Mobile Health Vehicle Market Synopsis

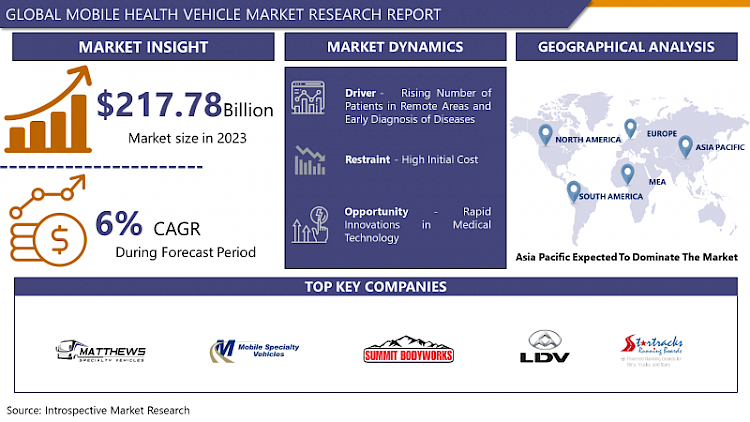

Mobile Health Vehicle Market Size Was Valued at USD 217.78 Billion in 2023, and is Projected to Reach USD 367.84 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.

Mobile Health Vehicles is a personalized healthcare clinic that uses integrated technology to make healthcare accessible to a larger population. According to the World Health Organization, they deploy mobile health vehicles to underprivileged areas that are cut off from medical facilities.

- Mobile Health Vehicles is a personalized healthcare clinic that uses integrated technology to make healthcare accessible to a larger population. According to the World Health Organization, they deploy mobile health vehicles to underprivileged areas that are cut off from medical facilities. The WHO also reports that the demand for these vehicles continues to grow due to numerous advantages. Mobile Health Vehicle is a response to a population living in remote and difficult areas, where their communities have been disconnected from mainstream services due to geographic and climatic conditions.

- The concept of mobile hospitals isn't entirely new, and shows just how necessary its use is, from military field hospitals to charities or large disastertent cities. While these cases can be reduced to mobile walkers with limited scope for outpatient medical activities, a full-featured hospital and Mobile health care is a highly complex system that far exceeds a compact target system. The Mobile health vehicles provide urgent care, preventive health screenings, and initiate chronic disease management.

Mobile Health Vehicle Market Trend Analysis

Transforming Healthcare Delivery with Mobile Health Vehicles

- The growing emphasis on accessible healthcare services is a response to the persistent challenge of healthcare disparities, particularly in remote or underserved communities. Mobile health vehicles have emerged as a strategic solution to bridge the gap between these communities and essential medical services. In rural areas where healthcare infrastructure is limited or nonexistent, these vehicles serve as lifelines, bringing healthcare directly to the doorstep of those who need it most. By bypassing geographical barriers and logistical constraints, mobile clinics ensure that individuals in remote areas have access to the same quality of care as their urban counterparts.

- Moreover, mobile health vehicles not only deliver essential medical services but also play a pivotal role in preventive healthcare efforts. Beyond treating existing health issues, these clinics offer health screenings, wellness checks, and education programs aimed at promoting healthier lifestyles and early disease detection. By proactively addressing health concerns before they escalate, mobile clinics contribute to long-term improvements in community health outcomes. Additionally, they foster a sense of trust and continuity of care within these communities, as healthcare providers develop relationships with patients over time, fostering a holistic approach to healthcare delivery. Overall, the emphasis on accessible healthcare services through mobile health vehicles represents a transformative shift in healthcare delivery, ensuring that no community is left behind in the pursuit of better health and well-being.

Technological Advancements Revolutionizing Mobile Healthcare

- Technological advancements are revolutionizing the landscape of mobile health vehicles, ushering in a new era of innovation and efficiency. The integration of telemedicine capabilities, diagnostic tools, and electronic health records systems into these mobile units enhances their capacity to deliver comprehensive healthcare services on-the-go. With telemedicine, healthcare providers can conduct virtual consultations, expanding access to specialized care for patients in remote or underserved areas. This not only reduces the need for physical travel but also enables timely interventions and consultations, improving patient outcomes and satisfaction.

- Furthermore, the incorporation of diagnostic tools within mobile health vehicles enables healthcare professionals to perform a wide range of tests and screenings onsite, from basic blood tests to advanced imaging procedures. This facilitates early disease detection and intervention, leading to better health outcomes and reduced healthcare costs in the long run. Additionally, the integration of electronic health records systems ensures seamless data management, allowing healthcare providers to access patient information in real-time and make informed decisions. This not only streamlines administrative processes but also enhances care coordination and continuity, ultimately leading to improved patient care experiences and outcomes.

- Moreover, advancements in mobile technology are fostering better patient engagement and personalized care delivery within mobile health vehicles. Mobile apps and wearable devices enable patients to actively participate in their healthcare journey, from monitoring vital signs to accessing educational resources and tracking their progress. This empowerment promotes proactive health management and adherence to treatment plans, ultimately leading to better health outcomes and reduced healthcare disparities. In essence, technological advancements are driving a paradigm shift in mobile healthcare delivery, enhancing accessibility, efficiency, and patient-centeredness, and paving the way for a more inclusive and effective healthcare system.

Mobile Health Vehicle Market Segment Analysis:

Mobile Health Vehicle Market is segmented based on Type and Application

By Type, Van segment is expected to dominate the market during the forecast period

- Vans stand out as the preferred choice for mobile clinics and mobile dental services due to a combination of factors that align closely with the needs of these healthcare applications. Firstly, their compact size makes them highly maneuverable, particularly in densely populated urban areas where space is at a premium. Navigating through narrow streets or parking in tight spots becomes significantly easier with vans, enabling healthcare providers to reach communities that might otherwise be inaccessible. This agility is crucial for ensuring that essential medical services can be delivered directly to those who need them most, regardless of their location.

- Moreover, vans offer a cost-effective solution for setting up mobile healthcare facilities. Compared to larger vehicles like trucks, vans generally have lower operational costs, including fuel consumption, maintenance, and initial investment. This affordability makes them an attractive option for healthcare organizations and providers looking to establish mobile clinics or dental services without incurring prohibitively high expenses. By leveraging vans for these purposes, healthcare professionals can allocate more resources towards patient care and medical equipment, enhancing the quality and accessibility of healthcare services for underserved communities. In essence, vans serve as versatile and efficient platforms for delivering vital medical care where it's needed most, contributing to improved health outcomes and wellness for individuals across diverse geographical areas.

By Application, Mobile clinics segment held the largest share in 2023

- Mobile clinics play a pivotal role in addressing healthcare disparities by bringing essential medical services directly to underserved communities. As the first point of contact for many individuals who lack access to traditional healthcare facilities, mobile clinics serve as a lifeline, providing preventive care, primary healthcare services, screenings, and health education. Given their versatility and adaptability, vans serve as the ideal platform for these mobile clinics, enabling healthcare providers to reach remote or marginalized populations with ease. Whether it's offering vaccinations, conducting wellness exams, or managing chronic conditions, mobile clinics housed within vans are equipped to address a wide spectrum of healthcare needs, thereby making a significant impact on public health outcomes.

- Furthermore, the ability of mobile clinics to hold the largest share in van-based services is underscored by their flexibility in deployment. These clinics can be quickly mobilized to respond to public health emergencies, natural disasters, or community health initiatives, demonstrating their agility and responsiveness in meeting evolving healthcare demands. By leveraging vans as mobile clinic units, healthcare organizations can optimize resource utilization, minimize operational costs, and maximize outreach efforts, ensuring that healthcare services are accessible to those who need them most. Ultimately, mobile clinics housed within vans not only serve as a vital link to healthcare for underserved populations but also symbolize a commitment to health equity and social justice by bringing quality care directly to the doorstep of those who would otherwise go without.

Mobile Health Vehicle Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- In Asia Pacific, the mobile health vehicle market holds a dominant share, driven by the rapid expansion of healthcare services and increasing adoption of mobile technology. Emerging economies like China and India are at the forefront of this growth trajectory, fueled by several factors. Urbanization trends have led to the concentration of populations in cities, creating a demand for innovative healthcare solutions that can reach people where they live and work. Moreover, rising healthcare expenditure, coupled with government initiatives aimed at improving healthcare accessibility in remote and underserved areas, further propel the expansion of mobile health services.

- Despite this significant growth potential, the market in Asia Pacific faces several challenges that influence its dynamics and adoption rates across different countries. Regulatory hurdles, such as complex licensing procedures and varying standards for mobile health services, can impede market entry and expansion. Infrastructure limitations, including inadequate internet connectivity and power supply in rural areas, pose challenges for the seamless operation of mobile health vehicles and the delivery of telemedicine services. Additionally, cultural factors, such as preferences for traditional healthcare practices and concerns about data privacy and security, may influence the acceptance and utilization of mobile health services among diverse populations in the region. Addressing these challenges will be crucial for unlocking the full potential of the mobile health vehicle market in Asia Pacific and ensuring equitable access to quality healthcare services for all.

Active Key Players in the Mobile Health Vehicle Market

- Matthews Specialty Vehicle

- Mobile Specialty Vehicles

- Summit Bodyworks

- LDV

- Startracks.org,Inc

- Legacy

- TOUTENKAMION

- ADI MOBILE HEALTH

- Odulair

- Imagi-Motive

- Mobile Healthcare Facilitie

- Other Key Players

Key Industry Developments in the Mobile Health Vehicle Market:

- On May 2023, Nomi Health, a healthcare programs, announced the acquisition of I Am Wellness, a provider of primary and family care services. The acquisition will help the companies by expanding the network of on-theground peer navigators while adding new virtual care programs and mobile units.

- On April 6, 2023, Kaiser Permanente Hawaii, a healthcare provider, launched the mobile health vehicle. The mobile health vehicle is equipped with modern medical equipment, two exam rooms, a lab, and physician documentation station.

|

Global Mobile Health Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 217.78 Bn |

|

Forecast Period 2024-32 CAGR: |

6% |

Market Size in 2032: |

USD 367.84 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Mobile Health Vehicle Market by Type

5.1 Mobile Health Vehicle Market Overview Snapshot and Growth Engine

5.2 Mobile Health Vehicle Market Overview

5.3 Van

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Van: Grographic Segmentation

5.4 Truck

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Truck: Grographic Segmentation

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Grographic Segmentation

Chapter 6: Mobile Health Vehicle Market by Application

6.1 Mobile Health Vehicle Market Overview Snapshot and Growth Engine

6.2 Mobile Health Vehicle Market Overview

6.3 Mobile Clinic

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Mobile Clinic: Grographic Segmentation

6.4 Mobile Dental

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Mobile Dental: Grographic Segmentation

6.5 Mobile Mammography

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Mobile Mammography: Grographic Segmentation

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Mobile Health Vehicle Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Mobile Health Vehicle Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Mobile Health Vehicle Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 MEDCOACH

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 MATTHEWS SPECIALTY VEHICLE

7.4 MOBILE SPECIALTY VEHICLES

7.5 SUMMIT BODYWORKS

7.6 LDV

7.7 STARTRACKS.ORG INC

7.8 LEGACY

7.9 TOUTENKAMION

7.10 ADI MOBILE HEALTH

7.11 ODULAIR

7.12 IMAGI-MOTIVE

7.13 MOBILE HEALTHCARE FACILITIE

7.14 OTHER MAJOR PLAYERS

Chapter 8: Global Mobile Health Vehicle Market Analysis, Insights and Forecast, 2017-2032

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Van

8.2.2 Truck

8.2.3 Others

8.3 Historic and Forecasted Market Size By Application

8.3.1 Mobile Clinic

8.3.2 Mobile Dental

8.3.3 Mobile Mammography

8.3.4 Others

Chapter 9: North America Mobile Health Vehicle Market Analysis, Insights and Forecast, 2017-2032

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Van

9.4.2 Truck

9.4.3 Others

9.5 Historic and Forecasted Market Size By Application

9.5.1 Mobile Clinic

9.5.2 Mobile Dental

9.5.3 Mobile Mammography

9.5.4 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Mobile Health Vehicle Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Van

10.4.2 Truck

10.4.3 Others

10.5 Historic and Forecasted Market Size By Application

10.5.1 Mobile Clinic

10.5.2 Mobile Dental

10.5.3 Mobile Mammography

10.5.4 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Mobile Health Vehicle Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Van

11.4.2 Truck

11.4.3 Others

11.5 Historic and Forecasted Market Size By Application

11.5.1 Mobile Clinic

11.5.2 Mobile Dental

11.5.3 Mobile Mammography

11.5.4 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Mobile Health Vehicle Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Van

12.4.2 Truck

12.4.3 Others

12.5 Historic and Forecasted Market Size By Application

12.5.1 Mobile Clinic

12.5.2 Mobile Dental

12.5.3 Mobile Mammography

12.5.4 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Mobile Health Vehicle Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Van

13.4.2 Truck

13.4.3 Others

13.5 Historic and Forecasted Market Size By Application

13.5.1 Mobile Clinic

13.5.2 Mobile Dental

13.5.3 Mobile Mammography

13.5.4 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Mobile Health Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 217.78 Bn |

|

Forecast Period 2024-32 CAGR: |

6% |

Market Size in 2032: |

USD 367.84 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MOBILE HEALTH VEHICLE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MOBILE HEALTH VEHICLE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MOBILE HEALTH VEHICLE MARKET COMPETITIVE RIVALRY

TABLE 005. MOBILE HEALTH VEHICLE MARKET THREAT OF NEW ENTRANTS

TABLE 006. MOBILE HEALTH VEHICLE MARKET THREAT OF SUBSTITUTES

TABLE 007. MOBILE HEALTH VEHICLE MARKET BY TYPE

TABLE 008. VAN MARKET OVERVIEW (2016-2028)

TABLE 009. TRUCK MARKET OVERVIEW (2016-2028)

TABLE 010. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 011. MOBILE HEALTH VEHICLE MARKET BY APPLICATION

TABLE 012. MOBILE CLINIC MARKET OVERVIEW (2016-2028)

TABLE 013. MOBILE DENTAL MARKET OVERVIEW (2016-2028)

TABLE 014. MOBILE MAMMOGRAPHY MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA MOBILE HEALTH VEHICLE MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA MOBILE HEALTH VEHICLE MARKET, BY APPLICATION (2016-2028)

TABLE 018. N MOBILE HEALTH VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE MOBILE HEALTH VEHICLE MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE MOBILE HEALTH VEHICLE MARKET, BY APPLICATION (2016-2028)

TABLE 021. MOBILE HEALTH VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC MOBILE HEALTH VEHICLE MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC MOBILE HEALTH VEHICLE MARKET, BY APPLICATION (2016-2028)

TABLE 024. MOBILE HEALTH VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA MOBILE HEALTH VEHICLE MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA MOBILE HEALTH VEHICLE MARKET, BY APPLICATION (2016-2028)

TABLE 027. MOBILE HEALTH VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA MOBILE HEALTH VEHICLE MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA MOBILE HEALTH VEHICLE MARKET, BY APPLICATION (2016-2028)

TABLE 030. MOBILE HEALTH VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 031. MEDCOACH: SNAPSHOT

TABLE 032. MEDCOACH: BUSINESS PERFORMANCE

TABLE 033. MEDCOACH: PRODUCT PORTFOLIO

TABLE 034. MEDCOACH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. MATTHEWS SPECIALTY VEHICLE: SNAPSHOT

TABLE 035. MATTHEWS SPECIALTY VEHICLE: BUSINESS PERFORMANCE

TABLE 036. MATTHEWS SPECIALTY VEHICLE: PRODUCT PORTFOLIO

TABLE 037. MATTHEWS SPECIALTY VEHICLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. MOBILE SPECIALTY VEHICLES: SNAPSHOT

TABLE 038. MOBILE SPECIALTY VEHICLES: BUSINESS PERFORMANCE

TABLE 039. MOBILE SPECIALTY VEHICLES: PRODUCT PORTFOLIO

TABLE 040. MOBILE SPECIALTY VEHICLES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. SUMMIT BODYWORKS: SNAPSHOT

TABLE 041. SUMMIT BODYWORKS: BUSINESS PERFORMANCE

TABLE 042. SUMMIT BODYWORKS: PRODUCT PORTFOLIO

TABLE 043. SUMMIT BODYWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. LDV: SNAPSHOT

TABLE 044. LDV: BUSINESS PERFORMANCE

TABLE 045. LDV: PRODUCT PORTFOLIO

TABLE 046. LDV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. STARTRACKS.ORG INC: SNAPSHOT

TABLE 047. STARTRACKS.ORG INC: BUSINESS PERFORMANCE

TABLE 048. STARTRACKS.ORG INC: PRODUCT PORTFOLIO

TABLE 049. STARTRACKS.ORG INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. LEGACY: SNAPSHOT

TABLE 050. LEGACY: BUSINESS PERFORMANCE

TABLE 051. LEGACY: PRODUCT PORTFOLIO

TABLE 052. LEGACY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. TOUTENKAMION: SNAPSHOT

TABLE 053. TOUTENKAMION: BUSINESS PERFORMANCE

TABLE 054. TOUTENKAMION: PRODUCT PORTFOLIO

TABLE 055. TOUTENKAMION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ADI MOBILE HEALTH: SNAPSHOT

TABLE 056. ADI MOBILE HEALTH: BUSINESS PERFORMANCE

TABLE 057. ADI MOBILE HEALTH: PRODUCT PORTFOLIO

TABLE 058. ADI MOBILE HEALTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ODULAIR: SNAPSHOT

TABLE 059. ODULAIR: BUSINESS PERFORMANCE

TABLE 060. ODULAIR: PRODUCT PORTFOLIO

TABLE 061. ODULAIR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. IMAGI-MOTIVE: SNAPSHOT

TABLE 062. IMAGI-MOTIVE: BUSINESS PERFORMANCE

TABLE 063. IMAGI-MOTIVE: PRODUCT PORTFOLIO

TABLE 064. IMAGI-MOTIVE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. MOBILE HEALTHCARE FACILITIE: SNAPSHOT

TABLE 065. MOBILE HEALTHCARE FACILITIE: BUSINESS PERFORMANCE

TABLE 066. MOBILE HEALTHCARE FACILITIE: PRODUCT PORTFOLIO

TABLE 067. MOBILE HEALTHCARE FACILITIE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 068. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 069. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 070. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MOBILE HEALTH VEHICLE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MOBILE HEALTH VEHICLE MARKET OVERVIEW BY TYPE

FIGURE 012. VAN MARKET OVERVIEW (2016-2028)

FIGURE 013. TRUCK MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 015. MOBILE HEALTH VEHICLE MARKET OVERVIEW BY APPLICATION

FIGURE 016. MOBILE CLINIC MARKET OVERVIEW (2016-2028)

FIGURE 017. MOBILE DENTAL MARKET OVERVIEW (2016-2028)

FIGURE 018. MOBILE MAMMOGRAPHY MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA MOBILE HEALTH VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE MOBILE HEALTH VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC MOBILE HEALTH VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA MOBILE HEALTH VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA MOBILE HEALTH VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Mobile Health Vehicle Market research report is 2024-2032.

MedCoach, Matthews Specialty Vehicle, Mobile Specialty Vehicles, Summit Bodyworks, LDV, and Other major players

The Mobile Health Vehicle Market is segmented into Type, Application, and region. By Type, the market is categorized into Van, Truck, and Others. By Application, the market is categorized into Mobile Clinic, Mobile Dental, Mobile Mammography, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Mobile Health Vehicles is a personalized healthcare clinic that uses integrated technology to make healthcare accessible to a larger population. According to the World Health Organization, they deploy mobile health vehicles to underprivileged areas that are cut off from medical facilities.

Mobile Health Vehicle Market Size Was Valued at USD 217.78 Billion in 2023, and is Projected to Reach USD 367.84 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.