Global Mobile Payment Market Overview

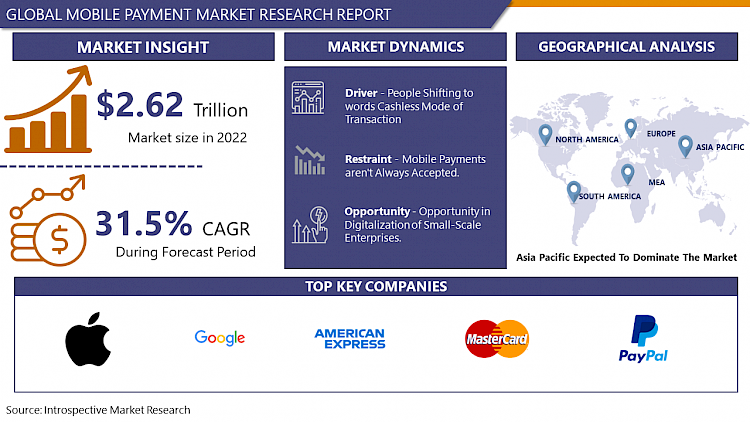

Global mobile payment market size was valued at USD 2.62 trillion in 2022, and is projected to reach USD 23.40 trillion by 2030, growing at a CAGR of 31.5% from 2023 to 2030.

- Mobile payment is an advanced method for making transactions. Traditional modes of payment are cash, cheques, or credit cards. Mobile payment is a medium through which individuals or enterprises do cashless transactions securely in minimum time. This method provides customers a new way to purchase any goods or services with the help of wireless devices such as smartphones, tablets, and others. Additionally, mobile payment uses different technologies such as SMS-based transactional payments, direct mobile billing, and NFC (Near Field Communication) to improve security and provide hassle-free transactions anytime and from anywhere. The mobile payment market is getting popular; it is the easiest way to accept in-person payments. It is a fast, secure and convenient way of money transfer for users to make immediate payments utilizing their smartphones for daily transactions in the modern world. Mobile payment technology offers various applications in end-user industries like the entertainment industry, food, retail stores, IT, and banking which helps in the growth of increasing use of mobile payment mode for transection. Many companies like Apple Pay, Samsung pay, Google pay, etc. offer mobile payment services. According to Statista PayPal’s annual payment volume came to USD 936 billion in 2020.

Market Dynamics And Factors For Mobile Payment Market

Drivers:

People Shifting To Words Cashless Mode Of Transection

- People moving to words cash-less transactions. Different companies provide services for easy money transfer by just using mobile phones or tabs. The majorly used non-cash payment methods are credit and debit cards, direct debits, and credit transfers. However, financial technology firms have developed a variety of mobile payment alternatives, for instance, the money transfer and payment service PayPal accepts credit cards and bank transfers. That enhances the moving rate of people towards mobile payments. Companies are also providing virtual wallets such as Apple Pay, Google Wallet, and Samsung Pay for secure transfers. Samsung Pay and Google Pay are reaching 100 million users each in 2020. This shows the high adoption rate and people are shifting to words cashless transactions in the upcoming year.

Restraints:

Mobile Payments Aren't Always Accepted.

- Mobile payment mode is a secure and effective method for doing online transactions. It supports the cash-less method of transection to buy or get goods and services. Mobile payments are accepted by a growing number of retailers, financial sector, and companies but there are tons of stores that don't take mobile payments. Apple Pay is the most widely accepted form of digital payment, and even so, only 36% of North American retailers support it. Lack of awareness, insecurities, and lack of trust in online services are the key factors that hamper the growth of the market. The developing region has connectivity issues, lack of resources, and high prices of electronic devices restrain the growth of the mobile payment market.

Opportunity:

Opportunity In Digitalization Of Small Scale Enterprises

- The world explores and there are endless limits of urbanization, with cities rapidly expanding infrastructures and populations, rural area is also developing. Digitalization helps in redefining the entire business strategy adopting the latest and new emerging digital technology to drive the business. As a result small scale enterprises in urban and especially in rural areas are shifting towards online mode of money transitions. Digitalization provides opportunities to carry out all the payment process digitally which gives more security and fast services. Digitalization has propagated the banking industry, food industry, agriculture industry, service industry through mobile payment functionality. Mobile payments are a subset of digital payment that allows payment through mobile devices. Hence digitalization provides opportunities for the growth of mobile payment market.

Segmentation Analysis Of Mobile Payment Market

- By payment type, proximity payment is expected to account for the largest market share in the forecasted period. Mobile proximity payments are mobile payments, the payer and the receiver are in the same location and where the transition is in between their devices takes place through proximity technology. Proximity technology used for mobile payment is Near Field Communication (NFC), Quick Response (QR) codes, digital wallets, card terminals, etc. It is an online mode of transaction for doing a quick and secure payment process. It helps to do transections by handy devices like smartphones, tabs at any time from anywhere bank to bank transitions are possible. That is helping in the growth of the mobile payment market.

- By end-user, the BFSI segment is expected to dominate the mobile payment market in the forecast period. BFSI (Banking, Financial Services, and Insurance) is one of the major sectors where businesses have better possibilities when it comes to digital transactions. In the financial services bank required valid customer bank accounts through which the bank receives and collects the payment. BFSI sector adopting new techniques for making payment transfers easy and convenient. Developing smartphone apps, adding new features such as remote deposit of checks, and providing training to educate consumers. Consequently, mobile banking adoption among consumers has been much faster, leading to the development of the mobile payment market in the upcoming period.

Regional Analysis Of Mobile Payment Market

- Asia Pacific region is expected largest market share of the mobile payment market in the projected period. The rapidly growing online market and supply of mobile devices create the need for mobile payment services in the market. This service enables easy cashless payments. It is the most convenient transaction that can be completed in the shortest period that improves the customer experience. In the Asia Pacific especially India and China dominate the largest share in the market. In India, digitalization and the government’s demonetization action have propelled the adoption of mobile payments. Also, the large population indicates the high consumer base for the mobile payment market in China, it is a leading country in the adoption of new technology, high use of smartphones, and growing need for less-time consuming payment methods in China are expected to boost the demand for mobile payments in the projected period.

- The North American region is the second most dominated region in the mobile payment market during the forecasted period. The coronavirus pandemic boosts mobile payment developments across the world, and North America was no exception. Indeed, the US bigger increase in NFC than other countries worldwide According to Statista In 2021, more than four out of 10 people U.S. smartphone users had used contactless payment methods not only NFC but mobile wallets, QR code payments, or PayPal transactions via a smartphone. PayPal, especially, is popular in the United States For instance, the number of active PayPal accounts was said to be over 400 million in 2021, up by over 70 million since early 2020. As result, that shows the increasing demand for mobile payment.

- Europe is the region that has the potential to grow in the mobile payment market in the upcoming period. Rising use of the online mode of money transfer in the Europe region due to the service provided by the key players. There are various apps, systems, and financial technology that provide mobile payment services more effectively. Moreover, the use of mobile payment services is larger in younger adults like age group 18-34 is significantly more likely to currently use a mobile payment service and this region contains a large population between this age group which leads to an increased demand for mobile payment market. Moreover, governments across the region have enforced strict regulatory policies, to support the development of payment technology and make a cashless economy. The Europe region holds a positive outlook for the mobile payment technologies market

- The South American region has the potential to grow in the mobile payment market due to the presence of developing countries. The rising population shows the high availability of large consumers of this region that support to increase in the use of mobile payment market in this region. The adoption of new technology helps in easier, more secure, and convenient mobile transactions through mobile payment technologies which increases the demand for the market in the forecast period.

Top Key Players Covered In Mobile Payment Market Are

- Apple (US)

- Google (US)

- American Express Company (US)

- MasterCard (US)

- PayPal (US)

- Isis Mobile Wallet (US)

- Visa (US)

- Merchant Customer Exchange (US)

- Alibaba Group Holdings Limite (China)

- Amazon.com Inc. (US)

- M Pesa (Africa)

- Money Gram International (US)

- Samsung Electronics Co. Ltd. (South Korea)

- WeChat (Tencent Holdings Limited) (China), and other major players.

Key Industry Development In The Mobile Payment Market

- In November 2021, the leading Japanese information and communication technology company Fujitsu Limited and, American Express International announced a new partnership to work on their global expense management by doing digital transformation in expense management.

- In March 2022, Visa acquired tink, Visa, and opened a banking platform that is used for financial businesses to give services, and financial products and do money transitions. Tink and Visa are commonly expected to work on providing better management of financial services, financial data, and money for their clients.

|

Global Mobile Payment Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.62 Tn. |

|

Forecast Period 2023-30 CAGR: |

31.5% |

Market Size in 2030: |

USD 23.40 Tn. |

|

Segments Covered: |

By Payment Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MOBILE PAYMENT MARKET BY PAYMENT TYPE (2017-2030)

- MOBILE PAYMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PROXIMITY PAYMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REMOTE PAYMENT

- MOBILE PAYMENT MARKET BY END-USER (2017-2030)

- MOBILE PAYMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BFSI

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- IT & TELECOMMUNICATION

- RETAIL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Mobile Payment Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- APPLE (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- GOOGLE (US)

- AMERICAN EXPRESS COMPANY (US)

- MASTERCARD (US)

- PAYPAL (US)

- ISIS MOBILE WALLET (US)

- VISA (US)

- MERCHANT CUSTOMER EXCHANGE (US)

- ALIBABA GROUP HOLDINGS LIMITE (CHINA)

- AMAZON.COM INC. (US)

- M PESA (AFRICA)

- MONEY GRAM INTERNATIONAL (US)

- SAMSUNG ELECTRONICS CO. LTD. (SOUTH KOREA)

- WECHAT (TENCENT HOLDINGS LIMITED) (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL MOBILE PAYMENT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Payment Type

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Mobile Payment Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.62 Tn. |

|

Forecast Period 2023-30 CAGR: |

31.5% |

Market Size in 2030: |

USD 23.40 Tn. |

|

Segments Covered: |

By Payment Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MOBILE PAYMENTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MOBILE PAYMENTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MOBILE PAYMENTS MARKET COMPETITIVE RIVALRY

TABLE 005. MOBILE PAYMENTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. MOBILE PAYMENTS MARKET THREAT OF SUBSTITUTES

TABLE 007. MOBILE PAYMENTS MARKET BY PAYMENT TYPE

TABLE 008. PROXIMITY PAYMENT MARKET OVERVIEW (2016-2028)

TABLE 009. REMOTE PAYMENT MARKET OVERVIEW (2016-2028)

TABLE 010. MOBILE PAYMENTS MARKET BY END-USER

TABLE 011. BFSI MARKET OVERVIEW (2016-2028)

TABLE 012. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

TABLE 013. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA MOBILE PAYMENTS MARKET, BY PAYMENT TYPE (2016-2028)

TABLE 015. NORTH AMERICA MOBILE PAYMENTS MARKET, BY END-USER (2016-2028)

TABLE 016. N MOBILE PAYMENTS MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE MOBILE PAYMENTS MARKET, BY PAYMENT TYPE (2016-2028)

TABLE 018. EUROPE MOBILE PAYMENTS MARKET, BY END-USER (2016-2028)

TABLE 019. MOBILE PAYMENTS MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC MOBILE PAYMENTS MARKET, BY PAYMENT TYPE (2016-2028)

TABLE 021. ASIA PACIFIC MOBILE PAYMENTS MARKET, BY END-USER (2016-2028)

TABLE 022. MOBILE PAYMENTS MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA MOBILE PAYMENTS MARKET, BY PAYMENT TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA MOBILE PAYMENTS MARKET, BY END-USER (2016-2028)

TABLE 025. MOBILE PAYMENTS MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA MOBILE PAYMENTS MARKET, BY PAYMENT TYPE (2016-2028)

TABLE 027. SOUTH AMERICA MOBILE PAYMENTS MARKET, BY END-USER (2016-2028)

TABLE 028. MOBILE PAYMENTS MARKET, BY COUNTRY (2016-2028)

TABLE 029. APPLE: SNAPSHOT

TABLE 030. APPLE: BUSINESS PERFORMANCE

TABLE 031. APPLE: PRODUCT PORTFOLIO

TABLE 032. APPLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. GOOGLE: SNAPSHOT

TABLE 033. GOOGLE: BUSINESS PERFORMANCE

TABLE 034. GOOGLE: PRODUCT PORTFOLIO

TABLE 035. GOOGLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. AMERICAN EXPRESS COMPANY: SNAPSHOT

TABLE 036. AMERICAN EXPRESS COMPANY: BUSINESS PERFORMANCE

TABLE 037. AMERICAN EXPRESS COMPANY: PRODUCT PORTFOLIO

TABLE 038. AMERICAN EXPRESS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. MASTERCARD: SNAPSHOT

TABLE 039. MASTERCARD: BUSINESS PERFORMANCE

TABLE 040. MASTERCARD: PRODUCT PORTFOLIO

TABLE 041. MASTERCARD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. PAYPAL: SNAPSHOT

TABLE 042. PAYPAL: BUSINESS PERFORMANCE

TABLE 043. PAYPAL: PRODUCT PORTFOLIO

TABLE 044. PAYPAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. ISIS MOBILE WALLET: SNAPSHOT

TABLE 045. ISIS MOBILE WALLET: BUSINESS PERFORMANCE

TABLE 046. ISIS MOBILE WALLET: PRODUCT PORTFOLIO

TABLE 047. ISIS MOBILE WALLET: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. VISA: SNAPSHOT

TABLE 048. VISA: BUSINESS PERFORMANCE

TABLE 049. VISA: PRODUCT PORTFOLIO

TABLE 050. VISA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. MERCHANT CUSTOMER EXCHANGE: SNAPSHOT

TABLE 051. MERCHANT CUSTOMER EXCHANGE: BUSINESS PERFORMANCE

TABLE 052. MERCHANT CUSTOMER EXCHANGE: PRODUCT PORTFOLIO

TABLE 053. MERCHANT CUSTOMER EXCHANGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ALIBABA GROUP HOLDINGS LIMITE: SNAPSHOT

TABLE 054. ALIBABA GROUP HOLDINGS LIMITE: BUSINESS PERFORMANCE

TABLE 055. ALIBABA GROUP HOLDINGS LIMITE: PRODUCT PORTFOLIO

TABLE 056. ALIBABA GROUP HOLDINGS LIMITE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. AMAZON.COM INC.: SNAPSHOT

TABLE 057. AMAZON.COM INC.: BUSINESS PERFORMANCE

TABLE 058. AMAZON.COM INC.: PRODUCT PORTFOLIO

TABLE 059. AMAZON.COM INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. M PESA: SNAPSHOT

TABLE 060. M PESA: BUSINESS PERFORMANCE

TABLE 061. M PESA: PRODUCT PORTFOLIO

TABLE 062. M PESA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MONEY GRAM INTERNATIONAL: SNAPSHOT

TABLE 063. MONEY GRAM INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 064. MONEY GRAM INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 065. MONEY GRAM INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SAMSUNG ELECTRONICS CO. LTD.: SNAPSHOT

TABLE 066. SAMSUNG ELECTRONICS CO. LTD.: BUSINESS PERFORMANCE

TABLE 067. SAMSUNG ELECTRONICS CO. LTD.: PRODUCT PORTFOLIO

TABLE 068. SAMSUNG ELECTRONICS CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. WECHAT (TENCENT HOLDINGS LIMITED): SNAPSHOT

TABLE 069. WECHAT (TENCENT HOLDINGS LIMITED): BUSINESS PERFORMANCE

TABLE 070. WECHAT (TENCENT HOLDINGS LIMITED): PRODUCT PORTFOLIO

TABLE 071. WECHAT (TENCENT HOLDINGS LIMITED): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 072. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 073. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 074. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MOBILE PAYMENTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MOBILE PAYMENTS MARKET OVERVIEW BY PAYMENT TYPE

FIGURE 012. PROXIMITY PAYMENT MARKET OVERVIEW (2016-2028)

FIGURE 013. REMOTE PAYMENT MARKET OVERVIEW (2016-2028)

FIGURE 014. MOBILE PAYMENTS MARKET OVERVIEW BY END-USER

FIGURE 015. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 016. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

FIGURE 017. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA MOBILE PAYMENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE MOBILE PAYMENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC MOBILE PAYMENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA MOBILE PAYMENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA MOBILE PAYMENTS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Mobile Payment market research report is 2023-2030.

Apple (US), Google (US), American Express Company (US), MasterCard (US), PayPal (US), Isis Mobile Wallet (US), Visa (US), Merchant Customer Exchange (US), Alibaba Group Holdings Limite (China), Amazon.com Inc. (US), M Pesa (Africa), Money Gram International (US), Samsung Electronics Co. Ltd. (South Korea), WeChat (Tencent Holdings Limited) (China), and other major players.

The mobile payment market is segmented into payment type, end-user, and region. By Payment Type the market is categorized into Proximity Payment, Remote Payment. By End-user, the market is categorized into BFSI, IT & Telecommunication, Retail and Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

Mobile payment is an advanced method for making transactions. Mobile payment is a medium through which individuals or enterprises do cashless transactions securely in minimum time.

Global mobile payment market size was valued at USD 2.62 trillion in 2022, and is projected to reach USD 23.40 trillion by 2030, growing at a CAGR of 31.5% from 2023 to 2030.