan Wax Market Segmented on the basis of type, function, and end-users.

By Type, Crude Montan Wax segment is expected to dominate the market during the forecast period

- The Crude Montan Wax segment is anticipated to maintain dominance in the market throughout the forecast period due to its widespread applicability and economic viability. As the initial form of extracted Montan wax, crude Montan wax serves as a versatile raw material across multiple industries. Its cost-effectiveness and ability to undergo further refinement for various applications contribute to its sustained dominance.

- Industries such as coatings, polishes, adhesives, and cosmetics utilize crude Montan wax as a base material, benefiting from its fundamental properties such as water repellence and gloss enhancement. Additionally, the refining process allows manufacturers to tailor the wax for specific purposes, amplifying its usability.

- The accessibility and adaptability of crude Montan wax as a starting material for diverse formulations underpin its market dominance, making it a pivotal segment driving growth across industries seeking sustainable and efficient raw materials.

By Application, Food segment held the largest market share of 38% in 2022

- The Food segment secured the largest market share in Montan wax applications due to its versatile uses in food-related products and packaging. Montan wax, known for its non-toxic and food-grade properties, is widely employed in the food industry for various purposes.

- In food packaging, Montan wax acts as a coating material for fruits, vegetables, and confectionery, providing a protective layer that extends shelf life and maintains product freshness. Its natural water-repellent properties make it an ideal choice for coating paper or cardboard used in food packaging, enhancing resistance to moisture and oils.

- Moreover, Montan wax finds applications as a glazing agent in the production of candies, chocolates, and other confectionery items, imparting shine and preventing moisture loss. Its non-toxic nature makes it suitable for direct contact with food items.

- The compliance of Montan wax with food safety regulations, combined with its EMULSIFIERlity as a protective coating and glazing agent, positions it as a pivotal component in the food industry, thereby securing the largest market share among various application segments.

Montan Wax Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is poised to dominate the Montan wax market over the forecast period due to several contributing factors. The region's dominance can be attributed to the rapid industrialization, expanding manufacturing sectors, and increasing demand for consumer goods across countries like China, India, Japan, and South Korea.

- Factors such as a burgeoning population, rising disposable income, and evolving consumer preferences for sustainable products drive the demand for Montan wax in various applications. Industries like automotive, cosmetics, packaging, and coatings in the Asia Pacific region extensively utilize Montan wax due to its versatile properties and cost-effectiveness.

- Additionally, the presence of a robust manufacturing base and increasing investments in research and development further support the growth of the Montan wax market in the region. Moreover, favorable government initiatives, coupled with the growing focus on eco-friendly solutions, contribute to the dominance of Asia Pacific in the Montan wax market during the forecast period.

Montan Wax Market Top Key Players:

- Altana (Germany)

- Amerilubes, L.L.C. (U.S.)

- Brother (Japan)

- Calwax Corporation (U.S.)

- Carmel Industries (Israel)

- Clariant Corporation (Switzerland)

- Dhariwal Corp. Private Limited (India)

- Excel International (U.S.)

- First Source Worldwide Llc. (U.S.)

- Frank B. Ross Co. Inc. (U.S.)

- Lumitos Ag (Germany)

- Mayur Dyes & Chemicals Corporation

- Paramelt B.V. (Netherlands)

- Parchvale Ltd. (U.K.)

- Poth Hille (U.K.)

- Romonta Gmbh (Germany)

- S. Kato & Co. (Japan)

- Stevenson-Seeley, Inc. (U.S.)

- Ter Hell & Co. Gmbh (Germany)

- Tianshi Wax (China)

- Völpker Spezialprodukte Gmbh

- Yunan Shangcheng Biotechnology Co Ltd. (China)

- Yunphos (China) and Other Major Players

|

Global Montan Wax Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 135.09 Mn. |

|

Forecast Period 2023-32 CAGR: |

4.4 % |

Market Size in 2032: |

USD 190.65 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MONTAN WAX MARKET BY TYPE (2016-2030)

- MONTAN WAX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CRUDE MONTAN WAX

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REFINED MONTAN WAX

- MONTAN WAX MARKET BY FUNCTION (2016-2030)

- MONTAN WAX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EMULSIFIER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LUBRICANTS

- THICKENING AGENTS

- RELEASE AGENTS

- MONTAN WAX MARKET BY END-USERS (2016-2030)

- MONTAN WAX MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COSMETICS

- PHARMACEUTICALS

- RUBBERS

- PLASTICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- MONTAN WAX Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ALTANA (GERMANY)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AMERILUBES, L.L.C. (U.S.)

- BROTHER (JAPAN)

- CALWAX CORPORATION (U.S.)

- CARMEL INDUSTRIES (ISRAEL)

- CLARIANT CORPORATION (SWITZERLAND)

- DHARIWAL CORP. PRIVATE LIMITED (INDIA)

- EXCEL INTERNATIONAL (U.S.)

- FIRST SOURCE WORLDWIDE LLC. (U.S.)

- FRANK B. ROSS CO. INC. (U.S.)

- LUMITOS AG (GERMANY)

- MAYUR DYES & CHEMICALS CORPORATION

- PARAMELT B.V. (NETHERLANDS)

- PARCHVALE LTD. (U.K.)

- POTH HILLE (U.K.)

- ROMONTA GMBH (GERMANY)

- S. KATO & CO. (JAPAN)

- STEVENSON-SEELEY, INC. (U.S.)

- TER HELL & CO. GMBH (GERMANY)

- TIANSHI WAX (CHINA)

- VÖLPKER SPEZIALPRODUKTE GMBH

- YUNAN SHANGCHENG BIOTECHNOLOGY CO LTD. (CHINA)

- YUNPHOS (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL MONTAN WAX MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By FUNCTION

- Historic And Forecasted Market Size By END-USERS

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Montan Wax Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 135.09 Mn. |

|

Forecast Period 2023-32 CAGR: |

4.4 % |

Market Size in 2032: |

USD 190.65 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MONTAN WAX MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MONTAN WAX MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MONTAN WAX MARKET COMPETITIVE RIVALRY

TABLE 005. MONTAN WAX MARKET THREAT OF NEW ENTRANTS

TABLE 006. MONTAN WAX MARKET THREAT OF SUBSTITUTES

TABLE 007. MONTAN WAX MARKET BY TYPE

TABLE 008. CRUDE MONTAN WAX MARKET OVERVIEW (2016-2028)

TABLE 009. REFINED MONTAN WAX MARKET OVERVIEW (2016-2028)

TABLE 010. MONTAN WAX MARKET BY FUNCTION

TABLE 011. EMULSIFIER MARKET OVERVIEW (2016-2028)

TABLE 012. LUBRICANTS MARKET OVERVIEW (2016-2028)

TABLE 013. THICKENING AGENTS MARKET OVERVIEW (2016-2028)

TABLE 014. RELEASE AGENTS MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. MONTAN WAX MARKET BY END-USERS

TABLE 017. COSMETICS MARKET OVERVIEW (2016-2028)

TABLE 018. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 019. RUBBERS MARKET OVERVIEW (2016-2028)

TABLE 020. PLASTICS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA MONTAN WAX MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA MONTAN WAX MARKET, BY FUNCTION (2016-2028)

TABLE 024. NORTH AMERICA MONTAN WAX MARKET, BY END-USERS (2016-2028)

TABLE 025. N MONTAN WAX MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE MONTAN WAX MARKET, BY TYPE (2016-2028)

TABLE 027. EUROPE MONTAN WAX MARKET, BY FUNCTION (2016-2028)

TABLE 028. EUROPE MONTAN WAX MARKET, BY END-USERS (2016-2028)

TABLE 029. MONTAN WAX MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC MONTAN WAX MARKET, BY TYPE (2016-2028)

TABLE 031. ASIA PACIFIC MONTAN WAX MARKET, BY FUNCTION (2016-2028)

TABLE 032. ASIA PACIFIC MONTAN WAX MARKET, BY END-USERS (2016-2028)

TABLE 033. MONTAN WAX MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA MONTAN WAX MARKET, BY TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA MONTAN WAX MARKET, BY FUNCTION (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA MONTAN WAX MARKET, BY END-USERS (2016-2028)

TABLE 037. MONTAN WAX MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA MONTAN WAX MARKET, BY TYPE (2016-2028)

TABLE 039. SOUTH AMERICA MONTAN WAX MARKET, BY FUNCTION (2016-2028)

TABLE 040. SOUTH AMERICA MONTAN WAX MARKET, BY END-USERS (2016-2028)

TABLE 041. MONTAN WAX MARKET, BY COUNTRY (2016-2028)

TABLE 042. ROMONTA BERGWERKS HOLDING AG: SNAPSHOT

TABLE 043. ROMONTA BERGWERKS HOLDING AG: BUSINESS PERFORMANCE

TABLE 044. ROMONTA BERGWERKS HOLDING AG: PRODUCT PORTFOLIO

TABLE 045. ROMONTA BERGWERKS HOLDING AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. CARMEL INDUSTRIES: SNAPSHOT

TABLE 046. CARMEL INDUSTRIES: BUSINESS PERFORMANCE

TABLE 047. CARMEL INDUSTRIES: PRODUCT PORTFOLIO

TABLE 048. CARMEL INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. PARAMELT B.V.: SNAPSHOT

TABLE 049. PARAMELT B.V.: BUSINESS PERFORMANCE

TABLE 050. PARAMELT B.V.: PRODUCT PORTFOLIO

TABLE 051. PARAMELT B.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. CLARIANT CORPORATION: SNAPSHOT

TABLE 052. CLARIANT CORPORATION: BUSINESS PERFORMANCE

TABLE 053. CLARIANT CORPORATION: PRODUCT PORTFOLIO

TABLE 054. CLARIANT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. CALWAX CORPORATION: SNAPSHOT

TABLE 055. CALWAX CORPORATION: BUSINESS PERFORMANCE

TABLE 056. CALWAX CORPORATION: PRODUCT PORTFOLIO

TABLE 057. CALWAX CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. VÖLPKER SPEZIALPRODUKTE GMBH.: SNAPSHOT

TABLE 058. VÖLPKER SPEZIALPRODUKTE GMBH.: BUSINESS PERFORMANCE

TABLE 059. VÖLPKER SPEZIALPRODUKTE GMBH.: PRODUCT PORTFOLIO

TABLE 060. VÖLPKER SPEZIALPRODUKTE GMBH.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. FIRST SOURCE WORLDWIDE LLC.: SNAPSHOT

TABLE 061. FIRST SOURCE WORLDWIDE LLC.: BUSINESS PERFORMANCE

TABLE 062. FIRST SOURCE WORLDWIDE LLC.: PRODUCT PORTFOLIO

TABLE 063. FIRST SOURCE WORLDWIDE LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. YUNAN SHANGCHENG BIOTECHNOLOGY: SNAPSHOT

TABLE 064. YUNAN SHANGCHENG BIOTECHNOLOGY: BUSINESS PERFORMANCE

TABLE 065. YUNAN SHANGCHENG BIOTECHNOLOGY: PRODUCT PORTFOLIO

TABLE 066. YUNAN SHANGCHENG BIOTECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. YUNPHOS: SNAPSHOT

TABLE 067. YUNPHOS: BUSINESS PERFORMANCE

TABLE 068. YUNPHOS: PRODUCT PORTFOLIO

TABLE 069. YUNPHOS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. BROTHER: SNAPSHOT

TABLE 070. BROTHER: BUSINESS PERFORMANCE

TABLE 071. BROTHER: PRODUCT PORTFOLIO

TABLE 072. BROTHER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. MAYUR DYES & CHEMICALS CORPORATION: SNAPSHOT

TABLE 073. MAYUR DYES & CHEMICALS CORPORATION: BUSINESS PERFORMANCE

TABLE 074. MAYUR DYES & CHEMICALS CORPORATION: PRODUCT PORTFOLIO

TABLE 075. MAYUR DYES & CHEMICALS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. S. KATO & CO.: SNAPSHOT

TABLE 076. S. KATO & CO.: BUSINESS PERFORMANCE

TABLE 077. S. KATO & CO.: PRODUCT PORTFOLIO

TABLE 078. S. KATO & CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. POTH HILLE: SNAPSHOT

TABLE 079. POTH HILLE: BUSINESS PERFORMANCE

TABLE 080. POTH HILLE: PRODUCT PORTFOLIO

TABLE 081. POTH HILLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. FRANK B. ROSS CO. INC.: SNAPSHOT

TABLE 082. FRANK B. ROSS CO. INC.: BUSINESS PERFORMANCE

TABLE 083. FRANK B. ROSS CO. INC.: PRODUCT PORTFOLIO

TABLE 084. FRANK B. ROSS CO. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. AMERILUBES L.L.C.: SNAPSHOT

TABLE 085. AMERILUBES L.L.C.: BUSINESS PERFORMANCE

TABLE 086. AMERILUBES L.L.C.: PRODUCT PORTFOLIO

TABLE 087. AMERILUBES L.L.C.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. PARCHVALE LTD.: SNAPSHOT

TABLE 088. PARCHVALE LTD.: BUSINESS PERFORMANCE

TABLE 089. PARCHVALE LTD.: PRODUCT PORTFOLIO

TABLE 090. PARCHVALE LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. ALTANA OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 091. ALTANA OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 092. ALTANA OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 093. ALTANA OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MONTAN WAX MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MONTAN WAX MARKET OVERVIEW BY TYPE

FIGURE 012. CRUDE MONTAN WAX MARKET OVERVIEW (2016-2028)

FIGURE 013. REFINED MONTAN WAX MARKET OVERVIEW (2016-2028)

FIGURE 014. MONTAN WAX MARKET OVERVIEW BY FUNCTION

FIGURE 015. EMULSIFIER MARKET OVERVIEW (2016-2028)

FIGURE 016. LUBRICANTS MARKET OVERVIEW (2016-2028)

FIGURE 017. THICKENING AGENTS MARKET OVERVIEW (2016-2028)

FIGURE 018. RELEASE AGENTS MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. MONTAN WAX MARKET OVERVIEW BY END-USERS

FIGURE 021. COSMETICS MARKET OVERVIEW (2016-2028)

FIGURE 022. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 023. RUBBERS MARKET OVERVIEW (2016-2028)

FIGURE 024. PLASTICS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA MONTAN WAX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE MONTAN WAX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC MONTAN WAX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA MONTAN WAX MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA MONTAN WAX MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Montan Wax Market research report is 2023-2030.

Altana (Germany), Amerilubes, L.L.C. (U.S.), Brother (Japan), Calwax Corporation (U.S.), Carmel Industries (Israel), Clariant Corporation (Switzerland), Dhariwal Corp. Private Limited (India), Excel International (U.S.), First Source Worldwide Llc. (U.S.), Frank B. Ross Co. Inc. (U.S.), Lumitos Ag (Germany), Mayur Dyes & Chemicals Corporation (India), Paramelt B.V. (Netherlands), Parchvale Ltd. (U.K.), Poth Hille (U.K.), Romonta Gmbh (Germany), S. Kato & Co. (Japan), Stevenson-Seeley, Inc. (U.S.), Ter Hell & Co. Gmbh (Germany), Tianshi Wax (China), Völpker Spezialprodukte Gmbh (China), Yunan Shangcheng Biotechnology Co Ltd. (China), Yunphos (China) and Other Major Players.

The Montan Wax Market is segmented into Type, Function, End-Users, and region. By Type, the market is categorized into Crude Montan Wax and Refined Montan Wax. By Function, the market is categorized into Emulsifier, Lubricants, Thickening Agents, Release Agents, and Others. By End-Users, the market is categorized into Food, Cosmetics, Pharmaceuticals, Rubbers, Plastics, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Montan wax, also known as lignite wax or OP wax, is a natural, high-quality wax derived from lignite, a type of soft coal. It is primarily composed of long-chain hydrocarbons and contains esters, free acids, and high molecular weight compounds. This wax is extracted through a complex refining process involving solvent extraction and purification methods.

The Global Montan Wax Market size is expected to grow from USD 135.09 million in 2022 to USD 190.65 million by 2030, at a CAGR of 4.4% during the forecast period (2023-2030).