Micro Electric Vehicle Market Synopsis

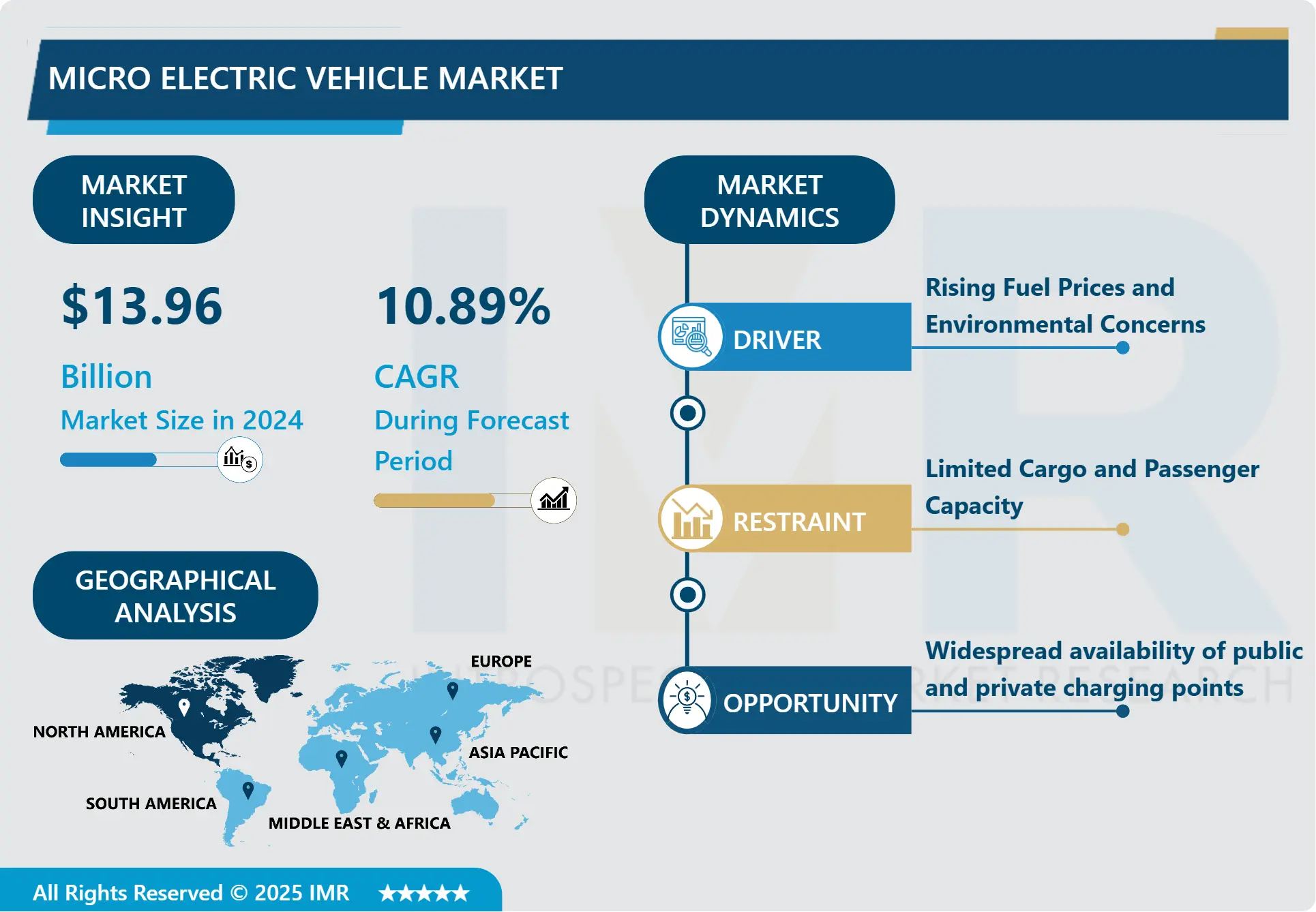

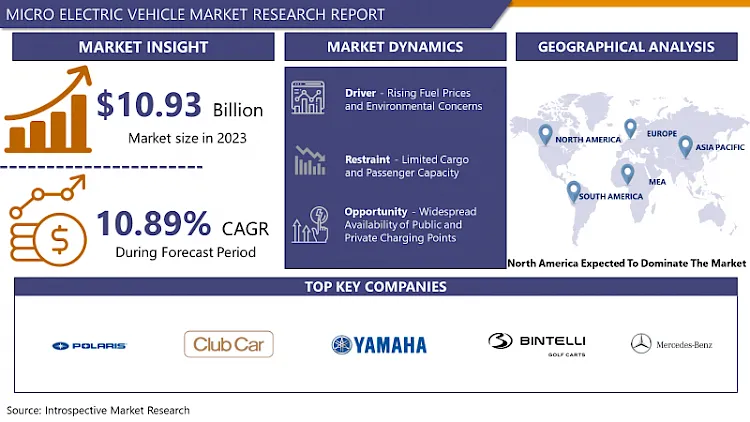

Global Micro Electric Vehicle Market Size Was Valued at USD 13.96 Billion in 2024 and is Projected to Reach USD 31.92 Billion by 2032, Growing at a CAGR of 10.89% From 2025-2032

Micro electric vehicles (EVs) are eco-friendly, compact transportation options for short commutes and urban mobility. Powered by rechargeable batteries, they are quiet and emission-free, making them a cost-effective solution for navigating city streets. With advancements in battery technology and sustainability concerns, MEVs are gaining popularity as practical alternatives for short-distance travel and last-mile delivery services. Micro electric vehicles (MEVs) are becoming increasingly popular due to their numerous benefits. MEVs provide environmentally friendly transportation by reducing the total carbon footprint and producing no tailpipe emissions, which supports international efforts to promote sustainability and combat climate change. MEVs require less fuel and maintenance than conventional internal combustion engine cars, making them a more affordable mobility alternative. Furthermore, their small size enables easier navigation through crowded metropolitan areas, resolving last-mile transit issues and improving accessibility.

Market trends show that consumers' tastes are moving toward more environmentally friendly modes of transportation, government incentives promoting the use of electric vehicles, and technology improvements all contribute to an increasing desire for MEVs. In metropolitan regions where traffic and pollution are major problems, there is a particularly high demand for MEVs. In addition, the popularity of delivery services and ride-sharing has increased demand for tiny electric automobiles and electric scooters for deliveries and short-distance travel.

MEVs are environmentally friendly by emitting zero tailpipe emissions, reducing air and noise pollution in urban areas. They also offer cost savings due to lower fuel and maintenance expenses than conventional vehicles. Their compact size enhances maneuverability and parking convenience, addressing urban congestion. Market trends show a surge in demand for MEVs due to advancements in battery technology, government incentives, and increased consumer awareness of environmental issues. This is particularly evident in electric scooter-sharing programs and delivery services.

Micro Electric Vehicle Market Trend Analysis

Rising Fuel Prices and Environmental Concerns

- Fuel savings on an electric vehicle (EV) are substantial as you do not need to purchase diesel or petrol to operate it. When considering the cost of diesel or petrol, charging an electric vehicle is far less expensive. Using sustainable energy sources, like solar power, can further lower your electricity costs. Due to their numerous moving components, cars fuelled by diesel or petrol need routine maintenance. Electric cars, on the other hand, don't have as many moving parts as other vehicles have. This implies that over time, your electric car maintenance expenses will probably be reduced.

- Eco-friendly transportation options are becoming increasingly popular due to concerns about the environment, particularly air pollution and climate change. Low-emission vehicles, or MEVs, operate with zero tailpipe emissions, which helps to improve air quality and lessen the harmful effects of greenhouse gas emissions on the environment.

- As people, governments, and businesses become more aware of environmental issues and the urgent need to reduce carbon footprints, they are actively seeking alternatives to traditional cars. In line with broader efforts to shift towards greener transportation options and mitigate the impacts of climate change, MEVs are a practical and ecologically responsible choice for urban travel.

Widespread availability of public and private charging points

- Range anxiety is one of the main worries that new owners of electric vehicles have, and it is addressed by the accessibility of charging infrastructure. When charging stations are easily accessible in public locations like parking lots, malls, and cities, MEV owners may easily refuel their cars, increasing their trips' range and general utility.

- The availability of charging infrastructure increases confidence and trust in MEVs' viability as a workable form of transportation. Customers are more inclined to think about switching to electric vehicles, including MEVs, for their constant commuting requirements as they witness the growing quantity of charging stations in their neighborhoods.

- Companies stand to gain a consumer base from the growth of the charging infrastructure. Businesses that provide charging stations may be able to draw in MEV customers who may decide to utilize their services while their cars charge, increasing foot traffic and possible income.

Micro Electric Vehicle Market Segment Analysis:

Micro Electric Vehicle Market Segmented on the basis of Type, Battery Type, and Application.

By Type, Quadricycles segment is expected to dominate the market during the forecast period

- Quadricycles are a great option for places where parking space is limited and traffic congestion is a common issue, thanks to their small size and low-speed capabilities. As cities around the globe promote sustainable transportation options and enforce stricter emission regulations, quadricycles are becoming an increasingly attractive and affordable transportation alternative for commuters looking for eco-friendly options.

- Quadricycles are a popular option among fleet operators and cost-conscious consumers due to their lower acquisition and running costs in comparison to larger electric vehicles. Their smaller size results in lower energy consumption and maintenance requirements, further improving their cost-effectiveness. The quadricycle market benefits from manufacturers' increased focus on innovation and product development, which enhances performance, safety features, and design appeal. This has resulted in quadricycles becoming more adaptable and desirable to customers beyond the typical urban commuting market.

By Application, Commercial use segment is expected to dominate the market during the forecast period

- Businesses are starting to realize how much using electric vehicles in their fleets can save them financially and environmentally. Due in large part to their cheaper maintenance and fuel costs, MEVs are less expensive to operate than traditional internal combustion engine cars. For business owners looking to cut expenses and increase profits, this cost-effectiveness is especially alluring.

- The commercial sector frequently entails short-distance travel and stop-and-go driving, which complements MEV characteristics well. These vehicles are perfect for last-mile delivery services, local transportation, and fleet operations since they perform well in city environments where pollution and traffic are major problems.

- Businesses are also encouraged to invest in electric fleets to comply with laws, lower their carbon footprints, and strengthen corporate sustainability programs, as governments all over the world impose harsher emissions restrictions and provide incentives to encourage the use of electric vehicles.

Micro Electric Vehicle Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is home to several major automotive and technology companies that have made large investments in the creation and manufacturing of electric vehicles. By using their resources and experience, these businesses can develop and launch cutting-edge MEV models that satisfy a wide range of customer wants and market preferences.

- The US and Canada, both countries with significant markets for electric golf carts, mobility vehicles for the disabled, and quadricycles, account for the lion's share of revenue for the North American market. Neighborhood electric cars were the previous name for micro-electric vehicles in a few US states. The primary responsibility of the US government is to lower greenhouse gas emissions and the nation's carbon footprint. To do this, it has implemented several incentives and subsidies to increase market demand for small electric cars. North America is anticipated to dominate the microelectric vehicles (MEVs) market due to several key factors

Micro Electric Vehicle Market Top Key Players:

- Club Car (US)

- Yamaha Golf-Car Company (US)

- Bintelli Electric Vehicles (US)

- Elio Motors Inc. (US)

- Polaris Inc. (US)

- Textron Inc. (US)

- Tesla, Inc. (US)

- Electrameccanica Vehicles Corp. (Canada)

- Renault Twizy (France)

- Bayerische Motoren Werke AG (Germany)

- Mercedes Benz Group AG (Germany)

- BMW Group (Germany)

- Volkswagen Group (Germany)

- Italcar Industrial Srl (Italy)

- Microlino AG (Switzerland)

- Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd (China)

- BYD Company Ltd. (China)

- G H Varley Pty Ltd. (Australia)

- Hyundai Motor Co. (South Korea)

- Mahindra and Mahindra Ltd. (India)

- PMV Electric Pvt. Ltd. (India)

- Nissan Motor Corporation (Japan), and Other Active Players.

Key Industry Developments in the Micro Electric Vehicle Market:

- In January 2023, Club Car, a renowned provider of golf, consumer, and utility vehicles, was appointed as the Official Golf Car of the Professional Golfers Association (PGA) of America. This strategic decision aims to facilitate Club Car's deeper collaboration with the golf industry, paving the way for expanded partnerships and enhanced engagement within the sport.

|

Global Micro Electric Vehicle Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.96 Bn. |

|

Forecast Period 2025-32 CAGR: |

10.89% |

Market Size in 2032: |

USD 31.92 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Battery Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Micro Electric Vehicle Market by Type (2018-2032)

4.1 Micro Electric Vehicle Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Quadricycle

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Neighborhood Electric Vehicle (NEV)

4.5 Golf Cart

Chapter 5: Micro Electric Vehicle Market by Battery Type (2018-2032)

5.1 Micro Electric Vehicle Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Lead-Acid Batteries

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Lithium-Ion Batteries

Chapter 6: Micro Electric Vehicle Market by Application (2018-2032)

6.1 Micro Electric Vehicle Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Commercial Use

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Personal Use

6.5 Public Utilities

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Micro Electric Vehicle Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABB

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BYD

7.4 XUJI GROUP

7.5 TELD

7.6 STAR CHARGE

7.7 CHARGEPOINT

7.8 WEBASTO

7.9 EFACEC

7.10 LEVITON

7.11 SIEMENS

7.12 IES SYNERGY

7.13 POD POINT

7.14 AUTO ELECTRIC POWER PLANT

7.15 DBT-CEV

7.16 CLIPPER CREEK

7.17 SCHNEIDER ELECTRIC

7.18 NITTO KOGYO

7.19 PANASONIC

7.20 TOYOTA HOME

7.21 KAWAMURA ELECTRIC

7.22 OTHER KEY PLAYERS

Chapter 8: Global Micro Electric Vehicle Market By Region

8.1 Overview

8.2. North America Micro Electric Vehicle Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Quadricycle

8.2.4.2 Neighborhood Electric Vehicle (NEV)

8.2.4.3 Golf Cart

8.2.5 Historic and Forecasted Market Size by Battery Type

8.2.5.1 Lead-Acid Batteries

8.2.5.2 Lithium-Ion Batteries

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Commercial Use

8.2.6.2 Personal Use

8.2.6.3 Public Utilities

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Micro Electric Vehicle Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Quadricycle

8.3.4.2 Neighborhood Electric Vehicle (NEV)

8.3.4.3 Golf Cart

8.3.5 Historic and Forecasted Market Size by Battery Type

8.3.5.1 Lead-Acid Batteries

8.3.5.2 Lithium-Ion Batteries

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Commercial Use

8.3.6.2 Personal Use

8.3.6.3 Public Utilities

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Micro Electric Vehicle Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Quadricycle

8.4.4.2 Neighborhood Electric Vehicle (NEV)

8.4.4.3 Golf Cart

8.4.5 Historic and Forecasted Market Size by Battery Type

8.4.5.1 Lead-Acid Batteries

8.4.5.2 Lithium-Ion Batteries

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Commercial Use

8.4.6.2 Personal Use

8.4.6.3 Public Utilities

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Micro Electric Vehicle Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Quadricycle

8.5.4.2 Neighborhood Electric Vehicle (NEV)

8.5.4.3 Golf Cart

8.5.5 Historic and Forecasted Market Size by Battery Type

8.5.5.1 Lead-Acid Batteries

8.5.5.2 Lithium-Ion Batteries

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Commercial Use

8.5.6.2 Personal Use

8.5.6.3 Public Utilities

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Micro Electric Vehicle Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Quadricycle

8.6.4.2 Neighborhood Electric Vehicle (NEV)

8.6.4.3 Golf Cart

8.6.5 Historic and Forecasted Market Size by Battery Type

8.6.5.1 Lead-Acid Batteries

8.6.5.2 Lithium-Ion Batteries

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Commercial Use

8.6.6.2 Personal Use

8.6.6.3 Public Utilities

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Micro Electric Vehicle Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Quadricycle

8.7.4.2 Neighborhood Electric Vehicle (NEV)

8.7.4.3 Golf Cart

8.7.5 Historic and Forecasted Market Size by Battery Type

8.7.5.1 Lead-Acid Batteries

8.7.5.2 Lithium-Ion Batteries

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Commercial Use

8.7.6.2 Personal Use

8.7.6.3 Public Utilities

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Micro Electric Vehicle Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.96 Bn. |

|

Forecast Period 2025-32 CAGR: |

10.89% |

Market Size in 2032: |

USD 31.92 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Battery Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||